Noticias del mercado

-

22:07

Major US stock indexes finished trading mixed

US stock indices showed mixed trends on Thursday after earnings from Facebook (FB) and Procter & Gamble (PG) disappointed investors and data showed that the US economy grew more slowly than expected.

For example, in the US economic growth accelerated in the second quarter, as the rise in consumer spending offset the decline due to weak business spending on equipment, assuming a steady pulse that can bring the Fed to raise interest rates this year. Gross domestic product expanded at an annual rate of 2.3%. In the first quarter GDP, as previously reported, it was reduced to 0.2%. However, this figure was revised to a rise of 0.6%.

"Revision of estimates of GDP growth in the first quarter indicates the likelihood of the Fed rate hike in September," - said the managing director of stock trading at Wedbush Securities Michael James.

In addition, as it became known today, the number of Americans who first applied for unemployment benefits last week rose from forty-year low, but the general trend shows that the labor market is strengthening. Primary applications for unemployment benefits, an indicator of layoffs, increased by 12,000 to 267,000 seasonally adjusted in the week ended July 25th. This Labor Department said Thursday.

Today his statements to publish more than 50 companies included in the calculation of the index Standard & Poor's 500. Among those already unveiled their finpokazateli companies about 75% higher than expectations for profit of 50% - in relation to revenue.

Almost all components of the index DOW closed in positive territory (19 of 30). Outsider were shares The Procter & Gamble Company (PG, -4.00%). Most remaining shares rose Microsoft Corporation (MSFT, + 1.53%).

Sector S & P index showed diverse dynamics. Most of the basic materials sector fell (-0.4%). The largest growth sector proved conglomerates (+ 1.1%).

At the close:

Dow -0.03% 17,746.05 -5.34

Nasdaq + 0.39% 5,131.61 +19.88

S & P + 0.05% 2,109.59 +1.02

-

21:00

Dow -0.00% 17,751.36 -0.03 Nasdaq +0.39% 5,131.67 +19.94 S&P -0.00% 2,108.55 -0.02

-

20:20

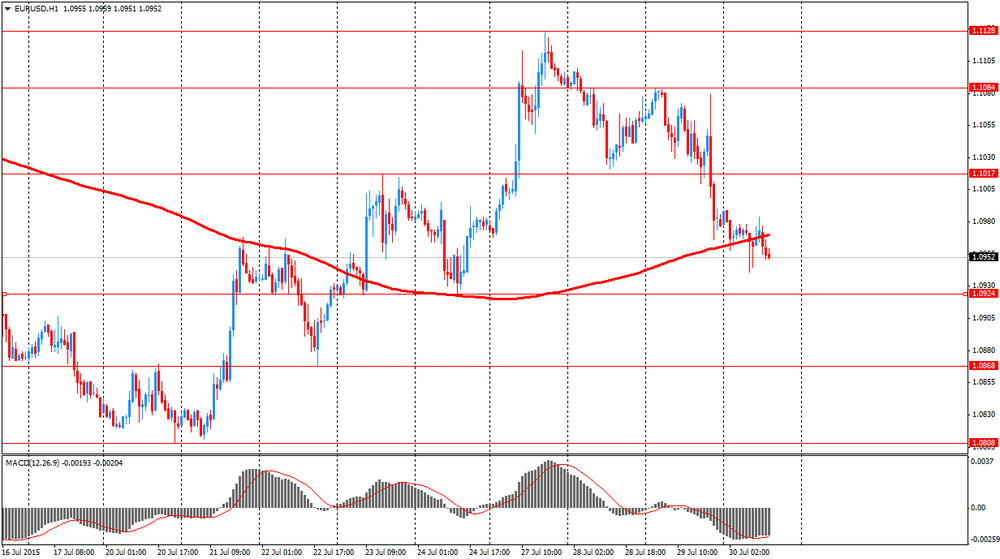

American focus: the dollar strengthened against most major currencies

Dollar rose significantly against the euro, reaching thus the level of $ 1.0900, helped by US data on GDP. The Commerce Department said that US economic growth accelerated in the second quarter, as the rise in consumer spending offset the decline due to weak business spending on equipment, assuming a steady pulse that can bring the Federal Reserve to raise interest rates this year. Gross domestic product expanded at an annual rate of 2.3 percent, said Thursday. In the first quarter GDP, as previously reported, it was reduced to 0.2 percent. However, this figure was revised to a rise of 0.6 percent. The revision of growth in the first quarter reflected the steps taken by the Government to clarify the seasonal adjustment for some components of GDP, which economists say they have residual seasonality in the data, as well as the new source data. A measure of private domestic demand, which excludes trading stocks and government spending increased 2.5 percent after rising 2.0 percent earlier in the year. Business spending fell by 1.6 percent after falling 7.4 percent earlier in the year. Equipment costs fell by 4.1 per cent. Expenditure on exploration and production decreased by 68.2 percent, showing the largest decline since the second quarter of 1986. This category decreased by 44.5 percent in the first quarter. But there are signs that the decline in energy prices possibly coming to an end. Data on Friday showed that the energy company said 21 oil rigs last week, noting the third increase in the last 33 weeks. Exports grew in the second quarter, despite the strong dollar, while imports grew moderately. It has defined a smaller trade deficit, which added 0.13 percentage points to GDP growth. The price index for personal consumption expenditures rose 2.2 percent, the fastest growth since the first quarter of 2012, after falling 1.9 percent earlier in the year. Excluding food and energy, prices rose 1.8 percent.

