Noticias del mercado

-

22:09

U.S. stocks closed

U.S. stocks retreated, with the Dow Jones Industrial Average losing more than 290 points, as investors shunned risk assets across the world while oil extended a selloff amid deepening concern that global growth is weakening.

The oil rout and worries about a China slowdown have continued to roil global markets, erasing as much as $2.4 trillion from the value of U.S. equities this year. While the S&P 500 recouped some losses in the past two weeks, trimming its worst start to a year since 2009, bearish sentiment has returned. The benchmark is down almost 11 percent from its all-time high set in May.

Investors are also assessing the campaign for the next U.S. president, after Senator Ted Cruz won Monday's Republican caucuses in Iowa in an upset over Donald Trump. Democrat Hillary Clinton held on to a narrow victory over Senator Bernie Sanders.

Among the rationales given for the selloff in U.S. equities this year, one that is rarely mentioned is the election cycle. Research from Ned Davis Research Group shows that the final year of a two-term presidency ranks last by returns, with the S&P 500 posting a median decline of 6.6 percent since 1953.

"More than 100 S&P 500 companies post results this week, and analysts estimate profits at index members fell 5.6 percent in the fourth quarter, better than Jan. 15 predictions for a 7 percent slump. Of those that have released financial results, 80 percent beat profit projections, while 49 percent topped sales estimates.

Investors will be looking this week at economic releases for indications of the strength of the U.S. economy, with the government's January jobs report coming into focus on Friday. Federal Reserve Bank of Kansas City President Esther George said today recent financial turmoil was anticipated and is no reason to delay further interest-rate increases.

George, who has consistently been among the most hawkish Fed officials, said last December's interest-rate hike, the first such move since 2006, was belated and cautioned it would be a mistake to wait too long to raise rates further.

-

21:00

DJIA 16154.49 -294.69 -1.79%, NASDAQ 4519.77 -100.60 -2.18%, S&P 500 1903.77 -35.61 -1.84%

-

18:10

Swiss National Bank Chairman Thomas Jordan: the Swiss franc remained significantly overvalued

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a speech on Tuesday that the Swiss franc remained significantly overvalued. He added that the central bank was ready to intervene in the foreign exchange market if needed.

-

18:00

European stocks close: stocks closed lower as oil prices dropped again

Stock indices closed lower as oil prices dropped again. Oil prices fell on concerns over the global oil oversupply.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.4% in December from 10.5% in November. It was the lowest reading since September 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.5%.

The lowest unemployment rate in the Eurozone in December was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.5% in October 2015) and Spain (20.8%).

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.8% in December, missing expectations for a 0.6% fall, after a 0.2% decrease in November.

Intermediate goods prices fell 0.3% in December, capital goods prices were flat, non-durable consumer goods prices declined 0.1%, and durable consumer goods prices were stable, while energy prices decreased 2.7%.

On a yearly basis, Eurozone's producer price index dropped 3.0% in December, missing expectations for a 2.8% decrease, after a 3.2% fall in November.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in December. Energy prices dropped at an annual rate of 9.0%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 20,000 in January, exceeding expectations for a 7,000 decline, after a 16,000 decrease in December. December's figure was revised up from a 13,000 decline.

The unemployment rate declined to 6.2% in January from 6.3% in December. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 55.0 in January from 57.8 in December, missing expectations for a decrease to 57.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in new business, while the employment rose was at the weakest pace since September 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,922.01 -138.09 -2.28 %

DAX 9,581.04 -176.84 -1.81 %

CAC 40 4,283.99 -108.34 -2.47 %

-

18:00

European stocks closed: FTSE 5922.01 -138.09 -2.28%, DAX 9581.04 -176.84 -1.81%, CAC 40 4283.99 -108.34 -2.47%

