Noticias del mercado

-

22:10

Major US stock indexes finished trading with an increase

Major stock indexes in Wall Street rose on Friday. Employment growth in the US in August, has been slower than expected, which could eliminate the increase in interest rates by the Fed this month.

As it became known, employment growth in the US slowed more than expected in August after two consecutive months of steady gains and moderate wage growth. The number of people employed in the non-agricultural sector of the US economy grew by 151,000 jobs last month after a revised upward growth to 275,000 in July. The unemployment rate remained unchanged at 4.9% as more people entered the labor market. Economists had forecast a rise in the number of employees by 180 000 last month, and a decrease in the unemployment rate by one tenth of a percentage point to 4.8%.

In addition, new orders for manufactured goods in the United States recorded their biggest increase in nine months in July as the overall demand has increased, it is a sign of hope for the embattled manufacturing sector. The Commerce Department reported Friday that new orders for manufactured goods jumped 1.9% after a downwardly revised decline of 1.8% in June. It was the biggest increase since October 2015, and after two months of decline in a row. Economists had forecast an increase of industrial orders by 2.0% in July after a previously reported decline of 1.5% in June.

However, data released by the Institute for Supply Management (ISM) in New York, showed that business activity in New York deteriorated sharply at the end of August, almost completely offsetting the increase in the previous month. As it became known, the business activity index fell to 47.5 points from 60.7 points in July (7-month high). Recall that in June figure was at 45.4.

Most of the DOW index components increased (28 of 30). More rest rose stocks Apple Inc. (AAPL, + 0.92%). Outsider were shares of NIKE, Inc. (NKE, -0.91%).

All business sectors S & P index recorded an increase. The leader turned out to be the basic materials sector (+ 1.5%).

-

21:00

Dow +0.32% 18,477.89 +58.59 Nasdaq +0.31% 5,243.26 +16.05 S&P +0.36% 2,178.59 +7.73

-

18:08

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Friday after data showed U.S. employment growth in August was slower than expected, which could rule out an interest rate increase this month. The Labor Department's monthly jobs report showed nonfarm payrolls rose by 151,000 last month, while the unemployment rate remained unchanged at 4.9%. Economists polled by Reuters had forecast addition of 180,000 jobs last month.

Most of all Dow stocks in positive area (28 of 30). Top gainer - Chevron Corporation (CVX, +1.19%). Top loser - Wal-Mart Stores Inc. (WMT, -0.47%).

All S&P sectors also in positive area. Top gainer - Basic Materials (+1.5%).

At the moment:

Dow 18493.00 +98.00 +0.53%

S&P 500 2178.25 +11.00 +0.51%

Nasdaq 100 4802.50 +25.00 +0.52%

Oil 44.47 +1.31 +3.04%

Gold 1323.10 +6.00 +0.46%

U.S. 10yr 1.61 +0.04

-

18:00

European stocks closed: FTSE 100 +148.63 6894.60 +2.20% DAX +149.51 10683.82 +1.42% CAC 40 +102.50 4542.17 +2.31%

-

17:50

The price of oil rose by about 3 percent

Oil futures increased significantly today, as weak data on the US labor market weighed on the dollar. However, since the beginning of the week oil still shows a significant drop on concerns about market saturation.

The dollar index weakened sharply after the release of the employment report, which makes oil and other commodities denominated in dollars more affordable for holders of the euro and other currencies.

Investors also await the publication of Baker Hughes data on the number of active US drilling rigs. Recall the previous week, their number has remained unchanged, at 406. Prior to this, their number has grown for eight consecutive weeks.

However, the market continues to be uncertain regarding the outcome of the OPEC meeting to be held later this month. The cartel is likely to resume negotiations on freezing oil production from the oil-producing countries, within and outside OPEC, however, many questions remain regarding the success of the event. Earlier this year, an attempt to freeze co-production levels fell after Saudi Arabia's refusal to take part in the initiative because of Iran. Meanwhile, today, Russian President urged major oil-producing countries to agree on limiting production at a meeting in Algeria.

Analysts say that if OPEC will not be able to make a deal in Algeria, the next opportunity to take additional measures to support the market will bepresented at a meeting in Vienna, which is scheduled for November 30th. However, experts are still skeptical about the prospects of the agreements. "Oil prices will remain volatile in the coming weeks", - said Hans van Cleef, senior oil economist at ABN Amro.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 44.44 dollars per barrel.

October futures price for North Sea petroleum mix of Brent crude rose to 46.80 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:36

