Noticias del mercado

-

20:20

American focus: the dollar strengthened against most major currencies

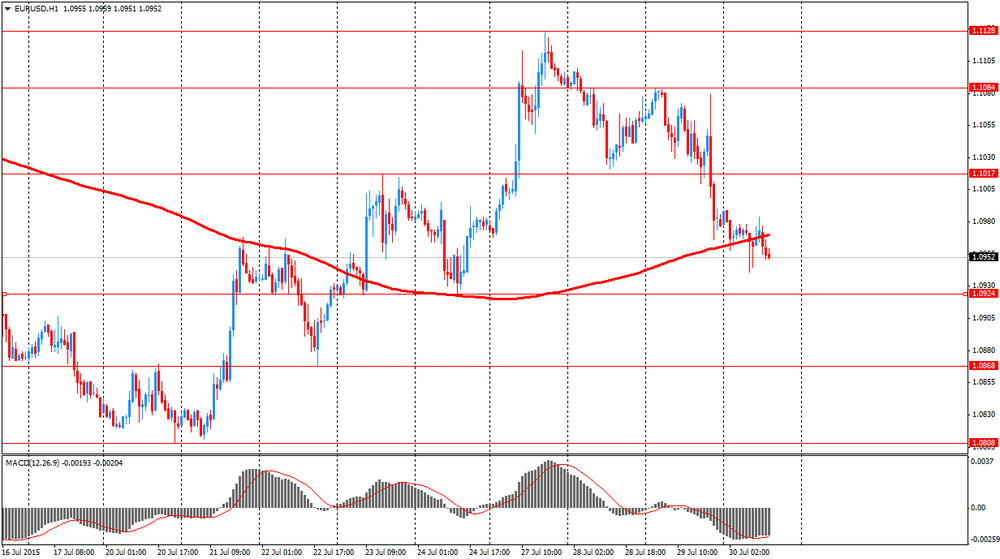

Dollar rose significantly against the euro, reaching thus the level of $ 1.0900, helped by US data on GDP. The Commerce Department said that US economic growth accelerated in the second quarter, as the rise in consumer spending offset the decline due to weak business spending on equipment, assuming a steady pulse that can bring the Federal Reserve to raise interest rates this year. Gross domestic product expanded at an annual rate of 2.3 percent, said Thursday. In the first quarter GDP, as previously reported, it was reduced to 0.2 percent. However, this figure was revised to a rise of 0.6 percent. The revision of growth in the first quarter reflected the steps taken by the Government to clarify the seasonal adjustment for some components of GDP, which economists say they have residual seasonality in the data, as well as the new source data. A measure of private domestic demand, which excludes trading stocks and government spending increased 2.5 percent after rising 2.0 percent earlier in the year. Business spending fell by 1.6 percent after falling 7.4 percent earlier in the year. Equipment costs fell by 4.1 per cent. Expenditure on exploration and production decreased by 68.2 percent, showing the largest decline since the second quarter of 1986. This category decreased by 44.5 percent in the first quarter. But there are signs that the decline in energy prices possibly coming to an end. Data on Friday showed that the energy company said 21 oil rigs last week, noting the third increase in the last 33 weeks. Exports grew in the second quarter, despite the strong dollar, while imports grew moderately. It has defined a smaller trade deficit, which added 0.13 percentage points to GDP growth. The price index for personal consumption expenditures rose 2.2 percent, the fastest growth since the first quarter of 2012, after falling 1.9 percent earlier in the year. Excluding food and energy, prices rose 1.8 percent.

