Noticias del mercado

-

23:30

Australia: AIG Services Index, November 48.2

-

21:00

Dow -0.93% 17,721.53 -166.82 Nasdaq -0.70% 5,120.25 -36.06 S&P -1.12% 2,079.02 -23.61

-

18:41

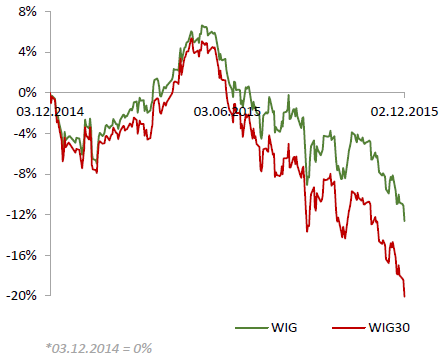

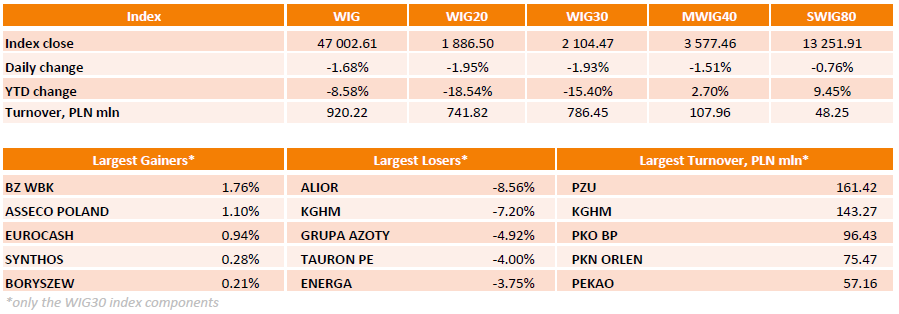

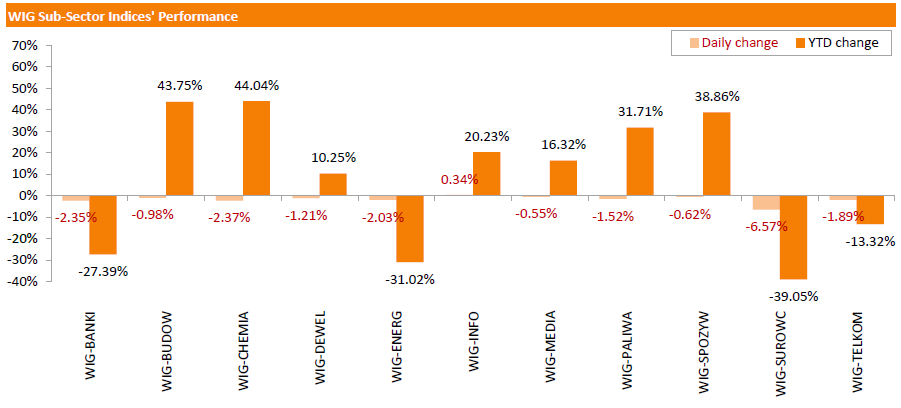

WSE: Session Results

Polish equity market retreated on Wednesday. The broad market measure, the WIG Index, plunged by 1.68%. Information technology sector (+0.34%) was the sole advancer among the WIG's 11 industry groups. At the same time, the materials (-6.57%) posed the biggest decline.

The large-cap stocks lost 1.93%, as measured by the WIG30 Index. Within the index components, banking name ALIOR (WSE: ALR) led the decliners with a 8.56% drop. It was followed by copper producer KGHM (WSE: KGH), which tumbled by 7.2% after Poland's Finance Minister said that they would not scrap the copper tax next year. Other most prominent losers included chemical company GRUPA AZOTY (WSE: ATT), bank PKO BP (WSE: PKO) and gencos TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and ENEA (WSE: ENA), which plummeted by 3.22%-4.92%. On the other side of the ledger, bank BZ WBK (WSE: BZW) and IT-company ASSECO POLAND (WSE: ACP) became the biggest gainers, advancing by 1.76% and 1.1% respectively.

-

18:00

European stocks closed: FTSE 100 6,420.93 +25.28 +0.40% CAC 40 4,905.76 -8.77 -0.18% DAX 11,190.02 -71.22 -0.63%

-

18:00

European stocks close: stocks closed mixed on speculation that the European Central Bank will add further stimulus measures

Stock indices closed mixed on speculation that the European Central Bank (ECB) will add further stimulus measures after the release of the weaker-than-expected consumer price inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.1% in November, missing expectations for a rise to 0.2%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.9% in November from 1.1% in October. Analysts expected the inflation to decline to 1.0%.

Food, alcohol and tobacco prices were up 1.5% in November, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 7.3%.

Eurozone's producer price index declined 0.3% in October, beating expectations for a 0.4% drop, after a 0.4% decrease in September. September's figure was revised down from a 0.3% fall.

Intermediate goods prices fell 0.4% in October, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.4%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in October, beating expectations for a 3.2% decrease, after a 3.2% fall in September. September's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in October. Energy prices dropped at an annual rate of 9.7%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 55.3 in November from 58.8 in October, missing expectations for a fall to 58.2. It was the lowest level since April.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a decline in all three broad areas of construction activity.

