Noticias del mercado

-

22:10

Major US stock indexes ended Tuesday slightly lower

U.S. stocks ended Tuesday slightly lower, as earlier gains faded by the end of the trading session. Investors remained cautious ahead of the important jobs report on Friday and a looming deadline for Greece and its lenders to find a solution to the debt crisis.

Treasury notes fell, pushing yields higher, on signs that global inflation may be rising from a low level. A report from Europe showed that consumer prices are rising there for the first time in six months.

Utilities led the declines as bond yields rose. The energy sector gained as oil prices climbed.

Сomponents of The Dow Jones Industrial Average closed mixed. Intel Corporation (INTC, -2.03%) was an outsider. The Boeing Company (BA, +1.40%) rose more than other.

Sectors of the S&P showed mixed dinamics too. Basic Materials grew more than other (+1.2%). Utilities fell 1.1%.

At the close:

Dow -0.16% 18,011.84 -28.53

Nasdaq -0.13% 5,076.53 -6.40

S&P -0.10% 2,109.59 -2.14

-

21:10

DOW -0.08% 18,025.33 -15.04, Nasdaq -0.11% 5,077.09 -5.84, S&P -0.07% 2,110.24 -1.49

-

20:44

American focus: the euro rallied amid optimism that Greece is moving closer to ending months of acrimony with creditors

The euro rose as Europe's leaders intensify Geece's bailout talks. Talks lasted into the early hours of Tuesday morning in Berlin, involving German Chancellor Angela Merkel, International Monetary Fund chief Christine Lagarde, ECB President Mario Draghi, French President Francois Hollande and European Commission President Jean-Claude Juncker. The goal was to hammer out an offer that Greece could consider in coming days, according to two people familiar with the plan.

The euro was boosted by an uptick in consumer prices along with the fact that there's the possibility of an 11th-hour deal coming through in Greece.

The inflation rate in the euro area increased to 0.3% in May. That exceeded the 0.2% forecast. Core inflation accelerated to 0.9%, the fastest in nine months. Separate German data showed unemployment declined for an eighth month in May.

The ECB meets Wednesday in Frankfurt. The central bank is in the early days of a 1.1 trillion-euro ($1.2 trillion) bond-buying program which Executive Board Member Benoit Coeure said would be frontloaded in May and June.

The ECB's latest projections foresee an average inflation rate of zero this year, rising to 1.8% by 2017. Its main refinancing rate is set at 0.05% while the deposit facility is at minus 0.2%.

-

19:11

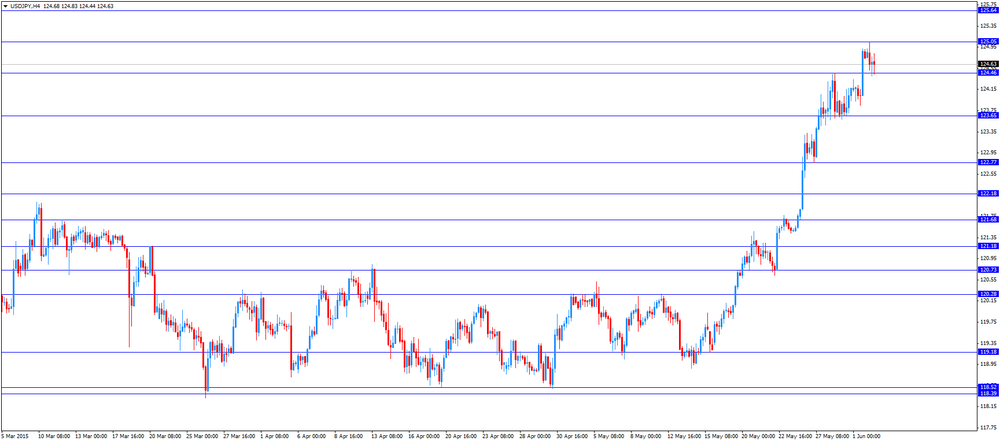

WSE: Session Results

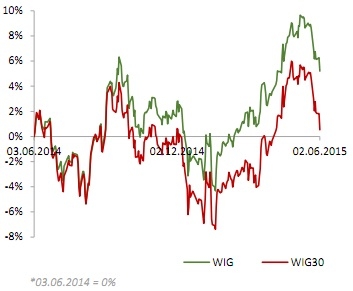

Polish equity market declined on Tuesday. The broad market benchmark - the WIG index went down by 1.01%. Most of the sectors recorded losses, with materials (-2.20%), utilities (-1.81%) and telecommunications (-1.58%) lagging behind. At the same time, chemicals sector (+0.73%) appeared to be the strongest group.

