Noticias del mercado

-

17:53

Australian Industry Group’s services purchasing managers’ index for Australia rises to 48.4 in January

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index rose to 48.4 in January from 46.3 in December.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in January.

Main contributor to the rise was health and community services sector.

-

17:34

China targets a 6.5%-7.0% growth in 2016

China's National Development and Reform Commission (NDRC) Chairman Xu Shaoshi said on Wednesday that the country targets a 6.5%-7.0% growth in 2016. He noted that downward pressure on the economy will remain this year.

Xu pointed out that China's attempts to curb overcapacity will increase unemployment in provinces with high output of steel and coal.

"Now the problems are worse than they were two years ago but the government has the ability to cope," he said.

-

17:11

Building permits in Australia jump 9.2% in December

The Australian Bureau of Statistics released its building permits data on Wednesday. Building permits in Australia rose 9.2% in December, exceeding expectations for a 5.0% gain, after a 12.4% drop in November. November's figure was revised up from a 12.7% decrease.

Building permits for private sector houses climbed 5.4% in December, while building permits for private sector dwellings excluding houses jumped 12.8%.

The seasonally adjusted estimate of the value of total building approved was up 1.1% in December, after a 3.8% decline in November.

On a yearly basis, building permits fell 2.5% in December, after a 8.4% decrease in November.

-

17:05

NIESR raises its 2017 GDP growth forecast for the U.K.

The National Institute of Economic and Social Research (NIESR) upgraded its GDP growth forecast for the U.K. for 2017 on Tuesday. The U.K. GDP is expected to grow 2.3% in 2016, unchanged from the previous estimate. The NIESR expects the U.K. economy to expand at 2.7% in 2017, up from the previous estimate of 2.6%.

The NIESR said that the economic growth will be driven by consumer spending.

The think tank said that it expects the Bank of England's interest rate to remain unchanged until the second half of 2016.

The inflation is expected to rise 0.3% this year, 1.3% in 2017 and 2.1% in 2018.

The NIESR also said that the Chancellor will miss his main fiscal target.

-

16:37

Spain’s services PMI falls to 54.6 in January

Markit Economics released services purchasing managers' index (PMI) for Spain on Wednesday. Spain's services purchasing managers' index (PMI) fell to 54.6 in January from 55.1 in December. It was the lowest level since December 2014

New business and employment continued to grow in January.

"The latest services PMI data from Spain paints a broadly positive picture of the health of the sector at the start of 2016, with strong inflows of new work recorded and employment continuing to rise in response to building capacity pressures," Senior Economist at Markit Andrew Harker said.

-

16:30

U.S.: Crude Oil Inventories, January 7.792 (forecast 4.8)

-

16:20

Italy’s services PMI drops to 53.6 in January

Markit/ADACI's services purchasing managers' index (PMI) for Italy dropped to 53.6 in January from 55.3 in December.

A reading above 50 indicates expansion in the sector.

The index was driven by a slower growth in new business and job creation.

"The service sector began the year growing at a softer pace than was seen in December; however this shouldn't raise too many eyebrows as December marked one of the best months in quite some time. It was encouraging to see new business rise again after a marked gain in the month before, which maintains momentum and should mean that more jobs are added in the coming months," an economist at Markit Phil Smith said.

-

16:09

ISM non-manufacturing purchasing managers’ index falls to 53.5 in January

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index fell to 53.5 in January from 55.8 in December, missing expectations for a decrease to 55.1.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index slid to 56.5 in January from 58.9 in December.

The business activity/production index dropped to 53.9 in January from 59.5 in December.

The ISM's employment index was down to 52.1 in January from 56.3 in December.

The prices index declined to 46.4 in January from 51.0 in December.

-

16:01

Final Markit/Nikkei services purchasing managers' index for Japan climbs to 52.4 in January

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan climbed to 52.4 in January from 51.5 in December.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders.

"January data showed positive signs for the Japanese service sector. Business activity growth accelerated to a five-month high, supported further by a solid expansion in new orders. With the headline indices remaining positive in both the manufacturing and service sectors, this bodes well for growth early on in 2016," economist at Markit, Amy Brownbill, said.

-

16:00

U.S.: ISM Non-Manufacturing, January 53.5 (forecast 55.1)

-

15:55

Final U.S. services PMI drops to 53.2 in January

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) fell to 53.2 in January from 54.3 in December, down from the preliminary reading of 53.7. It was the lowest level since late-2013.

