Noticias del mercado

-

22:16

U.S.: Total Vehicle Sales, mln, August 16.98 (forecast 17.2)

-

16:44

-

16:10

US ISM manufacturing in contraction territory. USD declines

Economic activity in the manufacturing sector contracted in August following five consecutive months of expansion, while the overall economy grew for the 87th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®. The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The August PMI® registered 49.4 percent, a decrease of 3.2 percentage points from the July reading of 52.6 percent. The New Orders Index registered 49.1 percent, a decrease of 7.8 percentage points from July.

-

16:00

U.S.: ISM Manufacturing, August 49.4 (forecast 52)

-

16:00

U.S.: Construction Spending, m/m, July 0% (forecast 0.5%)

-

15:53

August data pointed to a further moderate upturn in business conditions across the U.S. manufacturing sector

August data pointed to a further moderate upturn in business conditions across the U.S. manufacturing sector. However, the overall pace of improvement slowed since July amid weaker rises in new orders and payroll numbers. The latest survey also highlighted a sustained drop in inventory volumes among manufacturing firms. Meanwhile, input cost inflation remained subdued and average prices charged by manufacturers were broadly unchanged over the month. At 52.0 in August, the seasonally adjusted Markit final U.S. Manufacturing Purchasing Managers' Index™ (PMI™) dropped from 52.9 in July but remained comfortably above the neutral 50.0 value.

-

15:45

U.S.: Manufacturing PMI, August 52 (forecast 52.1)

-

15:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR233m) 1.1200 (1.0bln) 1.1300 (397m)

USD/JPY:100.00 (USD 1.09bln) 102.30 (200m) 103.00 (782m) 103.50 (300m) 103.90 (830m) 105.00 (400m)

USD/CHF 0.9950 (USD 225m)

AUD/USD: 0.7500(AUD 627m) 0.7515-16 (671m) 0.7600 (275m) 0.7650 (706m) 0.7710 (451m)

USD/CAD: 1.2845-50 (USD 317m) 1.3090 (240m) 1.3100 (642m) 1.3150 (280m)

NZD/USD 0.7300 (NZD 230m)

-

14:38

US jobless claims continue to decline

In the week ending August 27, the advance figure for seasonally adjusted initial claims was 263,000, an increase of 2,000 from the previous week's unrevised level of 261,000. The 4-week moving average was 263,000, a decrease of 1,000 from the previous week's unrevised average of 264,000. There were no special factors impacting this week's initial claims. This marks 78 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

14:37

US nonfarm business sector labor productivity decreased at a 0.6-percent annual

Nonfarm business sector labor productivity decreased at a 0.6-percent annual rate during the second quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 1.1 percent and hours worked increased 1.7 percent. (All quarterly percent changes in this release are seasonally

adjusted annual rates.) From the second quarter of 2015 to the second quarter of 2016, productivity decreased 0.4 percent, the first four-quarter decline in the series since a 0.6-percent decline in the second quarter of 2013.Unit labor costs in the nonfarm business sector increased 4.3 percent in the second quarter of 2016, reflecting a 3.7-percent increase in hourly compensation and a 0.6-percent decline in productivity. Unit labor costs increased 2.6 percent over the last four quarters.

-

14:30

U.S.: Initial Jobless Claims, 263 (forecast 265)

-

14:30

U.S.: Continuing Jobless Claims, 2159 (forecast 2145)

-

14:30

U.S.: Nonfarm Productivity, q/q, Quarter II -0.6% (forecast -0.6%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter II 4.3% (forecast 2.1%)

-

14:21

European session review: the pound rose sharply on manufacturing PMI data

The following data was published:

(Time / country / index / period / previous value / forecast)

Switzerland 7:15 Retail sales, y / y in July -3.9% -2.2%

Switzerland 7:30 PMI in the manufacturing sector in August 50.1 50.5 51

France 7:50 PMI in the manufacturing sector (the final data) August 48.6 48.5 48.3

7:55 Germany Index of business activity in the manufacturing sector (the final data) August 53.8 53.6 53.6

8:00 Eurozone PMI in the manufacturing sector (the final data) August 52 51.8 51.7

8:30 UK PMI index of manufacturing activity in August with 48.3 Revised 48.2 49.0 53.3

The British pound rose sharply on evidence of improving manufacturing activity (PMI) in August. More positive data tempered concerns about the negative consequences of Brexit.

