Noticias del mercado

-

22:17

U.S. stocks closed

U.S. stocks staged an afternoon rally to finish little changed, shrugging off a renewed rout in crude sparked by concern that China's economy is slowing. The dollar declined after a Federal Reserve official said policy moves are not predetermined amid recent market turmoil.

The Standard & Poor's 500 Index fell just short of a third day of gains after erasing all of a 1 percent decline amid advances in consumer and technology shares. The Bloomberg Dollar Spot Index fell 0.4 percent as Fed Vice Chairman Stanley Fischer said market turbulence's impact on U.S. growth will factor into officials' policy decision. Crude fell more than 6 percent, halting the longest winning run this year after after an index of Chinese manufacturing dropped to a three-year low. Treasuries fell.

Fischer's dovish comments added to optimism among equity investors recently emboldened by signals from central banks in Europe and Japan that they stand ready to do what is needed to spur growth. The advance in American benchmarks even as crude retreated decoupled, at least temporarily, assets that have moved in lockstep so far this year.

Investors are also looking to U.S. data for indications of the health of the world's biggest economy and the possible trajectory of interest rates. Household spending cooled in December, while consumer purchases were little changed. A report from the Institute for Supply Management showed manufacturing contracted in January.

-

21:00

DJIA 16454.04 -12.26 -0.07%, NASDAQ 4620.88 6.93 0.15%, S&P 500 1940.18 -0.06 0%

-

20:18

American focus: the US dollar weakened

The US dollar continued to fall against major currencies after data showed that manufacturing activity in the US falls again in January, holding at lows since July 2009.

A report published by the Institute of Supply Management (ISM), showed that in January, activity in the US manufacturing sector has improved slightly, while exceeding the average forecast. The PMI index for the manufacturing amounted to US in January to 48.2 points against 48.0 points in December. It was expected that this figure will remain unchanged.

ISM report came after after data on personal income and spending by the Ministry of Commerce.

The Commerce Department reported that the volume of personal spending in the US was unchanged in December, which was associated with a decrease in purchases of cars and falling demand for public services due to the unusually warm weather.

According to the data, personal spending remained unchanged in December after rising 0.5 percent in November, which was revised down from 0.3 percent. Adjusted for inflation, consumer spending rose 0.1 percent following gains of 0.4 percent in November. Economists had expected consumer spending, which accounts for over two-thirds of US economic activity, will grow by 0.1 percent in December. At the end of 2015, consumer spending rose by 3.4 percent after rising 4.2 percent in 2014.

The report also stated that the amount of personal income rose in December by 0.3 percent, as in November. Wages increased by 0.2 percent after rising 0.5 percent in November. Overall, in 2015 personal income rose by 4.5 percent, recording the highest growth since 2012. Recall in 2014, revenues grew by 4.4 percent.

Given that revenue growth exceeded a change costs, the savings rate rose in December to $ 753.3 billion. (The highest rate since December 2012), compared to $ 717.8 billion. In November. The higher the amount of savings and the rise in house prices should help to soften the blow of the recent stock market crash, and stimulate the growth of spending in early 2016.

In addition, the Ministry of Commerce said that the price index for personal consumption expenditures fell 0.1 percent after rising 0.1 percent in November. For 12 months (to December), the figure rose by 0.6 percent after increasing 0.4 percent in November. Last growth rate was the highest since December 2014. The basic price index for personal consumption expenditures remained unchanged in December after rising 0.2 percent in November. Analysts had expected the index to rise by 0.1 percent. In annual terms, the core index increased 1.4 percent, as in November.

Previously, little impact on the dynamics of the euro was data for Germany and the euro zone. The Markit Economics said that the growth rate of activity in the industrial sector in Germany slowed to a three-month low in January as weak demand from abroad caused a decline in new orders. According to the data, the final Purchasing Managers' Index for Manufacturing fell to 52.3 in January from 53.2 in the previous month. The latter value was slightly above the 52.1 preliminary assessment, however, the index has fallen to its lowest level since October. Analysts had expected the index was 52.1 points. The report also reported that the decline in oil and commodity prices has significantly reduced purchasing prices, prompting the company to lower average selling prices. Despite the fall in prices, production and new orders increased at a slower pace, mainly due to weak demand in export markets. Meanwhile, the growth rate of outstanding orders were the weakest in three months.

Another report showed that the increase in activity in the manufacturing sector slowed in the euro zone beginning in 2016, as incoming orders failed to show a significant increase, although the companies have sharply reduced their selling prices. Manufacturing PMI for the euro zone fell to 52.3 points against 53.2 points in December. The index coincided with the preliminary assessment and to the median forecast of experts. Despite the decline, the index remained above 50, indicating expansion confident. Sub-manufacturing index fell in January to 53.4 points compared to 54.5 in December. The data also showed that the index measuring prices for the products of companies, fell to 48.3 from 49.8 in December, its lowest level since January 2015.

In focus were also statements by the ECB. Benoit Ker noted that during the March meeting of the European Central Bank will review and possibly revise the measures of quantitative easing. Ker added that the evidence clearly suggests that monetary policy has the desired result. Meanwhile, Ewald Nowotny said that he hoped for a more rational approach markets in March in respect of incentive measures. He admitted that for some months, inflation may reach negative values, and added that the core CPI remained relatively stable.

The pound rose against the dollar, supported by statistics on business activity. Today it became known that manufacturing activity in the UK grew moderately in January, against expectations of a slight deterioration, helped increase production. However, companies have reduced their staff at the fastest pace in three years and reported a decline in export orders. The index of manufacturing activity PMI rose to a three-month high in January and amounted to 52.9 points versus 52.1 points. Analysts had expected the index to fall to 52.1 points. The volume of production increased at the fastest pace since June 2014, which was headed by growth in consumer and investment goods. In addition, the data showed that manufacturers reduced their staff at the fastest pace since February 2013, while new export orders fell at the fastest pace since June of last year, while the pound fell about 3 percent on a trade-weighted basis in the last month. "The domestic market remains the key growth driver. Even after the recent weakening of the exchange rate, a number of manufacturers still indicate that a high rate of the pound against the euro had a negative impact on the inflow of orders", - said Rob Dobson, senior economist at Markit.

-

19:00

European Central Bank President Mario Draghi: the central bank will review its asset-buying programme at its March monetary policy meeting and will add further stimulus measures if needed

The European Central Bank (ECB) President Mario Draghi said in a speech on Monday that the central bank will review its asset-buying programme at its March monetary policy meeting and will add further stimulus measures if needed.

He pointed out that downside risks were increased and inflation in the Eurozone is weaker than expected in December.

"Downside risks have increased again amid heightened uncertainty about emerging market economies' growth prospects, volatility in financial and commodity markets, and geopolitical risks. Inflation dynamics are also tangibly weaker than we expected in December," the ECB president noted.

-

18:53

European Central Bank Governing Council member Ewald Nowotny: the slowdown in the Chinese economy is a risk to developed countries

The European Central Bank (ECB) Governing Council member Ewald Nowotny said on Monday that the global economy was expanding moderately, adding that the slowdown in the Chinese economy is a risk to developed countries.