The index was driven by a slower growth in output and new business. Employment continued to strengthen.

"The US upturn has lost substantial momentum over the past two months, the trend in business activity sliding to the worst for over three years. Slower service sector activity, combined with subdued manufacturing growth, means January's expansion was the weakest seen since October 2012 with the sole exception of October 2013, when business was affected by the government shutdown," Chief Economist at Markit Chris Williamson said.

-

15:45

U.S.: Services PMI, January 53.2 (forecast 53.7)

-

15:19

Preliminary consumer prices in Italy decrease 0.2% in January

The Italian statistical office Istat released its preliminary consumer price inflation data for Italy on Wednesday. Preliminary consumer prices in Italy decreased 0.2% in January, after a flat reading in December.

Prices for services related to recreation including repair and personal care fell 0.5% in January, energy prices dropped 1.7%, while prices of unprocessed food decreased 0.5%.

On a yearly basis, consumer prices climbed 0.3% in January, after a 0.1% increase in December.

Prices for goods were flat year-on-year in January, while services prices rose 0.7%.

Consumer price inflation excluding unprocessed food and energy prices rose to 0.8% year-on-year in January from 0.6% in December.

-

15:08

BRC: U.K. shop prices are down 1.8% year-on-year in January

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.8% year-on-year in January, after a 2.0% decline in December.

The decline was mainly driven by a drop in non-food prices, which plunged 3.0% year-on-year in January.

Food prices rose at an annual rate of 0.1% in January.

"Higher levels of consumer confidence are currently translating into other parts of consumer spending - in leisure, entertainment and eating out - rather than into shopping which is providing the backdrop to a tough trading environment for retailers but great news for shoppers," BRC Chief Executive, Helen Dickinson, said.

-

14:51

Option expiries for today's 10:00 ET NY cut

USDJPY: 116.50 (USD 725m) 118.50 (1.69bln) 118.50 (570m) 119.00 (253m) 119.50 (291m) 121.00 (515m)

EURUSD 1.0700 (EUR 342m) 1.0800 (571m) 1.0875 (704m) 1.0930-25 (325m) 1.1000 (435m)

GBPUSD 1.4300-05 (GBP 333m) 1.4500 (318m)

USDCHF 1.1000 (USD 218m)

AUDUSD 0.7150 (359m)

USDCAD 1.3800 (USD 515m) 1.4000 (160m) 1.4200 (760m)

-

14:39

Japan’s consumer confidence index declines to 42.5 in January

Japan's Cabinet Office released its consumer confidence index on Wednesday. The consumer confidence index declined to 42.5 in January from 42.7 in December, missing expectations for a rise to 43.8.

The decrease was driven by declines in 3 of 4 sub-indexes. The overall livelihood sub-index decreased to 40.9 in January from 41.1 in December, the income growth sub-index was down to 41.2 from 41.8, the employment sub-index fell to 45.8 from 46.3, while the willingness to buy durable goods sub-index rose to 42.0 from 41.6.

-

14:26

U.S. ADP Employment Report: private sector adds 205,000 jobs in January

Private sector in the U.S. added 205,000 jobs in January, according the ADP report on Wednesday. December's figure was revised up to 267,000 jobs from a previous reading of 257,000 jobs.

Analysts expected the private sector to add 195,000 jobs.

Services sector added 192,000 jobs in January, while goods-producing sector added 13,000.

"Job growth remains strong despite the turmoil in the global economy and financial markets. Manufacturers and energy companies are reducing payrolls, but job gains across all other industries remain robust. The U.S. economy remains on track to return to full employment by mid-yea," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in January. The U.S. economy is expected to add 190,000 jobs in January, after adding 292,000 jobs in December.

-

14:15

U.S.: ADP Employment Report, January 205 (forecast 195)

-

13:59

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the better-than-expected services PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m December -12.4% Revised From -12.7% 5% 9.2%

00:30 Australia Trade Balance December -2.73 Revised From -2.90 -2.5 -3.535

01:45 China Markit/Caixin Services PMI January 50.2 52.4

04:30 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Consumer Confidence January 42.7 43.8 42.5

08:50 France Services PMI (Finally) January 49.8 50.6 50.3

08:55 Germany Services PMI (Finally) January 56 55.4 55

09:00 Eurozone Services PMI (Finally) January 54.2 53.6 53.6

09:30 United Kingdom Purchasing Manager Index Services January 55.5 55.3 55.6

10:00 Eurozone Retail Sales (MoM) December 0.0% Revised From -0.3% 0.3% 0.3%

10:00 Eurozone Retail Sales (YoY) December 1.6% Revised From 1.4% 1.5% 1.4%

12:00 U.S. MBA Mortgage Applications January 8.8% -2.6%

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 195,000 jobs in January.

