Noticias del mercado

-

20:26

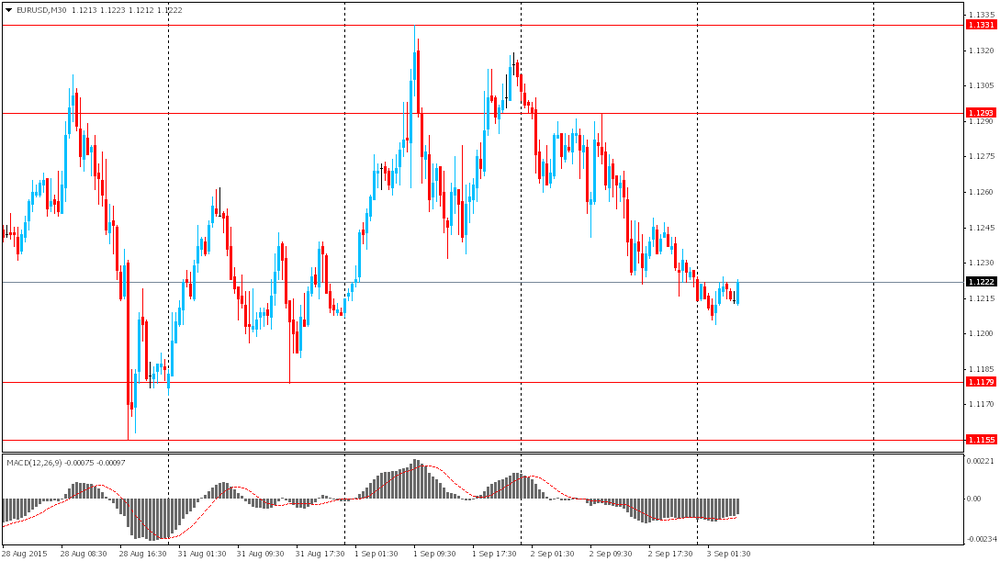

American focus: the euro fell sharply

The euro fell sharply against the US dollar after the European Central Bank has shown a willingness to introduce additional measures to stimulate the European economy.

Since March the ECB to buy government bonds worth about 60 billion euros a month, trying to stimulate inflation and economic growth in the euro area by increasing the money supply. However, the weak inflation data and a disappointing outlook for economic growth could force the central bank to extend the program of quantitative easing before the end of this year.

According to analysts based on comments from ECB President Mario Draghi, who have demonstrated a tendency to mitigate the monetary policy. In his remarks Draghi stressed "the willingness of the central bank to act if necessary." Thus, we can expect that the ECB will continue to undertake further efforts to achieve their goals.

Despite the ECB's program of quantitative easing, the euro has steadily increased over the past few months.

The weakening of the single currency could help European exporters by making their goods more affordable for overseas buyers.

