Noticias del mercado

-

21:00

S&P 500 2,077.86 -8.38 -0.40 %, NASDAQ 4,923.69 -23.75 -0.48 %, Dow 17,869.24 -107.07 -0.60 %

-

18:18

Fitch Ratings’ Risk Radar Global 1Q15: deflation in the Eurozone is the largest potential risk

Fitch Ratings released its Risk Radar Global 1Q15 on Monday. The agency said that deflation in the Eurozone is the largest potential risk, despite the European Central Bank's (ECB) quantitative easing programme.

Fitch Ratings pointed out that underlying inflation remains subdued and longer-term inflation expectations are still below the ECB's 2% target. The agency noted that quantitative easing should help reduce the risk of prolonged deflation in the Eurozone due to a weaker euro.

Emerging markets face increasing pressures due to the structural adjustment in China and recession in Russia and Brazil, the report showed. The growth in emerging economies is expected to be 3.6% in 2015 and 4.2% in 2016, according to the report.

-

18:01

European stocks close: stocks closed lower as concerns over Greece's debt problems weighed on markets

Stock indices closed lower as concerns over Greece's debt problems weighed on markets. The Greek government failed to reach an agreement with its creditors on Monday.

The consumer inflation in the Eurozone rose to an annual rate of -0.1% in March from -0.3% in February. Analysts had expected a 0.3% drop. Lower energy prices weighed on the consumer inflation.

Eurozone's unemployment rate fell to 11.3% in February from 11.4% in January. January's figure was revised down from 11.2%. Analysts had expected the unemployment rate to decline to 11.2%.

The number of unemployed people in Germany declined by 14,000 in March, exceeding expectations for a 10,000 decline, after a 20,000 drop in February.

Germany's adjusted unemployment rate was down to 6.4% in March from 6.5% in February. Analysts had expected the unemployment rate to remain unchanged 6.5%.

German adjusted retail sales fell 0.5% in February, beating forecasts of a 0.9% drop, after a 2.3% gain in January. January's figure was revised down from a 2.9% increase.

French consumer spending increased 0.1% in February, missing expectations for a 0.3% gain, after a 0.7% rise in January. January's figure was revised up from a 0.6% increase.

The gross domestic product in the U.K. rose 0.6% in the fourth quarter, up from a previous estimate of 0.5% gain, exceeding expectations for a 0.5% rise.

On a yearly basis, the U.K. GDP increased 3.0% in the fourth quarter, up from a previous estimate of 2.7% rise, exceeding expectations for a 2.7% gain.

The U.K. current account deficit narrowed to £18.5 billion in the fourth quarter from £27.7 billion in the third quarter. The third quarter's figure was revised down from a deficit of £27.0 billion. Analysts had expected the current account deficit to decrease to £21.2 billion.

Business Investment in the U.K. rose 0.9% in fourth quarter, after a 1.4% rise the previous quarter.

On a yearly basis, business Investment in the U.K. surged 3.7% in fourth quarter, after a 2.1% increase the previous quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,773.04 -118.39 -1.72 %

DAX 11,966.17 -119.84 -0.99 %

CAC 40 5,033.64 -49.88 -0.98 %

-

18:00

European stocks closed: FTSE 100 6,786.21 -105.22 -1.53 %, CAC 40 5,041.15 -42.37 -0.83 %, DAX 11,984.38 -101.63 -0.84 %

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed to lower against the most major currencies despite the mostly better-than-expected U.S. economic data

The U.S. dollar traded mixed to lower against the most major currencies despite the mostly better-than-expected U.S. economic data. The Conference Board's consumer confidence index for the U.S. jumped to 101.3 in March from 98.8 in February, beating expectations for a decline to 96.6. February's figure was revised up from 96.4.

The increase was driven by the better outlook for the labour market and incomes.

The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 46.3 in March from 45.8 in February, missing expectations for a rise to 52.5. The harsh weather and labour problems at West Coast ports weighed on the index.

The S&P/Case-Shiller home price index increased 4.6% in January, in line with expectations, after a 4.4% gain in December. December's figure was revised down from a 4.5% rise.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that the increase was driven by low interest rates and strong consumer confidence in the U.S.

The euro traded mixed against the U.S. dollar. Concerns over Greece's debt problems weighed on the euro. The Greek government failed to reach an agreement with its creditors on Monday.

The consumer inflation in the Eurozone rose to an annual rate of -0.1% in March from -0.3% in February. Analysts had expected a 0.3% drop. Lower energy prices weighed on the consumer inflation.

Eurozone's unemployment rate fell to 11.3% in February from 11.4% in January. January's figure was revised down from 11.2%. Analysts had expected the unemployment rate to decline to 11.2%.

The number of unemployed people in Germany declined by 14,000 in March, exceeding expectations for a 10,000 decline, after a 20,000 drop in February.

Germany's adjusted unemployment rate was down to 6.4% in March from 6.5% in February. Analysts had expected the unemployment rate to remain unchanged 6.5%.

