Noticias del mercado

-

21:00

DJIA 16157.37 -259.21 -1.58%, NASDAQ 4361.94 -147.62 -3.27%, S&P 500 1876.45 -39.00 -2.04%

-

21:00

U.S.: Consumer Credit , December 21.27 (forecast 16)

-

18:00

European stocks close: stocks closed lower on the U.S. labour market data

Stock indices closed lower on the U.S. labour market data. According to the U.S. Labor Department on Friday, the U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

European Central Bank (ECB) Governing Council member Bostjan Jazbec said in an interview with the Wall Street Journal Friday that the central bank is ready to add further stimulus in March if needed. But he pointed out that further stimulus measures will depend on the incoming economic data.

Meanwhile, the economic data from the Eurozone was mixed. Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders declined 0.7% in December, missing expectations for a 0.5% decrease, after a 1.5% rise in November.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 0.6% in December, while domestic orders dropped by 2.5%.

New orders from the Eurozone declined 6.9% in December, while orders from other countries climbed 5.5%.

Orders of the intermediate goods decreased by 2.0% in December, capital goods orders were down 0.5%, while consumer goods orders climbed 4.3%.

According to the French Customs, France's trade deficit narrowed to €3.94 billion in December from €4.53 billion in November, exceeding expectations for a decline to a deficit of €4.4 billion. November's figure was revised up from a deficit of €4.63 billion.

Exports declined 0.9% in December, while imports dropped 2.2%.

On a yearly basis, exports rose 1.8% in December, while imports gained 2.9%.

In 2015 as whole, the trade deficit fell to €45.7 billion from €58.3 billion in 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,848.06 -50.70 -0.86 %

DAX 9,286.23 -107.13 -1.14 %

CAC 40 4,200.67 -27.86 -0.66 %

-

18:00

European stocks closed: FTSE 5848.06 -50.70 -0.86%, DAX 9286.23 -107.13 -1.14%, CAC 40 4200.67 -27.86 -0.66%

-

17:52

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes sharply lower on Friday after data showing a surge in wages in January and an eight-year low unemployment rate kept the prospects of a Fed rate hike alive this year. Nonfarm payrolls increased by 151,000 jobs last month, below the 190,000 expected by economists polled by Reuters as the boost to hiring from unseasonably mild weather faded. Despite the expected slowdown in job growth, the unemployment rate fell to 4,9%, the lowest since February 2008, and average hourly earnings increased 0,5%, suggesting the labor market recovery remains firm.

Most of Dow stocks in negative area (24 of 30). Top looser - NIKE, Inc. (NKE, -4,62%). Top gainer - Verizon Communications Inc. (VZ, +0,99%).

All S&P sectors in negative area. Top looser - Technology (-3,0%).

At the moment:

