Noticias del mercado

-

23:57

Schedule for today, Friday, Feb 5’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia Retail Sales, M/M December 0.4% 0.5%

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index (Preliminary) December 103.5 102.8

05:00 Japan Coincident Index (Preliminary) December 111.9

07:00 Germany Factory Orders s.a. (MoM) December 1.5% -0.5%

07:45 France Trade Balance, bln December -4.63 -4.4

13:30 Canada Trade balance, billions December -1.99 -2.2

13:30 Canada Unemployment rate January 7.1% 7.1%

13:30 Canada Employment January 22.8 5.5

13:30 U.S. Average hourly earnings January 0% 0.3%

13:30 U.S. Average workweek January 34.5 34.5

13:30 U.S. International Trade, bln December -42.37 -43

13:30 U.S. Unemployment Rate January 5% 5%

13:30 U.S. Nonfarm Payrolls January 292 190

15:00 Canada Ivey Purchasing Managers Index January 49.9 50

20:00 U.S. Consumer Credit December 13.95 16

-

23:30

Australia: AiG Performance of Construction Index, January 46.3 (forecast 46.8)

-

18:12

Dallas Fed President Robert Kaplan: the Fed should be patient on further interest rate hikes

Dallas Fed President Robert Kaplan said on Thursday that the Fed should be patient on further interest rate hikes as financial conditions tightened.

"Financial conditions have tightened, and we know that non-U.S. growth is weakening, and I have got to take that into account as a policymaker," he said.

Kaplan is not a voting member on the Federal Open Market Committee (FOMC) this year.

-

17:42

European Central Bank Executive Board member Yves Mersch: productivity in the Eurozone was driven by job cuts

European Central Bank (ECB) Executive Board member Yves Mersch said in a speech on Thursday that productivity in the Eurozone was driven by job cuts.

"Much of the (meagre) productivity growth seen in the euro area has come through labour shedding rather than from strong value added growth. And if those displaced don't have the right skills to find another job, structural unemployment is likely to increase further, or they will be forced to consider low productivity sectors, and then aggregate productivity growth will stagnate once more," he said.

Mersch pointed out that there are further possibilities of monetary policy easing, adding that the central bank's toolbox is not exhausted.

-

16:53

Bank of England Governor Mark Carney: an interest rate hike is more likely than interest rate cut

The Bank of England (BoE) Governor Mark Carney said at a press conference on Thursday that an interest rate hike is more likely than interest rate cut. He noted that he expects wages to grow solidly this year, and the 2% inflation target will be reached in around two years.

The BoE governor pointed out that the central bank did not discuss negative interest rates.

Carney said that there are downside risks from the slowdown in the global economy.

-

16:38

State Secretariat for Economic Affairs’ consumer confidence index data for Switzerland rises to -14 in January

The State Secretariat for Economic Affairs released its consumer confidence index data for Switzerland on Thursday. The index rose to -14 in January from -18 in October.

"Although confidence in the future trend on the labour market increased slightly, the level is still relatively low. Expectations over price trends have again been revised downwards," the State Secretariat for Economic Affairs said in a statement.

The household expectations sub-index remained unchanged at -16 in January, while the expected unemployment sub-index was down to 68 from 74.

-

16:28

Real wages in Germany climb by 2.5% in 2015

Destatis released its real wages growth data for Germany on Thursday. Real wages in Germany rose by 2.5% in 2015, after a 1.7% growth in 2014. It was the biggest increase since the series began in 2008.

Nominal earnings climbed 2.8% in 2015. In the same period, German consumer price index increased 0.3%.

-

16:23

U.S. factory orders decline 2.9% in December

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. dropped 2.9% in December, missing expectations for a 2.8% fall, after a 0.7% decline in November. It was the largest decline since December 2014.

November's figure was revised down from a 0.2% decrease.

A strong dollar and a weak demand abroad weighed on factory orders.

Durable goods orders were slid 5.0% in December.

Orders for transportation equipment plunged 12.6%, while orders for automobiles and parts climbed 1.4%.

Factory orders excluding transportation declined 0.8% in December, after a 0.7% drop in November. November's figure was revised down from a 0.3% fall.

