Noticias del mercado

-

23:30

Australia: AIG Services Index, January 48.4

-

22:45

New Zealand: Employment Change, q/q, Quarter IV 0.9% (forecast 0.8%)

-

22:45

New Zealand: Unemployment Rate, Quarter IV 5.3% (forecast 6.1%)

-

20:20

American focus: the US dollar weakened

The US dollar weakened slightly against other major currencies in quiet trading as oil prices resumed their downward trend, while concerns about global economic growth persist.

Asylum-yen strengthened after the price of oil back towards $ 30 a barrel after jumping to $ 34 in the previous three sessions.

Meanwhile, investors remained cautious amid concerns about global economic growth after data on Monday showed a reduction of manufacturing activity in China in January, the sixth consecutive month.

Positive impact on the growth of the euro also had data on the labor market in the eurozone. Statistical Office, Eurostat reported that the results of December the unemployment rate in the euro area decreased to 10.4% from 10.5% in November. The latter value was the lowest since September 2011. Recall that in December 2014, unemployment was 11.4%. Experts expect that the unemployment rate will be 10.5%. Meanwhile, it was reported that among the 28 EU countries the unemployment rate in December remained at 9.0% (with a minimum of June 2009). In the corresponding month in 2014, unemployment was at 9.9%. According to estimates by Eurostat, 21,944 million. Men and women in ES28, of which 16.750 million. Resident in the euro area, were unemployed in December. Compared with November, the number of unemployed decreased by 52 000 in the EU and 49 000 in the euro area. Compared with December 2014, unemployment fell by 2.026 million. EU and 1,501,000. In the eurozone. Youth unemployment was 4.454 mln., Of which 3.057 million. Were registered in the euro area. Compared with December 2014, unemployment decreased by 426,000 in the EU and 229,000 in the eurozone. In December 2015, the youth unemployment rate was 19.7% in the EU and 22.0% in the euro area.

A slight pressure is applied to the statistics on producer prices. Eurostat said that in December, producer prices in the euro area decreased by 0.8%. In the EU it was also recorded a drop of 0.8%. Analysts had expected prices in the euro area will decrease by 0.6%. Recall that in November, prices fell by 0.2% in the euro area and among the 28 EU countries. In annual terms, the producer price index decreased by 3.0% in the euro area and fell by 3.2% in the EU. In November, prices in the euro area and fell by 3.2%. Experts expect that the prices in the euro zone will fall by 2.8%.

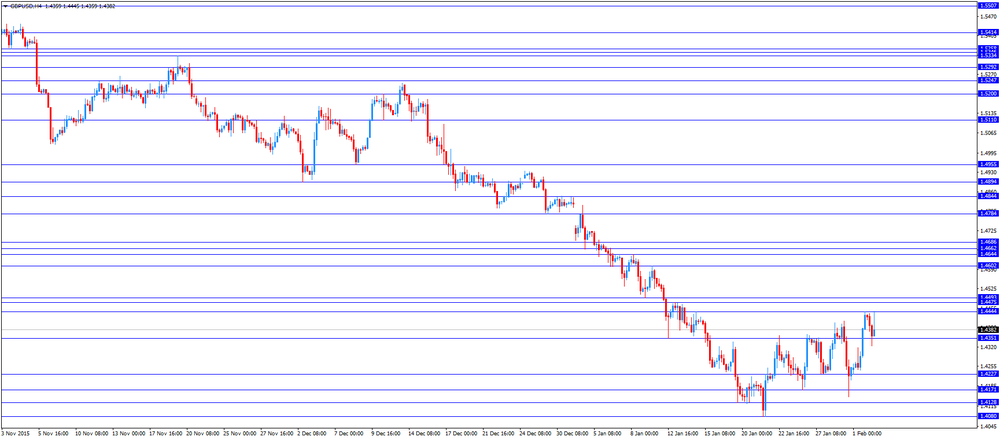

The British pound rose sharply against the dollar, reaching yesterday's high. Strengthening pound noted despite the risk aversion and the data on activity in the construction sector in Britain. Most likely, support the pound had news that Britain has reached an agreement with the EU on one of the points of the plan of conservation into the EU. During the talks with the President of Cameron's EU Tusk parties approved the draft proposals for the reform of the EU. They relate to the possibility to change or block the action of European laws, if they are found to be undesirable 55% or more of the countries - EU members. According to the source, it should strengthen the role of the national parliaments of European countries. Later, Cameron said that the draft of the revised document on the relationship of Britain and the European Union demonstrates the substantial progress on all issues in which Britain wanted to make a difference.