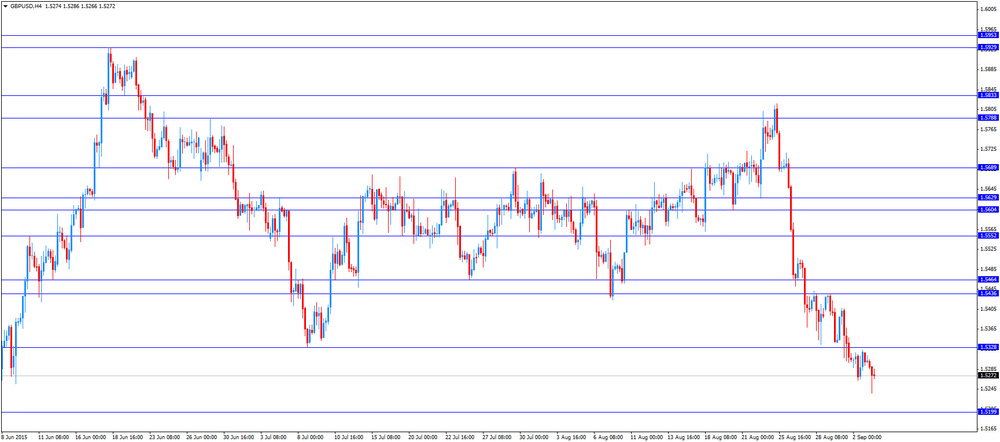

The pound fell against the dollar, updating the yesterday's low, which was caused by the publication of weak data on PMI Britain. The research results, published by Markit Economics, showed that last month the UK service sector recorded its weakest rate of expansion more than two years, reflecting signs of economic weakness in the United States and China. The report says that the purchasing managers' index for the service industry fell in August to its lowest level since May 2013, amounted to 55.6 points. Recall that in July figure was at 57.4 points. Analysts believe that the index will rise to the level of 57.6 points. However, it should be emphasized, the rate remains above the 50 mark for 32 consecutive months, which is the second long-term series since the beginning of this statistic, namely July 1996. Despite the slowdown, the company services sector again increased the number of employees in August and at a faster pace than in July. However, the pace of job creation was slower than the average for the first half of 2015. Also, the data showed that input price inflation fell for the third month in a row, while selling prices rose slightly.

The by Markit said that given the latest statistics, the rate of economic growth in the UK is likely to slow to 0.5 percent in the three months to September, against 0.7 percent in the second quarter. "Even after taking into account the usual seasonal influences, in August, noted unexpected sharp slowdown in economic growth," - said the chief economist at Markit Chris Williamson.

The Canadian dollar rose after the data on the trade balance strany.Otchet published statistical agencies of Canada, showed that the trade deficit narrowed in July, in spite of expected gains, which increased hopes for economic recovery after a weak first half.

As it became known, the volume of Canadian exports rose in July by 2.3% and was mainly concentrated in the sector of non-energy goods. Excluding energy, exports increased by 4.0%. On the other hand, imports increased by 1.7%. As a result, the merchandise trade deficit with the rest of the world declined from 0.811 million. Canadian dollars to 0.593 million. Canadian dollars. It was expected that the deficit will expand to 1.3 billion. Canadian dollars.

Exports to the other, except for the United States increased by 2.9% to 10.7 billion. Canadian dollars, led by growth in exports to China by 11.7%. Meanwhile, imports from countries other than the United States decreased by 3.1% to 15.1 billion. Canadian dollars. Imports from the UK fell by 40.2%. Consequently, the deficit in trade with other countries except the US, declined in July from 5.2 billion. Canadian dollars to 4.4 billion. Canadian dollars.

Exports to the US increased by 2.1% to 34.7 billion. Canadian dollars. At the same time, imports from the US grew by 4.3% to 30.9 billion. Canadian dollars. As a result, the trade surplus with the United States in Canada decreased to 3.8 billion. Canadian dollars to 4.4 billion. Canadian dollars in June.

Total exports rose to 45.5 billion. Canadian dollars, reaching a peak with the July 2014 year. Increasing noted in 5 of 11 categories. The main increase in exports accounted for automobiles and parts, consumer goods, as well as aircraft and other transport equipment and parts. Increase in these categories was partially offset by lower exports of energy products.

Exports of vehicles and parts increased by 9.9%, to 7.6 billion. Canadian dollars., While exports of consumer goods rose by 7.3%, reaching a record $ 6.4 billion. Canadian dollars. Exports of goods and other materials rose by $ 619 million., To 1.4 billion. Canadian dollars. Sending planes, other transport equipment and spare parts increased by 19.2% to 2.4 billion. Canadian dollars. Meanwhile, exports of energy products fell 5.7%, to 7.3 billion. Canadian dollars.

Total imports rose to $ 46.1 billion. In July. Growth was observed in 8 of 11 categories. Increased imports of energy products, aircraft and other vehicles and spare parts, as well as electronic and electrical equipment and spare parts were partially offset by a decrease in imports of metals and non-metallic mineral products.

-

17:14

International Monetary Fund: the slowdown in the Chinese economy could have a negative impact on the global economic growth

The International Monetary Fund (IMF) said on Thursday that the slowdown in the Chinese economy could have a negative impact on the global economic growth. The lender noted that the problems in China could lead to a weaker growth outlook. But the IMF still expects the global economy to expand by 3.3% this year.

