Noticias del mercado

-

17:56

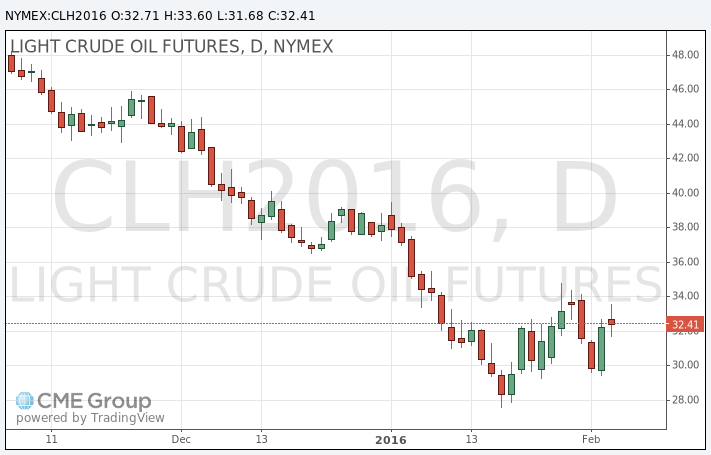

WTI crude declines again

WTI crude fell after a rise earlier. Earlier in the day, oil prices increased on a weaker U.S. dollar.

Venezuelan Oil Minister Eulogio del Pino said on Thursday that non-OPEC members Russia and Oman OPEC members Iraq, Iran, Algeria, Nigeria, Ecuador and Venezuela are ready to take part in a meeting to discuss the stabilisation of the oil market, if such meeting will take place.

News that Turkey was preparing for a military invasion of Syria also supported oil prices. The Russian Defense Ministry said on Thursday that there are "reasonable grounds" Turkey was preparing for invasion.

WTI crude oil for March delivery fell to $31.68 a barrel on the New York Mercantile Exchange.

Brent crude oil for April climbed to $35.54 a barrel on ICE Futures Europe.

-

17:27

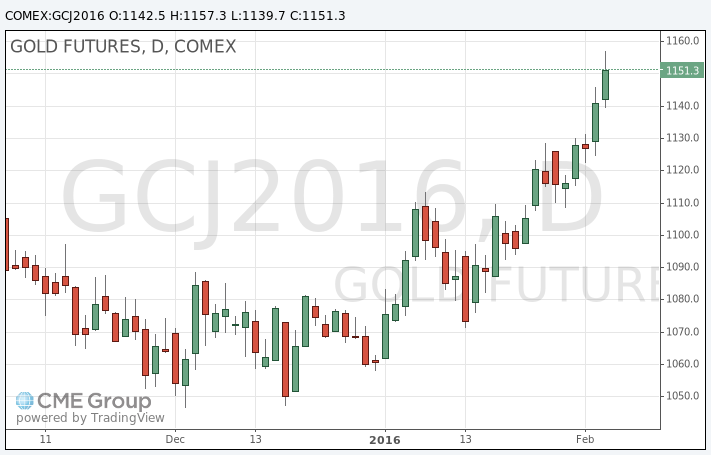

Gold rise climbs on speculation that the Fed will delay its further interest rate hikes

Gold price climbed on speculation that the Fed will delay its further interest rate hikes. New York Fed President William Dudley said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

Market participants eyed the U.S. initial jobless claims data. According to the U.S. Labor Department on Thursday, the number of initial jobless claims in the week ending January 30 in the U.S. rose by 8,000 to 285,000 from 277,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected jobless claims to increase to 280,000.

Official labour market data will be released tomorrow. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in January. The U.S. economy is expected to add 190,000 jobs in January, after adding 292,000 jobs in December.

April futures for gold on the COMEX today decreased to 1157.30 dollars per ounce.

-

14:44

Initial jobless claims rise to 285,000 in the week ending January 30

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending January 30 in the U.S. rose by 8,000 to 285,000 from 277,000 in the previous week. The previous week's figure was revised down from 278,000.

Analysts had expected jobless claims to increase to 280,000.

Jobless claims remained below 300,000 the 48th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 18,000 to 2,255,000 in the week ended January 23.

-

07:22

Oil prices rose

West Texas Intermediate futures for March delivery is currently at $32.58 (+0.93%), while Brent crude is at $35.31 (+0.77%) amid a weaker dollar and fresh speculation of a meeting between producers.

The Energy Information Administration reported on Wednesday that U.S. crude oil inventories rose by 7.8 million barrels to 502.7 million barrels in the week ending January 29 marking the highest level since 1982 when inventories statistics began. Other sources suggest that crude oil inventories rose beyond 500 million barrels in 1930. This information led to a decline in crude oil prices, however they jumped later amid a weaker dollar.

Ecuador officials said there might be a special OPEC meeting later in January. However experts say that such comments normally come from poor OPEC members and any meeting of that kind is unlikely for as long as powerful members remain silent.

-

07:06

Gold steadied after a rally

Gold is currently at $1,142.60 (+0.11%) holding on to a three-month high after rising overnight as global economic uncertainties are likely to persuade the Federal Reserve to postpone a rate hike. Prospects of slower rates growth are positive for the non-interest-paying precious metal.

Analysts from BMI Research suggest gold will fluctuate in a $1,000-$1,200 range this year amid weaker outlook for Fed rates. This forecast is more bullish than earlier expectations of a decline below $1,000 per ounce.

-

01:05

Commodities. Daily history for Feb 3’2016:

(raw materials / closing price /% change)

Oil 32.75 +1.46%

Gold 1,143.00 +0.15%

-