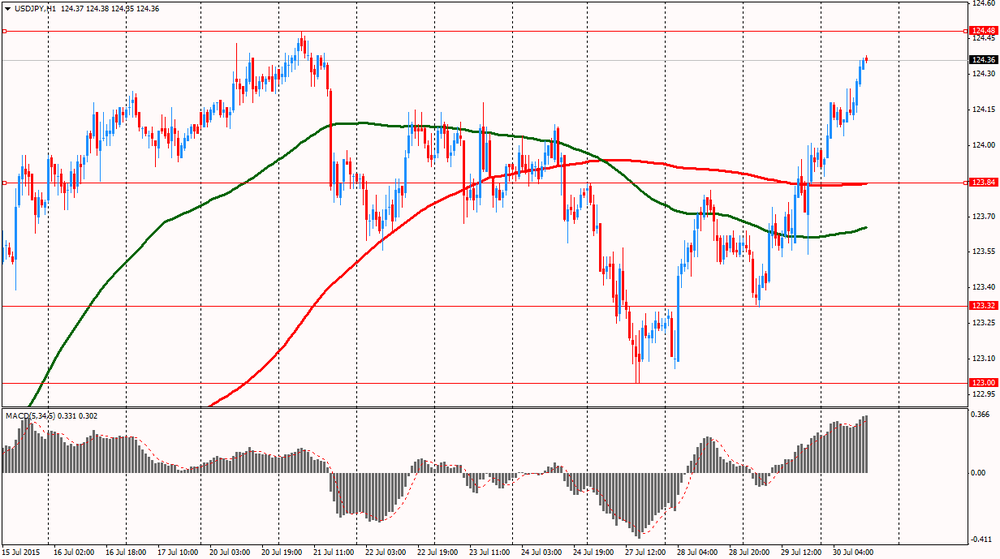

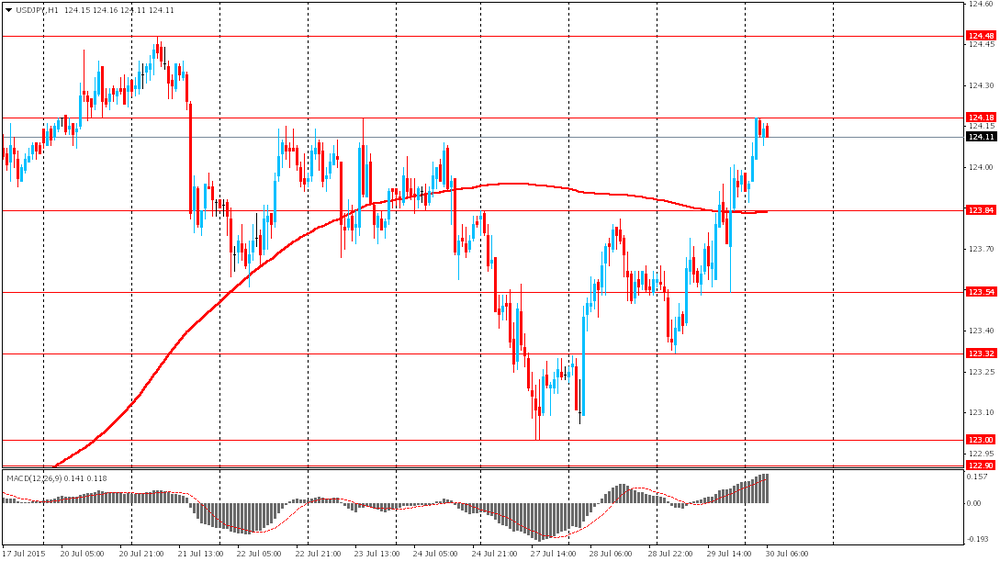

The yen continued to fall against the US dollar, approaching to the lowest since June 10 after the last Federal Reserve indicated that interest rates may be increased in the coming months, with a certain probability in September. In his statement at the rate the Fed noted that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment. The Fed chief Janet Yellen said that the Central Bank may raise rates in September if the economy continues to improve the alleged rate.

Meanwhile, support for the dollar have data on GDP and the US labor market. As it became known, the number of Americans who first applied for unemployment benefits last week rose to forty minimum, but the general trend shows that the labor market is strengthening. Primary applications for unemployment benefits, an indicator of layoffs, increased by 12,000 to 267,000 seasonally adjusted in the week ended July 25th. Economists expected 270,000 initial claims for unemployment benefits last week. Previous week remained at 255000. The level of initial claims for the week ended July 18 was the lowest since November 1973.