According to the IMF, the Fed should remain data-dependent and the interest rate hike should be gradual.

The lender noted that the European Central Bank should be ready to extend its asset buying programme if there is not sufficient improvement in inflation, while the Bank of Japan should also be ready ease its monetary policy further.

The IMF pointed out that the Chinese monetary policy should achieve a smooth transition to more sustainable growth.

-

16:57

European Central Bank President Mario Draghi: there are new downside risks to growth and inflation

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Recovery in the Eurozone continued, but at a weaker pace than expected;

- The central bank could extend its asset buying programme if needed;

- A slowdown in the Chinese economy will have a negative impact on the global trade and on the stock markets;

- There are new downside risks to growth and inflation;

- The weaker inflation outlook was due to "transitory effects";

- The limit on sovereign bond ownership by the central bank will be raised to 33% from 25%.

- Recovery in the Eurozone continued, but at a weaker pace than expected;

-

16:32

ISM non-manufacturing purchasing managers’ index falls to 59.0 in August

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Thursday. The index fell to 59.0 in August from 60.3 in July, beating expectations for an increase to 58.1.

A reading above 50 indicates a growth in the service sector.

The decline was driven by falls in prices paid, employment and new orders.

The business activity/production index declined to 63.9 in August from 64.9 in July.

The ISM's new orders index decreased to 63.4 in August from 63.8 in July.

The ISM's employment index declined to 56.0 in August from 59.6 in July.

The prices paid index dropped to 50.8 in August from 53.7 in July, the lowest level since April.

-

16:18

Final Markit/Nikkei services purchasing managers' index for Japan increases to 53.7 in August

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan increased to 53.7 in August from 51.2 in July.

A reading below 50 indicates contraction of activity.

The index was driven by a rise new business, while cost pressures eased.

"Activity growth accelerated to the strongest since October 2013, underpinned by a solid increase in new orders. In contrast, employment levels declined, offsetting the slight increase seen at the start of Q3. That said, the rate of job shedding was marginal," economist at Markit, Amy Brownbill, said.

-

16:00

U.S.: ISM Non-Manufacturing, August 59 (forecast 58.1)

-

15:57

Makit’s final U.S. services PMI is up to 56.1 in August

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Thursday. The final U.S. services PMI rose to 56.1 in August from 55.7 in July, up from the preliminary reading of 55.2.

A reading over 50 indicates expansion in the sector.

The increase was driven by a faster pace in new business.

"The US economy is enjoying a solid third quarter, with robust survey readings so far pointing to 2.5% annualised GDP growth. Employment growth is also holding up well, with PMI surveys signalling another month of non-farm payroll growth in excess of 200,000 in August," Markit Economics Chief Economist Chris Williamson noted.

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E941mn), $1.1100(E876mn), $1.1350(E215mn), $1.1500(E490mn)

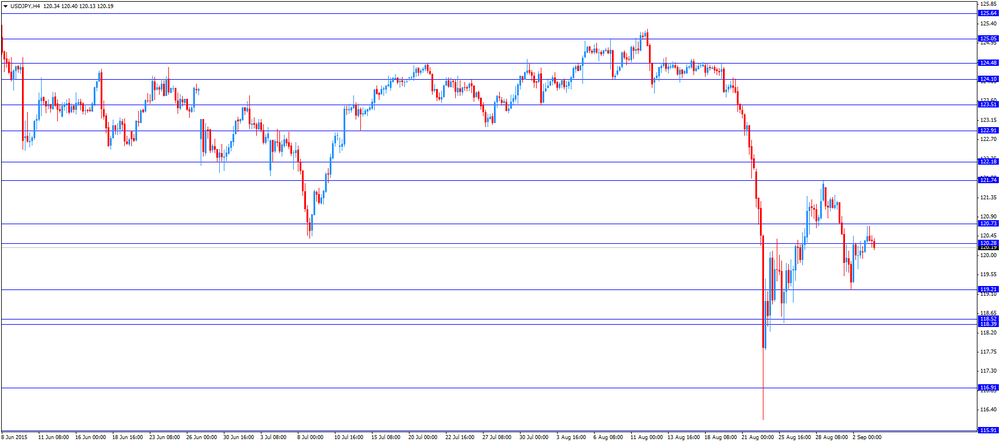

USD/JPY: Y120.45($305mn), Y121.00-05($503mn), Y121.75($766mn), Y122.50($550mn), Y123.00($358mn), Y123.25($616mn)