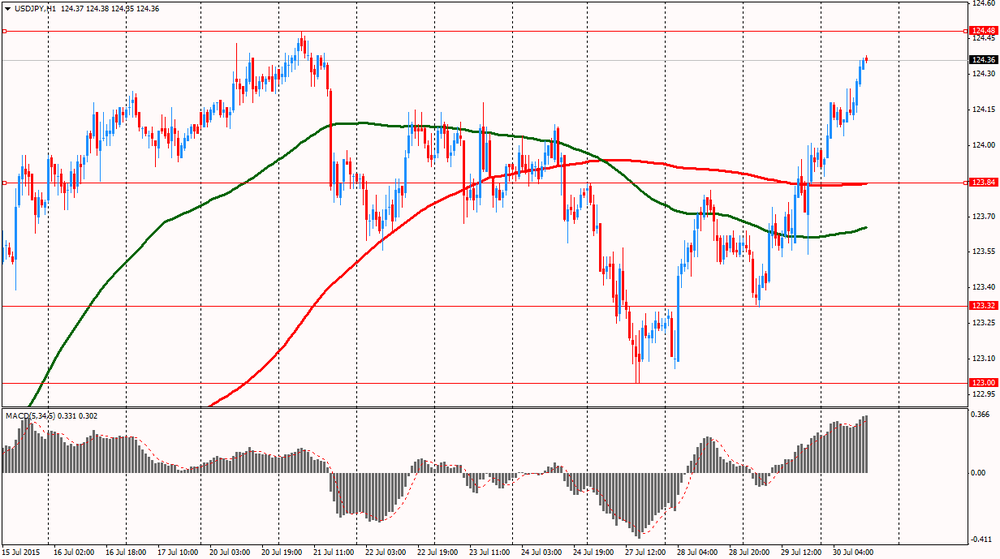

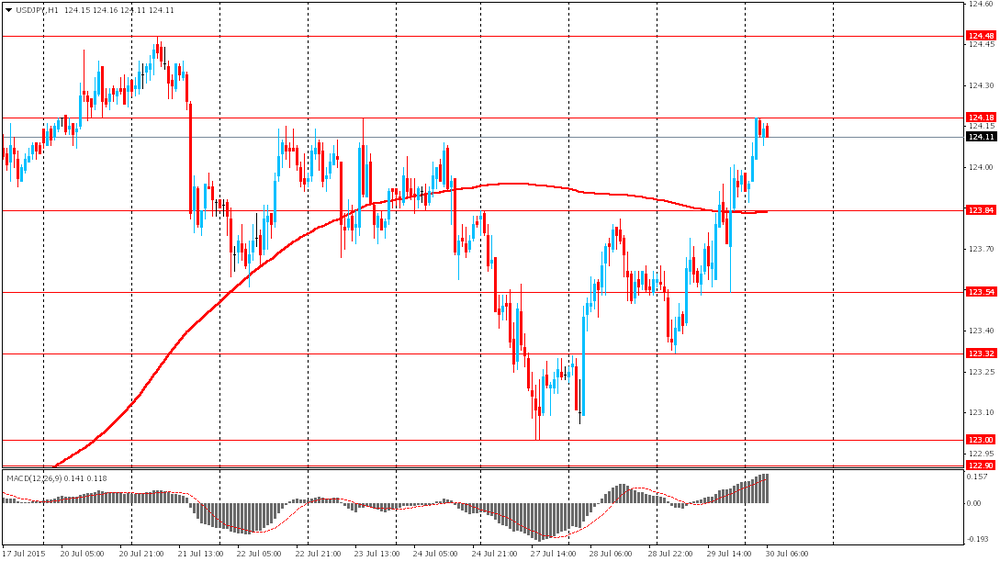

The yen continued to fall against the US dollar, approaching to the lowest since June 10 after the last Federal Reserve indicated that interest rates may be increased in the coming months, with a certain probability in September. In his statement at the rate the Fed noted that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment. The Fed chief Janet Yellen said that the Central Bank may raise rates in September if the economy continues to improve the alleged rate.

Meanwhile, support for the dollar have data on GDP and the US labor market. As it became known, the number of Americans who first applied for unemployment benefits last week rose to forty minimum, but the general trend shows that the labor market is strengthening. Primary applications for unemployment benefits, an indicator of layoffs, increased by 12,000 to 267,000 seasonally adjusted in the week ended July 25th. Economists expected 270,000 initial claims for unemployment benefits last week. Previous week remained at 255000. The level of initial claims for the week ended July 18 was the lowest since November 1973.

