Noticias del mercado

-

22:12

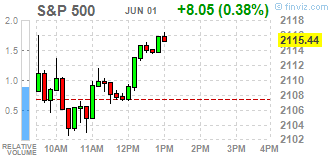

Major US stock indexes rose slightly

Major US stock indexes rose slightly, investors evaluate US economic data against the background of the general economic recovery.

For example, a report published by the Institute for Supply Management (ISM), showed that in May manufacturing activity in the US has improved, beating forecasts for a slight improvement. PMI index for the US manufacturing in May was 52.8 points versus 51.5 points in April. The latter value was higher than the estimates of experts - is expected to increase to 52.0 points. Opinion about the strength of economic recovery remains mixed, as, ultimately, the Federal Reserve may raise interest rates.

In addition, construction spending in the US rose significantly in April, thus reaching its highest level in more than six years, which helped increase in the sector of housing, non-residential construction and government projects. According to the Ministry of Trade, the results of April construction spending increased by 2.2% (seasonally adjusted), while amounting to $ 1 trillion. (Up to November 2008). We also add the figure for March was revised upward - up to + 0.5% from -0.6%. Experts expect that the cost will increase by 0.8%.

It should also be noted that oil prices fell in today's trading, which was caused by the growth of the US dollar and expectations that oil production by OPEC will remain high. Analysts point out that at the meeting on Friday, the Organization of Petroleum Exporting Countries (OPEC) is likely to decide not to reduce production. According to a May report by oil production in the OPEC in April increased by 18 million barrels - up to 30.84 million barrels per day.

Almost all components of the index DOW closed in positive territory (17 of 30). Outsider shares were Intel Corporation (INTC, -1.65%). Most remaining shares rose Microsoft Corporation (MSFT, + 0.90%).

Almost all sectors of the S & P closed in the positive zone. Most of the services sector grew (+ 0.4%). Outsiders were conglomerates sector (-0.8%).

At the close:

Dow + 0.16% 18,040.37 +29.69

Nasdaq + 0.25% 5,082.93 +12.90

S & P + 0.21% 2,111.73 +4.34

-

21:00

Dow +0.45% 18,091.95 +81.27 Nasdaq +0.49% 5,094.85 +24.82 S&P +0.47% 2,117.33 +9.94

-

20:29

American focus: the dollar rose against most major currencies

The US dollar appreciated strongly against the euro, while returning to a session high, which was associated with the publication of positive statistics on business activity in the manufacturing sector. The Markit reported that activity in the US manufacturing sector continued to grow in May - the final PMI index was 54.0 against preliminary level of 53.8 and 54.1 index in late April. "The data for May point to a further strong recovery of industrial production growth in the US, but the pace of new orders slowed to its lowest level since the beginning of 2014," - noted in the Markit.

Meanwhile, a report published by the Institute for Supply Management (ISM), showed that in May manufacturing activity in the US has improved, beating forecasts for a slight improvement. PMI index for the US manufacturing in May was 52.8 points versus 51.5 points in April. Expected to increase to 52.0 points. Sub-indices showed themselves as follows: employment index rose in May to 51.7 against 48.3 in April, the price index improved to 49.5 from 40.5, the index of inventories rose to 51.5 from 49.5, the index of production It fell to 54.5 from 56.0 and the new orders index rose to 55.8 from 53.5.

The pound fell markedly against the dollar, approaching to the lowest since May 7, against the background of data on manufacturing activity in Britain and upbeat statistics .Napomnim US, growth in the UK manufacturing sector improved less than expected in May, due to a modest expansion of output and new orders, showed the survey data from Markit Economics on Monday. The index of purchasing managers by Markit / Chartered Institute of Purchasing and Supply rose slightly to 52.0 in May from 51.8 in April, which was revised up from 51.9. Economists had expected the figure will be 52.5 for the month. Any reading above 50 indicates expansion in the sector. Industrial production increased at a slower pace in May, but the pace of the weakening was less severe than a sharp slowdown in April, led by strong domestic demand. New orders also rose in May, but the growth rate was better than the 7-month low in the previous month. Manufacturers increased employment twenty-fifth consecutive month in May, although the growth rate was only minor. On the price front, the purchase prices fell again in May, which was due to lower costs for raw materials. Meanwhile, sales prices increased for the first time in five months in May.

