Noticias del mercado

-

22:09

Almost all of the major US stock indexes showed increase

Major stock indexes Wall Street ended the session mostly in positive territory. The dynamics of trading data dictated by the United States, as well as in the oil market situation.

US Bureau of Labor Statistics reported that labor productivity in the non-agricultural sector of the economy declined by 0.6% annually in the second quarter of 2016. Production volume increased by 1.1% and the number of hours worked increased by 1.7%.

In addition, as it became known, the number of Americans who applied for unemployment benefits rose less than expected last week, indicating stability in the labor market, which could push the Fed closer to raising interest rates. Primary applications for unemployment benefits for 2000 and increased by a seasonally adjusted reached 263,000 for the week ended August 27th. The data for the previous week were not revised. Economists forecast that initial applications for unemployment benefits will rise to 265,000 last week.

However, a report published by the supply (ISM) Management Institute showed that in August activity in the US manufacturing sector has deteriorated markedly. The PMI for the US the production sector was 49.4 points versus 52.6 points in July. It was expected that this figure will drop to 52 points.

The Commerce Department reported that construction spending remained unchanged in July, after rising 0.9% in June, with those previously reported decrease in June by 0.6%. In addition, construction spending in May was revised, and showed an increase of 0.1% instead of falling 0.1%. Construction costs rose by 1.5% compared to last year. Economists forecast that construction spending will grow by 0.5% in July.

Oil futures fell markedly, continuing yesterday's trend and updating the 3-week low. The pressure on prices have concerns about over-saturation of the market, which intensified after the publication in the US petroleum inventories report.

DOW index components were mixed (16 red, 14 black). Outsider were shares of American Express Company (AXP, -1.19%). Most remaining shares increased Wal-Mart Stores Inc. (WMT, + 1.78%).

Most of the S & P sectors closed in the red. conglomerates (-1.6%) sectors fell most. Maximizing showed the service sector (+ 0.3%).

At the close:

Dow + 0.10% 18,419.30 +18.42

Nasdaq + 0.27% 5,227.21 +13.99

S & P -0.00% 2,170.86 -0.09

-

21:00

Dow -0.05% 18,391.87 -9.01 Nasdaq +0.17% 5,222.02 +8.80 S&P -0.14% 2,167.92 -3.03

-

18:03

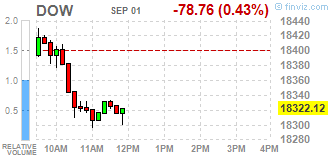

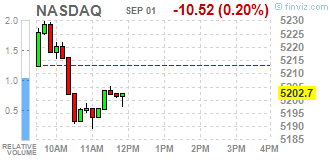

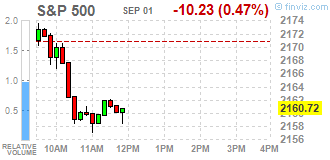

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday, starting September on a dour note after a steeper-than-expected decline in monthly factory activity raised doubts about growth and the ability of the economy to withstand an interest rate hike. A report from the Institute of Supply Management showed U.S. factory activity contracted for the first time in six months in August as new orders and production tumbled. The report precedes Friday's monthly nonfarm payrolls numbers which are likely to set the tone for the Fed policy meeting regarding the timing of the next rate hike.

Most of all Dow stocks in negative area (24 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +0.71%). Top loser - American Express Company (AXP, -1.48%).

All S&P sectors also in negative area. Top loser - Conglomerates (-1.2%).

At the moment:

Dow 18308.00 -87.00 -0.47%

S&P 500 2158.50 -11.00 -0.51%

Nasdaq 100 4761.75 -12.00 -0.25%

Oil 43.52 -1.18 -2.64%

Gold 1316.60 +5.20 +0.40%

U.S. 10yr 1.56 +0.00

-

18:00

European stocks closed: FTSE 100 -35.54 6745.97 -0.52% DAX -58.38 10534.31 -0.55% CAC 40 +1.45 4439.67 +0.03%