With regard to the previously submitted data from Markit / CIPS, they showed that the rate of growth of business activity in the construction industry slowed sharply in January, exceeding the forecasts of experts and reaching 9-month low. According to the PMI index in the construction sector fell to 55.0 points compared to 57.8 points in December. Analysts had expected the index to fall to 57.5 points. The volume of new orders rose weakest pace in four months, while the pace of hiring new staff building firms were the slowest since September of 2013. Optimism among construction companies fell to its lowest level since December 2014. Markit also noted that the decline in the construction of houses and commercial real estate were the main reasons for the deterioration of the index in January. "The construction sector in Britain started the new year with a sharp deterioration. Increased economic uncertainty had a negative impact on the growth of new orders and the amount handed over the objects that fell to the lowest level since the summer of 2013," said Tim Moore, economist at Markit.

The Swiss franc fell moderately against the dollar. The reason for this was the weak retail sales data and statements of the SNB. As it became known, the volume of retail sales in Switzerland declined in December, recording the fifth consecutive monthly decline. According to the data, sales declined by 1.6 percent per annum, after falling 1.7 percent in November (revised from -3.1 per cent). Excluding fuel, the turnover in the retail sector fell in December by 1.5 percent compared with 0.8 percent drop in November. On a monthly basis, retail sales rose in December by 1.1 percent, offsetting a decrease of 0.6 percent recorded in November (revised from -0.8 per cent). At the same time, sales excluding fuel rose 0.8 percent after falling 0.6 percent in November. In nominal terms, sales decreased by 3 percent compared to last year and 1 percent in monthly terms.

Meanwhile, the head of the SNB's Jordan once again said that the franc remains overvalued. He added that if necessary, the Central Bank is ready to make an intervention.

-

18:10

Swiss National Bank Chairman Thomas Jordan: the Swiss franc remained significantly overvalued

The Swiss National Bank (SNB) Chairman Thomas Jordan said in a speech on Tuesday that the Swiss franc remained significantly overvalued. He added that the central bank was ready to intervene in the foreign exchange market if needed.

-

15:06

Italy’s unemployment rate remains unchanged at 11.4% in December

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate remained unchanged at 11.4% in December. December's figure was revised up from 11.3%.

The number of unemployed people was 2.898 million in December, up by 0.6% from the month before.

The youth unemployment rate fell to 37.9% in December from 38.0% in November.

The employment rate remained unchanged at 56.4% in December.

-

14:50

Option expiries for today's 10:00 ET NY cut

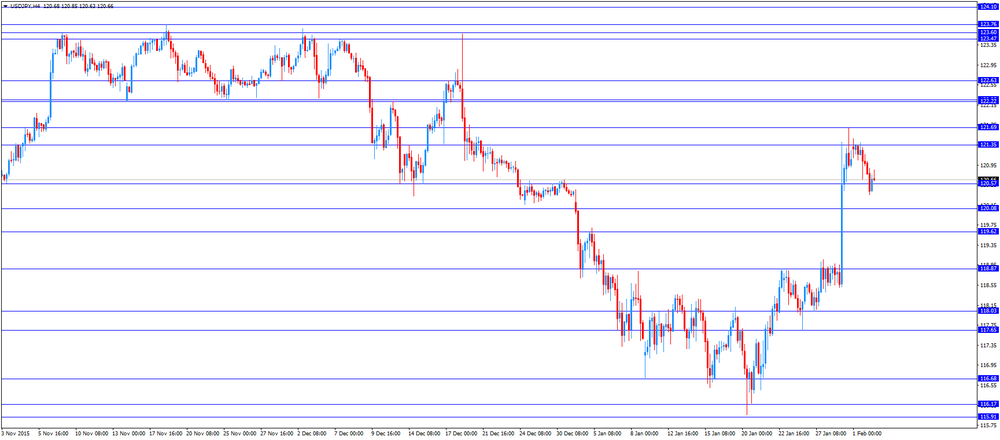

USDJPY: 119.00 (400m) 120.50 (232m) 121.00 (995m) 121.50 (801m)

Y121.75 (200m) Y122.00 (650m)

EURUSD 1.0845-50 (EUR 303m) 1.0930 (149m) 1.1000 (226m)

GBPUSD 1.4315 (GBP 236m) 1.4500 (131m)

EURJPY 130.82 (EUR 536m)

AUDNZD 1.0880 (AUD 924m)

-

14:48

Number of registered unemployed people in Spain increase by 57,247 in January

Spain's labour ministry release its labour market figures on Tuesday The number of registered unemployed people increased by 57,247 in January, after a 55,790 fall in December.

