Noticias del mercado

-

22:16

U.S.: Total Vehicle Sales, mln, August 16.98 (forecast 17.2)

-

22:09

Almost all of the major US stock indexes showed increase

Major stock indexes Wall Street ended the session mostly in positive territory. The dynamics of trading data dictated by the United States, as well as in the oil market situation.

US Bureau of Labor Statistics reported that labor productivity in the non-agricultural sector of the economy declined by 0.6% annually in the second quarter of 2016. Production volume increased by 1.1% and the number of hours worked increased by 1.7%.

In addition, as it became known, the number of Americans who applied for unemployment benefits rose less than expected last week, indicating stability in the labor market, which could push the Fed closer to raising interest rates. Primary applications for unemployment benefits for 2000 and increased by a seasonally adjusted reached 263,000 for the week ended August 27th. The data for the previous week were not revised. Economists forecast that initial applications for unemployment benefits will rise to 265,000 last week.

However, a report published by the supply (ISM) Management Institute showed that in August activity in the US manufacturing sector has deteriorated markedly. The PMI for the US the production sector was 49.4 points versus 52.6 points in July. It was expected that this figure will drop to 52 points.

The Commerce Department reported that construction spending remained unchanged in July, after rising 0.9% in June, with those previously reported decrease in June by 0.6%. In addition, construction spending in May was revised, and showed an increase of 0.1% instead of falling 0.1%. Construction costs rose by 1.5% compared to last year. Economists forecast that construction spending will grow by 0.5% in July.

Oil futures fell markedly, continuing yesterday's trend and updating the 3-week low. The pressure on prices have concerns about over-saturation of the market, which intensified after the publication in the US petroleum inventories report.

DOW index components were mixed (16 red, 14 black). Outsider were shares of American Express Company (AXP, -1.19%). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 1.78%).

Most of the S & P sectors closed in the red. conglomerates (-1.6%) sectors fell most. Maximizing showed the service sector (+ 0.3%).

At the close:

Dow + 0.10% 18,419.30 +18.42

Nasdaq + 0.27% 5,227.21 +13.99

S & P -0.00% 2,170.86 -0.09

-

21:00

Dow -0.05% 18,391.87 -9.01 Nasdaq +0.17% 5,222.02 +8.80 S&P -0.14% 2,167.92 -3.03

-

18:03

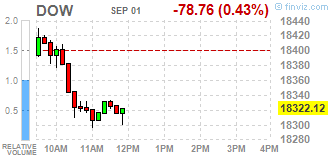

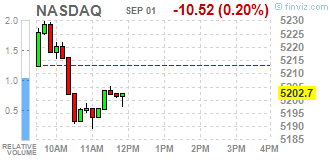

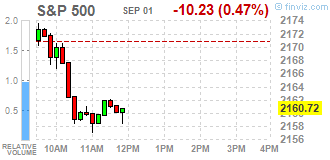

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday, starting September on a dour note after a steeper-than-expected decline in monthly factory activity raised doubts about growth and the ability of the economy to withstand an interest rate hike. A report from the Institute of Supply Management showed U.S. factory activity contracted for the first time in six months in August as new orders and production tumbled. The report precedes Friday's monthly nonfarm payrolls numbers which are likely to set the tone for the Fed policy meeting regarding the timing of the next rate hike.

Most of all Dow stocks in negative area (24 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +0.71%). Top loser - American Express Company (AXP, -1.48%).

All S&P sectors also in negative area. Top loser - Conglomerates (-1.2%).

At the moment:

Dow 18308.00 -87.00 -0.47%

S&P 500 2158.50 -11.00 -0.51%

Nasdaq 100 4761.75 -12.00 -0.25%

Oil 43.52 -1.18 -2.64%

Gold 1316.60 +5.20 +0.40%

U.S. 10yr 1.56 +0.00

-

18:00

European stocks closed: FTSE 100 -35.54 6745.97 -0.52% DAX -58.38 10534.31 -0.55% CAC 40 +1.45 4439.67 +0.03%

-

17:47

Oil down more than 2 percent

Oil futures fell markedly, continuing yesterday's trend and updating the 3-week low. The pressure on prices put concerns about over-saturation of the market, which intensified after the publication of the US petroleum inventories report.

Recall, the US Department of Energy reported that in the week from August 19 to 26 commercial oil stocks rose 2.28 million barrels to 525.87 million. Analysts were expecting growth of only 1.31 million barrels. Gasoline inventories fell last week by 691 thousand. barrels to 232.004 million barrels. Experts predicted a decline of 1 million barrels. Distillate stocks rose by 1.496 million barrels to 154.753 million barrels. Analysts expected an increase of 300,000 barrels. The utilization of refining capacity increased by 0.3% to 92.8%. Analysts had expected a decline of 0.4%. US domestic oil production dropped to 8.488 million. barrels per day versus 8.548 million. barrels per day from the previous week.

"Recent data in the US oil reserves suggest that excess supply will remain longer than expected," - said Hans van Cleef, an economist at ABN AMRO Bank N.V. - In addition, the possible strengthening of the dollar, if the Fed will raise rates will negatively affect the price of oil. Also the uncertainty regarding the OPEC meeting, the results of which will be shown later this month.