-

17:35

WSE: Session Results

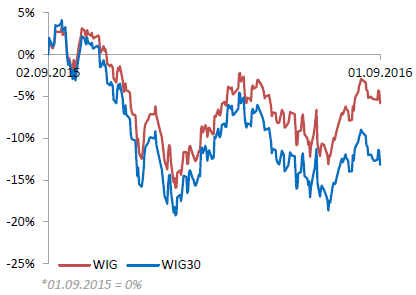

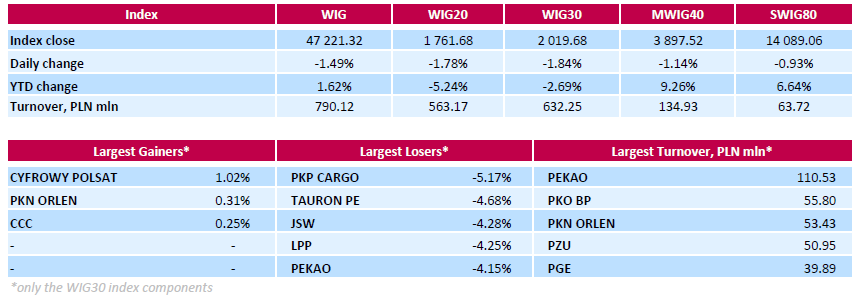

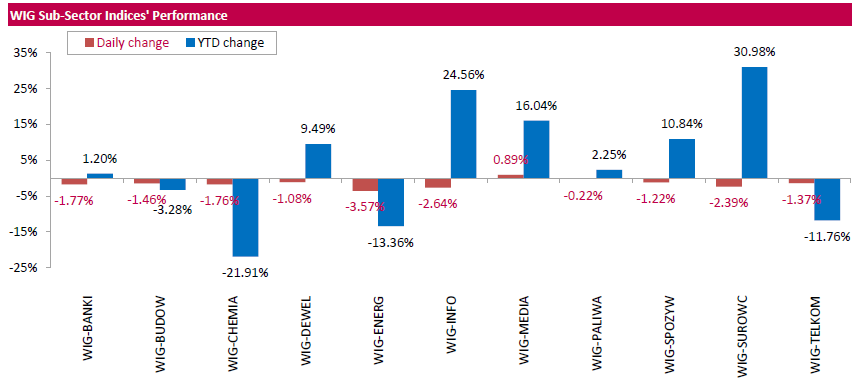

Polish equity market closed lower on Thursday. The broad market measure, the WIG index, declined by 1.49%. All sectors, but for media (+0.89%), were down, with utilities (-3.57%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, dropped by 1.84%. A majority of the index components recorded losses, with railway freight transport operator PKP CARGO (WSE: PKP) underperforming with a 5.17% decline. Other major laggards were genco TAURON PE (WSE: TPE), coking coal miner JSW (WSE: JSW), clothing retailer LPP (WSE: LPP) and bank PEKAO (WSE: PKO), which tumbled by 4.15%-4.68%. At the same time, the few gainers included media group CYFROWY POLSAT (WSE: CPS), oil refiner PKN ORLEN (WSE: PKN) and footwear retailer CCC (WSE: CCC), advancing by 1.02%, 0.31% and 0.25% respectively.

-

15:52

WSE: After start on Wall Street

The beginning of the US market was not easy for the bulls, which despite the small increases of contracts for the S&P500 had to be at the start in trying to reconcile with the equilibrium level. Deepen drops of oil market. After yesterday's strike of supply caused by, among others, the next higher-than-expected increase in crude oil inventories today the oil market is still govern by bears.

Somewhat surprising deterioration in sentiment on the Warsaw Stock Exchange applies today not only blue chips, but also the broad market. However, in the case of small and medium-sized companies is considerable room for profit taking. An hour before the close of trading the WIG20 index was at the level of 1,770 points (-1,26%).

-

15:34

U.S. Stocks open: Dow +0.12%, Nasdaq +0.18%, S&P +0.05%

-

15:25

Before the bell: S&P futures +0.06%, NASDAQ futures +0.14%

U.S. stock-index futures fluctuated after briefly erasing gains, as falling crude prices tempered optimism amid positive signs for global growth while investors await Friday's key payrolls data.

Global Stocks:

Nikkei 16,926.84 +39.44 +0.23%

Hang Seng 23,162.34 +185.46 +0.81%

Shanghai 3,062.97 -22.52 -0.73%

FTSE 6,779.05 -2.46 -0.04%

CAC 4,472.99 +34.77 +0.78%

DAX 10,619.78 +27.09 +0.26%

Crude $44.33 (-0.83%)

Gold $1305.90 (-0.42%)

-

14:40

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) reiterated with a Buy at Mizuho; target $120

Intel (INTC) assumed with Buy rating at Roth Capital

-

13:18

WSE: Mid session comment

The first half of the first in this month's session on the Warsaw market was marked by declines. Today the weakest sector remains the energy, but other sectors are also under the pressure.

Strongly lose today the shares of the bank PKO BP (WSE: PKO) after interview of the CEO and the words about superiority of financing of the economy over the payment of dividends by bank.

One of the two main brake among the blue chips next to PKO BP today are values of PGE. Share price falls by 3.3 per cent, which means that PGE values are today quoted the lowest in history.

In the mid-session the WIG20 index was at the level of 1,778 points (-0.85%) and with the turnover of PLN 290 million.

-

12:56

Major stock indices in Europe mostly higher

Most European stock indexes rising, mining stocks rise in price on strong macroeconomic data from China.

Official PMI for China's processing industry, published on Thursday, rose unexpectedly in August to 50.4 points from 49.9 points in July, indicating a increase in activity in the sector. Experts on average expected a decline to 49.9 index points.

Meanwhile, a similar index for the processing industry, calculated by Caixin Media, and Markit, fell last month to 50 points from 50.6 points in July. Analysts had expected a less sharp decline to 50.1 points.

Also, investor sentiment was supported by data on the growth of business activity in Switzerland and the UK. PMI in Switzerland in August rose to 51 from 50.1, signaling a slight recovery in economic activity. For nine consecutive months the index is above the threshold of 50 that separates contraction from expansion.