The increase was mainly driven by a loss in temporary services jobs which were added over the Christmas period.

On a yearly basis, the number of registered unemployed people fell by 678,200 people in 2015.

-

14:34

The People's Bank of China injects 100 billion yuan into market

The People's Bank of China (PBoC) on Tuesday injected 100 billion yuan ($15.2 billion) into market to boost liquidity via 14-day reverse repos and 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

-

14:25

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

08:15 Switzerland Retail Sales Y/Y December -1.7% Revised From -3.1% -1.6%

08:15 Switzerland Retail Sales (MoM) December -0.6% Revised From -0.8% 1.1%

08:55 Germany Unemployment Rate s.a. January 6.3% 6.3% 6.2%

08:55 Germany Unemployment Change January -16 Revised From -13 -7 -20

09:30 United Kingdom PMI Construction January 57.8 57.5 55

10:00 Eurozone Producer Price Index, MoM December -0.2% -0.6% -0.8%

10:00 Eurozone Producer Price Index (YoY) December -3.2% -2.8% -3.0%

10:00 Eurozone Unemployment Rate December 10.5% 10.5% 10.4%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The FOMC Member Esther George will speak at 18:00 GMT.

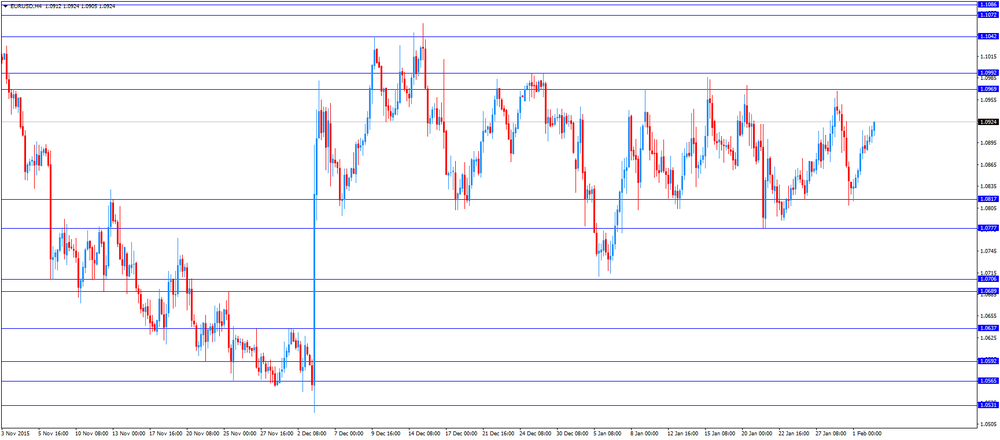

The euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.4% in December from 10.5% in November. It was the lowest reading since September 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.5%.

The lowest unemployment rate in the Eurozone in December was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.5% in October 2015) and Spain (20.8%).

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.8% in December, missing expectations for a 0.6% fall, after a 0.2% decrease in November.

Intermediate goods prices fell 0.3% in December, capital goods prices were flat, non-durable consumer goods prices declined 0.1%, and durable consumer goods prices were stable, while energy prices decreased 2.7%.

On a yearly basis, Eurozone's producer price index dropped 3.0% in December, missing expectations for a 2.8% decrease, after a 3.2% fall in November.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in December. Energy prices dropped at an annual rate of 9.0%.

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 20,000 in January, exceeding expectations for a 7,000 decline, after a 16,000 decrease in December. December's figure was revised up from a 13,000 decline.

The unemployment rate declined to 6.2% in January from 6.3% in December. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected construction PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 55.0 in January from 57.8 in December, missing expectations for a decrease to 57.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in new business, while the employment rose was at the weakest pace since September 2013.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its retail sales data for Switzerland on Tuesday. Retail sales in Switzerland were down at an annual rate of 1.6% in December, after a 1.7% decrease in November. November's figure was revised up from a 3.1% drop.