WSE: Session Results

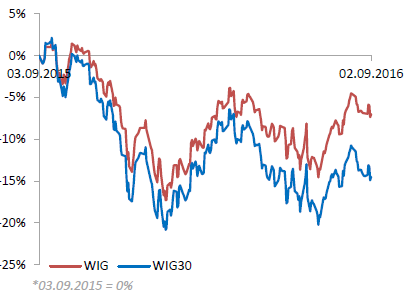

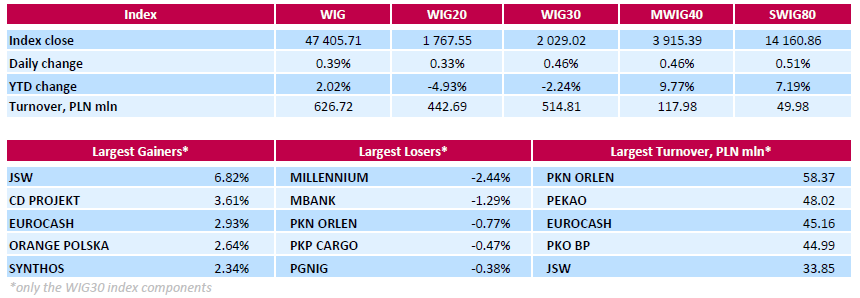

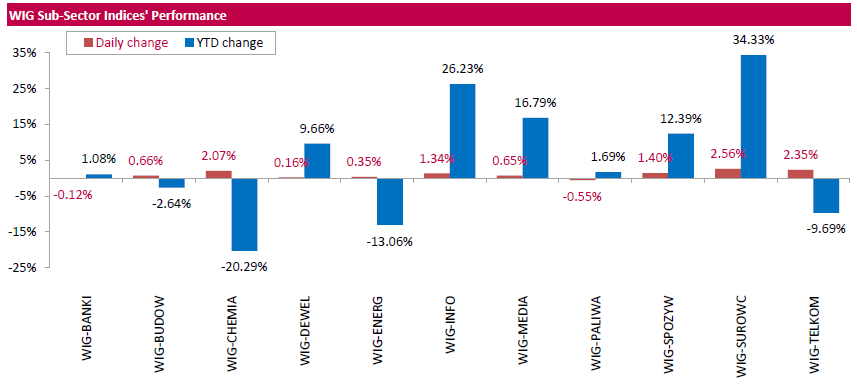

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, rose by 0.39%. Except for banking sector (-0.12%) and oil and gas (-0.55%), every sector in the WIG Index gained, with materials (+2.56%) outperforming.

The large-cap stocks' measure, the WIG30 Index added 0.46%. A majority of the index components recorded advances. In the index basket, coking coal miner JSW (WSE: JSW) was the strongest name, climbing by 6.82%. It was followed by videogame developer CD PROJEKT (WSE: CDR), FMCG-wholesaler EUROCASH (WSE: EUR), telecommunication services provider ORANGE POLSKA (WSE: OPL) and chemical producer SYNTHOS (WSE: SNS), which added between 2.34% and 3.61%. On the other side of the ledger, banking sector names MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK) led a handful of losers, dropping by 2.44% and 1.29% respectively.

-

17:28

Gold rose more than 1%

Gold rose more than 1% after the release of US labor market data, but then lost some ground on profit taking and renewed strengthening of the dollar.

The Labor Department said that employment growth in the US slowed more than expected in August after two consecutive months of steady gains and moderate wage growth. The number of people employed in the non-agricultural sector of the US economy has grown by 151 000 jobs after a growth of 275,000 in July. At the same time employment in the manufacturing industry and the construction industry declined. The unemployment rate remained unchanged at 4.9 percent, as more people entered the labor market. Economists had forecast a rise in the number of employees by 180 000 last month, and a decrease in the unemployment rate to 4.8 percent. Other details of the report showed the pace of growth in labor force participation remained unchanged at 62.8 percent. Lower employment growth came after the economy has created a total of 546,000 jobs in June and July.

The smaller-than-expected wage growth also likely reflects the difficulties of data adjustment for seasonal variations. Over the past few years, in August, the government estimates of the number of jobs have been weak and subsequently revised upwards.

"The presented data on employment put an end to the probability of raising the Fed rate in September, - says Joe Manimbo, Western Union analyst -. Will they be raised later in the year it depends on whether the US GDP growth will accelerate after the weakness in the 1st half of the year" . As it is known, higher interest rates tend to have a downward pressure on gold.

In addition, data showed that the reserves of the world's largest gold exchange-traded fund SPDR Gold Shares were down yesterday by 0.57 percent, to 937.89 tonnes.

The cost of the October futures for gold on COMEX rose to $ 1318.7 per ounce.

-

16:08

US: largest increase in factory orders in 9 months

New orders for manufactured durable goods in July increased $9.7 billion or 4.4 percent to $228.9 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 4.2 percent June decrease. Excluding transportation, new orders increased 1.5 percent. Excluding defense, new orders increased 3.8 percent.

Inventories of manufactured durable goods in July, up following six consecutive monthly decreases, increased $1.2 billion or 0.3 percent to $383.0 billion. This followed a 0.1 percent June decrease.

Revised seasonally adjusted June figures for all manufacturing industries were: new orders, $447.0 billion (revised from $447.4 billion); shipments, $460.2 billion (revised from $460.0 billion); unfilled orders, $1,127.4 billion (revised from $1,128.0 billion); and total inventories, $619.6 billion (revised from $619.1 billion).

-

16:00

U.S.: Factory Orders , July 1.9% (forecast 2%)

-

15:42

WSE: After start on Wall Street

Data from the US labor market were clearly weaker than expected and the increase in the number of jobs was less than forecast. The increase in wages also fell out pale. The data seem to prejudge the lack of interest rate hikes at the September FOMC meeting. Yields on US debt and the dollar signaled such a scenario. The first reaction to weaker data was not, however, continued. Pronunciation of data eased slightly upward adjustment of the data from the previous month, which also caused a reduction in response to the current data. After taming of investors with the data, on the equity markets we are dealing with light increases.

As one would expect Americans began Friday's trading with a clear growth, which is a consequence of weaker data from the labor market. The S&P500 after a few minutes of the session rising more than 0.4 percent

-

15:33

U.S. Stocks open: Dow +0.50%, Nasdaq +0.46%, S&P +0.45%

-

15:23

Before the bell: S&P futures +0.36%, NASDAQ futures +0.46%

U.S. stock-index futures advanced as August payroll data signaled steady labor-market growth, though not enough to force the Federal Reserve to raise interest rates.

Global Stocks:

Nikkei 16,925.68 -1.16 -0.01%

Hang Seng 23,266.70 +104.36 +0.45%

Shanghai 3,067.50 +4.19 +0.14%

FTSE 6,801.87 +55.90 +0.83%

CAC 4,490.71 +51.04 +1.15%

DAX 10,579.79 +45.48 +0.43%

Crude $43.90 (+1.71%)

Gold $1329.80 (+0.96%)

-

14:54

-

14:51

US trade balance improves in July

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $39.5 billion in July, down $5.2 billion from $44.7 billion in June, revised. July exports were $186.3 billion, $3.4 billion

more than June exports. July imports were $225.8 billion, $1.8 billion less than June imports.

