Noticias del mercado

-

21:00

DJIA 16386.56 35.18 0.22%, NASDAQ 4745.07 -4.91 -0.10%, S&P 500 1953.52 4.66 0.24%

-

18:13

WSE: Session Results

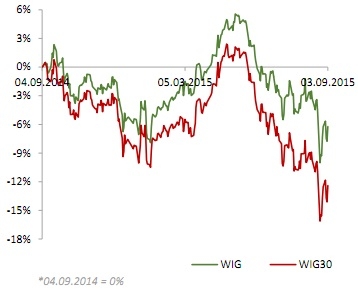

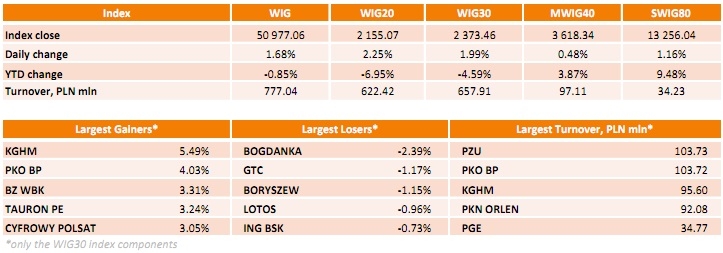

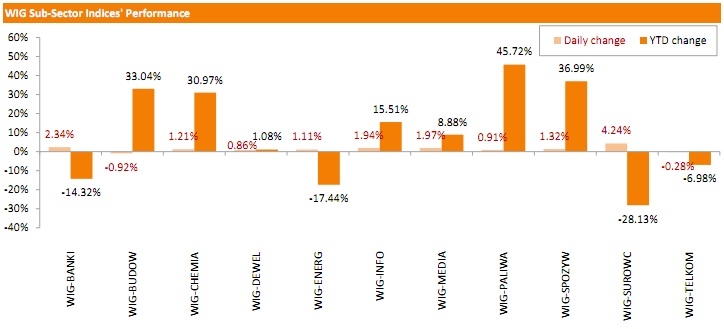

Polish equity market advanced on Thursday. The broad market measure, the WIG Index, surged by 1.68%. Except for constructions (-0.92%) and telecommunications (-0.28%), every sector in the WIG Index gained, with materials (+4.24%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.99%. A majority of the index components returned gains, with the way up led by KGHM (WSE: KGH) and PKO BP (WSE: PKO), climbing 5.49% and 4.03% respectively. They were followed by BZ WBK (WSE: BZW), TAURON PE (WSE: TPE) and CYFROWY POLSAT (WSE: CPS), gaining 3.05%-3.31%. At the same time, the poorest-performing names, including BOGDANKA (WSE: LWB), GTC (WSE: GTC) and BORYSZEW (WSE: BRS), were down by 2.39%, 1.17% and 1.15% respectively.

-

18:00

European stocks closed: FTSE 6194.10 110.79 1.82%, DAX 10317.84 269.79 2.68%, CAC 40 4653.79 98.87 2.17%

-

18:00

European stocks close: stocks closed higher on a possible extension of the ECB’s asset buying programme

Stock indices closed higher on comments by the European Central Bank (ECB) President Mario Draghi. He said that the central bank could extend its asset buying programme if needed, adding that the limit on sovereign bond ownership by the central bank will be raised to 33% from 25%.

The ECB lowered its economic growth and inflation forecasts. Eurozone's economy is expected to expand 1.4% in 2015, down from the previous estimate of a 1.5% gain, 1.7% in 2016, down from the previous estimate of a 1.9% rise, and 1.8% in 2017, down from the previous estimate of a 2.0% increase.

Eurozone's inflation is expected to rise 0.1% in 2015, down from the previous estimate of a 0.3% gain, 1.1% in 2016, down from the previous estimate of a 1.5% rise, and 1.7% in 2017, down from the previous estimate of a 1.8% increase.

The central bank kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

Meanwhile, the economic from the Eurozone was mostly positive. Retail sales in the Eurozone rose 0.4% in July, missing expectations for a 0.6% rise, after a 0.2% decrease in June. June's figure was revised up from a 0.6% drop.

