Noticias del mercado

-

17:41

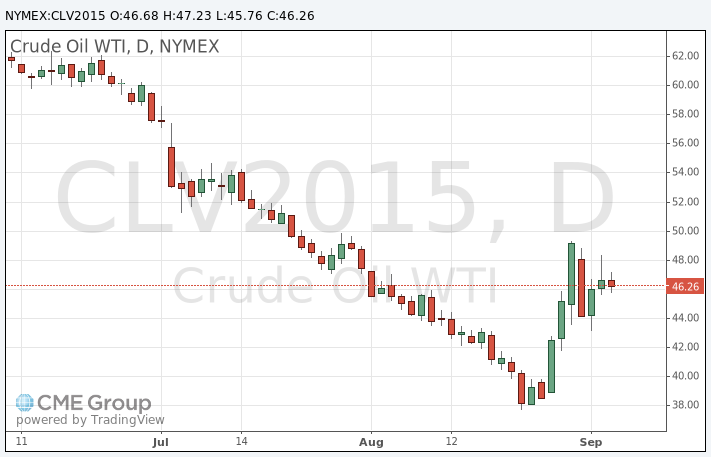

Oil prices decrease after the release of the U.S. labour market data

Oil prices declined after the release of the U.S. labour market data. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The activity in the market may be limited on Friday, according to analysts. Chinese markets were closed for a public holiday today. U.S. markets will be closed for a Labour Day holiday on Monday.

Concerns over the global oil oversupply continue to weigh on oil prices.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 1 rigs to 675 last week. It was the sixth consecutive increase.

WTI crude oil for October delivery declined to $45.76 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $50.43 a barrel on ICE Futures Europe.

-

17:20

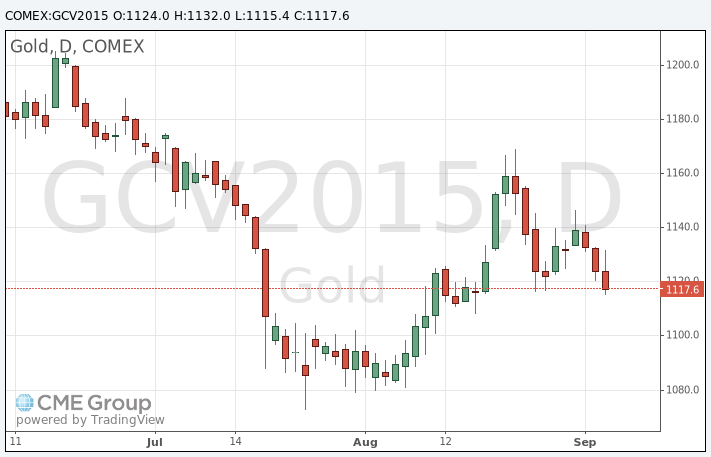

Gold price declines on the uncertainty over the interest rate hike by the Fed this month

Gold price decreased on the uncertainty over the interest rate hike by the Fed this month. The U.S. Labor Department released the labour market data today. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The labour-force participation rate remained unchanged at 62.6% in August. It was the lowest level since October 1977.

These figures could mean that the Fed will not raise its interest rate this month.

October futures for gold on the COMEX today fell to 1115.40 dollars per ounce.

-

15:44

Fitch Ratings expects the economy in China to grow in the second half of the year

Fitch Ratings said in its report "China's New Normal" on Friday that it expects the economy in China to grow in the second half of the year. But the agency added that the growth potential in the medium term is lower.

"Pessimism over China's short-term outlook is overdone and a growth pick-up in the second half is already in the pipeline," Fitch said.

The Chinese economy could expand about 5% on average over 2016-2020, according to Fitch.

"Fitch also expects more volatility around the new normal of slower growth, both in real economic activity and in financial markets," the agency said.

-

15:01

U.S. unemployment rate declines to 5.1% in August, 173,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The increase was partly driven by a rise in health care and social assistance employment. Health care and social assistance sector added 56,000 jobs in August, construction added 3,000 jobs, while the manufacturing sector lost 17,000 jobs.

Financial activities sector rose by 19,000 jobs in August, professional and business services sector added 33,000 jobs, while mining and logging sector shed 10,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The labour-force participation rate remained unchanged at 62.6% in August. It was the lowest level since October 1977.

These figures could mean that the Fed will not raise its interest rate this month.

-

10:18

Saudi Arabia plans to lower selling prices for exports to Europe and North America in October

Saudi Arabia plans to lower selling prices for exports to Europe and North America in October. State-owned Saudi Arabian Oil Company (Saudi Aramco) has already lowered its official selling prices to U.S. buyers by 55 and 60 cents for Arab Medium and light crude oil respectively.

According to Bloomberg, Saudi Arabia reduced its oil production to 10.5 million barrels per day in August. It was the first reduction in 2015.

-

09:12

Oil prices declined

West Texas Intermediate futures for October delivery fell to $46.08 (-1.43%), while Brent crude declined to $49.95 (-1.44%) ahead of U.S. employment data, which could set a direction for oil prices depending on its impact on the greenback. The report is due today 12:30 GMT.

Saudi King Salman will meet with U.S. President Barack Obama in Washington on Friday to discuss Iran nuclear deal and conflicts in the Middle East. This will be the first visit of the king to the United States since ascending to the throne in January.

-

08:56

Gold steady ahead of U.S. jobs data

Gold is currently at $1,124.40 (-0.01%). The precious metal headed for a second weekly drop as the dollar gained after European Central Bank meeting. ECB President Mario Draghi said that the bank will expand stimulus by allowing officials to buy higher proportions of each euro area member's debt.

Investors are waiting for U.S. payrolls data to assess strength of the U.S. labor market, which matters for Fed officials a lot when it comes to interest rates decisions.

Gold's declines in terms of the U.S. dollar weighed on gold mining in the U.S. The US Geological Survey showed that the country's gold production (world's fourth largest producer) fell 10% to 76.9 tonnes in the January-May period compared to the same five months last year.

-

00:33

Commodities. Daily history for Sep 3’2015:

(raw materials / closing price /% change)

Oil 46.69 -0.13%

Gold 1,124.50 0.00%

-