"Recent developments in China - since last year, world's largest economy in terms of GDP based on purchasing power parity - are of particular concern," he said.

-

18:00

European stocks closed: FTSE 6060.10 -23.69 -0.39%, DAX 9757.88 -40.23 -0.41%, CAC 40 4392.33 -24.69 -0.56%

-

18:00

European stocks close: stocks closed lower on the mixed manufacturing PMI data from the Eurozone, on falling oil prices and on the weak Chinese manufacturing PMI data

Stock indices closed lower on the mixed manufacturing PMI data from the Eurozone, on falling oil prices and on the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 52.2 in January from 53.2 in December, in line with the preliminary reading.

The drop was driven by a softer growth in output and new orders.

"Growth of order books, exports and output all slowed. If the slowdown in business activity wasn't enough to worry policymakers, prices charged by producers fell at the fastest rate for a year to spur further concern about deflation becoming ingrained," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in January from 53.2 in December, up from the preliminary reading of 52.1.

The index was driven by a weaker rise in production and new orders. Lower energy and raw material prices weighed on input costs.

France's final manufacturing purchasing managers' index (PMI) declined to 50.0 in January from 51.4 in December, in line with the preliminary reading.

The index was driven by a drop in new orders, and input and output prices.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.9 in January from 52.1 in December, exceeding expectations for a rise to 51.8. December's figure was revised up from 51.9.

The increase was driven by a rise in domestic demand.

"The UK manufacturing sector registered an uptick in its rate of expansion at the start of 2016, shrugging off a number of potential headwinds, ranging from global financial market volatility to localised flooding in the North of the country. The domestic market remains the key growth driver," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,837 in December from 70,424 in November, exceeding expectations for a decrease to 69,600. November's figure was revised up from 70,410.

Consumer credit in the U.K. rose by £1.169 billion in December, missing expectations for an £1.300 billion increase, after a £1.479 billion gain in November. November's figure was revised down from £1.476 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,060.1 -23.69 -0.39 %

DAX 9,757.88 -40.23 -0.41 %

CAC 40 4,392.33 -24.69 -0.56 %

-

17:54

Wall Street. Major U.S. stock-indexes fell

U.S. stocks slightly fell on Monday as weak Chinese economic data exacerbated concerns about a global slowdown and oil prices resumed their slide. The data from China showed that the world's second-largest economy's manufacturing sector contracted in January at the fastest pace since 2012. Oil prices fell about 5% after the China data added to worries about demand and an OPEC source played down talk of an emergency meeting to stem the decline. Oil prices have fallen more than 70% since mid-2014. Adding to the cautious note, data on Monday showed that U.S. consumer spending was unchanged in December and manufacturing activity continued to contract in January.

Most of Dow stocks in negative area (18 of 30). Top looser - Exxon Mobil Corporation (XOM, -2,40%). Top gainer - NIKE, Inc. (NKE, +1,53%).

Almost all S&P sectors in negative area. Top looser - Basic Materials (-2,1%). Top gainer - Utilities (+0,9%).

At the moment:

Dow 16334.00 -22.00 -0.13%

S&P 500 1926.75 -3.25 -0.17%

Nasdaq 100 4265.00 +2.00 +0.05%

Oil 31.96 -1.66 -4.94%

Gold 1125.20 +8.80 +0.79%

U.S. 10yr 1.96 +0.03

-

17:44

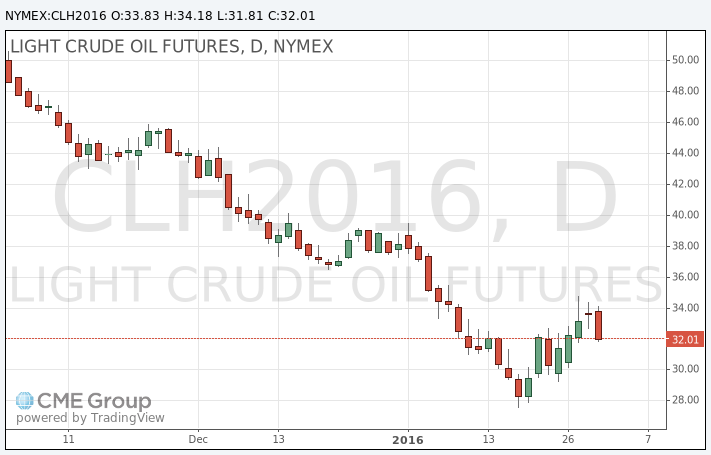

Oil prices fall on concerns over the global oil oversupply and on a weak Chinese manufacturing PMI data

Oil prices declined on concerns over the global oil oversupply and on a weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A senior OPEC delegate said on Monday that it was too early to talk about an OPEC emergency meeting to discuss the output cut.

WTI crude oil for March delivery fell to $31.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for April declined to $35.72 a barrel on ICE Futures Europe.

