Noticias del mercado

-

21:00

S&P 500 2,055.26 -12.63 -0.61 %, NASDAQ 4,860.76 -40.12 -0.82 %, Dow 17,670.36 -105.76 -0.59 %

-

18:24

Greek Interior Minster Nikos Voutsis: Greece will not pay the 450 million euros to the International Monetary Fund on time

The Greek Interior Minster Nikos Voutsis warned on Wednesday that Greece will not pay the 450 million euros to the International Monetary Fund (IMF) on time if its creditors do not unblock a new tranche of loans by April 9.

He noted that Athens will first pay salaries and pensions.

-

18:05

European stocks close: stocks closed higher on the better-than-expected manufacturing PMIs from the Eurozone

Stock indices closed higher on the better-than-expected manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in March from a preliminary reading of 51.9. Analysts had expected the final index to remain unchanged at 51.9.

Germany's final manufacturing PMI increased to 52.8 in March from a preliminary reading of 52.4. Analysts had expected the final index to remain unchanged at 52.4.

France's final manufacturing PMI climbed to 48.8 in March from a preliminary reading of 48.2. Analysts had expected the final index to remain unchanged at 48.2.

Concerns over Greece's debt problems continue to weigh on the euro.

The U.K. manufacturing PMI increased to 54.4 in March from 54.0 in February, missing expectations for a rise to 54.5. February's figure was revised down from 54.1.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,809.5 +36.46 +0.54 %

DAX 12,001.38 +35.21 +0.29 %

CAC 40 5,062.22 +28.58 +0.57 %

-

18:00

European stocks closed: FTSE 100 6,808.39 +35.35 +0.52 %, CAC 40 5,064.34 +30.70 +0.61 %, DAX 12,001.22 +35.05 +0.29 %

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies after the weaker-than-expected U.S. economic data. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. declined to 51.5 in March from 52.9 in February, missing expectations for a decline to 52.5. It was the fifth consecutive decline.

The harsh weather, higher health-care costs and the stronger dollar weighed on the index.

Private sector in the U.S. added 189,000 jobs in March, according the ADP report on Wednesday. It was the slowest pace since January 2014.

February's figure was revised up to 214,000 jobs from a previous reading of 212,000 jobs.

Analysts expected the private sector to add 231,000 jobs.

Construction spending in the U.S. declined 0.1% in February, in line with expectations, after a 1.7% drop in January. It was the second consecutive decline.

January's figure was revised down from a 1.1% decrease.

A 0.8% decrease in public construction outlays weighed on construction spending.

The euro traded mixed against the U.S. dollar. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in March from a preliminary reading of 51.9. Analysts had expected the final index to remain unchanged at 51.9.

Germany's final manufacturing PMI increased to 52.8 in March from a preliminary reading of 52.4. Analysts had expected the final index to remain unchanged at 52.4.

France's final manufacturing PMI climbed to 48.8 in March from a preliminary reading of 48.2. Analysts had expected the final index to remain unchanged at 48.2.

Concerns over Greece's debt problems continue to weigh on the euro.

The British pound traded higher against the U.S. dollar. The U.K. manufacturing PMI increased to 54.4 in March from 54.0 in February, missing expectations for a rise to 54.5. February's figure was revised down from 54.1.

The Swiss franc traded mixed against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland was up to 47.9 in March from 47.3 in February, beating expectations for a decline to 47.2.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any economic reports from New Zealand.

The kiwi was supported by the better-than-expected Chinese manufacturing PMI. Chinese manufacturing PMI rose to 54.1 in March from 49.9 in February, beating expectations for a decline to 49.7.

Chinese final HSBC manufacturing PMI climbed to 49.6 in March from 49.2 in February, exceeding expectations for a gain to 49.3.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the better-than-expected building permits from Australia. Building approvals in Australia fell 3.2% in February, beating expectations for a 3.7% decline, after a 5.9% increase in January. January's figure was revised down from a 7.9% rise.

The AIG manufacturing index increased to 46.3 in March from 45.4 in February.

The Japanese yen rise against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the release of the economic data in Japan. Japan's Tankan manufacturing index remained unchanged at 12 in the first quarter. Analysts had expected an increase to 14.

Japan's Tankan non-manufacturing index rose to 19 in the first quarter from 16 in the fourth quarter, exceeding expectations for a rise to 17.

Japanese final manufacturing PMI declined to 50.3 in March from 50.4 in February. Analysts had expected the index to remain unchanged at 50.4.

