Noticias del mercado

-

19:40

American focus: the US dollar rose

The US dollar rose against most major currencies, even after data showed that employment in the US private sector grew in August, less than expected, as concerns over the outlook for the global economy remain.

Data provided by Automatic Data Processing (ADP), have shown that the rate of increase of employment in the US private sector accelerated slightly in August, but was lower than the expectations of experts.

According to a report last month, the number of employees increased by 190 thousand. People, compared with a revised downward indicator for July at 177 thousand. (Originally reported growth of 185 thousand.). We add, according to the average forecast value of this indicator was to reach 201 thousand.

If we analyze the cross-sectional size of the companies, including small business employment increased by 85 thousand. (Among those with work from 1 to 19 employees - 50 ths., While among companies with 20-49 employees, the number rose to 35 thous.). With regard to medium-sized businesses (50-499 employees), there employment increased by 66 thousand. Man. Large enterprises (500 and more than 1,000 employees), meanwhile, have increased the number of employees by 40 thousand. (Companies with 500-999 employees increased employment by 5 thousand., As an enterprise with more than 1,000 employees increased employment by 34 thousand.).

In addition, the data showed that, in the context of a sector the number of employed among the companies producing goods increased by 17 thousand., While among those who provide services, rose to 173 thousand.

If we assess the growth sectors of the industry, you can see the following picture: the construction of 17 thousand., The production of 7 thousand., Trade / transportation / utilities 28 th., Financial services 13 th., Professional / business services 29 thous.

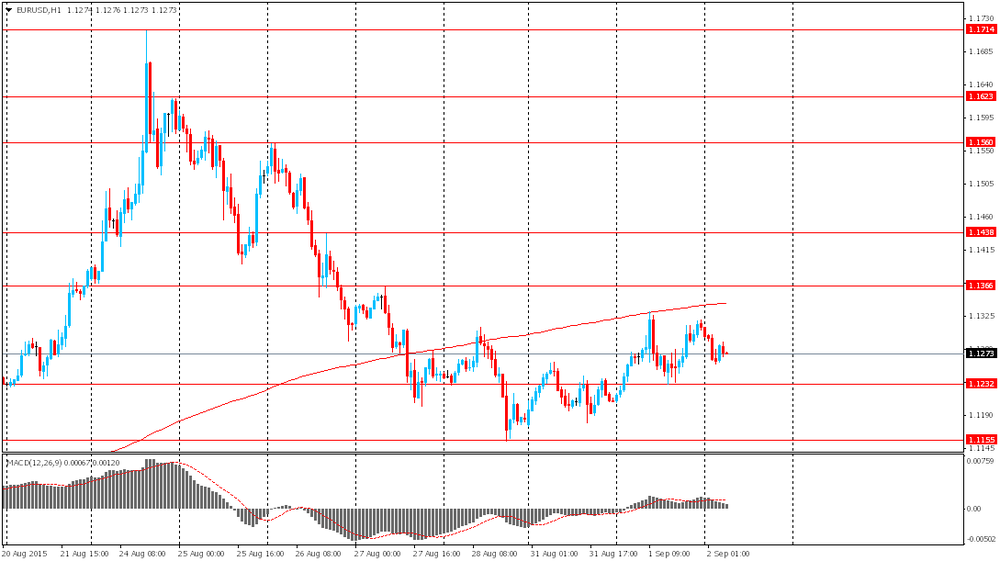

The euro fell against the dollar, while the experts point out that the focus will be the stock market and tomorrow's decision on the monetary policy of the ECB. Investors will be closely watching Draghi comments on the situation in China, the rate of June and the euro zone economy.

Little influenced by today's data on producer prices of the eurozone, which confirmed the predictions of experts. Statistical Office, Eurostat reported, on the basis of July, producer prices in the euro area decreased by 0.1%, while in the EU was registered a drop of 0.2%. We recall that in June, prices remained stable in the euro area and fell by 0.1% among the 28 EU countries. In annual terms, the producer price index decreased by 2.1% in the euro area and fell by 2.7% in the EU. At the end of June, prices in the euro area and fell by 2.1% (revised from -2.2%). The monthly change in the index in the euro area was associated with a decrease in prices in the energy sector (-0.5%), zero change in intermediate goods and an increase of 0.1% in the segment of durable capital goods and consumer durables. In general, prices in the industry, excluding energy remained stable. The largest decline in industrial producer prices was observed in Denmark (-2.6%), Estonia (-1.5%), Greece (-1.4%) and Belgium (-1.0%). Growth was recorded only in Ireland (1.3%), Cyprus (0.6%) and Slovakia (by 0.2%) and Spain (0.1%).