-

17:43

WSE: Session Results

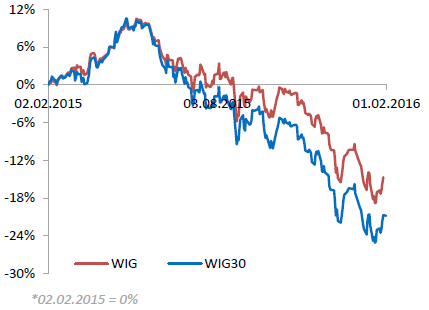

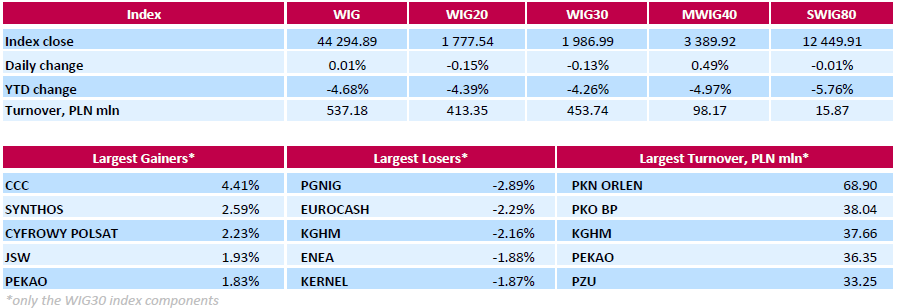

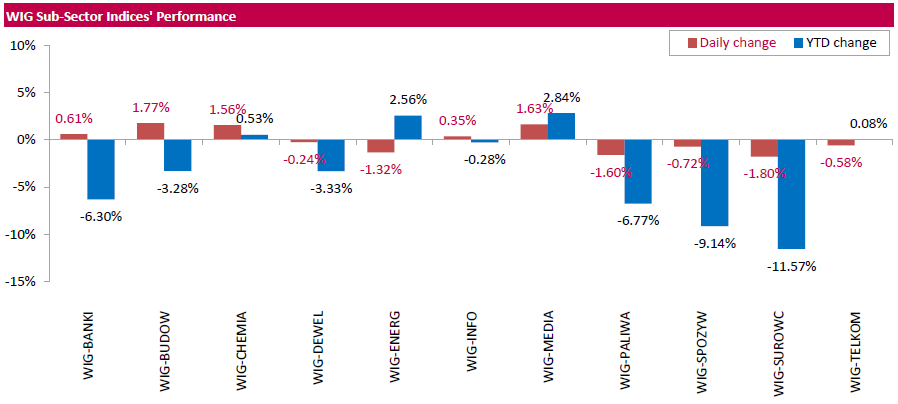

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, edged up 0.01%. Sector performance within the WIG Index was mixed. Construction sector (+1.77%) was the strongest group, while materials (-1.80%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.13%. The decliners were led by oil and gas producer PGNIG (WSE: PGN), FMCG wholesaler EUROCASH (WSE: EUR) and copper producer KGHM (WSE: KGH), which lost between 2.16% and 2.89%. At the same time, footwear retailer CCC (WSE: CCC) recorded the strongest daily result, climbing by 4.41% on the back of the company's strong January sales report and its deputy CEO statement that ССС will recommend paying out a dividend from 2015 profit. It was followed by chemical producer SYNTHOS (WSE: SNS) and media- and telecommunications group CYFROWY POLSAT (WSE: CPS), gaining 2.59% and 2.23% respectively.

-

17:25

Gold rise as global stock markets decline and on the weak Chinese manufacturing PMI data

Gold price rose as global stock markets declined and on the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A weaker U.S. dollar also supported gold. The U.S. dollar fell against other currencies after the release of the U.S. economic data. The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

April futures for gold on the COMEX today increased to 1129.40 dollars per ounce.

-

16:49

Canadian manufacturing PMI rises to 49.3 in January

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Monday. The index rose to 49.3 in January from 47.5 in December.

The rise was driven by a softer decline in output, new business and employment.

"While Canadian business conditions continued to deteriorate in January, we saw signs of stabilization in the manufacturing industry supported by strong export sales alongside a pick up in the US economy and a weakening Canadian dollar," RBC senior vice-president and chief economist, Craig Wright, said.

-

16:35

Italy’s final manufacturing PMI slides to 53.2 in January

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) slid to 53.2 in January from 55.6 in December.

The decline was driven by a softer growth in output and new orders.

"The first batch of PMI data for 2016 showed a cooling in the rate of growth in the manufacturing sector from the sharp pace seen at the end of last year. There remained significant forward momentum, however, with new orders rising broadly in line with average for 2015 and job creation reaching a seven-month high," Markit economist Phil Smith said.

-

16:31

Construction spending in the U.S. is up 0.1% in December

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. rose 0.1% in December, missing expectations for a 0.6% gain, after a 0.6% decrease in November. November's figure was revised down from a 0.4% fall.

The increase was mainly driven by a rise in public spending, which climbed 1.9% in December.

Private construction was down 0.6% in December.

Spending on private residential construction climbed 0.9% in December, while spending on private non-residential construction projects slid 2.1%.

-

16:23

Greece’s final manufacturing PMI declines to 50.0 in January

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Monday. Greece's manufacturing purchasing managers' index (PMI) declined to 50.0 in January from 50.2 in December.

Output and new orders rose in January, while job creation rose.

"Goods producers reported a more stable working environment in January, signalling a shift away from the downturn that immersed the sector in 2015. Encouragingly for firms, employee numbers expanded at the quickest pace since July 2007, while input prices fell for the first time in one year," Markit economist Samuel Agass said.

-

16:19

European Central Bank purchases €14.52 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €14.52 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.68 billion of covered bonds, and €1.80 billion of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

16:17

ISM manufacturing purchasing managers’ index rises to 48.2 in January

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index rose to 48.2 in January from 48.0 in December. Analysts had expected the index to remain unchanged at 48.0.

A reading above 50 indicates expansion, below indicates contraction.

The increase was mainly driven by rises in new orders and in production. The production index increased to 50.2 in January from 49.9 in October.

The new orders index climbed to 51.5 in January from 48.8 in December.

The employment index was down to 45.9 in January from 48.0 in December.

The price index remained unchanged at 33.5 in January.

-

16:00

U.S.: ISM Manufacturing, January 48.2 (forecast 48)

-

16:00

U.S.: Construction Spending, m/m, December 0.1% (forecast 0.6%)

-

15:53

U.S. final manufacturing purchasing managers' index (PMI) increases to 52.4 in January

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 52.4 in January from 51.2 in December, down from the previous estimate of 52.7.

A reading above 50 indicates expansion in economic activity.

The index was driven by a faster pace of growth in output and new orders. Job creation eased in January.

"Despite picking up slightly, the January PMI reading is one of the worst seen over the past two years, highlighting the ongoing plight of the manufacturing sector," Markit's Chief Economist Chris Williamson said.

-

15:45

U.S.: Manufacturing PMI, January 52.4 (forecast 52.7)

-

15:44

Spain’s manufacturing PMI rises to 55.4 in January

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) rose to 55.4 in January from 53.0 in December.

The increase was driven by a rise in output, new orders and employment.

"The Spanish manufacturing sector shrugged off uncertainty surrounding the make-up of the next government in January, posting a strong start to 2016. One key highlight was the fastest rise in new business since prior to the economic crisis, while efforts to increase stock holdings point to confidence in the near-term outlook for orders," a senior economist at Markit Andrew Harker said.

-

15:32

U.S. Stocks open: Dow -0.59%, Nasdaq -0.64%, S&P -0.59%

-

15:17

Before the bell: S&P futures -0.58%, NASDAQ futures -0.40%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 17,865.23 +346.93 +1.98%

Hang Seng 19,595.5 -87.61 -0.45%

Shanghai Composite 2,689.25 -48.35 -1.77 %

FTSE 6,008.82 -74.97 -1.23%

CAC 4,364.98 -52.04 -1.18%

DAX 9,692.29 -105.82 -1.08%

Crude oil $32.14 (-4.40%)

Gold $1120.50 (+0.37%)

-

15:03

U.S. personal spending is flat in December

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

This data suggests that American consumers were cautious.

The saving rate climbed was 5.5% in December, up from 5.6% in November.

Personal income increased 0.3% in December, exceeding expectations for 0.2% rise, after a 0.3% gain in November.

In 2015 as whole, personal income rose 4.5%, after a 4.4% increase in 2014. It was the largest rise since 2012.

Wages and salaries were up 0.2% in December, after a 0.5% gain in November.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in December, missing forecasts of a 0.1% increase, after a 0.1% gain in November. November's figure was revised up from a flat reading.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.4% in December. November's figure was revised up from a 1.3% gain.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Twitter, Inc., NYSE

TWTR

18.08

7.62%

321.5K

Google Inc.

GOOG

754.34

1.53%

8.6K

Barrick Gold Corporation, NYSE

ABX

10

0.91%

9.8K

International Business Machines Co...

IBM

125.13

0.27%

0.4K

The Coca-Cola Co

KO

42.99

0.16%

9.9K

Home Depot Inc

HD

125.76

0.00%

4.9K

HONEYWELL INTERNATIONAL INC.