The increase was driven by higher gasoline sales, which rose 0.8% in July.

On a yearly basis, retail sales in the Eurozone climbed 2.7% in July, exceeding forecasts of a 2.0% gain, after a 1.7% increase in June. June's figure was revised up from a 1.2% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in August from 54.0 in July, up from the preliminary reading of 54.3.

The index was driven by rises in new business and business activity.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.6 in August from 57.4 in July, missing expectations for a rise to 57.6. It was the lowest level since May 2013.

The decline was partly driven by a slower growth in business since April 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,194.1 +110.79 +1.82 %

DAX 10,317.84 +269.79 +2.68 %

CAC 40 4,653.79 +98.87 +2.17 %

-

17:41

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday as data pointed to a strengthening U.S. economy and the European Central Bank indicated it could prolong its stimulus program. The ECB also cut its inflation and growth forecasts for the euro zone in the wake of lower oil prices, weaker growth in China and a strengthening euro. Investors, however, were cautious ahead of the critical monthly U.S. jobs report on Friday, which may feed into the Federal Reserve's interest rate decision.

Almost all of Dow stocks in positive area (28 of 30). Top looser - Caterpillar Inc. (CAT, -1.95%). Top gainer - Intel Corporation (INTC, +2.49).

All S&P index sectors also in positive area. Top gainer - Basic materials (+1,5%).

At the moment:

Dow 16494.00 +164.00 +1.00%

S&P 500 1967.00 +20.00 +1.03%

Nasdaq 100 4284.00 +24.00 +0.56%

10 Year yield 2,18% -0,02

Oil 47.62 +1.37 +2.96%

Gold 1123.90 -9.70 -0.86%

-

17:14

International Monetary Fund: the slowdown in the Chinese economy could have a negative impact on the global economic growth

The International Monetary Fund (IMF) said on Thursday that the slowdown in the Chinese economy could have a negative impact on the global economic growth. The lender noted that the problems in China could lead to a weaker growth outlook. But the IMF still expects the global economy to expand by 3.3% this year.

According to the IMF, the Fed should remain data-dependent and the interest rate hike should be gradual.

The lender noted that the European Central Bank should be ready to extend its asset buying programme if there is not sufficient improvement in inflation, while the Bank of Japan should also be ready ease its monetary policy further.

The IMF pointed out that the Chinese monetary policy should achieve a smooth transition to more sustainable growth.

-

16:57

European Central Bank President Mario Draghi: there are new downside risks to growth and inflation

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Recovery in the Eurozone continued, but at a weaker pace than expected;

- The central bank could extend its asset buying programme if needed;

- A slowdown in the Chinese economy will have a negative impact on the global trade and on the stock markets;

- There are new downside risks to growth and inflation;

- The weaker inflation outlook was due to "transitory effects";

- The limit on sovereign bond ownership by the central bank will be raised to 33% from 25%.

- Recovery in the Eurozone continued, but at a weaker pace than expected;

-

16:32

ISM non-manufacturing purchasing managers’ index falls to 59.0 in August

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Thursday. The index fell to 59.0 in August from 60.3 in July, beating expectations for an increase to 58.1.

A reading above 50 indicates a growth in the service sector.

The decline was driven by falls in prices paid, employment and new orders.

The business activity/production index declined to 63.9 in August from 64.9 in July.

The ISM's new orders index decreased to 63.4 in August from 63.8 in July.

The ISM's employment index declined to 56.0 in August from 59.6 in July.

The prices paid index dropped to 50.8 in August from 53.7 in July, the lowest level since April.

-

16:18

Final Markit/Nikkei services purchasing managers' index for Japan increases to 53.7 in August

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan increased to 53.7 in August from 51.2 in July.

A reading below 50 indicates contraction of activity.

The index was driven by a rise new business, while cost pressures eased.

"Activity growth accelerated to the strongest since October 2013, underpinned by a solid increase in new orders. In contrast, employment levels declined, offsetting the slight increase seen at the start of Q3. That said, the rate of job shedding was marginal," economist at Markit, Amy Brownbill, said.