German adjusted retail sales fell 0.5% in February, beating forecasts of a 0.9% drop, after a 2.3% gain in January. January's figure was revised down from a 2.9% increase.

French consumer spending increased 0.1% in February, missing expectations for a 0.3% gain, after a 0.7% rise in January. January's figure was revised up from a 0.6% increase.

The British pound traded higher against the U.S. dollar. The gross domestic product in the U.K. rose 0.6% in the fourth quarter, up from a previous estimate of 0.5% gain, exceeding expectations for a 0.5% rise.

On a yearly basis, the U.K. GDP increased 3.0% in the fourth quarter, up from a previous estimate of 2.7% rise, exceeding expectations for a 2.7% gain.

The U.K. current account deficit narrowed to £18.5 billion in the fourth quarter from £27.7 billion in the third quarter. The third quarter's figure was revised down from a deficit of £27.0 billion. Analysts had expected the current account deficit to decrease to £21.2 billion.

Business Investment in the U.K. rose 0.9% in fourth quarter, after a 1.4% rise the previous quarter.

On a yearly basis, business Investment in the U.K. surged 3.7% in fourth quarter, after a 2.1% increase the previous quarter.

The Canadian dollar rose against the U.S. dollar despite the weak Canadian GDP data. Canada's GDP decreased 0.1% in January, missing expectations for a 0.2% gain, after a 0.3% rise in December.

The decrease was driven by a decline the services sector. Service-sector output was down 0.3% in January. It was the first decline since February 2014.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the mixed economic data from New Zealand. The ANZ business confidence index for New Zealand climbed to 35.8 in February from 34.4 in January.

Building permits in New Zealand dropped 6.3% in February, after a 4.6% decline in January. January's figure was revised down from a 3.8% decrease.

The Australian dollar increased against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the mostly weak economic data from Australia. Australia's HIA new home sales climb 1.1% in February, after a 1.8% gain in January.

Private sector credit in Australia climbed 0.5% in February, in line with expectations, after a 0.6% increase in January.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after the housing starts data from Japan. Housing starts in Japan dropped 3.1% in February, beating expectations for a 7.0% fall, after a 13.0% rise in January.

-

17:04

Fed Richmond President Jeffrey Lacker: June will be “the appropriate time” to hike interest rate

The Fed Richmond President, Jeffrey Lacker, said on Tuesday that June will be "the appropriate time" to hike interest rate in the U.S. as labour market and other conditions continued to improve.

He noted that headline inflation is likely to recover toward 2% this year.

The Fed Richmond president also said that he has not decided if he will dissent in case the FOMC officials should vote not to hike interest rates in a June policy meeting.

Lacker is a voting member of the Federal Open Market Committee this year.

-

16:55

U.S. consumer confidence index soars to 101.3 in March

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index jumped to 101.3 in March from 98.8 in February, beating expectations for a decline to 96.6. February's figure was revised up from 96.4.

"Consumers' assessment of current conditions declined for the second consecutive month, suggesting that growth may have softened in Q1, and doesn't appear to be gaining any significant momentum heading into the spring months," the director of economic indicators at The Conference Board, Lynn Franco, said.

The increase was driven by the better outlook for the labour market and incomes. The Conference Board's consumer expectations index for the next six months rose to 96.0 in March from 90.0 in February.

The present conditions index fell to 109.1 in March from 112.1 in February.

-

16:31

Chicago purchasing managers' index slightly rise to 46.3 in March

The Institute for Supply Management released its Chicago purchasing managers' index on Tuesday. The index climbed to 46.3 in March from 45.8 in February, missing expectations for a rise to 52.5.

A reading below the 50 mark indicates contraction.

The harsh weather and labour problems at West Coast ports weighed on the index.

Only employment subindex was above 50, while production, new orders, order backlog and supplier deliveries were below 50.

-

16:02

S&P/Case-Shiller home price index rises 4.6% in January

The S&P/Case-Shiller home price index increased 4.6% in January, in line with expectations, after a 4.4% gain in December.

December's figure was revised down from a 4.5% rise.

Chairman of the index committee at S&P Dow Jones Indices David Blitzer said that the increase was driven by low interest rates and strong consumer confidence in the U.S.

"Home prices are rising roughly twice as fast as wages, putting pressure on potential homebuyers and heightening the risk that any uptick in interest rates could be a major setback," he added.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

-

16:00

U.S.: Consumer confidence , March 101.3 (forecast 96.6)

-

15:47

International Monetary Fund’s (IMF) Cofer (Currency Composition of Official Foreign Exchange Reserves) report: an outflow of central-bank funds from euros and into the U.S. dollar continued in the fourth quarter

According to preliminary data for the 4th quarter of 2014, many countries are diversifying their foreign exchange reserves, holding funds in other currencies beyond the U.S. dollar and the euro.

Source: http://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4

-

15:45

U.S.: Chicago Purchasing Managers' Index , March 46.3 (forecast 52.5)

-

15:41

Canada's GDP declines 0.1% in January

Statistics Canada released GDP (gross domestic product) data on Tuesday. Canada's GDP decreased 0.1% in January, missing expectations for a 0.2% gain, after a 0.3% rise in December.