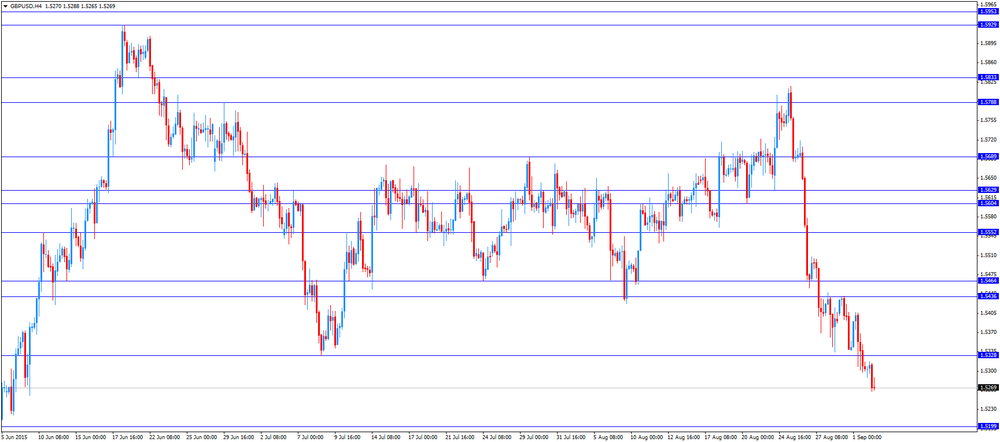

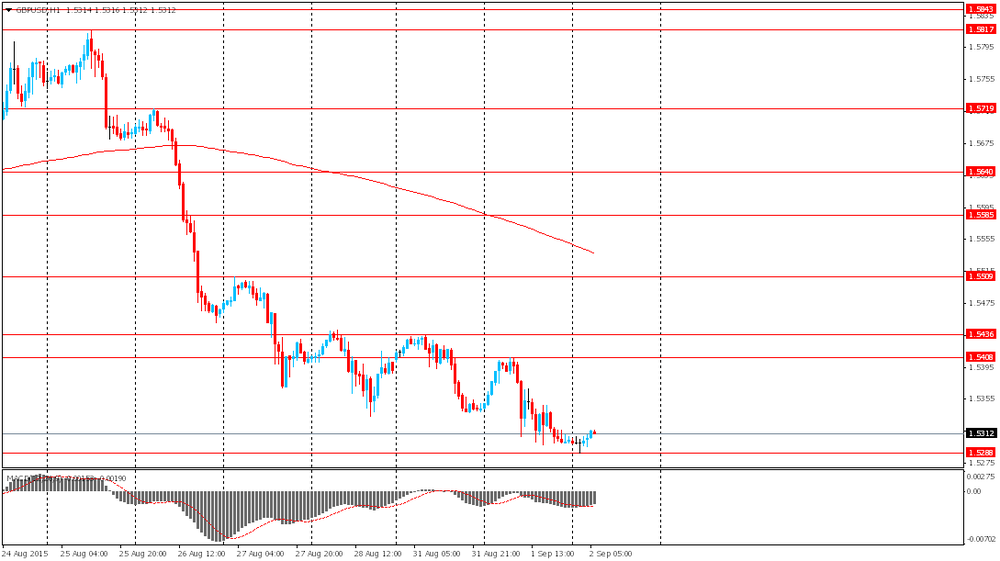

The pound fell earlier moderately against the US currency, while a foothold below the level of $ 1.5300, which was associated with the publication of weak data on Britain, but later rebounded above the opening level. According to the Markit / CIPS, the index of purchasing managers in the construction industry in Britain rose in August to 57.3 points against 57.1 points in July, pointing out the steady expansion. However, analysts expected the index to the level of 57.5 points. The greatest increase in activity was seen in the housing sector buildings. The volume of construction works in the commercial sphere also grew strongly, while engineering projects remained in the doldrums. "Construction companies in Britain continued to show a confident increase in activity in August, helped by growth in residential and commercial construction," - said Tim Moore, senior economist at Markit. The data also showed that construction firms positively look at their prospects. Most companies expect growth in the volume of work over the next year, while only 1 out of 20 expect reductions. Meanwhile, it was reported that employment continued to rise faster rate and a fall in oil prices slowed the rising cost of raw materials.