-

15:57

Makit’s final U.S. services PMI is up to 56.1 in August

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Thursday. The final U.S. services PMI rose to 56.1 in August from 55.7 in July, up from the preliminary reading of 55.2.

A reading over 50 indicates expansion in the sector.

The increase was driven by a faster pace in new business.

"The US economy is enjoying a solid third quarter, with robust survey readings so far pointing to 2.5% annualised GDP growth. Employment growth is also holding up well, with PMI surveys signalling another month of non-farm payroll growth in excess of 200,000 in August," Markit Economics Chief Economist Chris Williamson noted.

-

15:35

U.S. Stocks open: Dow +0.31%, Nasdaq +0.20%, S&P +0.33%

-

15:35

European Central Bank keeps its interest rate unchanged at 0.05%

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.05%. This decision was widely expected by analysts.

The interest rate remains unchanged since September 2014.

-

15:28

The European Central Bank (ECB) lowers the amount of emergency funding (ELA) to Greek banks to €89.1 billion from €89.7 billion on Thursday

-

15:25

Before the bell: S&P futures +0.51%, NASDAQ futures +0.43%

U.S. stock-index futures rose as investors get a break from declines driven by China and the European Central Bank revamped its stimulus program.

Global Stocks:

Nikkei 18,182.39 +86.99 +0.48%

FTSE 6,182.45 +99.14 +1.63%

CAC 4,648.89 +93.97 +2.06%

DAX 10,292.73 +244.68 +2.44%

China stocks were closed today.

Crude oil $46.12 (-0.48%)

Gold $1122.80 (-0.90%)

-

15:14

European Central Bank cuts its economic growth and inflation forecasts

The European Central Bank (ECB) lowered its economic growth and inflation forecasts. Eurozone's economy is expected to expand 1.4% in 2015, down from the previous estimate of a 1.5% gain, 1.7% in 2016, down from the previous estimate of a 1.9% rise, and 1.8% in 2017, down from the previous estimate of a 2.0% increase.

Eurozone's inflation is expected to rise 0.1% in 2015, down from the previous estimate of a 0.3% gain, 1.1% in 2016, down from the previous estimate of a 1.5% rise, and 1.7% in 2017, down from the previous estimate of a 1.8% increase.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.12

2.22%

41.4K

Tesla Motors, Inc., NASDAQ

TSLA

252.88

2.10%

16.8K

Twitter, Inc., NYSE

TWTR

28.15

1.19%

16.9K

ALCOA INC.

AA

9.43

1.18%

7.5K

Cisco Systems Inc

CSCO

25.95

1.17%

0.3K

Starbucks Corporation, NASDAQ

SBUX

55.88

1.12%

8.0K

Pfizer Inc

PFE

32.30

1.03%

32.3K

Intel Corp

INTC

28.88

0.98%

26.4K

Boeing Co

BA

131.88

0.96%

10.3K

Amazon.com Inc., NASDAQ

AMZN

515.00

0.87%

6.6K

Merck & Co Inc

MRK

53.42

0.83%

0.8K

Microsoft Corp

MSFT

43.72

0.83%

3.5K

United Technologies Corp

UTX

92.00

0.83%

0.3K

Goldman Sachs

GS

186.00

0.81%

3.9K

Exxon Mobil Corp

XOM

73.81

0.79%

0.3K

International Business Machines Co...

IBM

146.19

0.79%

0.1K

Citigroup Inc., NYSE

C

52.16

0.79%

10.0K

Yandex N.V., NASDAQ

YNDX

11.82

0.77%

0.1K

Google Inc.

GOOG

619.00

0.76%

3.9K

General Motors Company, NYSE

GM

29.43

0.75%

0.3K

Procter & Gamble Co

PG

70.33

0.74%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

59.54

0.74%

3.2K

General Electric Co

GE

24.75

0.73%

0.9K

JPMorgan Chase and Co

JPM

63.00

0.69%

0.6K

Yahoo! Inc., NASDAQ

YHOO

31.99

0.69%

1.5K

AT&T Inc

T

33.04

0.67%

16.6K

McDonald's Corp

MCD

96.68

0.67%

18.1K

Hewlett-Packard Co.