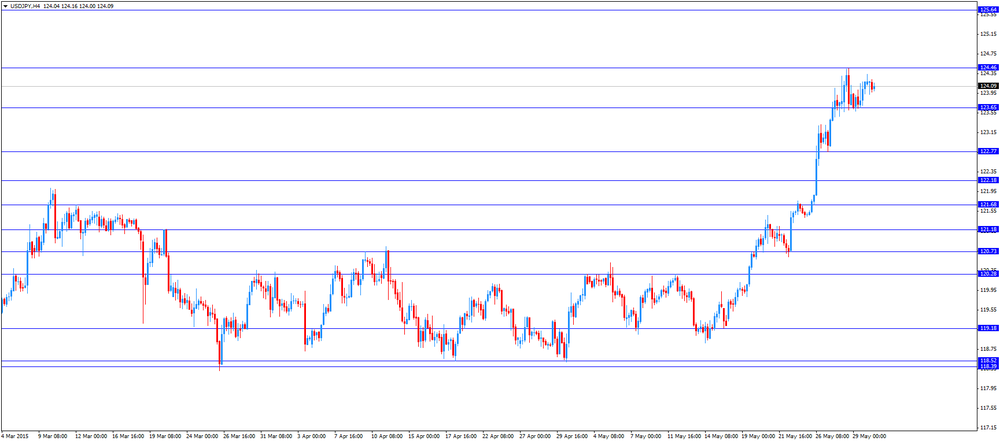

The yen depreciated substantially against the US dollar, almost reaching Y125.00. Analysts say that the pair was caused by the strong performance of manufacturing activity and construction spending in the United States. Recall, construction spending in the US rose significantly in April, thus reaching its highest level in more than six years, which helped increase in the sector of housing, non-residential construction and government projects. The Commerce Department said: the results of April construction spending increased by 2.2 percent (seasonally adjusted), while reaching $ 1 trillion. (Up to November 2008). We also add the figure for March was revised upward - up to 0.5 percent from 0.6 percent. Experts expect that the cost will increase by 0.8 percent. The report said the April change was due to the rising costs of housing construction (0.6 percent) and non-residential activities, such as office buildings, hotels and shopping centers (3.1 percent). Meanwhile, spending on government projects rose by 3.3 percent, reflecting the biggest jump in the sector for three years and offset the decline in federal government spending by 3.6 percent.

-

20:27

WSE: Session Results

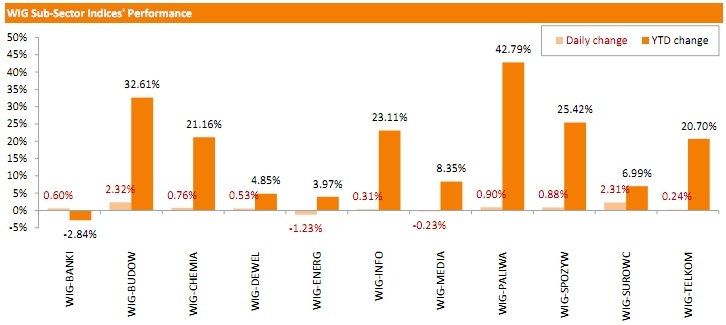

Polish equity market recorded a marginal rise on Monday. The broad market benchmark - the WIG index added 0.13%. Sector-wise, utilities and media sectors were the only decliners, with corresponding measures - the WIG-ENERG index and the WIG-MEDIA index dropping by 1.23% and 0.23% respectively.

The large-cap stocks measure - the WIG30 index underperformed the broad market indicator, inching down 0.02%. Clothing retailer LPP (WSE: LPP) led the decliners, losing 5.53% on repot the company's May gross margin fell 10pp Y/Y. The news the insurer PZU (WSE: PZU) agreed to buy a 25% stake in the banking name ALIOR (WSE: ALR) to build a top-five banking group in Poland dragged down the quotations of both companies: the former lost 2.72% on fears the company's plans may limit its dividend payout, while the latter fell by 1.02% as the agreed deal value indicated a price tag of PLN 89.25 per share compared to the bank's closing price on Friday of PLN 92.96. Besides, notable losses were generated by PGE (WSE: PGE; -1.95%), HANDLOWY (WSE: BHW; -1.47%) and ING BSK (WSE: ING; -1.38%). At the same time, BZ WBK (WSE: BZW) outperformed, advancing 3.44%. It was followed by KGHM (WSE: KGH), gaining 2.82% on the back of higher copper prices. GTC (WSE: GTC) went up by 2.45% as the WSE announced requirements for the company for its stock to be withdrawn from the market. The action is aimed to protect the rights of minority shareholders.

-

19:09

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday, as investors digested a slew of data that sent a mixed picture on the pace of the economy's recovery. Data from ISM showed the pace of manufacturing growth rose in May. Other data showed construction spending surged in April, but consumer spending was unexpectedly flat. The data left investor's with mixed thoughts about the strength of the economy's recovery and, ultimately, when the Federal Reserve will raise interest rates.

Most of Dow stocks in positive area (20 of 30). Top looser - Intel Corporation (INTC, -1.36%). Top gainer - Microsoft Corporation (MSFT, +1.25%).

Most of S&P index sectors also in positive area. Top gainer - Services (+0,4%). Top looser - Basic Materials (-0.7%).

At the moment:

Dow 18065.00 +56.00 +0.31%

S&P 500 2112.75 +6.75 +0.32%

Nasdaq 100 4529.00 +18.00 +0.40%

10-year yield 2.18% +0.08

Oil 59.55 -0.75 -1.24%

Gold 1191.00 +1.20 +0.10%

-

18:00

European stocks closed: FTSE 100 6,953.58 -30.85 -0.44% CAC 40 5,025.3 +17.41 +0.35% DAX 11,436.05 +22.23 +0.19%

-

18:00

European stocks close: stocks closed mixed on mixed economic data from the Eurozone and as the Greek debt crisis weighed on markets

Stock indices closed mixed on mixed economic data from the Eurozone and as the Greek debt crisis weighed on markets. German preliminary consumer price index rose 0.1% in May, in line with expectations, after a flat reading in April.