Sales of food, beverages and tobacco rose at an annual rate of 0.1% in December, while non-food sales dropped 2.3%.

On a monthly basis, retail sales climbed by 1.1% in December, after a 0.6% fall in November. November's figure was revised up from a 0.8% decline.

Sales of food, beverages and tobacco rose 0.4% in December, while non-food sales increased 0.7%.

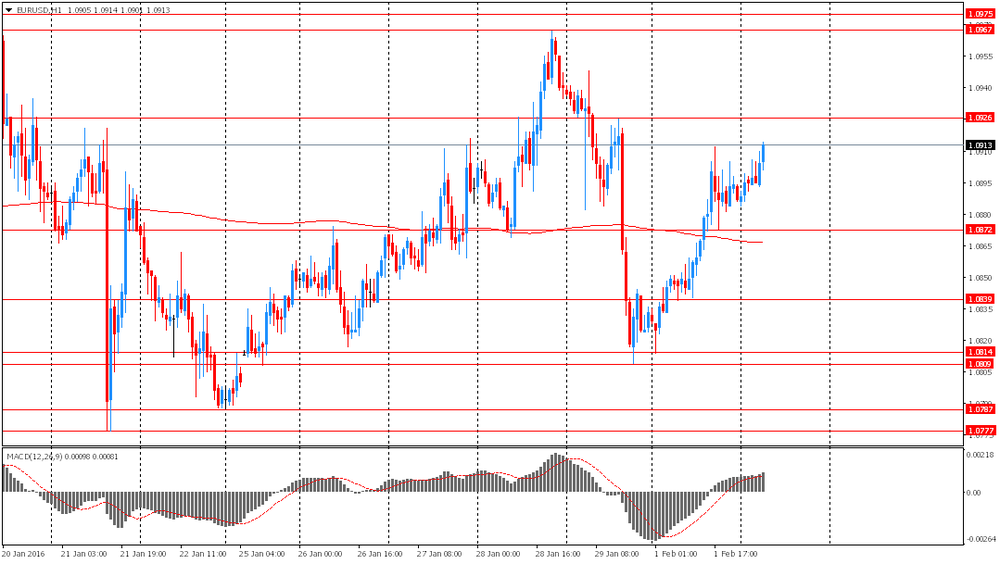

EUR/USD: the currency pair rose to $1.0922

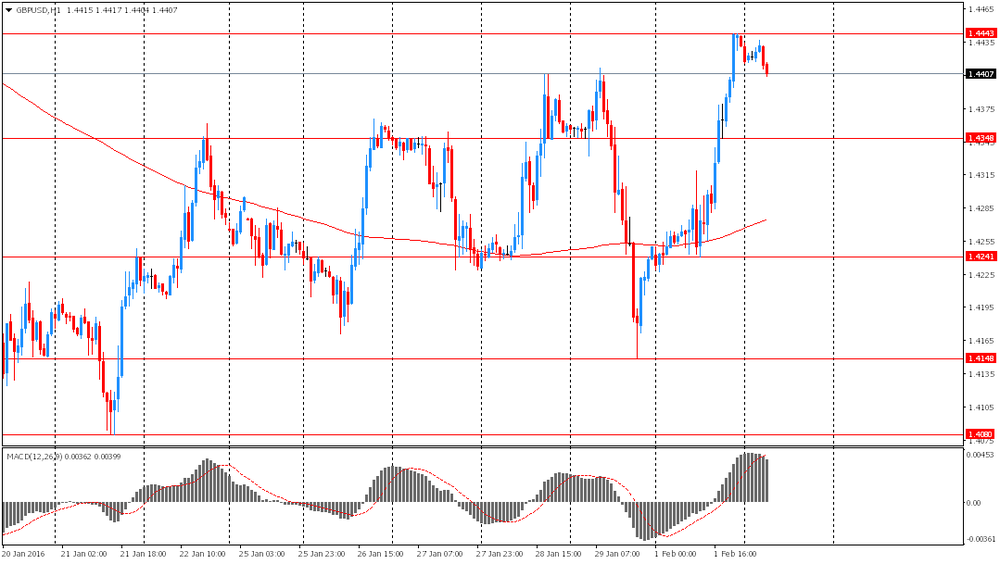

GBP/USD: the currency pair traded mixed

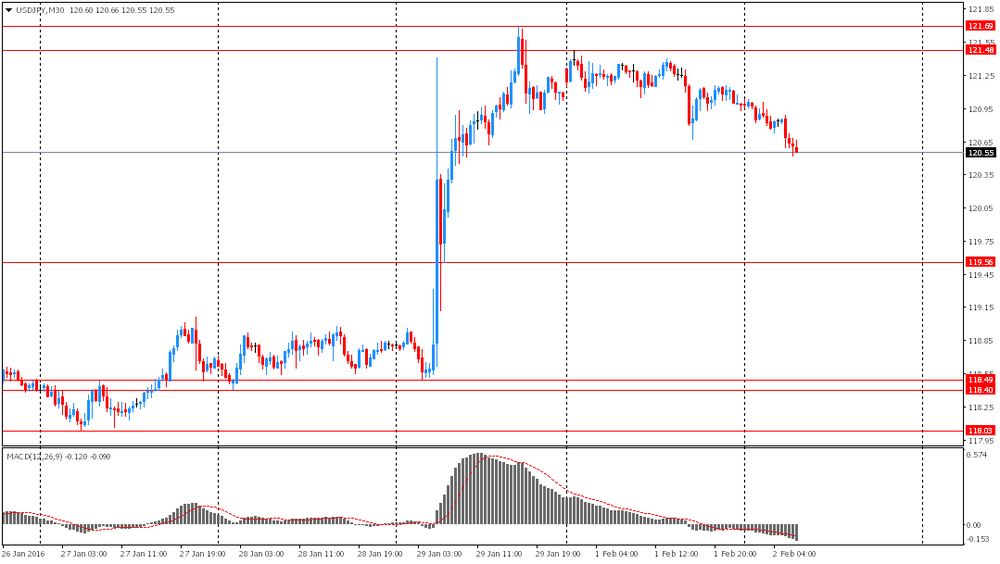

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

18:00 U.S. FOMC Member Esther George Speaks

21:45 New Zealand Employment Change, q/q Quarter IV -0.4% 0.8%

21:45 New Zealand Unemployment Rate Quarter IV 6% 6.1%

23:50 Japan Monetary Policy Meeting Minutes

-

14:00

Orders

EUR/USD

Offers 1.0920-25 1.0945-50 1.0985 1.1000 1.1025 1.1050

Ордера на покупку 1.0880-85 1.0850 1.0830 1.0800 1.0780-85 1.0765 1.0750 1.0730 1.0700

GBP/USD

Offers 1.4400 1.4425-30 1.4450 1.4475 1.4500 1.4520 1.4545-50

Bids 1.4370 1.4350 1.4320 1.4300 1.4285 1.4265 1.4250 1.4225-30 1.4200

EUR/GBP

Offers 0.7620 0.7655-60 0.7680 0.7700 0.7720-25 0.7750-55

Bids 0.7560 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers 131.80-85 132.00 132.30 132.50 132.80 133.00

Bids 131.40 131.00 130.80 130.40 130.00 129.80 129.5