HON

103.2

0.00%

0.3K

Merck & Co Inc

MRK

50.62

-0.10%

32.3K

American Express Co

AXP

53.32

-0.34%

3.7K

United Technologies Corp

UTX

87.31

-0.43%

0.3K

Johnson & Johnson

JNJ

103.89

-0.53%

0.7K

Yahoo! Inc., NASDAQ

YHOO

29.35

-0.54%

14.8K

McDonald's Corp

MCD

123.1

-0.55%

1.5K

Starbucks Corporation, NASDAQ

SBUX

60.42

-0.58%

8.3K

Citigroup Inc., NYSE

C

42.33

-0.59%

1.1K

Travelers Companies Inc

TRV

106.4

-0.60%

0.1K

International Paper Company

IP

34

-0.61%

0.1K

Pfizer Inc

PFE

30.29

-0.66%

0.1K

Ford Motor Co.

F

11.86

-0.67%

0.1K

AT&T Inc

T

35.81

-0.69%

9.3K

Facebook, Inc.

FB

111.44

-0.69%

64.9K

Intel Corp

INTC

30.8

-0.71%

3.6K

Verizon Communications Inc

VZ

49.6

-0.74%

0.4K

Wal-Mart Stores Inc

WMT

65.87

-0.74%

0.1K

ALTRIA GROUP INC.

MO

60.65

-0.75%

0.6K

Goldman Sachs

GS

160.3

-0.78%

5.3K

Visa

V

73.9

-0.79%

7.2K

Walt Disney Co

DIS

95.01

-0.85%

1.7K

General Electric Co

GE

28.85

-0.86%

9.2K

Microsoft Corp

MSFT

54.59

-0.91%

7.3K

General Motors Company, NYSE

GM

29.35

-0.98%

1.9K

JPMorgan Chase and Co

JPM

58.9

-1.01%

1.2K

Apple Inc.

AAPL

96.3

-1.07%

59.5K

Cisco Systems Inc

CSCO

23.5

-1.22%

0.8K

Deere & Company, NYSE

DE

76

-1.31%

1.6K

Nike

NKE

61.18

-1.34%

2.2K

ALCOA INC.

AA

7.19

-1.37%

6.1K

Amazon.com Inc., NASDAQ

AMZN

578.5

-1.45%

8.8K

Caterpillar Inc

CAT

61.25

-1.59%

1.2K

Exxon Mobil Corp

XOM

76.6

-1.61%

14.1K

Chevron Corp

CVX

85.06

-1.63%

3.6K

Yandex N.V., NASDAQ

YNDX

13.15

-2.01%

1.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.48

-2.61%

32.7K

Tesla Motors, Inc., NASDAQ

TSLA

185

-3.24%

15.8K

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yahoo! (YHOO) reiterated with a Neutral at Mizuho; target $32

Microsoft (MSFT) reiterated with an Outperform at RBC Capital Mkts; target lowered to $63 from $65

Honeywell (HON) target raised to $113 from $106 at Stifel

Walt Disney (DIS) target lowered to $92 from $112 at Jefferies

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.50 (USD 500m) 121.50 (485m)

EUR/USD 1.0800 (EUR 1.3bln) 1.0850 (866m) 1.0950 (1.26bln) 1.1000 (1.5bln)

USD/CAD 1.3750 (USD 1bln)

AUD/USD 0.7000 (AUD 935m) 0.7050 (316m) 0.7200 (368m)

NZD/USD 0.6325 (NZD 199m) 0.6425 (348m) 0.6605 (219m)

-

14:36

European Central Bank Executive Board member Benoit Coeure: the central bank will review its asset-buying programme at its March monetary policy meeting

The European Central Bank (ECB) Executive Board member Benoit Coeure said in a speech on Monday that the central bank will review its asset-buying programme at its March monetary policy meeting, noting that the asset-buying programme was" working.

"The euro area numbers clearly show that our monetary policy is having the intended effect. [4] It represents a major contribution to the ongoing cyclical recovery. And the Governing Council will review and possibly reconsider its stance when it meets in March," he said.

"But for the recovery to become structural - and thus to increase growth potential and reduce structural unemployment - monetary policy does not suffice," Coeure added.

-

14:30

U.S.: Personal Income, m/m, December 0.3% (forecast 0.2%)

-

14:30

U.S.: Personal spending , December 0.0% (forecast 0.1%)

-

14:30

U.S.: PCE price index ex food, energy, Y/Y, December 1.4%

-

14:30

U.S.: PCE price index ex food, energy, m/m, December 0.0% (forecast 0.1%)

-

14:19

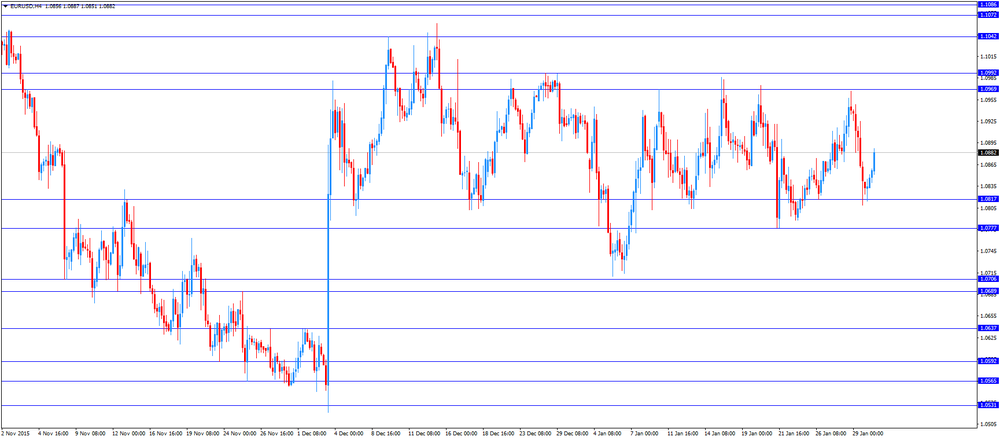

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the release of the mixed manufacturing PMI data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI January 49.7 49.6 49.4

01:00 China Non-Manufacturing PMI January 54.4 53.5

01:45 China Markit/Caixin Manufacturing PMI January 48.2 48.4

02:00 Japan Manufacturing PMI (Finally) January 52.6 52.4 52.3

08:30 Switzerland Manufacturing PMI January 50.4 Revised From 52.1 50.9 50

08:50 France Manufacturing PMI (Finally) January 51.4 50 50

08:55 Germany Manufacturing PMI (Finally) January 53.2 52.1 52.3

09:00 Eurozone Manufacturing PMI (Finally) January 53.2 52.3 52.3

09:30 United Kingdom Consumer credit, mln December 1479 Revised From 1476 1300 1169

09:30 United Kingdom Mortgage Approvals December 70.42 Revised From 70.41 69.6 70.84

09:30 United Kingdom Purchasing Manager Index Manufacturing January 52.1 Revised From 51.9 51.8 52.9

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.1% in December, after a flat reading in November.