Dow 16137.00 -191.00 -1.17%

S&P 500 1878.00 -29.75 -1.56%

Nasdaq 100 4042.50 -113.25 -2.73%

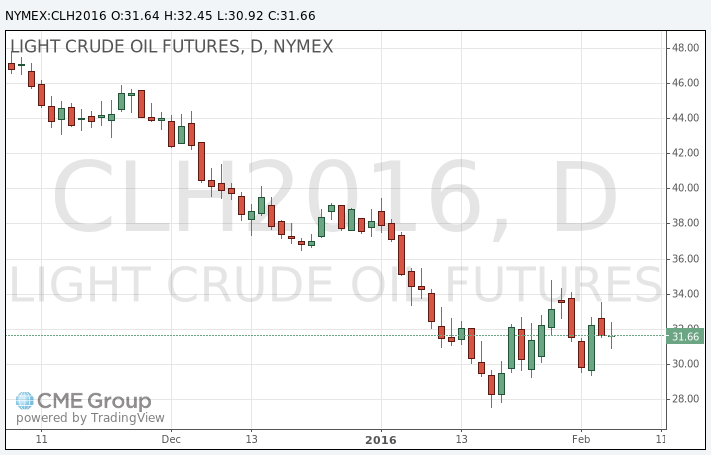

Oil 31.69 -0.03 -0.09%

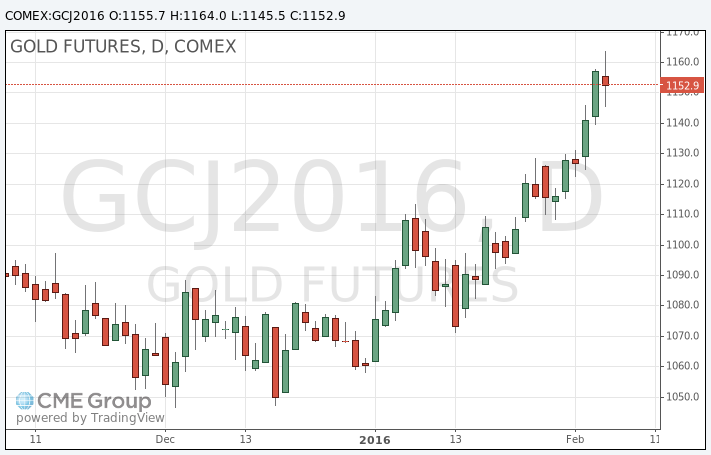

Gold 1155.70 -1.80 -0.16%

U.S. 10yr 1.88 +0.02

-

17:50

WSE: Session Results

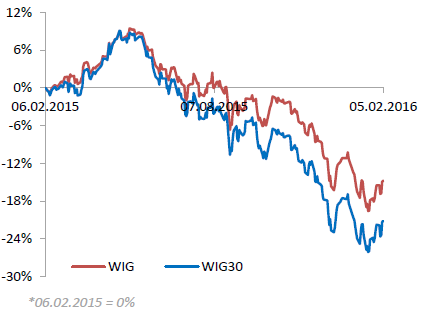

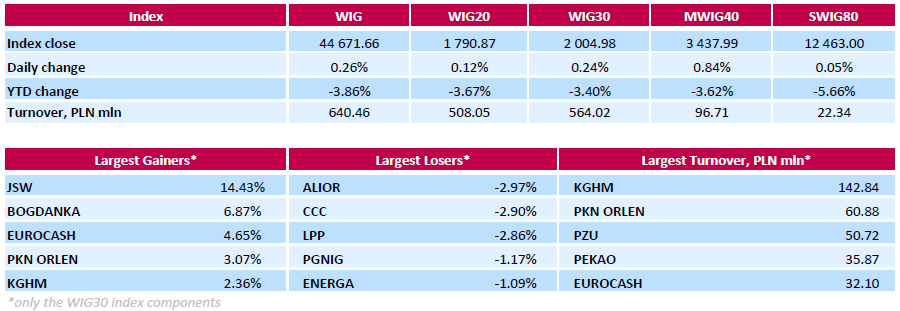

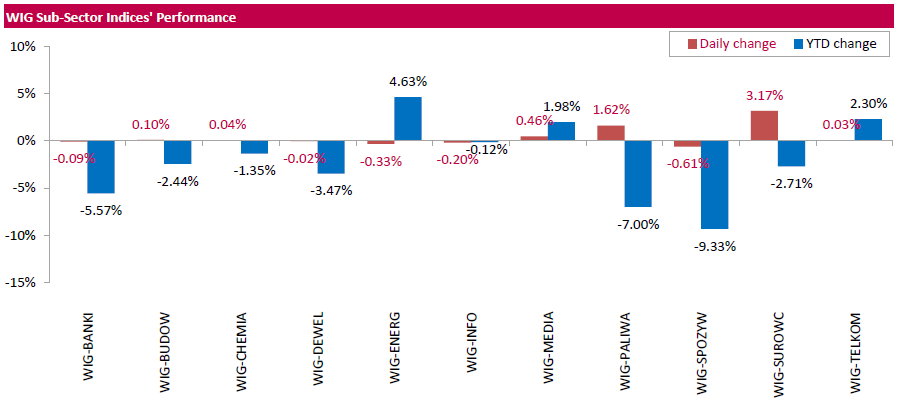

Polish equity market closed higher on Friday. The broad market measure, the WIG index, added 0.26%. Sector performance within the WIG Index was mixed. Materials sector (+3.17%) was the strongest group, while food sector (-0.61%) lagged behind.

The large-cap benchmark, the WIG30 Index, rose by 0.24%. Within the index components, coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB) led the gainers, skyrocketing by 14.43% and 6.87% respectively on news that China plans to cut overcapacity in the country's coal industry, which is suffering from declining demand and falling prices. As China's State Council stated, the coal production in the country will be cut by 500 mln tonnes (or 20%) in the next three to five years. Other major advancers were FMCG wholesaler EUROCASH (WSE: EUR), oil refiner PKN ORLEN (WSE: PKN) and copper producer KGHM (WSE: KGH), climbing 4.65%, 3.07% and 2.36% respectively. On the other side of the ledger, bank ALIOR (WSE: ALR) and retailers CCC (WSE: CCC) and LPP (WSE: LPP) were among the weakest performers, dropping by 2.97%, 2.9% and 2.86% respectively.

-

17:49

Oil prices remain volatile

Oil prices were volatile as concerns over the global oil oversupply continued to weigh. Saudi Arabia on Thursday lowered its crude prices for customers in Asia. Saudi Arabian Oil Co. (Saudi Aramco), the country's state-owned oil company, said that it cut its Arab Light crude by $0.20 a barrel to $1 a barrel. Saudi Aramco lowered the premium for Arab Extra Light crude by $0.40 a barrel to $1.30 a barrel. This action could add to the escalation of the situation in the Middle East as Iran plans to raise its oil exports.

Market participants are also awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported on last Friday that the number of active U.S. rigs declined by 12 rigs to 498 last week. It was the lowest level since March 2010.

WTI crude oil for March delivery traded in the range $30.92 - $32.45 a barrel on the New York Mercantile Exchange.

Brent crude oil for April fell to $34.35 a barrel on ICE Futures Europe.

-

17:29

Gold rise declines on a stronger U.S. dollar after the release of the U.S. labour market data

Gold price fell on a stronger U.S. dollar after the release of the U.S. labour market data. According to the U.S. Labor Department on Friday, the U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December. December's figure was revised down from a rise of 292,000 jobs.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The increase was partly driven by a rise in the private sector. The private sector added 158,000 jobs in January.

The manufacturing sector added 29,000 jobs in January, construction added 18,000, while mining sector shed 7,000 jobs.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

The labour-force participation rate increased to 62.7% in January from 62.6% in December.

April futures for gold on the COMEX today decreased to 1145.50 dollars per ounce.

-

16:44

European Central Bank Governing Council member Bostjan Jazbec: the central bank is ready to add further stimulus in March if needed

European Central Bank (ECB) Governing Council member Bostjan Jazbec said in an interview with the Wall Street Journal Friday that the central bank is ready to add further stimulus in March if needed. But he pointed out that further stimulus measures will depend on the incoming economic data.

-

16:36

Ai Group/HIA Australian Performance of Construction Index is down to 46.3 in January

The Australian Industry Group (AiG) released its construction data for Australia on late Thursday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 46.3 in January from 46.8 in December. Analysts had expected the index to remain unchanged at 46.8.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by weak activity in the commercial construction sector.

-

16:20

Canada’s Ivey purchasing managers’ index jumps to 66.0 in January

Canada's seasonally adjusted Ivey purchasing managers' index jumped to 66.0 in January from 49.9 in December. Analysts had expected the index to rise to 50.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 51.1 in January from 54.3 in December, while employment index fell to 55.1 from 59.7.

The prices index was increased to 71.6 in January from 61.9 in December, while inventories climbed to 61.5 from 50.8.

