Noticias del mercado

-

22:05

U.S. stocks closed

U.S. stocks fluctuated, as commodities from copper to gold advanced amid a slide in the dollar that was fueled by speculation global growth may not be strong enough to warrant further central-bank tightening. Crude erased an advance to fall back below $32 a barrel.

The Standard & Poor's 500 Index swung between gains and losses after rising 0.8 percent. Disappointing results at retailers dragged consumer shares lower. Crude slid, while the Bloomberg Dollar Spot Index headed for its biggest two-day loss since 2009. Emerging-market equities rallied almost 3 percent. The pound fell after Ian McCafferty, the Bank of England's only policy dissenter over the past six months, dropped his call for higher interest rates.

The dollar's retreat was sparked by data showing the U.S. services sector grew at the slowest pace in nearly two years, underscoring the vulnerability of the American economy to unsteadiness abroad. The report tipped the fixed-income market's balance closer toward zero rate hikes by the Federal Reserve this year, amid prospects central banks from Asia to Europe will act to quell the turmoil that's roiled markets in 2016. The greenback's drop helped prop up the price of gold and industrial metals.

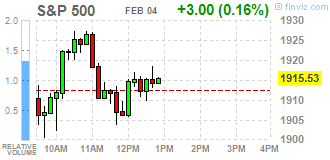

The S&P 500 was little changed at 1,914.32 at 3:52 p.m. in New York. The gauge advanced yesterday for the first time this month, erasing a drop of more than 1 percent as oil's surge topped 7 percent. The benchmark equity gauge is down more than 6 percent so far in 2016.

Materials shares advanced 2.2 percent, as Freeport McMoRan Inc. surged with copper. Energy producers fell 0.2 percent after earlier gaining. Shares in consumer-discretionary stocks fell. Kohl's Corp. sank 19 percent after slow sales squeezed profits. Ralph Lauren Corp. plunged after the company cut its annual forecast.

Economic data did little to alter perceptions on the strength of the world's largest economy. Initial jobless claims last week rose more than expected, Labor Department data showed, while factory orders declined at a faster pace in December than the previous month.

-

21:01

DJIA 16377.27 40.61 0.25%, NASDAQ 4494.59 -9.65 -0.21%, S&P 500 1911.24 -1.29 -0.07%

-

18:58

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes are little changed on Thursday as equities tracked oil prices. Oil pared earlier gains but remained steady after jumping 7% on Wednesday as the dollar weakened after weak U.S. data and comments from a Fed policymaker signaled that further rate hikes could be delayed. Wall Street opened lower after data showed that weekly jobless claims rose more than expected and nonfarm productivity fell in the fourth quarter at its fastest pace in more than a year. New orders for U.S. factory goods also fell in December by the most in a year. Chances of future interest rate increases this year are steadily fading.

Dow stocks mixed (16 in positive area, 14 in negative). Top looser - NIKE, Inc. (NKE, -3,02%). Top gainer - Caterpillar Inc. (CAT, +3,65%).

Most of S&P sectors in negative area. Top looser - Healthcare (-0,9%). Top gainer - Conglomerates (+2,3%).

At the moment:

Dow 16342.00 +79.00 +0.49%

S&P 500 1912.75 +4.25 +0.22%

Nasdaq 100 4166.25 -5.25 -0.13%

Oil 32.36 +0.08 +0.25%

Gold 1155.00 +13.70 +1.20%

U.S. 10yr 1.87 -0.01

-

18:14

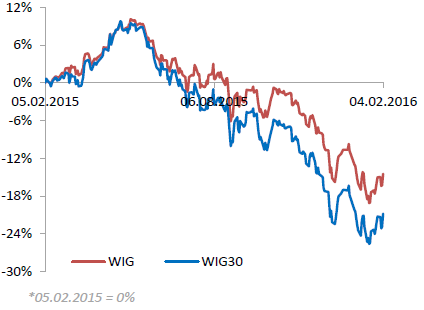

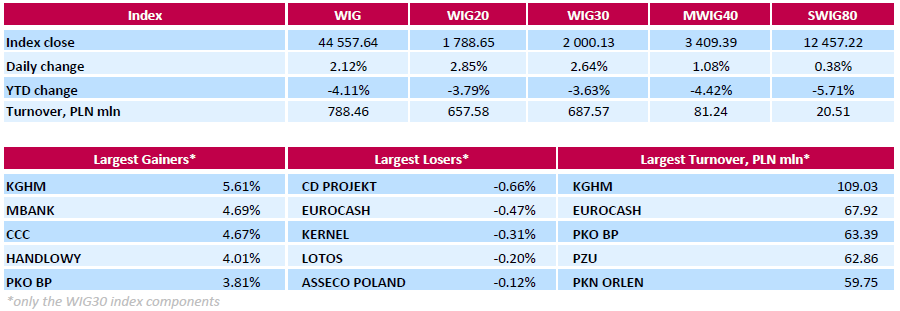

WSE: Session Results

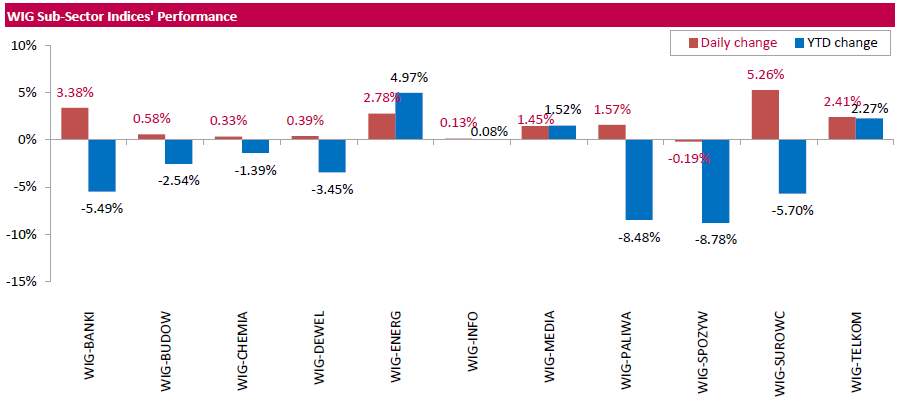

Polish equity market surged on Thursday. The broad market measure, the WIG index, rose by 2.12%. Food sector (-0.19%) was sole decliner within the WIG Index, while materials (+5.26%) outpaced.

The large-cap stocks' measure, the WIG30 Index, gained 2.64%. Only five index constituents generated losses: videogame developer CD PROJEKT (WSE: CDR), FMCG wholesaler EUROCASH (WSE: EUR), agricultural producer KERNEL (WSE: KER), oil refiner LOTOS (WSE: LTS) and IT-company ASSECO POLAND (WSE: ACP) slipped by 0.12%-0.66%. On the plus side, copper producer KGHM (WSE: KGH) led the gainers with a 5.61% jump, benefiting from copper price rebound. It was followed by bank MBANK (WSE: MBK), which advanced 4.69% after the company reported better-than-expected Q4 FY2015 net profit (it reported a net profit of PLN 309.5 mln, while analysts expected PLN 283 mln). Other noticeable risers were footwear retailer CCC (WSE: CCC) and banks HANDLOWY (WSE: BHW), PKO BP (WSE: PKO), ALIOR (WSE: ALR) and PEKAO (WSE: PEO), adding 3.49%-4.67%.

-

18:12

Dallas Fed President Robert Kaplan: the Fed should be patient on further interest rate hikes

Dallas Fed President Robert Kaplan said on Thursday that the Fed should be patient on further interest rate hikes as financial conditions tightened.

"Financial conditions have tightened, and we know that non-U.S. growth is weakening, and I have got to take that into account as a policymaker," he said.

Kaplan is not a voting member on the Federal Open Market Committee (FOMC) this year.

-

18:05

European stocks close: stocks closed mixed as oil prices remained volatile

Stock indices closed mixed as oil prices remained volatile.

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

"Europe's moderate growth is facing increasing headwinds, from slower growth in emerging markets such as China, to weak global trade and geopolitical tensions in Europe's neighbourhood," EU Commission Vice President Valdis Dombrovskis said.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

The European Central Bank (ECB) President Mario Draghi said in a speech on Thursday that it is better to act earlier than too late as the risks are too high.

"Adopting a wait-and-see attitude and extending the policy horizon brings with it risks: namely a lasting de-anchoring of expectations leading to persistently weaker inflation. And if that were to happen, we would need a much more accommodative monetary policy to reverse it. Seen from that perspective, the risks of acting too late outweigh the risks of acting too early," he said.

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

The BoE released its quarterly inflation report on Thursday. The central bank downgraded its growth forecasts. The economy is expected to expand 2.2% in 2016, down from its previous forecast of a 2.5% rise, and 2.3% in 2017, down from its previous forecast of a 2.6% gain.

"The MPC judges the risks to the central projection to be skewed a little to the downside in the near term, reflecting the possibility of greater persistence of low inflation," the central bank said.