-

16:00

U.S.: Factory Orders , December -2.9% (forecast -2.8%)

-

15:59

Germany's construction PMI increases to 55.5 in January

Markit Economics released construction purchasing managers' index (PMI) for Germany on Thursday. Germany's construction purchasing managers' index (PMI) increased to 55.5 in January from 57.9 in December.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"Germany's construction sector roars back to health at the beginning of the year, with the headline Construction PMI reaching its highest level in nearly five years. House building remained a particularly bright spot in the data, rising at the steepest rate in nine years," an economist at Markit, Oliver Kolodseike, said.

-

15:54

Bank of England’s quarterly inflation report: the central bank downgrades its growth forecasts

The Bank of England (BoE) released its quarterly inflation report on Thursday. The central bank downgraded its growth forecasts. The economy is expected to expand 2.2% in 2016, down from its previous forecast of a 2.5% rise, and 2.3% in 2017, down from its previous forecast of a 2.6% gain.

"The MPC judges the risks to the central projection to be skewed a little to the downside in the near term, reflecting the possibility of greater persistence of low inflation," the central bank said.

The BoE said that inflation in the U.K. will remain below 1% through 2016. The BoE noted that inflation is expected to rise modestly in the coming months.

-

15:47

Germany's retail PMI falls to 49.5 in January

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Thursday. Germany's retail purchasing managers' index (PMI) declined to 49.5 in January from 50.5 in December.

The decline was driven by a fall in buying activity and stock holdings.

"It's a disappointing start to the year for German retailers, as unfavourable weather conditions acted as a drag on sales. Moreover, the headline index has now failed to signal any meaningful growth for three months, with the latest reading the lowest in nearly one-and-a-half year," an economist at Markit, Oliver Kolodseike, said.

-

15:06

Productivity in the U.S. non-farm businesses slides at a 3.0% annual rate in the fourth quarter

The U.S. Labor Department released non-farm productivity figures on Thursday. Preliminary productivity in the U.S. non-farm businesses slid at a 3.0% annual rate in the fourth quarter, missing expectations for a 1.8% decrease, after a 2.1% increase in the third quarter. It was the biggest drop since the first quarter of 2014.

The third quarter's figure was revised down from a 2.2% gain.

The drop was driven by a rise in labour-related production costs.

Hours worked jumped by 3.3% in the fourth quarter, while output rose by 0.1%.

In 2015 as whole, productivity rose 0.6%, the weakest rise since 2013, after a 0.7% increase in 2014.

Preliminary unit labour costs increased 4.5% in the fourth quarter, exceeding expectations for a 3.9% rise, after a 1.9 gain in the third quarter. The third quarter's figure was revised up from a 1.8% increase.

In 2015 as whole, labour costs climbed 2.4, the largest increase since 2007, after a 2.0% gain.

-

14:44

Initial jobless claims rise to 285,000 in the week ending January 30

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 30 in the U.S. rose by 8,000 to 285,000 from 277,000 in the previous week. The previous week's figure was revised down from 278,000.

Analysts had expected jobless claims to increase to 280,000.

Jobless claims remained below 300,000 the 48th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 18,000 to 2,255,000 in the week ended January 23.

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter IV 4.5% (forecast 3.9%)

-

14:30

U.S.: Initial Jobless Claims, January 285 (forecast 280)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter IV -3.0% (forecast -1.8%)

-

14:30

U.S.: Continuing Jobless Claims, January 2255 (forecast 2240)

-

14:29

Bank of England's Monetary Policy Committee February minutes: all members vote to keep the central bank's monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

The consumer price inflation in the U.K. was 0.2% in December, below the central bank's 2% target. The BoE noted that inflation is expected to rise modestly in the coming months.

The BoE noted that the domestic private sector remained resilient, while consumer confidence was robust.

The central bank said that there are downside risks to the global growth and to the central bank's forecasts from the slowdown in emerging economies.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

-

14:15

Bank of England keeps its interest rate on hold at 0.5% in February

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

14:09

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:15 U.S. FOMC Member Rosengren Speaks

08:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Halifax house price index January 2% Revised From 1.7% 0.3% 1.7%

08:30 United Kingdom Halifax house price index 3m Y/Y January 9.5% 9.7%

09:00 Eurozone ECB Economic Bulletin

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom BOE Inflation Letter

12:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 2,000 to 280,000 last week.

