Noticias del mercado

-

21:00

Dow +0.71% 17,844.99 +125.07 Nasdaq +0.71% 5,144.86 +36.19 S&P +0.77% 2,096.42 +16.01

-

18:37

WSE: Session Results

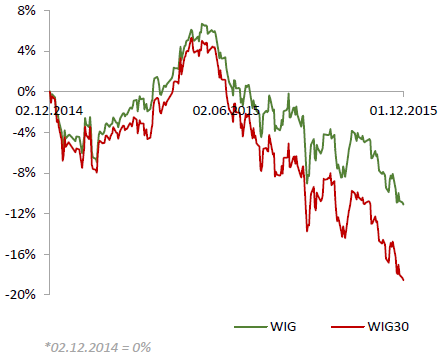

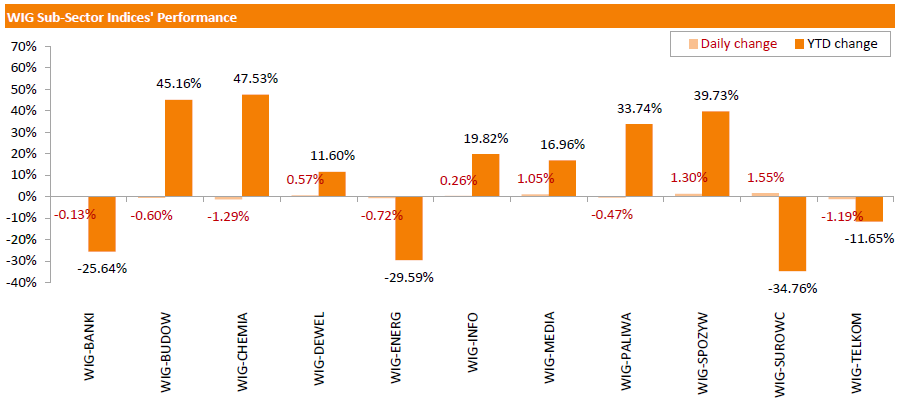

Polish equity market declined on Tuesday. The broad market measure, the WIG Index, slumped by 0.23%. Sector-wise, chemicals names (-1.29%) lagged behind, while materials stocks (+1.55%) were the strongest group.

The large-cap stocks fell by 0.25%, as measured by the WIG30 Index. In the index basket, retailer CCC (WSE: CCC) led the decliners, tumbling by 6.29% as the company's monthly sales report showed its revenue growth slowed substantially in November compared with October. Other major laggards were two banking names HANDLOWY (WSE: BHW) and ALIOR (WSE: ALR), and two utilities names TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), which plummeted by 2.2%-4.27%. On the other side of the ledger, agri name KERNEL (WSE: KER) became the biggest gainer with a 2.94% advance, followed by FMCG distributor EUROCASH (WSE: EUR) and coal miner BOGDANKA (WSE: LWB), which quotations went up by 1.92% and 1.88% respectively.

-

18:22

The Bank of England's Financial Policy Committee: the financial system in the U.K. recovered from financial crisis

The Bank of England's (BoE) Financial Policy Committee (FPC) released its Financial Stability Report on Tuesday. The FPC said that the financial system in the U.K. recovered from financial crisis.

"Following the global financial crisis, there was a period of heightened risk aversion and retrenchment from risk-taking. The system has now moved out of that period," the FPC said.

The FPC plans to introduce new rule that banks will need to hold £10 billion extra capital.

The results of the 2015 stress test were also released. All 7 major banks passed the test. But Royal Bank of Scotland Group and Standard Chartered passed the tests by improving their capital ratios through the testing process.

"UK banks are significantly more resilient now than they were before the financial crisis. Capital requirements for the largest banks have increased ten-fold, their holdings of liquid assets have increased four times, their trading assets are down by a third, interbank exposures are down by two thirds. And the result of the Bank's 2015 stress tests underscores these improvements," the BoE Governor Mar Carney said.

He also said that the interest rate hikes by the BoE will be limited and gradual once the BoE will start raising its interest rate.

-

18:00

European stocks close: stocks closed mixed ahead of the European Central Bank's monetary policy meeting this week

Stock indices closed mixed as market participants were cautious ahead of the European Central Bank's (ECB) monetary policy meeting on Thursday. Analysts expect the central bank to add further stimulus measures.

Meanwhile, the economic data from Eurozone was positive. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.7% in October from 10.8% in September. It was the lowest reading since January 2012. Analysts had expected the unemployment rate to remain unchanged at 10.8%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.8 in November from 52.3 in October, in line with the preliminary reading.

Production and new orders grew in all countries except Greece.

"The euro area's manufacturing recovery continued to build momentum in November, with factory output and new orders both showing the largest monthly gains for one-and-a-half years," Chris Williamson, Chief Economist at Markit said.

"It's by no means a spectacular pace of expansion, however, broadly consistent with 2% annualised growth, and there are also few signs of underlying inflationary pressures picking up," he added.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 52.9 in November from 52.1 in October, up from the preliminary reading of 52.6.

France's final manufacturing purchasing managers' index (PMI) remains unchanged at 50.6 in November, down from the preliminary reading of 50.8.

The Federal Labour Agency released its unemployment figures for Germany on Monday. The number of unemployed people in Germany fell by 13,000 in November, exceeding expectations for a 5,000 decline, after a 7,000 decrease in October. October's figure was revised up from a 5,000 decline.

The unemployment rate fell to 6.3% in November from 6.4% in October. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 52.7 in November from 55.2 in October, missing expectations for a fall to 53.6. October's figure was revised down from 55.5.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"UK manufacturing is moving back into expansion mode during quarter four, as it starts to reverse the losses sustained in the prior quarter. Although the pace of growth so far is only very modest, it positions manufacturing as less of a drag on the broader economy," Markit's Senior Economist Rob Dobson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,395.65 +39.56 +0.62 %

DAX 11,261.24 -120.99 -1.06 %

CAC 40 4,914.53 -43.07 -0.87 %

-

18:00

European stocks closed: FTSE 100 6,395.65 +39.56 +0.62% CAC 40 4,914.53 -43.07 -0.87% DAX 11,261.24 -120.99 -1.06%

-

17:56

Oil prices fall on concerns over the global oil oversupply ahead of the OPEC’s meeting

Oil prices traded lower on concerns over the global oil oversupply ahead of the OPEC's meeting. The OPEC will meet in Vienna on December 04 to decide on the oil output limit. Analysts expect the OPEC to keep its output limit unchanged.

Reuters reported today that OPEC source said the oil price could decline toward $35 a barrel if the Fed will raise its interest rate this month.

Today's Chinese economic data supported oil prices. The Chinese manufacturing PMI fell to 49.6 in November from 49.8 in October, according to the Chinese government. It was the lowest reading since August 2012. Analysts had expected the index to remain unchanged at 49.8. The services PMI rose to 53.6 in November from 53.1 in October.

The Chinese Markit/Caixin manufacturing PMI rose to 48.6 in November from 48.3 in October, beating expectations for a reading of 48.3.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for January delivery declined to $41.55 a barrel on the New York Mercantile Exchange.

