Noticias del mercado

-

22:21

U.S. stocks rallied

U.S. stocks rallied, after the Standard & Poor's 500 Index posted one of its steepest drops this year, amid a respite from a global equities selloff.

A surge in the final minutes pushed the S&P 500 up 1.8 percent to 1,948.87 at 4 p.m. in New York, closing at the session high after the gauge fell 3.8 percent over the previous two sessions. Equities jumped in early trading and then trimmed their gains by more than half before an afternoon rebound along with oil prices.

The benchmark equity gauge's 3 percent decline on Tuesday -- its third-biggest of 2015 -- marked a sour start to what has historically been the worst month of the year. The S&P 500 falls 1.1 percent on average in September, according to data compiled by Bloomberg going back to 1927.

Another troubling sign is that futures on Chicago Board Options Exchange Volatility Index have climbed, showing traders predict turbulent markets will endure. The gauge known as the VIX fell 11 percent Wednesday to 27.93, after a record monthly jump in August,up 135 percent.

The S&P 500 slumped 6.3 percent last month as China's currency devaluation spurred concern over global growth, erasing more than $5.7 trillion in equity market values worldwide, while volatility surged the most on record. The equity index entered a correction last week, only to then rally more than 6 percent over two days. It closed Wednesday 9.1 percent below its all-time high set in May.

Chinese shares closed lower on the last trading day of this week as investors assessed the level of state support before a major military parade on Thursday. Mainland markets will be closed Thursday and Friday to commemorate the end of World War II.

Amid continuing concerns that China's slowdown will weigh on the global economy, traders are now pricing in a 32 percent chance that the Federal Reserve will raise interest rates this month, down from 38 percent on Monday. Policy makers have a little more than two weeks to assess incoming data before deciding whether to act on rates.

A report from the Fed Wednesday said the economy expanded across most regions and industries in July and August as tighter labor markets boosted wages for some workers. Six of 12 Fed districts reported "moderate" growth, and five others said expansion was "modest," according to the Beige Book.

Data today on private payrolls showed companies added 190,000 workers in August, below the 200,000 forecast by economists surveyed by Bloomberg. Attention will focus on the government's monthly jobs report, due Friday, as a major data point before the Fed's meeting. A separate gauge Wednesday showed July factory orders rose less than forecast by economists.

-

21:00

DJIA 16257.98 199.63 1.24%, NASDAQ 4706.24 70.13 1.51%, S&P 500 1935.03 21.18 1.11%

-

19:28

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday, rebounding from steep losses a day earlier, after China intervened to support its financial markets and help stem a global equities selloff. Eight of the 10 major S&P sectors were higher with the technology index's .SPLRCT 1.2 percent rise leading the advancers. Apple (AAPL), Microsoft (MSFT) and Intel (INTC) were all up about 2%.

Almost all of Dow stocks in positive area (29 of 30). Top looser - Chevron Corporation (CVX, -0.40%). Top gainer - Apple Inc. (AAPL, +2.78).

Almost all S&P index sectors also in positive area. Top gainer - Utilities (-0.1%). Top gainer - Consumer goods (+1,3%).

At the moment:

Dow 16239.00 +152.00 +0.94%

S&P 500 1931.25 +15.25 +0.80%

Nasdaq 100 4207.00 +48.75 +1.17%

10 Year yield 2,17% -0,00

Oil 45.02 -0.39 -0.86%

Gold 1134.50 +2.00 +0.18%

-

18:06

WSE: Session Results

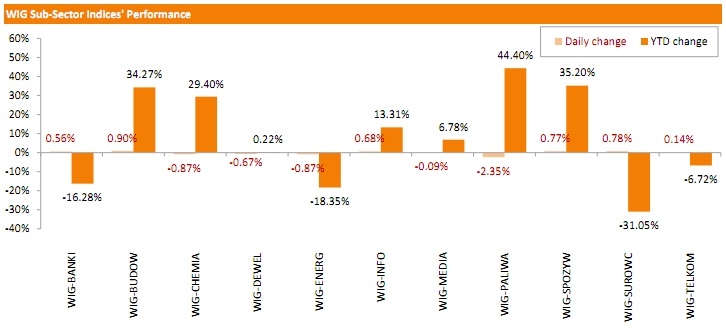

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, posted a 0.31% drop. Within the index performance was mixed, with constructions (+0.9%) outperforming and oil and gas sector (-2.35%) lagging.