Manufacturing activity in the UK unexpectedly jumped in August, showed Markit data.

Purchasing managers index of manufacturing rose to 53.3 from 41-month low of 48.3, published in July, after the EU referendum. The index was expected to rise to 49.

A reading above 50 indicates expansion in the sector. The index indicates that the sector expanded the most in ten months in August.

The monthly increase in the index was the highest in over a 25-years of the survey.

"The companys said that the work that had been postponed in July, have now been restarted since manufacturers and their customers began to regain a sense of returning to work, as usual," said Rob Dobson, senior economist at IHS Markit.

The euro weakened against the US dollar after the index of business activity in the manufacturing sector in the euro area, but then regained some lost ground.

In the euro zone manufacturing sector expanded at the slowest pace in three months in August, revealed Markit data.

Purchasing Managers' Index fell to 51.7 in August from 52 in July. A preliminary assessment was 51.8.

The data showed that the rate of expansion slowed for production, new orders and new export orders, which led to a weaker rate of job creation.

Research indicates that industrial production is growing at a constant, though not impressive annual rate of just under 2 percent, said Chris Williamson, chief economist at IHS Markit.

Germany and the Netherlands recorded the strongest rate of expansion. At the same time, the French continued to decline in August.

Production recovery in Germany, which began in December 2014, continued in August. The final manufacturing PMI in Germany from Markit / BME fell to 53.6 in August, according to a preliminary estimate, from 53.8 in July.

French manufacturing PMI reached 48.3 in August, compared to 48.6 in July. The initial estimate was 48.5. The last reading was below the neutral 50.0 threshold of the sixth month in a row.

The Swiss franc fell sharply against the US dollar on retail sales, but then rose after the release of the index of business activity in the manufacturing sector

Retail sales in Switzerland fell in July compared with the same period last year. Retail sales fell in nominal terms by 2.6% compared to July 2015 and decreased by 2.2% in real terms.