The increase was driven by higher energy, food and services costs.

On a yearly basis, German preliminary consumer price index increased to 0.7% in May from 0.5% in April, in line with expectations. It was the highest level since October 2014.

Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in May from 52.0 in April, down from a preliminary reading of 52.3.

Spain, the Netherlands and Italy were strongest performers.

Markit's Chief Economist Chris Williamson said that Spain and Italy benefited in particular from exports.

Germany's final manufacturing PMI decreased to 51.1 in May from 52.1 in April, down from a preliminary reading of 51.4.

France's final manufacturing PMI climbed to 49.4 in May from 48.0 in April, up a preliminary reading of 49.3.

The Greek debt crisis also weighed on markets. Greece have to repay €300 million IMF loans this week but a new debt deal between Greece and its creditors is not reached yet.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.0 in May from 51.8 in April, missing expectations for a rise to 52.5. April's figure was revised down from 51.9.

The increase was driven by rises in output and new orders.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,953.58 -30.85 -0.44 %

DAX 11,436.05 +22.23 +0.19 %

CAC 40 5,025.3 +17.41 +0.35 %

-

17:42

Oil prices traded lower on the stronger U.S. dollar and on concerns that OPEC keeps unchanged its oil production

Oil prices traded lower on the stronger U.S. dollar and on concerns that OPEC keeps unchanged its oil production. The U.S. dollar traded higher against the most major currencies as the U.S. manufacturing activity increased in May. The Institute for Supply Management's manufacturing purchasing managers' index for the U.S. climbed to 52.8 in May from 51.5 in April, exceeding expectations for a gain to 52.0. It was the highest level since February.

Investors are awaiting OPEC's meeting on June 05. It is expected that OPEC keeps unchanged its oil production.

WTI crude oil for July delivery declined to $59.52 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $64.53 a barrel on ICE Futures Europe.

-

17:23

Gold price traded higher on the Greek debt problem

Gold price traded higher on the weak U.S. consumer spending and on comments by Boston Fed President Eric Rosengren. Personal spending was flat in April, missing expectations for 0.2% gain, after a 0.5% increase in March. March's figure was revised up from a 0.4% rise.

Consumer spending makes more than two-thirds of U.S. economic activity.

Consumers cut back on purchases. The saving rate rose to 5.6% in April from 5.2% in March.

Personal income increased 0.4% in April, exceeding expectations for a 0.3% rise, after a flat reading in March.

The increase in personal pending was driven by a rise in in wages and salaries, which climbed 0.2% in April.

Boston Fed President Eric Rosengren said on Monday that it is not right time for hiking interest rate.

"The data have disappointed before, and an appropriately data-dependent monetary policy requires confirmation in the numbers, not just in forecasts of better times," Rosengren said.

The Greek debt crisis also supported gold price. Greece have to repay €310 million IMF loans this week but a new debt deal between Greece and its creditors is not reached yet.

June futures for gold on the COMEX today rose to 1200.10 dollars per ounce.

-

17:12

Boston Fed President Eric Rosengren: it is not right time for hiking interest rate

Boston Fed President Eric Rosengren said on Monday that it is not right time for hiking interest rate.

"The conditions for beginning the tightening of monetary policy have not yet been met," Rosengren said.

Boston Fed president noted that there is only a little sign of a rebound.

"The data have disappointed before, and an appropriately data-dependent monetary policy requires confirmation in the numbers, not just in forecasts of better times," Rosengren said.

Rosengren is not a voting member of the Federal Open Market Committee this year.

-

16:55

ISM manufacturing purchasing managers’ index climbs to 52.8 in May

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index climbed to 52.8 in May from 51.5 in April, exceeding expectations for a gain to 52.0. It was the highest level since February.

A reading above 50 indicates expansion, below indicates contraction.

The increase was driven by a rise in the employment index, which rose to 51.7 in May from 48.3 in April.

The production index dropped to 54.5 in May from 56.0 in April.

The new orders index was up to 55.8 in May from 53.5 in April.

The prices paid index increased to 49.5 in May from 40.5 in April.

-

16:51

ISM manufacturing purchasing managers’ index climbs to 53.5 in June

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 53.5 in June from 52.8 in May, exceeding expectations for a gain to 53.1. It was the highest level since January.

A reading above 50 indicates expansion, below indicates contraction.

The increase was driven by higher employment in the manufacturing sector. The employment index climbed to 55.5 in June from 51.7 in May.

The production index fell to 54.0 in June from 54.5 in May.

The new orders index was up to 56.0 in June from 55.8 in May.

The prices paid index remained unchanged at 49.5 in June.

-

16:31

Construction spending in the U.S. jumps 2.2% in April

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. rose 2.2% in April, exceeding expectations for a 0.8% gain, after a 0.5% increase in March. It was the highest rise since May 2012.

March's figure was revised up from a 0.6% decrease.

The rise was driven by an increase in private and public construction. Private construction spending gained 1.8% in April. It was the highest level since October 2008.