Brent crude oil for January fell to $44.10 a barrel on ICE Futures Europe.

-

17:31

Gold trades mixed as market participants are cautious ahead the release of the U.S. labour market data on Friday

Gold traded mixed as market participants are cautious ahead the release of the U.S. labour market data on Friday. The better-than-expected U.S. labour market data will add to speculation that the Fed will start raising its interest rate this month.

Today's U.S. economic data supported gold price. The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index declined to 48.6 in November from 50.1 in October, missing expectations for a rise to 50.4. It was the lowest level since November of 2012.

December futures for gold on the COMEX currently traded at 1065.20 dollars per ounce.

-

17:10

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes kicked off the last month of the year on a positive note as investors await data and policy decisions by central banks.

U.S. auto sales are expected to rise above 18 million vehicles on an annualized basis for November, continuing the pace for record sales in 2015. Investors are keeping an eye on data for clues regarding the health of the U.S. economy that might enable the Federal Reserve to raise interest rates for the first time in nearly a decade. The main data this week is the November employment report, which is expected to show that the economy added 200,000 jobs during the month. Analysts say a strong report virtually guarantees a rate rise this month.

Most of Dow stocks in positive area (27 of 30). Top looser - Caterpillar Inc. (CAT, -1.07%). Top gainer - The Boeing Company (BA. +2.30%).

Most of S&P index sectors also in positive area. Top looser - Conglomerates (-0.2%). Top gainer - Technology (+1,0%).

At the moment:

Dow 17832.00 +118.00 +0.67%

S&P 500 2092.50 +12.75 +0.61%

Nasdaq 100 4703.50 +34.75 +0.74%

Oil 41.38 -0.27 -0.65%

Gold 1065.10 -0.20 -0.02%

U.S. 10yr 2.18 -0.04

-

16:50

Final Markit/Nikkei manufacturing purchasing managers' index for Japan increases to 52.6 in November, the highest reading since reading since March 2014

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 52.6 in November from 52.4 in October, down from the preliminary reading of 52.8. It was the highest reading since reading since March 2014.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders, employment and buying activity.

"Supporting total new order growth was an increase in international demand, as new export orders rose at the quickest rate since June. Subsequently, both buying activity and employment expanded, with the former increasing at the sharpest rate in over a year," economist at Markit, Amy Brownbill, said.

-

16:38

Italy’s final manufacturing PMI rises to 54.9 in November

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Tuesday. Italy's manufacturing purchasing managers' index (PMI) climbed to 54.9 in November from 54.1 in October.

The increase was driven by rises in in output, new orders and employment.

"The tailwinds from a weak euro and falling commodity prices continue to benefit manufacturers overall, while at the same time demand in the domestic market continues to improve and is adding impetus to the upturn," Markit economist Phil Smith said.

-

16:32

Construction spending in the U.S. is up 1.0% in October

The U.S. Commerce Department released construction spending data on Tuesday. Construction spending in the U.S. rose 1.0% in October, exceeding expectations for a 0.5% gain, after a 0.6% increase in September.

The increase was mainly driven by a rise in private construction, which was up 0.8% in October.

Spending on private residential construction climbed 1.0% in October.

Spending on private non-residential construction projects increased 0.6% in October, while public construction spending increased 1.4%.

-

16:09

ISM manufacturing purchasing managers’ index falls to 48.6 in November, the lowest level since November of 2012

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Tuesday. The index declined to 48.6 in November from 50.1 in October, missing expectations for a rise to 50.4. It was the lowest level since November of 2012.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in production and new orders. The production index decreased to 49.2 in November from 52.9 in October.

The new orders index fell to 48.9 in November from 52.9 in October.

The employment index was up to 51.3 in November from 47.6 in October.

The price index was down to 35.5 in November from 39.0 in October.

-

16:00

U.S.: Construction Spending, m/m, October 1% (forecast 0.5%)

-

16:00

U.S.: ISM Manufacturing, November 48.6 (forecast 50.4)

-

15:57

U.S. final manufacturing purchasing managers' index (PMI) declines to 52.8 in November

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 52.8 in November from 54.1 in October, up from the previous estimate of 52.6.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in output, new orders and employment.

"While the pace of manufacturing growth appears to have slowed in November, it remains encouragingly resilient, which is all the more impressive once headwinds such as the strength of the dollar and malaise in overseas markets are taken into account," Markit's Chief Economist Chris Williamson said.

-

15:45

U.S.: Manufacturing PMI, November 52.8 (forecast 52.6)

-

15:44

Greece’s final manufacturing PMI climbs to 48.1 in November

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Tuesday. Greece's manufacturing purchasing managers' index (PMI) climbed to 48.1 in November from 47.3 in October.

The contraction of production eased in October, while job shedding also eased.

"The Greek manufacturing sector appears to be edging towards stability, judging from the latest PMI survey data. The rate at which operating conditions are deteriorating seems to have shifted into a lower gear, suggesting the economy is slowly adapting to the austerity measures that have been implemented by the government," Markit economist Samuel Agass said.

-

15:39

Spain’s manufacturing PMI rises to 53.1 in November

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Tuesday. Spain's manufacturing purchasing managers' index (PMI) rose to 53.1 in November from 51.3 in October.

The increase was driven by a faster pace of production growth and new orders.

"Spanish manufacturers recorded a welcome pickup in growth during November, bringing an end to a prolonged slowdown. This provides some optimism that the sector will be able to remain in growth mode as the year draws to a close," a senior economist at Markit Andrew Harker said.

-

15:34

U.S. Stocks open: Dow +0.43%, Nasdaq +0.41%, S&P +0.49%

-

15:33

Italian final GDP rises 0.2% in the third quarter

The Italian statistical office Istat released its final gross domestic product (GDP) data for Italy on Tuesday. The Italian final GDP increased 0.2% in the third quarter, in line with the preliminary reading, after a 0.3% rise in the second quarter.

Final consumption expenditure climbed by 0.4% in the third quarter, gross fixed capital formation declined by 0.4%, imports rose by 0.5%, while exports fell by 0.8%.

On a yearly basis, Italian final GDP rose 0.8% in the third quarter, down from the preliminary reading of 0.9%, after a 0.6% increase in the second quarter.

-

15:28

Italy’s unemployment rate decreases to 11.5% in October, the lowest level since December 2012

The Italian statistical office Istat released its unemployment data on Tuesday. The seasonally adjusted unemployment rate decreased to 11.5% in October from 11.6 in September. It was the lowest level since December 2012.

September's figure was revised down from 11.8%.

The number of unemployed people was 2.927 million in October, down by 0.5% from the month before.

The youth unemployment rate rose to 39.8% in October from 39.4% in September.

The employment rate decreased to 56.3% in October from 56.4% in September.