-

16:00

Canada: Ivey Purchasing Managers Index, January 66 (forecast 50)

-

15:33

U.S. Stocks open: Dow -0.12%, Nasdaq -0.52%, S&P -0.42%

-

15:27

Before the bell: S&P futures -0.26%, NASDAQ futures -0.28%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,819.59 -225.40 -1.32%

Hang Seng 19,288.17 +105.08 +0.55%

Shanghai Composite 2,763.95 -17.07 -0.61%

FTSE 5,901.15 +2.39 +0.04%

CAC 4,237.05 +8.52 +0.20%

DAX 9,388.1 -5.26 -0.06%

Crude oil $31.82 (+0.32%)

Gold $1155.40 (-0.18%)

-

15:14

U.S. trade deficit widens to $43.36 billion in December

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit widened to $43.36 billion in December from a deficit of $42.23 billion in November. November's figure was revised up from a deficit of $42.37 billion.

Analysts had expected a trade deficit of $43.0 billion.

The rise of a deficit was driven by a drop in exports. A stronger U.S. dollar and a weak demand abroad weighed on exports.

Exports fell by 0.3% in December, while imports increased by 0.3%.

In 2015 as whole, the trade deficit rose by 4.6% to $531.5 billion compared with the previous year. Exports dropped 4.8% in 2015, while imports declined 3.1%.

-

15:08

U.S. unemployment rate declined to 4.9% in January, 151,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December. December's figure was revised down from a rise of 292,000 jobs.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The increase was partly driven by a rise in the private sector. The private sector added 158,000 jobs in January.

The manufacturing sector added 29,000 jobs in January, construction added 18,000, while mining sector shed 7,000 jobs.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

The labour-force participation rate increased to 62.7% in January from 62.6% in December.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

11.25

0.63%

26.8K

The Coca-Cola Co

KO

42.57

0.09%

2.0K

International Paper Company

IP

35.1

0.09%

5.8K

Goldman Sachs

GS

156.5

0.01%

0.1K

AT&T Inc

T

36.53

0.00%

0.1K

Visa

V

73.68

0.00%

1.0K

Cisco Systems Inc

CSCO

23.54

0.00%

3.6K

Home Depot Inc

HD

121.11

0.00%

4.8K

International Business Machines Co...

IBM

127.65

0.00%

1.5K

McDonald's Corp

MCD

120.66

0.00%

0.5K

Microsoft Corp

MSFT

52

0.00%

1.8K

Procter & Gamble Co

PG

80.7

0.00%

2.2K

Verizon Communications Inc

VZ

50.43

0.00%

1.9K

Wal-Mart Stores Inc

WMT

66.42

0.00%

0.3K

Walt Disney Co

DIS

95.43

0.00%

9.0K

Google Inc.

GOOG

708.01

0.00%

31.0K

Hewlett-Packard Co.

HPQ

9.86

0.00%

5.1K

Yahoo! Inc., NASDAQ

YHOO

29.15

0.00%

9.1K

Citigroup Inc., NYSE

C

40.75

-0.10%

179.1K

Exxon Mobil Corp

XOM

79.72

-0.14%

5.3K

Chevron Corp

CVX

84.52

-0.32%

43.2K

Nike

NKE

59.95

-0.37%

1.6K

Apple Inc.

AAPL

96.22

-0.39%

33.7K

JPMorgan Chase and Co

JPM

58.15

-0.43%

6.2K

Pfizer Inc

PFE

28.87

-0.45%

0.1K

ALTRIA GROUP INC.

MO

59.17

-0.52%

2.9K

Starbucks Corporation, NASDAQ

SBUX

57.98

-0.53%

1k

General Electric Co

GE

29.02

-0.55%

0.7K

Boeing Co

BA

122.9

-0.57%

3.7K

Ford Motor Co.

F

11.46

-0.61%

75.1K

Caterpillar Inc

CAT

65.5

-0.70%

0.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.68

-0.70%

106.9K

General Motors Company, NYSE

GM

28.44

-0.70%

3.4K

American Express Co

AXP

53.98

-0.74%

2.0K

Intel Corp

INTC

29.55

-0.74%

81.0K

ALCOA INC.

AA

8.24

-0.84%

7.4K

Twitter, Inc., NYSE

TWTR

16.7

-1.24%

32.8K

Facebook, Inc.

FB

109.1

-1.26%

60.3K

Amazon.com Inc., NASDAQ

AMZN

529.21

-1.31%

0.6K

Johnson & Johnson

JNJ

102.5

-1.35%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

53.28

-1.37%

1.3K

Tesla Motors, Inc., NASDAQ

TSLA

171

-2.47%

1.4K

-

14:52

Canada's trade deficit narrows to C$0.59 billion in December

Statistics Canada released the trade data on Friday. Canada's trade deficit narrowed to C$0.59 billion in December from a deficit of C$1.59 billion in November. November's figure was revised up from a deficit of C$1.99 billion.

Analysts had expected a trade deficit of C$2.2 billion.

The decline in deficit was driven by a rise in exports. Exports climbed 3.9% in December.

Exports of aircraft and other transportation equipment and parts jumped by 26.4% in December, exports of consumer goods increased 6.4%, exports of metal ores and non-metallic minerals fell by 20.1%, while exports of metal and non-metallic mineral product were up 8.5%.

Imports rose 1.6% in December.

Imports of metal and non-metallic mineral products climbed by 5.4% in December, imports of electronic and electrical equipment and parts gained 2.3%, imports of consumer goods rose 2.0%, while imports of energy products increased 7.9%.