The large-cap stocks' measure, the WIG30 Index, fell by 0.44%. CCC (WSE: CCC) was the index's sharpest decliner, tumbling by 4.5% on reported slowdown in sales growth in August. It was followed by PGNIG (WSE: PGN), ENEA (WSE: ENA) and PKN ORLEN (WSE: PKN), losing 4.01%, 2.15% and 1.87% respectively. On the contrary, BOGDANKA (WSE: LWB), KERNEL (WSE: KER) and EUROCASH (WSE: EUR) gained the most, adding more than 3% each.

-

18:00

European stocks closed: FTSE 6098.05 39.51 0.65%, DAX 10069.38 53.81 0.54%, CAC 40 4566.23 25.07 0.55%

-

18:00

European stocks close: stocks closed higher as concerns over a slowdown in the global economy eased

Stock indices rebounded after the yesterday's drop. Stock markets Tuesday traded lower on concerns over the slowdown in the global economy. International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that the global growth will be weaker than expected earlier due to a slower recovery in advanced economies and a further slowdown in emerging economies.

The weak manufacturing and services PMIs from China also weighed on the markets on Tuesday.

Meanwhile, the economic from the Eurozone was weak on Wednesday. Eurozone's producer price index declined 0.1% in July, in line with expectations, after a flat reading in June. June's figure was revised up from a 0.1% drop.

Intermediate goods prices were flat in July, capital goods prices rose 0.1%, and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 0.5%.

On a yearly basis, Eurozone's producer price index dropped 2.1% in July, in line with expectations, after a 2.1% fall in June. June's figure was revised up from a 2.2% decline.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in July. Energy prices dropped at an annual rate of 6.5%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 57.3 in August from 57.1 in July, missing expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a strong rise in business activity and employment.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,083.31 +24.77 +0.41 %

DAX 10,048.05 +32.48 +0.32 %

CAC 40 4,554.92 +13.76 +0.30 %

-

16:24

U.S. factory orders are up 0.4% in July

The U.S. Commerce Department released factory orders data on Wednesday. Factory orders in the U.S. rose 0.4% in July, missing expectations for a 0.9% gain, after a 2.2% increase in June. June's figure was revised up from a 1.8% rise.

The increase was driven by a rise in orders for motor vehicles, which jumped 4% in July, the largest rise since July 2014.

Durable goods increased by 2.2% in July, while orders for nondurable goods dropped 1.3%.

-

15:38

Revised productivity in the U.S. non-farm businesses rises 3.3% in the second quarter

The U.S. Labor Department released its revised non-farm productivity figures on Wednesday. Revised productivity in the U.S. non-farm businesses rose at a 3.3% annual rate in the second quarter, up from the preliminary reading of a 1.3% increase, after a 1.1% drop in the first quarter.

The upward revision was driven by higher output, which rose 4.7% in the second quarter, up from the preliminary reading of a 2.8% gain.

Hours worked climbed by 1.4%, down from the preliminary reading of a 1.5% rise.

Revised unit labour costs decreased 1.4% in the second quarter, down from the preliminary reading of a 0.5% increase, after a 2.3 gain in the first quarter.

-

15:33

U.S. Stocks open: Dow +1.27%, Nasdaq +1.37%, S&P +0.97%

-

15:28

Before the bell: S&P futures +1.12%, NASDAQ futures +1.17%

U.S. stock-index futures extended their advance as crude oil erased an earlier retreat.

Global Stocks:

Nikkei 18,095.4 -70.29 -0.39%

Hang Seng 20,934.94 -250.49 -1.18%

Shanghai Composite 3,155.04 -11.58 -0.37%

FTSE 6,119.79 +61.25 +1.01%

CAC 4,579.83 +38.67 +0.85%

DAX 10,086.26 +70.69 +0.71%

Crude oil $44.77 (-1.41%)

Gold $1136.20 (-0.32%)

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

American Express Co

AXP

74.25

0.34%

0.3K

Barrick Gold Corporation, NYSE

ABX

6.78

0.44%

7.0K

Chevron Corp

CVX

78.75

0.72%

2.2K

Exxon Mobil Corp

XOM

72.60

0.72%

4.2K

Procter & Gamble Co

PG

69.40

0.73%

1.1K

The Coca-Cola Co

KO

39.04

0.75%

0.4K

ALCOA INC.

AA

9.29

0.76%

1.5K

Wal-Mart Stores Inc

WMT

64.32

0.78%

0.9K

Caterpillar Inc

CAT

75.50

0.80%

16.6K

Nike

NKE

109.50

0.80%

6.5K

FedEx Corporation, NYSE

FDX

149.25

0.82%

0.5K

Pfizer Inc

PFE

31.64

0.89%

5.6K

Cisco Systems Inc

CSCO

25.35

0.92%

1.7K

McDonald's Corp

MCD

94.35

0.94%

11.3K

Boeing Co

BA

128.65

0.95%

0.2K

Johnson & Johnson

JNJ

93.00

0.99%

0.6K

International Business Machines Co...