The large-cap stock universe's measure - the WIG30 index posted a 1.27% drop. CCC (WSE: CCC) led the decliners, losing 7.47% on the announcement the company's major shareholder agreed to sell a 7.8-percent stake in the company at PLN 170 per share, representing a discount of 8.6% to the Monday market value. BZ WBK (WSE: BZW) and GTC (WSE: GTC) corrected down by 3.95% and 3.25% respectively after yesterday's growth. Besides, LPP (WSE: LPP) extended its losses by 3.49% despite releasing positive outlook for the second half of 2015. On the contrary, ALIOR (WSE: ALR) was the biggest advancer, posting a 2.24% growth. It was followed by GRUPA AZOTY (WSE: ATT), TVN (WSE: TVN) and ENERGA (WSE: ENG), gaining 1.49%, 1.36% and 1.05% respectively.

-

18:26

Major U.S. stock-indexes are little changed

Major U.S. stock-indexes slightly rose on Tuesday, paring some of their losses earlier in the session because weak factory orders data fell. New orders for U.S. factory goods unexpectedly fell in April as demand for transportation equipment and other goods weakened, suggesting that manufacturing remained constrained by a strong dollar and spending cuts in the energy sector. The data is the latest that shows the economy might not be rebounding strongly enough in the second quarter, after a first-quarter slump, to permit a rate hike earlier rather than later in the year.

Most of Dow stocks in positive area (18 of 30). Top looser - Intel Corporation (INTC, -1.74%). Top gainer - The Boeing Company (BA, +1.86%).

Most of S&P index sectors also in positive area. Top gainer - Basic Materials (+1,3%). Top looser - Utilities (-1.3%).

At the moment:

Dow 18045.00 +22.00 +0.12%

S&P 500 2111.50 +2.25 +0.11%

Nasdaq 100 4519.00 -2.50 -0.06%

10-year yield 2.27% +0.08

Oil 61.08 +0.88 +1.46%

Gold 1192.60 +3.90 +0.33%

-

18:01

European stocks close: stocks closed lower as the Greek debt problem weighed on markets

Stock indices closed lower as the Greek debt problem weighed on markets. The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week.

"As long as it doesn't meet economic conditions, we can't come to an agreement. It's not right to think that we can meet half way," he noted.

Dijsselbloem believes that a deal between Greece and its creditors could be reached.

Earlier, Greek Prime Minister Alexis Tsipras said that the government had submitted realistic proposals to its lenders. He added that the decision rests on the European Union's leaders.

In total, Athens has to repay almost €1.6 billion in June, starting with repayment of €300 million on Friday.

The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April. April's figure was revised up from a 8,000 fall.

The number of unemployed people in Germany was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,928.27 -25.31 -0.36 %

DAX 11,328.8 -107.25 -0.94 %

CAC 40 5,004.46 -20.84 -0.41 %

-

18:00

European stocks closed: FTSE 100 6,928.27 -25.31 -0.36% CAC 40 5,004.46 -20.84 -0.41% DAX 11,328.8 -107.25 -0.94%

-

17:41

Oil prices traded higher on expectations for higher oil demand and on a weaker U.S. dollar

Oil prices traded higher on expectations for higher oil demand and on a weaker U.S. dollar. Saudi Arabia's oil minister, Ali al-Naimi, has said on Monday that he expects oil demand to rise in the second half of this year, while oil supply declines.

Investors are awaiting OPEC's meeting on June 05. It is expected that OPEC keeps unchanged its oil production.

Investors are also awaiting the release of U.S. crude oil inventories. Analysts expect U.S. crude oil inventories to decline by 857,000 barrels in the week ending May 29.

WTI crude oil for July delivery rose to $60.88 a barrel on the New York Mercantile Exchange.

Brent crude oil for July increased to $65.28 a barrel on ICE Futures Europe.

-

17:25

Gold price traded higher on a weaker U.S. dollar and on concerns over the Greek debt crisis

Gold price traded higher on a weaker U.S. dollar and on concerns over the Greek debt crisis. The U.S. dollar declined against the most major currencies after the weaker-than-expected U.S. factory orders data. Factory orders in the U.S. declined 0.4% in April, missing expectations for a flat reading, after a 2.2% gain in March. March's figure was revised up from a 2.1% rise.

