Noticias del mercado

-

21:00

DJIA 16083.84 -290.92 -1.78%, NASDAQ 4680.10 -53.39 -1.13%, S&P 500 1919.45 -31.68 -1.62%

-

18:02

WSE: Session Results

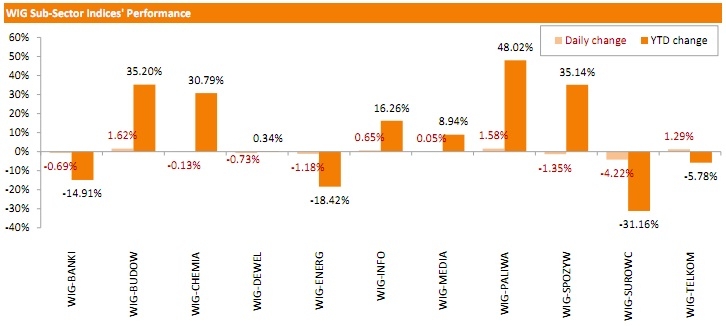

Polish equities shed on Friday. The broad market measure, the WIG Index, fell by 0.36%. Sector-wise, materials (-4.22%) posted the steepest losses, while constructions (+1.62%) fared the best.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.3%. In the index basket, KGHM (WSE: KGH) was the poorest performer, slumping 4.84% on tumbling copper prices. It was followed by ENEA (WSE: ENA), PGNIG (WSE: PGN) and BORYSZEW (WSE: BRS), plunging 3.77%, 3.34% and 3.11% respectively. On the plus side, PKN ORLEN (WSE: PKN) and LPP (WSE: LPP) posted the best gains, returning 4.12% and 2.88% respectively.

-

18:00

European stocks closed: FTSE 6055.02 -139.08 -2.25%, DAX 10057.01 -260.83 -2.53%, CAC 40 4530.97 -122.82 -2.64%

-

18:00

European stocks close: stocks closed lower after the mixed U.S. labour market data

Stock indices closed lower after the mixed U.S. labour market data. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

It remains unclear if the Fed starts raising its interest rate this month.

Meanwhile, the economic data from the Eurozone was mostly negative. Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) slid to 51.4 in August from 54.2 in July.

A reading above 50 indicates expansion in the sector.

Sales in Germany increased, while sales in France and Italy declined.

"There was some payback, though the PMI indices for year-on-year sales and gross margins remained close to their recent highs, pointing to solid underlying trends," an economist at Markit, Phil Smith, said.

German seasonal adjusted factory orders dropped 1.4% in July, missing expectations for a 0.6% decline, after a 1.8% rise in June. June's figure was revised down from a 2.0% increase.

The decline was driven by a drop in foreign orders. Foreign orders plunged by 5.2% in July, while domestic orders increased by 4.1%.

New orders from the Eurozone rose 2.2% in July, while orders from other countries slid 9.5%.

French consumer confidence index remained unchanged at 93 in August, missing expectation for a rise to 94.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,042.92 -151.18 -2.44 %

DAX 10,038.04 -279.80 -2.71 %

CAC 40 4,523.08 -130.71 -2.81 %

-

17:28

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday as investors assessed August jobs data, which showed that fewer-than-expected jobs were added to the economy even as unemployment rate dropped to its lowest in more than seven years. Non farm payrolls increased 173,000 last month after an upwardly revised 245,000 rise in July and below the 220,000 that economists polled by Reuters had expected. Unemployment rate dropped to 5.1 percent and wages accelerated. The report underscored the U.S. economy's steady recovery in the face of volatile global financial markets and China's slowing growth, and kept alive the prospect of the U.S. Federal Reserve raising rates at its Sept. 16-17 meeting.

All Dow stocks in negative area (30 of 30). Top looser - JPMorgan Chase & Co. (JPM, -2.57%).

All S&P index sectors also in negative area. Top looser - Basic Materials (-2.1%).

