Noticias del mercado

-

17:44

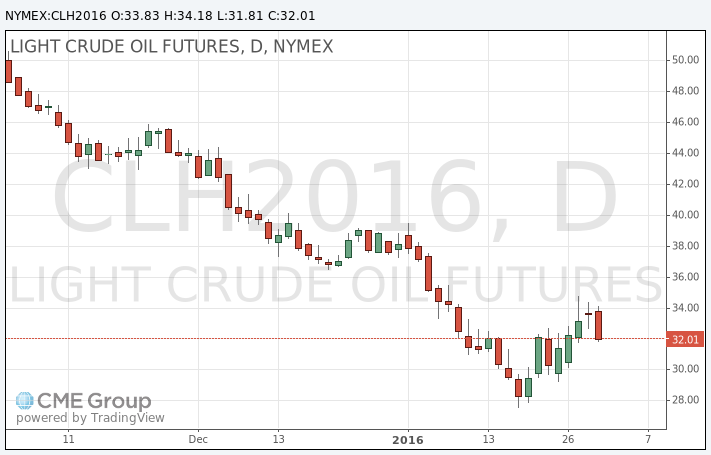

Oil prices fall on concerns over the global oil oversupply and on a weak Chinese manufacturing PMI data

Oil prices declined on concerns over the global oil oversupply and on a weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A senior OPEC delegate said on Monday that it was too early to talk about an OPEC emergency meeting to discuss the output cut.

WTI crude oil for March delivery fell to $31.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for April declined to $35.72 a barrel on ICE Futures Europe.

-

17:25

Gold rise as global stock markets decline and on the weak Chinese manufacturing PMI data

Gold price rose as global stock markets declined and on the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

A weaker U.S. dollar also supported gold. The U.S. dollar fell against other currencies after the release of the U.S. economic data. The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

April futures for gold on the COMEX today increased to 1129.40 dollars per ounce.

-

15:03

U.S. personal spending is flat in December

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in December, missing expectations for a 0.1% gain, after a 0.5% increase in November. November's figure was revised up from a 0.3% rise.

Consumer spending makes more than two-thirds of U.S. economic activity. Consumer spending grew 2.2% in the fourth quarter, after a 3.0% increase in the third quarter.

In 2015 as whole, the U.S. consumer spending climbed 3.4%, after a 4.2% growth in 2014.

This data suggests that American consumers were cautious.

The saving rate climbed was 5.5% in December, up from 5.6% in November.

Personal income increased 0.3% in December, exceeding expectations for 0.2% rise, after a 0.3% gain in November.

In 2015 as whole, personal income rose 4.5%, after a 4.4% increase in 2014. It was the largest rise since 2012.

Wages and salaries were up 0.2% in December, after a 0.5% gain in November.

The personal consumption expenditures (PCE) price index excluding food and energy was flat in December, missing forecasts of a 0.1% increase, after a 0.1% gain in November. November's figure was revised up from a flat reading.

On a yearly basis, the PCE price index excluding food and index remained unchanged at 1.4% in December. November's figure was revised up from a 1.3% gain.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

10:43

Chinese Markit/Caixin manufacturing PMI rises to 48.4 in January

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

"Recent macroeconomic indicators show the economy is still in the process of bottoming out and efforts to trim excess capacity are just starting to show results. The pressure on economic growth remains intense in light of continued global volatility. The government needs to watch economic trends closely and proactively make fine adjustments to prevent a hard landing," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:41

Official data: Chinese manufacturing PMI declines to 49.4 in January, the lowest reading since August 2012

The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012.

Analysts had expected the index to decline to 49.6.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The services PMI decreased to 53.5 in January from 54.4 in December.

-

10:10

The number of active U.S. rigs falls by 12 rigs to 498 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 12 rigs to 498 last week. It was the lowest level since March 2010.

Combined oil and gas rigs declined by 18 to 619.

-

07:42

Oil prices declined

West Texas Intermediate futures for March delivery declined to $33.14 (-1.43%), while Brent crude fell to $35.44 (-1.53%) amid weak economic data from China. According to an official report released today, activity in China's manufacturing sector contracted at the fastest pace in nearly three-and-a-half years in January. Meanwhile expectations for oil producers to co-operate and reduce output deteriorated.

Analysts expect weakness of the Chinese economy and ample oil supplies to weigh on crude prices throughout 2016.

-

07:20

Gold traded higher

Gold climbed to $1,122.20 (+0.52%) amid uncertainty over the global economy and signs of weakness in the Chinese economy. China Federation of Logistics and Purchasing reported on Monday that the country's Manufacturing PMI declined to 49.4 in January compared to 49.7 reported previously and 49.6 expected.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund in the world, rose about 4% in January.

Nevertheless analysts don't expect gains to be sustained for a long time. Societe Generale forecasts gold price to average at $1,040 in the first quarter and $955 in the last quarter of the current year.

-

01:03

Commodities. Daily history for Jan 29’2016:

(raw materials / closing price /% change)

Oil 33.74 +0.36%

Gold 1,118.40 +0.18%

-