The drop was driven by lower orders for durable goods, which declined by 1.0% in April.

Non-durable goods orders were up 0.2% in April. Orders for transportation equipment plunged by 2.4% in April, after a 15.1% rise in March.

The Greek debt crisis also supported gold price. The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week.

"As long as it doesn't meet economic conditions, we can't come to an agreement. It's not right to think that we can meet half way," he noted.

Dijsselbloem believes that a deal between Greece and its creditors could be reached.

June futures for gold on the COMEX today rose to 1192.60 dollars per ounce.

-

17:07

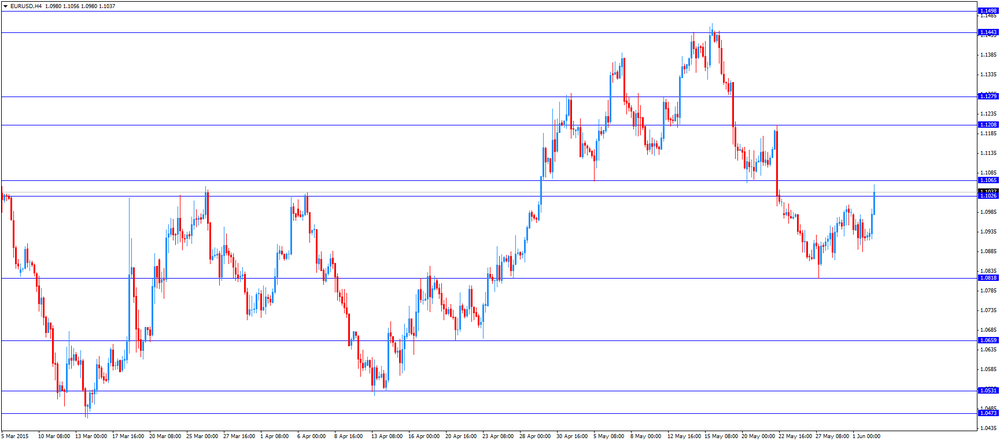

Bank of Japan Governor Haruhiko Kuroda: the exchange rate should be stable and should reflect the economic fundamentals

The Bank of Japan (BoE) Governor Haruhiko Kuroda said after his meeting with Japanese Prime Minister Shinzo Abe that the exchange rate should be stable and should reflect the economic fundamentals.

He declined to comment the recent movement of the yen.

Kuroda also said that the central bank's monetary policy is targeted at price stability, not at directly weakening the yen.

-

16:59

U.S. factory orders drop 0.4% in April

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. declined 0.4% in April, missing expectations for a flat reading, after a 2.2% gain in March. March's figure was revised up from a 2.1% rise.

The drop was driven by lower orders for durable goods, which declined by 1.0% in April.

Non-durable goods orders were up 0.2% in April.

Orders for transportation equipment plunged by 2.4% in April, after a 15.1% rise in March.

-

16:43

Federal Reserve Governor Lael Brainard: there are no signs of a significant bounce-back in the U.S. economy in the second quarter

Federal Reserve Governor Lael Brainard said in Washington on Tuesday that there are no signs of a significant bounce-back in the U.S. economy in the second quarter. She added that it might better to delay the interest rate hike. But the Fed governor did not rule out the interest rate hike this year.

"If continued labor market strengthening is confirmed and inflation readings continue to improve, liftoff could come before the end of the year," she said.

Brainard noted that she was concerned that the recent economic weakness might be not entirely transitory.

Brainard is a voting member of the Federal Open Market Committee this year.

-

16:18

Greek Prime Minister Alexis Tsipras: the government had submitted realistic proposals to its lenders

Greek Prime Minister Alexis Tsipras said on Tuesday morning that the government had submitted realistic proposals to its lenders. He added that the decision rests on the European Union's leaders.

-

16:03

Head of the Eurogroup Jeroen Dijsselbloem: the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week.

"As long as it doesn't meet economic conditions, we can't come to an agreement. It's not right to think that we can meet half way," he noted.

Dijsselbloem believes that a deal between Greece and its creditors could be reached.