-

17:04

Federal Reserve Bank of Atlanta President Dennis Lockhart: the June to September period remained a “reasonable time frame” to hike interest rates

The Federal Reserve Bank of Atlanta President Dennis Lockhart said on Wednesday that the U.S. economy will pick up in the second quarter. He added that a slowdown in the economy in the first quarter was temporary.

Lockhart noted that the June to September period remained a "reasonable time frame" to hike interest rates.

The Federal Reserve Bank of Atlanta president believes that more people are not recorded in official unemployment figures.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

16:53

Construction spending in the U.S. is down 0.1% in February

The U.S. Commerce Department released construction spending data on Wednesday. Construction spending in the U.S. declined 0.1% in February, in line with expectations, after a 1.7% drop in January. It was the second consecutive decline.

January's figure was revised down from a 1.1% decrease.

A 0.8% decrease in public construction outlays weighed on construction spending.

Spending on federal government projects rose 9%, but state and local government outlays dropped by 1.6%.

Spending on private construction projects increased 0.2%, while spending on private residential construction spending declined 0.2%.

Spending on single-family construction plunged 1.4%, while multi-family home building climbed 4.1%.

-

16:32

ISM manufacturing purchasing managers’ index declines to 51.5 in March

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Wednesday. The index declined to 51.5 in March from 52.9 in February, missing expectations for a decline to 52.5. It was the fifth consecutive decline.

The harsh weather, higher health-care costs and the stronger dollar weighed on the index.

A reading above 50 indicates expansion, below indicates contraction.

The new orders index fell to 51.8 in March from 52.5 in February.

The prices paid index increased to 39.0 in March from 35.0 in February.

The employment index decreased to 50.0 in March from 51.4 in February.

-

16:30

U.S.: Crude Oil Inventories, March 4.766

-

16:00

U.S.: ISM Manufacturing, March 51.5 (forecast 52.5)

-

16:00

U.S.: Construction Spending, m/m, February -0.1% (forecast -0.1%)

-

15:45

U.S.: Manufacturing PMI, March 55.7 (forecast 55.3)

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0750(E323mn), $1.0800(E2.1bn)

USD/JPY: Y119.50/55($617mn)

GBP/USD: $1.4900(stg226mn)

EUR/GBP: stg0.7200(E255mn), stg0.7270(E706mn)

AUD/USD: $0.7600/05(A$360mn), $0.7640/50(A$1.0bn)

AUD/JPY: Y91.00(A$410mn)

USD/CAD: Cad1.2680($256mn), Cad1.2700($220mn), Cad1.2800($200mn), Cad1.2900($300mn)

USD/CHF: Chf0.9600($350mn)

NZD/USD: $0.7530/35(NZ$900mn)

-

15:32

U.S. Stocks open: Dow -0.13%, Nasdaq -0.13%, S&P -0.15%

-

15:28

Before the bell: S&P futures -0.28%, NASDAQ futures -0.17%

U.S. stock-index futures maintained losses as data on private payrolls showed companies added fewer workers than forecast in March.

Global markets:

Nikkei 19,034.84 -172.15 -0.90%

Hang Seng 25,082.75 +181.86 +0.73%

Shanghai Composite 3,810.29 +62.40 +1.66%

FTSE 6,821.49 +48.45 +0.72%

CAC 5,083.14 +49.50 +0.98%

DAX 12,040.07 +73.90 +0.62%

Crude oil $47.72 (+0.27%)

Gold $1192.70 (+0.81%)

-

15:12

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

82.27

+0.02%

40.1K

Exxon Mobil Corp

XOM

85.05

+0.06%

4.9K

Apple Inc.

AAPL

124.65

+0.18%

224.4K

Facebook, Inc.

FB

82.61

+0.48%

75.3K

JPMorgan Chase and Co

JPM

60.58

+0.66%

5.4K

Barrick Gold Corporation, NYSE

ABX

11.02

+1.00%

80.5K

Hewlett-Packard Co.

HPQ

31.52

+1.16%

20.9K

Yandex N.V., NASDAQ

YNDX

15.36

+1.29%

3.1K

Twitter, Inc., NYSE

TWTR

51.05

+1.94%

99.7K

3M Co

MMM

164.95

0.00%

5.4K

AT&T Inc

T

32.65

0.00%

17.5K

E. I. du Pont de Nemours and Co

DD

71.47

0.00%

3.0K

Johnson & Johnson

JNJ

100.60

0.00%

17.2K

McDonald's Corp

MCD

97.44

0.00%

5.8K

The Coca-Cola Co

KO

40.55

0.00%

68.5K

FedEx Corporation, NYSE

FDX

165.45

0.00%

5.7K

HONEYWELL INTERNATIONAL INC.