-

17:57

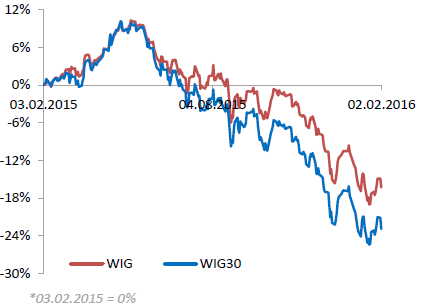

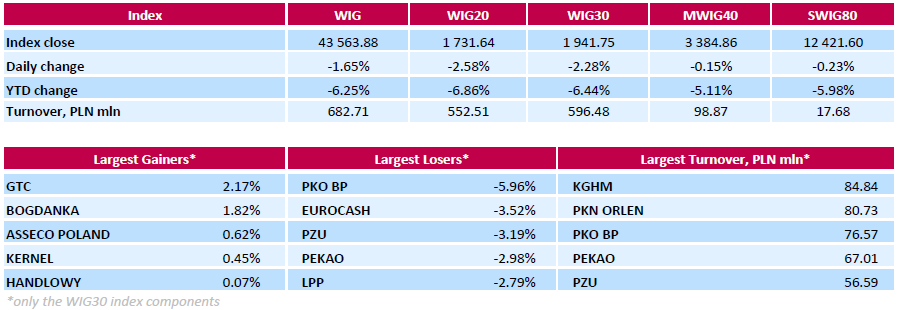

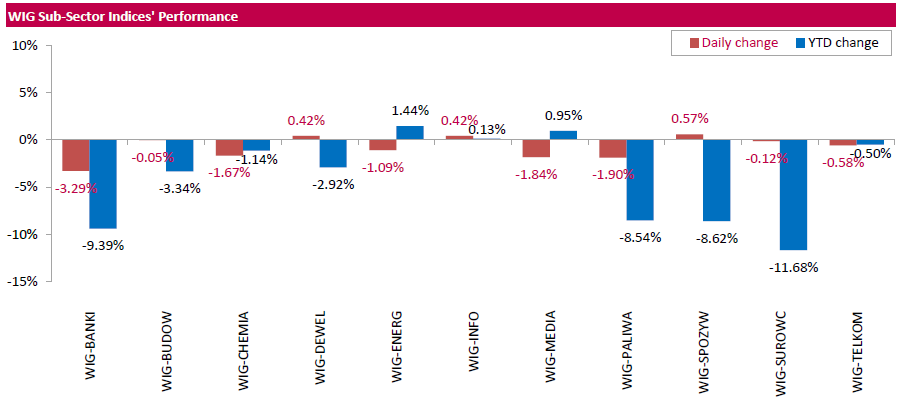

WSE: Session Results

Polish equity market plunged on Tuesday, with the broad market measure, the WIG Index, declining by 1.65%. Sector-wise, food sector (+0.52%), developing sector (+0.42%) and IT (+0.42%) were the only sectors, which posted positive results. At the same time, banking sector (-3.29%) was hit the hardest, after Fitch Ratings warned that a bank tax and introduction of a proposed Swiss franc-denominated bill may hurt their credit profiles.

The large-cap companies' measure, the WIG30 Index, fell by 2.28%. Only five index constituents managed to generate positive returns: property developer GTC (WSE: GTC) jumped 2.17%, thermal coal miner BOGDANKA (WSE: LWB) advanced 1.82%, IT-company ASSECO POLAND (WSE: ACP) added 0.62%, agricultural producer KERNEL (WSE: KER) gained 0.45% and bank HANDLOWY (WSE: BHW) inched up 0.07%. At the same time, the session's most prominent losers were banking name PKO BP (WSE: PKO), FMCG wholesaler EUROCASH (WSE: EUR) and insurer PZU (WSE: PZU), tumbling by 5.96%, 3.52% and 3.19% respectively.

-

17:17

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as falling oil prices weighed on energy shares. Oil prices were down 5% as hopes for a deal between OPEC and Russia on output cuts faded with Goldman Sachs saying it was "highly unlikely".

Consumer savings from cheap gasoline have failed to translate into higher spending. U.S. consumers are opting to save or pay down debt rather than buying big-ticket items.

Most of Dow stocks in negative area (29 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -3,94%). Top gainer - E. I. du Pont de Nemours and Company (DD, +2,57%).

All S&P sectors in negative area. Top looser - Basic Materials (-3,3%).