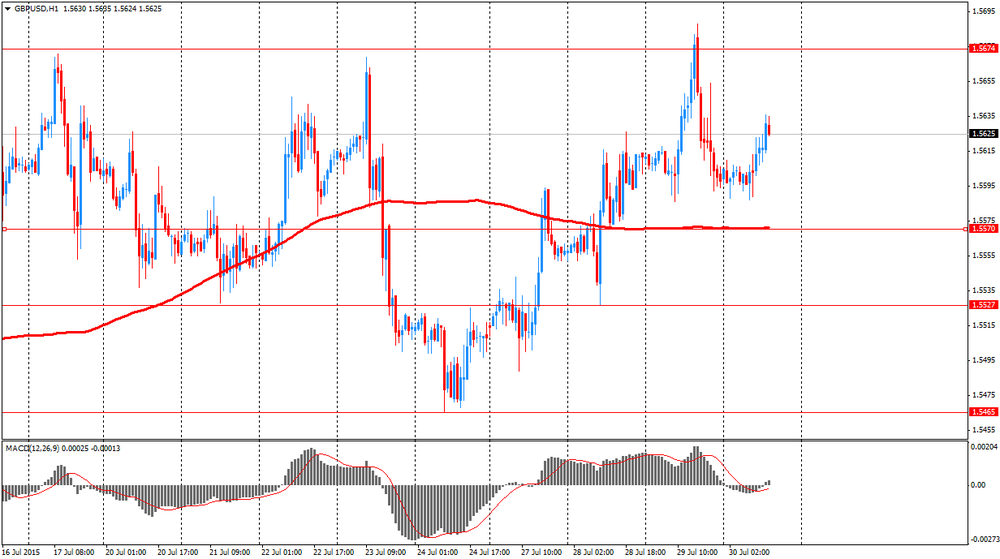

The pound fell sharply against the dollar, at least updating session. The pressure on the currency has stats on the US, which has strengthened expectations of a rate hike this year. The US Commerce Department reported that gross domestic product grew 2.3% in the three months ended June 30. The US economy in the first quarter showed an increase of 0.6%, confounding forecasts for a 0.2% reduction. While economists had forecast GDP growth of 2.6%, the report indicates that the economy is showing strong recovery. The data came after the Federal Reserve said yesterday that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment.

-

19:20

European stock markets closed above the zero mark

European stocks rose modestly on Thursday, recording the third consecutive increase in-session, which was associated with the publication of strong corporate accountability. Also supporting markets have data for the euro area, reporting the unexpected increase trust companies in most major economies in the region. The survey was carried out of the European Commission at the time when Greece is so much closer to the exit from the euro zone as no country before. Nonetheless, Greece July 13 failed to reach agreement with creditors that will allow the country over the next three years to obtain new loans. Increased confidence in the companies suggests that the observed recent increase in investment and employment is likely to continue, supporting the economic recovery in the eurozone. Sentiment in the euro-zone economy, which takes into account the mood of businesses and consumers, in July rose to 104.0 from 103.5 in the previous month, reaching the highest level since July 2011. The index is still above the long-term average level of 100.0. Economists expected a decline to 103.3.

Focus has also proved the Economic Bulletin of the ECB. It was reported that the unhurried recovery of the European economy is gaining momentum due to falling oil prices and loose monetary policy, but the increase in corporate spending remains weak. Cheap oil also puts downward pressure on inflation, which is a problem for the bank, which will launch the QE program to prevent deflation and accelerating inflation. The Bank believes that its measures are bearing fruit, and expects that prices will rise by the end of the year, and will continue to rise in 2016 and 2017. The ECB said that the latest figures correspond to the continuation of economic expansion in the second quarter.

Minor influenced by news from Greece. Today, the IMF said that high debt levels and poor implementation of reforms cut Greece from third financial aid programs. According to the resolution, presented yesterday at a meeting of the IMF, the Fund does not agree to participate in the third program of assistance. The Fund will decide whether to take part in the second stage, just after Greece agrees to carry out the proposed reforms, and creditors - debt relief. Yesterday the head of the IMF Lagarde said that the IMF insists on debt restructuring of Greece. "We see a situation where we have analyzed the debt and decided that it can not be maintained. To Greece succeeded, and any program can run external financing, requires substantial debt restructuring," - said Lagarde.

Investors also drew attention to the statistics on the United States, which supported the view that a rate hike is not far off. Recall of US GDP in the II quarter 2015 increased by 2.3% in terms of annual growth. Analysts on average had forecast an increase in the US economy in April-June by 2.6%. The indicator for the I quarter of this year has been significantly improved - up to + 0.6% from the previously announced reduction of 0.2%.

FTSE 100 6,668.87 +37.87 + 0.57% CAC 40 5,046.42 +28.98 + 0.58% DAX 11,257.15 +45.30 + 0.40%

Shares of Royal Dutch Shell Plc rose 5.7% after the company said it would cut 6.5 thousand. Jobs this year and will cost optimization to convince investors that it is able to survive the difficult period of reduction in price materials.

The cost of Nokia jumped 6.6%. The Finnish company has completed the second quarter of 2015 with higher profits than expected, thanks to a substantial increase in software sales.

The price of the French automaker Renault dropped 8.1%, as the growth rate of profit group behind rival PSA Peugeot Citroen.