HPQ

28.18

0.64%

0.3K

Visa

V

70.04

0.60%

0.4K

Walt Disney Co

DIS

102.5

0.60%

11.8K

The Coca-Cola Co

KO

39.13

0.59%

0.1K

Ford Motor Co.

F

13.95

0.58%

1.4K

ALTRIA GROUP INC.

MO

53.44

0.58%

2.9K

Nike

NKE

111.05

0.57%

0.3K

Verizon Communications Inc

VZ

45.60

0.55%

0.1K

Apple Inc.

AAPL

112.88

0.48%

351.5K

FedEx Corporation, NYSE

FDX

151.50

0.45%

0.2K

Facebook, Inc.

FB

90.25

0.40%

124.3K

Home Depot Inc

HD

116.9

0.36%

7.9K

American Express Co

AXP

75.20

0.35%

0.5K

Chevron Corp

CVX

78.30

0.31%

18.7K

Johnson & Johnson

JNJ

93.64

0.31%

1.6K

Deere & Company, NYSE

DE

80.78

0.00%

0.7K

Caterpillar Inc

CAT

76.00

-0.13%

5.2K

Barrick Gold Corporation, NYSE

ABX

6.59

-1.49%

16.5K

-

14:57

U.S. trade deficit narrows to $41.86 billion in July

The U.S. Commerce Department released the trade data on Thursday. The U.S. trade deficit narrowed to $41.86 billion in July from a deficit of $45.21 billion in June. June's figure was revised up from a deficit of $43.84 billion.

Analysts had expected a trade deficit of $42.4 billion.

The decline of a deficit was driven by a rise in exports. Exports were by 0.4% in July, while imports decreased by 1.1%.

Exports to Canada were down 8.3%, while exports to China declined by 1.9%.

Imports from China fell 0.2% in July.

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Boeing (BA) reiterated at Sector Perform at RBC Capital Mkts, target lowered to $145 from $159.

-

14:47

Initial jobless claims rise by 12,000 to 282,000 in the week ending August 29

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 29 in the U.S. rose by 12,000 to 282,000 from 270,000 in the previous week. The previous week's figure was revised down from 271,000.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 18th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 9,000 to 2,257,000 in the week ended August 22.

-

14:41

Canada's trade deficit narrows to C$0.53 billion in July

Statistics Canada released the trade data on Thursday. Canada's trade deficit narrowed to C$0.53 billion in July from a deficit of C$0.81 billion in June. June's figure was revised down from a deficit of C$0.48 billion.

Analysts had expected a trade deficit of C$1.3 billion.

The decrease in deficit was driven by an increase in exports. Exports increased 2.3% in July.

Exports of energy products dropped by 5.7% in July, exports of consumer goods jumped 7.3%, exports of motor vehicles and parts soared 9.9%, while exports of aircraft and other transportation equipment and parts were up 19.2%.

Imports climbed 1.7% in July.

Imports of aircraft and other transportation equipment and parts jumped by 22.9% in July, imports of metal and non-metallic mineral products dropped 9.6%, while imports of energy products soared 12.9%.

-

14:27

France’s unemployment rate remains unchanged at 10.3% in the second quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France remained unchanged at 10.3% in the second quarter.

The number of unemployed people in France was 2.9 million.

The number of unemployed people under 24 years fell by 0.6% to 23.4% in the second quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

14:20

Italy’s services PMI rises to 54.6 in August, the highest level since March 2010

Markit/ADACI's services purchasing managers' index (PMI) for Italy climbed to 54.6 in August from 52.0 in July. It was the highest level since March 2010.

A reading above 50 indicates expansion in the sector.

The increase was driven by a rise in employment and new business.

"Data showed companies in the service sector creating jobs again after a brief hiatus during July, encouraged by growth in their backlogs of work. A slower increase in new business and a deterioration in companies' future expectations pose some downside risks to the pace of growth in the near-term, however," an economist at Markit Phil Smith said.