Manufacturing activity in the UK unexpectedly jumped in August, showed Markit data. Purchasing managers index of manufacturing rose to 53.3 from 41-month low of 48.3, published in July, after the EU referendum. The index was to rise to 49. A reading above 50 indicates expansion in the sector. The index indicates that the sector expanded the most in ten months in August. The monthly increase was the highest over a 25-year history of the survey. "The companys said that the work that had been postponed in July, have now been restarted since manufacturers and their customers began to regain a sense of returning to work, as usual," said Rob Dobson, senior economist at IHS Markit.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,7% - to 346.05 points.

The index of 50 largest enterprises of the euro zone Euro Stoxx 50 added 0.6%. The index operator Stoxx Ltd. said yesterday that from September 19, the index will exclude Italian insurer Assicurazioni Generali and UniCredit Bank, as well as the French retailer Carrefour. Their place will be taken by Adidas AG, the Irish building materials producer CRH Plc and Ahold supermarket chain.

Commodities rise in price on the statistical data of China, and the quotations of mining companies Antofagasta, of Glencore and Anglo American rising by more than 1.6%.

The price of the French construction company Eiffage SA rose 2.6% on the back of its strong profits in the first half.

Capitalization of the second largest spirits producer Pernod Ricard increased by 1.9%. The company increased its net profit by 43% and gave an optimistic outlook for the current reporting period.

Roche Holding AG's shares added 0.3% after the Swiss pharmaceutical company said its immunotherapeutic drug Tecentriq showed positive results in the Phase III studies.

At the moment:

FTSE 6771.07 -10.44 -0.15%

DAX 10634.13 41.44 0.39%

CAC 4477.14 38.92 0.88%

-

10:14

Major stock exchanges open higher: FTSE + 0.5%, DAX + 0.3%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.5%

-

09:20

WSE: After opening

WIG20 index opened at 1796.61 points (+0.17%)*

WIG 48045.86 0.23%

WIG30 2063.62 0.29%

mWIG40 3948.49 0.15%

*/ - change to previous close

After yesterday's boring and slightly downward session Thursday trading on the WSE we start on the green side. Improving sentiment on our parquet is the result of adaptation to the today's atmosphere in global markets. In Europe, major indexes are also increasing, the DAX by 0.4 per cent. The futures on the S&P500 after a weak session in the US herald return of growth. Market apparently does not interfere with speculation about the possibility of interest rate hikes in the US. For the Warsaw Stock Exchange also helps the publication of the PMI index for Polish industry for August (reading 51.5 pts. vs. forecast of 50.9 pts.), which surprises positively and may calm gloomy comments about the national economy.

-

08:35

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.1%, CAC 40 + 0.3%, FTSE + 0.3%

-

08:21

WSE: Before opening

Yesterday's session in the US market brought decline about 0.2 percent. The morning trading of futures on US indices, which grow by about 0.25%, offset this situation. The index in Shanghai slightly loses value, like most of Asia parquets, except the Hong Kong and Tokyo. This may mean a neutral start of trading on both the European markets and on the Warsaw Stock Exchange.

The most important macro publication will be today ISM index for US manufacturing (16:00 Warsaw time), which will be analyzed through the prism of the upcoming decision of the Federal Reserve.

Thursday's morning trading on the currency market brings a continuation of the stabilization of quotations of PLN after recent declines. Polish currency is valued at the market as follows: PLN 4.3634 per euro, PLN 3.9139 against the US dollar. Yields on Polish debt amounts to 2.784% in the case of 10-year bonds.

-

07:21

Global Stocks

European stocks fell Wednesday, ending the last day of August with energy stocks hurt as the oil market sold off, but a report that Deutsche Bank AG and Commerzbank AG held merger talks sent shares of the German lending heavyweights higher.

U.S. stocks finished lower Wednesday, and the Dow industrials and S&P 500 closed lower for the month of August, as oil prices fell and promising economic data supported the case for a Federal Reserve rate hike this year.

Asian shares were broadly weaker early Thursday, as markets cautiously awaited the release of U.S. jobs data that could jolt markets out of their summer malaise. A recent report from payroll processor ADP, which showed private U.S. employers continued to hire at a solid clip in August by adding 177,000 workers, raised hopes for a strong showing in U.S. non-farm payrolls, the next test of the likelihood of an interest-rate rise.

-

00:29

Stocks. Daily history for Aug 31’2016:

(index / closing price / change items /% change)

Nikkei 225 16,887.40 +162.04 +0.97%

Shanghai Composite 3,085.48 +10.81 +0.35%

S&P/ASX 200 5,433.03 -45.26 -0.83%

FTSE 100 6,781.51 -39.28 -0.58%

CAC 40 4,438.22 -19.27 -0.43%

Xetra DAX 10,592.69 -64.95 -0.61%

S&P 500 2,170.95 -5.17 -0.24%

Dow Jones Industrial Average 18,400.88 -53.42 -0.29%

S&P/TSX Composite 14,597.95 -86.90 -0.59%

-