The BoE said that inflation in the U.K. will remain below 1% through 2016. The BoE noted that inflation is expected to rise modestly in the coming months.

The Bank of England (BoE) Governor Mark Carney said at a press conference on Thursday that an interest rate hike is more likely than interest rate cut. He noted that he expects wages to grow solidly this year, and the 2% inflation target will be reached in around two years.

The BoE governor pointed out that the central bank did not discuss negative interest rates.

Carney said that there are downside risks from the slowdown in the global economy.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,898.76 +61.62 +1.06 %

DAX 9,393.36 -41.46 -0.44 %

CAC 40 4,228.53 +1.57 +0.04%

-

18:00

European stocks closed: FTSE 5898.76 61.62 1.06%, DAX 9393.36 -41.46 -0.44%, CAC 40 4228.53 1.57 0.04%

-

17:42

European Central Bank Executive Board member Yves Mersch: productivity in the Eurozone was driven by job cuts

European Central Bank (ECB) Executive Board member Yves Mersch said in a speech on Thursday that productivity in the Eurozone was driven by job cuts.

"Much of the (meagre) productivity growth seen in the euro area has come through labour shedding rather than from strong value added growth. And if those displaced don't have the right skills to find another job, structural unemployment is likely to increase further, or they will be forced to consider low productivity sectors, and then aggregate productivity growth will stagnate once more," he said.

Mersch pointed out that there are further possibilities of monetary policy easing, adding that the central bank's toolbox is not exhausted.

-

16:53

Bank of England Governor Mark Carney: an interest rate hike is more likely than interest rate cut

The Bank of England (BoE) Governor Mark Carney said at a press conference on Thursday that an interest rate hike is more likely than interest rate cut. He noted that he expects wages to grow solidly this year, and the 2% inflation target will be reached in around two years.

The BoE governor pointed out that the central bank did not discuss negative interest rates.

Carney said that there are downside risks from the slowdown in the global economy.

-

16:38

State Secretariat for Economic Affairs’ consumer confidence index data for Switzerland rises to -14 in January

The State Secretariat for Economic Affairs released its consumer confidence index data for Switzerland on Thursday. The index rose to -14 in January from -18 in October.

"Although confidence in the future trend on the labour market increased slightly, the level is still relatively low. Expectations over price trends have again been revised downwards," the State Secretariat for Economic Affairs said in a statement.

The household expectations sub-index remained unchanged at -16 in January, while the expected unemployment sub-index was down to 68 from 74.

-

16:28

Real wages in Germany climb by 2.5% in 2015

Destatis released its real wages growth data for Germany on Thursday. Real wages in Germany rose by 2.5% in 2015, after a 1.7% growth in 2014. It was the biggest increase since the series began in 2008.

Nominal earnings climbed 2.8% in 2015. In the same period, German consumer price index increased 0.3%.

-

16:23

U.S. factory orders decline 2.9% in December

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. dropped 2.9% in December, missing expectations for a 2.8% fall, after a 0.7% decline in November. It was the largest decline since December 2014.

November's figure was revised down from a 0.2% decrease.

A strong dollar and a weak demand abroad weighed on factory orders.

Durable goods orders were slid 5.0% in December.

Orders for transportation equipment plunged 12.6%, while orders for automobiles and parts climbed 1.4%.

Factory orders excluding transportation declined 0.8% in December, after a 0.7% drop in November. November's figure was revised down from a 0.3% fall.

-

15:59

Germany's construction PMI increases to 55.5 in January

Markit Economics released construction purchasing managers' index (PMI) for Germany on Thursday. Germany's construction purchasing managers' index (PMI) increased to 55.5 in January from 57.9 in December.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"Germany's construction sector roars back to health at the beginning of the year, with the headline Construction PMI reaching its highest level in nearly five years. House building remained a particularly bright spot in the data, rising at the steepest rate in nine years," an economist at Markit, Oliver Kolodseike, said.

-

15:54

Bank of England’s quarterly inflation report: the central bank downgrades its growth forecasts

The Bank of England (BoE) released its quarterly inflation report on Thursday. The central bank downgraded its growth forecasts. The economy is expected to expand 2.2% in 2016, down from its previous forecast of a 2.5% rise, and 2.3% in 2017, down from its previous forecast of a 2.6% gain.

"The MPC judges the risks to the central projection to be skewed a little to the downside in the near term, reflecting the possibility of greater persistence of low inflation," the central bank said.