-

15:14

Before the bell: S&P futures +0.35%, NASDAQ futures +0.38%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 20,012.4 +264.93 +1.34%

Hang Seng 22,381.35 +384.93 +1.75%

Shanghai Composite 3,457.73 +12.33 +0.36%

FTSE 6,394.12 +38.03 +0.60%

CAC 4,943.73 -13.87 -0.28%

DAX 11,363.58 -18.65 -0.16%

Crude oil $41.31 (-0.82%)

Gold $1067.00 (+0.16%)

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.27

1.10%

21.9K

Amazon.com Inc., NASDAQ

AMZN

671.75

1.05%

16.0K

Barrick Gold Corporation, NYSE

ABX

7.41

0.95%

11.9K

Hewlett-Packard Co.

HPQ

12.65

0.88%

3.2K

Johnson & Johnson

JNJ

102.04

0.79%

1K

Merck & Co Inc

MRK

53.43

0.79%

0.9K

Ford Motor Co.

F

14.43

0.70%

18.3K

General Motors Company, NYSE

GM

36.45

0.69%

6.9K

Starbucks Corporation, NASDAQ

SBUX

61.81

0.68%

2.3K

ALCOA INC.

AA

9.42

0.64%

8.7K

FedEx Corporation, NYSE

FDX

159.50

0.61%

1.1K

Boeing Co

BA

146.30

0.58%

3.5K

Walt Disney Co

DIS

114.05

0.51%

10.7K

Microsoft Corp

MSFT

54.62

0.50%

24.6K

Visa

V

79.40

0.49%

0.2K

JPMorgan Chase and Co

JPM

67.00

0.48%

0.2K

Google Inc.

GOOG

746.00

0.46%

1K

Goldman Sachs

GS

190.85

0.44%

4.5K

Cisco Systems Inc

CSCO

27.37

0.44%

13.1K

Wal-Mart Stores Inc

WMT

59.08

0.41%

7.0K

Pfizer Inc

PFE

32.90

0.40%

8.2K

Nike

NKE

132.80

0.39%

3.7K

Home Depot Inc

HD

133.78

0.37%

1K

Citigroup Inc., NYSE

C

54.29

0.37%

1.1K

Intel Corp

INTC

34.89

0.35%

0.1K

Facebook, Inc.

FB

104.60

0.35%

14.3K

AT&T Inc

T

33.78

0.33%

27.6K

Chevron Corp

CVX

91.62

0.33%

3.6K

UnitedHealth Group Inc

UNH

113.08

0.33%

0.1K

Apple Inc.

AAPL

118.65

0.30%

128.6K

Tesla Motors, Inc., NASDAQ

TSLA

230.90

0.28%

5.8K

Verizon Communications Inc

VZ

45.55

0.22%

20.6K

The Coca-Cola Co

KO

42.71

0.21%

1.9K

Exxon Mobil Corp

XOM

81.79

0.16%

10.6K

Procter & Gamble Co

PG

74.93

0.12%

4.0K

Twitter, Inc., NYSE

TWTR

25.43

0.12%

25.4K

International Business Machines Co...

IBM

139.42

0.00%

0.8K

Deere & Company, NYSE

DE

79.50

-0.09%

1.4K

American Express Co

AXP

71.50

-0.20%

1.6K

General Electric Co

GE

29.88

-0.20%

20.7K

Caterpillar Inc

CAT

72.35

-0.41%

0.4K

Yahoo! Inc., NASDAQ

YHOO

33.65

-0.47%

8.9K

-

14:52

Canada's GDP climbs 0.6% in the third quarter

Statistics Canada released GDP (gross domestic product) growth data on Tuesday. Canada's GDP growth dropped 0.5% in September, missing expectations for a flat reading, after a 0.1% rise in August.

On a quarterly basis, GDP climbed 0.6% in the third quarter, after 0.1% decline in the second quarter.

The quarterly rise was driven by increased international demand for Canadian goods and services. Exports of goods and services rose 2.3% in the third quarter, while imports of goods and services declined 0.7%.

Household final consumption expenditure was up 0.4% in the third quarter as spending on durable, non-durable and semi-durable goods rose.

The household saving rate fell to 4.2% in the third quarter from 4.9% in the second quarter.

Final domestic demand was flat in the third quarter, after a 0.1% rise in the second quarter.

Mineral exploration and evaluation plunged 9.3% in the third quarter.

Business gross fixed capital formation dropped 0.8% in the third quarter.

On a yearly basis, GDP rose 2.3% in the third quarter, in line with expectations, after 0.3% drop in the second quarter. The second quarter's figure was revised up from a 0.5% decline.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Merck (MRK) upgraded to Overweight at Barclays

Johnson & Johnson (JNJ) upgraded to Overweight at Barclays

Downgrades:

Other:

Amazon (AMZN) target raised to $850 from $700 at Barclay

Pfizer (PFE) resumed with an Equal Weight at Barclays

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 1.3bln)

EUR/USD 1.0500 (EUR 960m) 1.0550 (391m) 1.0600 (2bln)

GBP/USD 1.5175 (GBP 428m)

AUD/USD 0.7100 (AUD 280m) 0.7150 (AUD 425m) 0.7300 (230m)

NZD/USD 0.6300 (NZD 834m)

EUR/JPY 132.30 (EUR 1.1bln)

EUR/GBP 0.6950 (EUR 690m) 0.7050 (600m)

AUD/JPY 87.00 (AUD 774m)

AUD/NZD 1.0840 (AUD 373m) 1.1000 (225m)

-

14:39

Switzerland's GDP is flat in the third quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Tuesday. Switzerland's GDP was flat in the third quarter, missing expectations for a 0.2% rise, after a 0.2% increase in the second quarter.

GDP was driven by a positive contribution from household spending and the balance of trade in goods, while the balance of trade in services had a negative impact.

Exports of goods climbed 1.1% in the third quarter, while exports of services decreased 0.3%.

Imports of goods were flat in the third quarter, while imports of services were up 0.6%.

Household spending climbed by 0.4% in the third quarter, public spending was up 1.8%, equipment and software spending rose 0.2%, while construction spending decreased 0.9%.

On a yearly basis, Switzerland's economy grew at 0.8% in the third quarter, missing expectations for a 0.9% rise, after a 0.9% increase in the second quarter. The second quarter's figure was revised down from a 1.2% gain.

-

14:30

Canada: GDP (m/m) , September -0.5% (forecast 0%)

-

14:30

Canada: GDP QoQ, Quarter III 0.6%

-

14:30

Canada: GDP (YoY), Quarter III 2.3% (forecast 2.3%)

-

14:24

Swiss manufacturing PMI falls to 49.7 in November

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Tuesday. The manufacturing purchasing managers' index in Switzerland fell to 49.7 in November from 50.7 in October, missing expectations for an increase to 51.0.

A reading above 50 indicates contraction.

The decline was largely driven by a drop in production. The production decreased to 49.5 In November from 53.7 in October.

Purchase prices increased to 38.4 in November from 36.1 in October, while the backlog of orders sub-index rose to 51.5 from 51.2.

Employment fell to 43.9 in November from 44.0 in October.