EUR/JPY: Y135.00(E250mn)

GBP/USD: $1.5440(Gbp200mn)

AUD/USD: $0.7000(A$130mn), $0.7120(A$157mn)

USD/CAD: C$1.3150($686mn), C$1.3190($640mn), C$1.3450($1.09bn)

-

15:45

U.S.: Services PMI, August 56.1 (forecast 55.2)

-

15:35

European Central Bank keeps its interest rate unchanged at 0.05%

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

-

15:28

The European Central Bank (ECB) lowers the amount of emergency funding (ELA) to Greek banks to €89.1 billion from €89.7 billion on Thursday

-

15:14

European Central Bank cuts its economic growth and inflation forecasts

The European Central Bank (ECB) lowered its economic growth and inflation forecasts. Eurozone's economy is expected to expand 1.4% in 2015, down from the previous estimate of a 1.5% gain, 1.7% in 2016, down from the previous estimate of a 1.9% rise, and 1.8% in 2017, down from the previous estimate of a 2.0% increase.

Eurozone's inflation is expected to rise 0.1% in 2015, down from the previous estimate of a 0.3% gain, 1.1% in 2016, down from the previous estimate of a 1.5% rise, and 1.7% in 2017, down from the previous estimate of a 1.8% increase.

-

14:57

U.S. trade deficit narrows to $41.86 billion in July

The U.S. Commerce Department released the trade data on Thursday. The U.S. trade deficit narrowed to $41.86 billion in July from a deficit of $45.21 billion in June. June's figure was revised up from a deficit of $43.84 billion.

Analysts had expected a trade deficit of $42.4 billion.

The decline of a deficit was driven by a rise in exports. Exports were by 0.4% in July, while imports decreased by 1.1%.

Exports to Canada were down 8.3%, while exports to China declined by 1.9%.

Imports from China fell 0.2% in July.

-

14:47

Initial jobless claims rise by 12,000 to 282,000 in the week ending August 29

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 29 in the U.S. rose by 12,000 to 282,000 from 270,000 in the previous week. The previous week's figure was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 9,000 to 2,257,000 in the week ended August 22.

-

14:41

Canada's trade deficit narrows to C$0.53 billion in July

Statistics Canada released the trade data on Thursday. Canada's trade deficit narrowed to C$0.53 billion in July from a deficit of C$0.81 billion in June. June's figure was revised down from a deficit of C$0.48 billion.

Analysts had expected a trade deficit of C$1.3 billion.

The decrease in deficit was driven by an increase in exports. Exports increased 2.3% in July.

Exports of energy products dropped by 5.7% in July, exports of consumer goods jumped 7.3%, exports of motor vehicles and parts soared 9.9%, while exports of aircraft and other transportation equipment and parts were up 19.2%.

Imports climbed 1.7% in July.

Imports of aircraft and other transportation equipment and parts jumped by 22.9% in July, imports of metal and non-metallic mineral products dropped 9.6%, while imports of energy products soared 12.9%.

-

14:30

U.S.: Initial Jobless Claims, August 282 (forecast 275)

-

14:30

Canada: Trade balance, billions, July -0.59 (forecast -1.3)

-

14:30

U.S.: International Trade, bln, July -41.86 (forecast -42.4)

-

14:30

U.S.: Continuing Jobless Claims, August 2257 (forecast 2250)

-

14:27

France’s unemployment rate remains unchanged at 10.3% in the second quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France remained unchanged at 10.3% in the second quarter.

The number of unemployed people in France was 2.9 million.