In 2015 as whole, the trade deficit was C$23.3 billion, down from a surplus of C$4.8 billion in 2014. Exports fell 0.9% in 2015, while imports rose 4.4%.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Buy from Neutral at UBS

JPMorgan Chase (JPM) upgraded to Buy from Neutral at UBS

Coca-Cola (KO) upgraded to Neutral at Susquehanna

Downgrades:

Other:

-

14:44

Option expiries for today's 10:00 ET NY cut

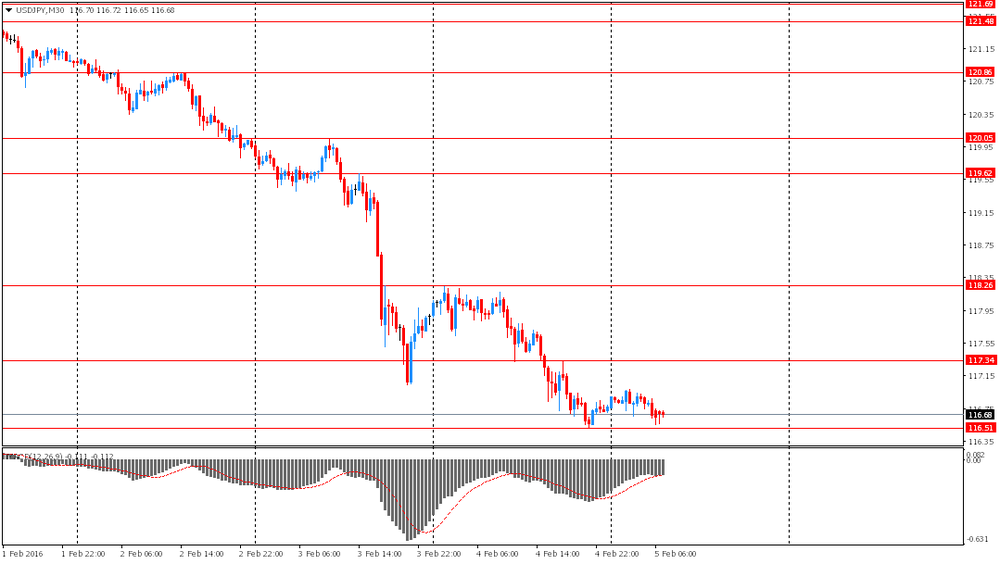

USDJPY: 115.00 (USD 776m) 115.50 (200m) 115.65-70 (380m) 117.00 (897m)117.20 (300m) 117.80-85 (790m) 118.00 (1.3bln)

EURUSD 1.0875 (EUR 1.8bln) 1.1000 (2.3bln) 1.1050 (462m) 1.1100 (852m) 1.1200 (2.3bln) 1.1300 (569m))

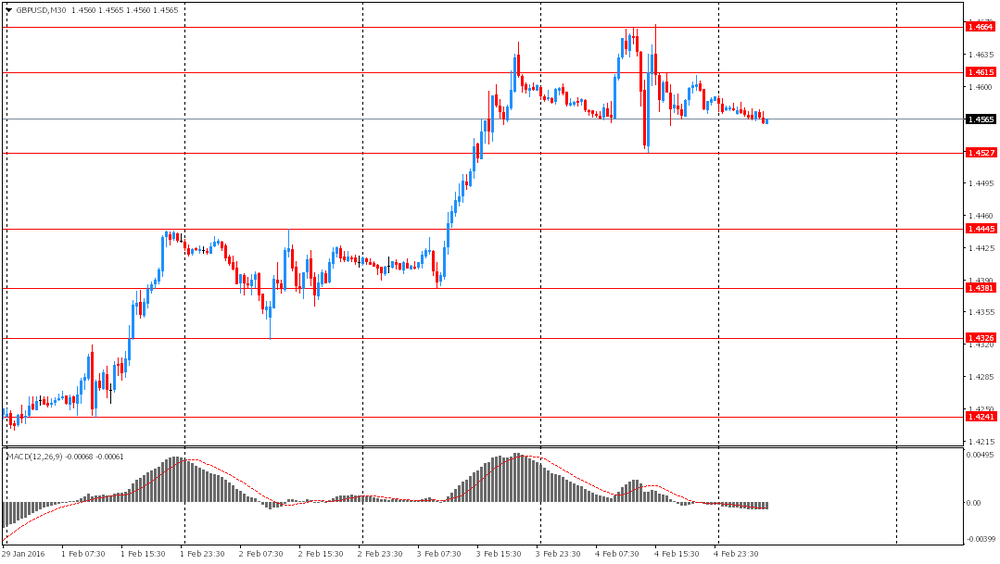

GBPUSD 1.4350 (GBP 331m) 1.4500 (668m) 1.4700 (513m)

NZDUSD 0.6500 (NZD 178m) 0.6550 (238m) 0.6700 (149m)

AUDUSD 0.7075 (AUD 200m) 0.7100-05 (441m) 0.7125 (349m) 0.7150 (209m) 0.7200 (493m)

USDCAD 1.3525 (USD 245m) 1.3700 (580m) 1.3795-1.3800 (840m) 1.3890-1.3900 (660m) 1.4085-1.4100 (1.5bln)

-

14:40

Canada’s unemployment rate rises rose to 7.2% in January

Statistics Canada released the labour market data on Friday. Canada's unemployment rate rose to 7.2% in January from 7.1% in December. Analysts had expected the unemployment rate to remain unchanged at 7.1%.

The labour participation rate remained unchanged at 65.9% in January.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people fell by 5,700 jobs in January, missing expectations for a rise of 5,500 jobs, after a 1,300 increase in November. December's figure was revised down from a 22,800 gain.

The decrease was driven by a drop in part-time work. Full-time employment was up by 5,600 in January, while part-time employment slid by 11,300 jobs.

Employment fell in agriculture, manufacturing, transportation and warehousing, and public administration.

-

14:31

U.S.: Average hourly earnings , January 0.5% (forecast 0.3%)

-

14:31

Canada: Employment , January -5.7 (forecast 5.5)

-

14:31

Canada: Trade balance, billions, December -0.59 (forecast -2.2)

-

14:31

U.S.: Average workweek, January 34.6 (forecast 34.5)

-

14:30

U.S.: Unemployment Rate, January 4.9% (forecast 5%)

-

14:30

U.S.: Nonfarm Payrolls, January 151 (forecast 190)

-

14:30

Canada: Unemployment rate, January 7.2% (forecast 7.1%)

-

14:30

U.S.: International Trade, bln, December -43.36 (forecast -43)

-

14:25

Retail sales in Australia are flat in December

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia were flat in December, missing expectations for a 0.5% rise, after a 0.4% gain in November.