The cost of the October futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 43.67 dollars per barrel.

October futures price for North Sea petroleum mix of mark Brent fell to 45.79 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:35

WSE: Session Results

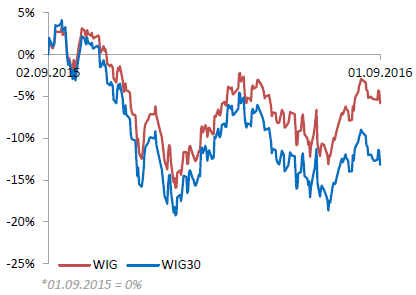

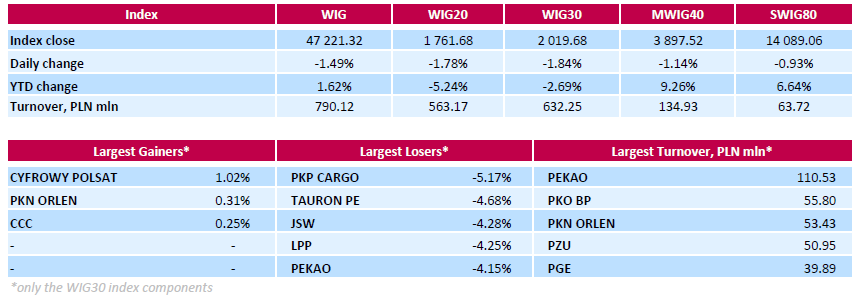

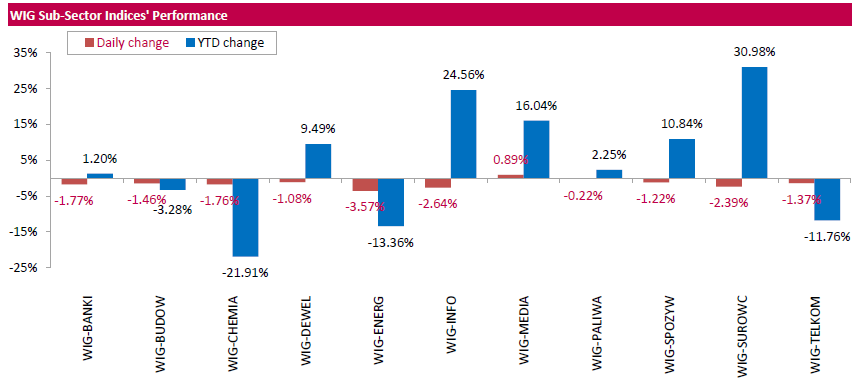

Polish equity market closed lower on Thursday. The broad market measure, the WIG index, declined by 1.49%. All sectors, but for media (+0.89%), were down, with utilities (-3.57%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, dropped by 1.84%. A majority of the index components recorded losses, with railway freight transport operator PKP CARGO (WSE: PKP) underperforming with a 5.17% decline. Other major laggards were genco TAURON PE (WSE: TPE), coking coal miner JSW (WSE: JSW), clothing retailer LPP (WSE: LPP) and bank PEKAO (WSE: PKO), which tumbled by 4.15%-4.68%. At the same time, the few gainers included media group CYFROWY POLSAT (WSE: CPS), oil refiner PKN ORLEN (WSE: PKN) and footwear retailer CCC (WSE: CCC), advancing by 1.02%, 0.31% and 0.25% respectively.

-

17:28

Gold price rose

The price of gold rose sharply, stepping back from the two-month low, move caused by the fall of the dollar in response to the disappointing data on business activity in the US.

The report submitted by the Institute for Supply Management (ISM), showed that in August manufacturing sector has deteriorated markedly, exceeding thus the average forecast. The PMI was 49.4 points versus 52.6 points in July. It was expected that this figure will drop to 52 points. More detailed information is shown: the index of stocks in August fell to 49.0 against 49.5 in July, while the production index fell to 49.6 from 55.4. The new orders index plummeted to 49.1 against 56.9 in July, while the employment index fell to 48.3 from 49.4. Meanwhile, the price index fell to 53.0 from 55.0 in July

Analysts said the data from the ISM reinforced fears about the economy in general, but it is unlikely to have a strong impact on the Fed's plans to tighten policy.

"If tomorrow's NFP data will be good, the price of gold may fall to $ 1260- $ 1270, as markets will increasingly rely on a rate hike in September," - said Shu Jiang, principal analyst at Shandong Gold Group.

The cost of the October futures for gold on COMEX rose to $ 1312.8 per ounce.

-

16:44

-

16:10

US ISM manufacturing in contraction territory. USD declines

Economic activity in the manufacturing sector contracted in August following five consecutive months of expansion, while the overall economy grew for the 87th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®. The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The August PMI® registered 49.4 percent, a decrease of 3.2 percentage points from the July reading of 52.6 percent. The New Orders Index registered 49.1 percent, a decrease of 7.8 percentage points from July.