The BoE said that inflation in the U.K. will remain below 1% through 2016. The BoE noted that inflation is expected to rise modestly in the coming months.

-

15:47

Germany's retail PMI falls to 49.5 in January

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Thursday. Germany's retail purchasing managers' index (PMI) declined to 49.5 in January from 50.5 in December.

The decline was driven by a fall in buying activity and stock holdings.

"It's a disappointing start to the year for German retailers, as unfavourable weather conditions acted as a drag on sales. Moreover, the headline index has now failed to signal any meaningful growth for three months, with the latest reading the lowest in nearly one-and-a-half year," an economist at Markit, Oliver Kolodseike, said.

-

15:35

U.S. Stocks open: Dow +0.10%, Nasdaq -0.21%, S&P -0.04%

-

15:06

Productivity in the U.S. non-farm businesses slides at a 3.0% annual rate in the fourth quarter

The U.S. Labor Department released non-farm productivity figures on Thursday. Preliminary productivity in the U.S. non-farm businesses slid at a 3.0% annual rate in the fourth quarter, missing expectations for a 1.8% decrease, after a 2.1% increase in the third quarter. It was the biggest drop since the first quarter of 2014.

The third quarter's figure was revised down from a 2.2% gain.

The drop was driven by a rise in labour-related production costs.

Hours worked jumped by 3.3% in the fourth quarter, while output rose by 0.1%.

In 2015 as whole, productivity rose 0.6%, the weakest rise since 2013, after a 0.7% increase in 2014.

Preliminary unit labour costs increased 4.5% in the fourth quarter, exceeding expectations for a 3.9% rise, after a 1.9 gain in the third quarter. The third quarter's figure was revised up from a 1.8% increase.

In 2015 as whole, labour costs climbed 2.4, the largest increase since 2007, after a 2.0% gain.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

10.98

2.33%

30.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

4.94

1.86%

188.6K

Yahoo! Inc., NASDAQ

YHOO

27.95

0.98%

48.5K

Yandex N.V., NASDAQ

YNDX

13.35

0.91%

26.5K

International Business Machines Co...

IBM

124.98

0.21%

0.4K

McDonald's Corp

MCD

121.66

0.16%

1.6K

Caterpillar Inc

CAT

63.33

0.09%

0.1K

United Technologies Corp

UTX

86

0.05%

0.5K

Goldman Sachs

GS

152.68

0.00%

0.5K

ALCOA INC.

AA

7.54

-0.13%

17.6K

HONEYWELL INTERNATIONAL INC.

HON

101.98

-0.18%

0.4K

AT&T Inc

T

36.65

-0.19%

3.4K

Johnson & Johnson

JNJ

103.9

-0.23%

0.2K

Starbucks Corporation, NASDAQ

SBUX

59.35

-0.30%

0.4K

The Coca-Cola Co

KO

42.56

-0.37%

197.8K

Wal-Mart Stores Inc

WMT

66

-0.41%

1.7K

Verizon Communications Inc

VZ

50.4

-0.43%

1.1K

Pfizer Inc

PFE

29.53

-0.47%

5.6K

Walt Disney Co

DIS

94.65

-0.52%

1.9K

Visa

V

73.98

-0.54%

0.6K

General Motors Company, NYSE

GM

28.76

-0.55%

3.7K

Cisco Systems Inc

CSCO

22.97

-0.56%

3.4K

Home Depot Inc

HD

123.1

-0.56%

1.0K

General Electric Co

GE

28.5

-0.59%

1.1K

Intel Corp

INTC

29.16

-0.61%

0.4K

Apple Inc.

AAPL

95.11

-0.75%

82.9K

Nike

NKE

62.01

-0.77%

0.4K

Microsoft Corp

MSFT

51.75

-0.79%

2.5K

Exxon Mobil Corp

XOM

77.8

-0.87%

26.0K

Ford Motor Co.

F

11.36

-0.87%

24.3K

Google Inc.

GOOG

720.55

-0.88%

3.3K

Amazon.com Inc., NASDAQ

AMZN

526

-0.95%

15.7K

American Express Co

AXP

53.56

-1.02%

104.2K

Twitter, Inc., NYSE

TWTR

16.36

-1.21%

16.8K

Chevron Corp

CVX

83.59

-1.22%

10.3K

Citigroup Inc., NYSE

C

39.84

-1.29%

35.5K

ALTRIA GROUP INC.

MO

59.07

-1.29%

1.0K

JPMorgan Chase and Co

JPM

56.62

-1.38%

4.0K

Facebook, Inc.