HON

104.31

0.00%

18.1K

International Paper Company

IP

55.49

0.00%

24.7K

Ford Motor Co.

F

16.14

-0.01%

119.8K

Google Inc.

GOOG

547.95

-0.01%

6.5K

Starbucks Corporation, NASDAQ

SBUX

94.68

-0.02%

2.1K

Nike

NKE

100.30

-0.03%

29.5K

Amazon.com Inc., NASDAQ

AMZN

371.99

-0.03%

3.7K

Chevron Corp

CVX

104.90

-0.08%

2.9K

Walt Disney Co

DIS

104.80

-0.09%

13.0K

Microsoft Corp

MSFT

40.61

-0.11%

32.9K

Tesla Motors, Inc., NASDAQ

TSLA

188.57

-0.11%

8.8K

American Express Co

AXP

78.00

-0.15%

3.2K

United Technologies Corp

UTX

117.03

-0.15%

28.7K

Intel Corp

INTC

31.22

-0.16%

123.3K

ALTRIA GROUP INC.

MO

49.93

-0.18%

22.5K

Home Depot Inc

HD

113.38

-0.20%

17.2K

Caterpillar Inc

CAT

79.86

-0.21%

0.5K

General Motors Company, NYSE

GM

37.42

-0.21%

64.9K

Pfizer Inc

PFE

34.71

-0.23%

2.8K

Procter & Gamble Co

PG

81.75

-0.23%

49.1K

Citigroup Inc., NYSE

C

51.40

-0.23%

25.6K

General Electric Co

GE

24.74

-0.28%

136.6K

Merck & Co Inc

MRK

57.29

-0.33%

15.4K

Boeing Co

BA

149.57

-0.34%

3.5K

Verizon Communications Inc

VZ

48.46

-0.35%

1.4K

ALCOA INC.

AA

12.87

-0.39%

54.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.87

-0.42%

66.9K

Cisco Systems Inc

CSCO

27.35

-0.63%

23.3K

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Hewlett-Packard (HPQ) upgraded to Buy from Hold at Jefferies

Downgrades:

Other:

Twitter (TWTR) initiated with a Buy at Jefferies

-

14:49

ADP report: private sector added 189,000 jobs in March, the slowest pace since January 2014

Private sector in the U.S. added 189,000 jobs in March, according the ADP report on Wednesday. It was the slowest pace since January 2014.

February's figure was revised up to 214,000 jobs from a previous reading of 212,000 jobs.

Analysts expected the private sector to add 231,000 jobs.

The Chief Economist of Moody's Analytics, Mark Zandi said that falling oil prices and a stronger dollar weighed on the labour market. Moody's Analytics helps to comply the ADP report.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.5% in March. The U.S. economy is expected to add 251,000 jobs in March, after a 295,000 increase in February.

-

14:15

U.S.: ADP Employment Report, March 189 (forecast 231)

-

14:00

Orders

EUR/USD

Offers 1.1100 1.1050 1.0100 1.0950 1.0900 1.0860/50 1.0800

Bids 1.0700 1.0660/55 1.0600/10

GBP/USD

Offers 1.4995/500 1.4950 1.4920 1.4900

Bids 1.4725/20 1.4710/00 1.4685/80 1.4630

EUR/JPY

Offers 131.00 130.40/50 130.00

Bids 128.50 128.20/00 127.50

USD/JPY

Offers 122.05/00 121.70 121.20 121.00 120.50/45

Bids 119.40 118.90 118.65/60 118.35 118.00

EUR/GBP

Offers 0.7400 0.7385/90 0.7340 0.7300

Bids 0.7220 0.7210/00 0.7150

AUD/USD

Offers 0.7850 0.7825 0.7800 0.7780 0.7700 0.7665

Bids 0.7560 0.7500

-

14:00

Foreign exchange market. European session: the British pound fell against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m February 5.9% Revised From 7.9% -3.7% -3.2%

