Noticias del mercado

-

17:48

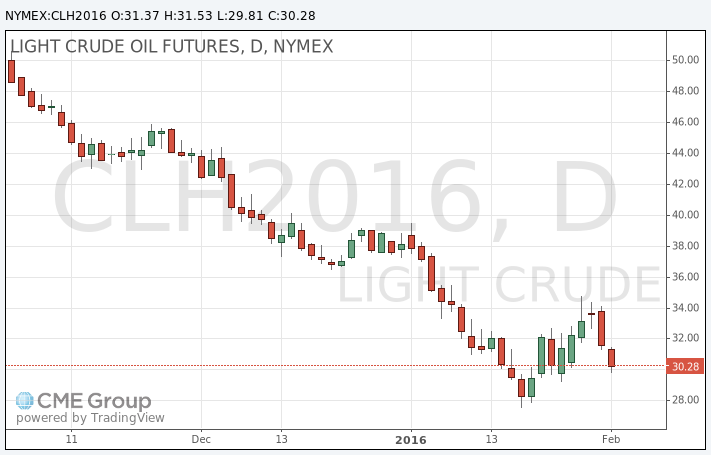

Oil prices fall on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. News reported that Iran plans to boost its exports to 2.3 million barrels per day in the next fiscal year starting on March 21.

Russia's Energy Ministry released its oil output data on Tuesday. Oil output in Russia increased by 1.5% to 10.88 million barrels per day (bpd) in January from 10.83 million bpd in December.

Russian Foreign Minister Sergei Lavrov said on Tuesday that Russia is ready to cooperate with the Organization of the Petroleum Exporting Countries (OPEC) to stabilise the oil market.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for March delivery fell to $29.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for April declined to $32.50 a barrel on ICE Futures Europe.

-

17:28

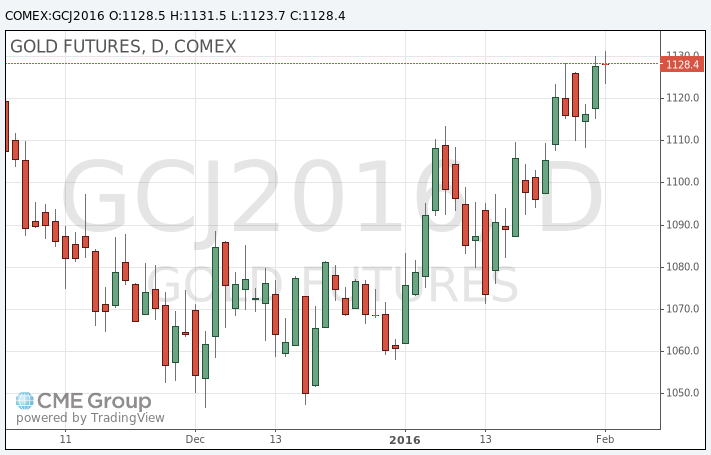

Gold rise declines but remains near 3-month high

Gold price fell but remained near 3-month high. Gold price rose on Monday, supported by the weak Chinese manufacturing PMI data. The Chinese manufacturing PMI fell to 49.4 in January from 49.7 in December, according to the Chinese government on Monday. It was the lowest reading since August 2012. Analysts had expected the index to decline to 49.6.

The Chinese Markit/Caixin manufacturing PMI rose to 48.4 in January from 48.2 in December. The increase was driven by a softer drop in new orders.

April futures for gold on the COMEX today decreased to 1123.70 dollars per ounce.

-

16:21

Russia’s oil output rises by 1.5% in January

Russia's Energy Ministry released its oil output data on Tuesday. Oil output in Russia increased by 1.5% to 10.88 million barrels per day (bpd) in January from 10.83 million bpd in December.

Bashneft was the main contributor in January. The output rose 10.2% year-on-year.

Rosneft cut it oil production by 0.9% in January, while Lukoil reduced its oil output by 2.9%.

-

16:13

Russia is ready to cooperate with OPEC to stabilise the oil market

Russian Foreign Minister Sergei Lavrov said on Tuesday that Russia is ready to cooperate with the Organization of the Petroleum Exporting Countries (OPEC) to stabilise the oil market.

He noted that the country is ready to meet with OPEC and to discuss oil prices.

-

14:34

The People's Bank of China injects 100 billion yuan into market

The People's Bank of China (PBoC) on Tuesday injected 100 billion yuan ($15.2 billion) into market to boost liquidity via 14-day reverse repos and 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

-

10:23

OPEC delegates of Saudi Arabia, Kuwait, Qatar and the United Arab Emirates are against an emergency meeting of OPEC

The Organization of the Petroleum Exporting Countries (OPEC) delegates of Saudi Arabia, Kuwait, Qatar and the United Arab Emirates said that they were against an emergency meeting of OPEC.

"We still don't know how much oil Iran can add to the market and this won't be clear for weeks if not months so calling for an emergency meeting is pointless," a Gulf delegate said.

-

08:08

Oil prices declined

West Texas Intermediate futures for March delivery declined to $31.10 (-1.64%), while Brent crude fell to $33.65 (-1.72%) as market participants continued assessing recent weak data on manufacturing in the world's second-biggest oil consumer China.

The Russian Energy Ministry said on Monday that Russia and Venezuela discussed a possibility of co-operation with OPEC members, however analysts say that it is extremely unlikely that OPEC will co-operate with others to reduce output.

A poll by Reuters showed that U.S. crude oil inventories likely rose by 4.7 million barrels last week. The official data from the Energy Information Administration will be released on Wednesday.

-

07:56

Gold steadied

Gold is currently at $1,126.10 (-0.17%) after reaching a three-week high amid uncertainty over the global economy and signs of weakness in the Chinese economy. Bullion has also benefited from increased stocks volatility. The negative rates tendency among central banks is also favorable for gold.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose to 21.9 million ounces on Monday, the highest level since November 3.

-

00:32

Commodities. Daily history for Feb 1’2016:

(raw materials / closing price /% change)

Oil 31.32 -0.95%

Gold 1,128.60 +0.05%

-