Quotes Fiat Chrysler Automobiles NV rose 4.9% after increasing the profit forecast for the current year.

The cost of AstraZeneca Plc rose 2.7% after reporting quarterly earnings that exceeded the amount of analysts' forecasts.

Shares of Deutsche Bank, has tripled profits in the last quarter, rose 4.3%.

Capitalization Inchcape Plc rose 6.8% after the announcement of share buyback program.

-

19:16

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes fell on Thursday as earnings from Facebook (FB) and Procter & Gamble (FB) disappointed investors and data showed that the economy expanded at a slower-than-expected pace in the second quarter. Gross domestic product expanded at a 2.3% annual rate in the second quarter, below the 2.6% rise economists had expected, even as the Federal Reserve left doors open for a possible rate hike in September. The Fed has maintained near-zero interest rates for nearly a decade, saying it will raise rates only when it sees a sustained recovery in the economy.

Most of Dow stocks in positive area (20 of 30). Top looser - The Procter & Gamble Company (PG, -3.68%). Top gainer - Microsoft Corporation (MSFT, +1.80).

S&P index sectors are mixed. Top looser - Basic Materials (-0.5%). Top gainer - Conglomerates (+1.5%).

At the moment:

Dow 17675.00 -7.00 -0.04%

S&P 500 2102.25 +0.75 +0.04%

Nasdaq 100 4593.00 +28.00 +0.61%

10 Year yield 2,27% -0,01

Oil 48.90 +0.11 +0.23%

Gold 1090.00 -3.30 -0.30%

-

18:54

WSE: Session Results

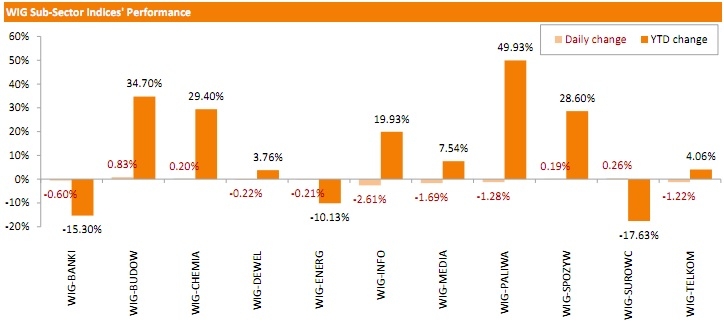

Polish equities were lower on Thursday. The broad market measure, the WIG Index, fell by 0.53%. Sector-wise, construction sector (+0.83%) fared the best, while informational technologies (-2.61%) lagged behind.

Large-cap stocks measure, the WIG30 Index, underperformed the broad market, recording a 0.85% drop. ASSECO POLAND (WSE: ACP), CYFROWY POLSAT (WSE: CPS) and BOGDANKA (WSE: LWB) were among the biggest laggards in the WIG30 Index, losing a respective 5.29%, 3.45% and 2.58%. On the contrary, FMCG wholesaler EUROCASH (WSE: EUR) became the best-performing stock, advancing 3.98% as good semiannual results of its direct competitor Biedronka retail chain sparked optimism about the entire sector. It was followed by GRUPA AZOTY (WSE: ATT), ING BSK (WSE: ING) and HANDLOWY (WSE: BHW), gaining 2.14%, 1.60% and 1.32% respectively.

-

18:00

European stocks closed: FTSE 100 6,668.87 +37.87 +0.57% CAC 40 5,046.42 +28.98 +0.58% DAX 11,257.15 +45.30 +0.40%

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0950(E647mn), $1.0960(E1.0bn), $1.1000(E1.4bn), $1.1080-1.1100(E1.58bn)

USD/JPY: Y122.40-60($1.345bn), Y123.70-75($460mn), Y123.95-124.00($1.15bn), Y125.00($402mn)

EUR/JPY: Y136.25(E240mn)

GBP/USD: $1.5500(Gbp548mn), $1.5605(Gbp429mn)

EUR/GBP: GBP0.7100(E616mn), Gbp7250(E402mn)

AUD/USD: $0.7250(A$358mn)

NZD/USD: $0.6565(NZ$279mn), $0.6600(NZ$302mn)

-

15:31

U.S. Stocks open: Dow -0.14%, Nasdaq -0.23%, S&P -0.16%

-

15:25

Before the bell: S&P futures -0.33%, NASDAQ futures -0.13%

U.S. stock-index futures declined as economic growth reinforced a case for higher interest rates, and earnings from Facebook Inc. and Procter & Gamble Co. disappointed.

Global Stocks:

Nikkei 20,522.83 +219.92 +1.08%

Hang Seng 24,497.98 -121.47 -0.49%

Shanghai Composite 3,705.73 -83.44 -2.20%

FTSE 6,690.99 +59.99 +0.90%

CAC 5,048.56 +31.12 +0.62%

DAX 11,238.85 +27.00 +0.24%

Crude oil $49.05 (+0.53%)

Gold $1085.90 (-0.59%)

-

15:19

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

AT&T Inc

T

34.70

+0.03%

4.4K

Nike

NKE

115.03

+0.10%

0.3K

E. I. du Pont de Nemours and Co

DD

55.53

+0.13%

0.3K

General Motors Company, NYSE

GM

32.00

+0.16%

2.3K

Verizon Communications Inc

VZ

46.64

+0.17%

3.4K

ALCOA INC.

