Noticias del mercado

-

17:42

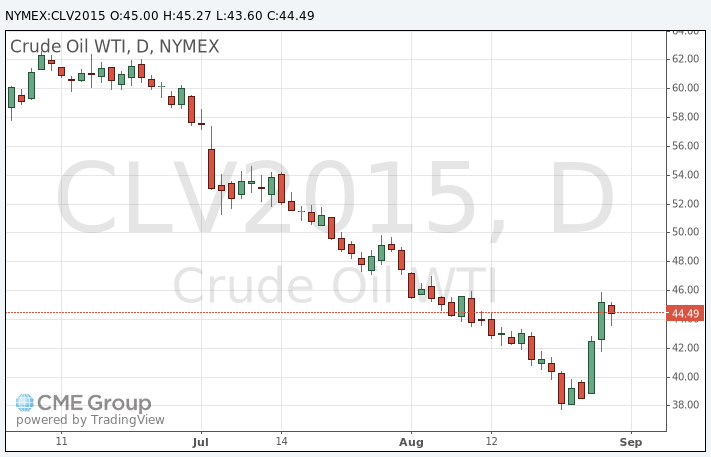

Oil prices declines on concerns over a slowdown in the Chinese economy and concerns over the global oil oversupply

Oil prices fell on concerns over a slowdown in the Chinese economy and concerns over the global oil oversupply. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 1 rigs to 675 last week. It was the sixth consecutive increase. Combined oil and gas rigs fell by 8 to 877.

The Chinese stock market declined on Monday. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

OPEC expressed concerns over the decline in oil prices in its bulletin on Monday.

"As the Organization has stressed on numerous occasions, it stands ready to talk to all other producers. But this has to be on a level playing field. OPEC will protect its own interests," OPEC said.

WTI crude oil for October delivery decreased to $43.60 a barrel on the New York Mercantile Exchange.

Brent crude oil for October fell to $48.62 a barrel on ICE Futures Europe.

-

17:24

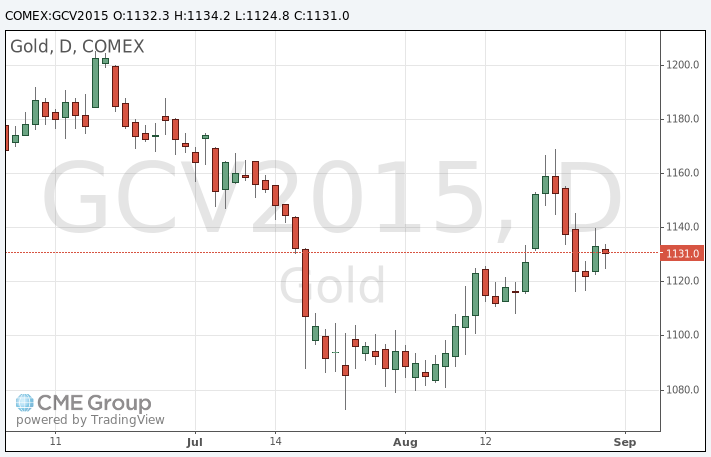

Gold price falls on a possible interest rate by the Fed in September

Gold price declined on a possible interest rate by the Fed in September. Gold lost 2.2% last week as market participants eyed the U.S. economic data.

Some Fed officials said at a conference at Jackson Hole, Wyoming, at the weekend, that the Fed could raise its interest rate this year despite the recent turbulences.

Market participants are awaiting the release of the U.S. ADP Employment report, ISM manufacturing and services PMIs, and the labour market data this week.

October futures for gold on the COMEX today fell to 1124.80 dollars per ounce.

-

10:18

The number of active U.S. rigs rises by 1 rigs to 675 last week

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 1 rigs to 675 last week. It was the sixth consecutive increase.

Combined oil and gas rigs fell by 8 to 877.

-

09:12

Oil prices fell after a week of gains

West Texas Intermediate futures for October delivery fell to $44.59 (-1.39%), while Brent crude dropped to $49.20 (-1.70%). Some analysts said that prices declined amid profit taking after both crudes finished last week with gains.

Investors are still focused on Fed interest rates. Higher rates would make this dollar-denominated commodity more expensive for holders of other currencies.

Market participants are also eyeing the result of planned United Nations-brokered talks later this week between Libya's warring factions aimed at forming a unity government. Yesterday the Tripoli-based central bank reported that Libya recorded a budget deficit of $3.3 billion in the first seven months of 2015 as oil prices and production fell.

-

08:49

Gold fluctuates near open level

Gold is currently at $1,133.40 (-0.05%) fluctuating near its open level as a data-rich week begins. Investors are waiting for more clues on future of interest rates in the U.S. Probability of a rate hike at a September 16-17 meeting is still in place after strong U.S. economic data, which were published at the end of last week. However Fed Vice Chairman Stanley Fischer increased uncertainty saying at the Jackson Hole symposium over the weekend that it was too early to tell whether September is suitable for an increase in rates.

Meanwhile St. Louis Federal Reserve Bank President James Bullard told Bloomberg on Friday that strong U.S. data are more important than volatility triggered by Asian markets. "The key question for the committee - and no decisions have been made here - but the key question for the committee is how much would you want to change the outlook based on the volatility that we've seen over the last 10 days? I think the answer to that is going to be not very much," he said.

Investors will also pay much attention to the U.S. August nonfarm payrolls due on Friday.

Turmoil in Asian equity markets supports demand for bullion; however investors are mostly focused on Fed rates.

-

00:32

Commodities. Daily history for Aug 28’2015:

(raw materials / closing price /% change)

Oil 45.33 +0.24%

Gold 1,133.30 -0.06%

-