The July decrease in the goods and services deficit reflected a decrease in the goods deficit of $5.3 billion to $60.3 billion and a decrease in the services surplus of $0.1 billion to $20.9 billion.

Year-to-date, the goods and services deficit decreased $0.5 billion, or 0.2 percent, from the same period in 2015. Exports decreased $63.7 billion or 4.8 percent. Imports decreased $64.2 billion or 4.0 percent. -

14:49

Labour productivity of Canadian businesses fell 0.3% in the second quarter

Labour productivity of Canadian businesses fell 0.3% in the second quarter, after increasing 0.4% in the first quarter. The decline occurred against a backdrop of temporary difficulties resulting from the wildfire in northern Alberta, which affected both output and labour.

The productivity decline in the second quarter reflected the fact that the decrease in business output was more pronounced than the decline in hours worked.

The productivity decline in the second quarter was attributable to goods-producing businesses (-0.9%). Labour productivity decreased in mining, quarrying, and oil and gas extraction (-0.6%) and manufacturing (-0.1%). On the other hand, productivity rose in utilities (+1.2%) and agriculture and forestry (+0.9%). Construction was virtually unchanged (+0.1%).

-

14:47

NFP below forecasts, market reaction uncertain so far

Total nonfarm payroll employment increased by 151,000 in August, and the unemployment rate remained at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several service-providing industries.

The number of unemployed persons was essentially unchanged at 7.8 million in August, and the unemployment rate was 4.9 percent for the third month in a row. Both measures have shown little movement over the year, on net.

The average workweek for all employees on private nonfarm payrolls decreased by 0.1 hour to 34.3 hours in August. In manufacturing, the workweek declined by 0.2 hour to 40.6 hours, while overtime was unchanged at 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.1 hour to 33.6 hours.

In August, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $25.73. Over the year, average hourly earnings have risen by 2.4 percent.

Average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $21.64 in August. -

14:31

U.S.: Nonfarm Payrolls, August 151 (forecast 180)

-

14:31

Canada: Labor Productivity, Quarter II -0.3% (forecast -0.4%)

-

14:31

U.S.: Average workweek, August 34.3 (forecast 34.5)

-

14:30

U.S.: Average hourly earnings , August 0.1% (forecast 0.2%)

-

14:30

U.S.: Unemployment Rate, August 4.9% (forecast 4.8%)

-

14:30

Canada: Trade balance, billions, July -2.49 (forecast -3.25)

-

14:30

U.S.: International Trade, bln, July -39.47 (forecast -42.7)

-

14:21

European session review: The markets are waiting for a very important NFP

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK index of business activity in the construction sector, m / m in August 45.9 46.1 49.2

9:00 Eurozone Producer Price Index m / m in July from 0.8% Revised 0.7% 0.1% 0.1%

9:00 Eurozone Producer Price Index y / y in July -3.1% -2.9% -2.8%

The British pound was trading almost flat against the dollar after a sharp rise the previous day. Today, investors evaluated data on the index of business activity in the construction sector.

UK construction sector registered a sustained reduction of business activity, but the rate of decline was only slight, showed Markit data.

Purchasing Managers Index from the Chartered Institute of Purchasing and Supply / Markit rose more than expected to 49.2 in August compared with a 85-month low of 45.9 in July. Last reading signaled the slowest rate of decline since the recession began in June.

Index value below 50 indicates a contraction in the sector. The index was forecast to rise to 46.1 was.

"The latest survey shows only a partial transition to stabilization, rather than a return to business as usual" said Tim Moore, senior economist at Markit.

The transition to stabilization correlated with more optimistic data on the UK manufacturing PMI for August, and gives us hope that in the short-term adverse fallout from the uncertainty of Brexit will be less severe than feared, Moore said.

The US dollar is rose slightly on the eve of employment data, which will help to assess the probability of a rate hike in September. Analysts at ING prefer "tactical long positions on the dollar" against the New Zealand dollar, the British pound and the Japanese yen, which are sensitive to changes in interest rates.

According to the consensus forecast of economists surveyed by the WSJ, the number of US jobs outside agriculture rose by 180 000. In August, ING expect an increase in the number of jobs at 150,000 and increase wages by 0.3% compared with the previous month. The consensus forecast assumes growth of wages by 0.2%. That should be enough to "spur the Fed's leadership," they say in ING.

Euro moderately weakened against the US dollar against the strengthening US currency and under the influence of data on producer prices in the euro area.

Eurozone producer prices continued to fall in July, but the rate of decline decreased for the third month in a row, according to Eurostat preliminary data released on Friday.

Producer prices fell by 2.8 percent year on year, after falling 3.1 percent in June. Economists had forecast a decline of 2.9 percent.

Compared with the previous month, producer prices rose 0.1 percent in July, after rising 0.8 percent in June, from a revised 0.7 percent. The last increase was in line with economists' expectations. Prices rose for the third month in a row.