-

16:00

U.S.: Factory Orders , April -0.4% (forecast 0.0%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E831mn), $1.0980(E883mn), $1.1000(E1.419bn)

USD/JPY: Y124.00($550mn)

GBP/USD: $1.5000(Gbp546mn)

USD/CHF: Chf0.9455($250mn)

AUD/USD: $0.7725(A$458mn)

NZD/USD: $0.7150(NZ$429mn)

USD/CAD: C$1.2505($235mn)

-

15:40

European Union's economics commissioner Pierre Moscovici: that there is “real progress” in debt talks between Greece and its creditors

The European Union's economics commissioner Pierre Moscovici said on Tuesday that there is "real progress" in debt talks between Greece and its creditors, but it is not enough to reach a deal.

"These discussions are beginning to bear fruit, I think that there is real progress, a better understanding between the Greek government and its creditors. There are solid foundations for progress to be made, but we're not there yet," he noted.

-

15:34

U.S. Stocks open: Dow -0.29%, Nasdaq -0.31%, S&P -0.24%

-

15:27

Before the bell: S&P futures -0.20%, NASDAQ futures -0.22%

U.S. stock-index futures fell as investors weighed the possibility of progress in Greece's debt talks before data on factory orders.

Global markets:

FTSE 6,947.5 -6.08 -0.09%

CAC 5,025.51 +0.21 0.00%

DAX 11,366.59 -69.46 -0.61%

Nikkei 20,543.19 -26.68 -0.13%

Hang Seng 27,466.72 -130.44 -0.47%

Shanghai Composite 4,911.57 +82.84 +1.72%

Crude oil $60.57 (+0.63%)

Gold $1190.90 (+0.19%)

-

15:14

Eurozone's producer price index declines 0.1% in April

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.1% in April, missing expectations for a 0.1% increase, after a 0.2% rise in March.

On a yearly basis, Eurozone's producer price index dropped 2.2% in April, missing expectations for a 2.0% decrease, after a 2.3% decline in March.

Eurozone's producer prices excluding energy fell 0.5% year-on-year in April. Energy prices dropped 6.4%.

Intermediate goods prices declined 1% in April, non-durable consumer goods prices decreased by 1.1%, and capital goods prices rose 0.85%, while durable consumer goods prices climbed 0.9%.

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Ford Motor Co.

F

15.37

+0.07%

1.7K

Exxon Mobil Corp

XOM

85.20

+0.08%

4.5K

Chevron Corp

CVX

102.85

+0.21%

2.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.39

+0.21%

4.7K

AMERICAN INTERNATIONAL GROUP

AIG

58.98

+0.51%

3.0K

3M Co

MMM

158.98

0.00%

0.2K

Microsoft Corp

MSFT

47.23

0.00%

4.4K

Verizon Communications Inc

VZ

49.22

0.00%

46.5K

Walt Disney Co

DIS

110.96

0.00%

1.3K

Deere & Company, NYSE

DE

92.64

0.00%

8.0K

Yahoo! Inc., NASDAQ

YHOO

43.35

0.00%

1.9K

Wal-Mart Stores Inc

WMT

74.71

-0.03%

19.0K

Starbucks Corporation, NASDAQ

SBUX

52.20

-0.04%

0.3K

Boeing Co

BA

141.13

-0.08%

0.7K

Barrick Gold Corporation, NYSE

ABX

11.81

-0.08%

1.6K

General Motors Company, NYSE

GM

36.15

-0.08%

29.6K

Cisco Systems Inc

CSCO

29.15

-0.10%

2.7K

Johnson & Johnson

JNJ

99.94

-0.10%

39.0K

JPMorgan Chase and Co

JPM

66.00

-0.12%

2.7K

The Coca-Cola Co

KO

40.89

-0.12%

40.2K

Procter & Gamble Co

PG

78.75

-0.13%

1.3K

Twitter, Inc., NYSE

TWTR

36.58

-0.14%

25.8K

Goldman Sachs

GS

207.50

-0.15%

0.3K

AT&T Inc

T

34.30

-0.15%

9.3K

Visa

V

69.00

-0.16%

16.5K

International Business Machines Co...

IBM

169.91

-0.16%

6.6K

Apple Inc.

AAPL

130.32

-0.16%

213.5K

Pfizer Inc

PFE

34.50

-0.17%

2.0K

General Electric Co

GE

27.23

-0.18%

0.9K

Hewlett-Packard Co.