Preliminary productivity in the U.S. non-farm businesses is expected to decline at a 1.8% annual rate in the fourth quarter, after a 2.2% rise in the third quarter.

Preliminary unit labour costs are expected to increase 3.9% in the fourth quarter, after a 1.8 gain in the third quarter.

The U.S. factory orders are expected to decline 2.8% in December, after a 0.2% rise in November.

The U.S. dollar was under pressure due to yesterday's comments by New York Fed President William Dudley. He said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

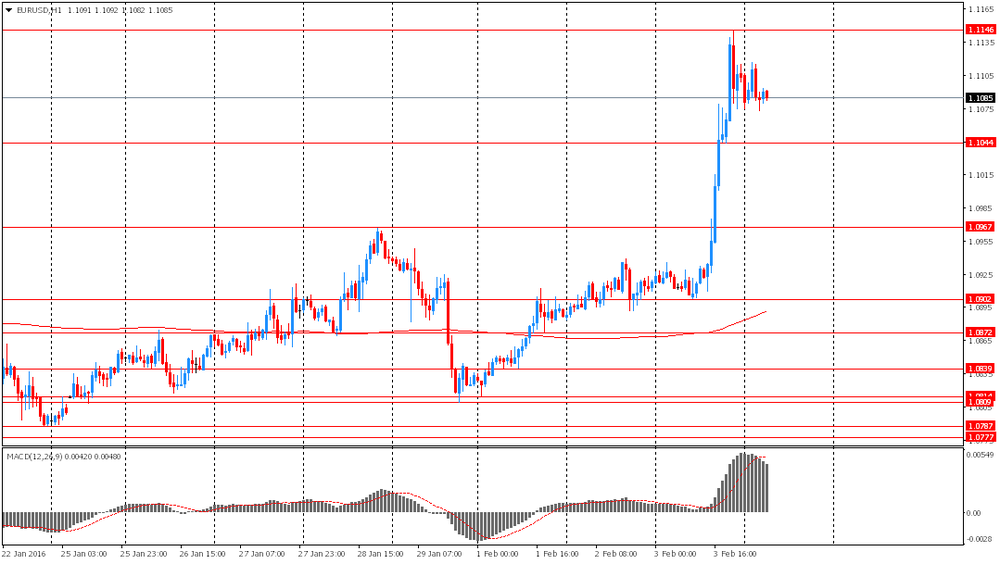

The euro traded higher against the U.S. dollar on a weaker U.S. dollar as market participants speculate that the Fed will delay further interest rate hikes.

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

The European Central Bank (ECB) President Mario Draghi said in a speech on Thursday that it is better to act earlier than too late as the risks are too high.

"Adopting a wait-and-see attitude and extending the policy horizon brings with it risks: namely a lasting de-anchoring of expectations leading to persistently weaker inflation. And if that were to happen, we would need a much more accommodative monetary policy to reverse it. Seen from that perspective, the risks of acting too late outweigh the risks of acting too early," he said.