The number of unemployed people under 24 years fell by 0.6% to 23.4% in the second quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

14:20

Italy’s services PMI rises to 54.6 in August, the highest level since March 2010

Markit/ADACI's services purchasing managers' index (PMI) for Italy climbed to 54.6 in August from 52.0 in July. It was the highest level since March 2010.

A reading above 50 indicates expansion in the sector.

The increase was driven by a rise in employment and new business.

"Data showed companies in the service sector creating jobs again after a brief hiatus during July, encouraged by growth in their backlogs of work. A slower increase in new business and a deterioration in companies' future expectations pose some downside risks to the pace of growth in the near-term, however," an economist at Markit Phil Smith said.

-

14:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the European Central Bank's (ECB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M July 0.6% Revised From 0.7% 0.4% -0.1%

01:30 Australia Trade Balance July -3.05 Revised From -2.93 -3.1 -2.46

07:50 France Services PMI (Finally) August 52 51.8 50.6

07:55 Germany Services PMI (Finally) August 53.8 53.6 54.9

08:00 Eurozone Services PMI (Finally) August 54 54.3 54.4

08:30 United Kingdom Purchasing Manager Index Services August 57.4 57.6 55.6

09:00 Eurozone Retail Sales (MoM) July -0.2% Revised From -0.6% 0.6% 0.4%

09:00 Eurozone Retail Sales (YoY) July 1.7% Revised From 1.2% 2% 2.7%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed to lower against the most major currencies ahead the release of the U.S. economic data. The U.S. trade deficit is expected to narrow to $42.4 billion in July from $43.84 billion in June.

The ISM non-manufacturing purchasing managers' index is expected to decline to 58.1 in August from 60.3 in July.

The number of initial jobless claims in the U.S. is expected to increase by 4,000 to 275,000 last week.

The euro traded mixed against the U.S. dollar after the European Central Bank's (ECB) interest rate decision. The central bank kept its interest rate unchanged at 0.05%.

The ECB's press conference is scheduled to be at 12:30 GMT.

Meanwhile, the economic from the Eurozone was mostly positive. Retail sales in the Eurozone rose 0.4% in July, missing expectations for a 0.6% rise, after a 0.2% decrease in June. June's figure was revised up from a 0.6% drop.

The increase was driven by higher gasoline sales, which rose 0.8% in July.

On a yearly basis, retail sales in the Eurozone climbed 2.7% in July, exceeding forecasts of a 2.0% gain, after a 1.7% increase in June. June's figure was revised up from a 1.2% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in August from 54.0 in July, up from the preliminary reading of 54.3.

The index was driven by rises in new business and business activity.

The British pound traded mixed against the U.S. dollar after the weaker-than-expected services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.6 in August from 57.4 in July, missing expectations for a rise to 57.6. It was the lowest level since May 2013.

The decline was partly driven by a slower growth in business since April 2013.

The Canadian dollar traded mixed against the U.S. dollar ahead the Canadian trade data. The Canadian trade deficit is expected to widen to C$1.3 billion in July from C$0.48 billion in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