-

14:17

Swiss retail sales decline 0.8% year-on-year in October

The Federal Statistical Office released its retail sales data for Switzerland on Tuesday. Retail sales in Switzerland were down at an annual rate of 0.8% in October, missing expectations for a 0.4% rise, after a 0.2% increase in September.

Sales of food, beverages and tobacco fell at an annual rate of 0.3% in October, while non-food sales rose 0.5%.

On a monthly basis, retail sales increased by 0.3% in October, after a 0.1% rise in September.

Sales of food, beverages and tobacco declined 0.2% in October, while non-food sales increased 0.7%.

-

14:07

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Current Account, bln Quarter III -20.5 Revised From -19.0 -16.5 -18.1

00:30 Australia Building Permits, m/m October 2.3% Revised From 2.2% -2.3% 3.9%

01:00 China Non-Manufacturing PMI November 53.1 53.6

01:00 China Manufacturing PMI November 49.8 49.8 49.6

01:35 Japan Manufacturing PMI (Finally) November 52.4 52.8 52.6

01:45 China Markit/Caixin Manufacturing PMI November 48.3 48.3 48.6

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

06:45 Switzerland Gross Domestic Product (YoY) Quarter III 0.9% Revised From 1.2% 0.9% 0.8%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.2% 0.2% 0.0%

08:15 Switzerland Retail Sales (MoM) October 0.1% 0.3%

08:15 Switzerland Retail Sales Y/Y October 0.2% 0.4% -0.8%

08:30 Switzerland Manufacturing PMI November 50.7 51 49.7

08:50 France Manufacturing PMI (Finally) November 50.6 50.8 50.6

08:55 Germany Manufacturing PMI (Finally) November 52.1 52.6 52.9

08:55 Germany Unemployment Change November -7 Revised From -5 -5 -13

08:55 Germany Unemployment Rate s.a. November 6.4% 6.4% 6.3%

09:00 Eurozone Manufacturing PMI (Finally) November 52.3 52.8 52.8

09:00 United Kingdom BOE Financial Stability Report

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 55.2 Revised From 55.5 53.6 52.7

10:00 Eurozone Unemployment Rate October 10.8% 10.8% 10.7%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to decline to 52.6 in November from 54.1 in October.

The ISM manufacturing purchasing managers' index is expected to rise to 50.4 in November from 50.1 in October.

The euro traded higher against the U.S. dollar on the positive economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.7% in October from 10.8% in September. It was the lowest reading since January 2012. Analysts had expected the unemployment rate to remain unchanged at 10.8%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.8 in November from 52.3 in October, in line with the preliminary reading.

Production and new orders grew in all countries except Greece.

"The euro area's manufacturing recovery continued to build momentum in November, with factory output and new orders both showing the largest monthly gains for one-and-a-half years," Chris Williamson, Chief Economist at Markit said.

"It's by no means a spectacular pace of expansion, however, broadly consistent with 2% annualised growth, and there are also few signs of underlying inflationary pressures picking up," he added.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 52.9 in November from 52.1 in October, up from the preliminary reading of 52.6.

France's final manufacturing purchasing managers' index (PMI) remains unchanged at 50.6 in November, down from the preliminary reading of 50.8.

The Federal Labour Agency released its unemployment figures for Germany on Monday. The number of unemployed people in Germany fell by 13,000 in November, exceeding expectations for a 5,000 decline, after a 7,000 decrease in October. October's figure was revised up from a 5,000 decline.

The unemployment rate fell to 6.3% in November from 6.4% in October. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

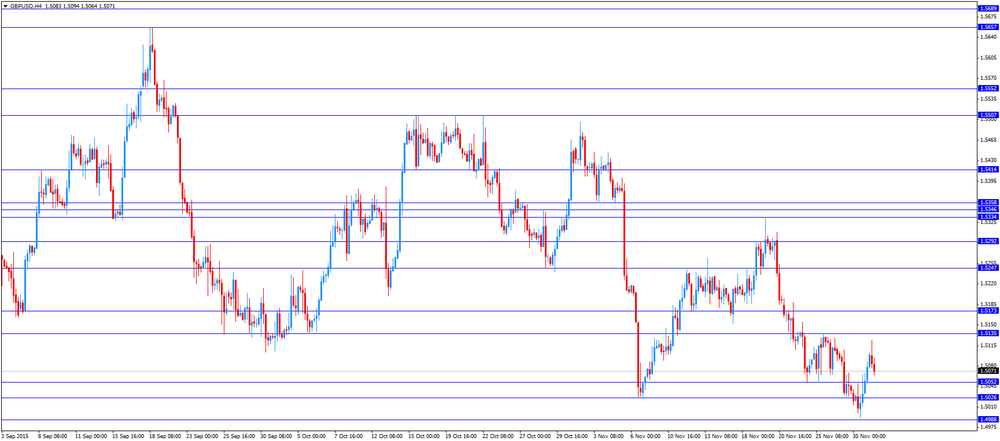

The British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 52.7 in November from 55.2 in October, missing expectations for a fall to 53.6. October's figure was revised down from 55.5.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"UK manufacturing is moving back into expansion mode during quarter four, as it starts to reverse the losses sustained in the prior quarter. Although the pace of growth so far is only very modest, it positions manufacturing as less of a drag on the broader economy," Markit's Senior Economist Rob Dobson said.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of Canadian gross domestic product (GDP) data. Canada's GDP growth is expected to be flat in September, after a 0.1% gain in August.

The Swiss franc traded lower against the U.S. dollar after the release of the weaker-than-expected Swiss economic data. Switzerland's GDP was flat in the third quarter, missing expectations for a 0.2% rise, after a 0.2% increase in the second quarter.

On a yearly basis, Switzerland's economy grew at 0.8% in the third quarter, missing expectations for a 0.9% rise, after a 0.9% increase in the second quarter. The second quarter's figure was revised down from a 1.2% gain.

Retail sales in Switzerland were down at an annual rate of 0.8% in October, missing expectations for a 0.4% rise, after a 0.2% increase in September.

On a monthly basis, retail sales increased by 0.3% in October, after a 0.1% rise in September.

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Tuesday. The manufacturing purchasing managers' index in Switzerland fell to 49.7 in November from 50.7 in October, missing expectations for an increase to 51.0.