-

16:30

U.S.: Crude Oil Inventories, August 4.667 (forecast -1.5)

-

16:24

U.S. factory orders are up 0.4% in July

The U.S. Commerce Department released factory orders data on Wednesday. Factory orders in the U.S. rose 0.4% in July, missing expectations for a 0.9% gain, after a 2.2% increase in June. June's figure was revised up from a 1.8% rise.

The increase was driven by a rise in orders for motor vehicles, which jumped 4% in July, the largest rise since July 2014.

Durable goods increased by 2.2% in July, while orders for nondurable goods dropped 1.3%.

-

16:00

U.S.: Factory Orders , July 0.4% (forecast 0.9%)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E252mn), $1.1110(E565mn), $1.1150(E465mn), $1.1200(E647mn), $1.1275(E370mn), $1.1300(E846mn)

USD/JPY: Y119.50($260mn), Y120.00($243mn), Y120.85($170mn), Y122.00($210mn)

EUR/JPY: Y135.00(E130mn)

GBP/USD: $1.5320-25(Gbp315mn)

AUD/USD: $0.6900(A$406mn) *NZD/USD: $0.6450(NZ$208mn), $0.6475(NZ$128mn)

USD/CAD: C$1.3000($276mn), C$1.3100($170mn), C$1.3200($326mn)

USD/CNY: Cny6.3500($795mn)

-

15:38

Revised productivity in the U.S. non-farm businesses rises 3.3% in the second quarter

The U.S. Labor Department released its revised non-farm productivity figures on Wednesday. Revised productivity in the U.S. non-farm businesses rose at a 3.3% annual rate in the second quarter, up from the preliminary reading of a 1.3% increase, after a 1.1% drop in the first quarter.

The upward revision was driven by higher output, which rose 4.7% in the second quarter, up from the preliminary reading of a 2.8% gain.

Hours worked climbed by 1.4%, down from the preliminary reading of a 1.5% rise.

Revised unit labour costs decreased 1.4% in the second quarter, down from the preliminary reading of a 0.5% increase, after a 2.3 gain in the first quarter.

-

14:31

ADP report: private sector adds 190,000 jobs in August

Private sector in the U.S. added 190,000 jobs in August, according the ADP report on Wednesday. July's figure was revised down to 177,000 jobs from a previous reading of 185,000 jobs.

Analysts expected the private sector to add 201,000 jobs.

Services sector added 173,000 jobs in August, while manufacturing sector added only 17,000.

"Recent global financial market turmoil has not slowed the U.S. job market, at least not yet. Job growth remains strong and broad-based, except in the energy industry, which continues to shed jobs. Large companies also remain more cautious in their hiring than smaller ones," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 5.2% in August from 5.3% in July. The U.S. economy is expected to add 220,000 jobs in August, after adding 215,000 jobs in July.

-

14:15

U.S.: ADP Employment Report, August 190 (forecast 201)

-

13:57

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected construction PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Gross Domestic Product (QoQ) Quarter II 0.9% 0.4% 0.2%

01:30 Australia Gross Domestic Product (YoY) Quarter II 2.5% Revised From 2.3% 2.2% 2.0%

08:30 United Kingdom PMI Construction August 57.1 57.5 57.3

09:00 Eurozone Producer Price Index, MoM July 0.0% Revised From -0.1% -0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) July -2.1% Revised From -2.2% -2.1% -2.1%

11:00 U.S. MBA Mortgage Applications August 0.2% 11.3%

The U.S. dollar traded mixed to higher against the most major currencies ahead the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 201,000 jobs in August.

The U.S. factory orders are expected to increase 0.9% in July, after a 1.8 gain in June.

The euro traded mixed against the U.S. dollar after the weak economic data from the Eurozone. Eurozone's producer price index declined 0.1% in July, in line with expectations, after a flat reading in June. June's figure was revised up from a 0.1% drop.

Intermediate goods prices were flat in July, capital goods prices rose 0.1%, and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 0.5%.

On a yearly basis, Eurozone's producer price index dropped 2.1% in July, in line with expectations, after a 2.1% fall in June. June's figure was revised up from a 2.2% decline.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in July. Energy prices dropped at an annual rate of 6.5%.