00:30 Australia Building Permits, y/y February 9.1% 14.3%

01:00 China Non-Manufacturing PMI March 53.9 53.7

01:00 China Manufacturing PMI March 49.9 49.7 50.1

01:35 Japan Manufacturing PMI (Finally) March 50.4 50.4 50.3

01:45 China HSBC Manufacturing PMI (Finally) March 49.2 49.3 49.6

07:30 Switzerland Manufacturing PMI March 47.3 47.2 47.9

07:50 France Manufacturing PMI (Finally) March 48.2 48.2 48.8

07:55 Germany Manufacturing PMI (Finally) March 52.4 52.4 52.8

08:00 Eurozone Manufacturing PMI (Finally) March 51.9 51.9 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing March 54.0 Revised From 54.1 54.5 54.4

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. economy is expected to add 231,000 jobs in March, according to the ADP employment report.

The ISM manufacturing purchasing managers' index is expected to decline to 52.5 in March from 52.9 in February.

The euro traded mixed against the U.S. dollar after the better-than-expected manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in March from a preliminary reading of 51.9. Analysts had expected the final index to remain unchanged at 51.9.

Germany's final manufacturing PMI increased to 52.8 in March from a preliminary reading of 52.4. Analysts had expected the final index to remain unchanged at 52.4.

France's final manufacturing PMI climbed to 48.8 in March from a preliminary reading of 48.2. Analysts had expected the final index to remain unchanged at 48.2.

Concerns over Greece's debt problems continue to weigh on the euro. The Greek government failed to reach an agreement with its creditors on Monday.

The British pound fell against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K. The U.K. manufacturing PMI increased to 54.4 in March from 54.0 in February, missing expectations for a rise to 54.5. February's figure was revised down from 54.1.

The Swiss franc traded mixed against the U.S. dollar after the better-than-expected manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland was up to 47.9 in March from 47.3 in February, beating expectations for a decline to 47.2.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.4738

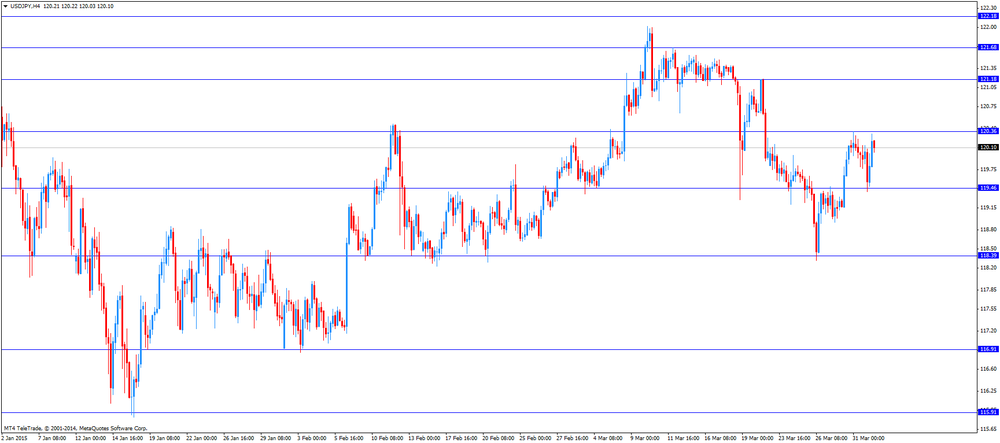

USD/JPY: the currency pair rose to Y120.32

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report March 212 231

13:00 U.S. FOMC Member Williams Speaks

14:00 U.S. Construction Spending, m/m February -1.1% -0.1%

14:00 U.S. ISM Manufacturing March 52.9 52.5

14:30 U.S. FOMC Member Dennis Lockhart Speaks

-

13:09

European Central Bank’s (ECB) Governing Council Member Jozef Makuch: quantitative easing by the ECB is working

The European Central Bank's (ECB) Governing Council Member and the governor of Slovakia's central bank Jozef Makuch said on Tuesday that quantitative easing by the ECB is working. He pointed out that there will be enough quality bonds for asset purchases by the ECB.

Makuch noted that quantitative easing do not replace reforms.

-

12:50

European stock markets mid-session: rally on solid PMI data pointing to recovery

European stocks rallied today after a steady start. The DAX started in negative territory but recovered. The solid start in the new quarter was mainly driven by better-than-expected PMI data in the Eurozone pointing to an economic recovery in the E.U. The ECB's quantitative easing seems to start having positive effects. Markets remain cautious about the Greek debt deal. The IMF and the ECB warned that the reform plans submitted are not detailed enough and Athens will have to take further steps to ensure further bailout releases.