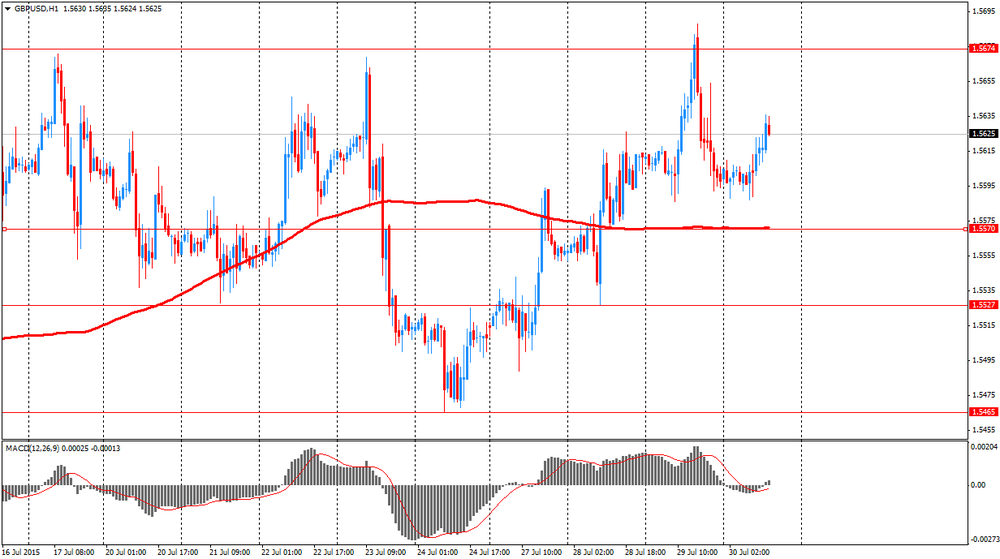

The pound fell sharply against the dollar, at least updating session. The pressure on the currency has stats on the US, which has strengthened expectations of a rate hike this year. The US Commerce Department reported that gross domestic product grew 2.3% in the three months ended June 30. The US economy in the first quarter showed an increase of 0.6%, confounding forecasts for a 0.2% reduction. While economists had forecast GDP growth of 2.6%, the report indicates that the economy is showing strong recovery. The data came after the Federal Reserve said yesterday that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0950(E647mn), $1.0960(E1.0bn), $1.1000(E1.4bn), $1.1080-1.1100(E1.58bn)

USD/JPY: Y122.40-60($1.345bn), Y123.70-75($460mn), Y123.95-124.00($1.15bn), Y125.00($402mn)

EUR/JPY: Y136.25(E240mn)

GBP/USD: $1.5500(Gbp548mn), $1.5605(Gbp429mn)

EUR/GBP: GBP0.7100(E616mn), Gbp7250(E402mn)

AUD/USD: $0.7250(A$358mn)

NZD/USD: $0.6565(NZ$279mn), $0.6600(NZ$302mn)

-

14:30

U.S.: GDP, q/q, Quarter II 2.3% (forecast 2.6%)

-

14:30

U.S.: PCE price index, q/q, Quarter II 2.2% (forecast 2%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter II 1.8% (forecast 1.6%)

-

14:30

U.S.: Initial Jobless Claims, July 267 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, July 2262 (forecast 2212)

-

14:15

European session review: the US dollar rose

The US dollar strengthened against other major currencies after the Federal Reserve indicated that interest rates may be increased in the coming months, with a certain probability in September.

In his statement yesterday at the rate the Fed noted that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment.

The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate.

On Thursday scheduled the publication of preliminary data on the growth of the US economy in the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The euro retreated from session lows after the data on the index of sentiment in the economy, but then fell again. The threat of a Greek exit from the euro zone does not have a negative impact on sentiment in the corporate sector in the region in July. Companies in the past month more optimistic about their own prospects, although increased consumer concerns.

The published data on Thursday the European Commission pointed to an unexpected increase in confidence in the companies in most major economies in the eurozone.

The survey was carried out of the European Commission at the time when Greece is so much closer to the exit from the euro zone as no country before. Nonetheless, Greece July 13 failed to reach agreement with creditors that will allow the country over the next three years to obtain new loans.

Increased confidence in the companies suggests that the observed recent increase in investment and employment is likely to continue, supporting the economic recovery in the eurozone.

Sentiment in the euro-zone economy, which takes into account the mood of businesses and consumers, in July rose to 104.0 from 103.5 in the previous month, reaching the highest level since July 2011. The index is still above the long-term average level of 100.0.

