Noticias del mercado

-

22:16

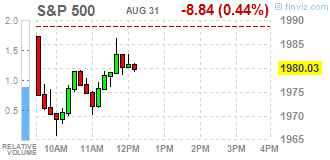

U.S. stocks declined

U.S. stocks declined, with the Standard & Poor's 500 Index posting its worst month in more than three years, as investors harbored concerns about slowing global growth and the impact of a potential interest-rate increase by the Federal Reserve as soon as September.

The S&P 500 lost 0.8 percent to 1,972.15 at 4 p.m. in New York, capping its biggest monthly slide since May 2012. The gauge in earlier trading fell as much as 1.2 percent before nearly erasing the retreat. The Dow Jones Industrial Average sank 0.7 percent to complete its worst monthly drop since May 2010.

Equities trimmed their losses in the late morning after energy shares in the benchmark index reversed a 2.5 percent selloff to rally as much as 1.4 percent. The move followed a jump in oil prices after a government report reduced its crude production estimates and OPEC said it's ready to talk to other global producers to achieve "fair prices." Stocks have been whipsawed by gains and losses since last week as markets remain subject to sudden shifts in investor sentiment.

The S&P 500 ended down 6.3 percent this month as China's currency devaluation earlier this month spurred concern over global growth, erasing more than $5.3 trillion in equity market values worldwide. The benchmark's 0.9 percent gain last week masked a volatile period in which the S&P 500 plunged the most since 2011 to enter a correction, only to rally more than 6 percent over two days for its best back-to-back gains since the beginning of the bull market in 2009.

More than $2 trillion of share value was erased from U.S. markets between the end of July and the lowest levels of last week, a sum equal to roughly two years of S&P 500 earnings, data compiled by Bloomberg show.

While August ranks in the middle among months based on share performance, it has produced some of the worst returns of the year since 2009. During the week ended August 12, 2011, the S&P 500 alternated between gains and losses of at least 4 percent for four days, something never seen in 88 years of data compiled by Bloomberg. In 2013, the S&P 500 fell 3.1 percent in August, one of only two months of negative returns in a year when the index surged 30 percent.

Despite this month's equities rout, remarks by Federal Reserve Vice Chairman Stanley Fischer suggested the central bank hasn't ruled out raising interest rates when the Federal Open Market Committee gathers on Sept. 16-17. Bets on a September liftoff climbed after Fischer said there is "good reason" to believe inflation will accelerate. Traders are now pricing in a 40 percent chance the central bank will act in September, up from a one-in-four chance last Wednesday.

The Fed has said it will be appropriate to raise rates when it has seen some further improvement in the labor market and is "reasonably confident" inflation will move back to its 2 percent target over the medium term.

-

21:00

DJIA 16487.91 -155.10 -0.93%, NASDAQ 4766.48 -61.85 -1.28%, S&P 500 1968.60 -20.27 -1.02%

-

18:18

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday on worries about the health of China's economy and the timing of a U.S. interest rate hike. The No. 2 Fed official said U.S. inflation would likely rebound as pressure from the dollar fades, allowing the Fed to raise interest rates gradually.

Most of all Dow stocks in negative area (21 of 30). Top looser - Merck & Co. Inc. (MRK, -2.24%). Top gainer - Intel Corporation (INTC, +1.30).

Most of all S&P index sectors in negative area. Top looser - Utilities (-2.0%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 16576.00 -83.00 -0.50%

S&P 500 1978.50 -11.25 -0.57%

Nasdaq 100 4313.00 -20.00 -0.46%

10 Year yield 2,18% -0,01

Oil 47.90 +2.68 +5.93%

Gold 1133.50 -0.50 -0.04%

-

18:00

European stocks closed: FTSE 6247.94 55.91 0.90%, DAX 10259.46 -39.07 -0.38%, CAC 40 4652.95 -22.18 -0.47%

-

18:00

European stocks close: stocks closed lower on concerns over a slowdown in the Chinese economy

Stock indices closed lower on concerns over a slowdown in the Chinese economy. The Chinese stock market declined again. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

Meanwhile, the economic data from the Eurozone was positive. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