At the moment:

Dow 16112.00 -236.00 -1.44%

S&P 500 1922.25 -23.75 -1.22%

Nasdaq 100 4185.50 -44.00 -1.04%

10 Year yield 2,13% -0,04

Oil 46.14 -0.61 -1.30%

Gold 1120.10 -4.40 -0.39%

-

17:05

Germany's retail PMI falls to 54.7 in August

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail purchasing managers' index (PMI) declined 54.7 in August from 57.7 in July.

The decline was driven by a weak wholesale price inflation

"Sales continued to increase solidly, despite the rate of growth easing from July's multi-year high, and companies are optimistic that September's sales will exceed plans," an economist at Markit, Oliver Kolodseike, said.

-

16:24

Canada’s Ivey purchasing managers’ index jumps to 58.0 in August

Canada's seasonally adjusted Ivey purchasing managers' index jumped to 58.0 in August from 52.9 in July. Analysts had expected the index to decrease to 52.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was up 48.2 in August from 47.6 in July, while employment index climbed to 56.3 in August from 49.1 in July.

The prices index was rose to 66.3 in August from 61.7 in July, while inventories increased to 42.4 from 41.2.

-

16:07

Richmond Fed President Jeffrey Lacker: the Fed should start raising its interest rate

Richmond Fed President Jeffrey Lacker said on Friday that the Fed should start raising its interest rate.

"I am not arguing that the economy is perfect, but nor is it on the ropes, requiring zero interest rates to get it back into the ring. It's time to align our monetary policy with the significant progress we have made," he said.

Richmond Fed president noted that the impact on the U.S. economy from the recent market turbulences is limited.

Lacker is a voting member of the Federal Open Market Committee this year.

-

15:44

Fitch Ratings expects the economy in China to grow in the second half of the year

Fitch Ratings said in its report "China's New Normal" on Friday that it expects the economy in China to grow in the second half of the year. But the agency added that the growth potential in the medium term is lower.

"Pessimism over China's short-term outlook is overdone and a growth pick-up in the second half is already in the pipeline," Fitch said.

The Chinese economy could expand about 5% on average over 2016-2020, according to Fitch.

"Fitch also expects more volatility around the new normal of slower growth, both in real economic activity and in financial markets," the agency said.

-

15:36

U.S. Stocks open: Dow -1.34%, Nasdaq -1.21%, S&P -1.27%

-

15:31

Former Bundesbank President Axel Weber: the ECB with its monetary policy actions has assumed responsibility to buy time

Former Bundesbank President Axel Weber said on Thursday that the ECB with its monetary policy actions has assumed responsibility to buy time, but it is nothing done.

He also said that he believes that the Fed is likely to raise its interest rates in September.

-

15:29

Before the bell: S&P futures -1.58%, NASDAQ futures -1.49%

U.S. equity futures extended losses as August payrolls data spurred expectations the Federal Reserve will raise interest rates when it meets this month.

Global Stocks:

Nikkei 17,792.16 -390.23 -2.15%

FTSE 6,053.54 -140.56 -2.27%

CAC 4,508.5 -145.29 -3.12%

DAX 10,012.46 -305.38 -2.96%

China stocks were closed today.

Crude oil $46.55 (-0.41%)

Gold $1128.20 (+0.31%)

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

6.50

0.31%

20.0K

UnitedHealth Group Inc

UNH

113.89

-0.09%

0.1K

Wal-Mart Stores Inc

WMT

64.67

-0.29%

4.6K

Facebook, Inc.

FB

87.85

-0.34%

54.8K

General Motors Company, NYSE

GM

29.00

-0.38%

0.4K

AT&T Inc

T

32.88

-0.48%

1.3K

ALCOA INC.

AA

9.52

-0.52%

22.2K

E. I. du Pont de Nemours and Co

DD

50.26

-0.59%

0.1K

McDonald's Corp

MCD

95.44

-0.59%

2.5K

Hewlett-Packard Co.

HPQ

27.79

-0.59%

1.8K

Yandex N.V., NASDAQ

YNDX

11.67

-0.60%

1.0K

ALTRIA GROUP INC.

MO

53.20

-0.73%

3.4K

Pfizer Inc

PFE

31.65

-0.75%

5.4K

Citigroup Inc., NYSE

C

51.40

-0.75%

9.5K

JPMorgan Chase and Co

JPM

62.20

-0.77%

0.6K

Twitter, Inc., NYSE

TWTR

28.08

-0.78%

33.7K

Boeing Co

BA

129.99

-0.79%

5.7K

Apple Inc.