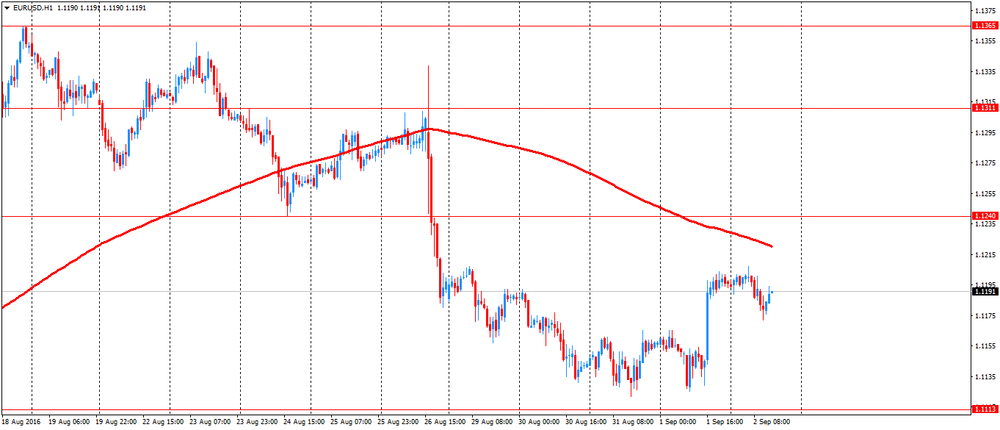

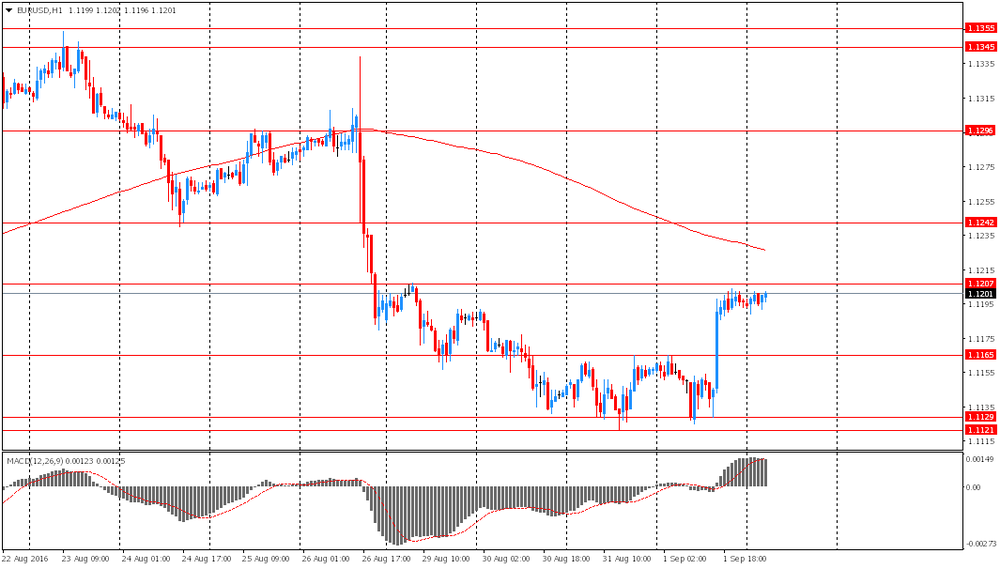

EUR / USD: during the European session, the pair fell to $ 1.1172

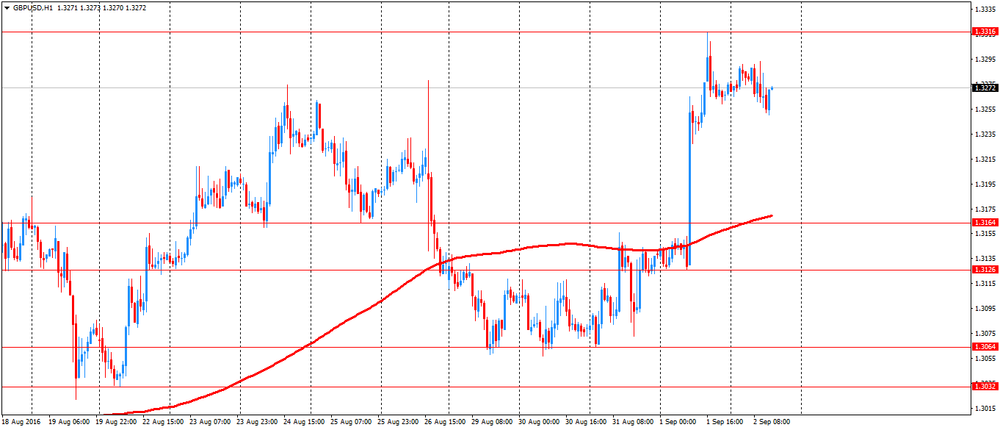

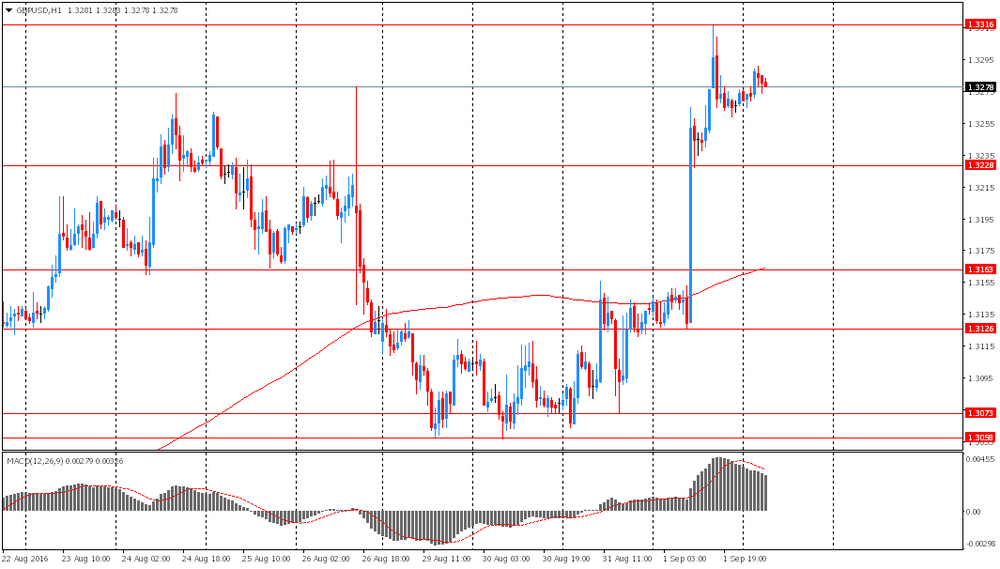

GBP / USD: during the European session, the pair fell to $ 1.3250

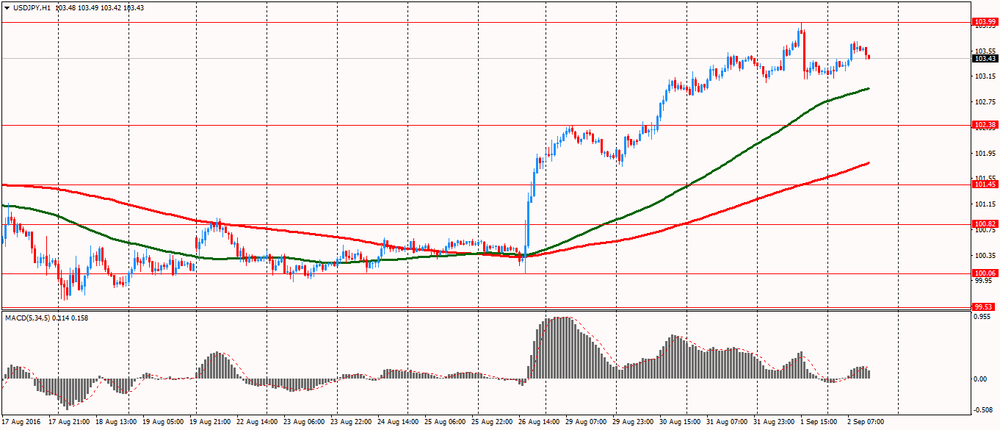

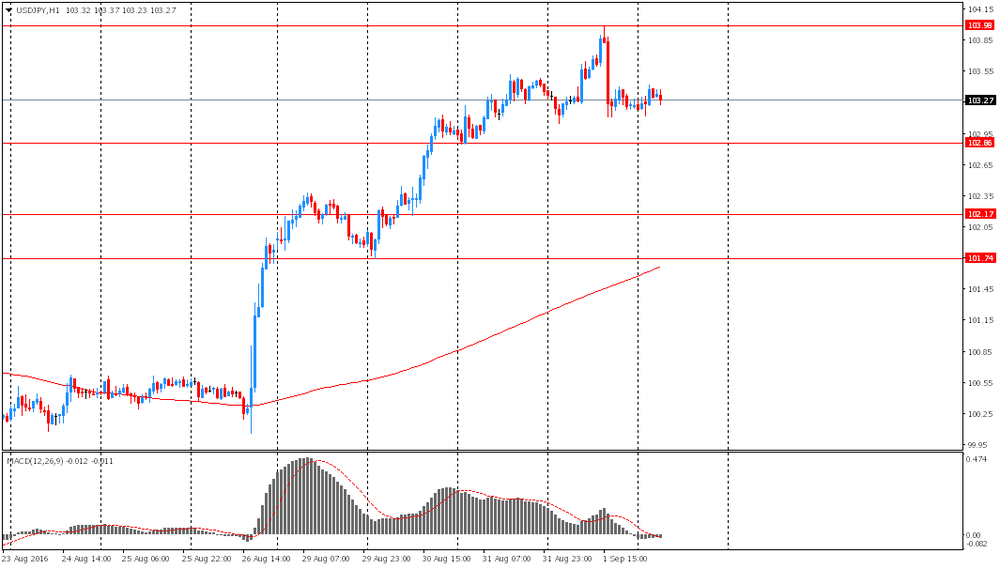

USD / JPY: during the European session, the pair rose to Y103.70

-

13:59

Orders

EUR/USD

Offers : 1.1225-30 1.1250 1.1280 1.1300 1.1320 1.1350-55

Bids : 1.1170 1.1150 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3300 1.3320 1.3350 1.3370-75 1.3390-1.3400 1.3420 1.3450

Bids : 1.3255-60 1.3230 1.3200 1.3175-80 1.3250 1.3120 1.3100 1.3080 1.3065 1.3050

EUR/GBP

Offers : 0.8450 0.8480 0.8500 0.8520-25 0.8535 0.8550

Bids : 0.8420 0.8400 0.8385 0.8370 0.8350 0.8330 0.8300

EUR/JPY

Offers : 116.20 116.50 117.00

Bids : 115.70 115.50 115.00 114.80 114.50 114.00 113.80 113.50

USD/JPY

Offers : 103.80 104.00 104.45-50 104.75 105.00 105.50

Bids : 103.20 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers : 0.7565 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7520 0.7500 0.7485 0.7450 0.7430 0.7400 0.7385 0.7350

-

13:27

Italian economy minister Padoan: Italy committed to target of lowering debt to GDP ration this year.

- several options including conversion of subordinated debt into equity are being studied for Monte de Paschi.

- G20 agreed on need for both private and public investments.

-

13:07

WSE: Mid session comment

The WIG20 trouble with access to the pros in the initial phase of the trading were not accidental. Descent below the minimum from the opening of the session despite that in the environment nothing alarming is happening, confirms that we are relatively weak market. This weakness is a result of, among others, return declines in major energy companies, which in the initial phase of the session bouncing up after yesterday's strong decline. However, the withdrawal can be seen also in the second and third line, so it does not look good. In addition, there were declines in our national currency, which, moreover, is weakening steadily for three weeks. Yesterday the hope of stopping this process gave a better-than-expected reading of the PMI for the industry. These data, however, helped little yesterday and EURPLN pair only not increased. Today sale of the zloty continues and it seems that PLN may remain under pressure even up for a week, means a decision by Moody's about rating for Poland, scheduled for 9 September.

At the halfway point of the session the WIG20 index was at the level of 1,755 pts. (-0.34%) and had a modest trading volume about PLN 170 mln.