The decrease was driven by a decline in the services sector. Service-sector output was down 0.3% in January. It was the first decline since February 2014.

Resource-sector output rose by 1.4% in January as oil-and-gas extraction climbed 2.6%.

Manufacturing output fell 0.7% in January.

-

15:37

U.S. Stocks open: Dow -0.48%, Nasdaq -0.37%, S&P -0.41%

-

15:24

Before the bell: S&P futures -0.46%, NASDAQ futures -0.34%

U.S. stock-index futures declined amid a retreat among energy companies.

Global markets:

Nikkei 19,206.99 -204.41 -1.05%

Hang Seng 24,900.89 +45.77 +0.18%

Shanghai Composite 3,749.07 -37.50 -0.99%

FTSE 6,783.2 -108.23 -1.57%

CAC 5,039.36 -44.16 -0.87%

DAX 11,967.59 -118.42 -0.98%

Crude oil $47.84 (-1.73%)

Gold $1185.60 (+0.07%)

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Tesla Motors, Inc., NASDAQ

TSLA

193.00

+1.28%

23.6K

Procter & Gamble Co

PG

82.60

-0.15%

0.6K

Google Inc.

GOOG

551.00

-0.19%

1K

AT&T Inc

T

32.90

-0.21%

9.4K

UnitedHealth Group Inc

UNH

120.75

-0.21%

34.1K

Cisco Systems Inc

CSCO

27.38

-0.22%

3.4K

General Electric Co

GE

25.04

-0.32%

18.0K

Intel Corp

INTC

31.36

-0.32%

3.5K

Verizon Communications Inc

VZ

48.96

-0.33%

0.7K

Apple Inc.

AAPL

125.93

-0.35%

223.6K

Johnson & Johnson

JNJ

101.17

-0.37%

0.1K

Ford Motor Co.

F

16.10

-0.37%

0.6K

Nike

NKE

100.51

-0.38%

0.6K

JPMorgan Chase and Co

JPM

60.72

-0.39%

12.0K

International Business Machines Co...

IBM

162.00

-0.41%

0.5K

Facebook, Inc.

FB

82.85

-0.41%

41.6K

Microsoft Corp

MSFT

40.79

-0.42%

12.3K

Amazon.com Inc., NASDAQ

AMZN

373.00

-0.42%

0.8K

Visa

V

65.37

-0.44%

2.7K

McDonald's Corp

MCD

97.40

-0.49%

2.9K

Walt Disney Co

DIS

105.60

-0.49%

5.3K

Yahoo! Inc., NASDAQ

YHOO

44.73

-0.49%

0.2K

Goldman Sachs

GS

190.06

-0.50%

1.8K

American Express Co

AXP

77.40

-0.50%

1.8K

Starbucks Corporation, NASDAQ

SBUX

95.50

-0.50%

2.5K

Pfizer Inc

PFE

34.82

-0.51%

0.9K

E. I. du Pont de Nemours and Co

DD

72.20

-0.52%

0.9K

Citigroup Inc., NYSE

C

51.35

-0.56%

8.0K

Boeing Co

BA

151.82

-0.58%

0.1K

General Motors Company, NYSE

GM

37.45

-0.61%

9.0K

Twitter, Inc., NYSE

TWTR

49.58

-0.62%

1.7K

Home Depot Inc

HD

113.91

-0.63%

0.2K

ALTRIA GROUP INC.

MO

50.20

-0.65%

3.4K

Travelers Companies Inc

TRV

108.88

-0.69%

0.1K

Caterpillar Inc

CAT

80.79

-0.71%

1.8K

Exxon Mobil Corp

XOM

85.00

-0.74%

10.1K

Wal-Mart Stores Inc

WMT

81.90

-0.76%

0.1K

Yandex N.V., NASDAQ

YNDX

15.18

-0.78%

2.1K

Chevron Corp

CVX

106.02

-0.82%

5.5K

ALCOA INC.

AA

12.84

-0.93%

41.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.06

-1.65%

10.8K

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

NIKE (NKE) target raised to $115 from $110 at Deutsche Bank; Buy

Apple (AAPL) target raised to $142 from $140 at RBC Capital Mkts; Outperform

-

15:01

U.S.: S&P/Case-Shiller Home Price Indices, y/y, January 4.6% (forecast 4.6%)

-

14:30

Canada: GDP (m/m) , January -0.1% (forecast 0.2%)

-

14:02

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's debt problems

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m February 1.8% 1.1%

00:00 New Zealand ANZ Business Confidence February 34.4 35.8

00:30 Australia Private Sector Credit, m/m February 0.6% 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y February 6.2% 6.2%

05:00 Japan Housing Starts, y/y February -13.0% -7.0% -3.1%

06:00 Germany Retail sales, real adjusted February 2.3% Revised From 2.9% -0.9% -0.5%

06:00 Germany Retail sales, real unadjusted, y/y February 5.0% Revised From 5.3% 3.7% 3.6%