Household goods sales were up 0.4% in December, department stores sales increased 0.4%, and food sales rose 0.4%, while clothing, footwear and personal accessory sales climbed 0.4%.

On a yearly basis, retail sales climbed 4.2% in December, after a 4.3% rise in November.

-

14:16

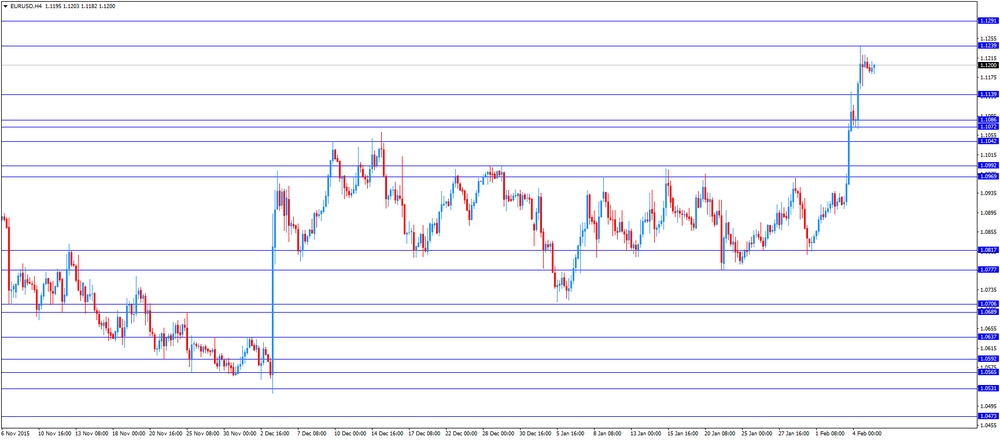

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M December 0.4% 0.5% 0.0%

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index (Preliminary) December 103.2 Revised From 103.5 102.8 102.0

05:00 Japan Coincident Index (Preliminary) December 111.9 111.2

07:00 Germany Factory Orders s.a. (MoM) December 1.5% -0.5% -0.7%

07:45 France Trade Balance, bln December -4.53 Revised From -4.63 -4.4 -3.94

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in January. The U.S. economy is expected to add 190,000 jobs in January, after adding 292,000 jobs in December.

The U.S. trade deficit is expected to widen to $43.0 billion in December from $42.37 billion in November.

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders declined 0.7% in December, missing expectations for a 0.5% decrease, after a 1.5% rise in November.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 0.6% in December, while domestic orders dropped by 2.5%.

New orders from the Eurozone declined 6.9% in December, while orders from other countries climbed 5.5%.

Orders of the intermediate goods decreased by 2.0% in December, capital goods orders were down 0.5%, while consumer goods orders climbed 4.3%.

According to the French Customs, France's trade deficit narrowed to €3.94 billion in December from €4.53 billion in November, exceeding expectations for a decline to a deficit of €4.4 billion. November's figure was revised up from a deficit of €4.63 billion.

Exports declined 0.9% in December, while imports dropped 2.2%.

On a yearly basis, exports rose 1.8% in December, while imports gained 2.9%.

In 2015 as whole, the trade deficit fell to €45.7 billion from €58.3 billion in 2014.

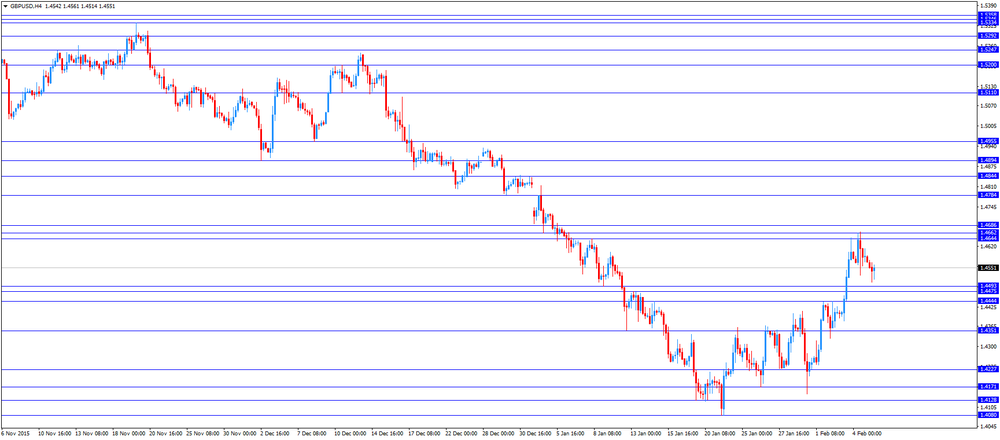

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian economic data. The unemployment rate in Canada is expected to remain unchanged at 7.1% in January.

Canada's economy is expected to add 5,500 jobs in January.

The Canadian trade deficit is expected to widen to C$2.2 billion in December from C$1.99 billion in November.