"The UK construction recovery is down but not out, according to November's survey data. Aside from a pre-election growth slowdown in April, the latest expansion of construction activity was the weakest for almost two-and-a-half years amid a sharp loss of housebuilding momentum," Senior Economist at Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,420.93 +25.28 +0.40 %

DAX 11,190.02 -71.22 -0.63 %

CAC 40 4,905.76 -8.77 -0.18 %

-

18:00

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes were little changed on Wednesday ahead of Federal Reserve Chair Janet Yellen's speech. Yellen will speak before the Economic Club of Washington. She also testifies on the economic outlook before a joint committee of Congress on Thursday.

Furthermore, data showed that the private sector added the most jobs since June as markets awaited clues from Yellen on an expected interest rate increase on Dec. 16. The economic data has not been playing ball with the Fed's policy plans in recent weeks and has been mixed at best. While construction spending has risen, there has been a sharp downturn in the manufacturing surveys along with weaker retail sales. However, job growth has been strong and Friday's employment report is expected to show that the U.S. economy added 200,000 jobs in November. Data on Wednesday showed U.S. private employers added 217,000 jobs in November, up from the 196,000 in October. Economists polled by Reuters had expected an addition of 190,000 jobs. The data could be an indication of the more comprehensive non-farm payrolls expected later in the week.

Most of Dow stocks in negative area (19 of 30). Top looser - Chevron Corporation (CVX, -1.27%). Top gainer - UnitedHealth Group Incorporated (UNH. +2.12%).

Most of S&P index sectors also in negative area. Top looser - Basic Materials (-1.6%). Top gainer - Technology (+0,1%).

At the moment:

Dow 17828.00 -34.00 -0.19%

S&P 500 2093.00 -7.00 -0.33%

Nasdaq 100 4723.25 +7.00 +0.15%

Oil 40.62 -1.23 -2.94%

Gold 1054.40 -9.10 -0.86%

U.S. 10yr 2.18 +0.03

-

17:49

Oil prices fall on the U.S. crude oil inventories data

Oil prices traded lower on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 1.18 million barrels to 489.4 million in the week to November 27. It was the tenth consecutive increase.

Analysts had expected U.S. crude oil inventories to decline by 1.25 million barrels.

Gasoline inventories increased by 135,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 428,000 million barrels.

U.S. crude oil imports increased by 414,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, up from 92.0% the previous week.

Market participants are awaiting the release of the results of the OPEC meeting. The OPEC will meet in Vienna on December 04 to decide on the oil output limit. Analysts expect the OPEC to keep its output limit unchanged.

WTI crude oil for January delivery declined to $40.70 a barrel on the New York Mercantile Exchange.

Brent crude oil for January fell to $43.30 a barrel on ICE Futures Europe.

-

17:29

Gold price falls more than 1%

Gold price dropped more than 1% on a stronger U.S. dollar. The greenback rose against other currencies after the release of the ADP Employment Report. Private sector in the U.S. added 217,000 jobs in November, according the ADP report on Wednesday. October's figure was revised up to 196,000 jobs from a previous reading of 182,000 jobs. Analysts expected the private sector to add 190,000 jobs.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in November. The U.S. economy is expected to add 200,000 jobs in November, after adding 271,000 jobs in October.

December futures for gold on the COMEX currently traded at 1055.40 dollars per ounce.

-

17:04

BRC: U.K. shop prices are down 2.1% year-on-year in November

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 2.1% year-on-year in November, after a 1.8% decline in October.

The decline was mainly driven by a drop in non-food prices, which plunged 3.3% year-on-year in November.

Food prices fell at an annual rate of 0.3% in November.

"Although the survey period does not cover Black Friday, it is likely that some retailers were discounting early in November in order to spread consumer spending over a longer period," BRC Chief Executive, Helen Dickinson, said.

-

16:55

Philadelphia Fed President Patrick Harker: it is hard for young people in the U.S. to find a job

Philadelphia Fed President Patrick Harker said in a speech on Wednesday that it is hard for young people in the U.S. to find a job.

"We recognize that while much of the economy has rebounded in recent years, significant barriers still exist for young people in the job market," he said.

"In order to meet the needs of our young people and to secure our long-term economic future, we need to make real investments in their training and employment today," Harker added.

He said nothing about the U.S. economy and the Fed's monetary policy.

-

16:47

U.S. crude inventories climb by 1.18 million barrels to 489.4 million in the week to November 27

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 1.18 million barrels to 489.4 million in the week to November 27. It was the tenth consecutive increase.

Analysts had expected U.S. crude oil inventories to decline by 1.25 million barrels.

Gasoline inventories increased by 135,000 barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 428,000 million barrels.

U.S. crude oil imports increased by 414,000 barrels per day.

Refineries in the U.S. were running at 94.5% of capacity, up from 92.0% the previous week.

-

16:30

U.S.: Crude Oil Inventories, November 1.177 (forecast -1.250)

-

16:28

Bank of Canada keeps its interest rate unchanged at 0.50% in December

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%, noting that the current monetary policy is appropriate. This decision was expected by analysts.

The BoC said that the Canadian economy is expected to expand moderately in the fourth quarter of 2015.

According to the central bank, the Canadian economy was adjusting to a drop in Canada's terms of trade, which was driven by the recovery in the U.S. economy, a lower Canadian dollar and stimulus measures by the BoC.

"The labour market has been resilient at the national level, although with significant job losses in resource-producing regions," the BoC noted.