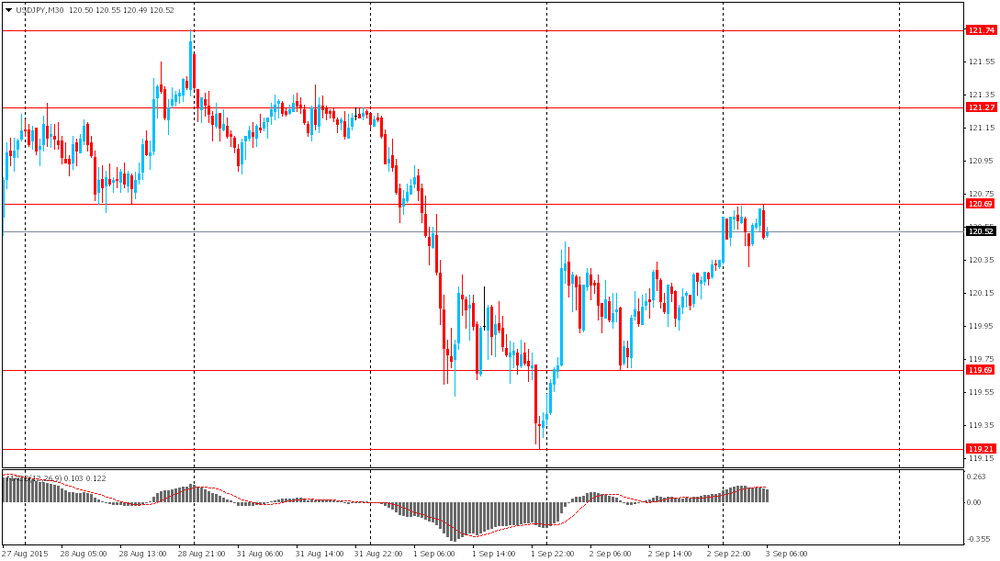

USD/JPY: the currency pair fell to Y120.13

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July -0.48 -1.3

12:30 U.S. International Trade, bln July -43.84 -42.4

12:30 U.S. Initial Jobless Claims August 271 275

13:45 U.S. Services PMI (Finally) August 55.7 55.2

14:00 U.S. ISM Non-Manufacturing August 60.3 58.1

-

14:00

Orders

EUR/USD

Offers 1.1290 1.1300 1.1320 1.1330 1.1340 1.1355-60 1.1400

Bids 1.1200 1.1180 1.1130 1.1120

GBP/USD

Offers 1.5400 1.5410 1.5420 1.5450 1.5480

Bids 1.5220 1.5200 1.5190

EUR/GBP

Offers 0.7395 0.7400 0.7420 0.7445-50

Bids 0.7305 0.7300 0.7280

EUR/JPY

Offers 135.50 136.00 136.50 137.00

Bids 135.00 134.50 134.00 133.50

USD/JPY

Offers 121.00 121.50 122.00

Bids 120.00 119.50 119.10 119.00 118.50

AUD/USD

Offers 0.7050 0.7100 0.7120 0.7200

Bids 0.6950 0.6900 0.6850 0.6800

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

11:55

Eurozone’s retail sales rises 0.4% in July

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone rose 0.4% in July, missing expectations for a 0.6% rise, after a 0.2% decrease in June. June's figure was revised up from a 0.6% drop.

The increase was driven by higher gasoline sales, which rose 0.8% in July.

Food, drinks and tobacco sales were up 0.2% in July, while non-food sales increased 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.7% in July, exceeding forecasts of a 2.0% gain, after a 1.7% increase in June. June's figure was revised up from a 1.2% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 3.1% in July, gasoline sales increased 1.6%, while food, drinks and tobacco sales rose 1.9%.

-

11:48

Spain’s services PMI is down to 59.6 in August

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) fell to 59.6 in August from 59.7 in July.

The index was driven by a weaker increase in input costs and output prices.

New business and employment continued to rise.

"The service sector remained the leading light in terms of Spanish PMI data in August, registering a further strong increase in business activity. We finally saw an easing off in the rate of job creation after it had accelerated in eight successive months, but the improvements in new work that have been recorded throughout the past couple of years are still translating into improvements in the labour market," Senior Economist at Markit Andrew Harker said.

-

11:38

France's final services PMI declines to 50.6 in August

Markit Economics released final services purchasing managers' index (PMI) for France on Thursday. France's final services purchasing managers' index (PMI) dropped to 50.6 in August from 52.0 in July, down from the preliminary reading of 51.8.

The decline was partly driven by a weaker rise in new business and backlogs.

"The French service sector lost further momentum in August, with activity growth slowing to a seven-month low. Prospects for third quarter GDP therefore look softer, following stagnation recorded in the second quarter. The survey's bright spot was the strongest business expectations reading for almost three-and-half years, signalling that companies are becoming a little more hopeful of a revival over the coming year," Senior Economist at Markit Jack Kennedy said.

-

11:22

Germany's final services PMI rises to 54.9 in August

Markit Economics released final services purchasing managers' index (PMI) for Germany on Thursday. Germany's final services purchasing managers' index (PMI) rose 54.9 in August from 53.8 in July, up from the preliminary reading of 53.6.

The index was driven by rises in output, new orders and employment.