Indexes on the close:

Name Price Change Change %

FTSE 100 closed

DAX 10,259.46 -39.07 -0.38 %

CAC 40 4,652.95 -22.18 -0.47 %

-

17:57

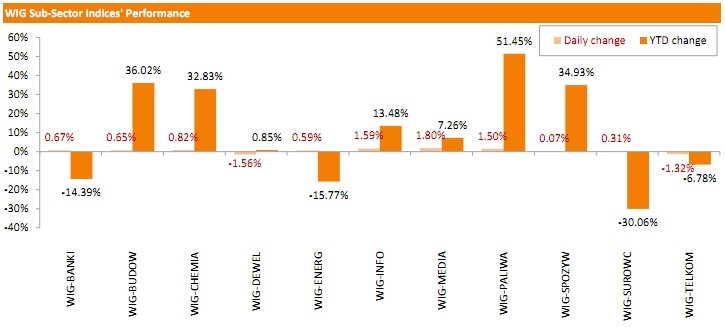

WSE: Session Results

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.6%. Real estate sector (-1.56%) and telecommunications (1.32%) were the only groups in the WIG, which recorded losses. At the same time, media sector (+1.8%) and information technologies (+1.59%) were the best performers.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.77%. In the index basket, coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) continued to rally for the third consecutive day, gaining 8.72% and 7.37% respectively. Other major outperformers were CYFROWY POLSAT (WSE: CPS), LPP (WSE: LPP) and ALIOR (WSE: ALR), which advanced by 3.86%, 3.56% and 2.06% respectively. On the other side of the ledger, GTC (WSE: GTC) led the decliners with a 4.07% drop, followed by CCC (WSE: CCC) and ORANGE POLSKA (WSE: OPL), sliding a respective 2.31% and 1.66%.

-

17:03

Atlanta Fed President Dennis Lockhart: the interest rate hike is possible in every monetary policy meeting this year

Atlanta Fed President Dennis Lockhart said in an interview with Fox Business News on Friday that the interest rate hike is possible in every monetary policy meeting this year.

"I think all the upcoming meetings, the next three meetings, should all be live meetings and I think we should keep our options open," he said.

-

16:55

Preliminary consumer prices in Italy increase 0.2% in August

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Monday. Preliminary consumer prices in Italy increased 0.2% in August, after a 0.1% decline July.

Services prices related to transport increased 0.2% in June, while services prices to recreation, including repair and personal care, gained 0.4%.

On a yearly basis, consumer prices climbed 0.2% in August, after a 0.2% increase in July.

Consumer price inflation excluding unprocessed food and energy prices fell to 0.7% year-on-year in August from 0.8% in July.

Services prices related to transport were up at an annual rate of 0.7% in August, while goods prices declined 0.5%.

-

16:44

European Central Bank purchases €9.8 billion of government bonds last week

The European Central Bank (ECB) purchased €9.8 billion of government bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.94 billion of covered bonds, and €106 million of asset-backed securities.

-

16:20

Chicago purchasing managers' index falls to 54.4 in August

The Chicago purchasing managers' index declined to 54.4 in August from 54.7 in July, missing expectations for an increase to 54.9, according to MNI indicators.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by decreases by the production and new orders indexes.

The employment index rose in August.

"While the slowdown earlier in the year looks temporary, we're still some way below the strong growth rates seen towards the end of 2014," Chief Economist of MNI Indicators Philip Uglow said.

-

15:41

Spanish current account deficit widens to €1.34 billion in June

The Bank of Spain released its current account data on Monday. Spain's current account deficit widened to €1.34 billion in June from a surplus of €1.15 billion in May.

The surplus on trade in goods and services decreased to €2.4 billion from €3.2 billion, while the deficit on primary and second income declined to €1.1 billion from €2 billion.

-

15:32

U.S. Stocks open: Dow -0.60%, Nasdaq -0.42%, S&P -0.49%

-

15:29

Before the bell: S&P futures -0.90%, NASDAQ futures -0.80%

U.S. stock-index futures fell, commodities declined and the yen strengthened as sentiment toward China soured while Federal Reserve officials signaled they're prepared to raise interest rates.