Public construction spending jumped 3.3% due to higher spending on state and local government projects.

-

16:14

U.S. final manufacturing purchasing managers' index (PMI) declines to 54.0 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) fell to 54.0 in May from 54.1 in April, beating the previous estimate of a decline to 53.8.

A reading above 50 indicates expansion in economic activity.

The decline was driven by lower new orders. The final new orders index slid to 54.3 in May from 55.3 in April. It was the lowest level since January 2014.

The Markit Chief Economist Chris Williamson said that lower new orders "provides further evidence that the strong dollar is hurting the economy".

-

16:00

U.S.: Construction Spending, m/m, April 2.2% (forecast 0.8%)

-

15:45

U.S.: Manufacturing PMI, May 54.0 (forecast 53.8)

-

15:34

U.S. Stocks open: Dow +0.47%, Nasdaq +0.46%, S&P +0.37%

-

15:32

German consumer price inflation rises 0.1% in May

Destatis released its consumer price data for Germany on Monday. German preliminary consumer price index rose 0.1% in May, in line with expectations, after a flat reading in April.

The increase was driven by higher energy, food and services costs.

On a yearly basis, German preliminary consumer price index increased to 0.7% in May from 0.5% in April, in line with expectations. It was the highest level since October 2014.

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0925(E649mn), $1.1000(E641mn), $1.1030(E359mn), $1.1050(E259mn)

USD/JPY: Y122.00($1.17bn), Y124.50($1.5bn)

EUR/JPY: Y135.00(E203mn)

GBP/USD: $1.5300(Gbp673mn)

AUD/USD: $0.7550(A$800mn), $0.7575(A$660mn), $0.7600(A$731mn), $0.7625(A$1.54bn), $0.7650(A$325mn)

AUD/JPY: Y96.15(A$842mn)

USD/CAD: C$1.2490($900mn), C$1.2600($500mn)

-

15:28

Before the bell: S&P futures +0.28%, NASDAQ futures +0.47%

U.S. stock-index futures rose amid optimism on progress in Greece's debt talks and before data on manufacturing activity.

Global markets:

Nikkei 20,569.87 +6.72 +0.03%

Hang Seng 27,597.16 +172.97 +0.63%

Shanghai Composite 4,829.44 +217.70 +4.72%

FTSE 6,985.07 +0.64 +0.01%

CAC 5,043.05 +35.16 +0.70%

DAX 11,442.5 +28.68 +0.25%

Crude oil $60.00 (-0.50%)

Gold $1190.60 (+0.21%)

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALTRIA GROUP INC.

MO

51.26

+0.12%

3.6K

General Electric Co

GE

27.31

+0.15%

33.4K

Hewlett-Packard Co.

HPQ

33.45

+0.15%

0.7K

3M Co

MMM

159.33

+0.16%

0.1K

FedEx Corporation, NYSE

FDX

173.52

+0.17%

1.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.69

+0.20%

32.7K

Chevron Corp

CVX

103.23

+0.22%

0.3K

Exxon Mobil Corp

XOM

85.39

+0.22%

1.9K

International Business Machines Co...

IBM

170.05

+0.24%

1.3K

Nike

NKE

101.92

+0.25%

0.2K

Merck & Co Inc

MRK

61.04

+0.25%

0.3K

Verizon Communications Inc

VZ

49.57

+0.26%

0.5K

Procter & Gamble Co

PG

78.60

+0.27%

13.1K

Amazon.com Inc., NASDAQ

AMZN

430.37

+0.27%

3.7K

Tesla Motors, Inc., NASDAQ

TSLA

251.50

+0.28%

12.2K

E. I. du Pont de Nemours and Co

DD

71.22

+0.30%

3.6K

American Express Co

AXP

79.97

+0.31%

1.9K

AT&T Inc

T

34.65

+0.32%

16.9K

McDonald's Corp

MCD

96.24

+0.32%

0.1K

ALCOA INC.

AA

12.54

+0.32%

35.1K

Caterpillar Inc

CAT

85.63

+0.36%

1.6K

Johnson & Johnson

JNJ

100.50

+0.36%

3.7K

Facebook, Inc.

FB

79.48

+0.37%

57.4K

Twitter, Inc., NYSE

TWTR

36.81

+0.38%

18.6K

Google Inc.

GOOG

534.22

+0.40%

1.8K

Pfizer Inc

PFE

34.90

+0.43%

4.4K

JPMorgan Chase and Co

JPM

66.07

+0.44%

1.1K

Wal-Mart Stores Inc

WMT

74.60

+0.44%

8.0K

Apple Inc.

AAPL

130.90

+0.48%

157.9K

General Motors Company, NYSE

GM

36.15

+0.50%

24.0K

Visa

V

69.03

+0.51%

13.0K

Home Depot Inc

HD

112.00

+0.52%

4.7K

Yahoo! Inc., NASDAQ

YHOO

43.17

+0.55%

2.5K

Ford Motor Co.