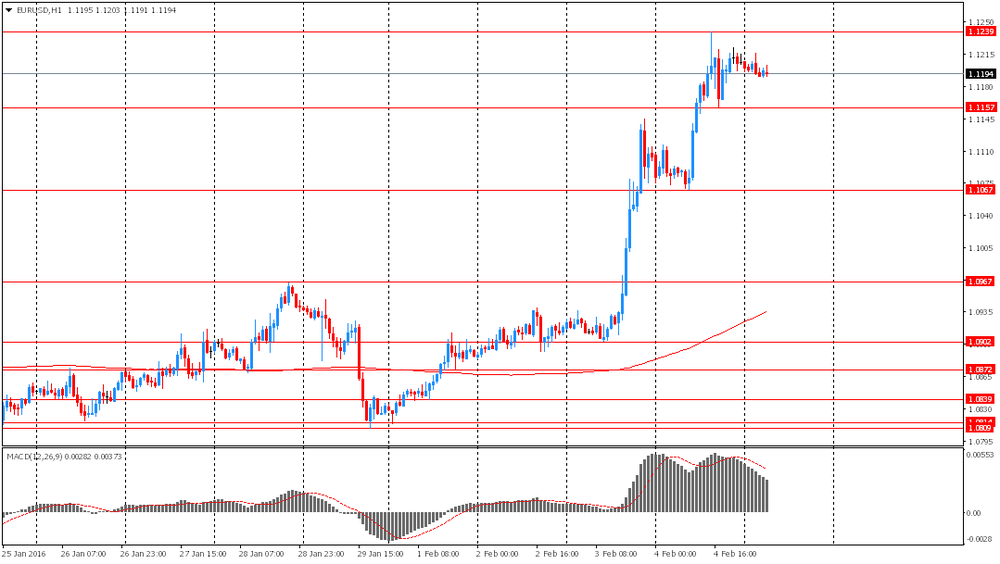

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Trade balance, billions December -1.99 -2.2

13:30 Canada Unemployment rate January 7.1% 7.1%

13:30 Canada Employment January 22.8 5.5

13:30 U.S. Average hourly earnings January 0% 0.3%

13:30 U.S. Average workweek January 34.5 34.5

13:30 U.S. International Trade, bln December -42.37 -43

13:30 U.S. Unemployment Rate January 5% 5%

13:30 U.S. Nonfarm Payrolls January 292 190

15:00 Canada Ivey Purchasing Managers Index January 49.9 50

-

14:01

Orders

EUR/USD

Offers 1.1200-05 1.1220 1.1235 1.125011275 1.1300 1.1330 1.1350

Bids 1.1180 1.1160 1.1130 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0980 1.0950

GBP/USD

Offers 1.4550 1.4575-80 1.4600 1.4625 1.4645-50 1.4665 1.4685 1.4700

Bids 1.4500 1.4480 1.4450 1.4430 1.4400 1.4385 1.4365 1.4350

EUR/GBP

Offers 0.7725-30 0.7750 0.7765 0.7780 0.7800 0.7830 0.7850

Bids 0.7680 0.7660 0.7640 0.7625 0.7600 0.7585 0.7565 0.7550

EUR/JPY

Offers 131.00 131.30 131.50 131.80-85 132.00 132.25 132.50

Bids 130.60 130.30 130.00 129.80 129.50 129.30 129.00

USD/JPY

Offers 117.00 117.30 117.60 117.80 118.00 118.25 118.45-50 118.70 118.85 119.00 119.30 119.50 120.00

Bids 116.55-60 116.25 116.00 115.85 115.65 115.50 115.30 115.00

AUD/USD

Offers 0.7200 0.7220 0.7245-50 0.7270 0.7285 0.7300 0.7325-30 0.7350

Bids 0.7170 0.7165 0.7150 0.7130 0.7100 0.7080 0.7060 0.7030 0.7000

-

12:01

European stock markets mid session: stocks traded higher as market participants are awaiting the release of the U.S. labour market data later in the day

Stock indices traded higher as market participants are awaiting the release of the U.S. labour market data later in the day. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in January. The U.S. economy is expected to add 190,000 jobs in January, after adding 292,000 jobs in December.

Meanwhile, the economic data from the Eurozone was mixed. Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders declined 0.7% in December, missing expectations for a 0.5% decrease, after a 1.5% rise in November.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 0.6% in December, while domestic orders dropped by 2.5%.

New orders from the Eurozone declined 6.9% in December, while orders from other countries climbed 5.5%.

Orders of the intermediate goods decreased by 2.0% in December, capital goods orders were down 0.5%, while consumer goods orders climbed 4.3%.

According to the French Customs, France's trade deficit narrowed to €3.94 billion in December from €4.53 billion in November, exceeding expectations for a decline to a deficit of €4.4 billion. November's figure was revised up from a deficit of €4.63 billion.

Exports declined 0.9% in December, while imports dropped 2.2%.

On a yearly basis, exports rose 1.8% in December, while imports gained 2.9%.

In 2015 as whole, the trade deficit fell to €45.7 billion from €58.3 billion in 2014.

Current figures:

Name Price Change Change %

FTSE 100 5,930.8 +32.04 +0.54 %

DAX 9,426.21 +32.85 +0.35 %

CAC 40 4,260.24 +31.71 +0.75 %

-

11:53

France’s current account deficit is €0.7 billion in December

The Bank of France released its current account data on Friday. France's current account deficit was €0.7 billion in December, down from a deficit of €1.5 billion in November. November's figure was revised down from a deficit of €1.4 billion.

The trade goods deficit narrowed to €1.1 billion in December from €2.6 billion in November, while the surplus on services fell to €0.1 billion from €0.8 billion.

-

11:49

Japan's leading index declines to 102.0 in December, the lowest level since January 2013

Japan's Cabinet Office released its preliminary leading index data on Friday. The leading index decreased to 102.0 in December from 103.2 in November. It was the lowest level since January 2013.

November's figure was revised down from 103.5.

Japan's coincident index was down to 111.2 in December from 111.9 in November. It was the lowest level since March 2015.

-

11:44

France's trade deficit narrows to €4.53 billion in November

According to the French Customs, France's trade deficit narrowed to €3.94 billion in December from €4.53 billion in November, exceeding expectations for a decline to a deficit of €4.4 billion. November's figure was revised up from a deficit of €4.63 billion.

Exports declined 0.9% in December, while imports dropped 2.2%.

On a yearly basis, exports rose 1.8% in December, while imports gained 2.9%.

In 2015 as whole, the trade deficit fell to €45.7 billion from €58.3 billion in 2014.

-

11:32

German seasonal adjusted factory orders decline 0.7% in December

Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders declined 0.7% in December, missing expectations for a 0.5% decrease, after a 1.5% rise in November.

The drop was driven by a decrease in domestic orders. Foreign orders increased by 0.6% in December, while domestic orders dropped by 2.5%.

New orders from the Eurozone declined 6.9% in December, while orders from other countries climbed 5.5%.