-

12:02

European stock markets mid session: stocks traded higher ahead of the European Central Bank’s press conference on the central bank’s monetary policy

Stock indices traded higher ahead of the European Central Bank's (ECB) press conference on the central bank's monetary policy. It is likely that the ECB will keep its monetary policy unchanged.

Meanwhile, the economic from the Eurozone was mostly positive. Retail sales in the Eurozone rose 0.4% in July, missing expectations for a 0.6% rise, after a 0.2% decrease in June. June's figure was revised up from a 0.6% drop.

The increase was driven by higher gasoline sales, which rose 0.8% in July.

On a yearly basis, retail sales in the Eurozone climbed 2.7% in July, exceeding forecasts of a 2.0% gain, after a 1.7% increase in June. June's figure was revised up from a 1.2% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in August from 54.0 in July, up from the preliminary reading of 54.3.

The index was driven by rises in new business and business activity.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.6 in August from 57.4 in July, missing expectations for a rise to 57.6. It was the lowest level since May 2013.

The decline was partly driven by a slower growth in business since April 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,174.74 +91.43 +1.50 %

DAX 10,224.1 +176.05 +1.75 %

CAC 40 4,618.4 +63.48 +1.39 %

-

11:55

Eurozone’s retail sales rises 0.4% in July

Eurostat released its retail sales data for the Eurozone on Thursday. Retail sales in the Eurozone rose 0.4% in July, missing expectations for a 0.6% rise, after a 0.2% decrease in June. June's figure was revised up from a 0.6% drop.

The increase was driven by higher gasoline sales, which rose 0.8% in July.

Food, drinks and tobacco sales were up 0.2% in July, while non-food sales increased 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 2.7% in July, exceeding forecasts of a 2.0% gain, after a 1.7% increase in June. June's figure was revised up from a 1.2% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 3.1% in July, gasoline sales increased 1.6%, while food, drinks and tobacco sales rose 1.9%.

-

11:48

Spain’s services PMI is down to 59.6 in August

Markit Economics released final services purchasing managers' index (PMI) for Spain on Thursday. Spain's final services purchasing managers' index (PMI) fell to 59.6 in August from 59.7 in July.

The index was driven by a weaker increase in input costs and output prices.

New business and employment continued to rise.

"The service sector remained the leading light in terms of Spanish PMI data in August, registering a further strong increase in business activity. We finally saw an easing off in the rate of job creation after it had accelerated in eight successive months, but the improvements in new work that have been recorded throughout the past couple of years are still translating into improvements in the labour market," Senior Economist at Markit Andrew Harker said.

-

11:38

France's final services PMI declines to 50.6 in August

Markit Economics released final services purchasing managers' index (PMI) for France on Thursday. France's final services purchasing managers' index (PMI) dropped to 50.6 in August from 52.0 in July, down from the preliminary reading of 51.8.

The decline was partly driven by a weaker rise in new business and backlogs.

"The French service sector lost further momentum in August, with activity growth slowing to a seven-month low. Prospects for third quarter GDP therefore look softer, following stagnation recorded in the second quarter. The survey's bright spot was the strongest business expectations reading for almost three-and-half years, signalling that companies are becoming a little more hopeful of a revival over the coming year," Senior Economist at Markit Jack Kennedy said.

-

11:22

Germany's final services PMI rises to 54.9 in August

Markit Economics released final services purchasing managers' index (PMI) for Germany on Thursday. Germany's final services purchasing managers' index (PMI) rose 54.9 in August from 53.8 in July, up from the preliminary reading of 53.6.

The index was driven by rises in output, new orders and employment.

"Today's PMI results suggest that Germany's service sector is in good shape. Activity increased at the fastest pace for five months, with hotels and restaurants reporting particularly strong growth. Companies also noted a stronger rise in new business, which in turn encouraged them to further add to their workforce numbers," an economist at Markit, Oliver Kolodseike, said.

-

11:05

Eurozone's final services PMI increases to 54.4 in August

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Thursday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in August from 54.0 in July, up from the preliminary reading of 54.3.

The index was driven by rises in new business and business activity.