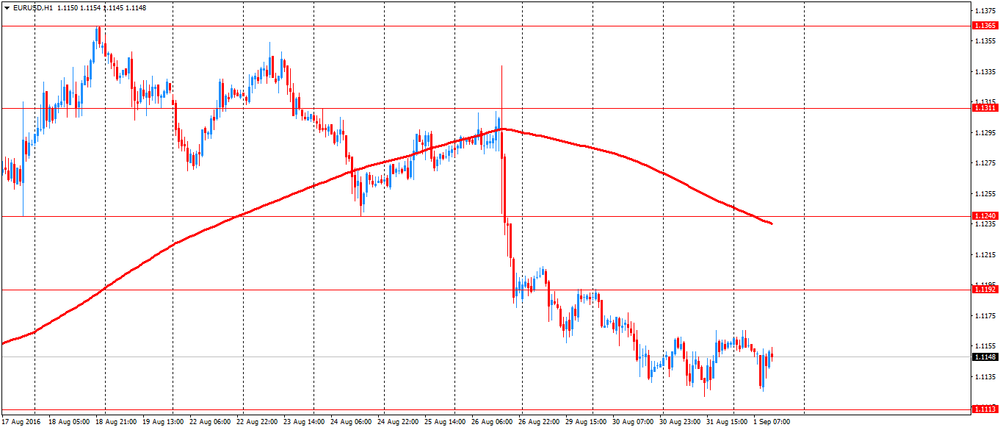

EUR / USD: during the European session, the pair fell to $ 1.1125 and retreated

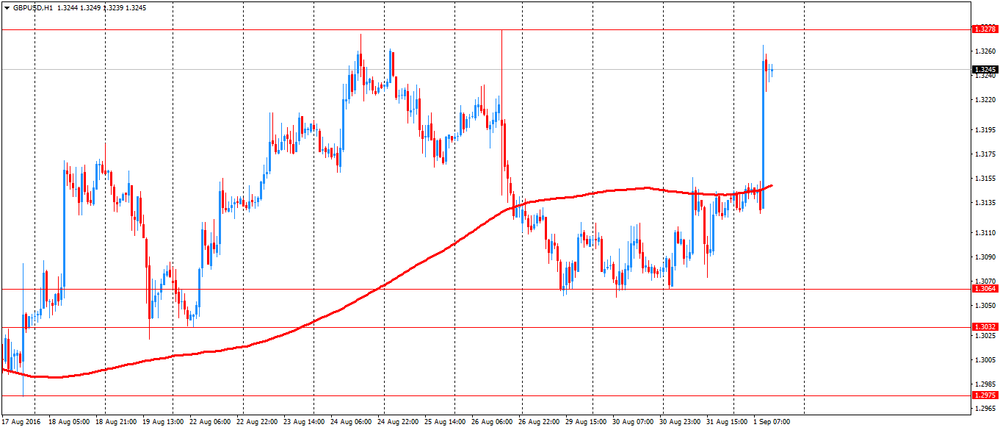

GBP / USD: during the European session, the pair rose to $ 1.3265

USD / JPY: during the European session, the pair rose to Y103.71

-

13:43

Orders

EUR/USD

Offers : 1.1150 1.1165 1.1180 1.1200 1.1225-30 1.1250 1.1280 1.1300

Bids : 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3160 1.3180 1.3200 1.3235 1.3250 1.3280 1.3300

Bids : 1.3120 1.3100 1.3080 1.3065 1.3050 1.3030 1.3000

EUR/GBP

Offers : 0.8500 0.8520-25 0.8535 0.8550 0.8565 0.8580 0.8600

Bids : 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers : 115.50 115.75 116.00 116.50 117.00

Bids : 115.00 114.80 114.50 114.00 113.80 113.50

USD/JPY

Offers : 103.50-55 103.75-80 104.00 104.45-50 104.75 105.00 105.50

Bids : 103.20 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers : 0.7530 0.7550 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7500 0.7485 0.7450 0.7430 0.7400 0.7385 0.7350

-

12:01

Manufacturing industries PMI in the Russian Federation in August exceeded 50 points - Markit

Business activity index (PMI) of manufacturing industries of the Russian Federation in August 2016 exceeded the mark of 50 points against 49.5 points in July, according to a survey by Markit.

The company notes that the index has risen above the mark of 50 points, only the second time since the beginning of 2016, after a moderate growth was recorded in new orders and production volumes.

-

10:58

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR233m) 1.1200 (1.0bln) 1.1300 (397m)

USD/JPY:100.00 (USD 1.09bln) 102.30 (200m) 103.00 (782m) 103.50 (300m) 103.90 (830m) 105.00 (400m)

USD/CHF 0.9950 (USD 225m)

AUD/USD: 0.7500(AUD 627m) 0.7515-16 (671m) 0.7600 (275m) 0.7650 (706m) 0.7710 (451m)

USD/CAD: 1.2845-50 (USD 317m) 1.3090 (240m) 1.3100 (642m) 1.3150 (280m)

NZD/USD 0.7300 (NZD 230m)

-

10:35

UK Manufacturing PMI climbs to ten-month high in August - Markit

August saw solid rebounds in the trends in UK manufacturing output and incoming new orders. Companies reported solid inflows of new work from both domestic and export sources, the latter aided by the sterling exchange rate. Employment rose for the first time in the year-to-date. At 53.3 in August, the seasonally adjusted Markit/CIPS Purchasing Managers' Index® (PMI® ) recovered sharply from the 41-month low of 48.3 posted in July following the EU referendum.