F

15.26

+0.59%

54.7K

Starbucks Corporation, NASDAQ

SBUX

52.28

+0.62%

12.9K

Intel Corp

INTC

34.68

+0.64%

14.4K

Cisco Systems Inc

CSCO

29.50

+0.65%

20.4K

The Coca-Cola Co

KO

41.23

+0.66%

28.1K

Boeing Co

BA

141.47

+0.68%

0.1K

Walt Disney Co

DIS

111.27

+0.82%

25.4K

Citigroup Inc., NYSE

C

54.72

+1.18%

82.3K

Microsoft Corp

MSFT

46.86

0.00%

16.9K

United Technologies Corp

UTX

117.17

0.00%

7.7K

HONEYWELL INTERNATIONAL INC.

HON

104.20

0.00%

0.4K

International Paper Company

IP

51.83

0.00%

7.3K

Yandex N.V., NASDAQ

YNDX

18.00

-0.17%

0.7K

Barrick Gold Corporation, NYSE

ABX

11.81

-0.42%

1.5K

-

15:03

U.S. personal spending is flat in April

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending was flat in April, missing expectations for 0.2% gain, after a 0.5% increase in March. March's figure was revised up from a 0.4% rise.

Consumer spending makes more than two-thirds of U.S. economic activity.

Consumers cut back on purchases. The saving rate rose to 5.6% in April from 5.2% in March.

Personal income increased 0.4% in April, exceeding expectations for a 0.3% rise, after a flat reading in March.

The increase in personal spending was driven by a rise in in wages and salaries, which climbed 0.2% in April.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in April, missing forecasts of a 0.2% increase, after a 0.1% gain in March.

On a yearly basis, the PCE price index excluding food and index increased 1.2% in April, after a 1.3% gain in March.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Citigroup (C) upgraded from Neutral to Buy at Goldman, tarhet raised from $57 to $61

Downgrades:

Other:

-

14:41

Swiss manufacturing PMI rises to 49.4 in May

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The Swiss manufacturing PMI rose to 49.4 in May from 47.9 in April, exceeding expectations for an increase to 48.4.

The increase was driven by a rise in backlog of orders.

"Industrial momentum appears to have only marginally slowed," the report said.

-

14:31

U.S.: PCE price index ex food, energy, Y/Y, April 1.2%

-

14:30

U.S.: Personal spending , April 0.0% (forecast 0.2%)

-

14:30

U.S.: Personal Income, m/m, April 0.4% (forecast 0.3%)

-

14:30

U.S.: PCE price index ex food, energy, m/m, April 0.1% (forecast 0.2%)

-

14:25

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m May 0.3% 0.3%

01:00 China Non-Manufacturing PMI May 53.4 53.2

01:00 China Manufacturing PMI May 50.1 50.2 50.2

01:30 Australia Company Gross Profits QoQ Quarter I -0.4% Revised From -0.2% 0.5% 0.2%

01:30 Australia Building Permits, m/m April 2.9% Revised From 2.8% -2% -4.4%

01:35 Japan Manufacturing PMI (Finally) May 49.9 50.9 50.9

01:45 China HSBC Manufacturing PMI (Finally) May 48.9 49.1 49.2

07:30 Switzerland Manufacturing PMI May 47.9 48.4 49.4

07:50 France Manufacturing PMI (Finally) May 48.0 49.3 49.4

07:55 Germany Manufacturing PMI (Finally) May 52.1 51.4 51.1

08:00 Eurozone Manufacturing PMI (Finally) May 52.0 52.3 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 51.8 Revised From 51.9 52.5 52.0

12:00 Germany CPI, m/m (Preliminary) May 0.0% 0.1% 0.1%

12:00 Germany CPI, y/y (Preliminary) May 0.5% 0.7% 0.7%

The U.S. dollar traded mixed against the most major currencies ahead of U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.2% in April, after a 0.1 rise in March.

Personal income in the U.S. is expected to rise 0.3% in April, after a flat reading in March.

Personal spending in the U.S. is expected to gain 0.2% in April, after a 0.4% increase in March.

The ISM manufacturing purchasing managers' index is expected to climb to 52.0 in May from 51.5 in March.

The euro traded mixed against the U.S. dollar after mixed economic data from the Eurozone. German preliminary consumer price index rose 0.1% in May, in line with expectations, after a flat reading in April.

On a yearly basis, German preliminary consumer price index increased to 0.7% in May from 0.5% in April, in line with expectations.

Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in May from 52.0 in April, down from a preliminary reading of 52.3.

Spain, the Netherlands and Italy were strongest performers.

Markit's Chief Economist Chris Williamson said that Spain and Italy benefited in particular from exports.

Germany's final manufacturing PMI decreased to 51.1 in May from 52.1 in April, down from a preliminary reading of 51.4.

France's final manufacturing PMI climbed to 49.4 in May from 48.0 in April, up a preliminary reading of 49.3.

The Greek debt crisis also weighed on markets. Greece have to repay €310 million IMF loans this week but a new debt deal between Greece and its creditors is not reached yet.

The British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.0 in May from 51.8 in April, missing expectations for a rise to 52.5. April's figure was revised down from 51.9.

The increase was driven by rises in output and new orders.

