Noticias del mercado

-

17:49

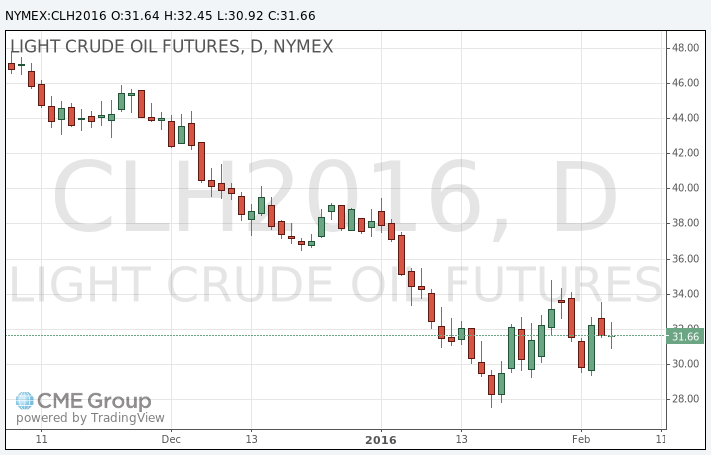

Oil prices remain volatile

Oil prices were volatile as concerns over the global oil oversupply continued to weigh. Saudi Arabia on Thursday lowered its crude prices for customers in Asia. Saudi Arabian Oil Co. (Saudi Aramco), the country's state-owned oil company, said that it cut its Arab Light crude by $0.20 a barrel to $1 a barrel. Saudi Aramco lowered the premium for Arab Extra Light crude by $0.40 a barrel to $1.30 a barrel. This action could add to the escalation of the situation in the Middle East as Iran plans to raise its oil exports.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 12 rigs to 498 last week. It was the lowest level since March 2010.

WTI crude oil for March delivery traded in the range $30.92 - $32.45 a barrel on the New York Mercantile Exchange.

Brent crude oil for April fell to $34.35 a barrel on ICE Futures Europe.

-

17:29

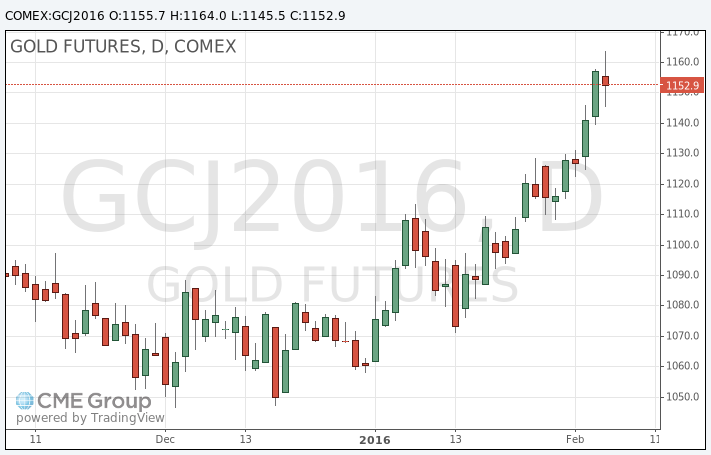

Gold rise declines on a stronger U.S. dollar after the release of the U.S. labour market data

Gold price fell on a stronger U.S. dollar after the release of the U.S. labour market data. According to the U.S. Labor Department on Friday, the U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December. December's figure was revised down from a rise of 292,000 jobs.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The increase was partly driven by a rise in the private sector. The private sector added 158,000 jobs in January.

The manufacturing sector added 29,000 jobs in January, construction added 18,000, while mining sector shed 7,000 jobs.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

The labour-force participation rate increased to 62.7% in January from 62.6% in December.

April futures for gold on the COMEX today decreased to 1145.50 dollars per ounce.

-

15:08

U.S. unemployment rate declined to 4.9% in January, 151,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December. December's figure was revised down from a rise of 292,000 jobs.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The increase was partly driven by a rise in the private sector. The private sector added 158,000 jobs in January.

The manufacturing sector added 29,000 jobs in January, construction added 18,000, while mining sector shed 7,000 jobs.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

The labour-force participation rate increased to 62.7% in January from 62.6% in December.

-

11:03

Saudi Arabia cuts its crude prices for customers in Asia

Saudi Arabia on Thursday lowered its crude prices for customers in Asia. Saudi Arabian Oil Co. (Saudi Aramco), the country's state-owned oil company, said that it cut its Arab Light crude by $0.20 a barrel to $1 a barrel. Saudi Aramco lowered the premium for Arab Extra Light crude by $0.40 a barrel to $1.30 a barrel.

This action could add to the escalation of the situation in the Middle East as Iran plans to raise its oil exports.

-

10:48

U.S. President Obama proposes a $10-a-barrel oil tax

U.S. President Obama on Thursday proposed a $10-a-barrel oil tax. This tax should be used for "clean transportation" projects.

-

07:33

Oil prices little changed

West Texas Intermediate futures for March delivery is currently at $31.75 (+0.09%), while Brent crude is at $34.36 (-0.29%) amid Friday's thin trading as many market participants in Asia prepared for the Lunar New Year.

A weaker dollar supports oil prices, however most fundamentals remain bearish: large crude oil stocks in the biggest consumer the U.S., slowing economic growth in the second-biggest consumer China and excessive supplies from producers amid lack of desire to cooperate.

-

07:14

Gold holds onto gains

Gold is currently at $1,154.90 (-0.22%) after reaching the highest level since October. Uncertainties over the global economy support this safe-haven asset. Today market participants are waiting for U.S. payrolls data. A weaker-than-expected report could send gold price higher as it would mean that the Federal Reserve will delay its next interest-rate hike.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose to 22.3 million ounces on Thursday, the highest level since October.

-

01:03

Commodities. Daily history for Feb 4’2016:

(raw materials / closing price /% change)

Oil 31.69 -0.09%

Gold 1,156.00 -0.13%

-