At the moment:

Dow 16100.00 -240.00 -1.47%

S&P 500 1903.25 -28.00 -1.45%

Nasdaq 100 4231.75 -59.75 -1.39%

Crude Oil 30.22 -1.40 -4.43%

Gold 1127.50 -0.50 -0.04%

U.S. 10yr 1.88 -0.09

-

15:32

U.S. Stocks open: Dow -0.93%, Nasdaq -0.73%, S&P -0.73%

-

15:15

Before the bell: S&P futures -0.94%, NASDAQ futures -0.89%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 17,750.68 -114.55 -0.64%

Hang Seng 19,446.84 -148.66 -0.76%

Shanghai Composite 2,750.45 +61.60 +2.29%

FTSE 5,944.44 -115.66 -1.91%

CAC 4,306.52 -85.81 -1.95%

DAX 9,639.15 -118.73 -1.22%

Crude oil $30.38 (-3.92%)

Gold $1125.70 (-0.20%)

-

15:06

Italy’s unemployment rate remains unchanged at 11.4% in December

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate remained unchanged at 11.4% in December. December's figure was revised up from 11.3%.

The number of unemployed people was 2.898 million in December, up by 0.6% from the month before.

The youth unemployment rate fell to 37.9% in December from 38.0% in November.

The employment rate remained unchanged at 56.4% in December.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Google Inc.

GOOG

792.00

5.32%

28.2K

E. I. du Pont de Nemours and Co

DD

54.55

2.35%

2.9K

AMERICAN INTERNATIONAL GROUP

AIG

56.50

0.37%

0.1K

Travelers Companies Inc

TRV

107.08

0.07%

0.1K

UnitedHealth Group Inc

UNH

115.94

0.04%

3.6K

FedEx Corporation, NYSE

FDX

132.31

0.00%

0.6K

Wal-Mart Stores Inc

WMT

67.39

-0.16%

0.2K

Deere & Company, NYSE

DE

76.65

-0.20%

0.1K

Facebook, Inc.

FB

114.82

-0.23%

46.9K

Nike

NKE

62.97

-0.30%

2.1K

International Business Machines Co...

IBM

124.44

-0.31%

0.3K

General Motors Company, NYSE

GM

30.00

-0.37%

83.0K

McDonald's Corp

MCD

124.10

-0.41%

0.2K

Starbucks Corporation, NASDAQ

SBUX

60.90

-0.49%

1.1K

AT&T Inc

T

36.00

-0.50%

6.4K

ALTRIA GROUP INC.

MO

60.59

-0.57%

0.1K

Walt Disney Co

DIS

94.60

-0.58%

10.0K

Visa

V

73.93

-0.61%

18.7K

Procter & Gamble Co

PG

80.62

-0.62%

10.9K

General Electric Co

GE

28.46

-0.63%

1.0K

Verizon Communications Inc

VZ

50.41

-0.69%

2.3K

The Coca-Cola Co

KO

42.70

-0.70%

36.5K

Yahoo! Inc., NASDAQ

YHOO

29.35

-0.74%

2.5K

Cisco Systems Inc

CSCO

23.30

-0.77%

8.8K

Ford Motor Co.

F

11.97

-0.83%

4.9K

Merck & Co Inc

MRK

50.27

-0.95%

11.7K

Johnson & Johnson

JNJ

103.35

-0.98%

0.5K

Goldman Sachs

GS

158.00

-1.03%

3.6K

Intel Corp

INTC

30.50

-1.04%

8.0K

Pfizer Inc

PFE

29.85

-1.06%

212.0K

Apple Inc.

AAPL

95.40

-1.07%

76.7K

Microsoft Corp

MSFT

54.10

-1.11%

49.8K

Caterpillar Inc

CAT

62.00

-1.12%

18.8K

Citigroup Inc., NYSE

C

42.00

-1.13%

5.1K

Amazon.com Inc., NASDAQ

AMZN

568.13

-1.16%

7.9K

American Express Co

AXP

54.06

-1.17%

0.6K

JPMorgan Chase and Co

JPM

58.15

-1.21%

20.6K

ALCOA INC.