Personal income in the U.S. is expected to rise 0.2% in December, after a 0.3% gain in November.

Personal spending in the U.S. is expected to gain 0.1% in December, after a 0.3% rise in November.

The final manufacturing purchasing managers' index is expected to climb to 52.7 in January from 51.2 in December.

The ISM manufacturing purchasing managers' index is expected to remain unchanged at 48.0 in January.

The euro traded higher against the U.S. dollar despite the release of the mixed manufacturing PMI data from the Eurozone. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 52.2 in January from 53.2 in December, in line with the preliminary reading.

The drop was driven by a softer growth in output and new orders.

"Growth of order books, exports and output all slowed. If the slowdown in business activity wasn't enough to worry policymakers, prices charged by producers fell at the fastest rate for a year to spur further concern about deflation becoming ingrained," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in January from 53.2 in December, up from the preliminary reading of 52.1.

The index was driven by a weaker rise in production and new orders. Lower energy and raw material prices weighed on input costs.

France's final manufacturing purchasing managers' index (PMI) declined to 50.0 in January from 51.4 in December, in line with the preliminary reading.

The index was driven by a drop in new orders, and input and output prices.

The British pound traded higher against the U.S. dollar after the release of the better-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.9 in January from 52.1 in December, exceeding expectations for a rise to 51.8. December's figure was revised up from 51.9.

The increase was driven by a rise in domestic demand.

"The UK manufacturing sector registered an uptick in its rate of expansion at the start of 2016, shrugging off a number of potential headwinds, ranging from global financial market volatility to localised flooding in the North of the country. The domestic market remains the key growth driver," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,837 in December from 70,424 in November, exceeding expectations for a decrease to 69,600. November's figure was revised up from 70,410.

Consumer credit in the U.K. rose by £1.169 billion in December, missing expectations for an £1.300 billion increase, after a £1.479 billion gain in November. November's figure was revised down from £1.476 billion.

The Swiss franc traded higher against the U.S. dollar. Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland fell to 50.0 in January from 50.4 in December, missing expectations for an increase to 50.9. December's figure was revised down from 52.1.

A reading above 50 indicates contraction.

The decline was largely driven by a drop in purchase prices. Purchase prices dropped to 41.7 in January from 45.4 in December, while the backlog of orders sub-index fell to 49.3 from 49.9.

EUR/USD: the currency pair rose to $1.0887

GBP/USD: the currency pair climbed to $1.4319

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. Personal Income, m/m December 0.3% 0.2%

13:30 U.S. Personal spending December 0.3% 0.1%

13:30 U.S. PCE price index ex food, energy, m/m December 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y December 1.3%

14:45 U.S. Manufacturing PMI (Finally) January 51.2 52.7

15:00 U.S. Construction Spending, m/m December -0.4% 0.6%

15:00 U.S. ISM Manufacturing January 48 48

16:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

14:00

Orders

EUR/USD

Offers 1.0870 1.0885 1.0900 1.0925 1.0945-50 1.0985 1.1000 1.1025 1.1050

Bids 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4300 1.4320 1.4350 1.4375-80 1.4400 1.4425-30 1.4450

Bids 1.4250 1.4225-30 1.4200 1.4185 1.4160 1.4130 1.4100

EUR/GBP

Offers 0.7620 0.7655-60 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7575-80 0.7560 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 131.80-85 132.00 132.30 132.50 132.80 133.00

Bids 131.30 131.00 130.80 130.40 130.00 129.80 129.5

USD/JPY

Offers 121.35 121.50 121.75-80 122.00 122.30 122.50 122.75 123.00

Bids 121.00 120.85 120.55-60 120.25 120.00 119.80 119.50 119.25-30 119.00

AUD/USD

Offers 0.7085 0.7100 0.7120-25 0.7150 0.7180 0.7200

Bids 0.7050 0.7030 0.70150.7000 0.6980 0.6950

-

12:00

European stock markets mid session: stocks traded lower on the mixed manufacturing PMI data from the Eurozone, on falling oil prices and on the weak Chinese manufacturing PMI data

Stock indices traded lower on the mixed manufacturing PMI data from the Eurozone, on falling oil prices and on the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 52.2 in January from 53.2 in December, in line with the preliminary reading.

The drop was driven by a softer growth in output and new orders.

"Growth of order books, exports and output all slowed. If the slowdown in business activity wasn't enough to worry policymakers, prices charged by producers fell at the fastest rate for a year to spur further concern about deflation becoming ingrained," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in January from 53.2 in December, up from the preliminary reading of 52.1.

The index was driven by a weaker rise in production and new orders. Lower energy and raw material prices weighed on input costs.

France's final manufacturing purchasing managers' index (PMI) declined to 50.0 in January from 51.4 in December, in line with the preliminary reading.

The index was driven by a drop in new orders, and input and output prices.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.9 in January from 52.1 in December, exceeding expectations for a rise to 51.8. December's figure was revised up from 51.9.

The increase was driven by a rise in domestic demand.

"The UK manufacturing sector registered an uptick in its rate of expansion at the start of 2016, shrugging off a number of potential headwinds, ranging from global financial market volatility to localised flooding in the North of the country. The domestic market remains the key growth driver," Markit's Senior Economist Rob Dobson said.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,837 in December from 70,424 in November, exceeding expectations for a decrease to 69,600. November's figure was revised up from 70,410.

Consumer credit in the U.K. rose by £1.169 billion in December, missing expectations for an £1.300 billion increase, after a £1.479 billion gain in November. November's figure was revised down from £1.476 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,058.63 -25.16 -0.41 %

DAX 9,730.64 -67.47 -0.69 %

CAC 40 4,386.51 -30.51 -0.69 %

-

11:49

Final Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 52.3 in January

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 52.3 in January from 52.6 in December, down from the preliminary reading of 52.4.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

The index was driven by a slower growth in new orders and a drop in input prices.

"The start of 2016 was generally positive for the Japanese manufacturing sector, with operating conditions improving at a solid rate. Production and new orders increased at robust rates, helping to boost employment numbers and encouraging firms to purchase more during the month," economist at Markit, Amy Brownbill, said.

-

11:46

Number of mortgages approvals in the U.K. rises to 70,837 in December

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Monday. The number of mortgages approvals in the U.K. was up to 70,837 in December from 70,424 in November, exceeding expectations for a decrease to 69,600. November's figure was revised up from 70,410.

Consumer credit in the U.K. rose by £1.169 billion in December, missing expectations for an £1.300 billion increase, after a £1.479 billion gain in November. November's figure was revised down from £1.476 billion.

Net lending to individuals in the U.K. increased by £4.4 billion in December, after a £5.3 billion gain in November.

-

11:39

Swiss manufacturing PMI falls to 50.0 in January

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland fell to 50.0 in January from 50.4 in December, missing expectations for an increase to 50.9. December's figure was revised down from 52.1.

A reading above 50 indicates contraction.

The decline was largely driven by a drop in purchase prices. Purchase prices dropped to 41.7 in January from 45.4 in December, while the backlog of orders sub-index fell to 49.3 from 49.9.