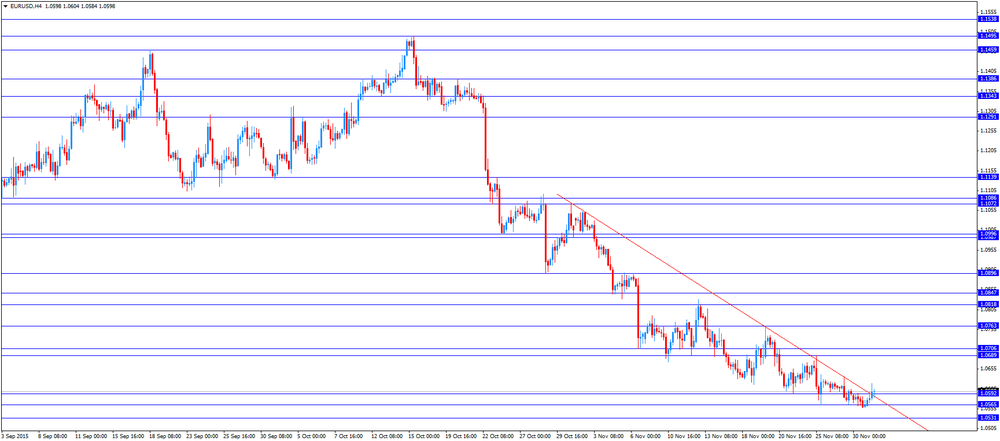

EUR/USD: the currency pair rose to $1.0619

GBP/USD: the currency pair fell to $1.5064

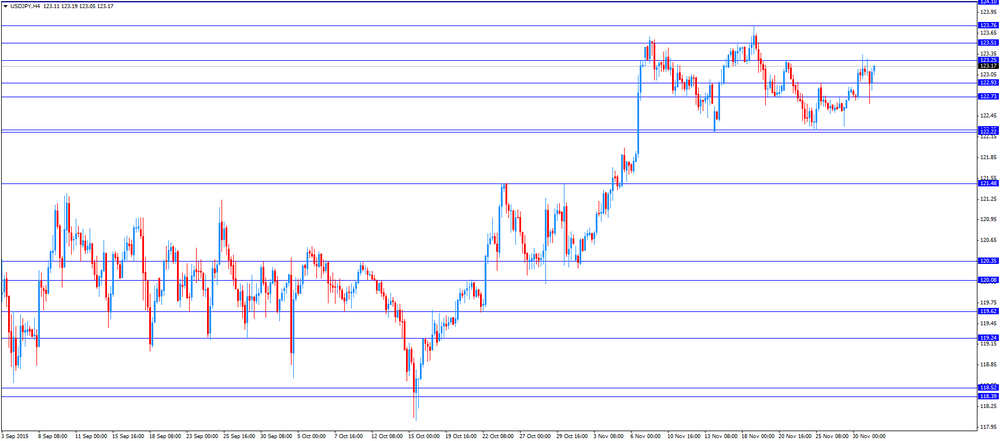

USD/JPY: the currency pair increased to Y123.19

The most important news that are expected (GMT0):

13:30 Canada GDP QoQ Quarter III -0.1%

13:30 Canada GDP (YoY) Quarter III -0.5% 2.3%

13:30 Canada GDP (m/m) September 0.1% 0%

14:45 U.S. Manufacturing PMI (Finally) November 54.1 52.6

15:00 U.S. Construction Spending, m/m October 0.6% 0.5%

15:00 U.S. ISM Manufacturing November 50.1 50.4

17:45 U.S. FOMC Member Charles Evans Speaks

23:30 Australia RBA's Governor Glenn Stevens Speech

-

14:00

Orders

EUR/USD

Offers 1.0600 1.0630-35 1.0650 1.0665 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0575-80 1.0560 1.0550 1.0525-30 1.0500 1.0485 1.0465 1.0450 1.0425-30 1.0400

GBP/USD

Offers 1.5110 1.5125 1.5135 1.5150-55 1.5170 1.5180-85 1.5200 1.5230 1.5250

Bids 1.5075-80 1.5050 1.5030 1.5015 1.5000 1.4985 1.4965 1.4950 1.4930 1.4900

EUR/GBP

Offers 0.7030-35 0.7050-55 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7010 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.80 131.00131.20 131.50 131.85 132.00 132.30 132.50

Bids 130.20 130.00 129.80 129.65 129.50 129.35 129.00 128.80 128.50

USD/JPY

Offers 123.00 123.20-25 123.35 123.50 123.75 124.00

Bids 122.65-70 122.50 122.20-25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7300 0.7325-30 0.7350 0.7375 0.7400

Bids 0.7275 0.7260 0.7250 0.7235 0.7200 0.7180-85 0.7165 0.7150

-

12:08

European stock markets mid session: stocks traded mixed despite the positive economic data from the Eurozone

Stock indices traded mixed despite the positive economic data from the Eurozone. Market participants were cautious ahead of the European Central Bank's (ECB) monetary policy meeting on Thursday. Analysts expect the central bank to add further stimulus measures.

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.7% in October from 10.8% in September. It was the lowest reading since January 2012. Analysts had expected the unemployment rate to remain unchanged at 10.8%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.8 in November from 52.3 in October, in line with the preliminary reading.

Production and new orders grew in all countries except Greece.

"The euro area's manufacturing recovery continued to build momentum in November, with factory output and new orders both showing the largest monthly gains for one-and-a-half years," Chris Williamson, Chief Economist at Markit said.

"It's by no means a spectacular pace of expansion, however, broadly consistent with 2% annualised growth, and there are also few signs of underlying inflationary pressures picking up," he added.

Germany's final manufacturing purchasing managers' index (PMI) climbed to 52.9 in November from 52.1 in October, up from the preliminary reading of 52.6.

France's final manufacturing purchasing managers' index (PMI) remains unchanged at 50.6 in November, down from the preliminary reading of 50.8.

The Federal Labour Agency released its unemployment figures for Germany on Monday. The number of unemployed people in Germany fell by 13,000 in November, exceeding expectations for a 5,000 decline, after a 7,000 decrease in October. October's figure was revised up from a 5,000 decline.

The unemployment rate fell to 6.3% in November from 6.4% in October. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 52.7 in November from 55.2 in October, missing expectations for a fall to 53.6. October's figure was revised down from 55.5.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"UK manufacturing is moving back into expansion mode during quarter four, as it starts to reverse the losses sustained in the prior quarter. Although the pace of growth so far is only very modest, it positions manufacturing as less of a drag on the broader economy," Markit's Senior Economist Rob Dobson said.

Current figures:

Name Price Change Change %

FTSE 100 6,385.22 +29.13 +0.46 %

DAX 11,353.07 -29.16 -0.26 %

CAC 40 4,936.51 -21.09 -0.43 %

-

12:02

Number of unemployed people in Germany declines by 13,000 in November

The Federal Labour Agency released its unemployment figures for Germany on Monday. The number of unemployed people in Germany fell by 13,000 in November, exceeding expectations for a 5,000 decline, after a 7,000 decrease in October. October's figure was revised up from a 5,000 decline.

The unemployment rate fell to 6.3% in November from 6.4% in October. Analysts had expected the unemployment rate to remain unchanged at 6.4%.

The number of unemployed people was 1.87 million in October, according to Destatis.

Destatis said that Germany's adjusted unemployment rate remained unchanged at 4.5% in October.

The employment rate remained unchanged at 65.1% in October, according to Destatis.

-

11:55

France’s final manufacturing PMI remains unchanged at 50.6 in November

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Tuesday. France's final manufacturing purchasing managers' index (PMI) remains unchanged at 50.6 in November, down from the preliminary reading of 50.8.

The index was driven by a slower growth of output.

"While there were no specific reports from surveyed manufacturers of an immediate drop in orders following the Paris attacks, the likely effect on consumer confidence will clearly not help the sector's prospects of breaking out of its prolonged sluggish phase as we head towards the end of the year," Markit Senior Economist Jack Kennedy said.