-

16:00

U.S.: ISM Manufacturing, August 49.4 (forecast 52)

-

16:00

U.S.: Construction Spending, m/m, July 0% (forecast 0.5%)

-

15:53

August data pointed to a further moderate upturn in business conditions across the U.S. manufacturing sector

August data pointed to a further moderate upturn in business conditions across the U.S. manufacturing sector. However, the overall pace of improvement slowed since July amid weaker rises in new orders and payroll numbers. The latest survey also highlighted a sustained drop in inventory volumes among manufacturing firms. Meanwhile, input cost inflation remained subdued and average prices charged by manufacturers were broadly unchanged over the month. At 52.0 in August, the seasonally adjusted Markit final U.S. Manufacturing Purchasing Managers' Index™ (PMI™) dropped from 52.9 in July but remained comfortably above the neutral 50.0 value.

-

15:52

WSE: After start on Wall Street

The beginning of the US market was not easy for the bulls, which despite the small increases of contracts for the S&P500 had to be at the start in trying to reconcile with the equilibrium level. Deepen drops of oil market. After yesterday's strike of supply caused by, among others, the next higher-than-expected increase in crude oil inventories today the oil market is still govern by bears.

Somewhat surprising deterioration in sentiment on the Warsaw Stock Exchange applies today not only blue chips, but also the broad market. However, in the case of small and medium-sized companies is considerable room for profit taking. An hour before the close of trading the WIG20 index was at the level of 1,770 points (-1,26%).

-

15:45

U.S.: Manufacturing PMI, August 52 (forecast 52.1)

-

15:34

U.S. Stocks open: Dow +0.12%, Nasdaq +0.18%, S&P +0.05%

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR233m) 1.1200 (1.0bln) 1.1300 (397m)

USD/JPY:100.00 (USD 1.09bln) 102.30 (200m) 103.00 (782m) 103.50 (300m) 103.90 (830m) 105.00 (400m)

USD/CHF 0.9950 (USD 225m)

AUD/USD: 0.7500(AUD 627m) 0.7515-16 (671m) 0.7600 (275m) 0.7650 (706m) 0.7710 (451m)

USD/CAD: 1.2845-50 (USD 317m) 1.3090 (240m) 1.3100 (642m) 1.3150 (280m)

NZD/USD 0.7300 (NZD 230m)

-

15:25

Before the bell: S&P futures +0.06%, NASDAQ futures +0.14%

U.S. stock-index futures fluctuated after briefly erasing gains, as falling crude prices tempered optimism amid positive signs for global growth while investors await Friday's key payrolls data.

Global Stocks:

Nikkei 16,926.84 +39.44 +0.23%

Hang Seng 23,162.34 +185.46 +0.81%

Shanghai 3,062.97 -22.52 -0.73%

FTSE 6,779.05 -2.46 -0.04%

CAC 4,472.99 +34.77 +0.78%

DAX 10,619.78 +27.09 +0.26%

Crude $44.33 (-0.83%)

Gold $1305.90 (-0.42%)

-

14:40

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) reiterated with a Buy at Mizuho; target $120

Intel (INTC) assumed with Buy rating at Roth Capital

-

14:38

US jobless claims continue to decline

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 263,000, an increase of 2,000 from the previous week's unrevised level of 261,000. The 4-week moving average was 263,000, a decrease of 1,000 from the previous week's unrevised average of 264,000. There were no special factors impacting this week's initial claims. This marks 78 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:37

US nonfarm business sector labor productivity decreased at a 0.6-percent annual

Nonfarm business sector labor productivity decreased at a 0.6-percent annual rate during the second quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 1.1 percent and hours worked increased 1.7 percent. (All quarterly percent changes in this release are seasonally

adjusted annual rates.) From the second quarter of 2015 to the second quarter of 2016, productivity decreased 0.4 percent, the first four-quarter decline in the series since a 0.6-percent decline in the second quarter of 2013.Unit labor costs in the nonfarm business sector increased 4.3 percent in the second quarter of 2016, reflecting a 3.7-percent increase in hourly compensation and a 0.6-percent decline in productivity. Unit labor costs increased 2.6 percent over the last four quarters.

-

14:30

U.S.: Initial Jobless Claims, 263 (forecast 265)

-

14:30

U.S.: Continuing Jobless Claims, 2159 (forecast 2145)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter II -0.6% (forecast -0.6%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter II 4.3% (forecast 2.1%)

-

14:21

European session review: the pound rose sharply on manufacturing PMI data

The following data was published:

(Time / country / index / period / previous value / forecast)

Switzerland 7:15 Retail sales, y / y in July -3.9% -2.2%

Switzerland 7:30 PMI in the manufacturing sector in August 50.1 50.5 51

France 7:50 PMI in the manufacturing sector (the final data) August 48.6 48.5 48.3

7:55 Germany Index of business activity in the manufacturing sector (the final data) August 53.8 53.6 53.6

8:00 Eurozone PMI in the manufacturing sector (the final data) August 52 51.8 51.7

8:30 UK PMI index of manufacturing activity in August with 48.3 Revised 48.2 49.0 53.3

The British pound rose sharply on evidence of improving manufacturing activity (PMI) in August. More positive data tempered concerns about the negative consequences of Brexit.

Manufacturing activity in the UK unexpectedly jumped in August, showed Markit data.

Purchasing managers index of manufacturing rose to 53.3 from 41-month low of 48.3, published in July, after the EU referendum. The index was expected to rise to 49.