Final data on Eurozone's, French and German Manufacturing for March was reported today.

The French Manufacturing PMI rose above estimates of 48.2 with reading to 48.8 compared to a previous reading of 47.6 - still remaining in negative territory as a reading below 50 indicates contraction.

German Manufacturing PMI came in above estimates of 52.4 at 52.8 from 51.1 in February.

Data for the Eurozone Manufacturing PMI came in with a reading above estimates at 52.2, beating estimates of 51.9 and February's 51 - the highest reading in 10 months.

The data shows that the ECB's quantitative easing starts to fuel Europe's economy and that the recovery is gaining pace. Lower energy prices and a weaker euro also have positive effects.

The FTSE 100 index is currently trading +0.95% quoted at 6,837.11. Germany's DAX 30 added +1.04% trading at 12,090.67. France's CAC 40 is currently trading at 5,101.43 points, +1.35%.

-

12:20

Oil: Brent Crude almost flat – WTI down

Oil is trading lower to steady, WTI declines for a fourth day as talks between western diplomats and officials from Iran are extended over today's deadline. If the talks will reach an agreement over Iran's atomic program could result in an end of the embargo and international sanctions which would add to the global supply glut.

Today market participants will also closely watch data on Crude Oil Inventories. Yesterday API reported that U.S. crude inventories rose by 5.2 million barrels in the week ended March 27.

Brent Crude added +0.29% currently trading at USD55.27 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate declined -0.50% currently quoted at USD47.36 a barrel.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

11:50

Gold declines a fourth day ahead of U.S. data

Gold is trading lower today for a fourth consecutive day - ending last month in negative territory. Gold prices were pushed lower by a stronger U.S. dollar as the precious metal which is dollar-denominated becomes more expensive for holders of other currencies. Today market participants will closely watch U.S. data on Employment - the ADP Employment Report - and the ISM Manufacturing report to get further indications on the strength of the world's largest economy and on the timing of a future rate hike by the Federal Reserve.

Gold is currently quoted at USD1,181.80, -0,14% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday the 17th of march gold traded as low as USD1,142.50, a three-month low.

-

11:35

Eurozone: Manufacturing PMI above estimates at 10-month high

Final data on Eurozone's, French and German Manufacturing for March was reported today.

The French Manufacturing PMI rose above estimates of 48.2 with reading to 48.8 compared to a previous reading of 47.6 - still remaining in negative territory as a reading below 50 indicates contraction.

German Manufacturing PMI came in above estimates of 52.4 at 52.8 from 51.1 in February.

Data for the Eurozone Manufacturing PMI came in with a reading above estimates at 52.2, beating estimates of 51.9 and February's 51 - the highest reading in 10 months.

The data shows that the ECB's quantitative easing starts to fuel Europe's economy and that the recovery is gaining pace. Lower energy prices and a weaker euro also have positive effects.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0750(E323mn), $1.0800(E2.1bn)

USD/JPY: Y119.50/55($617mn)

GBP/USD: $1.4900(stg226mn)

EUR/GBP: stg0.7200(E255mn), stg0.7270(E706mn)

AUD/USD: $0.7600/05(A$360mn), $0.7640/50(A$1.0bn)

AUD/JPY: Y91.00(A$410mn)

USD/CAD: Cad1.2680($256mn), Cad1.2700($220mn), Cad1.2800($200mn), Cad1.2900($300mn)

USD/CHF: Chf0.9600($350mn)

NZD/USD: $0.7530/35(NZ$900mn)

-

10:35

Press Review: Buffett Says Greek Exit From Euro ‘May Not Be a Bad Thing’

BLOOMBERG

Buffett Says Greek Exit From Euro 'May Not Be a Bad Thing'

(Bloomberg) -- Billionaire investor Warren Buffett said the euro region could withstand Greece's departure from the currency union.

"If it turns out the Greeks leave, that may not be a bad thing for the euro," Buffett told CNBC in an interview Tuesday. "If everybody learns that the rules mean something and if they come to general agreement about fiscal policy among members, or something of the sort, that they mean business, that could be a good thing."

Europe's most-indebted state is locked in negotiations with euro-area countries and the International Monetary Fund over the terms of its 240 billion-euro ($260 billion) rescue. The standoff, which has left Greece dependent upon European Central Bank loans, risks leading to a default within weeks and its potential exit from the euro area.