-

10:31

The pound on the rise after huge manufacturing PMI. GBP/USD up over 100 pips so far

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , August 53.3 (forecast 49.0)

-

10:14

German manufacutring PMI unchanged in August

The manufacturing upturn in Germany that started in December 2014 continued in August. Although the final seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers' Index® (PMI® ) - a single-figure snapshot of the performance of the manufacturing economy - fell from 53.8 in July to a 53.6, it remained above its long-run average (51.9) and signalled a solid improvement in manufacturers operating conditions. August data highlighted a further sharp rise in production volumes at German manufacturers, with the pace of expansion down only slightly from July's 27-month high. Increased demand was the main driver behind the rise in output, according to panel evidence.

-

10:12

Growth in the eurozone manufacturing sector lost momentum in August

Growth in the eurozone manufacturing sector lost momentum in August. Rates of expansion slowed for production, new orders and new export business, resulting in weaker job creation. The final Markit Eurozone Manufacturing PMI® posted 51.7 in August, a three-month low and down further from June's year-to-date high. The final reading was also a tick below its earlier flash estimate of 51.8. The PMI has now signalled growth for 38 consecutive months, marking a continuation of its survey-record unbroken sequence above the 50.0 stagnation mark.

-

10:00

Eurozone: Manufacturing PMI, August 51.7 (forecast 51.8)

-

09:55

Germany: Manufacturing PMI, August 53.6 (forecast 53.6)

-

09:50

France: Manufacturing PMI, August 48.3 (forecast 48.5)

-

09:31

Growth in the Spanish manufacturing sector remained muted in August

According to Markit, growth in the Spanish manufacturing sector remained muted in August. The health of the sector improved slightly as the rate of expansion in production eased. However, new orders returned to growth following a fall in July. With improvements in demand only modest, firms reduced the pace at which they took on extra staff. Meanwhile, inflationary pressures remained muted.

The headline Markit Spain Manufacturing PMI is a composite single-figure indicator of manufacturing performance. It is derived from indicators for new orders, output, employment, suppliers' delivery times and stocks of purchases. Any figure greater than 50.0 indicates overall improvement of the sector.

The PMI was unchanged at 51.0 in August, signalling a marginal improvement in business conditions for Spanish manufacturers, and one that was the same strength as July's 31-month low.

-

09:30

Switzerland: Manufacturing PMI, August 51 (forecast 50.5)

-

09:06

Today’s events

At 08:30 GMT Spain will hold an auction of 10-year and 30-year debt

At 09:00 GMT France will hold an auction of 10-year and 30-year bonds

At 16:25 GMT Statement by the US Federal Reserve member of the Open Market Committee Loretta Meister

-

08:34

AUD/USD: Trend, Momentum, Outlook - NAB

"Trend: Price has been captured in a parallel uptrend channel since bottoming in January 2016. More recently a series of higher lows/higher highs since the interim low in late May has re-established an interim uptrend. Price has tested towards LT trend resistance (now around 0.7730) in the recent weeks and the sharp rejections imply that the trend is not ready to extend beyond 0.7730/0.7835. At this stage we don't consider this to be a threat to the MT uptrend, but most likely an indication that upward progress may remain slow and a period of consolidation / correction will remain in play in the coming days to weeks. The base of the uptrend channel around 0.7360 is unlikely to be breached on a multi-month basis.

Momentum: LT momentum continues to confirm an uptrend bias and the July close in the monthly RSI (not shown here) highlights the fact that this uptrend was accelerating. This close completed a break above a five-year downtrend channel in the RSI and thus highlights the strongest LT momentum upswing in five years into the July close. ST/MT momentum bias is negative highlighting the current period of consolidation/correction.