The British pound traded lower against the U.S. dollar after the weaker-than-expected construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 57.3 in August from 57.1 in July, missing expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a strong rise in business activity and employment.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5263

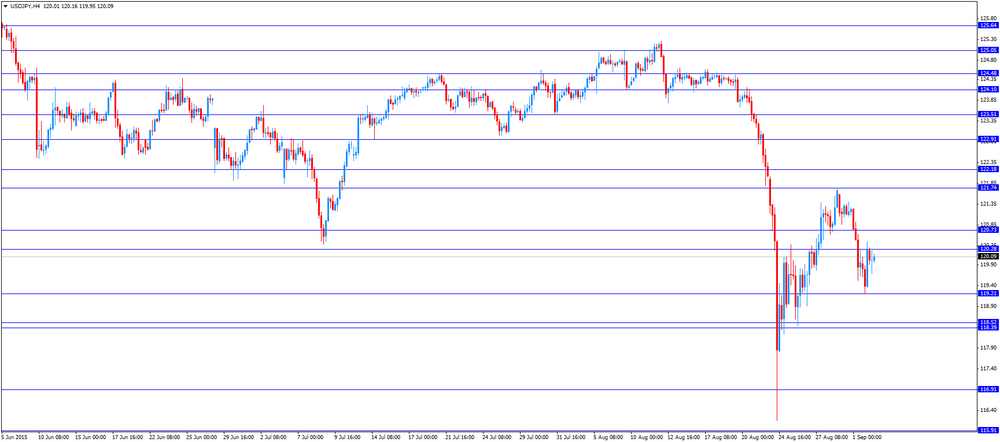

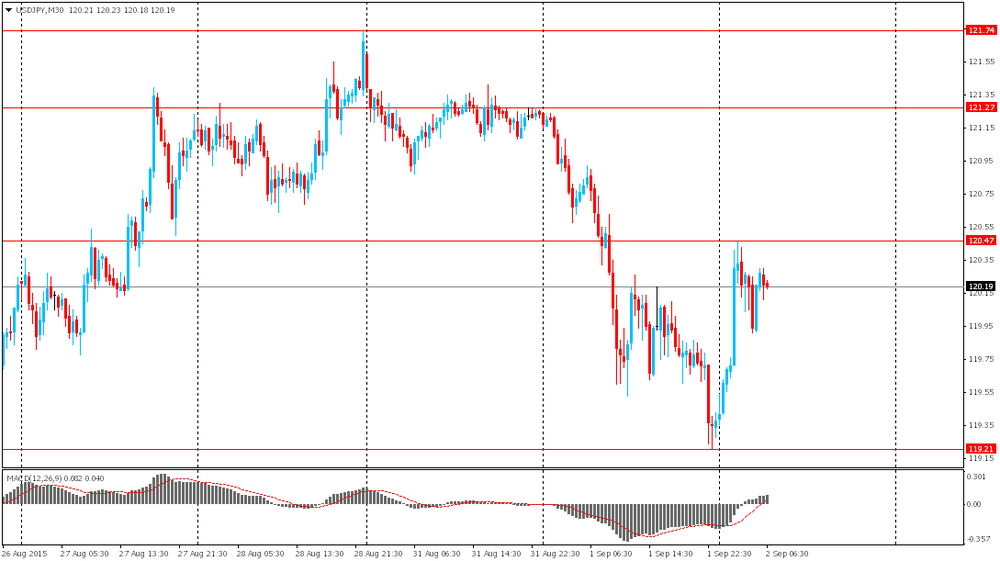

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report August 185 201

14:00 U.S. Factory Orders July 1.8% 0.9%

18:00 U.S. Fed's Beige Book

-

13:45

Orders

EUR/USD

Offers 1.1290 1.1300 1.1355-60 1.1400 1.1440

Bids 1.1210 1.1200 1.1180 1.1130 1.1120

GBP/USD

Offers 1.5380 1.5400 1.5420 1.5450 1.5480 1.5500-05

Bids 1.5250 1.5220 1.5200 1.5190

EUR/GBP

Offers 0.7395 0.7400 0.7420 0.7445-50

Bids 0.7350 0.7320 0.7300

EUR/JPY

Offers 136.00 136.50 136.80 137.00

Bids 135.00 134.50 134.00

USD/JPY

Offers 120.50 121.00 121.30 121.50 122.00

Bids 119.50 119.20 119.10 119.00

AUD/USD

Offers 0.7050 0.7100 0.7200 0.7250

Bids 0.7000 0.6950 0.6900 0.6850

-

13:00

U.S.: MBA Mortgage Applications, August 11.3%

-

11:42

Number of registered unemployed people in Spain increases by 21,679 in August

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people rose 21,679 in August. It was the first increase in seven months.