Risks to the country's financial stability are evolving as expected, and risks around the inflation are roughly balanced, the central bank said.

The BoC added that "vulnerabilities in the household sector continue to edge higher".

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:53

Atlanta Fed President Dennis Lockhart: the Fed could rise its interest rate this month

Atlanta Fed President Dennis Lockhart said in a speech on Wednesday that the Fed could rise its interest rate this month.

"Absent information that drastically changes the economic picture and outlook, I feel the case for liftoff is compelling," he said.

Lockhart noted that the next Fed's monetary meeting will be "historic" because it would be "the first increase in the policy interest rate in nearly 10 years".

Atlanta Fed president pointed out that the Fed's criterion of "further improvement in labour markets" has been met, while the downside effects on inflation were "transitory".

Lockhart is a voting member of the FOMC this year.

-

15:35

U.S. Stocks open: Dow -0.15%, Nasdaq 0%, S&P -0.12%

-

15:30

Before the bell: S&P futures -0.02%, NASDAQ futures +0.04%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 19,938.13 -74.27 -0.37%

Hang Seng 22,479.69 +98.34 +0.44%

Shanghai Composite 3,536.8 +80.49 +2.33%

FTSE 6,417.65 +22.00 +0.34%

CAC 4,908.55 -5.98 -0.12%

DAX 11,226.27 -34.97 -0.31%

Crude oil $41.09 (-1.82%)

Gold $1057 30 (-0.58%)

-

15:07

Revised productivity in the U.S. non-farm businesses rises 2.2% in the third quarter

The U.S. Labor Department released its revised non-farm productivity figures on Wednesday. Revised productivity in the U.S. non-farm businesses rose at a 2.2% annual rate in the third quarter, up from the preliminary reading of a 1.6% increase, after a 3.5% increase in the second quarter. The second quarter's figure was revised up from a 3.3% gain.

The upward revision was driven by higher nonfarm business output, which rose 1.8% in the third quarter, up from the preliminary reading of a 1.2% gain.

Hours worked declined by 0.3% in the third quarter, up from the preliminary reading of a 0.5% fall.

Revised unit labour costs climbed 1.8% in the third quarter, up from the preliminary reading of a 1.4% increase, after a 2.0 gain in the second quarter. The second quarter's figure was revised up from a 1.8% drop.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Yahoo! Inc., NASDAQ

YHOO

34.95

3.68%

210.5K

HONEYWELL INTERNATIONAL INC.

HON

104.70

0.53%

0.3K

Citigroup Inc., NYSE

C

55.13

0.46%

16.1K

JPMorgan Chase and Co

JPM

67.90

0.43%

11.4K

UnitedHealth Group Inc

UNH

116.26

0.43%

2.6K

AMERICAN INTERNATIONAL GROUP

AIG

64.30

0.28%

0.4K

Travelers Companies Inc

TRV

115.98

0.26%

2.3K

Chevron Corp

CVX

92.70

0.24%

10.7K

FedEx Corporation, NYSE

FDX

160.80

0.22%

0.5K

Walt Disney Co

DIS

115.50

0.10%

6.7K

AT&T Inc

T

33.80

0.09%

0.3K

Verizon Communications Inc

VZ

45.61

0.07%

22.3K

Amazon.com Inc., NASDAQ

AMZN

679.53

0.07%

8.0K

Google Inc.

GOOG

767.56

0.07%

2.8K

Yandex N.V., NASDAQ

YNDX

15.90

0.06%

5.9K

Visa

V

79.95

0.05%

1.2K

Microsoft Corp

MSFT

55.25

0.05%

12.5K

Facebook, Inc.

FB

107.17

0.05%

24.6K

Starbucks Corporation, NASDAQ

SBUX

61.40

0.05%

0.6K

Intel Corp

INTC

35.10

0.03%

18.8K

Exxon Mobil Corp

XOM

81.89

0.00%

340.4K

Goldman Sachs

GS

193.00

-0.04%

0.4K

The Coca-Cola Co

KO

42.86

-0.07%

5.0K

International Business Machines Co...

IBM

141.15

-0.09%

0.2K

General Electric Co

GE

30.14

-0.10%

15.0K

Pfizer Inc

PFE

33.58

-0.12%

47.8K

Twitter, Inc., NYSE

TWTR

25.50

-0.12%

15.1K

Wal-Mart Stores Inc

WMT

58.40

-0.17%

1K

American Express Co

AXP

72.05

-0.21%

55.2K

Tesla Motors, Inc., NASDAQ

TSLA

236.63

-0.24%

1.9K

Johnson & Johnson

JNJ

102.06

-0.29%

0.5K

McDonald's Corp

MCD

114.10

-0.31%

2.0K

Apple Inc.

AAPL

116.90

-0.37%

56.3K

Caterpillar Inc

CAT

71.28

-0.39%

22.2K

ALCOA INC.

AA

9.44

-0.42%

12.5K

Hewlett-Packard Co.

HPQ

12.68

-0.47%

0.1K

Nike

NKE

132.20

-0.83%

3.9K

Ford Motor Co.