"Today's PMI results suggest that Germany's service sector is in good shape. Activity increased at the fastest pace for five months, with hotels and restaurants reporting particularly strong growth. Companies also noted a stronger rise in new business, which in turn encouraged them to further add to their workforce numbers," an economist at Markit, Oliver Kolodseike, said.

-

11:05

Eurozone's final services PMI increases to 54.4 in August

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in August from 54.0 in July, up from the preliminary reading of 54.3.

The index was driven by rises in new business and business activity.

Eurozone's final composite output index rose to 54.3 in August from 53.9 in July, up from the preliminary reading of 54.1.

"Although global economic worries have intensified in recent weeks, the calming of Grexit fears has led to an improvement in the business environment across the Eurozone, pushing the pace of economic growth to its fastest for just over four years in August. The PMI is indicating euro area GDP growth close to 0.4% in the third quarter, a solid albeit unspectacular rate of expansion," Chief Economist at Markit Chris Williamson said.

He added that the upward revision of the index was driven by a stronger in Germany.

-

11:00

Eurozone: Retail Sales (YoY), July 2.7% (forecast 2%)

-

11:00

Eurozone: Retail Sales (MoM), July 0.4% (forecast 0.6%)

-

10:58

UK’s services PMI falls to 55.6 in August, the lowest level since May 2013

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.6 in August from 57.4 in July, missing expectations for a rise to 57.6. It was the lowest level since May 2013.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in business since April 2013.

"Even after allowing for usual seasonal influences, August saw an unexpectedly sharp slowing in the pace of economic growth. The services PMI came in well below even the most pessimistic of economists' forecasts1 and follows disappointing news of a stagnation in the manufacturing sector earlier in the week," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is expected to expand 0.5% in the third quarter, after a 0.7% growth in the second quarter.

-

10:48

Retail sales in Australia decline 0.1% in July

The Australian Bureau of Statistics released its retail sales data on Thursday. Retail sales in Australia declined 0.1% in July, missing expectations for a 0.4% gain, after a 0.6% rise in June. It was the first decline since June 2014.

June's figure was revised down from a 0.7% increase.

The decrease was partly driven by falls in sales of electrical goods and hardware. Sales of electrical goods dropped 3.3% in July, while hardware sales were down 1.4%.

-

10:35

Australia's trade deficit narrows to A$2.46 billion in July

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$2.46 billion in July from A$3.05 billion in June, beating expectations for a rise to a deficit of A$3.1 billion. June's figure was revised up from a deficit of A$2.93 billion.

Exports rose by 0.2% in July, while imports were flat.

-

10:30

United Kingdom: Purchasing Manager Index Services, August 55.6 (forecast 57.6)

-

10:27

Beige Book: several districts report increasing wage pressures

The Federal Reserve released its Beige Book on Wednesday. The Fed said that several districts "reported increasing wage pressures caused by labour market tightening".

Wage pressure could give Fed officials more confidence to start raising its interest rates.

According to the report, 11 of 12 districts reported moderate to modest growth. One district reported a slight growth.

Manufacturing activity was mostly positive.

-

10:00

Eurozone: Services PMI, August 54.4 (forecast 54.3)

-

09:55

Germany: Services PMI, August 54.9 (forecast 53.6)

-

09:50

France: Services PMI, August 50.6 (forecast 51.8)

-

08:29

Options levels on thursday, September 3, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1373 (5112)

$1.1338 (4156)

$1.1285 (5116)

Price at time of writing this review: $1.1226

Support levels (open interest**, contracts):

$1.1182 (3007)

$1.1122 (2630)

$1.1084 (4884)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 88398 contracts, with the maximum number of contracts with strike price $1,1200 (5116);

- Overall open interest on the PUT options with the expiration date September, 4 is 127571 contracts, with the maximum number of contracts with strike price $1,0500 (7885);

- The ratio of PUT/CALL was 1.44 versus 1.43 from the previous trading day according to data from September, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (2518)

$1.5500 (2081)

$1.5401 (660)

Price at time of writing this review: $1.5283

Support levels (open interest**, contracts):