HPQ

33.70

-0.18%

8.4K

E. I. du Pont de Nemours and Co

DD

71.50

-0.20%

0.1K

Home Depot Inc

HD

110.86

-0.20%

1.3K

Citigroup Inc., NYSE

C

54.34

-0.20%

52.7K

Merck & Co Inc

MRK

60.60

-0.25%

0.8K

Google Inc.

GOOG

532.68

-0.25%

0.2K

Facebook, Inc.

FB

80.07

-0.27%

27.8K

Amazon.com Inc., NASDAQ

AMZN

429.70

-0.28%

2.8K

American Express Co

AXP

79.20

-0.34%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

248.60

-0.34%

18.1K

McDonald's Corp

MCD

95.84

-0.39%

1.3K

ALTRIA GROUP INC.

MO

51.00

-0.39%

0.2K

Caterpillar Inc

CAT

85.06

-0.55%

1.7K

ALCOA INC.

AA

12.33

-0.72%

3.2K

Intel Corp

INTC

33.65

-0.75%

60.5K

-

15:04

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

American Intl (AIG) initiated at Overweight at Piper Jaffray

-

14:53

Greek manufacturing PMI increases to 48.0 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Tuesday. The Greek manufacturing PMI climbed to 48.0 in May from 46.5 in April.

A reading below 50 indicates a contraction in the sector.

The PMI remained below 50 due to lower output and new orders.

-

14:29

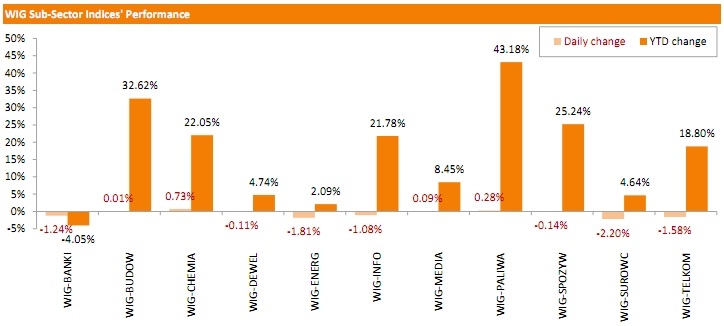

Foreign exchange market. European session: the euro rose against the U.S. dollar after the better-than-expected consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Current Account, bln Quarter I -10.2 Revised From -9.6 -10.8 -10.7

03:00 Japan Labor Cash Earnings, YoY April 0.1%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2.0% 2.0%

04:30 Australia RBA Rate Statement

07:55 Germany Unemployment Change May -9 Revised From -8 -10 -6

07:55 Germany Unemployment Rate s.a. May 6.4% 6.4% 6.4%

08:30 United Kingdom PMI Construction May 54.2 55.0 55.9

08:30 United Kingdom Consumer credit, bln April 1294 Revised From 1242 1000 1173

08:30 United Kingdom Net Lending to Individuals, bln April 3.3 Revised From 3.1 2.9

08:30 United Kingdom Mortgage Approvals April 61.94 Revised From 61.34 63 68.08

09:00 Eurozone Producer Price Index, MoM April 0.2% 0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) April -2.3% -2.0% -2.2%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) May 0.0% 0.2% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) May 0.6% 0.1% 0.9%

The U.S. dollar traded mixed to lower against the most major currencies ahead of U.S. factory orders data. Factory orders in the U.S. are expected to be flat in April, after a 2.1% gain in March.

The euro rose against the U.S. dollar after the better-than-expected consumer price inflation data from the Eurozone. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April. April's figure was revised up from a 8,000 fall.

The number of unemployed people in Germany was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

The Greek debt crisis continue to weigh on the euro. In total, Athens has to repay almost €1.6 billion in June, starting with repayment of €300 million on Friday.

The European Union's economics chief said on Tuesday that the Greek government has put forward first proposals for pension reform.

The news agency Dow Jones reported yesterday that Greece's creditors are preparing the final proposal. Negotiations on this issue were held between Angela Merkel, Francois Hollande, Christine Lagarde and Mario Draghi late Monday. Details of the talks were not disclosed.

The British pound traded higher against the U.S. dollar after the better-than-expected construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

The increase was driven by a rise in new orders, which grew for the first time in three months.