AA

10.18

+0.20%

21.4K

Johnson & Johnson

JNJ

100.00

+0.27%

0.1K

Intel Corp

INTC

29.15

+0.48%

17.8K

Hewlett-Packard Co.

HPQ

30.30

0.00%

3.7K

Wal-Mart Stores Inc

WMT

72.21

-0.03%

68.5K

Amazon.com Inc., NASDAQ

AMZN

528.70

-0.06%

8.7K

AMERICAN INTERNATIONAL GROUP

AIG

64.49

-0.08%

4.7K

Twitter, Inc., NYSE

TWTR

31.21

-0.10%

175.0K

McDonald's Corp

MCD

98.10

-0.11%

2.0K

American Express Co

AXP

75.60

-0.13%

0.1K

Chevron Corp

CVX

93.12

-0.14%

0.3K

Merck & Co Inc

MRK

58.45

-0.15%

6.0K

Goldman Sachs

GS

206.51

-0.16%

0.4K

Starbucks Corporation, NASDAQ

SBUX

57.42

-0.16%

1.3K

Exxon Mobil Corp

XOM

83.00

-0.17%

5.7K

Cisco Systems Inc

CSCO

28.34

-0.21%

0.1K

International Business Machines Co...

IBM

160.75

-0.21%

0.4K

Citigroup Inc., NYSE

C

58.74

-0.22%

20.4K

General Electric Co

GE

26.20

-0.23%

0.9K

Microsoft Corp

MSFT

46.17

-0.26%

2.3K

Walt Disney Co

DIS

119.51

-0.27%

3.1K

JPMorgan Chase and Co

JPM

68.75

-0.28%

0.2K

Google Inc.

GOOG

630.00

-0.31%

0.6K

Tesla Motors, Inc., NASDAQ

TSLA

263.00

-0.31%

2.9K

Apple Inc.

AAPL

122.60

-0.32%

81.4K

Ford Motor Co.

F

15.16

-0.33%

21.6K

Visa

V

75.70

-0.41%

0.4K

ALTRIA GROUP INC.

MO

54.15

-0.46%

7.5K

The Coca-Cola Co

KO

40.40

-0.47%

2.0K

Caterpillar Inc

CAT

76.96

-0.48%

0.1K

Pfizer Inc

PFE

35.58

-0.50%

0.4K

Yahoo! Inc., NASDAQ

YHOO

37.48

-0.50%

0.9K

Boeing Co

BA

143.23

-0.63%

0.1K

Home Depot Inc

HD

115.60

-0.66%

1.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.32

-1.44%

10.7K

Barrick Gold Corporation, NYSE

ABX

07.12

-1.52%

41.9K

Procter & Gamble Co

PG

79.01

-2.00%

44.3K

Yandex N.V., NASDAQ

YNDX

15.10

-2.01%

7.6K

Facebook, Inc.

FB

94.69

-2.37%

2.0M

-

15:11

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised:

from $100 to $110 at Oppenheimer;

from $105 to $115 at BofA/Merrill;

from $110 to $115 at Deutsche Bank;

from $95 to $115 at Monness Crespi & Hardt;

from $110 to $115 at Raymond James;

from $93 to $115 at Needham;

from $95 to $108 at Stifel;

from $94 to $118 at FBR Capital;

from $120 to $146 at Piper Jaffray.

-

14:45

-

14:30

U.S.: GDP, q/q, Quarter II 2.3% (forecast 2.6%)

-

14:30

U.S.: PCE price index, q/q, Quarter II 2.2% (forecast 2%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter II 1.8% (forecast 1.6%)

-

14:30

U.S.: Initial Jobless Claims, July 267 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, July 2262 (forecast 2212)

-

14:15

European session review: the US dollar rose

The US dollar strengthened against other major currencies after the Federal Reserve indicated that interest rates may be increased in the coming months, with a certain probability in September.

In his statement yesterday at the rate the Fed noted that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment.

The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate.

On Thursday scheduled the publication of preliminary data on the growth of the US economy in the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The euro retreated from session lows after the data on the index of sentiment in the economy, but then fell again. The threat of a Greek exit from the euro zone does not have a negative impact on sentiment in the corporate sector in the region in July. Companies in the past month more optimistic about their own prospects, although increased consumer concerns.

The published data on Thursday the European Commission pointed to an unexpected increase in confidence in the companies in most major economies in the eurozone.

The survey was carried out of the European Commission at the time when Greece is so much closer to the exit from the euro zone as no country before. Nonetheless, Greece July 13 failed to reach agreement with creditors that will allow the country over the next three years to obtain new loans.

Increased confidence in the companies suggests that the observed recent increase in investment and employment is likely to continue, supporting the economic recovery in the eurozone.