USD/JPY

Offers 120.80-85 121.00 121.35 121.50 121.75-80 122.00 122.30 122.50

Bids 120.40-45 120.25 120.00 119.80 119.50 119.25-30 119.00

AUD/USD

Offers 0.7100 0.7120-25 0.7150 0.7180 0.7200

Bids 0.7050 0.7030 0.70150.7000 0.6980 0.6950

-

11:49

Swiss retail sales decline 1.6% year-on-year in December

The Federal Statistical Office released its retail sales data for Switzerland on Tuesday. Retail sales in Switzerland were down at an annual rate of 1.6% in December, after a 1.7% decrease in November. November's figure was revised up from a 3.1% drop.

Sales of food, beverages and tobacco rose at an annual rate of 0.1% in December, while non-food sales dropped 2.3%.

On a monthly basis, retail sales climbed by 1.1% in December, after a 0.6% fall in November. November's figure was revised up from a 0.8% decline.

Sales of food, beverages and tobacco rose 0.4% in December, while non-food sales increased 0.7%.

-

11:40

Eurozone's producer price index declines 0.8% in December

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.8% in December, missing expectations for a 0.6% fall, after a 0.2% decrease in November.

Intermediate goods prices fell 0.3% in December, capital goods prices were flat, non-durable consumer goods prices declined 0.1%, and durable consumer goods prices were stable, while energy prices decreased 2.7%.