06:45 France Consumer spending February 0.7% Revised From 0.6% 0.3% 0.1%

06:45 France Consumer spending, y/y February 2.6% 3.0%

07:55 Germany Unemployment Change March -20 -10 -14K

07:55 Germany Unemployment Rate s.a. March 6.5% 6.5% 6.4%

08:30 United Kingdom Business Investment, q/q Quarter IV -1.4% -0.9%

08:30 United Kingdom Business Investment, y/y Quarter IV 2.1% 3.7%

08:30 United Kingdom Current account, bln Quarter IV -27.7 -21.2 £-25.3B

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.5% 0.5% 0.6%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.7%` 2.7% 3.0%

09:00 Eurozone Unemployment Rate February 11.4% Revised From 11.2% 11.2% 11.3%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) March -0.3% -0.3% -0.1%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The S&P/Case-Shiller home price index is expected to rise by 4.6% in January, after a 4.5% gain in December.

The U.S. consumer confidence is expected to increase to 96.6 in March from 96.4 from February.

The Chicago purchasing managers' index is expected to climb to 52.5 in March from 45.8 in February.

The euro traded lower against the U.S. dollar as concerns over Greece's debt problems weighed on the euro. The Greek government failed to reach an agreement with its creditors on Monday.

The consumer inflation in the Eurozone rose to an annual rate of -0.1% in March from -0.3% in February. Analysts had expected a 0.3% drop. Lower energy prices weighed on the consumer inflation.

Eurozone's unemployment rate fell to 11.3% in February from 11.4% in January. January's figure was revised down from 11.2%. Analysts had expected the unemployment rate to decline to 11.2%.

The number of unemployed people in Germany declined by 14,000 in March, exceeding expectations for a 10,000 decline, after a 20,000 drop in February.

Germany's adjusted unemployment rate was down to 6.4% in March from 6.5% in February. Analysts had expected the unemployment rate to remain unchanged 6.5%.

German adjusted retail sales fell 0.5% in February, beating forecasts of a 0.9% drop, after a 2.3% gain in January. January's figure was revised down from a 2.9% increase.

French consumer spending increased 0.1% in February, missing expectations for a 0.3% gain, after a 0.7% rise in January. January's figure was revised up from a 0.6% increase.

The British pound traded higher against the U.S. dollar after the better-than-expected economic data from the U.K. The gross domestic product in the U.K. rose 0.6% in the fourth quarter, up from a previous estimate of 0.5% gain, exceeding expectations for a 0.5% rise.

On a yearly basis, the U.K. GDP increased 3.0% in the fourth quarter, up from a previous estimate of 2.7% rise, exceeding expectations for a 2.7% gain.

The U.K. current account deficit narrowed to £18.5 billion in the fourth quarter from £27.7 billion in the third quarter. The third quarter's figure was revised down from a deficit of £27.0 billion. Analysts had expected the current account deficit to decrease to £21.2 billion.

Business Investment in the U.K. rose 0.9% in fourth quarter, after a 1.4% rise the previous quarter.

On a yearly basis, business Investment in the U.K. surged 3.7% in fourth quarter, after a 2.1% increase the previous quarter.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian GDP data. Canada's GDP is expected to rise 0.2% in January, after a 0.3% gain in December.