Sentiment in the euro-zone economy, which takes into account the mood of businesses and consumers, in July rose to 104.0 from 103.5 in the previous month, reaching the highest level since July 2011. The index is still above the long-term average level of 100.0.

Economists had expected the index decline in July to 103.3.

The European Commission confirmed that consumer confidence weakened in July, but the mood of the companies of the manufacturing sector, the service sector and the retail sector improved, while the mood of construction companies and the banking sector declined slightly.

EUR / USD: during the European session the pair fell to $ 1.0941, and then rose to $ 1.0984

GBP / USD: during the European session, the pair rose to $ 1.5636

USD / JPY: during the European session, the pair rose to Y124.38

-

13:45

Orders

EUR/USD

Offers 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200

Bids 1.0940 1.0900 1.0880 1.0860 1.0820-25 1.0800 1.0780 1.0750 1.0720

GBP/USD

Offers 1.5630 1.5650 1.5680 1.5700-10 1.5725-30 1.5750

Bids 1.5580-85 1.5565 1.5550 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7030 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.7000 0.6975-80 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 136.30 136.50 136.80 137.00 137.30 137.50 137.80 138.00

Bids 135.80 135.50 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 124.25-30 124.50 124.75 125.00 125.30 125.50

Bids 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7330 0.7350 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7280 0.7265 0.7250 0.7230 0.7200 0.7180 0.7150

-

12:30

Europe trades slightly higher on bumper day of earnings

European stocks traded higher on Thursday morning as investors keep an eye on a bumper morning of earnings and remain focused on continuing volatility in China markets.

The pan-European Stoxx 600 opened 0.6 percent higher but pared gains to trade near 0.2 percent by mid-morning.

Birtain's FTSE 100 was trading around 0.4 percent higher while the French CAC and German DAX saw 0.2 percent pop.

It's another mega day of earnings with a large number of companies reporting results.

Diageo reported full-year earnings on Thursday and said organic net sales were flat while pre-tax profit rose slightly as it continues to nurse a hangover in many drinks categories. Shares in the spirits maker were trading down 0.5 percent.

Shell said earnings in the second quarter, on a current cost of supplies (CCS) basis, came in at $3.4 billion - down from $5.1 billion for the same quarter a year ago. The Anglo-Dutch multinational also said lower oil prices could continue for a number of years, but the company's stock was trading 3.8 percent higher.

BT, the British telecoms giant, announced better-than-expected net profit of £511 million ($797 million) for the first quarter on Thursday, but shares in the firm were down 2.3 percent.

Deutsche Bank reported second-quarter earnings in line with expectations but said litigation charges were 1.2 billion euros, dragging down the group's bottom line. Despite this, Deutsche Bank was trading 2.5 percent up.

State-backed Royal Bank of Scotland reported a rise in second-quarter profit despite booking a £1.05 billion restructuring charge. Shares were trading around 0.5 percent higher by mid-morning.

Telecom equipment maker Nokia reported a 51 percent year-on-year rise in profits in the second quarter of 2015 with operating profit in its key networks business up 11 percent. Shares surged over 7.5 percent.

Siemens reported better-than-expected earnings sending shares in the company 3.1 percent higher.

Pharmaceutical giant AstraZeneca reported a smaller-than-expected decline in revenues in the second quarter and said upped its revenue guidance for the full year. Shares in the company traded 2.2 percent higher.

Renault shares plunged 7.4 percent after the French carmaker said new registrations were up just 0.8 percent in the first half of the year.

Swiss Re fell 2.8 percent after the open following a second quarter earnings report that missed analysts expectations.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0950(E647mn), $1.0960(E1.0bn), $1.1000(E1.4bn), $1.1080-1.1100(E1.58bn)

USD/JPY: Y122.40-60($1.345bn), Y123.70-75($460mn), Y123.95-124.00($1.15bn), Y125.00($402mn)

EUR/JPY: Y136.25(E240mn)

GBP/USD: $1.5500(Gbp548mn), $1.5605(Gbp429mn)

EUR/GBP: GBP0.7100(E616mn), Gbp7250(E402mn)

AUD/USD: $0.7250(A$358mn)

NZD/USD: $0.6565(NZ$279mn), $0.6600(NZ$302mn)

-

11:01

Eurozone: Economic sentiment index , July 104 (forecast 103.3)

-

11:01

Eurozone: Industrial confidence, July -3.0 (forecast -3.4)

-

11:00

Eurozone: Consumer Confidence, July -7.0 (forecast -7.1)

-

10:59

Eurozone: Business climate indicator , July 0.39 (forecast 0.15)

-

09:55

Germany: Unemployment Change, July 9 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , July 6.4% (forecast 6.4%)

-

09:00

Switzerland: KOF Leading Indicator, July 99.8 (forecast 90.3)

-

08:51

Oil prices climbed amid EIA data

West Texas Intermediate futures for September delivery climbed to $48.80 (+0.02%), while Brent crude advanced to $53.53 (+0.28%) after Energy Information Administration reported that U.S. crude stockpiles unexpectedly declined by 4.2 million barrels in the week ending July 24 vs expectations for an 184,000 barrels drop. Gasoline inventories fell by 363,000 barrels against analysts' forecasts of a 512,000-barrel increase. Meanwhile U.S. gasoline demand rose by 6.2% from a year ago.