-

11:47

Germany’s final manufacturing PMI rises to 52.9 in November

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Tuesday. Germany's final manufacturing purchasing managers' index (PMI) climbed to 52.9 in November from 52.1 in October, up from the preliminary reading of 52.6.

The index was driven by a rise in production and new orders. New export business showed the strongest rise since February 2014.

"The German Manufacturing PMI recovered some of the ground it had lost recently and rose to a three month high in November, with employment, new orders and output all rising at slightly stronger, although still moderate rates. For now, it seems as if Germany's goods-producing sector is largely unaffected by the VW emissions scandal," Markit economist Oliver Kolodseike said.

-

11:42

Eurozone’s final manufacturing PMI rises to 52.8 in November

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.8 in November from 52.3 in October, in line with the preliminary reading.

Production and new orders grew in all countries except Greece.

"The euro area's manufacturing recovery continued to build momentum in November, with factory output and new orders both showing the largest monthly gains for one-and-a-half years," Chris Williamson, Chief Economist at Markit said.

"It's by no means a spectacular pace of expansion, however, broadly consistent with 2% annualised growth, and there are also few signs of underlying inflationary pressures picking up," he added.

-

11:34

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. drops to 52.7 in November

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. declined to 52.7 in November from 55.2 in October, missing expectations for a fall to 53.6. October's figure was revised down from 55.5.

A reading above 50 indicates expansion.

The decline was driven by a slower pace of the growth in output and new orders.

"UK manufacturing is moving back into expansion mode during quarter four, as it starts to reverse the losses sustained in the prior quarter. Although the pace of growth so far is only very modest, it positions manufacturing as less of a drag on the broader economy," Markit's Senior Economist Rob Dobson said.

-

11:27

Eurozone's unemployment rate drops to 10.7% in October, the lowest reading since January 2012

Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.7% in October from 10.8% in September. It was the lowest reading since January 2012.

Analysts had expected the unemployment rate to remain unchanged at 10.8%.

There were 17.240 million unemployed in the Eurozone in October, down by 13.000 from September.

The lowest unemployment rate in the Eurozone in October was recorded in Germany (4.5%) and Malta (5.1%), and the highest in Greece (24.6% in August 2015) and Spain (21.6%).

The youth unemployment rate was 22.3% in the Eurozone in October, compared to 23.3% in October a year ago.

-

11:21

Chinese Markit/Caixin manufacturing PMI rises to 48.6 in November

The Chinese Markit/Caixin manufacturing PMI rose to 48.6 in November from 48.3 in October, beating expectations for a reading of 48.3.

Overall new business declined modestly, while new export work climbed at fastest pace in over a year.

"Pressure on economic growth has eased and fiscal policy has had a strong effect. Overall, the economy is still on track to become more stable," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

11:08

Official data: Chinese manufacturing PMI declines to 49.6 in November, the lowest reading since August 2012

The Chinese manufacturing PMI fell to 49.6 in November from 49.8 in October, according to the Chinese government. It was the lowest reading since August 2012.

Analysts had expected the index to remain unchanged at 49.8.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The decline was driven by weak demand both at home and abroad for products from China.

The services PMI rose to 53.6 in November from 53.1 in October.

-

11:01

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in December

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the Australian economy continued to recover moderately, and that the employment grew strongly.

The RBA governor also said that inflation is low and is expected to remain low.

Stevens noted that the Australian dollar was adjusting to the significant drop in key commodity prices.

-

11:00

Eurozone: Unemployment Rate , October 10.7% (forecast 10.8%)

-

10:56

Australia’s current account deficit narrows to A$18.1 billion in the third quarter

The Australian Bureau of Statistics released its current account data on Tuesday. Australia's current account deficit narrowed to A$18.1 billion in the third quarter from A$20.5 billion in the second quarter, missing expectations for a decline to a deficit of A$16.5 billion. The second quarter's figure was revised down from a deficit of A$19.0 billion.

The seasonally adjusted surplus on goods and services rose by A$6.12 billion in the third quarter, which was 1.5% of gross domestic product.

Australia's net foreign debt climbed 3% in the third quarter.

-

10:47

Capital spending in Japan jumps 11.2% in the third quarter

Japan's Ministry of Finance released its capital spending data on late Monday evening. Capital spending in Japan jumped 11.2% in the third quarter, after a 5.6% gain in the second quarter.

Capital spending excluding software soared 11.2% in the third quarter, after a 6.6% rise in the second quarter.

Company profits in Japan climbed 9.0% in the third quarter, while company sales were up 0.1%.

-

10:40

YouGov/Citi survey: expectations for inflation in the U.K. in the next 12 months fall in November

According to a monthly YouGov/Citi survey, expectations for inflation in the U.K. in the next 12 months fell in November. Inflation expectations declined to 1.2% in November from 1.4% in October.

Expectations for inflation over the next five to 10 years decreased to 2.6% in November from 2.7% in October.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , November 52.7 (forecast 53.6)

-

10:22

The Fed adopts a rule that would limit emergency loans to failing companies

The Fed adopted a rule that would limit emergency loans to failing companies on Monday. The rule will limit the Fed's ability to save companies that are supposedly "too big to fail".

The rule "eliminated the authority to lend for the purpose of aiding a failing firm or preventing a firm from entering bankruptcy or another resolution process," the Fed Chairwoman Janet Yellen said.

"Emergency lending is a critical tool that can be used in times of crisis to help mitigate extraordinary pressures in financial markets that would otherwise have severe adverse consequences for households, businesses, and the U.S. economy," she added.

-

10:11

The International Monetary Fund votes to add the yuan to its basket of reserve currencies

The International Monetary Fund (IMF) voted on Monday to add the yuan to its basket of reserve currencies. The addition will take effect October 1, 2016.

"The Executive Board's decision to include the RMB in the SDR basket is an important milestone in the integration of the Chinese economy into the global financial system. It is also a recognition of the progress that the Chinese authorities have made in the past years in reforming China's monetary and financial systems," the IMF Managing Director Christine Lagarde said on Monday.

The IMF's basket of reserve currencies (Special Drawing Rights SDR)) includes the yen, euro, pound, U.S. dollar and the yuan now. Weightings will be 41.73% for the U.S. dollar, 30.93% for the euro, 10.92% for the yuan, 8.33% for the yen and 8.09% for the British pound.

The SDR was modified in 2000 last time, when the euro replaced the German Deutsche Mark and the French franc.