-

12:38

Major stock indices in Europe show gains

Stock indices in Western Europe show a bullish mood. Investors are waiting for new data on the US labor market and try to assess the possible impact on the course of monetary policy by the Federal Reserve System, including the timing of the next increase in interest rates.

The official data of Ministry of Labor of unemployment in the US will be released today at 12:30 GMT. According to the average forecast of analysts, the number of jobs in the US increased by 18 th in August after increasing by 255 thousand. In July and the unemployment rate fell to 4.8% from 4.9% a month earlier.

The head of investment firm FXPrimus Marshall Gittler Department: "If the Fed is going to raise rates, it will happen in September or December, and if they hope to raise rates twice this year early good labor market conditions are extremely important".

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.6% to 345.56 points.

Shares of the French hotel chain Accor SA increased by 2.5% after analysts at Barclays raised their rating to "overweight".

McCarthy & Stone Plc shares fell by 12%, as the company expects the UK decision to withdraw from the EU and changes in the monetary policy of the Bank of England will be deprived of its ability to achieve its objectives for this year.

SBM Offshore's shares fell 13.5% after Brazilian prosecutors have refused to deal with the Dutch owner of the fleet production vessels, which would allow the company to avoid prosecution in connection with allegations of corruption because of contracts with oil company Petrobras.

At the moment:

FTSE 6803.47 57.50 0.85%

DAX 10558.23 23.92 0.23%

CAC 4480.61 40.94 0.92%

-

11:11

Producer prices in euro zone up 0.1% in July

In July 2016, compared with June 2016, industrial producer prices rose by 0.1% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In June 2016 prices increased by 0.8% in both zones. In July 2016, compared with July 2015, industrial producer prices decreased by 2.8% in the euro area and by 2.5% in the EU28.

The 0.1% increase in industrial producer prices in total industry in the euro area in July 2016, compared with June 2016, is due to rises of 0.3% for non-durable consumer goods, of 0.2% for intermediate goods and of 0.1% for both capital goods and durable consumer goods, while prices fell by 0.4% in the energy sector. Prices in total industry excluding energy increased by 0.2%.

-

11:05

Putin: no plans to move away from floating rouble regime

-

restrictions on capital movements would be harmful

-

no need to hurry Rosneft sale

-

govt prepares for deal in 2016

-

there should be strategic investors for 19.5% stake in Rosneft

-

can not discriminate against any market players in Bashneft privatisation

-

-

11:00

Eurozone: Producer Price Index, MoM , July 0.1% (forecast 0.1%)

-

11:00

Eurozone: Producer Price Index (YoY), July -2.8% (forecast -2.9%)

-

10:39

UK's construction sector closer to stabilisation

UK construction companies indicated a sustained reduction in business activity during August, but the pace of decline was only marginal and much softer than the seven-year record seen during July. New order volumes also moved closer to stabilisation, with the latest reduction the least marked since May. This contributed to a renewed rise in staffing levels across the construction sector and a rebound in business expectations for the next 12 months. However, latest data indicated a further steep acceleration in input cost inflation. Purchasing prices rose at the fastest pace for just over five years amid reports that exchange rate depreciation had acted as a catalyst for increased charges among suppliers of construction materials.

At 49.2 in August, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index® (PMI® ) remained below the 50.0 no-change threshold for the third consecutive month. However, the index was up from July's 85- month low (45.9), and the latest reading signalled the slowest pace of decline since the downturn began in June.

-

10:30

United Kingdom: PMI Construction, August 49.2 (forecast 46.1)

-

10:24

Oil trading higher

This morning in New York WTI crude oil futures increased by 0.19% to $ 43.26 and Brent rose by + 0.15% to $ 45.52 per barrel. Thus, the black gains moderately on the background of cautious trading ahead of NFP, which will help to assess the state of the world's largest economy and the leading oil consumer.

Raising rates could strengthen the dollar, which would have a negative impact on the price of oil, making oil more expensive for holders of other currencies.

In addition, analysts are more skeptical that OPEC and other producers, including Russia, will be able to agree on a production freeze at the meeting in Algiers in September.

-

09:41

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 293m) 1.1100 (331m) 1.1125 (411m) 1.1150 (348m) 1.1180-90 (361m) 1.1200 (1.9bln) 1.1250 (293m) 1.1295-1.1300 (466m) 1.1400 (473m)

USD/JPY:101.00 (USD 2.25bln) 101.48-50 (766m) 102.00-05 (2.66bln) 102.20-30 (1.27bln) 102.50 (590m) 103.50 (385m) 104.00 (770m) 105.00 (772m)

GBP/USD: 1.3100 (GBP 882m) 1.3200 (234m) 1.3250 (246m)

AUD/USD: 0.7315 (AUD 342m) 0.7400 (790m) 0.7575-80 (638m) 0.7590 (1.07bln) 0.7600 (756m) 0.7640-50 (667m) 0.7700 (255m) 0.7717 (324m) 0.718m)

USD/CAD: 1.3045-55 (USD 638m) 1.3150 (230m) 1.3200 (515m) 1.3400-10 (836m) 1.3450 (500m)

NZD/USD 0.7200-07 (NZD 470m)

-

09:24

Positive start for major stock exchanges: FTSE + 0.4%, DAX + 0.4%, CAC40 + 0.5%, FTMIB + 0.5%, IBEX + 0.4%

-

09:20

Today’s events

At 17:00 GMT a report by Baker Hughes on active oil rigs in the US

At 17:00 GMT a speech by Fed's Jeffrey Lacker

-

09:18

WSE: After opening

WIG20 index opened at 1760.27 points (-0.08%)*

WIG 47187.63 -0.07%

WIG30 2018.00 -0.08%

mWIG40 3897.95 0.01%

*/ - change to previous close

The WIG20 futures started the day six points above yesterday's close. After a very weak yesterday's session improvement in sentiment has come from external environment after the Americans once again defended themselves against drops and technical sell signal.