"The outlook still remains cautious for crude oil prices, especially Brent oil. Prices may not get any relief in the short term as players are expected to continue the fight for market share at the expense of price," ANZ said on Thursday. OPEC members are currently producing 3 barrels per day more than required.

-

08:38

Gold weighed by the dollar

Gold is currently at $1,093.00 (+0.04%). The precious metal approached its lowest level since 2010 after the U.S. dollar advanced against other major currencies on Fed statement. Yesterday FOMC members said that the U.S. economy was "expanding moderately", supporting expectations for an interest rate rise when the committee meets in September.

Later today the U.S. Department of Commerce will release preliminary estimate of second-quarter U.S. gross domestic product, with the economy expected to return to growth, expanding by 2.6%, after contracting in a weather-dependant first quarter.

A substantially higher growth rate would intensify expectations for a September rate increase.

"The slide that we've seen last week showed investors were already pricing in the effect of the first rate hike whether it's September or December. What matters is after the first rate hike, how would they conduct the rest of the rate increases," said Howie Lee, analyst at Phillip Futures.

-

08:35

Global Stocks: U.S. indices advanced

Major U.S. stock indices rose on Wednesday amid earnings reports and results of the FOMC meeting. Fed policymakers voted anonymously to keep the key rate near zero. On a meeting scheduled for September 16-17 they will have to make a hard decision. This time the Fed noted progress in the U.S. labor market. This indicates that the central bank prepares to raise rates in September or later this year. Nevertheless policymakers remained concerned about low inflation, which can persuade the committee to postpone a rate hike.

The Dow Jones Industrial Average rose 121.12 points, or 0.7%, to 17751.39. The S&P 500 climbed 15.32 points, or 0.7%, to 2108.57 (all sectors of the index advanced). The Nasdaq Composite gained 22.53 points, or 0.4%, to 5111.73.

Citrix Systems Inc. led the gains among S&P 500 stocks, soaring 8.1% after the software company's adjusted quarterly profit and revenue exceeded expectations.

In Asia this morning Hong Kong Hang Seng declined 0.02%, or 4.31 points, to 24,615.14. China Shanghai Composite Index slid 0.01%, or 0.41 points, to 3,788.76. The Nikkei gained 1.10%, or 222.55 points, to 20,525.46.

Asian stock indices are showing mixed results. Japanese stocks advanced following gains in U.S. equities.

Data on Japanese industrial production showed that the corresponding index rose by 0.8% m/m in June exceeding expectations for a 0.3% increase. On an annualized basis industrial production rose by 2.0% compared to a 3.9% drop reported previously.

The China Securities Regulatory Commission said late Tuesday it was investigating share dumping incidents that occurred on Monday.

-

08:32

Foreign exchange market. Asian session: the U.S. dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Export Price Index, q/q Quarter II -0.8% -4% -4.4%

01:30 Australia Import Price Index, q/q Quarter II -0.2% 1.5% 1.4%

01:30 Australia Building Permits, m/m June 2.3% Revised From 2.4% -0.8% -8.2%

The U.S. dollar advanced against the euro and the Japanese yen after Fed policymakers voted to keep the benchmark rate unchanged and noted that growth rates had been moderate in the past months. The labor market kept making progress, while inflation remained low.

The yen advanced slightly at the beginning of the session amid industrial production data, which showed that the corresponding index rose by 0.8% m/m in June. However this increase came after a 2.1% drop in May. That's why many analysts expect Japanese GDP to show contraction in the second quarter of the current year.

The New Zealand dollar is under pressure amid positive attitude towards the greenback. The kiwi got hit by a 4.1% decline in building permits. The previous reading was 0.

EUR/USD: the pair fell to $1.0965 in Asian trade

USD/JPY: the pair rose to Y124.20

GBP/USD: the pair traded around $1.5585-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland KOF Leading Indicator July 89.7 90.3

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change July -1 -5

09:00 Eurozone Economic sentiment index July 103.5 103.3

09:00 Eurozone Consumer Confidence (Finally) July -5.6 -7.1

09:00 Eurozone Business climate indicator July 0.1 0.15

09:00 Eurozone Industrial confidence July -3.4 -3.4

09:00 Eurozone Unemployment Rate June 11.1%

12:00 Germany CPI, m/m (Preliminary) July -0.1% 0.3%

12:00 Germany CPI, y/y (Preliminary) July 0.3% 0.3%

12:30 U.S. Continuing Jobless Claims July 2207 2212

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II -2% 2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 0.8% 1.6%

12:30 U.S. Initial Jobless Claims July 255 270

12:30 U.S. GDP, q/q (Preliminary) Quarter II -0.2% 2.6%

23:05 United Kingdom Gfk Consumer Confidence July 7 5

23:30 Japan Unemployment Rate June 3.3% 3.3%

23:30 Japan Household spending Y/Y June 4.8% 1.7%

23:30 Japan Tokyo Consumer Price Index, y/y July 0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y July 0.1% 0.0%