REUTERS

Weak demand hits China factory, services firms in March, more easing seen

(Reuters) - Surveys of China's factory and services sectors showed stubborn weakness in the world's second-biggest economy in March, adding to bets that Beijing will have to roll out more policy support to avert a sharper slowdown.

Three separate surveys showed Chinese companies shed jobs last month as they struggled with soft demand and deflationary pressures, suggesting that economic growth may have slipped below 7 percent in the first quarter of 2015, which would be the weakest in six years.

"We expect first-quarter growth to drop to 6.8 percent and the government might start easing policies significantly in the second quarter," said Zhang Zhiwei, an economist at Deutsche Bank in Hong Kong, adding that the central bank may relax banks' reserve requirement ratio (RRR) as early as this week or next.

Source: http://www.reuters.com/article/2015/04/01/us-china-economy-pmi-official-idUSKBN0MS31320150401

BLOOMBERG

Reckoning Arrives for Cash-Strapped Oil Firms Amid Bank Squeeze

(Bloomberg) -- Lenders are preparing to cut the credit lines to a group of junk-rated shale oil companies by as much as 30 percent in the coming days, dealing another blow as they struggle with a slump in crude prices, according to people familiar with the matter.

Sabine Oil & Gas Corp. became one of the first companies to warn investors that it faces a cash shortage from a reduced credit line, saying Tuesday that it raises "substantial doubt" about the company's ability to continue as a going concern. About 10 firms are having trouble finding backup financing, said the people familiar with the matter, who asked not to be named because the information hasn't been announced.

April is a crucial month for the industry because it's when lenders are due to recalculate the value of properties that energy companies staked as loan collateral. With those assets in decline along with oil prices, banks are preparing to cut the amount they're willing to lend. And that will only squeeze companies' ability to produce more oil.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , March 54.4 (forecast 54.5)

-

10:01

Eurozone: Manufacturing PMI, March 52.2 (forecast 51.9)

-

10:00

European stock markets First hour: Indices open mixed

European stocks open mixed today with the German DAX in negative territory. Stalling negotiations between Greece and the E.U. weigh on the markets as the country is struggling to unlock more bailout funds. Greece failed to reach an agreement with the European Union and the IMF. The proposed reforms were rather seen as 'ideas' than concrete plans and therefor dismissed.

Final data on Eurozone's, French and German Manufacturing for March was reported today. The French Manufacturing PMI rose above estimates of 48.2 with reading to 48.8. German Manufacturing PMI came in above estimates of 52.4 at 52.8. Data for the Eurozone showed that Manufacturing PMI a reading above estimates at 52.2, beating estimates of a reading of 51.9.

The commodity heavy FTSE 100 index is currently trading +0.37% quoted at 6,798 points. Germany's DAX 30 is trading at 11,955.64 points -0.09%. The DAX has risen almost 23% in the first quarter - the most in a quarter since 2003. France's CAC 40 is currently trading at 5,049.73 points, +0.32%.

-

09:57

Germany: Manufacturing PMI, March 52.8 (forecast 52.4)

-

09:50

France: Manufacturing PMI, March 48.8 (forecast 48.2)

-

09:32

Switzerland: Manufacturing PMI, March 47.9 (forecast 47.2)

-

09:00

Global Stocks: Wall Street drops, China continues to rally

U.S. stocks fell on Tuesday as the energy and healthcare sector led shares lower - reversing Monday's gains. The S&P 500 closed -0.88% with a final quote of 2,067.89 points. The DOW JONES index declined by -1.11%, closing at 17,776.12 points. The Conference Board's consumer confidence index for the U.S. jumped to 101.3 in March from 98.8 in February, beating expectations for a decline to 96.6. The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 46.3 in March from 45.8 in February, missing expectations for a rise to 52.5. The S&P/Case-Shiller home price index increased 4.6% in January, in line with expectations, after a 4.4% gain in December.

Chinese stocks were trading higher. Hong Kong's Hang Seng is currently trading +0.69% at 25,073.13 points. China's Shanghai Composite rose to 3,793.85 points closing+1.23%. China reported data on Non-Manufacturing PMI with a decline from 53.9 to 53.7. The Manufacturing PMI for March rose from 49.9 to 50.1, beating estimates for a decline to 49.7. Final data on the HSBC Manufacturing PMI came in at 49.6, above the estimated 49.3 and above the previous reading of 49.2. The PMI data shows signs of an economic recovery of the world second largest economy.