FB

111.07

-1.44%

250.9K

Boeing Co

BA

120.08

-1.47%

2.5K

Tesla Motors, Inc., NASDAQ

TSLA

168.66

-2.78%

4.4K

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Yahoo! (YHOO) upgraded to Buy from Neutral at Citigroup

Downgrades:

Other:

Verizon (VZ) initiated with a Neutral at DA Davidson; target $53

AT&T (T) initiated with a Buy at DA Davidson; target $41

General Motors (GM) target lowered to $30 from $35 at RBC Capital Mkts

-

14:44

Initial jobless claims rise to 285,000 in the week ending January 30

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 30 in the U.S. rose by 8,000 to 285,000 from 277,000 in the previous week. The previous week's figure was revised down from 278,000.

Analysts had expected jobless claims to increase to 280,000.

Jobless claims remained below 300,000 the 48th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 18,000 to 2,255,000 in the week ended January 23.

-

14:29

Bank of England's Monetary Policy Committee February minutes: all members vote to keep the central bank's monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

The consumer price inflation in the U.K. was 0.2% in December, below the central bank's 2% target. The BoE noted that inflation is expected to rise modestly in the coming months.

The BoE noted that the domestic private sector remained resilient, while consumer confidence was robust.

The central bank said that there are downside risks to the global growth and to the central bank's forecasts from the slowdown in emerging economies.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles".

-

14:15

Bank of England keeps its interest rate on hold at 0.5% in February

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

12:00

European stock markets mid session: stocks traded higher as commodity shares benefited from a weaker U.S. dollar

Stock indices traded higher as commodity shares benefited from a weaker U.S. dollar. The greenback remained under pressure after yesterday's comments by New York Fed President William Dudley. He said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

"Europe's moderate growth is facing increasing headwinds, from slower growth in emerging markets such as China, to weak global trade and geopolitical tensions in Europe's neighbourhood," EU Commission Vice President Valdis Dombrovskis said.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

The Bank of England will release its interest rate decision at 12:00 GMT. Analysts expect the central bank to keep its monetary policy unchanged.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in January, exceeding expectations for a 0.3% gain, after a 2.0% gain in December. December's figure was revised up from a 1.7% increase.

On a yearly basis, house prices climbed 9.7% in the three months to January, after a 9.5% increase in the three months to December.

"The imbalance between supply and demand continues to exert significant upward pressure on house prices. This situation looks set to persist over the coming months," Halifax's housing economist Martin Ellis said.

Current figures:

Name Price Change Change %

FTSE 100 5,914.74 +77.60 +1.33 %

DAX 9,471.95 +37.13 +0.39 %

CAC 40 4,237.07 +10.11 +0.24 %

-

11:51

Eurozone's retail PMI rises to 49.0 in January

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Thursday. Eurozone's construction purchasing managers' index (PMI) rise to 49.0 in January from 58.9 in December.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in Germany, France and Italy remained below 50.

"Sales were higher in January than the situation one year ago, although on a monthly basis they have slipped steadily since November. This loss of momentum is largely reflective of a slowdown in Germany, where sales have now fallen twice in the past three months, albeit marginally," an economist at Markit, Phil Smith, said.

-

11:46

Halifax: House prices in the U.K. jump 1.7% in January

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. jumped 1.7% in January, exceeding expectations for a 0.3% gain, after a 2.0% gain in December. December's figure was revised up from a 1.7% increase.

On a yearly basis, house prices climbed 9.7% in the three months to January, after a 9.5% increase in the three months to December.

"The imbalance between supply and demand continues to exert significant upward pressure on house prices. This situation looks set to persist over the coming months," Halifax's housing economist Martin Ellis said.

-

11:41

European Commission downgrades its growth and inflation forecasts for the Eurozone

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

"Europe's moderate growth is facing increasing headwinds, from slower growth in emerging markets such as China, to weak global trade and geopolitical tensions in Europe's neighbourhood," EU Commission Vice President Valdis Dombrovskis said.

German economic growth for 2016 and 2017 was lowered to 1.8% from the previous estimate of 1.9%.

The European Commission upgraded the Greek GDP forecast for 2016 to -0.8% from the previous estimate of -1.3%. Greece's economy is expected to expand 2.7% in 2017.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

-

11:21

European Central Bank President Mario Draghi: it is better to act earlier than too late as the risks are too high

The European Central Bank (ECB) President Mario Draghi said in a speech on Thursday that it is better to act earlier than too late as the risks are too high.