Eurozone's final composite output index rose to 54.3 in August from 53.9 in July, up from the preliminary reading of 54.1.

"Although global economic worries have intensified in recent weeks, the calming of Grexit fears has led to an improvement in the business environment across the Eurozone, pushing the pace of economic growth to its fastest for just over four years in August. The PMI is indicating euro area GDP growth close to 0.4% in the third quarter, a solid albeit unspectacular rate of expansion," Chief Economist at Markit Chris Williamson said.

He added that the upward revision of the index was driven by a stronger in Germany.

-

10:58

UK’s services PMI falls to 55.6 in August, the lowest level since May 2013

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.6 in August from 57.4 in July, missing expectations for a rise to 57.6. It was the lowest level since May 2013.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in business since April 2013.

"Even after allowing for usual seasonal influences, August saw an unexpectedly sharp slowing in the pace of economic growth. The services PMI came in well below even the most pessimistic of economists' forecasts1 and follows disappointing news of a stagnation in the manufacturing sector earlier in the week," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is expected to expand 0.5% in the third quarter, after a 0.7% growth in the second quarter.

-

10:48

Retail sales in Australia decline 0.1% in July

The Australian Bureau of Statistics released its retail sales data on Thursday. Retail sales in Australia declined 0.1% in July, missing expectations for a 0.4% gain, after a 0.6% rise in June. It was the first decline since June 2014.

June's figure was revised down from a 0.7% increase.

The decrease was partly driven by falls in sales of electrical goods and hardware. Sales of electrical goods dropped 3.3% in July, while hardware sales were down 1.4%.

-

10:35

Australia's trade deficit narrows to A$2.46 billion in July

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$2.46 billion in July from A$3.05 billion in June, beating expectations for a rise to a deficit of A$3.1 billion. June's figure was revised up from a deficit of A$2.93 billion.

Exports rose by 0.2% in July, while imports were flat.

-

10:27

Beige Book: several districts report increasing wage pressures

The Federal Reserve released its Beige Book on Wednesday. The Fed said that several districts "reported increasing wage pressures caused by labour market tightening".

Wage pressure could give Fed officials more confidence to start raising its interest rates.

According to the report, 11 of 12 districts reported moderate to modest growth. One district reported a slight growth.

Manufacturing activity was mostly positive.

-

08:27

Global Stocks: U.S. stock indices rose

U.S. stock indices climbed on Wednesday, although concerns about global economic growth persisted. Traders are waiting for a U.S. payrolls report, which will be published on Friday.

The Dow Jones Industrial Average rose 293.03 points, or 1.8%, to 16351.38 (29 out of its 30 components advanced). The S&P 500 gained 35.01, or 1.8%, to 1948.86. The Nasdaq Composite rose 113.87, or 2.5%, to 4749.98.

Yesterday Automatic Data Processing reported that private sector of the U.S. economy added 190,000 jobs in August after the 177,000 rise in July (revised down from 185,000). Economists had expected a 201,000 reading for August.

This morning in Asia the Nikkei added 252.20 points, or 1.39%, to 18,347.60. Chinese markets are on holiday due to anniversary of the end of World War Two in Asia.

Japanese stocks were supported by gains in U.S. stocks and a weaker yen. Such exporters as Nissan Motor and Toshiba climbed more than 3% each.

-

04:03

Nikkei 225 18,317.18 +221.78 +1.23 %

-

00:31

Stocks. Daily history for Sep 2’2015:

(index / closing price / change items /% change)

Nikkei 225 18,095.4 -70.29 -0.39 %

Hang Seng 20,934.94 -250.49 -1.18 %

S&P/ASX 200 5,101.46 +5.05 +0.10 %

Shanghai Composite 3,155.04 -11.58 -0.37 %

FTSE 100 6,083.31 +24.77 +0.41 %

CAC 40 4,554.92 +13.76 +0.30 %

Xetra DAX 10,048.05 +32.48 +0.32 %

S&P 500 1,948.86 +35.01 +1.83 %

NASDAQ Composite 4,749.98 +113.87 +2.46 %

Dow Jones 16,351.38 +293.03 +1.82 %

-