The services sector lost the most jobs.

-

11:25

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E252mn), $1.1110(E565mn), $1.1150(E465mn), $1.1200(E647mn), $1.1275(E370mn), $1.1300(E846mn)

USD/JPY: Y119.50($260mn), Y120.00($243mn), Y120.85($170mn), Y122.00($210mn)

EUR/JPY: Y135.00(E130mn)

GBP/USD: $1.5320-25(Gbp315mn)

AUD/USD: $0.6900(A$406mn) *NZD/USD: $0.6450(NZ$208mn), $0.6475(NZ$128mn)

USD/CAD: C$1.3000($276mn), C$1.3100($170mn), C$1.3200($326mn)

USD/CNY: Cny6.3500($795mn)

-

11:14

Eurozone's producer price index declines 0.1% in July

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.1% in July, in line with expectations, after a flat reading in June. June's figure was revised up from a 0.1% drop.

Intermediate goods prices were flat in July, capital goods prices rose 0.1%, and both durable and non-durable consumer goods prices climbed 0.1%, while energy prices decreased 0.5%.

On a yearly basis, Eurozone's producer price index dropped 2.1% in July, in line with expectations, after a 2.1% fall in June. June's figure was revised up from a 2.2% decline.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in July. Energy prices dropped at an annual rate of 6.5%.

-

11:00

Eurozone: Producer Price Index (YoY), July -2.1% (forecast -2.1%)

-

11:00

Eurozone: Producer Price Index, MoM , July -0.1% (forecast -0.1%)

-

10:49

UK construction PMI rises to 57.3 in August

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 57.3 in August from 57.1 in July, missing expectations for a rise to 57.5.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a strong rise in business activity and employment.

"UK construction companies remained on a reasonably strong growth footing in August, helped by a sustained recovery in both residential and commercial building activity. Meanwhile, there was another loss of momentum for civil engineering, which brought output growth within this sub-sector further below the multi-year highs seen in 2014," Senior Economist at Markit, Tim Moore, said.

-

10:38

Federal Reserve Bank of Boston President Eric Rosengren: it does not matter when to hike the interest rate

The Federal Reserve Bank of Boston President Eric Rosengren said on Tuesday that it does not matter when to hike the interest rate. He added that the interest rate hike will be gradual.

"While market attention has focused on the exact timing of potential rate rises, macroeconomic models of the economy overwhelmingly suggest little impact on the broader economic landscape from moving the timing of initial interest rate hikes forward or backward by a couple of months," he said.

The Federal Reserve Bank of Boston president noted that the employment target has been reached to start raising interest rates, but other targets such as inflation remain unclear.

Rosengren also said that the Fed should be cautious to start raising its interest rates due to the recent turbulences on the global markets.

Rosengren is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:30

United Kingdom: PMI Construction, August 57.3 (forecast 57.5)

-

10:21

Australia's GDP climbs 0.2% in the second quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 0.2% in the second quarter, missing expectations for a 0.4% gain, after a 0.9% rise in the first quarter.

On a yearly basis, Australia's GDP rose 2.0% in the second quarter, missing expectations for a 2.2% increase, after a 2.3% gain in the first quarter.

Final consumption spending was up 0.9% quarter-on-quarter and 2.9% year-on-year.

Terms of trade dropped 3.4% quarter-on-quarter and 10.6% year-on-year, while real net national disposable income decreased 0.9% quarter-on-quarter and fell 1.1% year-on-year.

Mining plunged 3.0% in the second quarter, while construction declined 0.6%.

-

10:12

OECD: consumer price inflation in the OECD area remains unchanged at 0.6% year-on-year in July

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area remained unchanged at 0.6% year-on-year in July.

Energy prices dropped at an annual rate of 9.5% in July, food prices decreased to 1.3% in July from 1.5% in June.

PI excluding food and energy in the OECD area rose to an annual rate to 1.7% in July from 1.6% in June.

July's CPI was 0.2% in the U.K, 1.3% in Canada, 0.2% in the U.S., 0.2% in Germany and 0.2% in Japan.