Orders of the intermediate goods decreased by 2.0% in December, capital goods orders were down 0.5%, while consumer goods orders climbed 4.3%.

-

11:16

Bank of England deputy governor Ben Broadbent: the U.K. economy recovered solidly

Bank of England (BoE) deputy governor Ben Broadbent said on Friday that the U.K. economy recovered solidly, and there is no urgency to hike interest rates. He pointed out that low inflation in the U.K. lead to higher real wages and consumption, and a stronger economic growth.

-

11:03

Saudi Arabia cuts its crude prices for customers in Asia

Saudi Arabia on Thursday lowered its crude prices for customers in Asia. Saudi Arabian Oil Co. (Saudi Aramco), the country's state-owned oil company, said that it cut its Arab Light crude by $0.20 a barrel to $1 a barrel. Saudi Aramco lowered the premium for Arab Extra Light crude by $0.40 a barrel to $1.30 a barrel.

This action could add to the escalation of the situation in the Middle East as Iran plans to raise its oil exports.

-

10:48

U.S. President Obama proposes a $10-a-barrel oil tax

U.S. President Obama on Thursday proposed a $10-a-barrel oil tax. This tax should be used for "clean transportation" projects.

-

10:38

Reserve Bank of Australia’s Statement on Monetary Policy: the central bank expects the Australian economy to expand faster

The Reserve Bank of Australia (RBA) released its Statement on Monetary Policy on Friday. The central bank expects the Australian economy to expand faster. The economy is expected to grow 2.25% - 3.25% by the end of 2016 and 2017, and 3% - 4% in mid-2018.

The inflation in Australia is expected to be 2% by the end of 2016 and 2% - 3% by the end of 2017 and by mid-2018.

The RBA hinted that further monetary policy easing may be needed.

"Continued low inflation may provide scope for easier policy, should that be appropriate to lend support to demand," the central bank said.

The RBA noted that the slowdown in the Chinese economy could spill over to other economies in the region.

-

10:25

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy fall to 44.2 in in the week ended January 31

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 44.2 in in the week ended January 31 from 44.6 the prior week.

The decline was driven by a less favourable assessment of the economy and a fall in personal finances sub-index. The measure of views of the economy declined to 36.5 from 37.2, the buying climate index was up to 40.6 from 40.2, while the personal finances index slid to 55.5 from 56.3.

-

10:22

Option expiries for today's 10:00 ET NY cut

USD/JPY: 115.00 (USD 776m) 115.50 (200m) 115.65-70 (380m) 117.00 (897m)117.20 (300m) 117.80-85 (790m) 118.00 (1.3bln)

EUR/USD 1.0875 (EUR 1.8bln) 1.1000 (2.3bln) 1.1050 (462m) 1.1100 (852m) 1.1200 (2.3bln) 1.1300 (569m))

GBP/USD 1.4350 (GBP 331m) 1.4500 (668m) 1.4700 (513m)

NZD/USD 0.6500 (NZD 178m) 0.6550 (238m) 0.6700 (149m)

AUD/USD 0.7075 (AUD 200m) 0.7100-05 (441m) 0.7125 (349m) 0.7150 (209m) 0.7200 (493m)

USD/CAD 1.3525 (USD 245m) 1.3700 (580m) 1.3795-1.3800 (840m) 1.3890-1.3900 (660m) 1.4085-1.4100 (1.5bln)

-

10:09

Cleveland Fed President Loretta Mester expects the U.S. economy to continue to expand and the U.S. labour market to strengthen

Cleveland Fed President Loretta Mester said in a speech on Thursday that she expected the U.S. economy to continue to expand and the U.S. labour market to strengthen despite volatility in financial markets and further drop in oil prices.

"Solid labour market indicators, including strong payroll growth, and healthy growth in real disposable income, suggest that underlying U.S. economic fundamentals remain sound," she said.

Mester noted that the Fed should continue to hike its interest rate gradually.

"While the actual path the fed funds rate follows will depend on the economic outlook, and thus, will be data dependent, my current view is that economic conditions will evolve in a way that will warrant rates moving up gradually over time to more normal levels," Cleveland Fed president said.

-

08:45

France: Trade Balance, bln, December -3.94 (forecast -4.4)

-

08:32

Options levels on friday, February 5, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1288 (2027)

$1.1263 (2148)

$1.1227 (4079)

Price at time of writing this review: $1.1192

Support levels (open interest**, contracts):

$1.1127 (2118)

$1.1088 (1590)

$1.1045 (1754)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 46128 contracts, with the maximum number of contracts with strike price $1,1000 (6164);

- Overall open interest on the PUT options with the expiration date February, 5 is 80945 contracts, with the maximum number of contracts with strike price $1,0800 (10147);

- The ratio of PUT/CALL was 1.75 versus 1.63 from the previous trading day according to data from February, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.4800 (1270)

$1.4701 (2747)

$1.4604 (2366)

Price at time of writing this review: $1.4547

Support levels (open interest**, contracts):

$1.4499 (1071)

$1.4400 (1621)

$1.4300 (1064)

Comments:

- Overall open interest on the CALL options with the expiration date February, 5 is 27248 contracts, with the maximum number of contracts with strike price $1,4650 (2910);

- Overall open interest on the PUT options with the expiration date February, 5 is 25743 contracts, with the maximum number of contracts with strike price $1,4550 (2309);

- The ratio of PUT/CALL was 0.94 versus 0.93 from the previous trading day according to data from February, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Foreign exchange market. Asian session: the U.S. dollar gained slightly

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Retail Sales, M/M December 0.4% 0.5% 0.0%

00:30 Australia RBA Monetary Policy Statement

05:00 Japan Leading Economic Index (Preliminary) December 103.2 Revised From 103.5 102.8 102.0

05:00 Japan Coincident Index (Preliminary) December 111.9 111.2

07:00 Germany Factory Orders s.a. (MoM) December 1.5% -0.5% -0.7%

The U.S. dollar climbed against the euro after the recent decline. This week the dollar index, which measures the value of the greenback against a basket of ten major currencies, fell by 2.4% amid speculation that the Federal Reserve will delay its next rate hike.