The Swiss franc traded mixed against the U.S. dollar after the better-than-expected manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland rose to 49.4 in May from 47.9 in April, exceeding expectations for an increase to 48.4.

The increase was driven by a rise in backlog of orders.

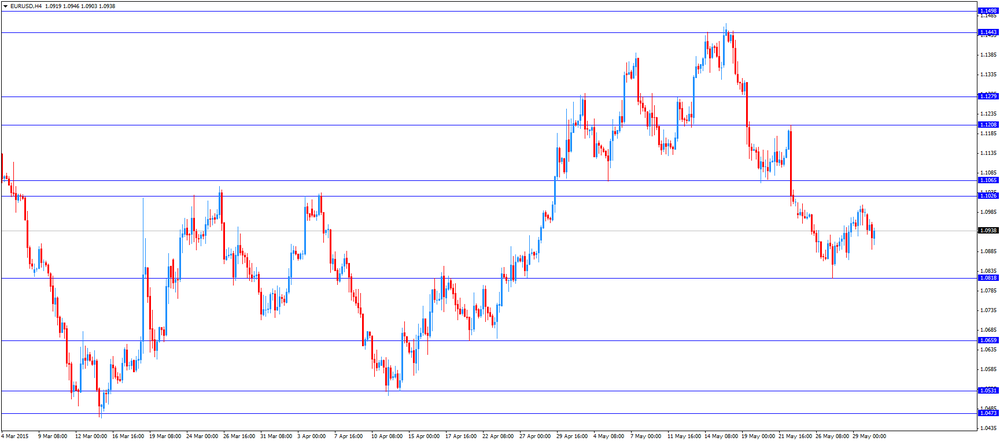

EUR/USD: the currency pair traded mixed

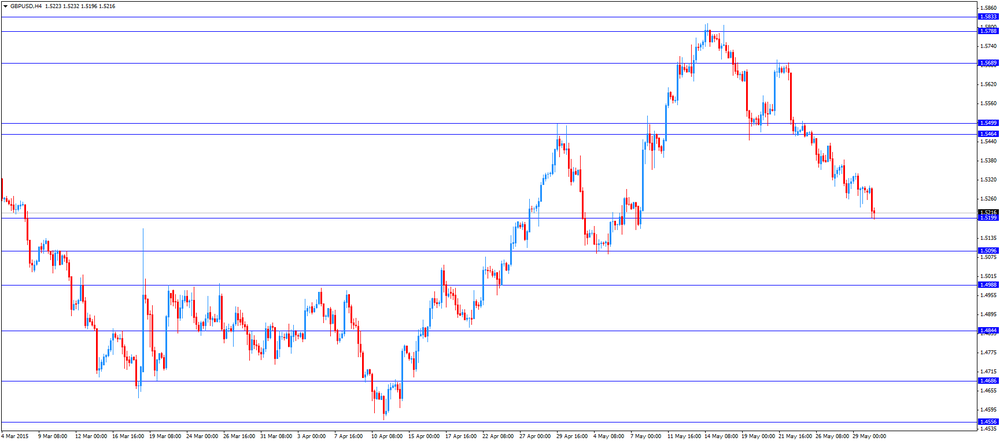

GBP/USD: the currency pair fell to $1.5196

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PCE price index ex food, energy, m/m April 0.1% 0.2%

12:30 U.S. Personal spending April 0.4% 0.2%

12:30 U.S. Personal Income, m/m April 0.0% 0.3%

12:30 U.S. PCE price index ex food, energy, Y/Y April 1.3%

13:45 U.S. Manufacturing PMI (Finally) May 54.1 53.8

14:00 U.S. Construction Spending, m/m April -0.6% 0.8%

14:00 U.S. ISM Manufacturing May 51.5 52.0

-

14:00

Germany: CPI, y/y , May 0.7% (forecast 0.7%)

-

14:00

Germany: CPI, m/m, May 0.1% (forecast 0.1%)

-

13:44

Orders

EUR/USD

Offers 1.1050/60 1.1000/10

Bids 1.0880 1.0875 1.0850

GBP/USD

Offers 1.5345/55 1.5320

Bids 1.5200-190 1.5150 1.5080/70 1.5055/50

EUR/GBP

Offers 0.7200-10

Bids

EUR/JPY

Offers 137.00 136.50 136.05/10

Bids 135.05/00 134.50 134.00

USD/JPY

Offers 125.50 125.00 124.50

Bids 123.80/70 123.50 123.05/00

AUD/USD

Offers 0.7745/50 0.7720 0.7700

Bids 0.7600 0.7550

-

12:00

European stock markets mid session: stocks traded lower on mostly weaker-than-expected manufacturing PMIs

Stock indices traded lower on mostly weaker-than-expected manufacturing purchasing mangers' index from the Eurozone.

Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in May from 52.0 in April, down from a preliminary reading of 52.3.

Spain, the Netherlands and Italy were strongest performers.

Markit's Chief Economist Chris Williamson said that Spain and Italy benefited in particular from exports.

Germany's final manufacturing PMI decreased to 51.1 in May from 52.1 in April, down from a preliminary reading of 51.4.