Global Stocks:

Nikkei 18,890.48 -245.84 -1.28%

Hang Seng 21,670.58 +58.19 +0.27%

Shanghai Composite 3,207.07 -25.28 -0.78%

FTSE 6,247.94 +55.91 +0.90%

CAC 4,629.14 -45.99 -0.98%

DAX 10,213.85 -84.68 -0.82%

Crude oil $43.94 (-2.90%)

Gold $1127.70 (-0.56%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Twitter, Inc., NYSE

TWTR

27.76

+3.47%

370.3K

Hewlett-Packard Co.

HPQ

28.00

-0.11%

0.1K

Intel Corp

INTC

28.38

-0.14%

13.4K

American Express Co

AXP

76.50

-0.20%

2.8K

Merck & Co Inc

MRK

55.25

-0.22%

0.2K

General Motors Company, NYSE

GM

28.90

-0.34%

19.9K

The Coca-Cola Co

KO

39.31

-0.35%

0.3K

Microsoft Corp

MSFT

43.75

-0.42%

2.4K

Boeing Co

BA

132.64

-0.45%

1.1K

3M Co

MMM

143.50

-0.49%

0.2K

ALTRIA GROUP INC.

MO

53.90

-0.50%

1.0K

Nike

NKE

111.90

-0.53%

1.1K

AT&T Inc

T

33.11

-0.54%

6.5K

International Business Machines Co...

IBM

147.18

-0.54%

0.2K

Walt Disney Co

DIS

101.92

-0.55%

12.7K

Amazon.com Inc., NASDAQ

AMZN

515.15

-0.55%

7.1K

Johnson & Johnson

JNJ

94.63

-0.57%

1.1K

McDonald's Corp

MCD

95.69

-0.58%

0.5K

Procter & Gamble Co

PG

70.80

-0.58%

9.8K

Starbucks Corporation, NASDAQ

SBUX

55.30

-0.59%

3.6K

Goldman Sachs

GS

186.60

-0.61%

4.3K

Home Depot Inc

HD

116.80

-0.61%

1.8K

Cisco Systems Inc

CSCO

25.84

-0.62%

0.6K

E. I. du Pont de Nemours and Co

DD

51.51

-0.64%

17.3K

Pfizer Inc

PFE

32.45

-0.64%

0.7K

Verizon Communications Inc

VZ

45.77

-0.65%

0.9K

Facebook, Inc.

FB

90.35

-0.73%

228.9K

Wal-Mart Stores Inc

WMT

64.46

-0.74%

1.4K

Deere & Company, NYSE

DE

81.85

-0.75%

0.3K

Google Inc.

GOOG

625.63

-0.75%

3.7K

Visa

V

71.90

-0.77%

0.2K

Citigroup Inc., NYSE

C

52.85

-0.81%

15.2K

AMERICAN INTERNATIONAL GROUP

AIG

60.50

-0.82%

1.4K

Apple Inc.

AAPL

112.27

-0.90%

282.5K

General Electric Co

GE

24.92

-0.94%

11.8K

Ford Motor Co.

F

13.60

-1.02%

6.4K

Chevron Corp

CVX

79.60

-1.03%

60.9K

UnitedHealth Group Inc

UNH

116.01

-1.08%

1.6K

JPMorgan Chase and Co

JPM

63.40

-1.14%

0.3K

Yahoo! Inc., NASDAQ

YHOO

32.75

-1.18%

7.5K

Exxon Mobil Corp

XOM

74.15

-1.23%

10.6K

Caterpillar Inc

CAT

74.98

-1.28%

6.9K

United Technologies Corp

UTX

91.75

-1.60%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

244.36

-1.66%

34.1K

Barrick Gold Corporation, NYSE

ABX

07.01

-1.68%

13.0K

ALCOA INC.