EUR/USD: the currency pair rose to $1.1038

GBP/USD: the currency pair increased to $1.5268

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Factory Orders April 2.1% 0.0%

14:00 U.S. FOMC Member Brainard Speaks

-

14:12

Reserve Bank of Australia kept its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA said that the decision was appropriate after the interest rate cut in June.

The central bank noted that the Australian dollar declined against a US dollar and against a basket of currencies, and the further interest rate cut is "both likely and necessary" as the Australian dollar fell due to lower key commodity prices.

The RBA also said that global economy grew moderately, and "global financial conditions remain very accommodative."

The RBA cut its interest rate to 2.00% from 2.25% in May.

-

14:00

Orders

EUR/USD

Offers 1.1000 1.1020 1.1050 1.1080 1.1100 1.1130 1.1150

Bids 1.0940 1.0925 1.0915 1.0900 1.0880-85 1.0865 1.0850 1.0825-30 1.0800

GBP/USD

Offers 1.5230 1.5250 1.5280 1.5300 1.5325 1.5240-50 1.5360 1.5385 1.5400

Bids 1.5200 1.5185 1.5165 1.5150 1.5130 1.5100 1.5090 1.5080 1.5050

EUR/GBP

Offers 0.7225-30 0.7250 0.7265 0.7285 0.7300

Bids 0.7200 0.7180-85 0.7165 0.7140 0.7120 0.7100 0.7085 0.7065 0.7050

EUR/JPY

Offers 136.80 137.00 137.30 137.50 138.00

Bids 136.00 135.80 135.50 135.30 135.00 134.80 134.40 134.00

USD/JPY

Offers 124.80 125.00 125.20 125.50 125.75 126.00

Bids 124.40 124.20 124.00 123.80 123.50 123.30 123.00 122.75-80 122.50

AUD/USD

Offers 0.7720-25 0.7760 0.7780 0.7800

Bids 0.7650 0.7625-30 0.7600 0.7585 0.7565 0.7550

-

12:04

European stock markets mid session: stocks traded lower on the Greek debt problem

Stock indices traded lower on the Greek debt problem. The European Union's economics chief said on Tuesday that the Greek government has put forward first proposals for pension reform.

The news agency Dow Jones reported yesterday that Greece's creditors are preparing the final proposal. Negotiations on this issue were held between Angela Merkel, Francois Hollande, Christine Lagarde and Mario Draghi late Monday. Details of the talks were not disclosed.

In total, Athens has to repay almost €1.6 billion in June, starting with repayment of €300 million on Friday.

The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April. April's figure was revised up from a 8,000 fall.

The number of unemployed people in Germany was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

Current figures:

Name Price Change Change %

FTSE 100 6,897.15 -56.43 -0.81 %

DAX 11,340.02 -96.03 -0.84 %

CAC 40 4,999.42 -25.88 -0.51 %

-

11:47

UK construction PMI climbs to 55.9 in May

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

-

11:38

Preliminary consumer price inflation in the Eurozone rises to 0.3% in May

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The increase was driven by ECB's quantitative easing programme.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

Food, alcohol and tobacco prices were up 1.2% in May, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 5.0%.

-

11:27

Number of mortgages approvals in the U.K. hits the highest level since February2014

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. rose to 68,076 in April from 61,945 in March, exceeding expectations for an increase to 63,000. It was the highest level since February2014 and the biggest monthly rise since February 2009.

The reading indicates a bounce-back in the U.K. housing market after the BoE introduced new controls on mortgage lending.

Consumer credit in the U.K. climbed by £1.173 billion in April, after a rise by £1.294 billion in March.

Net lending to individuals in the U.K. increased by £2.9 billion in April, after a £3.3 billion gain in March.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E831mn), $1.0980(E883mn), $1.1000(E1.419bn)

USD/JPY: Y124.00($550mn)

GBP/USD: $1.5000(Gbp546mn)

USD/CHF: Chf0.9455($250mn)

AUD/USD: $0.7725(A$458mn)

NZD/USD: $0.7150(NZ$429mn)

USD/CAD: C$1.2505($235mn)

-

11:10

Fed vice chairman warns that it is a mistake to believe that the financial crisis is over

Fed Vice Chairman Stanley Fischer said on Monday that he does not see "a major financial crisis on the horizon".

He noted that central banks should not rule out using interest rates to fight financial instability.