A reading above 50 indicates expansion in the sector. The index indicates that the sector expanded the most in ten months in August.

The monthly increase in the index was the highest in over a 25-years of the survey.

"The companys said that the work that had been postponed in July, have now been restarted since manufacturers and their customers began to regain a sense of returning to work, as usual," said Rob Dobson, senior economist at IHS Markit.

The euro weakened against the US dollar after the index of business activity in the manufacturing sector in the euro area, but then regained some lost ground.

In the euro zone manufacturing sector expanded at the slowest pace in three months in August, revealed Markit data.

Purchasing Managers' Index fell to 51.7 in August from 52 in July. A preliminary assessment was 51.8.

The data showed that the rate of expansion slowed for production, new orders and new export orders, which led to a weaker rate of job creation.

Research indicates that industrial production is growing at a constant, though not impressive annual rate of just under 2 percent, said Chris Williamson, chief economist at IHS Markit.

Germany and the Netherlands recorded the strongest rate of expansion. At the same time, the French continued to decline in August.

Production recovery in Germany, which began in December 2014, continued in August. The final manufacturing PMI in Germany from Markit / BME fell to 53.6 in August, according to a preliminary estimate, from 53.8 in July.

French manufacturing PMI reached 48.3 in August, compared to 48.6 in July. The initial estimate was 48.5. The last reading was below the neutral 50.0 threshold of the sixth month in a row.

The Swiss franc fell sharply against the US dollar on retail sales, but then rose after the release of the index of business activity in the manufacturing sector

Retail sales in Switzerland fell in July compared with the same period last year. Retail sales fell in nominal terms by 2.6% compared to July 2015 and decreased by 2.2% in real terms.

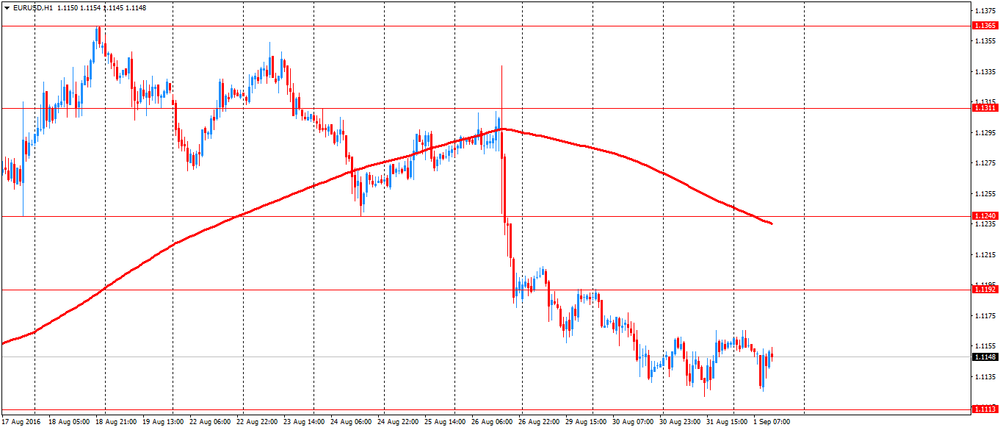

EUR / USD: during the European session, the pair fell to $ 1.1125 and retreated

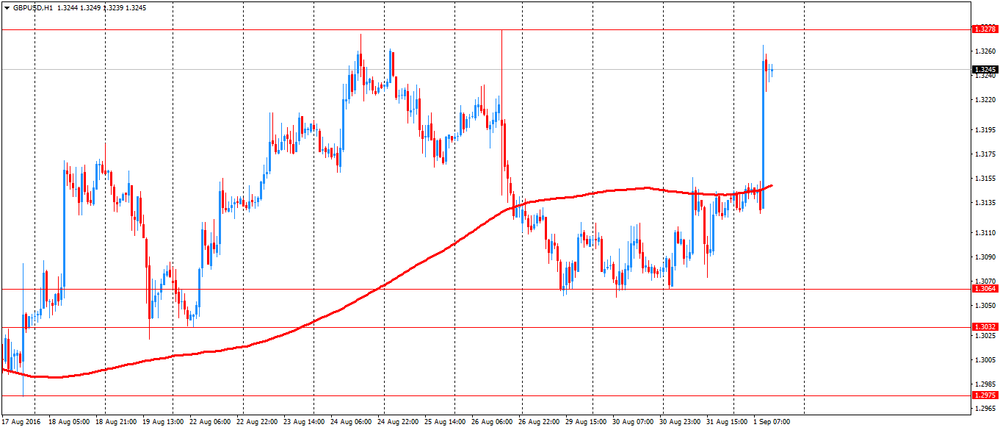

GBP / USD: during the European session, the pair rose to $ 1.3265

USD / JPY: during the European session, the pair rose to Y103.71

-

13:43

Orders

EUR/USD

Offers : 1.1150 1.1165 1.1180 1.1200 1.1225-30 1.1250 1.1280 1.1300

Bids : 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3160 1.3180 1.3200 1.3235 1.3250 1.3280 1.3300

Bids : 1.3120 1.3100 1.3080 1.3065 1.3050 1.3030 1.3000

EUR/GBP

Offers : 0.8500 0.8520-25 0.8535 0.8550 0.8565 0.8580 0.8600

Bids : 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers : 115.50 115.75 116.00 116.50 117.00

Bids : 115.00 114.80 114.50 114.00 113.80 113.50

USD/JPY

Offers : 103.50-55 103.75-80 104.00 104.45-50 104.75 105.00 105.50

Bids : 103.20 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers : 0.7530 0.7550 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7500 0.7485 0.7450 0.7430 0.7400 0.7385 0.7350

-

13:18

WSE: Mid session comment

The first half of the first in this month's session on the Warsaw market was marked by declines. Today the weakest sector remains the energy, but other sectors are also under the pressure.