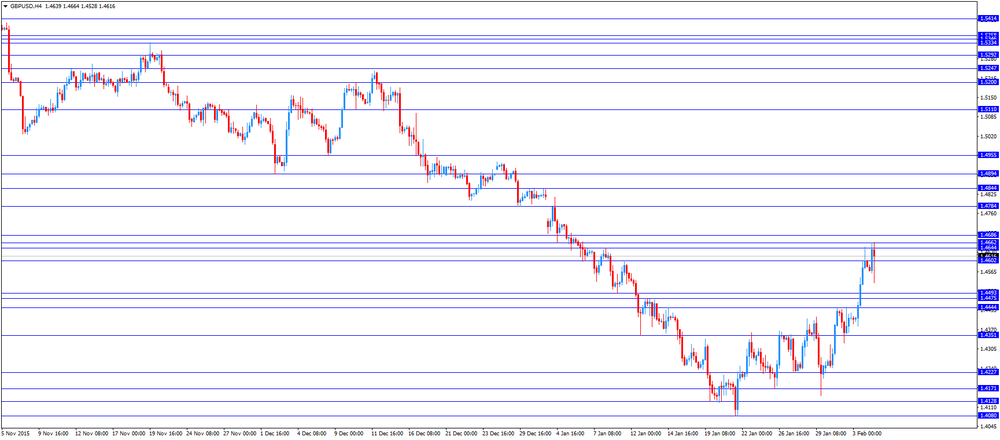

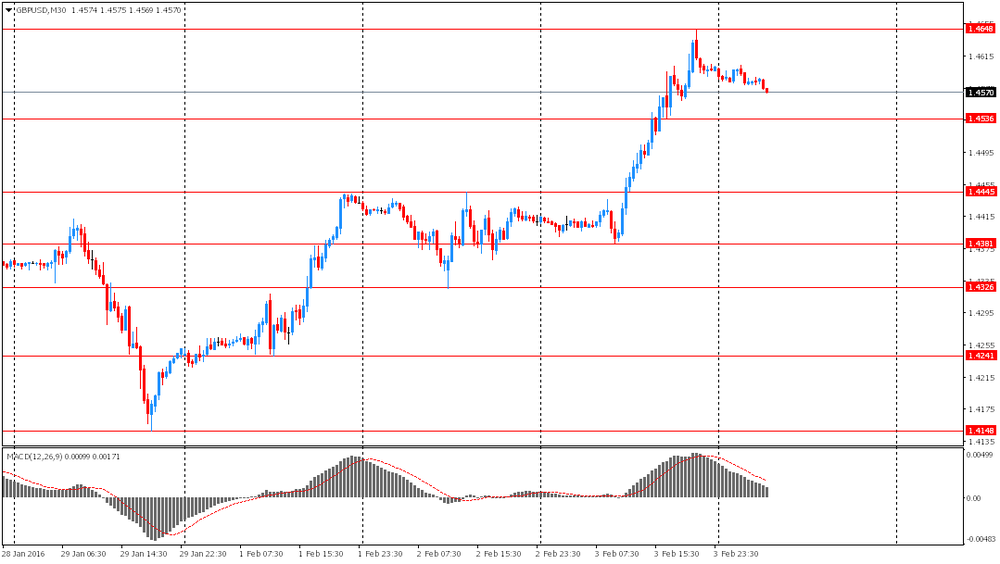

The British pound traded lower against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes today. All members voted to keep the central bank's monetary policy unchanged.

The central bank downgraded its growth forecasts. The economy is expected to expand 2.2% in 2016, down from its previous forecast of a 2.5% rise, and 2.3% in 2017, down from its previous forecast of a 2.6% gain.