AAPL

109.50

-0.79%

293.9K

Travelers Companies Inc

TRV

98.58

-0.80%

2.2K

Johnson & Johnson

JNJ

91.88

-0.82%

11.4K

United Technologies Corp

UTX

91.14

-0.84%

2.6K

General Electric Co

GE

24.30

-0.86%

1.4K

Walt Disney Co

DIS

101.08

-0.89%

10.0K

Verizon Communications Inc

VZ

45.30

-0.92%

3.3K

Exxon Mobil Corp

XOM

73.08

-0.96%

1.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.03

-0.99%

48.6K

American Express Co

AXP

74.50

-1.01%

1.4K

Ford Motor Co.

F

13.70

-1.01%

7.2K

Microsoft Corp

MSFT

43.05

-1.03%

4.3K

Google Inc.

GOOG

600.00

-1.03%

1.7K

Procter & Gamble Co

PG

69.20

-1.04%

0.2K

Nike

NKE

109.67

-1.06%

6.0K

Chevron Corp

CVX

77.42

-1.07%

38.0K

Goldman Sachs

GS

183.00

-1.11%

1.2K

Cisco Systems Inc

CSCO

25.61

-1.12%

0.7K

Amazon.com Inc., NASDAQ

AMZN

499.06

-1.12%

3.2K

Intel Corp

INTC

28.75

-1.13%

10.4K

Visa

V

69.60

-1.14%

1.1K

Home Depot Inc

HD

115.25

-1.16%

0.3K

International Business Machines Co...

IBM

145.00

-1.21%

0.6K

Merck & Co Inc

MRK

52.00

-1.23%

3.8K

Yahoo! Inc., NASDAQ

YHOO

32.12

-1.29%

4.9K

Caterpillar Inc

CAT

73.35

-1.48%

13.3K

Starbucks Corporation, NASDAQ

SBUX

53.85

-1.54%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

241.50

-1.66%

29.2K

-

15:01

U.S. unemployment rate declines to 5.1% in August, 173,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The increase was partly driven by a rise in health care and social assistance employment. Health care and social assistance sector added 56,000 jobs in August, construction added 3,000 jobs, while the manufacturing sector lost 17,000 jobs.

Financial activities sector rose by 19,000 jobs in August, professional and business services sector added 33,000 jobs, while mining and logging sector shed 10,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The labour-force participation rate remained unchanged at 62.6% in August. It was the lowest level since October 1977.

These figures could mean that the Fed will not raise its interest rate this month.

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Caterpillar (CAT) downgraded to Neutral from Outperform at Robert W. Baird, target lowered to $77 from $89

Other:

-

14:44

Canada’s economy adds 12,000 jobs in August, but the unemployment rate rises to 7.0%

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.0% in August from 6.8% in July. Analysts had expected the unemployment rate to remain unchanged at 6.8%.

The increase was driven by higher labour participation. The labour participation rate increased to 65.9% in August from 65.7% in July.

The number of employed people climbed by 12,000 jobs in August, beating expectations for a decline of 4,500 jobs, after a 6,600 increase in July.

The increase was driven by a rise in full-time work. Full-time employment was up by 54,000 in August, while part-time employment fell by 42,000 jobs.

The Bank of Canada monitors closely the labour participation rate.

-

14:19

Germany's construction PMI falls to 50.3 in August

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction purchasing managers' index (PMI) fell to 50.3 in August from 50.6 in July.

A reading above 50 indicates expansion in the sector.

The index was driven by a drop in new orders and as constructors expect activity to fall in the next 12 months.

"The marginal increase in overall construction output was attributed to fractional growth in work on residential and commercial building projects, while civil engineering activity contracted at the fastest pace in almost a year. Moreover, companies noted a lack of incoming new business and reported pessimism towards the 12-month outlook for activity," an economist at Markit, Oliver Kolodseike, said.