Strongly lose today the shares of the bank PKO BP (WSE: PKO) after interview of the CEO and the words about superiority of financing of the economy over the payment of dividends by bank.

One of the two main brake among the blue chips next to PKO BP today are values of PGE. Share price falls by 3.3 per cent, which means that PGE values are today quoted the lowest in history.

In the mid-session the WIG20 index was at the level of 1,778 points (-0.85%) and with the turnover of PLN 290 million.

-

12:56

Major stock indices in Europe mostly higher

Most European stock indexes rising, mining stocks rise in price on strong macroeconomic data from China.

Official PMI for China's processing industry, published on Thursday, rose unexpectedly in August to 50.4 points from 49.9 points in July, indicating a increase in activity in the sector. Experts on average expected a decline to 49.9 index points.

Meanwhile, a similar index for the processing industry, calculated by Caixin Media, and Markit, fell last month to 50 points from 50.6 points in July. Analysts had expected a less sharp decline to 50.1 points.

Also, investor sentiment was supported by data on the growth of business activity in Switzerland and the UK. PMI in Switzerland in August rose to 51 from 50.1, signaling a slight recovery in economic activity. For nine consecutive months the index is above the threshold of 50 that separates contraction from expansion.

Manufacturing activity in the UK unexpectedly jumped in August, showed Markit data. Purchasing managers index of manufacturing rose to 53.3 from 41-month low of 48.3, published in July, after the EU referendum. The index was to rise to 49. A reading above 50 indicates expansion in the sector. The index indicates that the sector expanded the most in ten months in August. The monthly increase was the highest over a 25-year history of the survey. "The companys said that the work that had been postponed in July, have now been restarted since manufacturers and their customers began to regain a sense of returning to work, as usual," said Rob Dobson, senior economist at IHS Markit.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,7% - to 346.05 points.

The index of 50 largest enterprises of the euro zone Euro Stoxx 50 added 0.6%. The index operator Stoxx Ltd. said yesterday that from September 19, the index will exclude Italian insurer Assicurazioni Generali and UniCredit Bank, as well as the French retailer Carrefour. Their place will be taken by Adidas AG, the Irish building materials producer CRH Plc and Ahold supermarket chain.

Commodities rise in price on the statistical data of China, and the quotations of mining companies Antofagasta, of Glencore and Anglo American rising by more than 1.6%.

The price of the French construction company Eiffage SA rose 2.6% on the back of its strong profits in the first half.

Capitalization of the second largest spirits producer Pernod Ricard increased by 1.9%. The company increased its net profit by 43% and gave an optimistic outlook for the current reporting period.

Roche Holding AG's shares added 0.3% after the Swiss pharmaceutical company said its immunotherapeutic drug Tecentriq showed positive results in the Phase III studies.

At the moment:

FTSE 6771.07 -10.44 -0.15%

DAX 10634.13 41.44 0.39%

CAC 4477.14 38.92 0.88%

-

12:01

Manufacturing industries PMI in the Russian Federation in August exceeded 50 points - Markit

Business activity index (PMI) of manufacturing industries of the Russian Federation in August 2016 exceeded the mark of 50 points against 49.5 points in July, according to a survey by Markit.

The company notes that the index has risen above the mark of 50 points, only the second time since the beginning of 2016, after a moderate growth was recorded in new orders and production volumes.

-

10:58

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR233m) 1.1200 (1.0bln) 1.1300 (397m)

USD/JPY:100.00 (USD 1.09bln) 102.30 (200m) 103.00 (782m) 103.50 (300m) 103.90 (830m) 105.00 (400m)

USD/CHF 0.9950 (USD 225m)

AUD/USD: 0.7500(AUD 627m) 0.7515-16 (671m) 0.7600 (275m) 0.7650 (706m) 0.7710 (451m)

USD/CAD: 1.2845-50 (USD 317m) 1.3090 (240m) 1.3100 (642m) 1.3150 (280m)

NZD/USD 0.7300 (NZD 230m)

-

10:46

Oil is gaining in early trading

This morning, New York crude oil futures for WTI rose by 0.67% to $ 45.00 and crude oil futures for Brent rose by 0.58% to $ 47.16 per barrel. Thus, the black gold is trading higher on the background of data on the growth in US energy stockpiles. US crude stocks rose last week by 2.3 million barrels, the US Department of Energy data show. Although analysts polled by The Wall Street Journal, predicted an increase of 1.2 million barrels. "

Gasoline inventories fell by 700 thousand barrels, vs a more significant decline expected. US domestic oil production fell for the week by 60 thousand barrels - to 8.48 million barrels per day.