"Most central bankers say they would prefer to use macroprudential tools rather than the interest rate" to maintain financial stability. It is not clear that there are sufficiently strong macroprudential tools to deal with all financial instability problems, and it would make sense not to rule out the possible use of the interest rate for this purpose, particularly when other tools appear to be lacking," the Fed vice chairman said.

Fischer pointed out that banks pushed back against regulations.

"Regulations have been strengthened and the bankers' backlash is both evident and making headway. Often when bankers complain about regulations, they give the impression that financial crises are now a thing of the past, and furthermore in many cases, that they played no role in the previous crisis," he said.

The Fed vice chairman warned that it is a mistake to believe that the financial crisis is over.

-

11:00

Eurozone: Harmonized CPI, Y/Y, May 0.3% (forecast 0.2%)

-

11:00

Eurozone: Producer Price Index (YoY), April -2.2% (forecast -2.0%)

-

11:00

Eurozone: Producer Price Index, MoM , April -0.1% (forecast 0.1%)

-

10:57

Number of unemployed people in Germany declines by 6,000 in May

Destatis released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April.

April's figure was revised up from a 8,000 fall.

The number of unemployed people was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

-

10:44

35% of respondents have seen equities as the riskiest asset class in 2015

Franklin Templeton Investments' survey showed that most respondents said that equities will be the riskiest asset class this year. 35% of respondents have seen equities as the riskiest asset class, followed by the euro (34%) and non-metal commodities (32%).

On the other hand, 59% of respondents said that stocks would be the most lucrative investment this year, followed by real estate (55&) and precious metals (39%).

32% of respondents said that they plan to increase their exposure to stocks in 2015, while 14% of respondents plan to reduce it.

38% of respondents were concerned over the global economy, followed by concerns over government fiscal policy and the debt crisis in the Eurozone (both 32%).

Franklin Templeton Investments interviewed over 11,500 investors in 23 countries across the Americas, Africa, Asia Pacific and Europe.

-

10:33

Number of unemployed people climbs 0.7% in April

The French labour ministry release its labour market figures on Monday. The number of unemployed people rose 0.7% to total 3.536 million in April.

The unemployment in France increased despite the fastest economic growth rate in two years in the first three months of 2015.

"We will need a few months before the economic pick-up translates into jobs," the labour ministry said.

-

10:31

United Kingdom: Net Lending to Individuals, bln, April 2.9

-

10:30

United Kingdom: Mortgage Approvals, April 68.08 (forecast 63)

-

10:30

United Kingdom: Consumer credit, bln, April 1173 (forecast 1000)

-

10:30

United Kingdom: PMI Construction, May 55.9 (forecast 55.0)

-

10:15

Australia’s current account deficit widens to A$10.7 billion in the first quarter

The Australian Bureau of Statistics released its current account data on Tuesday. Australia's current account deficit widened to A$10.7 billion in the first quarter from a deficit of A$10.2 billion in the fourth quarter, beating expectations for a rise to a deficit of A$10.8 billion.

The fourth quarter's figure was revised down from a deficit of A$9.6 billion.

Net exports of GDP rose 0.5% in the first quarter, after a 0.7% increase in the fourth quarter.

The balance on goods and services plunged 37% to a deficit of A$3.701 billion.

Net foreign equity dropped 26% to a deficit of A$76.296 billion, while net foreign debt increased 3% to a surplus of A$954.672 billion.

-

09:55

Germany: Unemployment Rate s.a. , May 6.4% (forecast 6.4%)

-

09:55

Germany: Unemployment Change, May -6 (forecast -10)

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Current Account, bln Quarter I -10.2 Revised From -9.6 -10.8 -10.7

03:00 Japan Labor Cash Earnings, YoY April 0.1%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2.0% 2.0%

04:30 Australia RBA Rate Statement

Australian dollar rises. Reserve Bank of Australia Governor Glenn Stevens and his board left the cash rate at a record-low 2 percent in Sydney Tuesday, as predicted by markets and economists. "Aussie gained as a minority in market who bet the RBA would cut today unwound their positions," said Masafumi Yamamoto, a senior strategist at Monex Inc. in Tokyo. "The Aussie's direction will depend on domestic data, especially whether the jobless rate will deteriorate or improve, and the strength of the U.S. dollar."