Economists had expected the index decline in July to 103.3.

The European Commission confirmed that consumer confidence weakened in July, but the mood of the companies of the manufacturing sector, the service sector and the retail sector improved, while the mood of construction companies and the banking sector declined slightly.

EUR / USD: during the European session the pair fell to $ 1.0941, and then rose to $ 1.0984

GBP / USD: during the European session, the pair rose to $ 1.5636

USD / JPY: during the European session, the pair rose to Y124.38

-

13:45

Orders

EUR/USD

Offers 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200

Bids 1.0940 1.0900 1.0880 1.0860 1.0820-25 1.0800 1.0780 1.0750 1.0720

GBP/USD

Offers 1.5630 1.5650 1.5680 1.5700-10 1.5725-30 1.5750

Bids 1.5580-85 1.5565 1.5550 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7030 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.7000 0.6975-80 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 136.30 136.50 136.80 137.00 137.30 137.50 137.80 138.00

Bids 135.80 135.50 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 124.25-30 124.50 124.75 125.00 125.30 125.50

Bids 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7330 0.7350 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7280 0.7265 0.7250 0.7230 0.7200 0.7180 0.7150

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0950(E647mn), $1.0960(E1.0bn), $1.1000(E1.4bn), $1.1080-1.1100(E1.58bn)

USD/JPY: Y122.40-60($1.345bn), Y123.70-75($460mn), Y123.95-124.00($1.15bn), Y125.00($402mn)

EUR/JPY: Y136.25(E240mn)

GBP/USD: $1.5500(Gbp548mn), $1.5605(Gbp429mn)

EUR/GBP: GBP0.7100(E616mn), Gbp7250(E402mn)

AUD/USD: $0.7250(A$358mn)

NZD/USD: $0.6565(NZ$279mn), $0.6600(NZ$302mn)

-

11:01

Eurozone: Economic sentiment index , July 104 (forecast 103.3)

-

11:01

Eurozone: Industrial confidence, July -3.0 (forecast -3.4)

-

11:00

Eurozone: Consumer Confidence, July -7.0 (forecast -7.1)

-

10:59

Eurozone: Business climate indicator , July 0.39 (forecast 0.15)

-

09:55

Germany: Unemployment Change, July 9 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , July 6.4% (forecast 6.4%)

-

09:00

Switzerland: KOF Leading Indicator, July 99.8 (forecast 90.3)

-

08:32

Foreign exchange market. Asian session: the U.S. dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Export Price Index, q/q Quarter II -0.8% -4% -4.4%

01:30 Australia Import Price Index, q/q Quarter II -0.2% 1.5% 1.4%

01:30 Australia Building Permits, m/m June 2.3% Revised From 2.4% -0.8% -8.2%

The U.S. dollar advanced against the euro and the Japanese yen after Fed policymakers voted to keep the benchmark rate unchanged and noted that growth rates had been moderate in the past months. The labor market kept making progress, while inflation remained low.

The yen advanced slightly at the beginning of the session amid industrial production data, which showed that the corresponding index rose by 0.8% m/m in June. However this increase came after a 2.1% drop in May. That's why many analysts expect Japanese GDP to show contraction in the second quarter of the current year.

The New Zealand dollar is under pressure amid positive attitude towards the greenback. The kiwi got hit by a 4.1% decline in building permits. The previous reading was 0.

EUR/USD: the pair fell to $1.0965 in Asian trade

USD/JPY: the pair rose to Y124.20

GBP/USD: the pair traded around $1.5585-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator July 89.7 90.3

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change July -1 -5

09:00 Eurozone Economic sentiment index July 103.5 103.3

09:00 Eurozone Consumer Confidence (Finally) July -5.6 -7.1

09:00 Eurozone Business climate indicator July 0.1 0.15

09:00 Eurozone Industrial confidence July -3.4 -3.4

09:00 Eurozone Unemployment Rate June 11.1%

12:00 Germany CPI, m/m (Preliminary) July -0.1% 0.3%

12:00 Germany CPI, y/y (Preliminary) July 0.3% 0.3%

12:30 U.S. Continuing Jobless Claims July 2207 2212

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II -2% 2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 0.8% 1.6%