The Nikkei dropped on Wednesday on soft Tankan survey and profit taking. The BoJ Tankan Manufacturing Index for the first quarter came in unchanged from a previous reading at 12, below estimates of an increase to 14. The BoJ Tankan Non-Manufacturing Index rose from 16 to 19, beating estimates of an increase to 17. Final data on the Japanese Manufacturing PMI came in lower at 50.3, below the previous reading of 50.4. Analysts expected an unchanged reading. The index declined by -0.90% closing at 19,034.84 points.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly higher against its major peers – aussie gains on China data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Building Permits, m/m February 7.9 -3.7% -3.2%

00:30 Australia Building Permits, y/y February 9.1% 14.3%

01:00 China Non-Manufacturing PMI March 53.9 53.7

01:00 China Manufacturing PMI March 49.9 49.7 50.1

01:35 Japan Manufacturing PMI (Finally) March 50.4 50.4 50.3

01:45 China HSBC Manufacturing PMI (Finally) March 49.2 49.3 49.6

The U.S. dollar is trading broadly higher against its major peers, only the Australian dollar booked gains against the greenback on better-than-expected data from Australia and China. Yesterday's mostly better-than-expected U.S. economic data supported the U.S. currency. The Conference Board's consumer confidence index for the U.S. jumped to 101.3 in March from 98.8 in February, beating expectations for a decline to 96.6. The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 46.3 in March from 45.8 in February, missing expectations for a rise to 52.5. The S&P/Case-Shiller home price index increased 4.6% in January, in line with expectations, after a 4.4% gain in December.

The Australian dollar jumped against the U.S. dollar after a six-day decline on solid data from Australia and China, Australia's biggest trade partner. Building permits for February declines less than expected from a revised previous reading of +5.9% to -3.2%. Analysts expected permits to decline by -3.7%. Year on year Building Permits rose +14.3% with a previous reading of +9.1%.

China reported data on Non-Manufacturing PMI with a decline from 53.9 to 53.7. The Manufacturing PMI for March rose from 49.9 to 50.1, beating estimates for a decline to 49.7. Final data on the HSBC Manufacturing PMI came in at 49.6, above the estimated 49.3 and above the previous reading of 49.2. The PMI data shows signs of an economic recovery of the world second largest economy.

New Zealand's dollar booked losses against the greenback during the Asian It's the seventh day of straight losses.

The Japanese yen is trading higher against the greenback in the Asian session. The BoJ Tankan Manufacturing Index for the first quarter came in unchanged from a previous reading at 12, below estimates of an increase to 14. The BoJ Tankan Non-Manufacturing Index rose from 16 to 19, beating estimates of an increase to 17. Final data on the Japanese Manufacturing PMI came in lower at 50.3, below the previous reading of 50.4. Analysts expected an unchanged reading.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling booked gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:30 Switzerland Manufacturing PMI March 47.3 47.2

07:50 France Manufacturing PMI (Finally) March 48.2 48.2

07:55 Germany Manufacturing PMI (Finally) March 52.4 52.4

08:00 Eurozone Manufacturing PMI (Finally) March 51.9 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing March 54.1 54.5

12:15 U.S. ADP Employment Report March 212 231

13:00 U.S. FOMC Member Williams Speaks

13:45 U.S. Manufacturing PMI (Finally) March 55.3 55.3

14:00 U.S. Construction Spending, m/m February -1.1% -0.1%

14:00 U.S. ISM Manufacturing March 52.9 52.5

14:30 U.S. Crude Oil Inventories March 8.2

14:30 U.S. FOMC Member Dennis Lockhart Speaks

19:30 U.S. Total Vehicle Sales, mln March 16.2 16.5

23:30 Australia MI Inflation Gauge, m/m March 0.0%

23:30 Australia MI Inflation Gauge, y/y March 1.3%

23:50 Japan Monetary Base, y/y March 36.7% 35.3%

-

08:22

Options levels on wednesday, April 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0908 (4064)

$1.0866 (2435)

$1.0829 (3533)

Price at time of writing this review: $1.0781

Support levels (open interest**, contracts):

$1.0725 (6815)

$1.0675 (3598)

$1.0594 (8209)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 70937 contracts, with the maximum number of contracts with strike price $1,1000 (5016);

- Overall open interest on the PUT options with the expiration date April, 2 is 82105 contracts, with the maximum number of contracts with strike price $1,0600 (8209);

- The ratio of PUT/CALL was 1.16 versus 1.21 from the previous trading day according to data from March, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.5100 (1646)