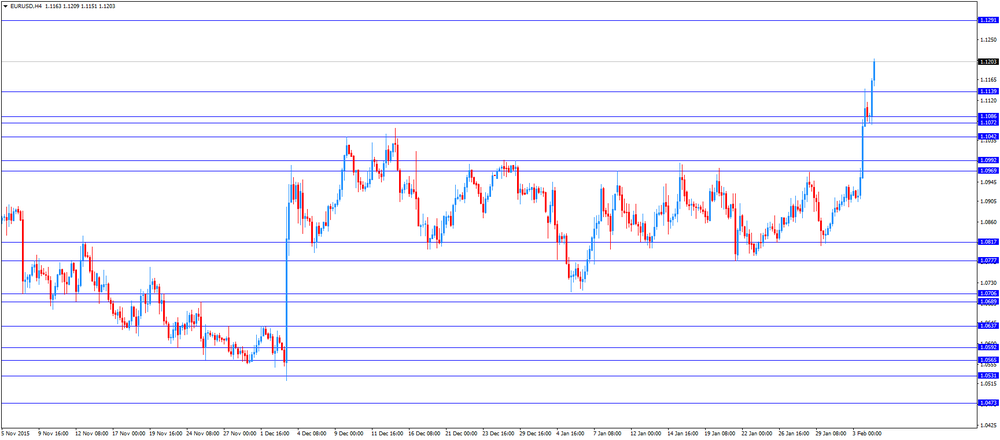

EUR/USD: the currency pair rose to $1.1209

GBP/USD: the currency pair decreased to $1.4528

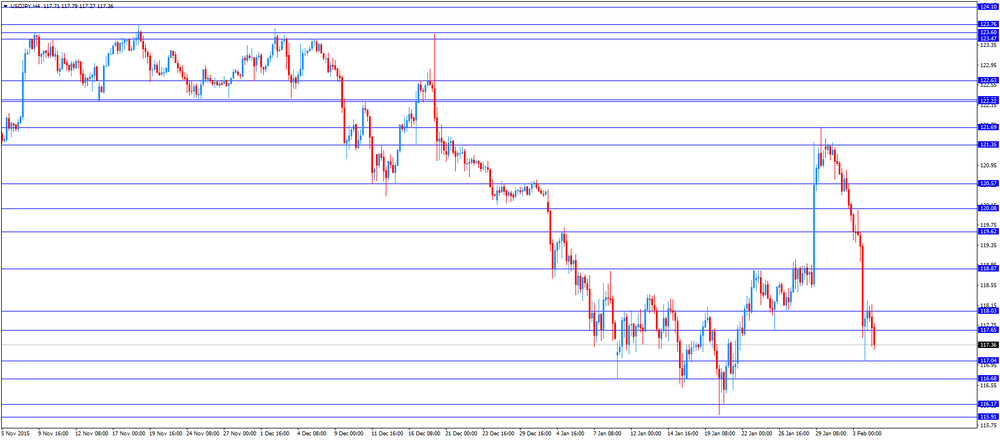

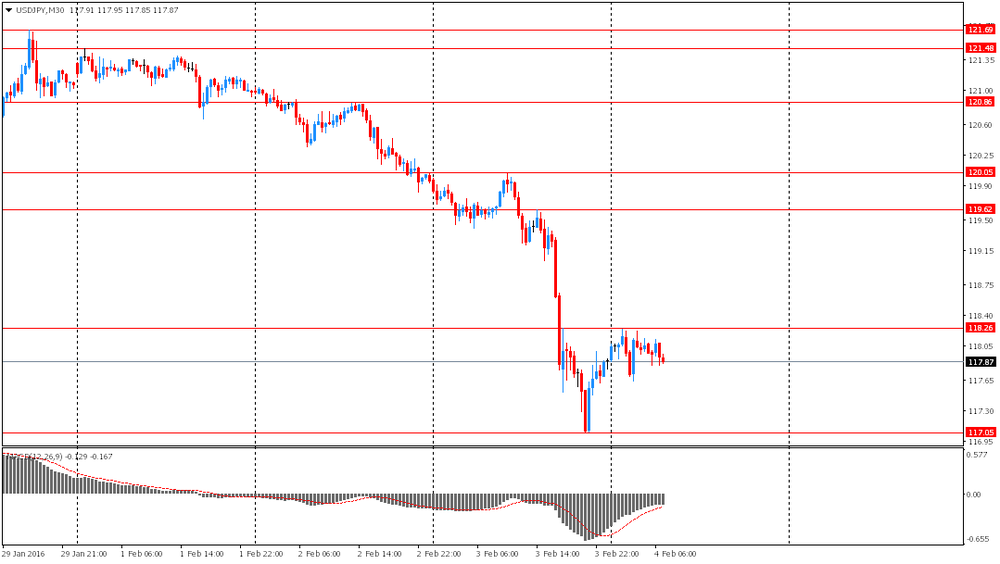

USD/JPY: the currency pair fell to Y117.27

The most important news that are expected (GMT0):

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 1.8% 3.9%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV 2.2% -1.8%

13:30 U.S. Initial Jobless Claims January 278 280

15:00 U.S. Factory Orders December -0.2% -2.8%

-

14:00

Orders

EUR/USD

Offers 1.1145-50 1.1170 1.1185 1.1200 1.1220 1.1235 1.1250

Bids 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0980 1.0950 1.0930 1.0900