France's final manufacturing PMI climbed to 49.4 in May from 48.0 in April, up a preliminary reading of 49.3.

The Greek debt crisis also weighed on markets. Greece have to repay €310 million IMF loans this week but a new debt deal between Greece and its creditors is not reached yet.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.0 in May from 51.8 in April, missing expectations for a rise to 52.5. April's figure was revised down from 51.9.

The increase was driven by rises in output and new orders.

Current figures:

Name Price Change Change %

FTSE 100 6,969.14 -15.29 -0.22 %

DAX 11,360.35 -53.47 -0.47 %

CAC 40 4,995.53 -12.36 -0.25 %

-

11:34

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbs to 52.0 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.0 in May from 51.8 in April, missing expectations for a rise to 52.5. April's figure was revised down from 51.9.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"Expectations of a broad rebound in UK economic growth during the second quarter of the year are called into question by these readings. Manufacturing looks on course to act as a minor drag on the economy, as the sector is hit by the combination of the strong pound and weak business investment," Markit's Senior Economist Rob Dobson said.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0925(E649mn), $1.1000(E641mn), $1.1030(E359mn), $1.1050(E259mn)

USD/JPY: Y122.00($1.17bn), Y124.50($1.5bn)

EUR/JPY: Y135.00(E203mn)

GBP/USD: $1.5300(Gbp673mn)

AUD/USD: $0.7550(A$800mn), $0.7575(A$660mn), $0.7600(A$731mn), $0.7625(A$1.54bn), $0.7650(A$325mn)

AUD/JPY: Y96.15(A$842mn)

USD/CAD: C$1.2490($900mn), C$1.2600($500mn)

-

11:14

Eurozone’s final manufacturing rises to 52.2 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in May from 52.0 in April, down from a preliminary reading of 52.3.

Spain, the Netherlands and Italy were strongest performers.

Markit's Chief Economist Chris Williamson said that Spain and Italy benefited in particular from exports.

Germany's final manufacturing PMI decreased to 51.1 in May from 52.1 in April, down from a preliminary reading of 51.4.

France's final manufacturing PMI climbed to 49.4 in May from 48.0 in April, up a preliminary reading of 49.3.

-

10:50

Greece’s Interior Minister Nikos Voutsis: Athens will reach a new debt deal with its creditors this week

Greece's Interior Minister Nikos Voutsis said on Saturday that Athens will reach a new debt deal with its creditors this week.

"We believe that we can and we must have a solution and a deal within the week," Voutsis noted.

The Greek interior minister is not involved in talks.

"Some parts of our program could be pushed back by six months or maybe by a year, so that there is some balance," he added.

Voutsis did not point out what parts of the anti-austerity program could be pushed back.

-

10:39

President of the Federal Reserve Bank of St. Louis James Bullard: the Fed’s base case is the interest rate hike in 2015

President of the Federal Reserve Bank of St. Louis James Bullard said on Thursday that the Fed's base case is the interest rate hike in 2015.

He noted that the first quarter figures were "a little bit suspect".

"The base case is definitely that we want to, at least for me, is that we definitely want to normalize policy, but we do have to get by this issue about the first-quarter GDP," the president of the Federal

Reserve Bank of St. Louis said. Bullard does not have a vote on the Fed's policy committee.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , May 52.0 (forecast 52.5)

-

10:17

U.S. oil and gas rigs decline by 10 to 875 last week, the lowest since January 2003

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 13 rigs to 646 last week, the lowest weekly level since August 2010. It was the 25th consecutive weekly fall.

Combined oil and gas rigs fell by 10 to 875. It was the lowest since January 2003.

-

10:00

Eurozone: Manufacturing PMI, May 52.2 (forecast 52.3)

-

09:55

Germany: Manufacturing PMI, May 51.1 (forecast 51.4)

-

09:50

France: Manufacturing PMI, May 49.4 (forecast 49.3)

-

09:30

Switzerland: Manufacturing PMI, May 49.4 (forecast 48.4)

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m May 0.3% 0.3%

01:00 China Non-Manufacturing PMI May 53.4 53.2

01:00 China Manufacturing PMI May 50.1 50.2 50.2

01:30 Australia Company Gross Profits QoQ Quarter I -0.4% Revised From -0.2% 0.5% 0.2%

01:30 Australia Building Permits, m/m April 2.9% Revised From 2.8% -2% -4.4%

01:35 Japan Manufacturing PMI (Finally) May 49.9 50.9 50.9

01:45 China HSBC Manufacturing PMI (Finally) May 48.9 49.1 49.2

The euro slid on concern about the impasse between Greece and its creditors, while oil and crops fell. Greece faces a week of tough decisions as creditors show no signs of budging over what it will take to seal an accord. Greece must make four payments totaling almost 1.6 billion euros ($1.78 billion) to the International Monetary Fund this month and its bailout package backed by the euro region expires at the end of June.