-

10:01

Eurozone: Manufacturing PMI, November 52.8 (forecast 52.8)

-

09:55

Germany: Manufacturing PMI, November 52.9 (forecast 52.6)

-

09:55

Germany: Unemployment Rate s.a. , November 6.3% (forecast 6.4%)

-

09:55

Germany: Unemployment Change, November -13 (forecast -5)

-

09:50

France: Manufacturing PMI, November 50.6 (forecast 50.8)

-

09:31

Switzerland: Retail Sales (MoM), October 0.3%

-

09:30

Switzerland: Manufacturing PMI, November 49.7 (forecast 51)

-

09:17

Switzerland: Retail Sales Y/Y, October -0.8% (forecast 0.4%)

-

09:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 1.3bln)

EUR/USD 1.0500 (EUR 960m) 1.0550 (391m) 1.0600 (2bln)

GBP/USD 1.5175 (GBP 428m)

AUD/USD 0.7100 (AUD 280m) 0.7150 (AUD 425m) 0.7300 (230m)

NZD/USD 0.6300 (NZD 834m)

EUR/JPY 132.30 (EUR 1.1bln)

EUR/GBP 0.6950 (EUR 690m) 0.7050 (600m)

AUD/JPY 87.00 (AUD 774m)

AUD/NZD 1.0840 (AUD 373m) 1.1000 (225m)

-

08:32

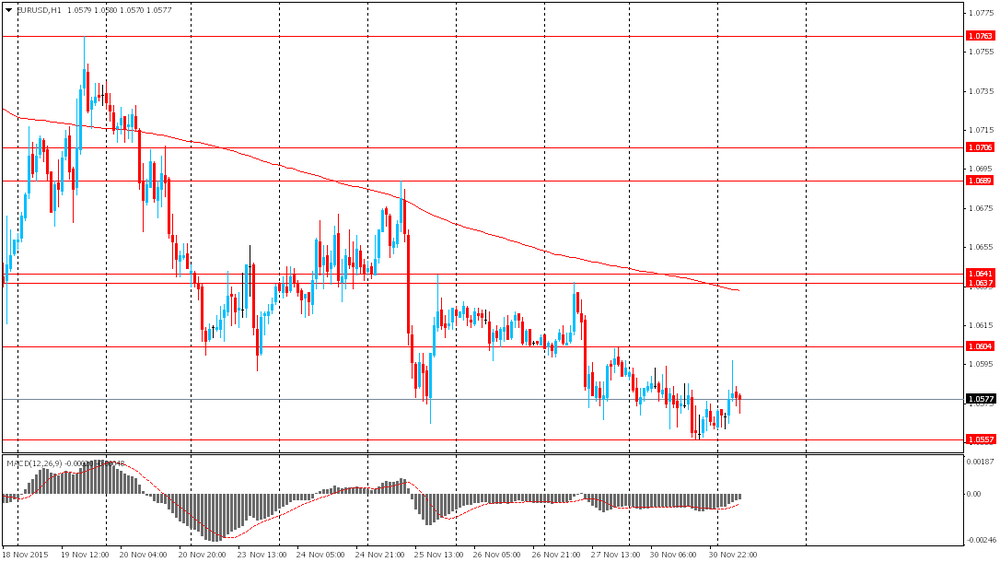

Options levels on Tuesday, December 1, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0746 (3941)

$1.0683 (2496)

$1.0636 (1061)

Price at time of writing this review: $1.0587

Support levels (open interest**, contracts):

$1.0543 (5549)

$1.0493 (5860)

$1.0440 (10313)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 101947 contracts, with the maximum number of contracts with strike price $1,1100 (6267);

- Overall open interest on the PUT options with the expiration date December, 4 is 122592 contracts, with the maximum number of contracts with strike price $1,0500 (10313);

- The ratio of PUT/CALL was 1.20 versus 1.24 from the previous trading day according to data from November, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.5400 (1915)

$1.5301 (2541)

$1.5202 (1167)

Price at time of writing this review: $1.5094

Support levels (open interest**, contracts):

$1.4996 (2714)

$1.4899 (2660)

$1.4799 (654)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28354 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 32334 contracts, with the maximum number of contracts with strike price $1,5050 (4396);

- The ratio of PUT/CALL was 1.14 versus 1.16 from the previous trading day according to data from November, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:12

Oil prices climbed ahead of OPEC meting

West Texas Intermediate futures for January delivery advanced to $41.99 (+0.82%), while Brent crude is currently at $44.85 (+0.54%). Market participants are waiting for OPEC meeting scheduled for December 4. There is speculation that the group, led by Saudi Arabia, will amend its policy and decrease production in order to support prices. However many analysts still doubt that OPEC will take this step. The cartel is likely to defend its market share against competitors.

Traders are also waiting for the key U.S. employment report, which also expected to be released on Friday. These data would increase volatility of the dollar and affect the dollar-denominated crude.

Meanwhile demand in world's second-biggest consumer of oil China is unlikely to rise significantly as activity in the country's manufacturing sector remains sluggish. According to China Federation of Logistics and Purchasing the Manufacturing PMI fell to 49.6 in November from 49.8 reported previously. The latest reading is the lowest since August 2012.

-

07:56

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Current Account, bln Quarter III -20.5 Revised From -19.0 -16.5 -18.1

00:30 Australia Building Permits, m/m October 2.3% Revised From 2.2% -2.3% 3.9%

01:00 China Non-Manufacturing PMI November 53.1 53.6

01:00 China Manufacturing PMI November 49.8 49.8 49.6

01:35 Japan Manufacturing PMI (Finally) November 52.4 52.8 52.6

01:45 China Markit/Caixin Manufacturing PMI November 48.3 48.3 48.6

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

06:45 Switzerland Gross Domestic Product (YoY) Quarter III 1.2% 0.9% 0.8%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.2% 0.2% 0.0%

The euro climbed against the U.S. dollar ahead of an ECB meeting scheduled for Thursday. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

The yen rose sharply against the U.S. dollar after sources reported that Japan's public pension fund had started to hedge a small amount of its investments against currency fluctuations, particularly against fluctuations in the euro in the "short term". This step was taken because of a negative outlook for the euro amid expectations for further easing by the European Central Bank.

The Australian dollar rose after the Reserve Bank of Australia left its benchmark interest rate at 2% as expected. The bank said the economy continued expanding at a moderate pace amid declines in mining investment. Inflation is expected to remain low and its outlook gives room for further policy easing.

EUR/USD: the pair rose to $1.0595 in Asian trade

USD/JPY: the pair fell to Y122.65

GBP/USD: the pair rose to $1.5095

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales (MoM) October 0.1%

08:15 Switzerland Retail Sales Y/Y October 0.2% 0.4%

08:30 Switzerland Manufacturing PMI November 50.7 51

08:50 France Manufacturing PMI (Finally) November 50.6 50.8

08:55 Germany Manufacturing PMI (Finally) November 52.1 52.6

08:55 Germany Unemployment Change November -5 -5

08:55 Germany Unemployment Rate s.a. November 6.4% 6.4%

09:00 Eurozone Manufacturing PMI (Finally) November 52.3 52.8

09:00 United Kingdom BOE Financial Stability Report

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 55.5 53.6

10:00 Eurozone Unemployment Rate October 10.8% 10.8%

13:30 Canada GDP QoQ Quarter III -0.1%

13:30 Canada GDP (YoY) Quarter III -0.5% 2.3%

13:30 Canada GDP (m/m) September 0.1% 0%

14:45 U.S. Manufacturing PMI (Finally) November 54.1 52.6

15:00 U.S. Construction Spending, m/m October 0.6% 0.5%

15:00 U.S. ISM Manufacturing November 50.1 50.4

17:45 U.S. FOMC Member Charles Evans Speaks

20:00 U.S. Total Vehicle Sales, mln November 18.24 18.1

23:30 Australia RBA's Governor Glenn Stevens Speech

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter III 0.0% (forecast 0.2%)

-

07:45

Switzerland: Gross Domestic Product (YoY), Quarter III 0.8% (forecast 0.9%)

-

07:33

Gold climbed on short-covering

Gold climbed to $1,071.50 (+0.58%) on short covering and as the dollar retreated from an eight-month high against a basket of major currencies. Investors have been preparing for a Federal Reserve's looming rate hike by selling gold.