GBP/USD

Offers 1.4625 1.4645-50 1.4665 1.4685 1.4700 1.4720-25 1.4750

Bids 1.4580 1.4565 1.4545-50 1.4525-30 1.4500 1.4480 1.4450 1.4430 1.4400

EUR/GBP

Offers 0.7625-30 0.7655-60 0.7680 0.7700 0.7730 0.7750

Bids 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

EUR/JPY

Offers 131.30 131.50 131.80-85 132.00 132.25 132.50 132.75 133.00

Bids 130.75 130.60 130.30 130.00 129.80 129.50

USD/JPY

Offers 118.00 118.25 118.45-50 118.70 118.85 119.00 119.30 119.50 120.00

Bids 117.50 117.30 117.00 116.85 116.65 116.50 116.25 116.00

AUD/USD

Offers 0.7200 0.7220 0.7245-50 0.7270 0.7285 0.7300

Bids 0.7180 0.7165 0.7150 0.7130 0.7100 0.7080 0.7060 0.7030 0.7000

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:51

Eurozone's retail PMI rises to 49.0 in January

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Thursday. Eurozone's construction purchasing managers' index (PMI) rise to 49.0 in January from 58.9 in December.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in Germany, France and Italy remained below 50.

"Sales were higher in January than the situation one year ago, although on a monthly basis they have slipped steadily since November. This loss of momentum is largely reflective of a slowdown in Germany, where sales have now fallen twice in the past three months, albeit marginally," an economist at Markit, Phil Smith, said.

-

11:46

Halifax: House prices in the U.K. jump 1.7% in January

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in January, exceeding expectations for a 0.3% gain, after a 2.0% gain in December. December's figure was revised up from a 1.7% increase.

On a yearly basis, house prices climbed 9.7% in the three months to January, after a 9.5% increase in the three months to December.

"The imbalance between supply and demand continues to exert significant upward pressure on house prices. This situation looks set to persist over the coming months," Halifax's housing economist Martin Ellis said.

-

11:41

European Commission downgrades its growth and inflation forecasts for the Eurozone

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

"Europe's moderate growth is facing increasing headwinds, from slower growth in emerging markets such as China, to weak global trade and geopolitical tensions in Europe's neighbourhood," EU Commission Vice President Valdis Dombrovskis said.

German economic growth for 2016 and 2017 was lowered to 1.8% from the previous estimate of 1.9%.

The European Commission upgraded the Greek GDP forecast for 2016 to -0.8% from the previous estimate of -1.3%. Greece's economy is expected to expand 2.7% in 2017.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

-

11:21

European Central Bank President Mario Draghi: it is better to act earlier than too late as the risks are too high

The European Central Bank (ECB) President Mario Draghi said in a speech on Thursday that it is better to act earlier than too late as the risks are too high.

"Adopting a wait-and-see attitude and extending the policy horizon brings with it risks: namely a lasting de-anchoring of expectations leading to persistently weaker inflation. And if that were to happen, we would need a much more accommodative monetary policy to reverse it. Seen from that perspective, the risks of acting too late outweigh the risks of acting too early," he said.

Draghi noted that the central bank's inflation target might be reached slower than previously estimated.

The ECB president pointed out that the central bank will add further stimulus measures if needed.

"There can be no doubt that if we needed to adopt a more expansionary policy, the risk of side effects would not stand in our way. We always aim to limit the distortions caused by our policy, but what comes first is the price stability objective," he said.

-

10:50

Standard and Poor's downgrades its forecasts for the Fed’s interest rate hikes in 2016

Rating agency Standard and Poor's (S&P) on Tuesday downgraded its forecasts for the Fed's interest rate hikes in 2016 due to low inflation and global market uncertainty. The agency said that the Fed will raise its interest rate twice this year, down from the previous forecast of four times.

-

10:35

New York Fed President William Dudley: a stronger U.S. dollar could have "significant consequences" for the U.S. economy

New York Fed President William Dudley said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

Dudley is a voting member on the Federal Open Market Committee (FOMC).

-

10:23

Britain’s Prime Minister David Cameron: there is no firm date for the EU referendum

Britain's Prime Minister David Cameron said on Wednesday that there was no firm date for the EU referendum. The first ministers in Scotland, Wales and Northern Ireland asked him not to hold the EU referendum in June, saying that it will be too soon after elections in their countries.

-

10:13

NAB business confidence index for Australia rises to 4 in the fourth quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index rose to 4 in the fourth quarter from 1 in the third quarter. The third quarter's figure was revised up from 0.

Business outlook remained positive, while global uncertainties are the greatest risk.

"The Survey is confirming yet again that despite the issues facing the mining sector, Australia continues to enjoy a relatively healthy, vibrant and adaptive economy", NAB Group Chief Economist Alan Oster said.