The yen weakened beyond 125 per dollar for the first time since 2002 as prospects for higher U.S. interest rates this year spurred demand for the greenback. The yen has dropped more than 30 percent since 2012 as the Bank of Japan carries out unprecedented bond buying to spur inflation.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0915-35

GBP / USD: during the Asian session, the pair was trading in the $ 1.5190-10

USD / JPY: during the Asian session the pair rose to Y125.05

-

08:11

Options levels on tuesday, June 2, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1123 (5053)

$1.1051 (6092)

$1.0999 (3645)

Price at time of writing this review: $1.0920

Support levels (open interest**, contracts):

$1.0863 (3473)

$1.0805 (2369)

$1.0769 (8799)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 115016 contracts, with the maximum number of contracts with strike price $1,1000 (6092);

- Overall open interest on the PUT options with the expiration date June, 5 is 129559 contracts, with the maximum number of contracts with strike price $1,0800 (8799);

- The ratio of PUT/CALL was 1.13 versus 1.14 from the previous trading day according to data from June, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (1476)

$1.5401 (2105)

$1.5303 (990)

Price at time of writing this review: $1.5208

Support levels (open interest**, contracts):

$1.5097 (1518)

$1.4999 (3118)

$1.4900 (1437)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 36381 contracts, with the maximum number of contracts with strike price $1,5700 (2626);

- Overall open interest on the PUT options with the expiration date June, 5 is 53308 contracts, with the maximum number of contracts with strike price $1,5000 (3118);

- The ratio of PUT/CALL was 1.46 versus 1.45 from the previous trading day according to data from June, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2.0%)

-

04:01

Nikkei 225 20,568.96 -0.91 0.00%, Hang Seng 27,523.53 -73.63 -0.27%, Shanghai Composite 4,879.16 +50.42 +1.04%

-

03:30

Australia: Current Account, bln, Quarter I -10.7 (forecast -10.8)

-

01:51

Japan: Monetary Base, y/y, May 35.6%

-

00:47

New Zealand: Overseas Trade Index, Quarter I 1.5%

-

00:34

Commodities. Daily history for Jun 1’2015:

(raw materials / closing price /% change)

Oil 60.20 -0.17%

Gold 1,188.70 -0.09%

-

00:33

Stocks. Daily history for Jun 1’2015:

(index / closing price / change items /% change)

Nikkei 225 20,569.87 +6.72 +0.03 %

Hang Seng 27,597.16 +172.97 +0.63 %

Shanghai Composite 4,829.44 +217.70 +4.72 %

FTSE 100 6,953.58 -30.85 -0.44 %

CAC 40 5,025.3 +17.41 +0.35 %

Xetra DAX 11,436.05 +22.23 +0.19 %

S&P 500 2,111.73 +4.34 +0.21 %

NASDAQ Composite 5,082.93 +12.90 +0.25 %

Dow Jones 18,040.37 +29.69 +0.16 %

-

00:32

Currencies. Daily history for Jun 1’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0921 -0,60%

GBP/USD $1,5198 -0,59%

USD/CHF Chf0,9457 +0,59%

USD/JPY Y124,75 +0,46%

EUR/JPY Y136,25 -0,13%

GBP/JPY Y189,59 -0,11%

AUD/USD $0,7608 -0,46%

NZD/USD $0,7102 -0,06%

USD/CAD C$1,2524 +0,57%

-

00:00

Schedule for today,Tuesday, June 2’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Current Account, bln Quarter I -9.6 -10.8

03:00 Japan Labor Cash Earnings, YoY April 0.1%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2.0%

04:30 Australia RBA Rate Statement

07:55 Germany Unemployment Change May -8 -10

07:55 Germany Unemployment Rate s.a. May 6.4% 6.4%

08:30 United Kingdom PMI Construction May 54.2 55.0

08:30 United Kingdom Consumer credit, bln April 1242 1000

08:30 United Kingdom Net Lending to Individuals, bln April 3.1

08:30 United Kingdom Mortgage Approvals April 61.34 62.5

09:00 Eurozone Producer Price Index, MoM April 0.2% 0.1%

09:00 Eurozone Producer Price Index (YoY) April -2.3% -2.0%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) May 0.0% 0.2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) May 0.6% 0.1%

14:00 U.S. Factory Orders April 2.1% 0.0%

14:00 U.S. FOMC Member Brainard Speaks

19:45 U.S. Total Vehicle Sales, mln May

20:30 U.S. API Crude Oil Inventories May 1.3

23:30 Australia AIG Services Index May 49.7

-