F

14.34

-1.51%

1.2K

Barrick Gold Corporation, NYSE

ABX

7.48

-1.58%

21.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.18

-1.80%

38.9K

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 1bln)

EUR/USD 1.0500 (EUR 4.6bln) 1.0550 (650m) 1.0600 (4bln) 1.0650 (1bln) 1.0700 (1.3bln)

GBP/USD 1.5100 (GBP 241m)

USD/CHF 1.0250 (USD 420m)

USD/CAD 1.3300 (USD 200m) 1.3350 (200m) 1.3500 (530m)

AUD/USD 0.7200 (AUD 600m)

EUR/JPY 130.00 (EUR 1bln) 132.00 (491m)

EUR/CHF 1.0900 (EUR 388m)

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Buy from Neutral at Citigroup

Downgrades:

Other:

NIKE (NKE) removed from Conviction Buy List at Goldman

-

14:41

Bank of Japan Deputy Governor Kikuo Iwata: a further slowdown in China and other emerging countries is a risk to the central bank’s inflation target

The Bank of Japan (BoJ) Deputy Governor Kikuo Iwata said on Wednesday that a further slowdown in China and other emerging countries is a risk to the central bank's 2% inflation target.

He also said that the BoJ is ready to add further stimulus measures if needed.

Iwata pointed out that the underlying trend in inflation was moving toward the 2% target.

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter III 2.2% (forecast 2.2%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter III 1.8% (forecast 1.1%)

-

14:23

U.S. ADP Employment Report: private sector adds 217,000 jobs in November

Private sector in the U.S. added 217,000 jobs in November, according the ADP report on Wednesday. October's figure was revised up to 196,000 jobs from a previous reading of 182,000 jobs.

Analysts expected the private sector to add 190,000 jobs.

Services sector added 204,000 jobs in November, while goods-producing sector added only 13,000.

"Job growth remains strong and steady. The current pace of job creation is twice that needed to absorb growth in the working age population. The economy is fast approaching full employment and will be there no later than next summer," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in November. The U.S. economy is expected to add 200,000 jobs in November, after adding 271,000 jobs in October.

-

14:15

U.S.: ADP Employment Report, November 217 (forecast 190)