The WIG20 index started the session from a decline and after some transactions were placed in the region of Thursday's minimum. Surroundings doing a bit better. The CAC, DAX and FTSE gaining in value, and the pan-European STOXX 600 rising by 0.2 percent. The pressure from the environment should help stabilize the WIG20, and the proximity of support around 1,750 points encourage technicians to try to play the rebound. Everything, of course, will only be a prelude before the data from the US. Traditionally, therefore, waiting for the publication of data may be accompanied by low trading activity and volatility of indices.

-

09:07

Asian session review: tight ranges in low activity

The yen was little changed in spite of statements of the Bank of Japan board member Makoto Sakurai. During his speech today Sakurai announced a number of different options for the purchase of new bonds and increasing the asset purchase program. However, the banker noted the absence of an acute need to run all of these mechanisms at the next meeting in September. "The Bank of Japan may make some technical changes to its monetary policy, however, is unlikely to change its attitude on the target inflation rate of 2% and nothing decisive at the September meeting" - said Sakurai. The official added that it is important for the regulator to analyze the effects of negative interest rates and the strengthening of the national currency.

The euro traded almost unchanged after yesterday's announcement of the ECB's Novotny. The official noted that the main reason for such low interest rates in the region is a negative situation in the European economy. "In the long term, low rates of economic growth will continue, and it is difficult to name the reason for this" - he said.

Today, investors' attention will focuse on key employment report in the US, which will be published today at 12: 00GMT. According to forecasts, the number of people employed in non-agricultural sectors grew in August at 180 thousand after increasing by 255 thousand. In July. The unemployment rate is likely to decline to 4.8% from 4.9%. The growth rate of the average hourly rate is estimated to have slowed to 0.2% from 0.3%.

EUR / USD: during the Asian session, the pair is trading in $ 1.1190-1.1205 range

GBP / USD: during the Asian session, the pair rose to $ 1.3290

USD / JPY: during the Asian session, the pair was trading in Y103.10-103.40 range

-

08:28

Options levels on friday, September 2, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1323 (4359)

$1.1289 (4866)

$1.1242 (3122)

Price at time of writing this review: $1.1195

Support levels (open interest**, contracts):

$1.1142 (2701)

$1.1077 (4471)

$1.1036 (5855)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52263 contracts, with the maximum number of contracts with strike price $1,1250 (4866);

- Overall open interest on the PUT options with the expiration date September, 9 is 58400 contracts, with the maximum number of contracts with strike price $1,1050 (5855);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from September, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.3501 (2145)

$1.3403 (2525)

$1.3307 (2812)

Price at time of writing this review: $1.3275

Support levels (open interest**, contracts):

$1.3195 (743)

$1.3098 (1105)

$1.2999 (1876)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 33087 contracts, with the maximum number of contracts with strike price $1,3300 (2812);

- Overall open interest on the PUT options with the expiration date September, 9 is 27111 contracts, with the maximum number of contracts with strike price $1,2800 (2704);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from September, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

August NFP: Scenarios & FX Trades - RBS

"RBS US Desk Strategy Economics do not believe Friday's data will compel the Fed to act as early as September. Following hefty increases in each of the prior two months, they look for job growth to have settled back a bit in August, with overall payrolls expected to have advanced by 175k. The details (average hourly earnings and average workweek) are also expected to be soft. As normal, the jerk reaction will be on the headline jobs growth print. However, the lasting impact may depend on details, most obviously average earnings

Below we set out possible currency reactions to a range of payrolls outcomes.

260 and above | USD out-performance as markets become curious about a pair of 25bp hikes

Futures markets price September as a near certainty and prices in a far higher probability of a further 25bp in December. USD out-performs in the G4 space. The prospect of strong US (and global) growth is seen ultimately providing an offset for EM FX but not immediately. The immediate EM consideration is the return of the focus on EM deleveraging and FX debt given more abrupt Fed hike pricing. Short EUR/USD, long USD/JPY, long USD/MYR (1m NDF)

210-260 | Continuation of recent stronger USD theme

A solid report that has a material impact on the pricing of a single quarter point rate hike in 2016, particularly towards the higher end of the band. Perhaps September but more likely December. Long USD/JPY, long USD/KRW

165-210 | Consensus, focus turns to ECB and BoJ meetings

The consensus and RBS US Desk Strategy Economics expectation fall within this band. Only a modest incremental change (higher) in rates expectations, with perhaps December rising to be more likely than not. Reaction on the day may depend on details and ultimately on Fed speaker comments in coming days. USD consolidates. EUR/USD drifts lower. Neutral, to mildly positive for EM FX.

145-165 | Vol suppressor

A volatility suppressing outcome. Re-establishment of carry positions. Mild EUR/USD retracement (higher) and short USD/INR

50-145 | Profit-taking in USD longs

Still in line with labour force growth, but little reason for the FOMC to act quickly with CPI and wage pressure subdued. Gives Yellen an opportunity to return to her preferred habitat of low rates for potentially much longer. Also a number that could be seen as consistent with a late economic cycle move, suggesting a very low terminal rate. Fed tightening off the table for September entirely.Profit-taking on recent established JPY shorts. There may be more concerns about global growth. Short USD/JPY, Long JPY/KRW".

Copyright © 2016 RBS, eFXnews™

-

08:24

WSE: Before opening

Thursday's trading on Wall Street ended much better than could have been expected after the beginning of the American session.

From the point of view of European markets, it is important that during the closing of session in Europe, the S&P500 was recorded on session minima and ended the session several points higher.

The reasons for this initial sell-off was a decline in oil prices, recession reading of ISM index for the industry and the weakness of the banking sector. Each of these elements may be of importance in the month just begun.