The ISM non-manufacturing purchasing managers' index is expected to fall to 55.1 in January from 55.8 in December.

The euro traded higher against the U.S. dollar despite the release of the weak services purchasing managers' index (PMI) data from the Eurozone. Markit Economics released final services PMI data for the Eurozone on Wednesday. Eurozone's final services PMI declined to 53.6 in January from 54.2 in December, in line with the preliminary reading.

The index was driven by a slower growth in business activity in Germany, Italy and Spain.

Eurozone's final composite output index fell to 53.6 in January from 54.3 in December, up from the preliminary reading of 53.5.

"A disappointing Eurozone PMI survey for January indicated one of the weakest expansions seen over the past year and raises the prospect of further stimulus," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's is expected to grow at 0.4% at the start of the year.

Germany's final services PMI slid to 55.0 in January from 56.0 in December, down from the preliminary reading of 55.4.

The index was driven by a slower growth in new orders and employment.

France's final services PMI climbed to 50.3 in January from 49.8 in December, down from the preliminary reading of 50.6.

The index was driven by a rise in new business, backlogs of work and employment.

December, in line with expectations, after a flat reading in November. November's figure was revised up from a 0.3% fall.

Non-food sales increased 0.2% in December, food, drinks and tobacco sales rose 0.6%, while automotive fuel sales declined 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in December, missing forecasts of a 1.5% gain, after a 1.6% increase in November. November's figure was revised up from a 1.4% gain.

Non-food sales gained 1.8% year-on-year in December, gasoline sales decreased 0.8%, while food, drinks and tobacco sales rose 0.8%.

In 2015 as whole, retail sales climbed 2.4%.

The British pound traded higher against the U.S. dollar after the release of the better-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.6 in January from 55.5 in December, beating expectations for a fall to 55.3.

The increase was driven by a faster growth in new business and job creation.

"The economy defied expectations and picked up speed in January, but cracks continue to appear in the country's resilience to the various headwinds," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is expected to expand 0.6% in the first quarter of 2016.