-

14:03

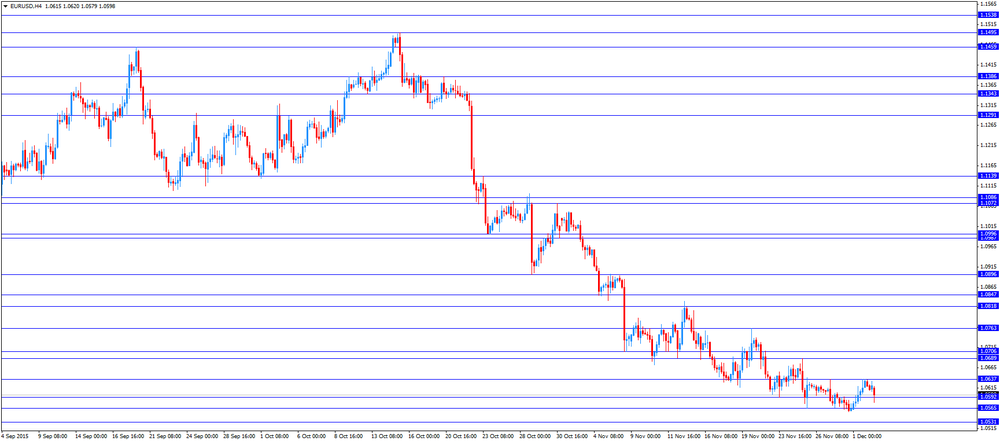

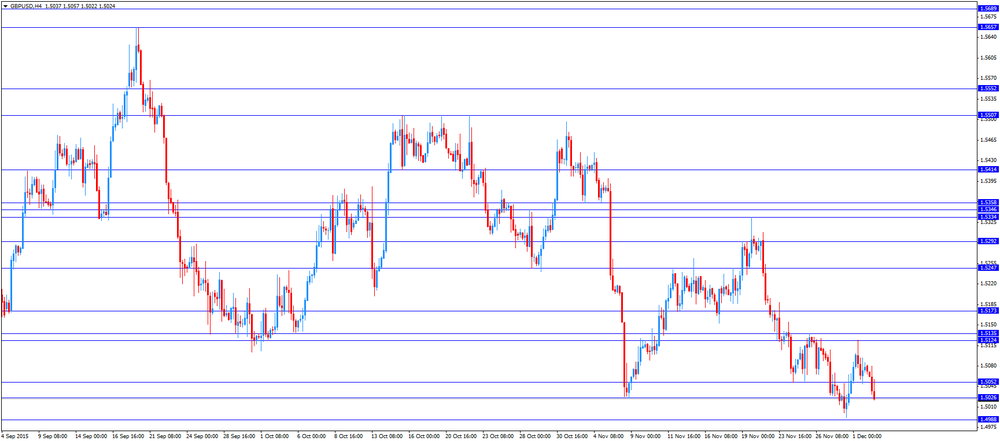

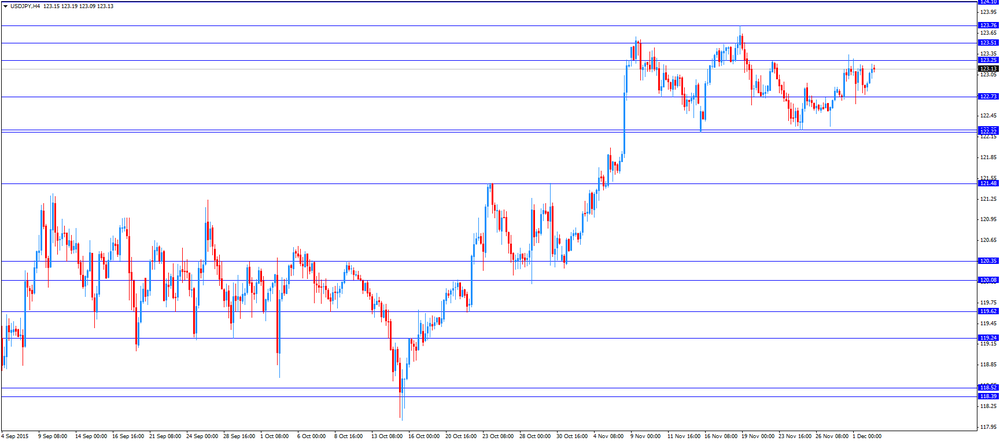

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the weaker-than-expected consumer price inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Gross Domestic Product (YoY) Quarter III 1.9% Revised From 2.0% 2.3% 2.5%

00:30 Australia Gross Domestic Product (QoQ) Quarter III 0.3% Revised From 0.2% 0.7% 0.9%

01:00 U.S. FOMC Member Brainard Speaks

09:30 United Kingdom PMI Construction November 58.8 58.2 55.3

10:00 Eurozone Producer Price Index, MoM October -0.4% Revised From -0.3% -0.4% -0.3%

10:00 Eurozone Producer Price Index (YoY) October -3.2% Revised From -3.1% -3.2% -3.1%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) November 1.1% 1% 0.9%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November 0.1% 0.2% 0.1%

12:00 U.S. MBA Mortgage Applications November -3.2% -0.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 190,000 jobs in November.

The Fed Chairwoman Janet Yellen will speak at 17:25 GMT.

The euro traded lower against the U.S. dollar on the weaker-than-expected consumer price inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.1% in November, missing expectations for a rise to 0.2%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.9% in November from 1.1% in October. Analysts expected the inflation to decline to 1.0%.

Food, alcohol and tobacco prices were up 1.5% in November, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 7.3%.

Eurozone's producer price index declined 0.3% in October, beating expectations for a 0.4% drop, after a 0.4% decrease in September. September's figure was revised down from a 0.3% fall.

Intermediate goods prices fell 0.4% in October, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.4%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in October, beating expectations for a 3.2% decrease, after a 3.2% fall in September. September's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in October. Energy prices dropped at an annual rate of 9.7%.

The British pound traded lower against the U.S. dollar after the weaker-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 55.3 in November from 58.8 in October, missing expectations for a fall to 58.2. It was the lowest level since April.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a decline in all three broad areas of construction activity.

"The UK construction recovery is down but not out, according to November's survey data. Aside from a pre-election growth slowdown in April, the latest expansion of construction activity was the weakest for almost two-and-a-half years amid a sharp loss of housebuilding momentum," Senior Economist at Markit, Tim Moore, said.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its interest rate unchanged.

EUR/USD: the currency pair declined to $1.0579

GBP/USD: the currency pair fell to $1.5022

USD/JPY: the currency pair increased to Y123.21

The most important news that are expected (GMT0):

13:10 U.S. FOMC Member Dennis Lockhart Speaks

13:15 U.S. ADP Employment Report November 182 190

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III 3.3% 2.2%

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter III -1.8% 1.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

17:25 U.S. Fed Chairman Janet Yellen Speaks

19:00 U.S. Fed's Beige Book

20:40 U.S. FOMC Member Williams Speaks

-

13:44

Orders

EUR/USD

Offers 1.0635 1.0650 1.0665 1.0685-90 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0600 1.0575-80 1.0560 1.0550 1.0525-30 1.0500 1.0485 1.0465 1.0450 1.0425-30 1.0400

GBP/USD

Offers 1.5085 1.5100 1.5120-25 1.5135 1.5150-55 1.5170 1.5180-85 1.5200 1.5230 1.5250

Bids 1.5050-55 1.5030 1.5015 1.5000 1.4985 1.4965 1.4950 1.4930 1.4900

EUR/GBP

Offers 0.7055-60 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7035-40 0.7020 0.7000 0.6980-85 0.6965 0.6950

EUR/JPY

Offers 130.85 131.00 131.20 131.50 131.85 132.00 132.30 132.50

Bids 130.50 130.20 130.00 129.80 129.65 129.50 129.35 129.00

USD/JPY

Offers 123.20-25 123.35 123.50 123.75 124.00 124.30 124.50

Bids 123.00 122.85 122.65-70 122.50 122.20-25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7350 0.7375 0.7400 0.7425-30 0.7450

Bids 0.7300 0.7285 0.7265-70 0.7250 0.7235 0.7200

-

13:00

U.S.: MBA Mortgage Applications, November -0.2%

-

12:04

European stock markets mid session: stocks traded higher on the ECB’s further action speculation

Stock indices traded higher on speculation that the European Central Bank (ECB) will add further stimulus measures after the release of the weaker-than-expected consumer price inflation data from the Eurozone. Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.1% in November, missing expectations for a rise to 0.2%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.9% in November from 1.1% in October. Analysts expected the inflation to decline to 1.0%.

Food, alcohol and tobacco prices were up 1.5% in November, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 7.3%.