-

12:03

European stock markets mid session: stocks traded lower ahead of the release of the U.S. labour market data

Stock indices traded lower ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to decline to 5.2% in August from 5.3% in July. The U.S. economy is expected to add 220,000 jobs in August, after adding 215,000 jobs in July.

The better-than-expected U.S. labour market data will add to speculation that the Fed starts raising its interest rate this month.

Meanwhile, the economic data from the Eurozone was mostly negative. Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) slid to 51.4 in August from 54.2 in July.

A reading above 50 indicates expansion in the sector.

Sales in Germany increased, while sales in France and Italy declined.

"There was some payback, though the PMI indices for year-on-year sales and gross margins remained close to their recent highs, pointing to solid underlying trends," an economist at Markit, Phil Smith, said.

German seasonal adjusted factory orders dropped 1.4% in July, missing expectations for a 0.6% decline, after a 1.8% rise in June. June's figure was revised down from a 2.0% increase.

The decline was driven by a drop in foreign orders. Foreign orders plunged by 5.2% in July, while domestic orders increased by 4.1%.

New orders from the Eurozone rose 2.2% in July, while orders from other countries slid 9.5%.

French consumer confidence index remained unchanged at 93 in August, missing expectation for a rise to 94.

Current figures:

Name Price Change Change %

FTSE 100 6,100.88 -93.22 -1.50 %

DAX 10,147.62 -170.22 -1.65 %

CAC 40 4,577.63 -76.16 -1.64 %

-

11:51

European Central Bank Governing Council Member Ewald Nowotny: the inflation in the Eurozone could be negative in the coming months

European Central Bank Governing Council Member Ewald Nowotny: the inflation in the Eurozone could be negative in the coming months

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Friday that the inflation in the Eurozone could be negative in the coming months.

"It is very possible that we in the euro area will in the next month or months get into negative territory once or twice," he said.

But Nowotny pointed out that the central bank does not want to add further stimulus measures in case of small changes.

"The central bank has a mid-term orientation, which means that we don't react to every small change," he noted.

Nowotny added that "there are limits to the effectiveness of monetary policy".

-

11:42

Bundesbank President Jens Weidmann: an expansive monetary policy alone will not be enough to achieve the long-term growth

The Bundesbank President Jens Weidmann said in an interview with Reuters on Friday that an expansive monetary policy alone will not be enough to achieve the long-term growth.

He also said that he did not believe that the recent market turbulences in China will have a significant impact on the global economy, adding that it was "a correction of the earlier dramatic rise in stock prices".

Weidmann noted that he was open to discussion on including the yuan in the International Monetary Fund's (IMF) benchmark currency basket.

"I am open in the discussion about taking the yuan into the IMF currency basket. The currency basket should in principle reflect relative global economic strengths," the Bundesbank president said.

-

11:28

Eurozone's retail PMI falls to 51.4 in August

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) slid to 51.4 in August from 54.2 in July.

A reading above 50 indicates expansion in the sector.

Sales in Germany increased, while sales in France and Italy declined.

"There was some payback, though the PMI indices for year-on-year sales and gross margins remained close to their recent highs, pointing to solid underlying trends," an economist at Markit, Phil Smith, said.

-

11:17

Switzerland’s consumer price inflation plunges 1.4% year-on-year in August, the biggest fall since 1959

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index declined 0.2% in August, in line with expectations, after a 0.1% drop in July.

On a yearly basis, Switzerland's consumer price index decreased to -1.4% in August from -1.3% in July, in line with forecasts. It was the biggest fall since July 1959.

The cost of overall imports slid by 5.5% year-on-year in August.

Low oil prices also weighed on the consumer price inflation.

-

11:07

French consumer confidence index remains unchanged at 93 in July

French statistical office INSEE released its consumer confidence index for France on Friday. French consumer confidence index remained unchanged at 93 in August, missing expectation for a rise to 94.

The index of the outlook on consumers' saving capacity declined to -11 in August from -8 in July.

The index of households' assessment of their financial situation in the past twelve months remained unchanged at -28 in August.

The index of the outlook on consumers' financial situation remained unchanged at -12 in August.

The index of the outlook on unemployment rising in coming months fell to 52 in August from 55 in the previous month.