IBM

144.10

1.00%

0.5K

Verizon Communications Inc

VZ

45.38

1.07%

5.7K

Intel Corp

INTC

28.12

1.08%

5.1K

General Electric Co

GE

24.14

1.09%

9.3K

Home Depot Inc

HD

114.35

1.13%

0.6K

Microsoft Corp

MSFT

42.31

1.17%

7.9K

Visa

V

69.78

1.19%

1.8K

AMERICAN INTERNATIONAL GROUP

AIG

59.50

1.31%

0.2K

Citigroup Inc., NYSE

C

51.62

1.33%

16.6K

Goldman Sachs

GS

184.68

1.41%

15.9K

JPMorgan Chase and Co

JPM

62.33

1.43%

7.0K

Walt Disney Co

DIS

100.98

1.48%

14.7K

Amazon.com Inc., NASDAQ

AMZN

504.12

1.53%

12.7K

Facebook, Inc.

FB

88.77

1.77%

182.2K

Ford Motor Co.

F

13.97

1.82%

17.7K

AT&T Inc

T

32.91

1.83%

50.5K

Apple Inc.

AAPL

109.87

2.00%

474.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.03

2.66%

30.1K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

AT&T (T) upgraded to Buy from Neutral at Citigroup

AT&T (T) upgraded to Buy from Neutral at Goldman

Downgrades:

Other:

Walt Disney (DIS) initiated with a Outperform at Credit Agricole

-

14:31

ADP report: private sector adds 190,000 jobs in August

Private sector in the U.S. added 190,000 jobs in August, according the ADP report on Wednesday. July's figure was revised down to 177,000 jobs from a previous reading of 185,000 jobs.

Analysts expected the private sector to add 201,000 jobs.

Services sector added 173,000 jobs in August, while manufacturing sector added only 17,000.

"Recent global financial market turmoil has not slowed the U.S. job market, at least not yet. Job growth remains strong and broad-based, except in the energy industry, which continues to shed jobs. Large companies also remain more cautious in their hiring than smaller ones," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 5.2% in August from 5.3% in July. The U.S. economy is expected to add 220,000 jobs in August, after adding 215,000 jobs in July.

-

12:00

European stock markets mid session: stocks traded lower as concerns over the slowdown in the global economy still weighed on the markets

Stock indices traded lower as concerns over the slowdown in the global economy still weighed on the markets. International Monetary Fund (IMF) Managing Director Christine Lagarde said on Tuesday that the global growth will be weaker than expected earlier due to a slower recovery in advanced economies and a further slowdown in emerging economies.

The weak manufacturing and services PMIs from China are still in focus.

Meanwhile, the economic from the Eurozone was weak. Eurozone's producer price index declined 0.1% in July, in line with expectations, after a flat reading in June. June's figure was revised up from a 0.1% drop.

Intermediate goods prices were flat in July, capital goods prices rose 0.1%, and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 0.5%.

On a yearly basis, Eurozone's producer price index dropped 2.1% in July, in line with expectations, after a 2.1% fall in June. June's figure was revised up from a 2.2% decline.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in July. Energy prices dropped at an annual rate of 6.5%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 57.3 in August from 57.1 in July, missing expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a strong rise in business activity and employment.

Current figures:

Name Price Change Change %

FTSE 100 6,052.83 -5.71 -0.09 %

DAX 9,991.23 -24.34 -0.24 %

CAC 40 4,530.33 -10.83 -0.24 %

-

11:42

Number of registered unemployed people in Spain increases by 21,679 in August

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people rose 21,679 in August. It was the first increase in seven months.

The services sector lost the most jobs.

-

11:14

Eurozone's producer price index declines 0.1% in July

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.1% in July, in line with expectations, after a flat reading in June. June's figure was revised up from a 0.1% drop.

Intermediate goods prices were flat in July, capital goods prices rose 0.1%, and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 0.5%.

On a yearly basis, Eurozone's producer price index dropped 2.1% in July, in line with expectations, after a 2.1% fall in June. June's figure was revised up from a 2.2% decline.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in July. Energy prices dropped at an annual rate of 6.5%.

-

10:49

UK construction PMI rises to 57.3 in August

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 57.3 in August from 57.1 in July, missing expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a strong rise in business activity and employment.