Today market participants are waiting for U.S. employment data. The number of employed is expected to have grown by 190,000 in January compared to a rise of 292,000 in December. The U.S. Labor Department reported that the number of initial jobless claims rose by 8,000 to 285,000 in the week ending January 30. The reading exceeded expectations for growth to 280,000. The number of claims has remained below 300,000 for 48 weeks in a row (the longest series since 1970s).

The Australian dollar fell after the Reserve Bank of Australia cut its short-term inflation forecast and 2017 GDP forecast. The GDP is expected to expand by 3% in 2017 compared to an earlier forecast of a 3.5% gain. Inflation is likely to bу 1.5% in 2016 compared to 2.0% expected earlier. The central bank's inflation target range is 2%-3%.

Retail sales volume was unchanged in Australia in December, while economists had expected growth of 0.5%. Sales expanded by 0.4% in the previous month.

EUR/USD: the pair fluctuated within $1.1185-15 in Asian trade

USD/JPY: the pair traded within Y116.55-00

GBP/USD: the pair fell to $1.4545

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Trade Balance, bln December -4.63 -4.4

13:30 Canada Trade balance, billions December -1.99 -2.2

13:30 Canada Unemployment rate January 7.1% 7.1%

13:30 Canada Employment January 22.8 5.5

13:30 U.S. Average hourly earnings January 0% 0.3%

13:30 U.S. Average workweek January 34.5 34.5

13:30 U.S. International Trade, bln December -42.37 -43

13:30 U.S. Unemployment Rate January 5% 5%

13:30 U.S. Nonfarm Payrolls January 292 190

15:00 Canada Ivey Purchasing Managers Index January 49.9 50

20:00 U.S. Consumer Credit December 13.95 16

-

08:00

Germany: Factory Orders s.a. (MoM), December -0.7% (forecast -0.5%)

-

07:33

Oil prices little changed

West Texas Intermediate futures for March delivery is currently at $31.75 (+0.09%), while Brent crude is at $34.36 (-0.29%) amid Friday's thin trading as many market participants in Asia prepared for the Lunar New Year.

A weaker dollar supports oil prices, however most fundamentals remain bearish: large crude oil stocks in the biggest consumer the U.S., slowing economic growth in the second-biggest consumer China and excessive supplies from producers amid lack of desire to cooperate.

-

07:14

Gold holds onto gains

Gold is currently at $1,154.90 (-0.22%) after reaching the highest level since October. Uncertainties over the global economy support this safe-haven asset. Today market participants are waiting for U.S. payrolls data. A weaker-than-expected report could send gold price higher as it would mean that the Federal Reserve will delay its next interest-rate hike.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose to 22.3 million ounces on Thursday, the highest level since October.

-

07:06

Global Stocks: U.S. stock indices little changed

U.S. stock indices ended Thursday session with small gains. Stocks followed oil prices throughout trading hours.

The Dow Jones Industrial Average gained 79.92 points, or 0.5%, to 16,416.58. The S&P 500 rose 2.92 points, or 0.2%, to 1,915.45. The Nasdaq Composite climbed 5.32 points, or 0.1%, to 4,509.56.

The U.S. Labor Department reported that the number of initial jobless claims rose by 8,000 to 285,000 in the week ending January 30. The reading exceeded expectations for growth to 280,000. The number of claims had remained below 300,000 for 48 weeks in a row (the longest series since 1970s).

Meanwhile U.S. factory orders fell sharply in December accelerating the pace of declines compared to the previous month. Data showed that factory orders fell by 2.9% in December to $456.5 billion. This was the biggest decline since December 2014. In 2015 on the whole factory orders fell by 6.6%.

This morning in Asia Hong Kong Hang Seng rose 0.84%, or 161.64, to 19,344.73. China Shanghai Composite Index declined 0.15%, or 4.20, to 2,776.83. The Nikkei fell 2.15%, or 366.48, to 16,678.51.

Asian stock indices traded mixed amid speculation that the Federal Reserve will delay the next rate hike. Activity on Chinese stock markets declined as market participants prepared for holiday.

-

06:04

Japan: Leading Economic Index , December 102.0 (forecast 102.8)

-

06:04

Japan: Coincident Index, December 111.2

-

03:03

Nikkei 225 16,893.12 -151.87 -0.89 %, Hang Seng 19,363.51 +180.42 +0.94 %, Shanghai Composite 2,783.71 +44.46 +1.62 %

-

01:30

Australia: Retail Sales, M/M, December 0.0% (forecast 0.5%)

-

01:03

Commodities. Daily history for Feb 4’2016:

(raw materials / closing price /% change)

Oil 31.69 -0.09%

Gold 1,156.00 -0.13%

-

01:02

Stocks. Daily history for Sep Feb 4’2016:

(index / closing price / change items /% change)

Nikkei 225 17,044.99 -146.26 -0.85 %

Hang Seng 19,183.09 +191.50 +1.01 %

Shanghai Composite 2,781.8 +42.55 +1.55 %

FTSE 100 5,898.76 +61.62 +1.06 %

CAC 40 4,228.53 +1.57 +0.04 %

Xetra DAX 9,393.36 -41.46 -0.44 %

S&P 500 1,915.45 +2.92 +0.15 %

NASDAQ Composite 4,509.56 +5.32 +0.12 %

Dow Jones 16,416.58 +79.92 +0.49 %

-

01:01

Currencies. Daily history for Feb 4’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1206 +0,92%

GBP/USD $1,4589 -0,08%

USD/CHF Chf0,9932 -1,06%

USD/JPY Y116,77 -0,95%

EUR/JPY Y130,87 -0,02%

GBP/JPY Y170,35 -1,06%

AUD/USD $0,7199 +0,44%

NZD/USD $0,6722 +0,86%

USD/CAD C$1,3752 -0,20%

-