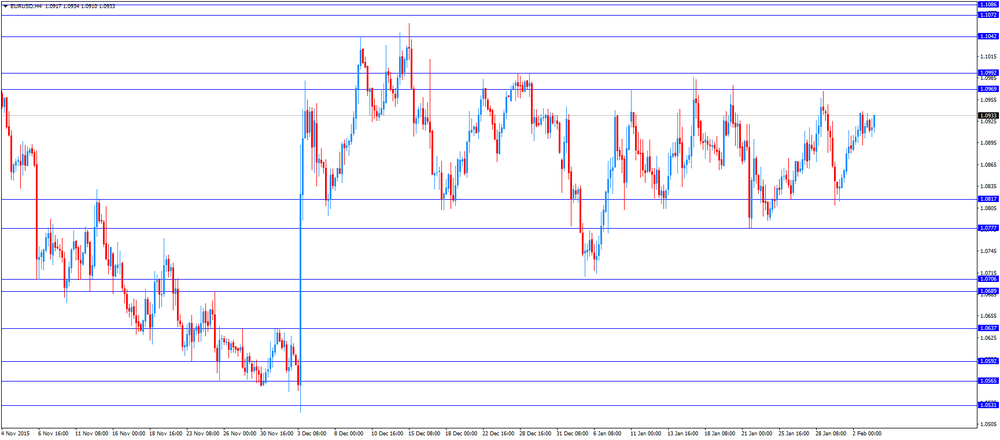

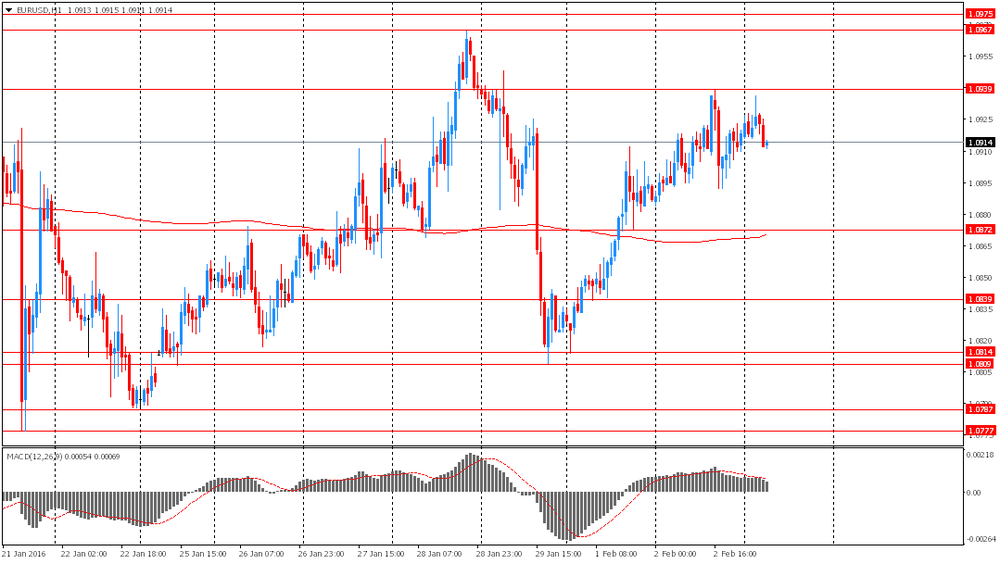

EUR/USD: the currency pair rose to $1.0934

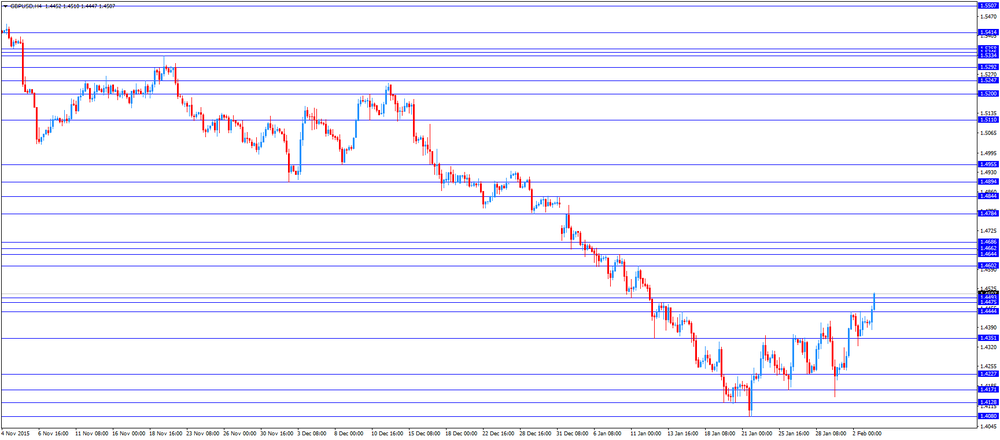

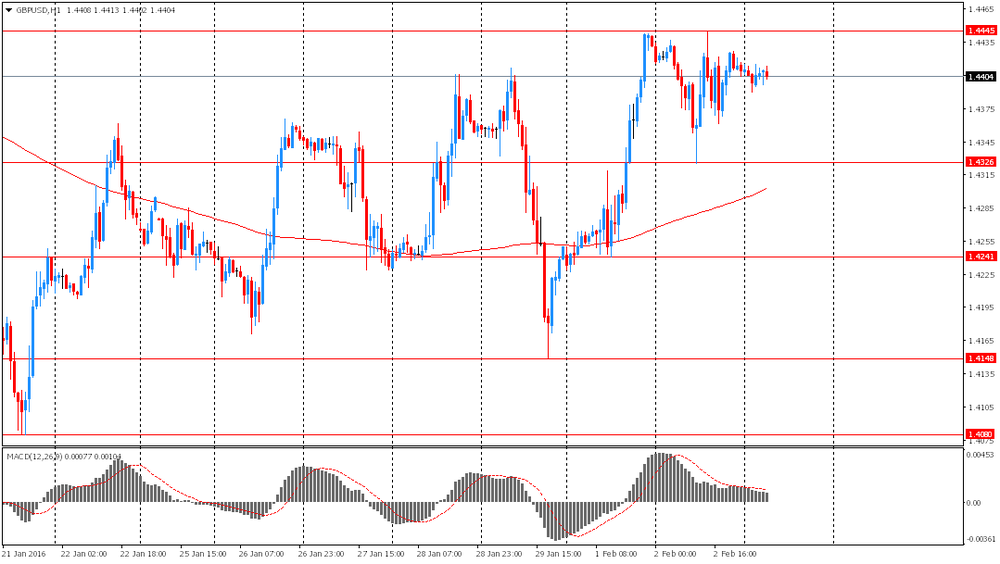

GBP/USD: the currency pair increased to $1.4510

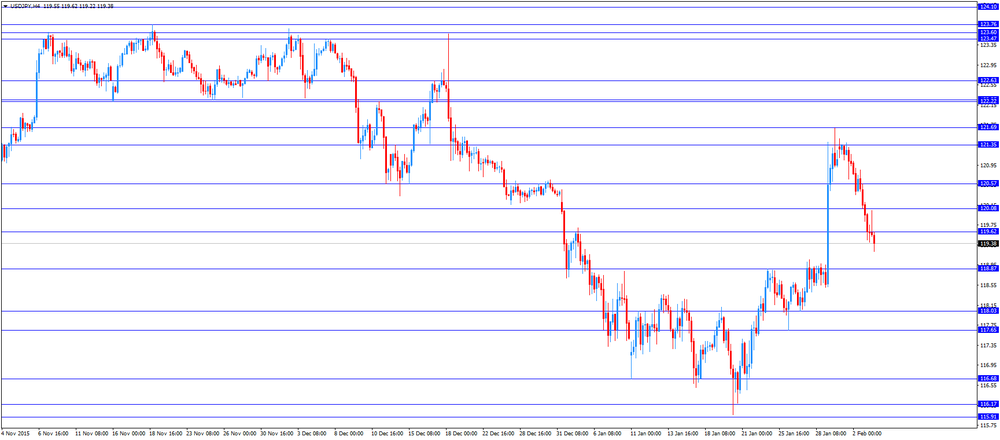

USD/JPY: the currency pair fell to Y119.22

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report January 257 195

14:45 U.S. Services PMI (Finally) January 54.3 53.7

15:00 U.S. ISM Non-Manufacturing January 55.8 55.1

15:30 U.S. Crude Oil Inventories January 8.383 4.8

-

13:45

Orders.

EUR/USD

Offers 1 .0920 1.0935 1.0950 1.0985 1.1000 1.1025 1.1050

Bids 1.0900 1.0880-85 1.0850 1.0830 1.0800 1.0780-85 1.0765 1.0750

GBP/USD

Offers 1.4435 1.4450 1.4475 1.4500 1.4520 1.4545-50 1.4575 1.4600

Bids 1.4400 1.4370 1.4350 1.4320 1.4300 1.4285 1.4265 1.4250 1.4225-30 1.4200

EUR/GBP

Offers 0.7585 0.7600 0.7620 0.7655-60 0.7680 0.7700

Bids 0.7550 0.7530 0.7500 0.7485 0.7450 0.7425 0.7400

EUR/JPY

Offers 130.80 131.00 131.30 131.50 131.80-85 132.00

Bids 130.40 130.00 129.80 129.50 129.30 129.00

USD/JPY

Offers 120.00 120.25 120.50 120.80-85 121.00 121.35 121.50 121.75-80 122.00

Bids 119.50 119.25-30 119.00 118.80 118.50 118.30 118.00

AUD/USD

Offers 0.7080 0.7100 0.7120-25 0.7150 0.7180 0.7200

Bids 0.7030 0.7000 0.6980 0.6950 0.6925 0.6900

-

13:00

U.S.: MBA Mortgage Applications, January -2.6%

-

11:56

France's final services PMI climbs to 50.3 in January

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) climbed to 50.3 in January from 49.8 in December, down from the preliminary reading of 50.6.

The index was driven by a rise in new business, backlogs of work and employment.

"The French service sector saw a return to expansionary territory in January, but the rate of growth was negligible. Lacklustre demand continued to weigh on the performance of the sector, with new orders rising at a below-trend pace," Senior Economist at Markit Jack Kennedy said.

-

11:53

Germany's final services PMI slides to 55.0 in January

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) slid to 55.0 in January from 56.0 in December, down from the preliminary reading of 55.4.

The index was driven by a slower growth in new orders and employment.