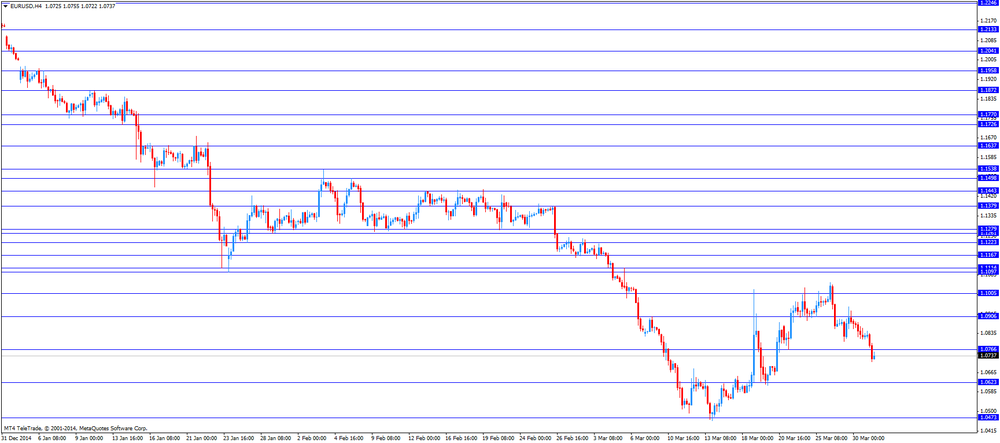

EUR/USD: the currency pair fell to $1.0712

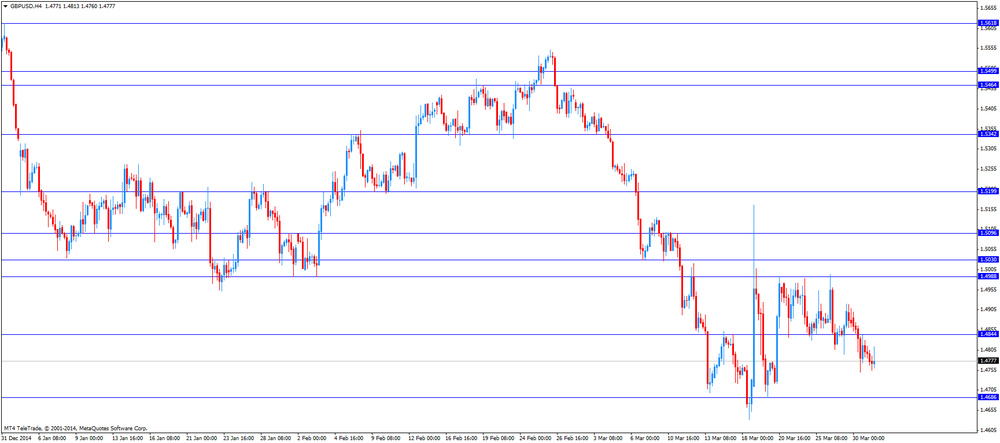

GBP/USD: the currency pair increased to $1.4813

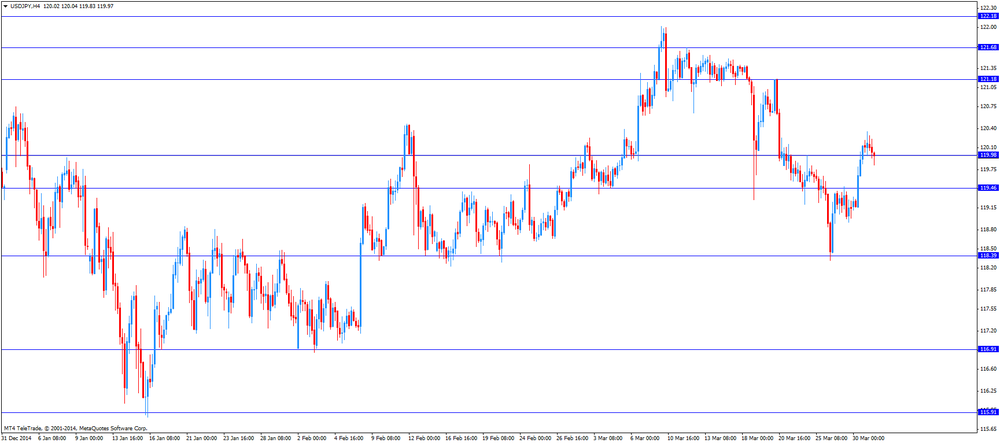

USD/JPY: the currency pair declined to Y119.83

The most important news that are expected (GMT0):

12:00 U.S. FOMC Member Laсker Speaks

12:30 Canada GDP (m/m) January 0.3% 0.2%

12:50 U.S. FOMC Member Dennis Lockhart Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January 4.5% 4.6%

13:45 U.S. Chicago Purchasing Managers' Index March 45.8 52.5

14:00 U.S. Consumer confidence March 96.4 96.6

20:30 U.S. API Crude Oil Inventories March 4.8

22:30 Australia AIG Manufacturing Index March 45.4

23:50 Japan BoJ Tankan. Manufacturing Index Quarter I 12 14

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter I 16 17

-

13:45

Orders

EUR/USD

Offers 1.1100 1.1050 1.0100 1.0950 1.0900 1.0860/50

Bids 1.0700 1.0660/55 1.0600/10

GBP/USD

Offers 1.4995/500 1.4950 1.4920 1.4900 1.4850/60

Bids 1.4725/20 1.4710/00 1.4685/80 1.4630

EUR/JPY

Offers 131.00 130.40/50 130.00

Bids 129.00 128.50 128.20/00 127.50

USD/JPY

Offers 122.05/00 121.70 121.20 121.00 120.50

Bids 119.50 118.90 118.65/60 118.35 118.00

EUR/GBP

Offers 0.7400 0.7385/90 0.7340

Bids 0.7265 0.7210/00

AUD/USD

Offers 0.7850 0.7825 0.7800 0.7780 0.7700 0.7665

Bids 0.7610/00 0.7590 0.7560 0.7500

-

13:22

Fed Vice Chairman Stanley Fischer: regulators must closely monitor the shadow banking sector

The Fed Vice Chairman Stanley Fischer said on Monday that non-bank companies and activities can also lead to financial instability. He noted that regulators must closely monitor the shadow banking sector.

Fischer offered some ideas how to regulate non-bank lenders. "To promote solvency, one could impose ratio-type capital requirements, such as leverage-ratio requirements or risk-based requirements," the Fed vice chairman said.

-

12:50

European stock markets mid-session: Indices decline on Greek worries

European stocks turn negative on Tuesday. Stalling negotiations between Greece and the E.U. weigh on the markets as the country is struggling to unlock more bailout funds. European stocks are still up for the best quarter in years fuelled by the ECB's quantitative easing program. A weak euro and falling energy prices further helped European indices to book gains.