The US continues to import oil that support the growth of reserves.

-

10:35

UK Manufacturing PMI climbs to ten-month high in August - Markit

August saw solid rebounds in the trends in UK manufacturing output and incoming new orders. Companies reported solid inflows of new work from both domestic and export sources, the latter aided by the sterling exchange rate. Employment rose for the first time in the year-to-date. At 53.3 in August, the seasonally adjusted Markit/CIPS Purchasing Managers' Index® (PMI® ) recovered sharply from the 41-month low of 48.3 posted in July following the EU referendum.

-

10:31

The pound on the rise after huge manufacturing PMI. GBP/USD up over 100 pips so far

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , August 53.3 (forecast 49.0)

-

10:14

Major stock exchanges open higher: FTSE + 0.5%, DAX + 0.3%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.5%

-

10:14

German manufacutring PMI unchanged in August

The manufacturing upturn in Germany that started in December 2014 continued in August. Although the final seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers' Index® (PMI® ) - a single-figure snapshot of the performance of the manufacturing economy - fell from 53.8 in July to a 53.6, it remained above its long-run average (51.9) and signalled a solid improvement in manufacturers operating conditions. August data highlighted a further sharp rise in production volumes at German manufacturers, with the pace of expansion down only slightly from July's 27-month high. Increased demand was the main driver behind the rise in output, according to panel evidence.

-

10:12

Growth in the eurozone manufacturing sector lost momentum in August

Growth in the eurozone manufacturing sector lost momentum in August. Rates of expansion slowed for production, new orders and new export business, resulting in weaker job creation. The final Markit Eurozone Manufacturing PMI® posted 51.7 in August, a three-month low and down further from June's year-to-date high. The final reading was also a tick below its earlier flash estimate of 51.8. The PMI has now signalled growth for 38 consecutive months, marking a continuation of its survey-record unbroken sequence above the 50.0 stagnation mark.

-

10:00

Eurozone: Manufacturing PMI, August 51.7 (forecast 51.8)

-

09:55

Germany: Manufacturing PMI, August 53.6 (forecast 53.6)

-

09:50

France: Manufacturing PMI, August 48.3 (forecast 48.5)

-

09:31

Growth in the Spanish manufacturing sector remained muted in August

According to Markit, growth in the Spanish manufacturing sector remained muted in August. The health of the sector improved slightly as the rate of expansion in production eased. However, new orders returned to growth following a fall in July. With improvements in demand only modest, firms reduced the pace at which they took on extra staff. Meanwhile, inflationary pressures remained muted.

The headline Markit Spain Manufacturing PMI is a composite single-figure indicator of manufacturing performance. It is derived from indicators for new orders, output, employment, suppliers' delivery times and stocks of purchases. Any figure greater than 50.0 indicates overall improvement of the sector.

The PMI was unchanged at 51.0 in August, signalling a marginal improvement in business conditions for Spanish manufacturers, and one that was the same strength as July's 31-month low.

-

09:30

Switzerland: Manufacturing PMI, August 51 (forecast 50.5)

-

09:20

WSE: After opening

WIG20 index opened at 1796.61 points (+0.17%)*

WIG 48045.86 0.23%

WIG30 2063.62 0.29%

mWIG40 3948.49 0.15%

*/ - change to previous close

After yesterday's boring and slightly downward session Thursday trading on the WSE we start on the green side. Improving sentiment on our parquet is the result of adaptation to the today's atmosphere in global markets. In Europe, major indexes are also increasing, the DAX by 0.4 per cent. The futures on the S&P500 after a weak session in the US herald return of growth. Market apparently does not interfere with speculation about the possibility of interest rate hikes in the US. For the Warsaw Stock Exchange also helps the publication of the PMI index for Polish industry for August (reading 51.5 pts. vs. forecast of 50.9 pts.), which surprises positively and may calm gloomy comments about the national economy.

-

09:06

Today’s events

At 08:30 GMT Spain will hold an auction of 10-year and 30-year debt

At 09:00 GMT France will hold an auction of 10-year and 30-year bonds

At 16:25 GMT Statement by the US Federal Reserve member of the Open Market Committee Loretta Meister

-

08:35

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.1%, CAC 40 + 0.3%, FTSE + 0.3%

-

08:34

AUD/USD: Trend, Momentum, Outlook - NAB

"Trend: Price has been captured in a parallel uptrend channel since bottoming in January 2016. More recently a series of higher lows/higher highs since the interim low in late May has re-established an interim uptrend. Price has tested towards LT trend resistance (now around 0.7730) in the recent weeks and the sharp rejections imply that the trend is not ready to extend beyond 0.7730/0.7835. At this stage we don't consider this to be a threat to the MT uptrend, but most likely an indication that upward progress may remain slow and a period of consolidation / correction will remain in play in the coming days to weeks. The base of the uptrend channel around 0.7360 is unlikely to be breached on a multi-month basis.

Momentum: LT momentum continues to confirm an uptrend bias and the July close in the monthly RSI (not shown here) highlights the fact that this uptrend was accelerating. This close completed a break above a five-year downtrend channel in the RSI and thus highlights the strongest LT momentum upswing in five years into the July close. ST/MT momentum bias is negative highlighting the current period of consolidation/correction.