Eurozone's producer price index declined 0.3% in October, beating expectations for a 0.4% drop, after a 0.4% decrease in September. September's figure was revised down from a 0.3% fall.

Intermediate goods prices fell 0.4% in October, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.4%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in October, beating expectations for a 3.2% decrease, after a 3.2% fall in September. September's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in October. Energy prices dropped at an annual rate of 9.7%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 55.3 in November from 58.8 in October, missing expectations for a fall to 58.2. It was the lowest level since April.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a decline in all three broad areas of construction activity.

"The UK construction recovery is down but not out, according to November's survey data. Aside from a pre-election growth slowdown in April, the latest expansion of construction activity was the weakest for almost two-and-a-half years amid a sharp loss of housebuilding momentum," Senior Economist at Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,426.65 +31.00 +0.48 %

DAX 11,309.38 +48.14 +0.43 %

CAC 40 4,932.91 +18.38 +0.37 %

-

11:57

Number of registered unemployed people in Spain declines by 27,071 in November

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people dropped by 27,071 in November, after a 82,327 increase in October.

Unemployment fell in all sectors.

The total number of people registered as unemployed was 4.15 million.

-

11:41

UK construction PMI falls to 55.3 in November

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 55.3 in November from 58.8 in October, missing expectations for a fall to 58.2. It was the lowest level since April.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a decline in all three broad areas of construction activity.

"The UK construction recovery is down but not out, according to November's survey data. Aside from a pre-election growth slowdown in April, the latest expansion of construction activity was the weakest for almost two-and-a-half years amid a sharp loss of housebuilding momentum," Senior Economist at Markit, Tim Moore, said.

-

11:33

Eurozone's producer price index declines 0.3% in October

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in October, beating expectations for a 0.4% drop, after a 0.4% decrease in September. September's figure was revised down from a 0.3% fall.

Intermediate goods prices fell 0.4% in October, capital goods prices were flat, non-durable consumer goods prices declined 0.2%, and durable consumer goods prices were stable, while energy prices decreased 0.4%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in October, beating expectations for a 3.2% decrease, after a 3.2% fall in September. September's figure was revised down from a 3.1% drop.

Eurozone's producer prices excluding energy fell 0.7% year-on-year in October. Energy prices dropped at an annual rate of 9.7%.

-

11:22

Preliminary consumer price inflation in the Eurozone remains unchanged at 0.0% year-on-year in November

Eurostat released its consumer price inflation data for the Eurozone on Wednesday. The preliminary consumer price inflation in the Eurozone remained unchanged at an annual rate of 0.1% in November, missing expectations for a rise to 0.2%.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco fell to an annual rate of 0.9% in November from 1.1% in October. Analysts expected the inflation to decline to 1.0%.

Food, alcohol and tobacco prices were up 1.5% in November, non-energy industrial goods prices gained 0.5%, and services prices climbed 1.1%, while energy prices dropped 7.3%.

-

11:08

Reserve Bank of Australia Governor Glenn Stevens: the Australian economy is respectable after a mining boom

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in a speech on late Tuesday evening that the Australian economy is respectable after a mining boom.

"Inflationary pressure was relatively contained on the way up, and while aggregate growth has been a little disappointing for the past couple of years, in the circumstances we face - including very difficult global conditions in the aftermath of the financial crisis - the outcomes are, I think, quite respectable," he said.

Stevens noted that he expects the Australian economy to continue to expand moderately.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, November 0.9% (forecast 1%)

-

11:00

Eurozone: Producer Price Index, MoM , October -0.3% (forecast -0.4%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, November 0.1% (forecast 0.2%)

-

11:00

Eurozone: Producer Price Index (YoY), October -3.1% (forecast -3.2%)

-

10:58

Australia's GDP climbs 0.9% in the third quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 0.9% in the third quarter, exceeding expectations for a 0.7% gain, after a 0.3% rise in the second quarter. The second quarter's figure was revised up from a 0.2% increase.

On a yearly basis, Australia's GDP rose 2.5% in the third quarter, beating expectations for a 2.3% increase, after a 1.9% gain in the second quarter. The second quarter's figure was revised down from a 2.0% rise.

Final consumption spending was up 0.7% in the third quarter.

Terms of trade dropped 2.4% in the third quarter, while real net national disposable income decreased 0.1%.

Mining jumped 5.2% in the third quarter, while new and used dwelling construction climbed 2.0%.

-

10:51

OECD: consumer price inflation in the OECD area rises to 0.6% year-on-year in October

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area rose to 0.6% year-on-year in October from 0.4% in September.

Energy prices dropped at an annual rate of 11.6% in October, while food prices increased to 1.5% in October from 1.4% in September.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.8% in October.

October's CPI was 0.3% in Germany, Italy, Japan, 0.2% in the U.S, 1.0% in Canada, and -0.1% in the U.K.

The consumer price inflation in Eurozone was 0.1% in October, while the inflation in China was 1.3%.

-

10:39

Reuters survey: OPEC’s oil production rises in November

According to a Reuters survey, the Organization of the Petroleum Exporting Countries' (OPEC) oil production rose in November due to higher output from Iraq. OPEC's oil output increased to 31.77 million barrels per day (bpd) from 31.64 million in October.

Saudi Arabia produced 10.25 million bpd in November.

Oil output fell in Angola, Libya and Nigeria, while oil output from Iran remained unchanged.

OPEC increased its oil production by about 1.50 million bpd since November 2014.