The production increased to 54.6 In January from 53.5 in December.

Employment rose to 47.9 in January from 46.5 in December.

-

11:30

France’s final manufacturing PMI declines to 50.0 in January

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) declined to 50.0 in January from 51.4 in December, in line with the preliminary reading.

The index was driven by a drop in new orders, and input and output prices.

"A drop in new orders for the first time in four months was the primary culprit, as a generally weak demand climate and client uncertainty continued to weigh on new work inflows," Markit Senior Economist Jack Kennedy said.

-

11:20

Germany’s final manufacturing PMI falls to 52.3 in January

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final manufacturing purchasing managers' index (PMI) fell to 52.3 in January from 53.2 in December, up from the preliminary reading of 52.1.

The index was driven by a weaker rise in production and new orders. Lower energy and raw material prices weighed on input costs.

"It's an unspectacular start to the year for German manufacturers. Although, the headline PMI signalled further growth in the sector, the pace of expansion was relatively sluggish. It's also a bit disappointing that the first reduction in selling prices for three months was not sufficient to generate a stronger increase in total new business. A source of weakness highlighted by the data was subdued demand from foreign markets," Markit economist Oliver Kolodseike said.

-

11:15

Eurozone’s final manufacturing PMI drops to 52.2 in January

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 52.2 in January from 53.2 in December, in line with the preliminary reading.

The drop was driven by a softer growth in output and new orders.

"Growth of order books, exports and output all slowed. If the slowdown in business activity wasn't enough to worry policymakers, prices charged by producers fell at the fastest rate for a year to spur further concern about deflation becoming ingrained," Chris Williamson, Chief Economist at Markit said.

-

10:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 119.50 (USD 500m) 121.50 (485m)

EUR/USD 1.0800 (EUR 1.3bln) 1.0850 (866m) 1.0950 (1.26bln) 1.1000 (1.5bln)

USD/CAD 1.3750 (USD 1bln)

AUD/USD 0.7000 (AUD 935m) 0.7050 (316m) 0.7200 (368m)

NZD/USD 0.6325 (NZD 199m) 0.6425 (348m) 0.6605 (219m)

-

10:54

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increases to 52.9 in January

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.9 in January from 52.1 in December, exceeding expectations for a rise to 51.8. December's figure was revised up from 51.9.

A reading above 50 indicates expansion.

The increase was driven by a rise in domestic demand.

"The UK manufacturing sector registered an uptick in its rate of expansion at the start of 2016, shrugging off a number of potential headwinds, ranging from global financial market volatility to localised flooding in the North of the country. The domestic market remains the key growth driver," Markit's Senior Economist Rob Dobson said.

-

10:43

Chinese Markit/Caixin manufacturing PMI rises to 48.4 in January

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

"Recent macroeconomic indicators show the economy is still in the process of bottoming out and efforts to trim excess capacity are just starting to show results. The pressure on economic growth remains intense in light of continued global volatility. The government needs to watch economic trends closely and proactively make fine adjustments to prevent a hard landing," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:41

Official data: Chinese manufacturing PMI declines to 49.4 in January, the lowest reading since August 2012

The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012.

Analysts had expected the index to decline to 49.6.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The services PMI decreased to 53.5 in January from 54.4 in December.

-

10:30

United Kingdom: Consumer credit, mln, December 1169 (forecast 1300)

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , January 52.9 (forecast 51.8)

-

10:30

United Kingdom: Mortgage Approvals, December 70.84 (forecast 69.6)

-

10:25

Bank of Greece Governor Yannis Stournaras: the country’s economy will to growth in the second half of this year

The Bank of Greece Governor Yannis Stournaras said in an interview with the Financial Times on Friday that the country's economy will to growth in the second half of this year.

"In 2016 we will have a negative carryover from the last quarter of 2015. We may have positive growth in the last two quarters," he said.

Stournaras noted that there was no risk that Greece will leave the Eurozone.

-

10:10

The number of active U.S. rigs falls by 12 rigs to 498 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 12 rigs to 498 last week. It was the lowest level since March 2010.

Combined oil and gas rigs declined by 18 to 619.

-

10:00

Eurozone: Manufacturing PMI, January 52.3 (forecast 52.3)

-

09:55

Germany: Manufacturing PMI, January 52.3 (forecast 52.1)

-

09:50

France: Manufacturing PMI, January 50 (forecast 50)

-

09:36

Earnings Season in U.S.: Major Reports of the Week

February 1

After the Close:

Alphabet (GOOG). Consensus EPS $8.09, Consensus Revenue $20762.00 mln

February 2

Before the Open:

Dow Chemical (DOW). Consensus EPS $0.70, Consensus Revenue $11169.48 mln

Exxon Mobil (XOM). Consensus EPS $0.64, Consensus Revenue $55285.48 mln

Pfizer (PFE). Consensus EPS $0.52, Consensus Revenue $13602.61 mln

After the Close:

Yahoo! (YHOO). Consensus EPS $0.13, Consensus Revenue $948.02 mln

February 3

Before the Open:

General Motors (GM). Consensus EPS $1.20, Consensus Revenue $36923.93 mln

International Paper Company (IP). Consensus EPS $0.82, Consensus Revenue $5685.09 mln

Merck (MRK). Consensus EPS $0.91, Consensus Revenue $10371.53 mln

-

09:30

Switzerland: Manufacturing PMI, January 50 (forecast 50.9)

-

08:06

Foreign exchange market. Asian session: the euro gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:00 China Manufacturing PMI January 49.7 49.6 49.4

01:00 China Non-Manufacturing PMI January 54.4 53.5

01:45 China Markit/Caixin Manufacturing PMI January 48.2 48.4

02:00 Japan Manufacturing PMI (Finally) January 52.6 52.4 52.3

The euro climbed against the U.S. dollar on expectations of strong retail sales data from the euro zone. Economists expect sales to have risen significantly in December. If data meet expectations this would be a positive sign for the economy of the single currency area. Some analysts believe that weak data released previously were driven by seasonal factors and the economy was actually doing better.

The yen little changed amid Japanese manufacturing activity data. The index came in at 52.3 points in January, having declined slightly from a twenty-month high reached in December. Economists had expected a reading of 52.4. Conditions in the manufacturing sector of the country's economy continued improving.

The Australian dollar declined at the beginning of the session amid data from Australia's major trading partner China. China Federation of Logistics and Purchasing reported that the country's Manufacturing PMI declined to 49.4 in January compared to 49.7 reported previously and 49.6 expected.