"Adopting a wait-and-see attitude and extending the policy horizon brings with it risks: namely a lasting de-anchoring of expectations leading to persistently weaker inflation. And if that were to happen, we would need a much more accommodative monetary policy to reverse it. Seen from that perspective, the risks of acting too late outweigh the risks of acting too early," he said.

Draghi noted that the central bank's inflation target might be reached slower than previously estimated.

The ECB president pointed out that the central bank will add further stimulus measures if needed.

"There can be no doubt that if we needed to adopt a more expansionary policy, the risk of side effects would not stand in our way. We always aim to limit the distortions caused by our policy, but what comes first is the price stability objective," he said.

-

10:50

Standard and Poor's downgrades its forecasts for the Fed’s interest rate hikes in 2016

Rating agency Standard and Poor's (S&P) on Tuesday downgraded its forecasts for the Fed's interest rate hikes in 2016 due to low inflation and global market uncertainty. The agency said that the Fed will raise its interest rate twice this year, down from the previous forecast of four times.

-

10:35

New York Fed President William Dudley: a stronger U.S. dollar could have "significant consequences" for the U.S. economy

New York Fed President William Dudley said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

Dudley is a voting member on the Federal Open Market Committee (FOMC).

-

10:23

Britain’s Prime Minister David Cameron: there is no firm date for the EU referendum

Britain's Prime Minister David Cameron said on Wednesday that there was no firm date for the EU referendum. The first ministers in Scotland, Wales and Northern Ireland asked him not to hold the EU referendum in June, saying that it will be too soon after elections in their countries.

-

10:13

NAB business confidence index for Australia rises to 4 in the fourth quarter

The National Australia Bank (NAB) released its Quarterly Business Confidence Survey on Thursday. The NAB business confidence index rose to 4 in the fourth quarter from 1 in the third quarter. The third quarter's figure was revised up from 0.

Business outlook remained positive, while global uncertainties are the greatest risk.

"The Survey is confirming yet again that despite the issues facing the mining sector, Australia continues to enjoy a relatively healthy, vibrant and adaptive economy", NAB Group Chief Economist Alan Oster said.

He added that risks to the outlook increased due to global market volatilities.

-

06:56

Global Stocks: U.S. stock indices traded mixed

U.S. stock indices ended highly volatile Wednesday session mixed. An increase in crude prices drove oil-related stocks higher. The Dow industrials rose reversing an early loss of 120 points.

The Dow Jones Industrial Average gained 183.19 points, or 1.1%, to 16,336.66. The S&P 500 rose 9.5 points, or 0.5%, to 1,912.53 (its energy sector's 4% gain was the strongest). The Nasdaq Composite lost 12.71 points, or 0.3%, to 4,504.24.

Business activity in the U.S. services sector weakened in January, the Institute for Supply Management reported. The corresponding index declined to 53.5 from 55.8 in the previous month. Economists had expected the index to have declined only to 55.1.

Meanwhile Markit Economics released the final reading of January U.S. Services PMI on Wednesday. The final Services PMI declined to 53.2 from 54.3 in December compared to the preliminary reading of 53.7. This was the lowest level since the end of 2013.

This morning in Asia Hong Kong Hang Seng rose 1.38%, or 261.87, to 19,253.46. China Shanghai Composite Index rose 1.46%, or 39.94, to 2,779.19. The Nikkei declined 0.70%, or 119.94, to 17,071.31.

Asian stock indices outside Japan rose. However activity on Chinese stock markets is gradually decreasing ahead of the Lunar New Year holiday. Japanese stocks were weighed by a stronger yen, which is unfavorable for the country's exporters.

-

03:08

Nikkei 225 17,136.13 -55.12 -0.32 %, Hang Seng 19,321.2 +329.61 +1.74 %, Shanghai Composite 2,762.91 +23.67 +0.86 %

-

01:02

Stocks. Daily history for Sep Feb 3’2016:

(index / closing price / change items /% change)

Nikkei 225 17,191.25 -559.43 -3.15 %

Hang Seng 18,991.59 -455.25 -2.34 %

Shanghai Composite 2,739.25 -10.32 -0.38 %

FTSE 100 5,837.14 -84.87 -1.43 %

CAC 40 4,226.96 -57.03 -1.33 %

Xetra DAX 9,434.82 -146.22 -1.53 %

S&P 500 1,912.53 +9.50 +0.50 %

NASDAQ Composite 4,504.24 -12.71 -0.28 %

Dow Jones 16,336.66 +183.12 +1.13 %

-