-

10:30

United Kingdom: PMI Construction, November 55.3 (forecast 58.2)

-

10:25

Fed Governor Lael Brainard: the Fed should be cautious in raising its interest rate

The Fed Governor Lael Brainard said in a speech on Wednesday that the Fed should be cautious in raising its interest rate.

"The slow progress on inflation, together with the likely low level of the longer-term neutral real rate and the slow pace at which the very low shorter-term rate may move to the longer-term rate, suggest that the federal funds rate is likely to adjust more gradually and to a lower level than in previous expansions. In short, "gradual and low" is likely to be the new normal," she said.

"We should be cautious about raising rates, do so gradually, and carefully assess the effects on economic and financial conditions as we go," Brainard added.

-

10:10

Chicago Fed President Charles Evans: the Fed should delay its interest rate hike until there are signs that inflation is accelerating toward 2% target

Chicago Fed President Charles Evans said in a speech on Tuesday that the Fed should delay its interest rate hike until there are signs that inflation is accelerating toward 2% target.

"Before raising rates, I would prefer to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation would bolster my confidence," he said.

Evans noted that the Fed should hike its interest rates gradually once it starts raising its interest rate.

"To me, it is vital that when we first raise rates, the FOMC also strongly and effectively communicates its plan for a gradual path for future rate increases," Chicago Fed president said.

He thinks that the interest rate should be "under 1 percent at the end of 2016", and he expects the U.S. economy to expand about 2.5% in 2016.

Evans is a voting member of the FOMC this year.

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 1bln)

EUR/USD 1.0500 (EUR 4.6bln) 1.0550 (650m) 1.0600 (4bln) 1.0650 (1bln) 1.0700 (1.3bln)

GBP/USD 1.5100 (GBP 241m)

USD/CHF 1.0250 (USD 420m)

USD/CAD 1.3300 (USD 200m) 1.3350 (200m) 1.3500 (530m)

AUD/USD 0.7200 (AUD 600m)

EUR/JPY 130.00 (EUR 1bln) 132.00 (491m)

EUR/CHF 1.0900 (EUR 388m)

-

08:35

Options levels on wednesday, December 2, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0769 (4167)

$1.0716 (2740)

$1.0679 (1136)

Price at time of writing this review: $1.0613

Support levels (open interest**, contracts):

$1.0582 (5546)

$1.0544 (3261)

$1.0488 (3232)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 104470 contracts, with the maximum number of contracts with strike price $1,1100 (6239);

- Overall open interest on the PUT options with the expiration date December, 4 is 121852 contracts, with the maximum number of contracts with strike price $1,0500 (10545);

- The ratio of PUT/CALL was 1.17 versus 1.20 from the previous trading day according to data from December, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.5301 (2550)

$1.5202 (1163)

$1.5105 (1338)

Price at time of writing this review: $1.5068

Support levels (open interest**, contracts):

$1.4997 (2550)

$1.4899 (2645)

$1.4800 (654)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28418 contracts, with the maximum number of contracts with strike price $1,5600 (3574);

- Overall open interest on the PUT options with the expiration date December, 4 is 31652 contracts, with the maximum number of contracts with strike price $1,5050 (4262);

- The ratio of PUT/CALL was 1.11 versus 1.14 from the previous trading day according to data from December, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:03

Oil prices declined

West Texas Intermediate futures for January delivery declined to $41.57 (-0.67%), while Brent crude slid to $44.25 (-0.43%) ahead of official data on U.S. crude stockpiles from the Energy Information Administration. Market participants are also waiting for OPEC meeting scheduled for December 4. Analysts widely expect the group, led by Saudi Arabia, to maintain output despite falling prices. The cartel is likely to defend its market share against competitors.

Meanwhile sources reported that Iranian Oil Minister Bijan Namdar Zanganeh sent a letter to OPEC calling on the cartel to reduce its current production of 31.3 million barrels per day to match its target of 30 million bpd.

-

07:41

Gold traded slightly higher

Gold is currently at $1,067.30 (+0.36%) still supported by short covering, however its outlook remains bearish as investors are preparing for the key U.S. jobs report due on Friday and a Federal Open Market Committee meeting later in December. Strong employment data would raise the probability of a rate hike and decrease demand for the non-interest-paying precious metal.

The dollar weakened slightly after disappointing manufacturing data; however bullion outlook is still driven by expectations of an imminent rate hike in the U.S.

-

07:39

Global Stocks: U.S. stock indices advanced

U.S. stock indices closed higher on Monday despite weak manufacturing data. Investors were focused on the looming ECB meeting and payrolls report.

The Dow Jones Industrial Average rose 168.43 points, or 1%, to 17,888.35. The S&P 500 climbed 22.22 points, or 1.1%, to 2,102.63. The Nasdaq Composite gained 47.64 points, or 0.9% to 5,156.31.

Business activity data from Markit Economics showed that American producers had lost momentum in November, while business conditions had improved at the slowest pace since October 2013. The Manufacturing PMI declined to 52.8 in November on a seasonally adjusted basis from 54.1. The index remained above the 50 points threshold, but the latest reading was below the post-crisis average of 54.3 points.

Meanwhile the Manufacturing PMI from the Institute for Supply Management came in at 48.6 in November compared to 50.1 in October. Economists had expected the index to improve to 50.4.