Today's trading on the market will certainly be subordinated to the US Department of Labor data (14:30 Warsaw time), which have shown an increase in the number of posts about 180k to 200k and everything below these figures will be regarded as confirmation of the lack of an increase at the September FOMC meeting.

We expect, therefore, that the Warsaw market will copy behavior of other exchanges. However, it is worth paying attention to good posture of emerging markets and the strengthening of the zloty.

Today in the morning the Polish zloty is valued by the market as follows: PLN 4.3595 per euro, PLN 3.8948 against the US dollar. Yields of national debt amounts 2,803% in the case of 10-year bonds.

-

08:23

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC 40 + 0.4%, FTSE + 0.3%

-

08:22

Japan consumer sentiment strengthened more than expected in August

Japan consumer sentiment strengthened more than expected in August, survey data from the Cabinet Office showed Friday.

The consumer sentiment index rose to 42.0 from 41.3 in the prior month. The score was expected to improve to 41.8.

Among components, the index measuring income growth rose by 0.5 points to 40.9 in August. Similarly, the gauge for overall livelihood improved slightly by 0.4 points to 40.9.

The index for willingness to buy durable goods gained 0.2 points to 41.5. At the same time, the employment index climbed 1.5 points to 44.5.

The survey was conducted among 8,400 households on August 15, rttnews notes.

-

08:21

Board member of the Bank of Japan, Makoto Sakurai: There are plenty of opportunities to purchase new bonds and increasing the asset purchase program

During his speech today Bank of Japan board member Makoto Sakurai announced a number of different options for the purchase of new bonds and increasing the asset purchase program. However, the banker noted the absence of an acute need to run all of these mechanisms at the next meeting in September. "The Bank of Japan may make some technical changes to its monetary policy, however, is unlikely to change its attitude on the target inflation rate of 2% and nothing decisive at the September meeting" - said Sakurai. The official added that it is important for the regulator to analyze the effects of negative interest rates and the strengthening of the national currency.

-

08:18

The monetary base in Japan surged 24.2 percent

According to rttnews, the monetary base in Japan surged 24.2 percent on year in August, the Bank of Japan said on Friday - coming in at 400.998 trillion yen.

That's down from 24.7 percent in July, and it marks the slowest rate of growth in more than a year.

Banknotes in circulation added an annual 5.7 percent, while coins in circulation gained 1.1 percent.

Current account balances spiked 32.0 percent, including a 30.9 percent jump in reserve account balances.

The adjusted monetary base climbed 28.3 percent to 400.793 trillion yen.

-

07:01

Japan: Consumer Confidence, August 42 (forecast 41.6)

-

06:35

Global Stocks

U.K. stocks turned lower Thursday, with many shares falling victim to a surge in the pound after U.K. manufacturing data surprised investors with an unexpectedly strong reading. "An early attempt at a rally in U.K. stocks wilted in afternoon trading as a rally in the pound devalued the foreign earnings of multinational firms," said Jasper Lawler, market analyst at CMC Markets, in a note.

U.S. stocks finished mostly higher on Thursday, recovering from earlier losses, as investors braced for the much-anticipated August jobs report on Friday, which could set the stage for a near-term interest-rate increase by the Federal Reserve. Earlier, stocks took a sharp step lower after a key data point: The Institute for Supply Management manufacturing index in August fell to 49.4% from 52.6% last month. A reading below 50% signals contraction.

Asian shares were down early Friday, as traders await results of the latest U.S. jobs report, the strength of which could help determine the timing of the next interest rate hike. Early in Friday's session, the Japanese yen rose against the U.S. dollar, weighing on export stocks, though the currency later pared some of the gains.

-

00:30

Commodities. Daily history for Sep 01’2016:

(raw materials / closing price /% change)

Oil 43.53 +0.86%

Gold 1,317.20 +0.01%

-

00:29

Stocks. Daily history for Sep 01’2016:

(index / closing price / change items /% change)

Nikkei 225 16,926.84 +39.44 +0.23%

Shanghai Composite 3,062.97 -22.52 -0.73%

S&P/ASX 200 5,415.56 -17.47 -0.32%

FTSE 100 6,745.97 -35.54 -0.52%

CAC 40 4,439.67 +1.45 +0.03%

Xetra DAX 10,534.31 -58.38 -0.55%

S&P 500 2,170.86 -0.09 0.00%

Dow Jones Industrial Average 18,419.30 +18.42 +0.10%

S&P/TSX Composite 14,683.91 +85.96 +0.59%

-

00:28

Currencies. Daily history for Sep 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1196 +0,35%

GBP/USD $1,3274 +1,02%

USD/CHF Chf0,9797 -0,38%

USD/JPY Y103,22 -0,13%

EUR/JPY Y115,57 +0,22%

GBP/JPY Y137,01 +0,91%

AUD/USD $0,7549 +0,48%

NZD/USD $0,7293 +0,67%

USD/CAD C$1,3092 -0,11%

-

00:00

Schedule for today, Friday, Sep 02’2016

(time / country / index / period / previous value / forecast)

05:00 Japan Consumer Confidence August 41.3 41.6

08:30 United Kingdom PMI Construction August 45.9 46.1

09:00 Eurozone Producer Price Index, MoM July 0.7% 0.1%

09:00 Eurozone Producer Price Index (YoY) July -3.1% -2.9%

12:30 Canada Trade balance, billions July -3.63 -3.25

12:30 Canada Labor Productivity Quarter II 0.4% -0.4%

12:30 U.S. Average workweek August 34.5 34.5

12:30 U.S. International Trade, bln July -44.51 -42.7

12:30 U.S. Average hourly earnings August 0.3% 0.2%

12:30 U.S. Nonfarm Payrolls August 255 180

12:30 U.S. Unemployment Rate August 4.9% 4.8%

14:00 U.S. Factory Orders July -1.5% 2%

-