Noticias del mercado

-

17:42

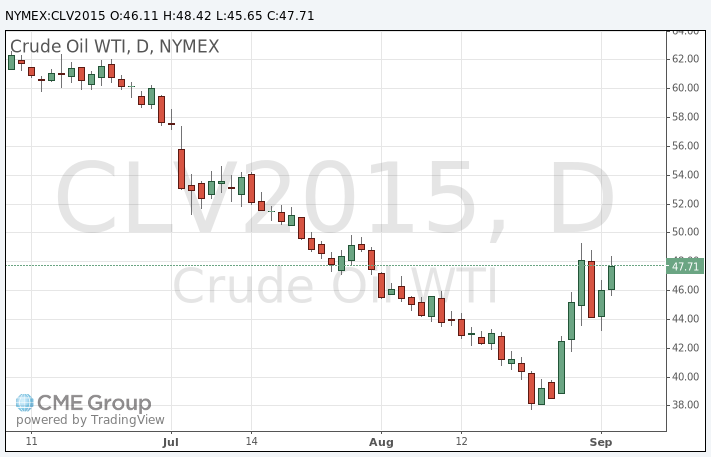

Oil prices rises as the stock markets increased on comments by the European Central Bank President Mario Draghi

Oil prices rose as the stock markets increased on comments by the European Central Bank (ECB) President Mario Draghi. He said that the central bank could extend its asset buying programme if needed, adding that the limit on sovereign bond ownership by the central bank will be raised to 33% from 25%.

The ECB lowered its economic growth and inflation forecasts.

A slowdown in the Chinese economy weighed on oil prices in the recent days. But the stock markets in China were closed for a public holiday today.

Oil prices declined on the U.S. crude oil inventories data yesterday. U.S. crude inventories climbed by 4.67 million barrels to 455.4 million in the week to August 28. It was the biggest one-week increase since April. Analysts had expected U.S. crude oil inventories to decline by 1.5 million barrels.

WTI crude oil for October delivery increased to $48.42 a barrel on the New York Mercantile Exchange.

Brent crude oil for October rose to $51.41 a barrel on ICE Futures Europe.

-

17:27

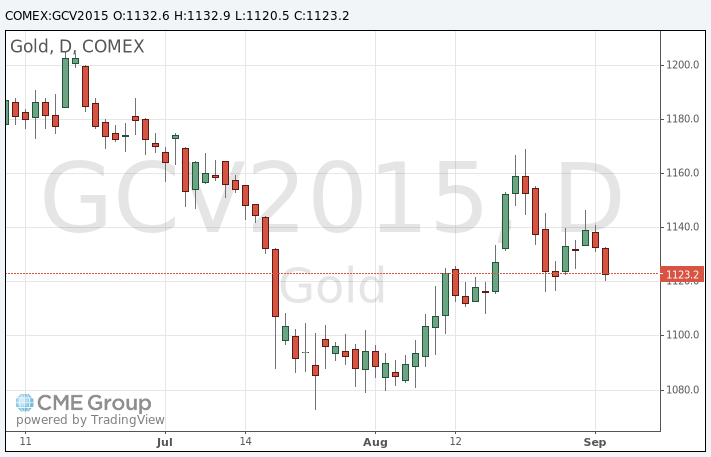

Gold price falls as the U.S. dollar increased on comments by the European Central Bank President Mario Draghi

Gold price fell as the U.S. dollar increased on comments by the European Central Bank (ECB) President Mario Draghi. He said that the central bank could extend its asset buying programme if needed, adding that the limit on sovereign bond ownership by the central bank will be raised to 33% from 25%.

The ECB lowered its economic growth and inflation forecasts.

The number of initial jobless claims in the week ending August 29 in the U.S. rose by 12,000 to 282,000 from 270,000 in the previous week. The previous week's figure was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Market participants are awaiting the release of the U.S. labour market. Official labour market data will be released tomorrow. Analysts expect that U.S. unemployment rate is expected to decline to 5.2% in August from 5.3% in July. The U.S. economy is expected to add 220,000 jobs in August, after adding 215,000 jobs in July.

October futures for gold on the COMEX today fell to 1120.50 dollars per ounce.

-

10:18

Iran’s Oil Minister Bijan Namdar Zanganeh: most OPEC members would like to see oil prices at $70 to $80 a barrel

Iran's Oil Minister Bijan Namdar Zanganeh said in an interview on Wednesday that most OPEC members would like to see oil prices at $70 to $80 a barrel.

He pointed out that Iran plans to boost its oil output despite the low oil prices as U.S. oil producer increased their activity.

"Some Opec members believed last year that lower prices could push expensive oil from the market. For some months we witnessed the exit of rigs from shale oil, now all of them are returning to these fields and their level of shale oil production didn't change considerably," Zanganeh said.

-

10:11

China may launch a global crude oil futures contract in October

China may launch a global crude oil futures contract in October. The new contract should compete with the London Brent and the U.S. WTI benchmarks, and boost the use of the yuan.

The Shanghai International Energy Exchange (INE) sent a draft of the contract to market participants last month.

The Chinese government approved the futures contract last year.

-

08:55

Oil prices declined amid mixed data

West Texas Intermediate futures for October delivery slid to $46.06 (-0.41%), while Brent crude declined to $50.19 (-0.61%) amid a mixed report from the Energy Information Administration. Data released on Wednesday showed that U.S. commercial crude stocks rose 4.7 million barrels to 455.4 million barrels in the week ended August 28. At the same time crude output fell 119,000 barrels to 9.22 million a day. Gasoline inventories fell 300,000 barrels to 214.2 million.

Analysts said that a looming rate hike by the Federal Reserve continues to weigh on oil. That's why investors will watch tomorrow's jobs report closely. This report is a key indicator of conditions of the U.S. labor market.

Some experts say that oil fundamentals are unlikely to change for the better as demand is seasonally weak.

-

08:28

Gold declined ahead of U.S. jobs data

Gold slid to $1,132.00 (-0.14%) as the dollar strengthened ahead of U.S. non-farm payrolls data, which are supposed to shed light on prospects of interest rates in the U.S. Higher rates would harm the non-interest bearing precious metal.

"Gold is awaiting the payroll data for indications of Fed intentions at the September FOMC meeting. So the market may move sideways until the numbers are released," said HSBC analyst James Steel.

Gold prices are also going to be under pressure, because Chinese buyers have left markets for holidays.

-

00:32

Commodities. Daily history for Sep 2’2015:

(raw materials / closing price /% change)

Oil 46.00 -0.54%

Gold 1,133.10 -0.04%

-