12:30 U.S. Initial Jobless Claims July 255 270

12:30 U.S. GDP, q/q (Preliminary) Quarter II -0.2% 2.6%

23:05 United Kingdom Gfk Consumer Confidence July 7 5

23:30 Japan Unemployment Rate June 3.3% 3.3%

23:30 Japan Household spending Y/Y June 4.8% 1.7%

23:30 Japan Tokyo Consumer Price Index, y/y July 0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y July 0.1% 0.0%

23:30 Japan National Consumer Price Index, y/y June 0.5% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y June 0.1% 0.0%

-

08:17

Options levels on thursday, July 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1143 (2611)

$1.1087 (2340)

$1.1050 (794)

Price at time of writing this review: $1.0958

Support levels (open interest**, contracts):

$1.0899 (3446)

$1.0865 (6484)

$1.0827 (3069)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 53759 contracts, with the maximum number of contracts with strike price $1,1200 (4184);

- Overall open interest on the PUT options with the expiration date August, 7 is 65292 contracts, with the maximum number of contracts with strike price $1,0900 (6484);

- The ratio of PUT/CALL was 1.21 versus 1.14 from the previous trading day according to data from July, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (1260)

$1.5802 (1748)

$1.5704 (1174)

Price at time of writing this review: $1.5596

Support levels (open interest**, contracts):

$1.5496 (1424)

$1.5398 (1395)

$1.5299 (1358)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22275 contracts, with the maximum number of contracts with strike price $1,5750 (3225);

- Overall open interest on the PUT options with the expiration date August, 7 is 23003 contracts, with the maximum number of contracts with strike price $1,5250 (2273);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from July, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:30

Australia: Import Price Index, q/q, Quarter II 1.4% (forecast 1.5%)

-

03:30

Australia: Building Permits, m/m, June -8.2% (forecast -0.8%)

-

03:30

Australia: Export Price Index, q/q, Quarter II -4.4% (forecast -4%)

-

01:52

Japan: Industrial Production (MoM) , June 0.8% (forecast 0.3%)

-

01:52

Japan: Industrial Production (YoY), June 2.0%

-

00:46

New Zealand: Building Permits, m/m, June -4.1% (forecast 2.5%)

-

00:28

Currencies. Daily history for Jul 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0977 -0,77%

GBP/USD $1,5598 -0,09%

USD/CHF Chf0,9675 +0,53%

USD/JPY Y123,97 +0,31%

EUR/JPY Y136,10 -0,44%

GBP/JPY Y193,38 +0,22%

AUD/USD $0,7289 -0,70%

NZD/USD $0,6643 -1,05%

USD/CAD C$1,2952 +0,21%

-

00:01

Schedule for today, Thursday, Jul 30’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Export Price Index, q/q Quarter II -0.8% -4%

01:30 Australia Import Price Index, q/q Quarter II -0.2% 1.5%

01:30 Australia Building Permits, m/m June 2.4% -0.8%

07:00 Switzerland KOF Leading Indicator July 89.7 90.5

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change July -1 -5

09:00 Eurozone Economic sentiment index July 103.5 103.3

09:00 Eurozone Consumer Confidence (Finally) July -5.6 -7.1

09:00 Eurozone Business climate indicator July 0.1 0.15

09:00 Eurozone Industrial confidence July -3.4 -3.4

09:00 Eurozone Unemployment Rate June 11.1%

12:00 Germany CPI, m/m (Preliminary) July -0.1% 0.2%

12:00 Germany CPI, y/y (Preliminary) July 0.3% 0.2%

12:30 U.S. Continuing Jobless Claims July 2207 2211

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II -2% 1.9%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 0.8% 1.6%

12:30 U.S. Initial Jobless Claims July 255 270

12:30 U.S. GDP, q/q (Preliminary) Quarter II -0.2% 2.6%

23:05 United Kingdom Gfk Consumer Confidence July 7 5

23:30 Japan Unemployment Rate June 3.3% 3.3%

23:30 Japan Household spending Y/Y June 4.8% 1.7%

23:30 Japan Tokyo Consumer Price Index, y/y July 0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y July 0.1% 0.0%

23:30 Japan National Consumer Price Index, y/y June 0.5% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y June 0.1% 0.0%

-