AA

7.12

-1.25%

8.1K

Barrick Gold Corporation, NYSE

ABX

9.91

-1.59%

2.7K

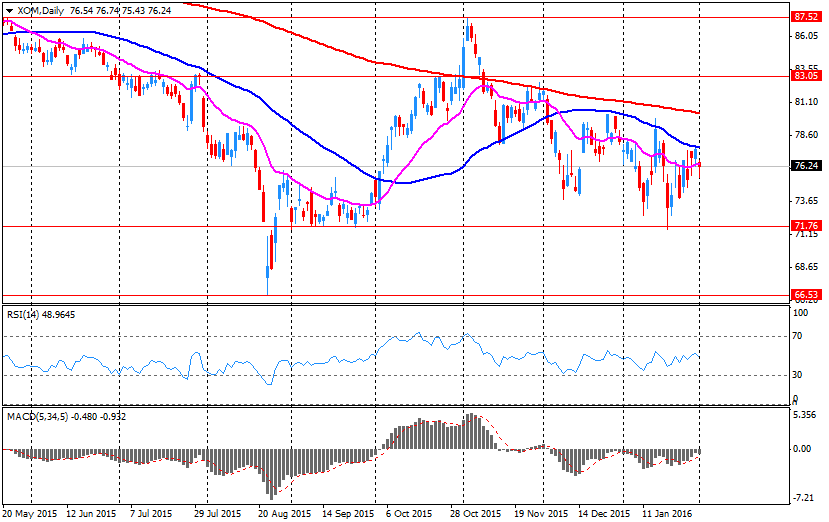

Exxon Mobil Corp

XOM

75.00

-1.69%

163.7K

Chevron Corp

CVX

83.81

-1.74%

1.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.65

-1.90%

9.1K

Hewlett-Packard Co.

HPQ

9.78

-1.91%

7.8K

Tesla Motors, Inc., NASDAQ

TSLA

193.15

-1.92%

2.9K

Twitter, Inc., NYSE

TWTR

17.30

-3.41%

93.4K

Yandex N.V., NASDAQ

YNDX

13.01

-4.34%

2.3K

-

14:48

Number of registered unemployed people in Spain increase by 57,247 in January

Spain's labour ministry release its labour market figures on Tuesday The number of registered unemployed people increased by 57,247 in January, after a 55,790 fall in December.

The increase was mainly driven by a loss in temporary services jobs which were added over the Christmas period.

On a yearly basis, the number of registered unemployed people fell by 678,200 people in 2015.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Twitter (TWTR) downgraded to Sell from Hold at Stifel; target $14

Other:

Alphabet (GOOG) target raised to $950 from $900 at Jefferies

Alphabet A (GOOGL) target raised to $1080 from $900 at Deutsche Bank

Alphabet A (GOOGL) target raised to $911 from $812 at Piper Jaffray; Overweight

Alphabet A (GOOGL) target raised to $1000 from $880 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $880 from $780 at Robert W. Baird

Alphabet A (GOOGL) target raised to $1050 at Bernstein

Alphabet A (GOOGL) target raised to $925 from $900 at Nomura

Alphabet A (GOOGL) target raised to $900 from $800 at Barclays

Alphabet A (GOOGL) target raised to $1070 from $850 at Mizuho

Alphabet A (GOOGL) target raised to $870 from $770 at Macquarie

-

14:34

The People's Bank of China injects 100 billion yuan into market

The People's Bank of China (PBoC) on Tuesday injected 100 billion yuan ($15.2 billion) into market to boost liquidity via 14-day reverse repos and 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