"German service providers remained in expansion mode at the start of 2016. Although output rose to the smallest extent in three months, the underlying rate of growth was robust overall, helped by a further sharp rise in new business," an economist at Markit, Oliver Kolodseike, said.

-

11:49

Eurozone's final services PMI declines to 53.6 in January

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) declined to 53.6 in January from 54.2 in December, in line with the preliminary reading.

The index was driven by a slower growth in business activity in Germany, Italy and Spain.

Eurozone's final composite output index fell to 53.6 in January from 54.3 in December, up from the preliminary reading of 53.5.

"A disappointing Eurozone PMI survey for January indicated one of the weakest expansions seen over the past year and raises the prospect of further stimulus," Chief Economist at Markit Chris Williamson said.

He added that the Eurozone's is expected to grow at 0.4% at the start of the year.

-

11:42

UK’s services PMI rises to 55.6 in January

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 55.6 in January from 55.5 in December, beating expectations for a fall to 55.3.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in new business and job creation.

"The economy defied expectations and picked up speed in January, but cracks continue to appear in the country's resilience to the various headwinds," the Chief Economist at Markit Chris Williamson said.

He added that the U.K. economy is expected to expand 0.6% in the first quarter of 2016.

-

11:38

Eurozone’s retail sales increase 0.3% in December

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone increased 0.3% in December, in line with expectations, after a flat reading in November. November's figure was revised up from a 0.3% fall.

Non-food sales increased 0.2% in December, food, drinks and tobacco sales rose 0.6%, while automotive fuel sales declined 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in December, missing forecasts of a 1.5% gain, after a 1.6% increase in November. November's figure was revised up from a 1.4% gain.

Non-food sales gained 1.8% year-on-year in December, gasoline sales decreased 0.8%, while food, drinks and tobacco sales rose 0.8%.

In 2015 as whole, retail sales climbed 2.4%.

-

11:27

Bank of Japan Governor Haruhiko Kuroda: there is no limit to monetary policy easing

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Wednesday that there was no limit to monetary policy easing.

"If we judge that existing measures in the toolkit are not enough to achieve the goal, what we have to do is to devise new tools, rather than give up the goal," he said.

"I am convinced that there is no limit to measures for monetary easing. The Bank will continue to devote itself to innovation in monetary policy measures," Kuroda added.

He pointed out that the central bank could cut its interest rate further if needed.

-

11:15

Australia's trade deficit widens to A$3.54 billion in December

The Australian Bureau of Statistics released its trade data on Wednesday. Australia's trade deficit widened to A$3.54 billion in December from A$2.73 billion in November, missing expectations for a decline to a deficit of A$2.5 billion. November's figure was revised up from a deficit of A$2.90 billion.

Exports decreased by 5.0% in December, while imports fell 1.0%.

In 2015 as whole, the deficit climbed to A$33.5 billion from a deficit of A$9.9 billion in 2014.

-

11:06

Reserve Bank of New Zealand Governor Graeme Wheeler: the interest rate cut is not “a mechanistic approach”

The Reserve Bank of New Zealand (RBNZ) Governor Graeme Wheeler said in a speech on Wednesday that the interest rate cut is not "a mechanistic approach". But he noted that further policy easing could be needed if concerns about the global economy will deepen.

"If concerns deepen around the prospects for the global economy and its impact on New Zealand, some further policy easing may be needed over the coming year to ensure future average inflation settles near the middle of the target range," Wheeler said.

-

11:00

Eurozone: Retail Sales (MoM), December 0.3% (forecast 0.3%)

-

11:00

Eurozone: Retail Sales (YoY), December 1.4% (forecast 1.5%)

-

10:57

Kansas City Federal Reserve President Esther George: the Fed should continue to raise its interest rate

Kansas City Federal Reserve President Esther George said in a speech on Tuesday that the Fed should continue to raise its interest rate.

"My view is that the Committee should continue the gradual adjustment of moving rates higher to keep them aligned with economic activity and inflation," Kansas City Federal Reserve president said.

George noted that the monetary could not respond to every volatility in financial markets.

"Even looking at developments so far this year, financial markets have been quite volatile. While taking a signal from such volatility is warranted, monetary policy cannot respond to every blip in financial markets," she said.

George is a voting member on the Federal Open Market Committee (FOMC).