On a yearly basis, Eurozone's producer price index dropped 3.0% in December, missing expectations for a 2.8% decrease, after a 3.2% fall in November.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in December. Energy prices dropped at an annual rate of 9.0%.

-

11:26

Eurozone's unemployment rate drops to 10.4% in December, the lowest reading since September 2011

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.4% in December from 10.5% in November. It was the lowest reading since September 2011.

Analysts had expected the unemployment rate to remain unchanged at 10.5%.

There were 16.750 million unemployed in the Eurozone in December, down by 49.000 from November.

The lowest unemployment rate in the Eurozone in December was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.5% in October 2015) and Spain (20.8%).

The youth unemployment rate was 22.0% in the Eurozone in December, compared to 23.0% in December a year ago.

-

11:20

Number of unemployed people in Germany declines by 20,000 in January

The Federal Labour Agency released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany fell by 20,000 in January, exceeding expectations for a 7,000 decline, after a 16,000 decrease in December. December's figure was revised up from a 13,000 decline.

The unemployment rate declined to 6.2% in January from 6.3% in December. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

The number of unemployed people was 1.91 million in December, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in December.

The employment rate fell to 65.6% in December from 65.9% in November, according to Destatis.

-

11:00

Eurozone: Unemployment Rate , December 10.4% (forecast 10.5%)

-

11:00

Eurozone: Producer Price Index (YoY), December -3.0% (forecast -2.8%)

-

11:00

Eurozone: Producer Price Index, MoM , December -0.8% (forecast -0.6%)

-

10:58

UK construction PMI drops to 55.0 in January

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 55.0 in January from 57.8 in December, missing expectations for a decrease to 57.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in new business, while the employment rose was at the weakest pace since September 2013.

"UK construction firms struggled for momentum at the start of this year, with heightened economic uncertainty acting as a brake on new orders and contributing to one of the weakest rises in output levels since the summer of 2013. Softer growth of house building activity and a more subdued increase in commercial construction were the main factors behind the slowdown," Senior Economist at Markit, Tim Moore, said.

-

10:54

Option expiries for today's 10:00 ET NY cut

USD/JPY: 119.00 (400m) 120.50 (232m) 121.00 (995m) 121.50 (801m), Y121.75 (200m) Y122.00 (650m)

EUR/USD 1.0845-50 (EUR 303m) 1.0930 (149m) 1.1000 (226m)

GBP/USD 1.4315 (GBP 236m) 1.4500 (131m)

EUR/JPY 130.82 (EUR 536m)

AUD/NZD 1.0880 (AUD 924m)

-

10:48

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in February

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the growth in the non-mining parts of the Australian economy strengthened in 2015, while employment picked up and that the unemployment rate fell.

The RBA governor also said that "consumer price inflation is likely to remain low over the next year or two", adding that the monetary policy should be accommodative.

Stevens noted that the Australian dollar was adjusting to the evolving economic outlook.

-

10:30

United Kingdom: PMI Construction, January 55 (forecast 57.5)

-

10:09

The Fed Vice Chairman Stanley Fischer: the Fed is concerns about the developments in the global financial markets, which could have a negative impact on the U.S. economy

The Fed Vice Chairman Stanley Fischer said in a speech on Monday that the Fed was concerns about the developments in the global financial markets, which could have a negative impact on the U.S. economy.

"Increased concern about the global outlook, particularly the ongoing structural adjustments in China and the effects of the declines in the prices of oil and other commodities on commodity exporting nations, appeared early this year to have triggered volatility in global asset markets," he said.

"At this point, it is difficult to judge the likely implications of this volatility. If these developments lead to a persistent tightening of financial conditions, they could signal a slowing in the global economy that could affect growth and inflation in the United States," the Fed vice chairman added.

Fischer pointed out that he did know the Fed's next move.