"UK construction companies remained on a reasonably strong growth footing in August, helped by a sustained recovery in both residential and commercial building activity. Meanwhile, there was another loss of momentum for civil engineering, which brought output growth within this sub-sector further below the multi-year highs seen in 2014," Senior Economist at Markit, Tim Moore, said.

-

10:38

Federal Reserve Bank of Boston President Eric Rosengren: it does not matter when to hike the interest rate

The Federal Reserve Bank of Boston President Eric Rosengren said on Tuesday that it does not matter when to hike the interest rate. He added that the interest rate hike will be gradual.

"While market attention has focused on the exact timing of potential rate rises, macroeconomic models of the economy overwhelmingly suggest little impact on the broader economic landscape from moving the timing of initial interest rate hikes forward or backward by a couple of months," he said.

The Federal Reserve Bank of Boston president noted that the employment target has been reached to start raising interest rates, but other targets such as inflation remain unclear.

Rosengren also said that the Fed should be cautious to start raising its interest rates due to the recent turbulences on the global markets.

Rosengren is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:21

Australia's GDP climbs 0.2% in the second quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 0.2% in the second quarter, missing expectations for a 0.4% gain, after a 0.9% rise in the first quarter.

On a yearly basis, Australia's GDP rose 2.0% in the second quarter, missing expectations for a 2.2% increase, after a 2.3% gain in the first quarter.

Final consumption spending was up 0.9% quarter-on-quarter and 2.9% year-on-year.

Terms of trade dropped 3.4% quarter-on-quarter and 10.6% year-on-year, while real net national disposable income decreased 0.9% quarter-on-quarter and fell 1.1% year-on-year.

Mining plunged 3.0% in the second quarter, while construction declined 0.6%.

-

10:12

OECD: consumer price inflation in the OECD area remains unchanged at 0.6% year-on-year in July

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area remained unchanged at 0.6% year-on-year in July.

Energy prices dropped at an annual rate of 9.5% in July, food prices decreased to 1.3% in July from 1.5% in June.

PI excluding food and energy in the OECD area rose to an annual rate to 1.7% in July from 1.6% in June.

July's CPI was 0.2% in the U.K, 1.3% in Canada, 0.2% in the U.S., 0.2% in Germany and 0.2% in Japan.

The consumer price inflation in the Eurozone was 0.2% in July.

-

08:17

Global Stocks: U.S. stock indices extended declines

U.S. stock indices fell on Tuesday amid concerns over China's economy as investors continued assessing weak manufacturing PMI data released on Tuesday. China is the second biggest economy in the world and its slowdown may harm global economic growth. IMF Managing Director Christine Lagarde warned on Tuesday that the world's emerging economies would have to be more resilient to withstand China's slowdown.

The Dow Jones Industrial Average lost 469.68 points, or 2.8%, to 16,058.35 (all of its 30 components fell). The S&P 500 fell 58.33 points, or 3%, to 1,913 (all of its 10 sectors declined). The Nasdaq Composite dropped 140.40 points, or 2.9%, to 4,636.10.

Meanwhile the Institute for Supply Management reported that activity in the U.S. manufacturing sector fell sharply. The corresponding index came in at 51.1 in August compared to 52.7 in July, while economists had expected the index to slide only to 52.6.

This morning in Asia Hong Kong Hang Seng climbed 0.03%, or 5.67 points, to 21,191.10. China Shanghai Composite Index rose 0.31%, or 9.71 points, to 3,176.34. The Nikkei rebounded by 1.11%, or 202.34 points, to 18,368.03.

Asian stocks fell at the beginning of today's session, but they advanced slightly later despite declines in U.S. equities.

A three-day vacation begins in China on September 3.

-

04:04

Nikkei 225 18,283.67 +117.98 +0.65 %, Hang Seng 20,923.15 -262.28 -1.24 %, Shanghai Composite 3,054.55 -112.08 -3.54 %

-

00:30

Stocks. Daily history for Sep 1’2015:

(index / closing price / change items /% change)

Nikkei 225 18,165.69 -724.79 -3.84 %

Hang Seng 21,185.43 -485.15 -2.24 %

S&P/ASX 200 5,096.41 -110.57 -2.12 %

Shanghai Composite 3,165.07 -40.91 -1.28 %

FTSE 100 6,058.54 -189.40 -3.03 %

CAC 40 4,541.16 -111.79 -2.40 %

Xetra DAX 10,015.57 -243.89 -2.38 %

S&P 500 1,913.85 -58.33 -2.96 %

NASDAQ Composite 4,636.11 -140.40 -2.94 %

Dow Jones 16,058.35 -469.68 -2.84 %

-