-

14:24

-

14:16

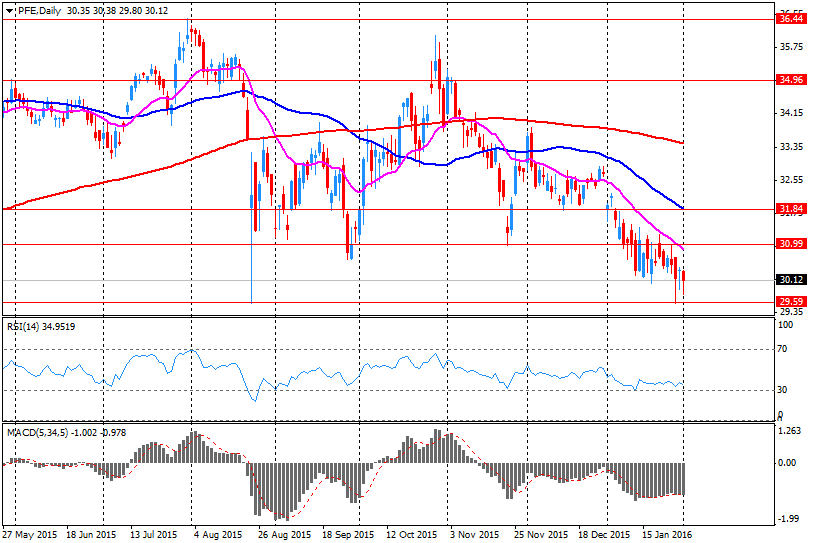

Company News: Pfizer (PFE) Q4 Results Beat Analysts’ Expectations

Pfizer reported Q4 FY 2015 earnings of $0.53 per share (versus $0.54 in Q4 FY 2014), beating analysts' consensus of $0.52.

The company's quarterly revenues amounted to $14.047 bln (+7.1% y/y), beating consensus estimate of $13.595 bln.

Pfizer also issued guidance for FY 2016, projecting EPS of $2.20-2.30 (versus analysts' consensus of $1.98) and revenues of $49-51 bln (versus analysts' consensus of $53 bln).

PFE fell to $29.75 (-1.39%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded lower as oil prices dropped again

Stock indices traded lower as oil prices dropped again. Oil prices fell on concerns over the global oil oversupply.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.4% in December from 10.5% in November. It was the lowest reading since September 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.5%.

The lowest unemployment rate in the Eurozone in December was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.5% in October 2015) and Spain (20.8%).

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.8% in December, missing expectations for a 0.6% fall, after a 0.2% decrease in November.

Intermediate goods prices fell 0.3% in December, capital goods prices were flat, non-durable consumer goods prices declined 0.1%, and durable consumer goods prices were stable, while energy prices decreased 2.7%.

On a yearly basis, Eurozone's producer price index dropped 3.0% in December, missing expectations for a 2.8% decrease, after a 3.2% fall in November.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in December. Energy prices dropped at an annual rate of 9.0%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 20,000 in January, exceeding expectations for a 7,000 decline, after a 16,000 decrease in December. December's figure was revised up from a 13,000 decline.

The unemployment rate declined to 6.2% in January from 6.3% in December. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 55.0 in January from 57.8 in December, missing expectations for a decrease to 57.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in new business, while the employment rose was at the weakest pace since September 2013.

Current figures:

Name Price Change Change %

FTSE 100 5,954.82 -105.28 -1.74 %

DAX 9,631.41 -126.47 -1.30 %

CAC 40 4,308.96 -83.37 -1.90 %

-

11:49

Swiss retail sales decline 1.6% year-on-year in December

The Federal Statistical Office released its retail sales data for Switzerland on Tuesday. Retail sales in Switzerland were down at an annual rate of 1.6% in December, after a 1.7% decrease in November. November's figure was revised up from a 3.1% drop.

Sales of food, beverages and tobacco rose at an annual rate of 0.1% in December, while non-food sales dropped 2.3%.

On a monthly basis, retail sales climbed by 1.1% in December, after a 0.6% fall in November. November's figure was revised up from a 0.8% decline.

Sales of food, beverages and tobacco rose 0.4% in December, while non-food sales increased 0.7%.

-

11:40

Eurozone's producer price index declines 0.8% in December

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.8% in December, missing expectations for a 0.6% fall, after a 0.2% decrease in November.

Intermediate goods prices fell 0.3% in December, capital goods prices were flat, non-durable consumer goods prices declined 0.1%, and durable consumer goods prices were stable, while energy prices decreased 2.7%.

On a yearly basis, Eurozone's producer price index dropped 3.0% in December, missing expectations for a 2.8% decrease, after a 3.2% fall in November.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in December. Energy prices dropped at an annual rate of 9.0%.

-

11:26

Eurozone's unemployment rate drops to 10.4% in December, the lowest reading since September 2011

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.4% in December from 10.5% in November. It was the lowest reading since September 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.5%.

There were 16.750 million unemployed in the Eurozone in December, down by 49.000 from November.

The lowest unemployment rate in the Eurozone in December was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.5% in October 2015) and Spain (20.8%).

The youth unemployment rate was 22.0% in the Eurozone in December, compared to 23.0% in December a year ago.

-

11:20

Number of unemployed people in Germany declines by 20,000 in January

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 20,000 in January, exceeding expectations for a 7,000 decline, after a 16,000 decrease in December. December's figure was revised up from a 13,000 decline.