This morning in Asia Hong Kong Hang Seng rose 0.41%, or 91.14, to 22,472.49. China Shanghai Composite Index rose 0.54%, or 18.71, to 3.475.02. The Nikkei fell 0.23%, or 45.43, to 19,966.97.

Asian indices traded mixed. Chinese stocks rose with property-related stocks leading the gains on speculation that mortgage interest payments could be made tax deductible.

Shares in Japanese electronics company Sharp gained 5.56% on talks that the state-backed fund Innovation Network Corporation of Japan was considering buying a majority stake in Sharp in an approximately $1.63 billion deal.

-

07:36

Foreign exchange market. Asian session: the euro weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Gross Domestic Product (YoY) Quarter III 1.9% Revised From 2.0% 2.3% 2.5%

00:30 Australia Gross Domestic Product (QoQ) Quarter III 0.3% Revised From 0.2% 0.7% 0.9%

01:00 U.S. FOMC Member Brainard Speaks

The euro declined against the U.S. dollar ahead of an ECB meeting. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

Today the Bank of Canada will make a decision on its benchmark rate and release an accompanying statement explaining economic conditions, which determined the decision. Persistent low commodity prices keep weighing on the country's economy. The Bank of Canada has cut its rates twice this year to offset the impact of falling oil prices.

The Australian dollar was supported by optimistic GDP data. The Australian Bureau of Statistics reported that the economy had expanded by 0.9% in the third quarter compared to Q2 and by 2.5% compared to the same period in 2014. These data were in line with expectations.

EUR/USD: the pair fell to $1.0610 in Asian trade

USD/JPY: the pair rose to Y123.10

GBP/USD: the pair fell to $1.5060

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction November 58.8 58.2

10:00 Eurozone Producer Price Index, MoM October -0.3% -0.4%

10:00 Eurozone Producer Price Index (YoY) October -3.1% -3.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) November 1.1% 1%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November 0.1% 0.2%

12:00 U.S. MBA Mortgage Applications November -3.2%

13:10 U.S. FOMC Member Dennis Lockhart Speaks

13:15 U.S. ADP Employment Report November 182 190

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III 3.3% 2.2%

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter III -1.8% 1.1%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories November 0.961 -1.250

17:25 U.S. Fed Chairman Janet Yellen Speaks

19:00 U.S. Fed's Beige Book

20:40 U.S. FOMC Member Williams Speaks

22:30 Australia AIG Services Index November 48.9

-

03:03

Nikkei 225 19,958.88 -53.52 -0.27 %, Hang Seng 22,409.81 +28.46 +0.13 %, Shanghai Composite 3,444.06 -12.25 -0.35 %

-

01:30

Australia: Gross Domestic Product (QoQ), Quarter III 0.9% (forecast 0.7%)

-

01:30

Australia: Gross Domestic Product (YoY), Quarter III 2.5% (forecast 2.3%)

-

00:33

Commodities. Daily history for Dec 1’2015:

(raw materials / closing price /% change)

Oil 41.65 -0.48%

Gold 1,068.30 +0.45%

-

00:33

Stocks. Daily history for Sep Dec 1’2015:

(index / closing price / change items /% change)

Nikkei 225 20,012.4 +264.93 +1.34 %

Hang Seng 22,381.35 +384.93 +1.75 %

Shanghai Composite 3,457.73 +12.33 +0.36 %

FTSE 100 6,395.65 +39.56 +0.62 %

CAC 40 4,914.53 -43.07 -0.87 %

Xetra DAX 11,261.24 -120.99 -1.06 %

S&P 500 2,102.63 +22.22 +1.07 %

NASDAQ Composite 5,156.31 +47.64 +0.93 %

Dow Jones 17,888.35 +168.43 +0.95 %

-

00:32

Currencies. Daily history for Dec 1’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0631 +0,63%

GBP/USD $1,5080 +0,17%

USD/CHF Chf1,0257 -0,29%

USD/JPY Y122,86 -0,20%

EUR/JPY Y130,67 +0,49%

GBP/JPY Y185,25 -0,03%

AUD/USD $0,7321 +1,30%

NZD/USD $0,6675 +1,41%

USD/CAD C$1,3357 -0,02%

-

00:02

Schedule for today, Wednesday, Dec 2’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Gross Domestic Product (YoY) Quarter III 2.0% 2.3%

00:30 Australia Gross Domestic Product (QoQ) Quarter III 0.2% 0.7%

01:00 U.S. FOMC Member Brainard Speaks

09:30 United Kingdom PMI Construction November 58.8 58.2

10:00 Eurozone Producer Price Index, MoM October -0.3% -0.4%

10:00 Eurozone Producer Price Index (YoY) October -3.1% -3.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) November 1.1% 1.1%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November 0.1% 0.3%

12:00 U.S. MBA Mortgage Applications November -3.2%

13:10 U.S. FOMC Member Dennis Lockhart Speaks

13:15 U.S. ADP Employment Report November 182 190

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter III 3.3% 2.2%

13:30 U.S. Unit Labor Costs, q/q (Finally) Quarter III -1.8% 1.0%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:30 U.S. Crude Oil Inventories November 0.961 -1.1

17:25 U.S. Fed Chairman Janet Yellen Speaks

19:00 U.S. Fed's Beige Book

20:40 U.S. FOMC Member Williams Speaks

22:30 Australia AIG Services Index November 48.9

-