-

10:47

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.50 (USD 725m) 118.50 (1.69bln) 118.50 (570m) 119.00 (253m) 119.50 (291m) 121.00 (515m)

EUR/USD 1.0700 (EUR 342m) 1.0800 (571m) 1.0875 (704m) 1.0930-25 (325m) 1.1000 (435m)

GBP/USD 1.4300-05 (GBP 333m) 1.4500 (318m)

USD/CHF 1.1000 (USD 218m)

AUD/USD 0.7150 (359m)

USD/CAD 1.3800 (USD 515m) 1.4000 (160m) 1.4200 (760m)

-

10:46

New Zealand’s unemployment rate drops to 5.3% in the fourth quarter

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate dropped to 5.3% in the fourth quarter from 6.0% in the third quarter, beating expectations for a rise to 6.1%.

Employment increased 0.9% in the fourth quarter, exceeding expectations for a 0.8% gain, after a 0.5% fall in the third quarter. The third quarter's figure was revised down from 0.4% decline.

The participation rate declined to 68.4% in the fourth quarter from 68.7% in the third quarter.

"Although the number of employed people has risen, there was also growth in the number of people not participating in the labour market. This has contributed to labour force participation falling for the third quarter in a row," labour market and household statistics manager Diane Ramsay said.

-

10:37

Chinese Markit/Caixin services PMI rises to 52.4 in January

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.4 in January from 50.2 in December.

The index was driven by a rise in new business.

"Overall, the fast development of the services sector has to a large extent offset the impact of weakening manufacturing, indicating a better economic structure. The government should continue to deepen reform, relax administrative controls and reduce restrictions on market entry for service providers. This will release the potential of the services sector and help improve the economic structur," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:30

United Kingdom: Purchasing Manager Index Services, January 55.6 (forecast 55.3)

-

10:22

Bank of Japan’s December monetary policy meeting minutes: there was a split over supplementary measures

The Bank of Japan (BoJ) released its December monetary policy meeting minutes on late Tuesday evening. According to minutes, there was a split over supplementary measures. 6 of 9 board members voted for the implementation of these supplementary measures.

The central bank said in December that the average maturity of the Japanese government bonds was increased to seven to 12 years from seven to 10 years, and that it would annually purchase ¥300 billion of ETFs (exchange-traded funds) issued by companies that are making investment in physical and human capital. This decision was not expected by analysts.

Board members shared the recognition that the Japanese economy continued to expand moderately.

Board members noted that consumer price inflation was about 0% and it "was likely to remain at this level for the time being due to the effects of the decline in energy prices".

The BoJ decided to keep unchanged its interest rate at its December meeting.

-

10:09

European Central Bank Executive Board member Yves Mersch: the central bank has no constraints in adding further stimulus measures

The European Central Bank (ECB) Executive Board member Yves Mersch said in an interview with the Wall Street Journal on Tuesday that the central bank has no constraints in adding further stimulus measures. He pointed out that the decision was not made yet.

"In terms of fantasy, the sky's the limit. But in the end, we have no constraint in the use, the diversity, or the volume of our toolbox as we see fit. I would not create any expectations in one direction or the other," Mersch said.

He noted that downside risks increased since December, adding that the reasons are falling oil prices and the slowdown in the Chinese economy.

-

10:00

Eurozone: Services PMI, January 53.6 (forecast 53.6)

-

09:55

Germany: Services PMI, January 55 (forecast 55.4)

-

09:50

France: Services PMI, January 50.3 (forecast 50.6)

-

08:26

Options levels on wednesday, February 3, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0986 (2966)

$1.0961 (5144)

$1.0944 (2244)

Price at time of writing this review: $1.0919

Support levels (open interest**, contracts):

$1.0891 (1583)

$1.0866 (4546)

$1.0833 (6212)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 45222 contracts, with the maximum number of contracts with strike price $1,1000 (6260);

- Overall open interest on the PUT options with the expiration date February, 5 is 72085 contracts, with the maximum number of contracts with strike price $1,0800 (10220);

- The ratio of PUT/CALL was 1.59 versus 1.56 from the previous trading day according to data from February, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.4701 (2323)

$1.4602 (2209)

$1.4504 (2420)

Price at time of writing this review: $1.4420

Support levels (open interest**, contracts):

$1.4393 (1449)

$1.4296 (1044)

$1.4198 (1751)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 26499 contracts, with the maximum number of contracts with strike price $1,4650 (2859);