Outlook: Recent failures around key resistance levels now at 0.7730/0.7835 have placed the interim uptrend on hold. The negative shift in MT momentum is further confirmation. ST risk remains negative and we see this period of ST consolidation/correction continuing in the coming days to weeks. We expect to see strong support towards 0.7360 but need to assess the price response if this level is challenged".

Copyright © 2016 NAB, eFXnews™

-

08:28

RBNZ will consider disclosure of lender liquidity - Bloomberg

-

RBNZ has identified areas of supervision framework of financial system for potential review after recently conducting a 'health check'

-

Central bank to investigate whether more of the data it gets privately from banks could be publicly disclosed via electronic "dashboard" project

-

"We may look at including, for example, large exposures, bank liquidity and LVR information" if it can be presented consistently across banks, is accurate and not commercially sensitive: Fiennes

-

RBNZ plans to review the attestation process within banks to confirm statements provided by directors are reliable and accurate

-

RBNZ to look at merits of attestation regime for insurers

-

-

08:27

Options levels on thursday, September 1, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1280 (5082)

$1.1248 (3986)

$1.1205 (1797)

Price at time of writing this review: $1.1148

Support levels (open interest**, contracts):

$1.1093 (3175)

$1.1062 (4300)

$1.1025 (5890)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52561 contracts, with the maximum number of contracts with strike price $1,1250 (5082);

- Overall open interest on the PUT options with the expiration date September, 9 is 58167 contracts, with the maximum number of contracts with strike price $1,1050 (5890);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.3401 (2088)

$1.3303 (2691)

$1.3205 (1516)

Price at time of writing this review: $1.3145

Support levels (open interest**, contracts):

$1.3093 (1087)

$1.2997 (1963)

$1.2898 (2100)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32602 contracts, with the maximum number of contracts with strike price $1,3300 (2691);

- Overall open interest on the PUT options with the expiration date September, 9 is 26567 contracts, with the maximum number of contracts with strike price $1,2800 (2706);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Australia: new capital expenditure fell 3.8% in the June quarter

The trend volume estimate for total new capital expenditure fell 3.8% in the June quarter 2016 while the seasonally adjusted estimate fell by 5.4%.

The trend volume estimate for buildings and structures fell by 7.0% in the June quarter 2016 while the seasonally adjusted estimate fell by 10.6%.

The trend volume estimate for equipment, plant and machinery rose by 1.9% in the June quarter 2016 while the seasonally adjusted estimate rose by 2.8%.

-

08:21

WSE: Before opening

Yesterday's session in the US market brought decline about 0.2 percent. The morning trading of futures on US indices, which grow by about 0.25%, offset this situation. The index in Shanghai slightly loses value, like most of Asia parquets, except the Hong Kong and Tokyo. This may mean a neutral start of trading on both the European markets and on the Warsaw Stock Exchange.

The most important macro publication will be today ISM index for US manufacturing (16:00 Warsaw time), which will be analyzed through the prism of the upcoming decision of the Federal Reserve.

Thursday's morning trading on the currency market brings a continuation of the stabilization of quotations of PLN after recent declines. Polish currency is valued at the market as follows: PLN 4.3634 per euro, PLN 3.9139 against the US dollar. Yields on Polish debt amounts to 2.784% in the case of 10-year bonds.

-

08:21

Aussie manufacturing PMI had the most significant fall in the history of the study

The index of activity in the manufacturing sector by Australian AiG amounted to 46.9 points, which is significantly lower than the previous value of 56.4, and was the most significant fall in the history of the study.

AiG explores the results of a survey of 200 producers in assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian dollar, and a value below 50 - negative.

Key findings of the Australian Industry Group:

The fall Australian PMI in August was heavily influenced by sub-sectors of food and beverages.

In addition, the sub-sector of textiles and clothing were affected by the decline in production and new orders, which contributed to an overall reduction.

Six of the seven sub-indices of industrial activity fell in August: Manufacturing (43.0 points), employment (44.6 points), inventories (48.3 points), delivery (46.2 points), sales (45 , 7 points) and exports (44.7 points). New orders continued to grow, albeit at a slower pace (51.5 points).

-

08:14

UK PM May says will push ahead with Article 50 without Parliamentary vote

-

08:13

Retail sales unchanged in Australia

According to abs.gov, the trend estimate rose 0.1% in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016.

The seasonally adjusted estimate was relatively unchanged (0.0%) in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016.

In trend terms, Australian turnover rose 2.7% in July 2016 compared with July 2015.

The following industries rose in trend terms in July 2016: Cafes, restaurants and takeaway food services (0.5%), Food retailing (0.1%), Other retailing (0.4%) and Clothing, footwear and personal accessory retailing (0.6%). Household goods retailing (-0.4%) and Department stores (-0.9%) fell in trend terms in July 2016.

The following states and territories rose in trend terms in July 2016: Queensland (0.2%), New South Wales (0.1%), South Australia (0.3%) and Tasmania (0.2%). Victoria (0.0%), Western Australia (0.0%) and the Australian Capital Territory (0.0%) were relatively unchanged. The Northern Territory (-0.4%) fell in trend terms in July 2016.