Market participants are waiting for the U.S. jobs report due on Friday to assess probability of a rate hike when the Federal Reserve's Federal Open Market Committee meets on December 15-16. Higher rates would be harmful for the non-interest-paying bullion.

Meanwhile physical demand in top consumer China was strong. Premiums on the Shanghai Gold Exchange were at a healthy $5-$6 an ounce.

-

07:30

Global Stocks: U.S. stock indices posted modest declines

U.S. stock indices declined slightly on Monday, but gained in November.

The Dow Jones Industrial Average declined 78.63 points, or 0.4%, to 17,719.86 (+0.3% over the month). The S&P 500 declined 9.64 points, or 0.4%, to 2,080.47 (less than +0.1% over the month). The Nasdaq Composite lost 18.86 points, or 0.4% to 5,108.67 (+1.1% over the month).

Investors are preparing for a week of strong data, including the key jobs report due on Friday. These data will hint investors to the outcome of the Federal Reserve's meeting later in December. The central bank of the U.S. is likely to raise its interest rates for the first time since June 2006, while the European Central Bank is expected to announce additional monetary policy easing on Thursday.

Meanwhile Chicago Purchasing Managers' Index worsened in November and fell below the 50 points threshold, which separates expansion from contraction. The index declined to 48.7 from 56.2 in October. Economists had expected a modest decline to 54.0.

This morning in Asia Hong Kong Hang Seng rose 2.06%, or 454.03, to 22,450.45. China Shanghai Composite Index edged up 0.05%, or 1.73, to 3.447.14. The Nikkei rose 0.95%, or 188.06, to 19,935.53.

Asian indices advanced. Chinese stocks posted minor gains amid mixed data. According to China Federation of Logistics and Purchasing the Manufacturing PMI fell to 49.6 in November from 49.8 reported previously. The latest reading was the lowest since August 2012. At the same time Markit Economics reported that the Manufacturing PMI climbed to 48.6 in November from 48.3 in October.

Investors are waiting for the ECB meeting on Thursday and the U.S. payrolls report on Friday.

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2% (forecast 2%)

-

03:03

Nikkei 225 19,904.59 +157.12 +0.80 %, Hang Seng 22,246.7 +250.28 +1.14 %, Shanghai Composite 3,428.27 -17.13 -0.50 %

-

02:45

China: Markit/Caixin Manufacturing PMI, November 48.6 (forecast 48.3)

-

02:35

Japan: Manufacturing PMI, November 52.6 (forecast 52.8)

-

02:01

China: Non-Manufacturing PMI, November 53.6

-

02:01

China: Manufacturing PMI , November 49.6 (forecast 49.8)

-

01:31

Australia: Current Account, bln, Quarter III -18.1 (forecast -16.5)

-

01:30

Australia: Building Permits, m/m, October 3.9% (forecast -2.3%)

-

00:50

Japan: Capital Spending, Quarter III 11.2%

-

00:31

Commodities. Daily history for Nov 30’2015:

(raw materials / closing price /% change)

Oil 41.68 +0.07%

Gold 1,065.80 0.00%

-

00:30

Stocks. Daily history for Sep Nov 30’2015:

(index / closing price / change items /% change)

Nikkei 225 19,747.47 -136.47 -0.69 %

Hang Seng 21,996.42 -71.90 -0.33 %

Shanghai Composite 3,445.68 +9.37 +0.27 %

FTSE 100 6,356.09 -19.06 -0.30 %

CAC 40 4,957.6 +27.46 +0.56 %

Xetra DAX 11,382.23 +88.47 +0.78 %

S&P 500 2,080.41 -9.70 -0.46 %

NASDAQ Composite 5,108.67 -18.86 -0.37 %

Dow Jones 17,719.92 -78.57 -0.44 %

-

00:29

Currencies. Daily history for Nov 30’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0564 -0,27%

GBP/USD $1,5055 +0,10%

USD/CHF Chf1,0287 -0,05%

USD/JPY Y123,10 +0,21%

EUR/JPY Y130,03 -0,07%

GBP/JPY Y185,31 +0,25%

AUD/USD $0,7226 +0,50%

NZD/USD $0,6581 +0,74%

USD/CAD C$1,3360 -0,07%

-

00:01

Schedule for today, Tuesday, Dec 1’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Current Account, bln Quarter III -19.0 -16.5

00:30 Australia Building Permits, m/m October 2.2% -2.3%

01:00 China Non-Manufacturing PMI November 53.1

01:00 China Manufacturing PMI November 49.8 49.8

01:35 Japan Manufacturing PMI (Finally) November 52.4 52.8

01:45 China Markit/Caixin Manufacturing PMI November 48.3 48.3

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2%

03:30 Australia RBA Rate Statement

06:45 Switzerland Gross Domestic Product (YoY) Quarter III 1.2% 0.9%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter III 0.2% 0.2%

08:15 Switzerland Retail Sales (MoM) October 0.1%

08:15 Switzerland Retail Sales Y/Y October 0.2%

08:30 Switzerland Manufacturing PMI November 50.7 51

08:50 France Manufacturing PMI (Finally) November 50.6 50.8

08:55 Germany Manufacturing PMI (Finally) November 52.1 52.6

08:55 Germany Unemployment Change November -5 -5

08:55 Germany Unemployment Rate s.a. November 6.4% 6.4%

09:00 Eurozone Manufacturing PMI (Finally) November 52.3 52.8

09:00 United Kingdom BOE Financial Stability Report

09:00 United Kingdom BOE Gov Mark Carney Speaks

09:30 United Kingdom Purchasing Manager Index Manufacturing November 55.5 54

10:00 Eurozone Unemployment Rate October 10.8% 10.8%

13:30 Canada GDP QoQ Quarter III -0.1%

13:30 Canada GDP (YoY) Quarter III -0.5% 2.4%

13:30 Canada GDP (m/m) September 0.1% 0.1%

14:45 U.S. Manufacturing PMI (Finally) November 54.1 52.6

15:00 U.S. Construction Spending, m/m October 0.6% 0.5%

15:00 U.S. ISM Manufacturing November 50.1 50.3

17:45 U.S. FOMC Member Charles Evans Speaks

20:00 U.S. Total Vehicle Sales, mln November 18.24 18.15

23:30 Australia RBA's Governor Glenn Stevens Speech

-