EUR/USD: the pair rose to $1.0850 in Asian trade

USD/JPY: the pair traded within Y121.05-45

GBP/USD: the pair rose to $1.4265

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI January 52.1 50.9

08:50 France Manufacturing PMI (Finally) January 51.4 50

08:55 Germany Manufacturing PMI (Finally) January 53.2 52.1

09:00 Eurozone Manufacturing PMI (Finally) January 53.2 52.3

09:30 United Kingdom Consumer credit, mln December 1476 1300

09:30 United Kingdom Mortgage Approvals December 70.41 69.6

09:30 United Kingdom Purchasing Manager Index Manufacturing January 51.9 51.8

13:30 U.S. Personal Income, m/m December 0.3% 0.2%

13:30 U.S. Personal spending December 0.3% 0.1%

13:30 U.S. PCE price index ex food, energy, m/m December 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y December 1.3%

14:45 U.S. Manufacturing PMI (Finally) January 51.2 52.7

15:00 U.S. Construction Spending, m/m December -0.4% 0.6%

15:00 U.S. ISM Manufacturing January 48 48

16:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

07:42

Oil prices declined

West Texas Intermediate futures for March delivery declined to $33.14 (-1.43%), while Brent crude fell to $35.44 (-1.53%) amid weak economic data from China. According to an official report released today, activity in China's manufacturing sector contracted at the fastest pace in nearly three-and-a-half years in January. Meanwhile expectations for oil producers to co-operate and reduce output deteriorated.

Analysts expect weakness of the Chinese economy and ample oil supplies to weigh on crude prices throughout 2016.

-

07:20

Gold traded higher

Gold climbed to $1,122.20 (+0.52%) amid uncertainty over the global economy and signs of weakness in the Chinese economy. China Federation of Logistics and Purchasing reported on Monday that the country's Manufacturing PMI declined to 49.4 in January compared to 49.7 reported previously and 49.6 expected.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund in the world, rose about 4% in January.

Nevertheless analysts don't expect gains to be sustained for a long time. Societe Generale forecasts gold price to average at $1,040 in the first quarter and $955 in the last quarter of the current year.

-

07:08

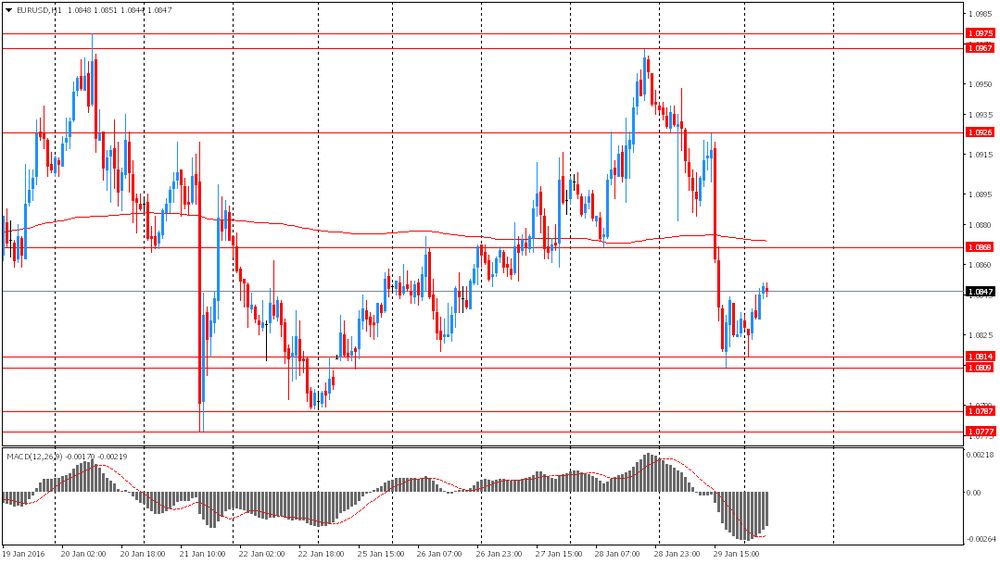

Options levels on monday, February 1, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0931 (5211)

$1.0901 (2283)

$1.0878 (2071)

Price at time of writing this review: $1.0847

Support levels (open interest**, contracts):

$1.0788 (5374)

$1.0760 (10176)

$1.0726 (4964)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 44552 contracts, with the maximum number of contracts with strike price $1,1000 (5319);

- Overall open interest on the PUT options with the expiration date February, 5 is 69693 contracts, with the maximum number of contracts with strike price $1,0800 (10176);

- The ratio of PUT/CALL was 1.56 versus 1.54 from the previous trading day according to data from January, 29

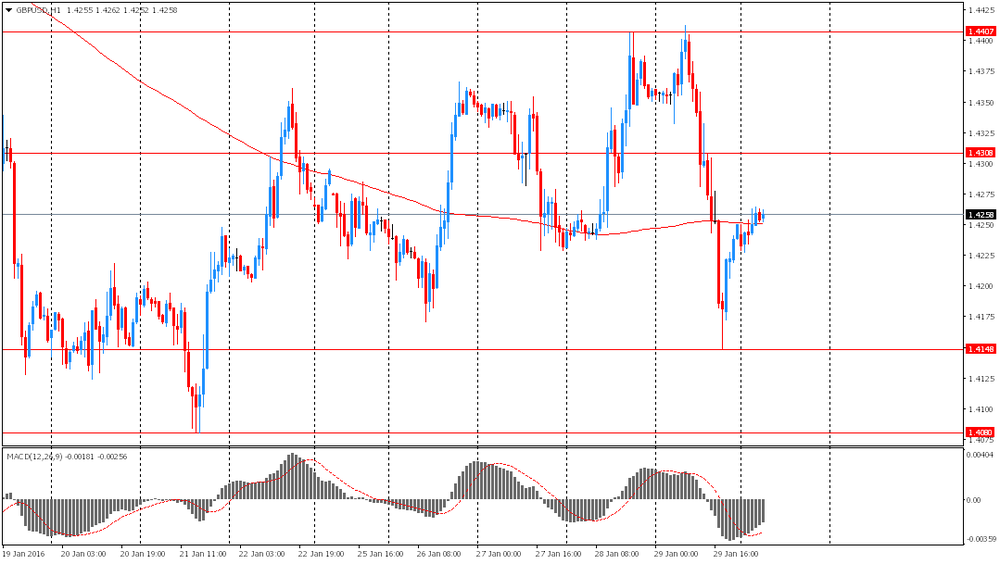

GBP/USD

Resistance levels (open interest**, contracts)

$1.4502 (2116)

$1.4404 (1743)

$1.4307 (514)

Price at time of writing this review: $1.4262

Support levels (open interest**, contracts):

$1.4193 (1401)

$1.4096 (1653)

$1.3998 (542)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 25505 contracts, with the maximum number of contracts with strike price $1,4650 (2873);

- Overall open interest on the PUT options with the expiration date February, 5 is 24270 contracts, with the maximum number of contracts with strike price $1,4550 (1987);

- The ratio of PUT/CALL was 0.95 versus 0.91 from the previous trading day according to data from January, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:03

Global Stocks: U.S. stock indices rose

U.S. stock indices rose on Friday as market participants thought that Bank of Japan's decision to introduce negative rates could interfere with the Federal Reserve's plans to gradually raise interest rates.

The Dow Jones Industrial Average gained 396.66 points, or 2.5%, to 16,466.30 (+2.3% over the week; -5.5% over the month). The S&P 500 rose 46.88 points, or 2.5%, to 1,940.24 (+1.8% over the week; -5.1% over the month). The Nasdaq Composite rose 107.28 points, or 2.4%, to 4,613.95 (+0.5% over the week; -7.9% over the month).