Outlook: Recent failures around key resistance levels now at 0.7730/0.7835 have placed the interim uptrend on hold. The negative shift in MT momentum is further confirmation. ST risk remains negative and we see this period of ST consolidation/correction continuing in the coming days to weeks. We expect to see strong support towards 0.7360 but need to assess the price response if this level is challenged".

Copyright © 2016 NAB, eFXnews™

-

08:28

RBNZ will consider disclosure of lender liquidity - Bloomberg

-

RBNZ has identified areas of supervision framework of financial system for potential review after recently conducting a 'health check'

-

Central bank to investigate whether more of the data it gets privately from banks could be publicly disclosed via electronic "dashboard" project

-

"We may look at including, for example, large exposures, bank liquidity and LVR information" if it can be presented consistently across banks, is accurate and not commercially sensitive: Fiennes

-

RBNZ plans to review the attestation process within banks to confirm statements provided by directors are reliable and accurate

-

RBNZ to look at merits of attestation regime for insurers

-

-

08:27

Options levels on thursday, September 1, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1280 (5082)

$1.1248 (3986)

$1.1205 (1797)

Price at time of writing this review: $1.1148

Support levels (open interest**, contracts):

$1.1093 (3175)

$1.1062 (4300)

$1.1025 (5890)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 52561 contracts, with the maximum number of contracts with strike price $1,1250 (5082);

- Overall open interest on the PUT options with the expiration date September, 9 is 58167 contracts, with the maximum number of contracts with strike price $1,1050 (5890);

- The ratio of PUT/CALL was 1.11 versus 1.11 from the previous trading day according to data from August, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.3401 (2088)

$1.3303 (2691)

$1.3205 (1516)

Price at time of writing this review: $1.3145

Support levels (open interest**, contracts):

$1.3093 (1087)

$1.2997 (1963)

$1.2898 (2100)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32602 contracts, with the maximum number of contracts with strike price $1,3300 (2691);

- Overall open interest on the PUT options with the expiration date September, 9 is 26567 contracts, with the maximum number of contracts with strike price $1,2800 (2706);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Australia: new capital expenditure fell 3.8% in the June quarter

The trend volume estimate for total new capital expenditure fell 3.8% in the June quarter 2016 while the seasonally adjusted estimate fell by 5.4%.

The trend volume estimate for buildings and structures fell by 7.0% in the June quarter 2016 while the seasonally adjusted estimate fell by 10.6%.

The trend volume estimate for equipment, plant and machinery rose by 1.9% in the June quarter 2016 while the seasonally adjusted estimate rose by 2.8%.

-

08:21

Aussie manufacturing PMI had the most significant fall in the history of the study

The index of activity in the manufacturing sector by Australian AiG amounted to 46.9 points, which is significantly lower than the previous value of 56.4, and was the most significant fall in the history of the study.

AiG explores the results of a survey of 200 producers in assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian dollar, and a value below 50 - negative.

Key findings of the Australian Industry Group:

The fall Australian PMI in August was heavily influenced by sub-sectors of food and beverages.

In addition, the sub-sector of textiles and clothing were affected by the decline in production and new orders, which contributed to an overall reduction.

Six of the seven sub-indices of industrial activity fell in August: Manufacturing (43.0 points), employment (44.6 points), inventories (48.3 points), delivery (46.2 points), sales (45 , 7 points) and exports (44.7 points). New orders continued to grow, albeit at a slower pace (51.5 points).

-

08:14

UK PM May says will push ahead with Article 50 without Parliamentary vote

-

08:13

Retail sales unchanged in Australia

According to abs.gov, the trend estimate rose 0.1% in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016.

The seasonally adjusted estimate was relatively unchanged (0.0%) in July 2016. This follows a rise of 0.1% in June 2016 and a rise of 0.1% in May 2016.

In trend terms, Australian turnover rose 2.7% in July 2016 compared with July 2015.

The following industries rose in trend terms in July 2016: Cafes, restaurants and takeaway food services (0.5%), Food retailing (0.1%), Other retailing (0.4%) and Clothing, footwear and personal accessory retailing (0.6%). Household goods retailing (-0.4%) and Department stores (-0.9%) fell in trend terms in July 2016.