The consumer price inflation in the Eurozone was 0.2% in July.

-

08:26

Options levels on wednesday, September 2, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1478 (2536)

$1.1409 (5111)

$1.1340 (5120)

Price at time of writing this review: $1.1274

Support levels (open interest**, contracts):

$1.1188 (2755)

$1.1120 (2754)

$1.1037 (2853)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 89816 contracts, with the maximum number of contracts with strike price $1,1350 (5111);

- Overall open interest on the PUT options with the expiration date September, 4 is 129264 contracts, with the maximum number of contracts with strike price $1,0500 (7885);

- The ratio of PUT/CALL was 1.41 versus 1.43 from the previous trading day according to data from September, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (2514)

$1.5501 (2081)

$1.5402 (640)

Price at time of writing this review: $1.5308

Support levels (open interest**, contracts):

$1.5198 (1441)

$1.5099 (373)

$1.5000 (1343)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30240 contracts, with the maximum number of contracts with strike price $1,5750 (2546);

- Overall open interest on the PUT options with the expiration date September, 4 is 34702 contracts, with the maximum number of contracts with strike price $1,5500 (2732);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from September, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:15

Foreign exchange market. Asian session: the Australian dollar declined amid GDP data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Gross Domestic Product (QoQ) Quarter II 0.9% 0.4% 0.2%

01:30 Australia Gross Domestic Product (YoY) Quarter II 2.3% 2.2% 2.0%

The yen advanced amid correction of the dollar and gains in Japanese stocks. Yesterday the greenback's decline was caused by statistics from China and the U.S. China Federation of Logistics and Purchasing reported that the country's manufacturing PMI fell to 49.7 in August from 50 in July, slipping below the 50 points threshold that separates expansion from contraction. The Institute for Supply management reported that U.S. manufacturing index came in at 51.1 in August compared to 52.7 in July, while economists had expected the index to slide only to 52.6.

The Australian dollar fell below $0.70 for a short while after release of Australian GDP data. A report showed that the country's GDP rose by 0.2% in the second quarter missing expectations for a 0.4% rise. In the first quarter the index came in at 0.9%. On an annualized basis GDP rose by 2.0%, while economists had expected a reading of +2.2%. Slower growth was caused by declines in mining and construction activity as well as by lower prices of export commodities.

EUR/USD: the pair fell to $1.1260 in Asian trade

USD/JPY: the pair rose to Y120.45

GBP/USD: the pair traded within $1.5290-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PMI Construction August 57.1 57.5

09:00 Eurozone Producer Price Index, MoM July -0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) July -2.2% -2.1%

11:00 U.S. MBA Mortgage Applications August 0.2%

12:15 U.S. ADP Employment Report August 185 201

14:00 U.S. Factory Orders July 1.8% 0.9%

14:30 U.S. Crude Oil Inventories August -5.452 -1.5

18:00 U.S. Fed's Beige Book

23:30 Australia AIG Services Index August 54.1

-

03:30

Australia: Gross Domestic Product (QoQ), Quarter II 0.2% (forecast 0.4%)

-

03:30

Australia: Gross Domestic Product (YoY), Quarter II 2.0% (forecast 2.2%)

-

00:28

Currencies. Daily history for Sep 1’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1309 +0,89%

GBP/USD $1,5304 -0,25%

USD/CHF Chf0,9588 -0,72%

USD/JPY Y119,38 -1,55%

EUR/JPY Y135,01 -0,65%

GBP/JPY Y182,68 -1,82%

AUD/USD $0,7013 -1,41%

NZD/USD $0,6336 -0,13%

USD/CAD C$1,3247 +0,84%

-

00:01

Schedule for today, Wednesday,Sep 2’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Gross Domestic Product (QoQ) Quarter II 0.9% 0.4%

01:30 Australia Gross Domestic Product (YoY) Quarter II 2.3% 2.2%

08:30 United Kingdom PMI Construction August 57.1 57.5

09:00 Eurozone Producer Price Index, MoM July -0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) July -2.2% -2.1%

11:00 U.S. MBA Mortgage Applications August 0.2%

12:15 U.S. ADP Employment Report August 185 201

14:00 U.S. Factory Orders July 1.8% 0.9%

14:30 U.S. Crude Oil Inventories August -5.452

18:00 U.S. Fed's Beige Book

23:30 Australia AIG Services Index August 54.1

-