Data on German Retail Sales (real adjusted) came in at -0.5%, declining less than the estimated -0.9%. The January reading was revised from 2.9% to 2.3%. Retail Sales (real unadjusted) declined year on year from revised 5.0% to 3.6%, growing at a slower pace than the predicted 3.7%.

French Consumer Spending rose less than expected in February. Data came in at 0.1% comaed to forecasts of 0.3% and a previous reading of 0.7%. Year on year consumer spending rose from 2.6% to 3.0%.

The Unemployment Rate in Germany, Europe's powerhouse and biggest economy of the Eurozone, fell to a record low in in March, the German labour agency reported today. The rate dropped from a previous reading of 6.5% in February to 6.4% in March - Analyst expected an unchanged reading. The number of unemployed people shrank by 15,000 to 2.8 million, more than the predicted decline by 10,000. The data clearly shows the positive momentum in Germany. The countries' businesses profit from a low euro boosting exports and low energy costs.

U.K.'s GDP for the fourth quarter rose more than estimated. Data came in at 0.6% compared to a previous reading of 0.5% and above the estimated unchanged reading. Year on year the GDP rose 3.0%, beating estimates of a flat reading of 2.7%.

Eurozone's Unemployment fell from 11.4% to 11.3%. Analyst expected the reading to be unchanged.

Eurozone's Harmonized CPI declined year on year with a reading of -0.1%, beating estimates of -0.3% for March.

The commodity heavy FTSE 100 index is currently trading -0.84% quoted at 6,833.24 points. Germany's DAX 30 is trading at 12,016.22 points -0.58%. The DAX has risen almost 23% in the first quarter - the most in a quarter since 2003. France's CAC 40 is currently trading at 5,073.35 points, -0.20%.

-

12:20

Gold set for a second straight month in negative territory

Gold is trading lower today - a third consecutive day - on track for a second straight month in negative territory. Gold is currently down 3% for the month. Gold prices were pushed lower by a stronger U.S. dollar as the precious metal becomes more expensive for holders of other currencies.

Gold is currently quoted at USD1,182.50, -0,26% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday the 17th of march gold traded as low as USD1,142.50, a three-month low.

-

12:00

Oil: prices continue to drop as Iran talks near end

Oil is trading lower for a third day as talks between western diplomats and officials from Iran are close to today's deadline. If the talks will reach an agreement over Iran's atomic program could result in an end of the embargo which would add to the global supply glut.

Today market participants will also closely watch data on API Crude Oil Inventories. Last week's inventories were reported at all-time highs.

Brent Crude lost -1.56% currently trading at USD55.41 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate dropped -1.75% currently quoted at USD47.83.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0700 (E323mn), $1.0800(E525mn), $1.1000(E504mn)

USD/JPY: Y118.00($1.0bn), Y120.00($945m), Y120.50($330mn)

EUR/JPY: Y128.50(E400mn)

EUR/GBP: Gbp0.7275-80(E785mn)

USD/CHF: Chf0.9540($620mn), Chf0.9600($764mn), Chf0.9800($624mn)

EUR/CHF: Chf1.0500(E307mn)

NZD/USD: $0.7550(NZ$1.36bn)

USD/CAD: C$1.2400(C$250mn)

-

11:15

German Unemployment Rate dropped to record low

The Unemployment Rate in Germany, Europe's powerhouse and biggest economy of the Eurozone, fell to a record low in in March, the German labour agency reported today. The rate dropped from a previous reading of 6.5% in February to 6.4% in March - Analyst expected an unchanged reading. The number of unemployed people shrank by 15,000 to 2.8 million, more than the predicted decline by 10,000. The data clearly shows the positive momentum in Germany. The countries' businesses profit from a low euro boosting exports and low energy costs.

Eurozone's Unemployment declined from 11.4% to 11.3%. Analyst expected the reading to be unchanged.

-

10:30

United Kingdom: Business Investment, q/q, Quarter IV -0.9%

-

10:30

United Kingdom: Business Investment, y/y, Quarter IV 3.7%

-

10:20

Press Review: Oil extends losses as deadline for Iran nuclear deal looms

BLOOMBERG

Melting Iron Ore Pressures RBA as April Rate Cut Now in Play

(Bloomberg) -- Australia's central bank is under intensifying pressure to cut interest rates next week as iron ore, the nation's biggest export, plunges to a decade low.

Traders' bets that the Reserve Bank of Australia will lower its cash rate by a quarter percentage point to a new record low of 2 percent have doubled to an 80 percent chance from 40 percent two weeks ago, swaps data compiled by Bloomberg show. Iron ore, which fell 47 percent last year, is headed for the biggest quarterly loss since at least 2009 as surging low-cost supplies swamp the global market while growth in demand from China slows.

A third of Australia's exports, or about 6 percent of gross domestic product, goes to China, and the majority of those shipments are iron ore. Kieran Davies of Barclays Bank plc estimates the fall in commodity prices means Australia's real exchange rate was 4 percent overvalued this quarter, prompting him to bring forward his rate-cut forecast to April from May.