$1.5001 (1376)

$1.4902 (1254)

Price at time of writing this review: $1.4853

Support levels (open interest**, contracts):

$1.4796 (1122)

$1.4699 (2233)

$1.4600 (1303)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 27218 contracts, with the maximum number of contracts with strike price $1,5100 (1646);

- Overall open interest on the PUT options with the expiration date April, 2 is 29017 contracts, with the maximum number of contracts with strike price $1,5050 (2351);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from March, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:10

Nikkei 225 19,146.16 -60.83 -0.32 %, Hang Seng 24,980.97 +80.08 +0.32 %, Shanghai Composite 3,767.56 +19.66 +0.52 %

-

03:46

China: HSBC Manufacturing PMI, March 49.6 (forecast 49.3)

-

03:37

Japan: Manufacturing PMI, March 50.3 (forecast 50.4)

-

03:02

China: Non-Manufacturing PMI, March 53.7

-

03:02

China: Manufacturing PMI , March 50.1 (forecast 49.7)

-

02:34

Australia: Building Permits, m/m, February -3.2% (forecast -3.7%)

-

02:33

Australia: Building Permits, y/y, February 14.3%

-

01:53

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter I 19 (forecast 17)

-

01:52

Japan: BoJ Tankan. Manufacturing Index, Quarter I 12 (forecast 14)

-

01:09

Commodities. Daily history for Mar 31’2015:

(raw materials / closing price /% change)

Oil 47.60 -2.22%

Gold 1,183.10 0.00%

-

01:08

Stocks. Daily history for Mar 31’2015:

(index / closing price / change items /% change)

Nikkei 225 19,206.99 -204.41 -1.05 %

Hang Seng 24,900.89 +45.77 +0.18 %

S&P/ASX 200 5,891.5 +45.42 +0.78 %

Shanghai Composite 3,749.07 -37.50 -0.99 %

FTSE 100 6,773.04 -118.39 -1.72 %

CAC 40 5,033.64 -49.88 -0.98 %

Xetra DAX 11,966.17 -119.84 -0.99 %

S&P 500 2,067.89 -18.35 -0.88 %

NASDAQ Composite 4,900.88 -46.56 -0.94 %

Dow Jones 17,776.12 -200.19 -1.11 %

-

01:01

Currencies. Daily history for Mar 31’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0740 -0,77%

GBP/USD $1,4823 +0,16%

USD/CHF Chf0,972 +0,46%

USD/JPY Y120,04 -0,06%

EUR/JPY Y128,43 -1,23%

GBP/JPY Y177,92 +0,09%

AUD/USD $0,7610 -0,53%

NZD/USD $0,7467 -0,31%

USD/CAD C$1,2678 -0,02%

-

00:31

Australia: AIG Manufacturing Index, March 46.3

-

00:01

Schedule for today, Wednesday, Apr 1’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m February 7.9 -3.7%

00:30 Australia Building Permits, y/y February 9.1%

01:00 China Non-Manufacturing PMI March 53.9

01:00 China Manufacturing PMI March 49.9 49.7

01:30 Japan Labor Cash Earnings, YoY February 1.3% 0.7%

01:35 Japan Manufacturing PMI (Finally) March 50.4 50.4

01:45 China HSBC Manufacturing PMI (Finally) March 49.2 49.3

07:30 Switzerland Manufacturing PMI March 47.3 47.2

07:50 France Manufacturing PMI (Finally) March 48.2 48.2

07:55 Germany Manufacturing PMI (Finally) March 52.4 52.4

08:00 Eurozone Manufacturing PMI (Finally) March 51.9 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing March 54.1 54.5

12:15 U.S. ADP Employment Report March 212 231

13:00 U.S. FOMC Member Williams Speaks

13:45 U.S. Manufacturing PMI (Finally) March 55.3 55.3

14:00 U.S. Construction Spending, m/m February -1.1% -0.1%

14:00 U.S. ISM Manufacturing March 52.9 52.5

14:30 U.S. Crude Oil Inventories March 8.2

14:30 U.S. FOMC Member Dennis Lockhart Speaks

19:30 U.S. Total Vehicle Sales, mln March 16.2 16.5

23:30 Australia MI Inflation Gauge, m/m March 0.0%

23:30 Australia MI Inflation Gauge, y/y March 1.3%

23:50 Japan Monetary Base, y/y March 36.7% 35.3%

-