Noticias del mercado

-

17:39

Oil prices rise on a weaker U.S. dollar

Oil prices rose on a weaker U.S. dollar. The U.S. dollar declined against other currencies after the release of the weaker-than-expected U.S. services PMI data.

The Chinese services PMI data also supported oil prices. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.4 in January from 50.2 in December. The index was driven by a rise in new business.

Gains were limited by the U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories increased by 7.79 million barrels to 502.7 million in the week to January 29.

Analysts had expected U.S. crude oil inventories to rise by 4.8 million barrels.

Gasoline inventories increased by 5.9 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 747,000 barrels.

U.S. crude oil imports increased by 647,000 barrels per day.

Refineries in the U.S. were running at 86.6% of capacity, down from 87.4% the previous week.

WTI crude oil for March delivery rose to $31.10 a barrel on the New York Mercantile Exchange.

Brent crude oil for April climbed to $33.78 a barrel on ICE Futures Europe.

-

17:34

China targets a 6.5%-7.0% growth in 2016

China's National Development and Reform Commission (NDRC) Chairman Xu Shaoshi said on Wednesday that the country targets a 6.5%-7.0% growth in 2016. He noted that downward pressure on the economy will remain this year.

Xu pointed out that China's attempts to curb overcapacity will increase unemployment in provinces with high output of steel and coal.

"Now the problems are worse than they were two years ago but the government has the ability to cope," he said.

-

17:16

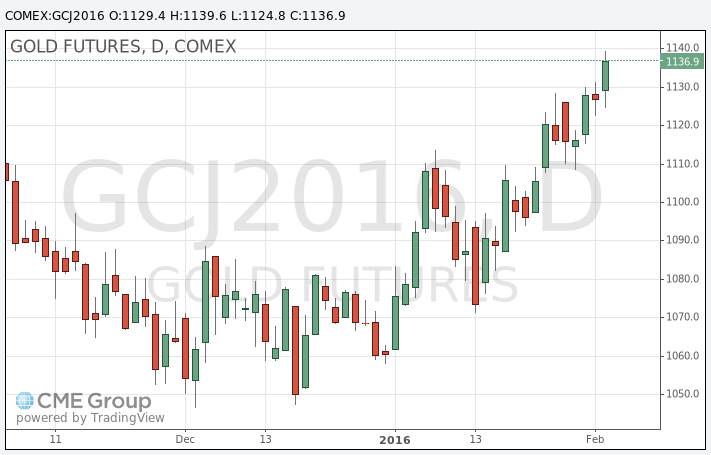

Gold rise climbs on a weaker U.S. dollar

Gold price climbed on a weaker U.S. dollar. The U.S. dollar declined against other currencies after the release of the weaker-than-expected U.S. services PMI data. The Institute for Supply Management released its non-manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The index fell to 53.5 in January from 55.8 in December, missing expectations for a decrease to 55.1.

Markit Economics released final services PMI for the U.S. on Wednesday. Final U.S. services PMI fell to 53.2 in January from 54.3 in December, down from the preliminary reading of 53.7. It was the lowest level since late-2013. The index was driven by a slower growth in output and new business. Employment continued to strengthen.

This data added to speculation that the Fed could delay its further interest rate hikes.

April futures for gold on the COMEX today decreased to 1139.60 dollars per ounce.

-

16:49

U.S. crude inventories climb by 7.79 million barrels to 502.7 million in the week to January 29

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 7.79 million barrels to 502.7 million in the week to January 29.

Analysts had expected U.S. crude oil inventories to rise by 4.8 million barrels.

Gasoline inventories increased by 5.9 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 747,000 barrels.

U.S. crude oil imports increased by 647,000 barrels per day.

Refineries in the U.S. were running at 86.6% of capacity, down from 87.4% the previous week.

-

14:26

U.S. ADP Employment Report: private sector adds 205,000 jobs in January

Private sector in the U.S. added 205,000 jobs in January, according the ADP report on Wednesday. December's figure was revised up to 267,000 jobs from a previous reading of 257,000 jobs.

Analysts expected the private sector to add 195,000 jobs.

Services sector added 192,000 jobs in January, while goods-producing sector added 13,000.

"Job growth remains strong despite the turmoil in the global economy and financial markets. Manufacturers and energy companies are reducing payrolls, but job gains across all other industries remain robust. The U.S. economy remains on track to return to full employment by mid-yea," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in January. The U.S. economy is expected to add 190,000 jobs in January, after adding 292,000 jobs in December.

-

10:37

Chinese Markit/Caixin services PMI rises to 52.4 in January

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.4 in January from 50.2 in December.

The index was driven by a rise in new business.

"Overall, the fast development of the services sector has to a large extent offset the impact of weakening manufacturing, indicating a better economic structure. The government should continue to deepen reform, relax administrative controls and reduce restrictions on market entry for service providers. This will release the potential of the services sector and help improve the economic structur," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

07:41

Oil prices continued falling

West Texas Intermediate futures for March delivery declined to $29.64 (-0.80%), while Brent crude fell to $32.39 (-1.01%) amid weak fundamentals. Production numbers from Canada, Brazil and Russia rose in 2015 and no talks about output cuts had materialized. Meanwhile the managing director of the National Iranian Oil Company said on Tuesday Iran plans to export 2.3 million barrels of crude oil per day in the fiscal year beginning March 21.

Morgan Stanley analysts believe that oil market will remain unbalance till the middle of 2017.

-

07:31

Gold steadied

Gold is currently at $1,128.30 (+0.10%) holding on to a three-month high amid strong demand for safe-haven assets on the background of falling stocks and oil prices. Physical demand rose in China ahead of the Lunar New Year holiday proving support for prices.

"A weaker US dollar, lower oil and fragile equity markets are in combination good for gold. We remain bullish as the economic trends do not argue for lower bullion in our view," HSBC analyst James Steel said.

-

00:35

Commodities. Daily history for Feb 2’2016:

(raw materials / closing price /% change)

Oil 29.71 -0.57%

Gold 1,129.60 +0.21%

-