REUTERS

Oil extends losses as deadline for Iran nuclear deal looms

(Reuters) - Oil futures extended losses on Tuesday, as Iran and six world powers ramped up the pace of negotiations to reach a preliminary deal that could ease sanctions and allow more Iranian crude onto world markets.

With a deadline less than 24 hours away, United States, Britain, France, Germany, Russia and China were trying to break an impasse in negotiations aimed at stopping Iran from having the capacity to develop a nuclear bomb, in exchange for an easing of international sanctions.

Officials said talks on a framework accord, which is intended as a prelude to a comprehensive agreement by the end of June, could yet fall apart over disagreements on enrichment research and the pace of lifting sanctions.

Source: http://www.reuters.com/article/2015/03/31/us-markets-oil-idUSKBN0MR07I20150331

REUTERS

Major European share indexes on track for best quarter in years

LONDON, March 31 (Reuters) - European shares extended gains on Tuesday and headed for their best quarterly performance in several years, with Kingfisher leading the market higher after announcing it planned to sell about 60 B&Q stores in Britain.

Shares in Europe's biggest home-improvement retailer were up nearly 5 percent after it said it would close the stores, part of new Chief Executive Veronique Laury's plan to shake up the group.

"The new Chief Executive's transformation plan sounds promising, and these results underline why it is necessary. The reaction to the company's ambitious plans has been positive in early trade and adds to the company's recent share price rise," said Richard Hunter, head of equities at Hargreaves Lansdown Stockbrokers.

Source: http://www.reuters.com/article/2015/03/31/markets-stocks-europe-idUSL6N0WX1FW20150331

-

10:00

European stock markets First hour: Indices open steady to higher – focus on Greece and German/French data

European stocks open steady to higher on Tuesday. Stalling negotiations between Greece and the E.U. weigh on the markets as the country is struggling to unlock more bailout funds.

Data on German Retail Sales (real adjusted) came in at -0.5%, declining less than the estimated -0.9%. The January reading was revised from 2.9% to 2.3%. Retail Sales (real unadjusted) declined year on year from revised 5.0% to 3.6%, growing at a slower pace than the predicted 3.7%.

French Consumer Spending rose less than expected in February. Data came in at 0.1% compared to forecasts of 0.3% and a previous reading of 0.7%. Year on year consumer spending rose from 2.6% to 3.0%.

Data from Germany, Eurozone's biggest economy, on the Unemployment Change showed a decline by -14,000 in March. Analysts expected a decline by -10,000. The Unemployment Rate came in lower-than expected at 6.4% compared to estimates and a previous reading of 6.5%.

The commodity heavy FTSE 100 index is currently trading +0.11% quoted at 6,898.93 points. Germany's DAX 30 is trading at 12,068.73 points -0.14%. The DAX has risen almost 23% in the first quarter - the most in a quarter since 2003. France's CAC 40 is currently trading at 5,087.65 points, +0.08%.

-

09:00

Global Stocks: Wall Street rallies

U.S. stocks rallied on Tuesday rebounding from last week's sharp losses. The S&P 500 closed +1.22% with a final quote of 2,086.24 points. The DOW JONES index added +1.49%, closing at 17,976.31 points - re-approaching the psychologically important 18,000 points mark.

Chinese stocks were trading mixed. Hong Kong's Hang Seng is currently trading +0.25% at 24,917.80 points. China's Shanghai Composite declined moderately to 3,780.14 points closing-0.17%. After the recent strong rally Chinese indices are seen overbought by many investors.

The Nikkei dropped on Tuesday after booking gains early in the session still ending the month in positive territory - a third month in a row. Shares were sold on profit taking at the end of the quarter. The index declined by -1.05% closing at 19,206.99 points.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly higher against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m February 1.8% 1.1%

00:00 New Zealand ANZ Business Confidence February 34.4 35.8

00:30 Australia Private Sector Credit, m/m February 0.6% 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y February 6.2% 6.2%

01:30 Japan Labor Cash Earnings, YoY February 1.3% 0.7% delayed

05:00 Japan Housing Starts, y/y February -13.0% -7.0% -3.1%

06:00 Germany Retail sales, real adjusted February 2.9% -0.9% -0.5%

06:00 Germany Retail sales, real unadjusted, y/y February 5.3% 3.7% 3.6%

06:45 France Consumer spending February 0.6% 0.3%

06:45 France Consumer spending, y/y February 2.6%

The U.S. dollar is trading broadly higher against its major peers in the absence of major economic news for the region. FED Vice Chairman Stanley Fischer did not comment on the FED's rate policy.

The Australian dollar declined against the U.S. dollar for a sixth day. HIA New Home Sales for February declined from a previous reading of 1.8% to 1.1%. Private Sector Credit was in line with expectations and rose by 0.5% with a January reading of 0.6%. Year on year Private Sector Credit was unchanged at 6.2%.