$1.5198 (1459)

$1.5100 (369)

$1.5000 (1343)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30280 contracts, with the maximum number of contracts with strike price $1,5750 (2546);

- Overall open interest on the PUT options with the expiration date September, 4 is 34804 contracts, with the maximum number of contracts with strike price $1,5500 (2732);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from September, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Foreign exchange market. Asian session: the U.S. dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Retail Sales, M/M July 0.6% Revised From 0.7% 0.4% -0.1%

01:30 Australia Trade Balance July -3.05 Revised From -2.93 -3.1 -2.46

The U.S. dollar rose against major currencies and currencies of developing economies ahead of Friday's employment data. The dollar's strength suggests that market participants expect a strong report; this would raise probability of a rate increase by the Federal Reserve this month.

The euro traded against the greenback without a defined dynamics ahead of today's ECB meeting. Economists don't expect the central bank to make any new statements, but it may hint that the asset purchase program will be extended considering changes in global markets.

The Australian dollar fell amid retail sales data. Seasonally adjusted retail sales fell by 0.1% in Australia in July after a 0.6% increase in June, while analysts had expected a +0.4% reading. The Australian Bureau of Statistics has also reported today that the country's trade deficit declined to A$2460 million in July from -A$2933 million reported previously. The actual reading is much smaller than a deficit of A$3160 million expected by economists.

EUR/USD: the pair fluctuated within $1.1205-25 in Asian trade

USD/JPY: the pair traded within Y120.35-70

GBP/USD: the pair traded around $1.5300

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:50 France Services PMI (Finally) August 52 51.8

07:55 Germany Services PMI (Finally) August 53.8 53.6

08:00 Eurozone Services PMI (Finally) August 54 54.3

08:30 United Kingdom Purchasing Manager Index Services August 57.4 57.6

09:00 Eurozone Retail Sales (MoM) July -0.6% 0.6%

09:00 Eurozone Retail Sales (YoY) July 1.2% 2%

11:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July -0.48 -1.3

12:30 U.S. Continuing Jobless Claims August 2269 2250

12:30 U.S. International Trade, bln July -43.84 -42.4

12:30 U.S. Initial Jobless Claims August 271 275

13:45 U.S. Services PMI (Finally) August 55.7 55.2

14:00 U.S. ISM Non-Manufacturing August 60.3 58.1

-

03:31

Australia: Retail Sales, M/M, July -0.1% (forecast 0.4%)

-

03:30

Australia: Trade Balance , July -2.46 (forecast -3.1)

-

01:30

Australia: AIG Services Index, August 55.6

-

00:29

Currencies. Daily history for Sep 2’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1224 -0,76%

GBP/USD $1,5300 -0,03%

USD/CHF Chf0,9692 +1,07%

USD/JPY Y120,35 +0,81%

EUR/JPY Y135,08 +0,05%

GBP/JPY Y184,12 +0,78%

AUD/USD $0,7040 +0,38%

NZD/USD $0,6353 +0,27%

USD/CAD C$1,3266 +0,14%

-

00:00

Schedule for today,Thursday, Sep 3’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Retail Sales, M/M July 0.7% 0.4%

01:30 Australia Trade Balance July -2.93 -3.1

07:50 France Services PMI (Finally) August 52 51.8

07:55 Germany Services PMI (Finally) August 53.8 53.6

08:00 Eurozone Services PMI (Finally) August 54 54.3

08:30 United Kingdom Purchasing Manager Index Services August 57.4 57.6

09:00 Eurozone Retail Sales (MoM) July -0.6% 0.6%

09:00 Eurozone Retail Sales (YoY) July 1.2% 2%

11:45 Eurozone ECB Interest Rate Decision 0.05%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July -0.48 -1.3

12:30 U.S. Continuing Jobless Claims August 2269 2250

12:30 U.S. International Trade, bln July -43.84 -42.4

12:30 U.S. Initial Jobless Claims August 271 275

13:45 U.S. Services PMI(Finally) August 55.7 55.2

14:00 U.S. ISM Non-Manufacturing August 60.3 58.1

-