23:30 Japan National Consumer Price Index, y/y June 0.5% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y June 0.1% 0.0%

-

08:17

Options levels on thursday, July 30, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1143 (2611)

$1.1087 (2340)

$1.1050 (794)

Price at time of writing this review: $1.0958

Support levels (open interest**, contracts):

$1.0899 (3446)

$1.0865 (6484)

$1.0827 (3069)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 53759 contracts, with the maximum number of contracts with strike price $1,1200 (4184);

- Overall open interest on the PUT options with the expiration date August, 7 is 65292 contracts, with the maximum number of contracts with strike price $1,0900 (6484);

- The ratio of PUT/CALL was 1.21 versus 1.14 from the previous trading day according to data from July, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5901 (1260)

$1.5802 (1748)

$1.5704 (1174)

Price at time of writing this review: $1.5596

Support levels (open interest**, contracts):

$1.5496 (1424)

$1.5398 (1395)

$1.5299 (1358)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22275 contracts, with the maximum number of contracts with strike price $1,5750 (3225);

- Overall open interest on the PUT options with the expiration date August, 7 is 23003 contracts, with the maximum number of contracts with strike price $1,5250 (2273);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from July, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:02

Nikkei 225 20,570.46 +267.55 +1.32 %, Hang Seng 24,808.14 +188.69 +0.77 %, Shanghai Composite 3,794.69 +5.52 +0.15 %

-

03:30

Australia: Building Permits, m/m, June -8.2% (forecast -0.8%)

-

03:30

Australia: Export Price Index, q/q, Quarter II -4.4% (forecast -4%)

-

03:30

Australia: Import Price Index, q/q, Quarter II 1.4% (forecast 1.5%)

-

01:52

Japan: Industrial Production (MoM) , June 0.8% (forecast 0.3%)

-

01:52

Japan: Industrial Production (YoY), June 2.0%

-

00:46

New Zealand: Building Permits, m/m, June -4.1% (forecast 2.5%)

-

00:32

Commodities. Daily history for Jul 29’2015:

(raw materials / closing price /% change)

Oil 48.89 +0.20%

Gold 1,095.80 +0.29%

-

00:30

Stocks. Daily history for Jul 29’2015:

(index / closing price / change items /% change)

Nikkei 225 20,302.91 -25.98 -0.13 %

Hang Seng 24,619.45 +115.51 +0.47 %

S&P/ASX 200 5,624.16 +39.47 +0.71 %

Shanghai Composite 3,790.26 +127.26 +3.47 %

FTSE 100 6,631 +75.72 +1.16 %

CAC 40 5,017.44 +40.12 +0.81 %

Xetra DAX 11,211.85 +37.94 +0.34 %

S&P 500 2,108.57 +15.32 +0.73 %

NASDAQ Composite 5,111.73 +22.53 +0.44 %

Dow Jones 17,751.39 +121.12 +0.69 %

-

00:28

Currencies. Daily history for Jul 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0977 -0,77%

GBP/USD $1,5598 -0,09%

USD/CHF Chf0,9675 +0,53%

USD/JPY Y123,97 +0,31%

EUR/JPY Y136,10 -0,44%

GBP/JPY Y193,38 +0,22%

AUD/USD $0,7289 -0,70%

NZD/USD $0,6643 -1,05%

USD/CAD C$1,2952 +0,21%

-

00:01

Schedule for today, Thursday, Jul 30’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA's Governor Glenn Stevens Speech

01:30 Australia Export Price Index, q/q Quarter II -0.8% -4%

01:30 Australia Import Price Index, q/q Quarter II -0.2% 1.5%

01:30 Australia Building Permits, m/m June 2.4% -0.8%

07:00 Switzerland KOF Leading Indicator July 89.7 90.5

07:55 Germany Unemployment Rate s.a. July 6.4% 6.4%

07:55 Germany Unemployment Change July -1 -5

09:00 Eurozone Economic sentiment index July 103.5 103.3

09:00 Eurozone Consumer Confidence (Finally) July -5.6 -7.1

09:00 Eurozone Business climate indicator July 0.1 0.15

09:00 Eurozone Industrial confidence July -3.4 -3.4

09:00 Eurozone Unemployment Rate June 11.1%

12:00 Germany CPI, m/m (Preliminary) July -0.1% 0.2%

12:00 Germany CPI, y/y (Preliminary) July 0.3% 0.2%

12:30 U.S. Continuing Jobless Claims July 2207 2211

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II -2% 1.9%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 0.8% 1.6%

12:30 U.S. Initial Jobless Claims July 255 270

12:30 U.S. GDP, q/q (Preliminary) Quarter II -0.2% 2.6%

23:05 United Kingdom Gfk Consumer Confidence July 7 5

23:30 Japan Unemployment Rate June 3.3% 3.3%

23:30 Japan Household spending Y/Y June 4.8% 1.7%

23:30 Japan Tokyo Consumer Price Index, y/y July 0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y July 0.1% 0.0%

23:30 Japan National Consumer Price Index, y/y June 0.5% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y June 0.1% 0.0%

-