New Zealand's dollar booked losses against the greenback during the Asian It's the sixth day of straight losses. The ANZ Business Confidence Index for February rose from 34.4 to 35.8.

The Japanese yen is trading almost flat to lower against the greenback. Japan Labor Cash Earnings were not reported and will be delayed due to a calculation issue. Housing Starts declined -3.1% year on year with a previous reading of -13.0%. Analysts expected a decline by -7.0%.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded moderately higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:55 Germany Unemployment Change March -20 -10

07:55 Germany Unemployment Rate s.a. March 6.5% 6.5%

08:30 United Kingdom Business Investment, q/q Quarter IV -1.4%

08:30 United Kingdom Business Investment, y/y Quarter IV 2.1%

08:30 United Kingdom Current account, bln Quarter IV -27.0 -21.2

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.5% 0.5%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.7%` 2.7%

09:00 Eurozone Unemployment Rate February 11.2% 11.2%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) March -0.3% -0.3%

12:00 U.S. FOMC Member Laсker Speaks

12:30 Canada GDP (m/m) January 0.3% 0.2%

12:50 U.S. FOMC Member Dennis Lockhart Speaks

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y January 4.5% 4.6%

13:45 U.S. Chicago Purchasing Managers' Index March 45.8 52.5

14:00 U.S. Consumer confidence March 96.4 96.6

20:30 U.S. API Crude Oil Inventories March 4.8

22:30 Australia AIG Manufacturing Index March 45.4

23:50 Japan BoJ Tankan. Manufacturing Index Quarter I 12 14

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter I 16 17

-

08:16

Options levels on tuesday, March 31, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0937 (3456)

$1.0884 (2670)

$1.0840 (1235)

Price at time of writing this review: $1.0783

Support levels (open interest**, contracts):

$1.0750 (7058)

$1.0718 (3528)

$1.0681 (3031)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 69190 contracts, with the maximum number of contracts with strike price $1,1000 (4933);

- Overall open interest on the PUT options with the expiration date April, 2 is 83488 contracts, with the maximum number of contracts with strike price $1,0600 (7859);

- The ratio of PUT/CALL was 1.21 versus 1.22 from the previous trading day according to data from March, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5001 (1040)

$1.4903 (1393)

$1.4808 (685)

Price at time of writing this review: $1.4780

Support levels (open interest**, contracts):

$1.4697 (2076)

$1.4599 (1277)

$1.4500 (573)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 26842 contracts, with the maximum number of contracts with strike price $1,5100 (1626);;

- Overall open interest on the PUT options with the expiration date April, 2 is 29133 contracts, with the maximum number of contracts with strike price $1,5050 (2330);

- The ratio of PUT/CALL was 1.09 versus 1.06 from the previous trading day according to data from March, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: Retail sales, real adjusted , February -0.5% (forecast -0.9%)

-

08:02

Germany: Retail sales, real unadjusted, y/y, February 3.6% (forecast 3.7%)

-

07:02

Japan: Housing Starts, y/y, February -3.1% (forecast -7.0%)

-

04:01

Nikkei 225 19,456.84 +45.44 +0.23 %, Hang Seng 25,034.54 +179.42 +0.72 %, Shanghai Composite 3,822.99 +36.42 +0.96 %

-

02:33

Australia: Private Sector Credit, y/y, February 6.2%

-

02:32

Australia: Private Sector Credit, m/m, February 0.5% (forecast 0.5%)

-

02:02

New Zealand: ANZ Business Confidence, February 35.8

-

02:02

Australia: HIA New Home Sales, m/m, February 1.1%

-

01:05

United Kingdom: Gfk Consumer Confidence, March 4 (forecast 1)

-

00:33

Commodities. Daily history for Mar 30’2015:

(raw materials / closing price /% change)

Oil 48.68 -0.39%

Gold 1,185.30 +0.04%

-

00:32

Stocks. Daily history for Mar 30’2015:

(index / closing price / change items /% change)

Nikkei 225 19,411.4 +125.77 +0.65 %

Hang Seng 24,855.12 +368.92 +1.51 %

S&P/ASX 200 5,846.09 -73.85 -1.25 %

Shanghai Composite 3,787.69 +96.60 +2.62 %

FTSE 100 6,891.43 +36.41 +0.53 %

CAC 40 5,083.52 +49.46 +0.98 %

Xetra DAX 12,086.01 +217.68 +1.83 %

S&P 500 2,086.24 +25.22 +1.22 %

NASDAQ Composite 4,947.44 +56.22 +1.15 %

Dow Jones 17,976.31 +263.65 +1.49 %

-

00:31

Currencies. Daily history for Mar 30’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0823 -0,55%

GBP/USD $1,4799 -0,49%

USD/CHF Chf0,9675 +0,57%

USD/JPY Y120,11 +0,81%

EUR/JPY Y130,01 +0,22%

GBP/JPY Y177,76 +0,32%

AUD/USD $0,7650 -1,29%

NZD/USD $0,7490 -1,04%

USD/CAD C$1,2681 +0,58%

-