AA

9.22

-2.02%

30.1K

Yandex N.V., NASDAQ

YNDX

12.07

-2.27%

2.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.26

-2.29%

125.8K

-

15:06

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Buy from Neutral at Sun Trust Rbsn Humphrey, target $38

Intel (INTC) upgraded to Outperform from Market Perform at Northland Capital, target $32

Goldman Sachs (GS) upgraded to Buy from Hold at Evercore ISI

Downgrades:

United Tech (UTX) downgraded to Equal Weight from Overweight at Barclays

Other:

-

15:05

Greek adjusted retail sales are down 0.5% in June

The Greek statistical office Hellenic Statistical Authority. Greek adjusted retail sales declined 0.5% in June, after a 2.1% gain in May.

On a yearly basis, German retail sales fell 0.4% in June, after a 4.1% rise in May. May's figure was revised down from a 4.2% increase.

Sales of food products decreased 0.3% in June, sales of non-food products dropped 1.1%, while sales of automotive fuel climbed by 4.4%.

-

14:43

Canadian current account deficit narrows to C$17.4 billion in the second quarter

Statistics Canada released current account data on Monday. Canadian current account deficit narrowed to C$17.4 billion in the second quarter from a deficit of C$18.2 billion in the first quarter. The first quarter figure was revised down from a deficit of C$17.5 billion.

The fall in deficit was driven by declines in the trade in goods and services deficit. The trade in goods deficit fell by C$0.3 billion to a record C$6.7 billion in the second quarter, while the deficit on international trade in services declined by $0.2 billion to C$5.5 billion.

-

14:25

Italian retail sales decline at a seasonally adjusted rate of 0.3% in June

The Italian statistical office Istat released its retail sales data for Italy on Monday. Italian retail sales fell at a seasonally adjusted rate of 0.3% in June, after a 0.2% decline in May.

Sales of food products fell 0.2% in June, while sales of non-food products declined by 0.3%.

On a yearly basis, retail sales in Italy rose 1.2% in June, after a 0.1% increase in May.

-

12:00

European stock markets mid session: stocks traded lower as the Chinese stock market declined again

Stock indices traded lower as the Chinese stock market declined again. The Financial Times reported that the Chinese government ended its large-scale share purchase programme.

Meanwhile, the economic data from the Eurozone was positive. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

Current figures:

Name Price Change Change %

FTSE 100 closed

DAX 10,179.32 -119.21 -1.16 %

CAC 40 4,628.52 -46.61 -1.00 %

-

11:44

Industrial production in Japan declines 0.6% in July

Japan's Ministry of Economy, Trade and Industry released its preliminary industrial production figures on late Sunday evening. Industrial production in Japan declined 0.6% in July, after a 0.8% gain in June.

On a yearly basis, Japan's industrial production was up 0.2% in July, after a 2.3% rise in June.

Lower overseas demand weighed on the Japanese industrial production.

The decline was driven by decreases in the electrical components and the transport equipment industries.

-

11:33

KOF leading indicator for Switzerland climbs to 100.7 in August

The Swiss Economic Institute KOF released its leading indicator for Switzerland on Monday. The KOF leading indicator rose to 100.7 in August from 100.4 in July, beating expectations for a decline to 99.5. July's figure was revised up from 99.8.

According to the institute, the outlook for the Swiss economy remained unchanged since July.

"Overall slightly positive tendencies in the manufacturing and banking sectors are balanced by slightly negative developments in primarily the construction sector. With the indicators capturing tendencies in the international environment as well as domestic consumption more or less stabilising at their previous readings, the overall result is a slight rise in the Barometer," the KOF said.

-

11:15

Preliminary consumer price inflation in the Eurozone remains unchanged at 0.2% in August

Eurostat released its consumer price inflation data for the Eurozone on Monday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.2% in August, beating expectations for a decline to 0.1%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco remained unchanged at an annual rate of 1.0% in August.

Food, alcohol and tobacco prices were up 1.2% in August, non-energy industrial goods prices gained 0.6%, and services prices climbed 1.2%, while energy prices dropped 7.1%.

-

10:54

German adjusted retail sales are up 1.4% in July

Destatis released its retail sales for Germany on Monday. German adjusted retail sales rose 1.4% in July, beating forecasts of a 1.0% gain, after a 1.0% drop in June. It was the biggest rise since October 2014.

June's figure was revised up from a 2.3% decline.