The following states and territories rose in trend terms in July 2016: Queensland (0.2%), New South Wales (0.1%), South Australia (0.3%) and Tasmania (0.2%). Victoria (0.0%), Western Australia (0.0%) and the Australian Capital Territory (0.0%) were relatively unchanged. The Northern Territory (-0.4%) fell in trend terms in July 2016.

-

08:10

Operating conditions stagnated across China’s manufacturing sector during August

Operating conditions stagnated across China's manufacturing sector during August, after a marginal improvement in the previous month. Production and total new orders both rose at slower rates, while export sales continued to decline. Job shedding meanwhile persisted, though the latest reduction in payrolls was the slowest seen in 2016 to date. This in turn contributed to a further rise in backlogs of work.

Price pressures eased, with both input costs and prices charged increasing at weaker rates than seen in July.

The seasonally adjusted Purchasing Managers' Index™ (PMI™) - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - fell from 50.6 in July to the no-change mark of 50.0 in August. This signalled stagnant operating conditions in the latest survey period, following an improvement in the health of the sector in the previous month.

-

04:02

Japan: Manufacturing PMI, August 49.5 (forecast 49.6)

-

03:46

China: Markit/Caixin Manufacturing PMI, August 50

-

03:31

Australia: Retail Sales, M/M, July 0.0% (forecast 0.3%)

-

03:31

Australia: Private Capital Expenditure, Quarter II -5.4% (forecast -4.2%)

-

03:30

Australia: Retail Sales, M/M, July 0.0% (forecast 0.3%)

-

03:01

China: Non-Manufacturing PMI, August 53.5

-

03:00

China: Manufacturing PMI , August 50.4 (forecast 49.9)

-

01:53

Japan: Capital Spending, June 3.1% (forecast 5.6%)

-

01:31

Australia: AIG Manufacturing Index, August 46.9

-

00:28

Currencies. Daily history for Aug 31’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1157 +0,13%

GBP/USD $1,3138 +0,45%

USD/CHF Chf0,9834 0,00%

USD/JPY Y103,35 +0,37%

EUR/JPY Y115,31 +0,49%

GBP/JPY Y135,77 +0,80%

AUD/USD $0,7513 +0,03%

NZD/USD $0,7244 +0,32%

USD/CAD C$1,3106 +0,09%

-

00:00

Schedule for today, Thursday, Sep 01’2016

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI August 49.9 49.9

01:00 China Non-Manufacturing PMI August 53.9

01:30 Australia Retail Sales, M/M July 0.1% 0.3%

01:30 Australia Private Capital Expenditure Quarter II -5.2% -4.2%

01:45 China Markit/Caixin Manufacturing PMI August 50.6

02:00 Japan Manufacturing PMI (Finally) August 49.3 49.6

07:15 Switzerland Retail Sales (MoM) July -0.5%

07:15 Switzerland Retail Sales Y/Y July -3.9%

07:30 Switzerland Manufacturing PMI August 50.1 50.5

07:50 France Manufacturing PMI (Finally) August 48.6 48.5

07:55 Germany Manufacturing PMI (Finally) August 53.8 53.6

08:00 Eurozone Manufacturing PMI (Finally) August 52 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing August 48.2 49.0

12:30 U.S. Continuing Jobless Claims 2145 2145

12:30 U.S. Unit Labor Costs, q/q (Finally) Quarter II -0.2% 2.1%

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II -0.6% -0.5%

12:30 U.S. Initial Jobless Claims 261 265

13:45 U.S. Manufacturing PMI (Finally) August 52.9 52.1

14:00 U.S. Construction Spending, m/m July -0.6% 0.5%

14:00 U.S. ISM Manufacturing August 52.6 52

20:00 U.S. Total Vehicle Sales, mln August 17.88 17.2

-