-

09:55

Germany: Unemployment Rate s.a. , January 6.2% (forecast 6.3%)

-

09:55

Germany: Unemployment Change, January -20 (forecast -7)

-

09:16

Switzerland: Retail Sales (MoM), December 1.1%

-

09:15

Switzerland: Retail Sales Y/Y, December -1.6%

-

08:36

Options levels on tuesday, February 2, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0981 (3162)

$1.0953 (5145)

$1.0933 (2280)

Price at time of writing this review: $1.0902

Support levels (open interest**, contracts):

$1.0873 (1565)

$1.0851 (4396)

$1.0821 (5931)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 45087 contracts, with the maximum number of contracts with strike price $1,1000 (5612);

- Overall open interest on the PUT options with the expiration date February, 5 is 70159 contracts, with the maximum number of contracts with strike price $1,0800 (10114);

- The ratio of PUT/CALL was 1.56 versus 1.56 from the previous trading day according to data from February, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.4702 (2432)

$1.4603 (2154)

$1.4506 (2316)

Price at time of writing this review: $1.4387

Support levels (open interest**, contracts):

$1.4296 (1020)

$1.4198 (1735)

$1.4099 (1402)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 26384 contracts, with the maximum number of contracts with strike price $1,4650 (2893);

- Overall open interest on the PUT options with the expiration date February, 5 is 24306 contracts, with the maximum number of contracts with strike price $1,4550 (1987);

- The ratio of PUT/CALL was 0.92 versus 0.95 from the previous trading day according to data from February, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Foreign exchange market. Asian session: the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

The euro climbed against the U.S. dollar. Market participants are waiting for euro zone unemployment data due at 10:00 GMT. The index is expected to have remained at 10.5% in December. Euro zone leading economy Germany will publish its unemployment data at 08:55 GMT.

The yen continued climbing against the U.S. dollar amid growing demand for safe-haven assets. The latest weak data on Chinese manufacturing added to investors' concerns over the global economy.

The Australian dollar declined after the Reserve Bank of Australia left its benchmark rate unchanged at 2.0%. This decision was widely expected by economists. The RBA noted that the rate could be cut if economic growth slows down. The bank added that inflation growth remains low and its outlook leaves room for further monetary policy easing.

EUR/USD: the pair rose to $1.0915 in Asian trade

USD/JPY: the pair fell to Y120.35

GBP/USD: the pair fell to $1.4375

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales Y/Y December -3.1%

08:15 Switzerland Retail Sales (MoM) December -0.8%

08:55 Germany Unemployment Rate s.a. January 6.3% 6.3%

08:55 Germany Unemployment Change January -13 -7

09:30 United Kingdom PMI Construction January 57.8 57.5

10:00 Eurozone Producer Price Index, MoM December -0.2% -0.6%

10:00 Eurozone Producer Price Index (YoY) December -3.2% -2.8%

10:00 Eurozone Unemployment Rate December 10.5% 10.5%

18:00 U.S. FOMC Member Esther George Speaks

21:00 U.S. Total Vehicle Sales, mln January 17.34 17.4

21:45 New Zealand Employment Change, q/q Quarter IV -0.4% 0.8%

21:45 New Zealand Unemployment Rate Quarter IV 6% 6.1%

22:30 Australia AIG Services Index January 46.3

23:50 Japan Monetary Policy Meeting Minutes

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2% (forecast 2%)

-

00:30

Currencies. Daily history for Feb 1’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0887 +0,50%

GBP/USD $1,4432 +1,26%

USD/CHF Chf1,0196 -0,44%

USD/JPY Y120,98 -0,07%

EUR/JPY Y131,72 +0,44%

GBP/JPY Y174,58 +1,19%

AUD/USD $0,7112 +0,49%

NZD/USD $0,6546 +1,10%

USD/CAD C$1,3945 -0,43%

-

00:01

Schedule for today, Tuesday, Feb 2’2016:

(time / country / index / period / previous value / forecast)

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2%

03:30 Australia RBA Rate Statement

08:15 Switzerland Retail Sales Y/Y December -3.1%

08:15 Switzerland Retail Sales (MoM) December -0.8%

08:55 Germany Unemployment Rate s.a. January 6.3% 6.3%

08:55 Germany Unemployment Change January -13 -7

09:30 United Kingdom PMI Construction January 57.8 57.6

10:00 Eurozone Producer Price Index, MoM December -0.2% -0.5%

10:00 Eurozone Producer Price Index (YoY) December -3.2% -2.9%

10:00 Eurozone Unemployment Rate December 10.5% 10.5%

18:00 U.S. FOMC Member Esther George Speaks

21:00 U.S. Total Vehicle Sales, mln January 17.34 17.4

21:45 New Zealand Employment Change, q/q Quarter IV -0.4% 0.8%

21:45 New Zealand Unemployment Rate Quarter IV 6% 6.1%

22:30 Australia AIG Services Index January 46.3

23:50 Japan Monetary Policy Meeting Minutes

-