On a yearly basis, German retail sales jumped 3.3% in July, exceeding expectations for a 1.9% gain, after a 5.2% rise in June. June's figure was revised up from a 5.1% increase.

Sales of non-food products increased at an annual rate of 3.1% in July, while sales of food products climbed by 2.6%.

-

10:43

Federal Reserve Bank of Atlanta President Dennis Lockhart: the interest rate hike by the Fed in September is still possible

Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview on Bloomberg television Friday that the interest rate hike by the Fed in September is still possible. But he added that there is a risk now.

"We are sort of anxious to get going, but given the events of the last several weeks, a risk factor has arisen. It has to be considered an open question whether we move now or wait a little while," he said.

Lockhart is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:32

Swiss National Bank President Thomas Jordan: the interest rates in Switzerland will remain negative for a while

The Swiss National Bank (SNB) President Thomas Jordan said in an interview with the NZZ am Sonntag that the interest rates in Switzerland will remain negative for a while as there are many risks that could lead to a stronger Swiss franc, which is already a "clearly overvalued".

He added that "there are lights at the end of the tunnel" as the Fed and the Bank of England may start raising its interest rates and as Eurozone's economy is recovering.

Jordan pointed out that the central bank is ready to intervene in the foreign exchange market if needed, and it intervened in June.

The SNB president noted that the Swiss economy is in line with central bank's forecasts.

-

10:12

Bank of America Corp.: the rise in China's stock market will be short-lived

The rise in China's stock market will be short-lived as the government's intervention is too expensive to be continued for a long time, according to Bank of America Corp.

"As soon as people sense the government is withdrawing from direct intervention, there will be lots of investors starting to dump stocks again," China equity strategist at Bank of America in Singapore, David Cui, said.

He added that the Shanghai Composite Index have to fall another 35% before shares will become attractive.

Cui expects that the government will end its direct market purchases within the next month or two.

-

08:13

Global Stocks: Asian stock indices declined on Monday

U.S. stock indices mostly ended Friday with modest gains as market volatility steadied compared to earlier days. Strong GDP and consumer spending data, which came in on Thursday and Friday, gave investors confidence about the U.S. economy.

The Dow Jones Industrial Average lost 11.76 points, or 0.1%, to 16643.01. The S&P 500 added 1.21, or 0.1%, to 1988.87. The Nasdaq Composite gained 15.62, or 0.3%, to 4828.32.

This morning in Asia Hong Kong Hang Seng declined 0.77%, or 165.95 points, to 21,446.44. China Shanghai Composite Index dropped 2.61%, or 84.27 points, to 3,148.08. The Nikkei dropped 1.82%, or 348.81 points, to 18,787.51.

Japanese stocks are in the red zone. Analysts believe that investors are waiting for news on Fed interest rate hike prospects. The decision itself will be made at a meeting held on September 16-17. Fed Vice Chairman Stanley Fischer said at the Jackson Hole symposium over the weekend that it was too early to tell whether September is suitable for an increase in rates.

Stocks were also influenced by Japanese industrial production data. The corresponding index fell 0.6% in July missing expectations for a 0.1% reading. On an annualized basis it dropped to 0.2% from 2.3%.

-

04:02

Nikkei 225 18,915.87 -220.45 -1.15 %, Hang Seng 21,592.65 -19.74 -0.09 %, Shanghai Composite 3,203.56 -28.79 -0.89 %

-

00:32

Stocks. Daily history for Aug 28’2015:

(index / closing price / change items /% change)

Nikkei 225 19,136.32 +561.88 +3.03 %

Hang Seng 21,612.39 -226.15 -1.04 %

S&P/ASX 200 5,263.56 +30.24 +0.58 %

Shanghai Composite 3,234.61 +151.02 +4.90 %

FTSE 100 6,247.94 +55.91 +0.90 %

CAC 40 4,675.13+16.95 +0.36 %

Xetra DAX 10 ,298.53 -17.09 -0.17 %

S&P 500 1,988.87 +1.21 +0.06 %

NASDAQ Composite 4,828.33 +15.62 +0.32 %

Dow Jones 16,643.01 -11.76 -0.07 %

-