- Overall open interest on the PUT options with the expiration date February, 5 is 24441 contracts, with the maximum number of contracts with strike price $1,4550 (1987);

- The ratio of PUT/CALL was 0.92 versus 0.92 from the previous trading day according to data from February, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:04

Foreign exchange market. Asian session: the Australian dollar fell

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Building Permits, m/m December -12.4% Revised From -12.7% 5% 9.2%

00:30 Australia Trade Balance December -2.73 Revised From -2.90 -2.5 -3.535

01:45 China Markit/Caixin Services PMI January 50.2 52.4

04:30 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Consumer Confidence January 42.7 43.8 42.5

The Australian dollar fell amid weak trade balance data. The country's trade balance came in at -A$3.54 billion in December compared to -A$2.73 billion reported previously, while economists had expected -A$2.5 billion. Slower economic growth in China and lower prices of such major export goods as iron ore and coal harmed Australia's trade balance. Expoirts fell by 5% in December, while imports fell by 1%.

The euro little changed ahead of retail sales data from the euro zone. Economists expect sales to have risen significantly in December. If data meet expectations this would be a positive sign for the economy of the single currency area. Some analysts believe that weak data released previously were driven by seasonal factors and the economy was actually doing better.

The yen rose against the U.S. dollar amid demand for safe-haven assets as stocks continued falling. Market participants were more cautious about the global economic growth after China released weak manufacturing data on Monday.

The New Zealand dollar jumped after Statistics New Zealand released unemployment data. The unemployment rate fell to 5.3% in the fourth quarter (the lowest level since March 2009), while economists had expected a reading of 6.1%. The unemployment rate stood at 6.0% in the third quarter.

EUR/USD: the pair fluctuated within $1.0910-35 in Asian trade

USD/JPY: the pair fell to Y119.40

GBP/USD: the pair traded within $1.4390-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:50 France Services PMI (Finally) January 49.8 50.6

08:55 Germany Services PMI (Finally) January 56 55.4

09:00 Eurozone Services PMI (Finally) January 54.2 53.6

09:30 United Kingdom Purchasing Manager Index Services January 55.5 55.3

10:00 Eurozone Retail Sales (MoM) December -0.3% 0.3%

10:00 Eurozone Retail Sales (YoY) December 1.4% 1.5%

12:00 U.S. MBA Mortgage Applications January 8.8%

13:15 U.S. ADP Employment Report January 257 195

14:45 U.S. Services PMI (Finally) January 54.3 53.7

15:00 U.S. ISM Non-Manufacturing January 55.8 55.1

15:30 U.S. Crude Oil Inventories January 8.383 4.8

-

06:01

Japan: Consumer Confidence, January 42.5 (forecast 43.8)

-

02:47

China: Markit/Caixin Services PMI, January 52.4

-

01:30

Australia: Building Permits, m/m, December 9.2% (forecast 5%)

-

01:30

Australia: Trade Balance , December -3.53 (forecast -2.5)

-

00:33

Currencies. Daily history for Feb 2’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0918 +0,28%

GBP/USD $1,4409 -0,16%

USD/CHF Chf1,0183 -0,13%

USD/JPY Y119,95 -0,86%

EUR/JPY Y130,98 -0,56%

GBP/JPY Y172,85 -1,00%

AUD/USD $0,7036 -1,08%

NZD/USD $0,6513 -0,51%

USD/CAD C$1,4053 +0,77%

-

00:00

Schedule for today, Wednesday, Feb 3’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m December -12.7% 5%

00:30 Australia Trade Balance December -2.90 -2.5

01:45 China Markit/Caixin Services PMI January 50.2

04:30 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Consumer Confidence January 42.7 43.8

08:50 France Services PMI (Finally) January 49.8 50.6

08:55 Germany Services PMI (Finally) January 56 55.4

09:00 Eurozone Services PMI (Finally) January 54.2 53.6

09:30 United Kingdom Purchasing Manager Index Services January 55.5 55.3

10:00 Eurozone Retail Sales (MoM) December -0.3% 0.3%

10:00 Eurozone Retail Sales (YoY) December 1.4% 1.5%

12:00 U.S. MBA Mortgage Applications January 8.8%

13:15 U.S. ADP Employment Report January 257 195

14:45 U.S. Services PMI (Finally) January 54.3 53.7

15:00 U.S. ISM Non-Manufacturing January 55.8 55.1

15:30 U.S. Crude Oil Inventories January 8.383

-