EUR / USD: during the Asian session the pair fell to $ 1.0930

GBP / USD: during the Asian session, the pair was trading in the $ 1.5255-00

USD / JPY: during the Asian session, the pair was trading around Y124.10

-

08:10

Options levels on monday, June 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1136 (5048)

$1.1074 (6051)

$1.1031 (3658)

Price at time of writing this review: $1.0942

Support levels (open interest**, contracts):

$1.0909 (7180)

$1.0852 (3878)

$1.0778 (9497)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 114724 contracts, with the maximum number of contracts with strike price $1,1000 (6051);

- Overall open interest on the PUT options with the expiration date June, 5 is 130416 contracts, with the maximum number of contracts with strike price $1,0800 (9497);

- The ratio of PUT/CALL was 1.14 versus 1.15 from the previous trading day according to data from May, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.5600 (2263)

$1.5501 (1479)

$1.5403 (2104)

Price at time of writing this review: $1.5289

Support levels (open interest**, contracts):

$1.5196 (2290)

$1.5098 (1380)

$1.4999 (3105)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 36268 contracts, with the maximum number of contracts with strike price $1,5700 (2626);

- Overall open interest on the PUT options with the expiration date June, 5 is 52551 contracts, with the maximum number of contracts with strike price $1,5000 (3105);

- The ratio of PUT/CALL was 1.45 versus 1.48 from the previous trading day according to data from May, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:01

Nikkei 225 20,475.09 -88.06 -0.43 %, Hang Seng 27,380.82 -43.37 -0.16 %, Shanghai Composite 4,631.18 +19.44 +0.42 %

-

03:47

China: HSBC Manufacturing PMI, May 49.2 (forecast 49.1)

-

03:35

Japan: Manufacturing PMI, May 50.9 (forecast 50.9)

-

03:30

Australia: Building Permits, m/m, April -4.4% (forecast -2%)

-

03:30

Australia: Company Gross Profits QoQ, Quarter I 0.2% (forecast 0.5%)

-

03:00

China: Manufacturing PMI , May 50.2 (forecast 50.2)

-

03:00

China: Non-Manufacturing PMI, May 53.2

-

02:30

Australia: MI Inflation Gauge, m/m, May 0.3%

-

01:28

Australia: AIG Manufacturing Index, May 52.3

-

00:32

Commodities. Daily history for May 29’2015:

(raw materials / closing price /% change)

Oil 59.00 -1.21%

Gold 1,187.50 -1.37%

-

00:31

Stocks. Daily history for Apr May 29’2015:

(index / closing price / change items /% change)

Nikkei 225 20,563.15 +11.69 +0.06 %

Hang Seng 27,424.19 -30.12 -0.11 %

S&P/ASX 200 5,777.2 +64.07 +1.12 %

Shanghai Composite 4,613.19 -7.08 -0.15 %

FTSE 100 6,984.43 -56.49 -0.80 %

CAC 40 5,007.89 -129.94 -2.53 %

Xetra DAX 11,413.82 -263.75 -2.26 %

S&P 500 2,107.39 -13.40 -0.63 %

NASDAQ Composite 5,070.03 -27.95 -0.55 %

Dow Jones 18,010.68 -115.44 -0.64 %

-

00:30

Currencies. Daily history for May 29’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0986 +0,26%

GBP/USD $1,5288 -0,18%

USD/CHF Chf0,9401 -0,32%

USD/JPY Y124,18 +0,60%

EUR/JPY Y136,43 +0,46%

GBP/JPY Y189,8 -0,01%

AUD/USD $0,7643 -0,10%

NZD/USD $0,7106 -0,84%

USD/CAD C$1,2452 +0,22%

-

00:02

Schedule for today,Monday, June 1’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia MI Inflation Gauge, m/m May 0.3%

01:00 China Non-Manufacturing PMI May 53.4

01:00 China Manufacturing PMI May 50.1 50.2

01:30 Australia Company Gross Profits QoQ Quarter I -0.2% 0.5%

01:30 Australia Building Permits, m/m April 2.8% -2%

01:35 Japan Manufacturing PMI (Finally) May 49.9 50.9

01:45 China HSBC Manufacturing PMI (Finally) May 48.9 49.1

07:30 Switzerland Manufacturing PMI May 47.9 48.4

07:50 France Manufacturing PMI (Finally) May 48.0 49.3

07:55 Germany Manufacturing PMI (Finally) May 52.1 51.4

08:00 Eurozone Manufacturing PMI (Finally) May 52.0 52.3

08:30 United Kingdom Purchasing Manager Index Manufacturing May 51.9 52.5

12:00 Germany CPI, m/m (Preliminary) May 0.0% 0.1%

12:00 Germany CPI, y/y (Preliminary) May 0.5% 0.7%

12:30 U.S. PCE price index ex food, energy, m/m April 0.1% 0.2%

12:30 U.S. Personal spending April 0.4% 0.2%

12:30 U.S. Personal Income, m/m April 0.0% 0.3%

12:30 U.S. PCE price index ex food, energy, Y/Y April 1.3%

13:45 U.S. Manufacturing PMI (Finally) May 54.1 53.8

14:00 U.S. Construction Spending, m/m April -0.6% 0.8%

14:00 U.S. ISM Manufacturing May 51.5 52.0

22:45 New Zealand Overseas Trade Index Quarter I -1.9%

23:50 Japan Monetary Base, y/y May 35.2%

-