He added that risks to the outlook increased due to global market volatilities.

-

09:31

United Kingdom: Halifax house price index, January 1.7% (forecast 0.3%)

-

09:31

United Kingdom: Halifax house price index 3m Y/Y, January 9.7%

-

08:34

Options levels on thursday, February 4, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1190 (2989)

$1.1161 (2993)

$1.1122 (6274)

Price at time of writing this review: $1.1074

Support levels (open interest**, contracts):

$1.1015 (2603)

$1.0981 (1634)

$1.0941 (2344)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 47710 contracts, with the maximum number of contracts with strike price $1,1000 (6274);

- Overall open interest on the PUT options with the expiration date February, 5 is 77656 contracts, with the maximum number of contracts with strike price $1,0800 (10165);

- The ratio of PUT/CALL was 1.63 versus 1.59 from the previous trading day according to data from February, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.4801 (1268)

$1.4703 (2565)

$1.4607 (2230)

Price at time of writing this review: $1.4573

Support levels (open interest**, contracts):

$1.4497 (966)

$1.4399 (1574)

$1.4299 (1031)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 27081 contracts, with the maximum number of contracts with strike price $1,4650 (2966);

- Overall open interest on the PUT options with the expiration date February, 5 is 25306 contracts, with the maximum number of contracts with strike price $1,4550 (2187);

- The ratio of PUT/CALL was 0.93 versus 0.92 from the previous trading day according to data from February, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:43

Foreign exchange market. Asian session: the pound slid after rallying yesterday

The pound gave up some of its yesterday's gains ahead of Bank of England meeting scheduled for today. The central bank will announce its interest rate decision, publish minutes and inflation letter. The BOE is expected to keep its benchmark rate unchanged at 0.5%. Quarterly inflation and economic growth forecasts will show whether policymakers still intend to raise rates in 2016. The central bank may be more cautious considering slower growth in advanced economies, low commodity prices and weaker wage growth in the U.K.

Market participants are also waiting for data on U.S. labor market (nonfarm productivity, initial jobless claims). These reports may help forecast payrolls data due on Friday. A median forecast suggests that the U.S. economy generated 280,000 jobs in January.

EUR/USD: the pair fluctuated within $1.1075-15 in Asian trade

USD/JPY: the pair traded within Y117.65-25

GBP/USD: the pair fell to $1.4565

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 U.S. FOMC Member Rosengren Speaks

08:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Halifax house price index January 1.7% 0.3%

08:30 United Kingdom Halifax house price index 3m Y/Y January 9.5%

09:00 Eurozone ECB Economic Bulletin

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom BOE Inflation Letter

12:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims January 2268 2240

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 1.8% 3.9%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV 2.2% -1.8%

13:30 U.S. Initial Jobless Claims January 278 280

15:00 U.S. Factory Orders December -0.2% -2.8%

22:30 Australia AiG Performance of Construction Index January 46.8 46.8

-

01:02

Currencies. Daily history for Feb 3’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1103 +1,67%

GBP/USD $1,4601 +1,31%

USD/CHF Chf1,0037 -1,45%

USD/JPY Y117,88 -1,76%

EUR/JPY Y130,90 -0,06%

GBP/JPY Y172,15 -0,41%

AUD/USD $0,7167 +1,83%

NZD/USD $0,6664 +2,27%

USD/CAD C$1,3780 -1,98%

-

00:13

Schedule for today, Thursday, Feb 4’2016:

(time / country / index / period / previous value / forecast)

07:15 U.S. FOMC Member Rosengren Speaks

08:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Halifax house price index January 1.7% 0.3%

08:30 United Kingdom Halifax house price index 3m Y/Y January 9.5%

09:00 Eurozone ECB Economic Bulletin

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom BOE Inflation Letter

12:45 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims January 2268 2240

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 1.8% 3.9%

13:30 U.S. Nonfarm Productivity, q/q Quarter IV 2.2% -1.8%

13:30 U.S. Initial Jobless Claims January 278 280

15:00 U.S. Factory Orders December -0.2% -2.8%

22:30 Australia AiG Performance of Construction Index January 46.8 46.8

-