The unemployment rate declined to 6.2% in January from 6.3% in December. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

The number of unemployed people was 1.91 million in December, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in December.

The employment rate fell to 65.6% in December from 65.9% in November, according to Destatis.

-

10:58

UK construction PMI drops to 55.0 in January

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 55.0 in January from 57.8 in December, missing expectations for a decrease to 57.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in new business, while the employment rose was at the weakest pace since September 2013.

"UK construction firms struggled for momentum at the start of this year, with heightened economic uncertainty acting as a brake on new orders and contributing to one of the weakest rises in output levels since the summer of 2013. Softer growth of house building activity and a more subdued increase in commercial construction were the main factors behind the slowdown," Senior Economist at Markit, Tim Moore, said.

-

10:48

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in February

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the growth in the non-mining parts of the Australian economy strengthened in 2015, while employment picked up and that the unemployment rate fell.

The RBA governor also said that "consumer price inflation is likely to remain low over the next year or two", adding that the monetary policy should be accommodative.

Stevens noted that the Australian dollar was adjusting to the evolving economic outlook.

-

10:09

The Fed Vice Chairman Stanley Fischer: the Fed is concerns about the developments in the global financial markets, which could have a negative impact on the U.S. economy

The Fed Vice Chairman Stanley Fischer said in a speech on Monday that the Fed was concerns about the developments in the global financial markets, which could have a negative impact on the U.S. economy.

"Increased concern about the global outlook, particularly the ongoing structural adjustments in China and the effects of the declines in the prices of oil and other commodities on commodity exporting nations, appeared early this year to have triggered volatility in global asset markets," he said.

"At this point, it is difficult to judge the likely implications of this volatility. If these developments lead to a persistent tightening of financial conditions, they could signal a slowing in the global economy that could affect growth and inflation in the United States," the Fed vice chairman added.

Fischer pointed out that he did know the Fed's next move.

-

07:47

Global Stocks: U.S. stock indices little changed

U.S. stock indices reversed opening loses and closed little changed on Monday.

The Dow Jones Industrial Average closed 17.12 points, or 0.1% lower at 16,449 after an initial decline of 160 points. The S&P 500 slid 0.86 point, or 0.04%, to 1,939.38 (its energy sector led declines closing 1.9% lower). The Nasdaq Composite gained 6.41 points, or 0.1%, to 4,620.

A report by the Institute for Supply Management showed that activity in the U.S. manufacturing sector slightly improved in January beating median forecasts. The Manufacturing PMI came in at 48.2 in January after a 48.0 reading in December. The index was expected to stay unchanged.

Comments from Fed Vice Chairman Stanley Fischer suggested that the central bank was in no rush to raise interest rates further. Fischer also noted that inflation was likely to stay low for a longer time. These comments supported stocks.

This morning in Asia Hong Kong Hang Seng lost 0.82%, or 1 61.25, to 19,434.25. China Shanghai Composite Index rose 1.68%, or 45.16, to 2,734.02. The Nikkei declined 0.64%, or 114.55, to 17,750.68.

Asian stock indices traded mixed. Japanese stocks fell amid declines in U.S. equities and profit-taking.

Chinese stocks gained. Today the People's Bank of China injected around $15.2 billion into the financial system in order to saturate the market with liquidity ahead of a week-long holiday.

-

03:03

Nikkei 225 17,814.11 -51.12 -0.29 %, Hang Seng 19,468.37 -127.13 -0.65 %, Shanghai Composite 2,692.57 +3.72 +0.14 %

-

00:31

Stocks. Daily history for Sep Feb 1’2016:

(index / closing price / change items /% change)

Nikkei 225 17,865.23 +346.93 +1.98 %

Hang Seng 19,595.5 -87.61 -0.45 %

Shanghai Composite 2,689.25 -48.35 -1.77 %

FTSE 100 6,060.1 -23.69 -0.39 %

CAC 40 4,392.33 -24.69 -0.56 %

Xetra DAX 9,757.88 -40.23 -0.41 %

S&P 500 1,939.38 -0.86 -0.04 %

NASDAQ Composite 4,620.37 +6.41 +0.14 %

Dow Jones 16,449.18 -17.12 -0.10 %

-