The index for future inflation expectations decreased to -36 in August from -37 in July.

-

10:55

German seasonal adjusted factory orders drop 1.4% in July

Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders dropped 1.4% in July, missing expectations for a 0.6% decline, after a 1.8% rise in June. June's figure was revised down from a 2.0% increase.

The decline was driven by a drop in foreign orders. Foreign orders plunged by 5.2% in July, while domestic orders increased by 4.1%.

New orders from the Eurozone rose 2.2% in July, while orders from other countries slid 9.5%.

Orders of the intermediate goods fell by 0.2% in July, capital goods orders were down 1.6%, while consumer goods orders decreased 6.3%.

On a yearly basis, factory orders fell by 0.6% in July, after 7% gain in June.

-

10:40

EU Financial Affairs Commissioner Pierre Moscovici: the turbulences in China will not destabilise the European economy

EU Financial Affairs Commissioner Pierre Moscovici said in an interview on Thursday that the turbulences in China will not destabilise the European economy.

"We have seen how monetary authorities, above all in China, have reacted well and have the tools to continue to do so," he said.

Moscovici added that the European economy can benefit from low energy prices and low interest rates.

-

10:33

More employers in the U.S. report that they could not find qualified workers

The U.S. National Federation of Independent Business (NFIB) said on Thursday that small-business owners in the U.S. added a net 0.13 worker per company in August, up from 0.05 in July.

The NFIB surveyed 656 small business owners. More employers reported that they could not find qualified workers.

"This strong a gain sets the stage for a decline in the unemployment rate and indicates that labour markets remain tight with owners having difficulty finding qualified workers," NFIB chief economist William Dunkelberg said.

-

10:11

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 41.4 in the week ended August 30

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 41.4 in in the week ended August 30 from 42.0 the prior week. The measure of views of the economy decreased to 32.7 from 34.6. It was the biggest decline since late February.

The buying climate index fell to 36.9 from 37.2.

The personal finances index was up to 54.6 from 54.3.

-

08:29

Global Stocks: U.S. stock indices posted mixed results

U.S. stock indices traded mixed on Thursday ahead of a key jobs report, which will be released today.

The Dow Jones Industrial Average rose 23.38 points, or 0.1%, to 16,374.76. The S&P 500 added 2.27 points, or 0.1%, to 1,951.13. The Nasdaq Composite lost 16.48 points, or 0.4%, to 4,733.50.

U.S. Department of Labor reported on Thursday that the number of initial jobless claims rose in the week ended August 29, but remained at a historically low level. Initial claims rose by 12,000 to 282,000 on a seasonally adjusted basis. Economists had expected 275,000 claims. The index has been below a psychological level of 300,000 for 26 weeks. However this is the fifth rise in six weeks.

Meanwhile activity in the non-manufacturing sector of the U.S. economy weakened in August. The Non-manufacturing index by the Institute for Supply Management slid to 59.0 from 60.3 reported previously. Analysts expected the index to decline to 58.1.

This morning in Asia Hong Kong Hang Seng lost 0.60%, or 125.44 points, to 20,809.50. The Nikkei fell 2.40%, or 435.97 points, to 17,746.42. Chinese markets are on holiday.

Asian stock indices declined ahead of U.S. payrolls data. According to a median forecast, the U.S. economy generated 220,000 jobs in August compared to +215,000 in July.

-

04:01

Nikkei 225 18,048.88 -133.51 -0.73 %, Topix 1,460.66 -14.32 -0.97 %

-

00:32

Stocks. Daily history for Sep 3’2015:

(index / closing price / change items /% change)

Nikkei 225 18,182.39 +86.99 +0.5 %

S&P/ASX 200 5,027.8 -73.67 -1.4 %

FTSE 100 6,194.1 +110.79 +1.82 %

CAC 40 4,653.79 +98.87 +2.17 %

Xetra DAX 10,317.84 +269.79 +2.68 %

S&P 500 1,951.13 +2.27 +0.12 %

NASDAQ Composite 4,733.5 -16.48 -0.35 %

Dow Jones 16,374.76 +23.38 +0.14 %

-