All of the S&P's 10 sectors closed in the positive territory on Friday. However January became the worst month for the U.S. indices since 2009.

This morning in Asia Hong Kong Hang Seng lost 0.64%, or 1 25.16, to 19,557.95. China Shanghai Composite Index fell 1.42%, or 38.86, to 2,698.74. The Nikkei gained 1.94%, or 340.04, to 17,858.34.

Asian stock indices traded mixed. Japanese stocks rose after the Bank of Japan unexpectedly introduced negative rates on Friday. Gains in U.S. equities supported stocks as well.

Chinese stocks fell after China Federation of Logistics and Purchasing reported that the country's Manufacturing PMI declined to 49.4 in January compared to 49.7 reported previously and 49.6 expected. Meanwhile the corresponding index for the non-manufacturing sector declined to 53.5 in January from 54.4. The 50 points threshold separates contraction from expansion.

-

03:02

Japan: Manufacturing PMI, January 52.3 (forecast 52.4)

-

02:59

Nikkei 225 17,723.84 +205.54 +1.17 %, Hang Seng 19,606.37 -76.74 -0.39 %, Shanghai Composite 2,730.98 -6.62 -0.24 %

-

02:46

China: Markit/Caixin Manufacturing PMI, January 48.4

-

01:59

China: Manufacturing PMI , January 49.4 (forecast 49.6)

-

01:59

China: Non-Manufacturing PMI, January 53.5

-

01:03

Commodities. Daily history for Jan 29’2016:

(raw materials / closing price /% change)

Oil 33.74 +0.36%

Gold 1,118.40 +0.18%

-

01:02

Stocks. Daily history for Sep Jan 29’2016:

(index / closing price / change items /% change)

Nikkei 225 17,518.3 +476.85 +2.80 %

Hang Seng 19,683.11 +487.28 +2.54 %

Shanghai Composite 2,737.65 +81.98 +3.09 %

FTSE 100 6,083.79 +152.01 +2.56 %

CAC 40 4,417.02 +94.86 +2.19 %

Xetra DAX 9,798.11 +158.52 +1.64 %

S&P 500 1,940.24 +46.88 +2.48 %

NASDAQ Composite 4,613.95 +107.28 +2.38 %

Dow Jones 16,466.3 +396.66 +2.47 %

-

01:01

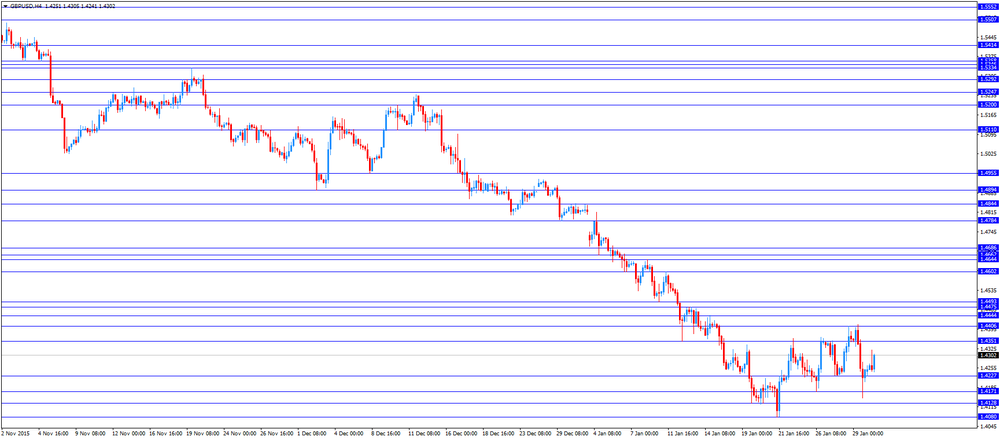

Currencies. Daily history for Jan 29’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0833 -0,99%

GBP/USD $1,4250 -0,76%

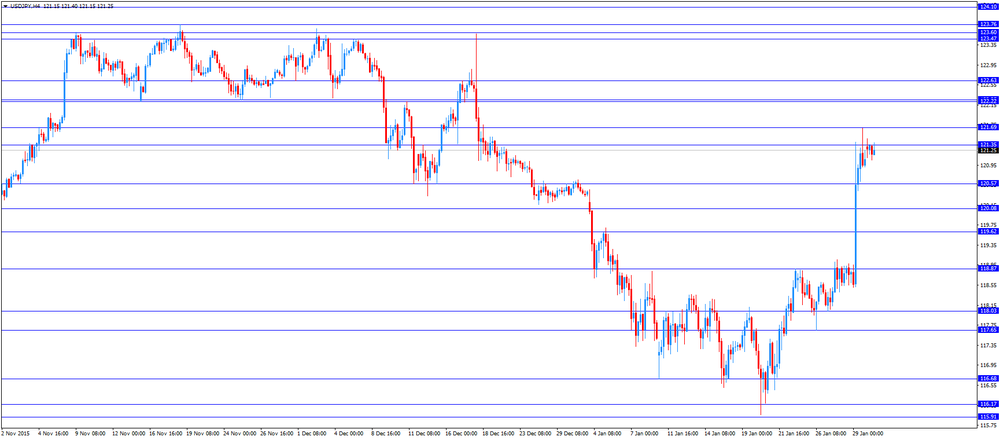

USD/CHF Chf1,0241 +1,03%

USD/JPY Y121,06 +1,87%

EUR/JPY Y131,14 +0,89%

GBP/JPY Y172,5 +1,11%

AUD/USD $0,7077 -0,07%

NZD/USD $0,6474 -0,08%

USD/CAD C$1,4005 -0,16%

-

00:32

Australia: MI Inflation Gauge, m/m, January 0.4%

-

00:01

Schedule for today, Monday, Feb 01’2016:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI January 49.7 49.6

01:00 China Non-Manufacturing PMI January 54.4

01:45 China Markit/Caixin Manufacturing PMI January 48.2

02:00 Japan Manufacturing PMI (Finally) January 52.6 52.4

08:30 Switzerland Manufacturing PMI January 52.1 50.9

08:50 France Manufacturing PMI (Finally) January 51.4 50

08:55 Germany Manufacturing PMI (Finally) January 53.2 52.1

09:00 Eurozone Manufacturing PMI (Finally) January 53.2 52.3

09:30 United Kingdom Consumer credit, mln December 1476 1300

09:30 United Kingdom Mortgage Approvals December 70.41 69.6

09:30 United Kingdom Purchasing Manager Index Manufacturing January 51.9 51.8

13:30 U.S. Personal Income, m/m December 0.3% 0.2%

13:30 U.S. Personal spending December 0.3% 0.1%

13:30 U.S. PCE price index ex food, energy, m/m December 0.0% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y December 1.3%

14:45 U.S. Manufacturing PMI (Finally) January 51.2 52.7

15:00 U.S. Construction Spending, m/m December -0.4% 0.6%

15:00 U.S. ISM Manufacturing January 48 48

16:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-