-

08:10

Operating conditions stagnated across China’s manufacturing sector during August

Operating conditions stagnated across China's manufacturing sector during August, after a marginal improvement in the previous month. Production and total new orders both rose at slower rates, while export sales continued to decline. Job shedding meanwhile persisted, though the latest reduction in payrolls was the slowest seen in 2016 to date. This in turn contributed to a further rise in backlogs of work.

Price pressures eased, with both input costs and prices charged increasing at weaker rates than seen in July.

The seasonally adjusted Purchasing Managers' Index™ (PMI™) - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - fell from 50.6 in July to the no-change mark of 50.0 in August. This signalled stagnant operating conditions in the latest survey period, following an improvement in the health of the sector in the previous month.

-

07:21

Global Stocks

European stocks fell Wednesday, ending the last day of August with energy stocks hurt as the oil market sold off, but a report that Deutsche Bank AG and Commerzbank AG held merger talks sent shares of the German lending heavyweights higher.

U.S. stocks finished lower Wednesday, and the Dow industrials and S&P 500 closed lower for the month of August, as oil prices fell and promising economic data supported the case for a Federal Reserve rate hike this year.

Asian shares were broadly weaker early Thursday, as markets cautiously awaited the release of U.S. jobs data that could jolt markets out of their summer malaise. A recent report from payroll processor ADP, which showed private U.S. employers continued to hire at a solid clip in August by adding 177,000 workers, raised hopes for a strong showing in U.S. non-farm payrolls, the next test of the likelihood of an interest-rate rise.

-

04:02

Japan: Manufacturing PMI, August 49.5 (forecast 49.6)

-

03:46

China: Markit/Caixin Manufacturing PMI, August 50

-

03:31

Australia: Retail Sales, M/M, July 0.0% (forecast 0.3%)

-

03:31

Australia: Private Capital Expenditure, Quarter II -5.4% (forecast -4.2%)

-

03:30

Australia: Retail Sales, M/M, July 0.0% (forecast 0.3%)

-

03:01

China: Non-Manufacturing PMI, August 53.5

-

03:00

China: Manufacturing PMI , August 50.4 (forecast 49.9)

-

01:53

Japan: Capital Spending, June 3.1% (forecast 5.6%)

-

01:31

Australia: AIG Manufacturing Index, August 46.9

-

00:30

Commodities. Daily history for Aug 31’2016:

(raw materials / closing price /% change)

Oil 44.86 +0.36%

Gold 1,311.80 +0.03%

-

00:29

Stocks. Daily history for Aug 31’2016:

(index / closing price / change items /% change)

Nikkei 225 16,887.40 +162.04 +0.97%

Shanghai Composite 3,085.48 +10.81 +0.35%

S&P/ASX 200 5,433.03 -45.26 -0.83%

FTSE 100 6,781.51 -39.28 -0.58%

CAC 40 4,438.22 -19.27 -0.43%

Xetra DAX 10,592.69 -64.95 -0.61%

S&P 500 2,170.95 -5.17 -0.24%

Dow Jones Industrial Average 18,400.88 -53.42 -0.29%

S&P/TSX Composite 14,597.95 -86.90 -0.59%

-

00:28

Currencies. Daily history for Aug 31’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1157 +0,13%

GBP/USD $1,3138 +0,45%

USD/CHF Chf0,9834 0,00%

USD/JPY Y103,35 +0,37%

EUR/JPY Y115,31 +0,49%

GBP/JPY Y135,77 +0,80%

AUD/USD $0,7513 +0,03%

NZD/USD $0,7244 +0,32%

USD/CAD C$1,3106 +0,09%

-

00:00

Schedule for today, Thursday, Sep 01’2016

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI August 49.9 49.9

01:00 China Non-Manufacturing PMI August 53.9

01:30 Australia Retail Sales, M/M July 0.1% 0.3%

01:30 Australia Private Capital Expenditure Quarter II -5.2% -4.2%

01:45 China Markit/Caixin Manufacturing PMI August 50.6

02:00 Japan Manufacturing PMI (Finally) August 49.3 49.6

07:15 Switzerland Retail Sales (MoM) July -0.5%

07:15 Switzerland Retail Sales Y/Y July -3.9%

07:30 Switzerland Manufacturing PMI August 50.1 50.5

07:50 France Manufacturing PMI (Finally) August 48.6 48.5

07:55 Germany Manufacturing PMI (Finally) August 53.8 53.6

08:00 Eurozone Manufacturing PMI (Finally) August 52 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing August 48.2 49.0

12:30 U.S. Continuing Jobless Claims 2145 2145

12:30 U.S. Unit Labor Costs, q/q (Finally) Quarter II -0.2% 2.1%

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II -0.6% -0.5%

12:30 U.S. Initial Jobless Claims 261 265

13:45 U.S. Manufacturing PMI (Finally) August 52.9 52.1

14:00 U.S. Construction Spending, m/m July -0.6% 0.5%

14:00 U.S. ISM Manufacturing August 52.6 52

20:00 U.S. Total Vehicle Sales, mln August 17.88 17.2

-