Noticias del mercado

-

22:06

Major US stock indexes finished trading below zero

Major stock indexes on Wall Street showed a decline in the last trading day of summer on the background of the intensified decline in oil prices.

Oil prices fell by more than 3% after weekly government data pointed to a marked increase in crude oil inventories in the United States.

US Department of Energy reported that in the week from August 19 to 26 commercial oil stocks rose 2.28 million barrels to 525.87 million. Analysts had expected growth stocks only 1.31 million barrels. Oil reserves in Cushing terminal fell by 1 million barrels to 63.9 million barrels.

As shown by data provided by Automatic Data Processing (ADP), employment growth in the private sector of the US slowed in August, but were slightly above forecasts of experts. According to the report, in August, the number of employees increased by 177 thousand. People in comparison with the upwardly revised July index at the level of 194 thousand. (Originally reported growth of 179 thousand.). Analysts had expected the number of people employed will increase by 175 thousand.

At the same time, it became known that the transaction is pending home sales in the US rose in July after two consecutive months of decline, as demand rose almost across the board, suggesting that the housing market remains on solid ground. The National Association of Realtors reported Wednesday that the index of pending home sales, based on contracts signed in the past month increased by 1.3 percent to 111.3, finishing second in a period of ten years.

In addition, the Managers Association of Chicago reported that the PMI index fell to 51.5 against 55.8 in July. It was expected that the figure will be 54.0 points.

Most DOW components of the index closed in negative territory (20 of 30). Most remaining shares rose Intel Corporation (INTC, + 0.49%). Outsider were shares of Chevron Corporation (CVX, -1.17%).

Most of the S & P sectors registered a decline. The leader turned conglomerates sector (+ 0.6%). Most of the basic materials sector fell (-1.5%).

At the close:

Dow -0.29% 18,400.40 -53.90

Nasdaq -0.19% 5,213.22 -9.77

S & P -0.24% 2,170.87 -5.25

-

21:01

Dow -0.44% 18,372.84 -81.46 Nasdaq -0.38% 5,202.89 -20.10 S&P -0.46% 2,166.03 -10.09

-

18:59

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes extended losses on Wednesday, the last trading day of August, as lower oil prices weighed on energy stocks.

Oil prices fell more 3% after U.S. government data showed a large unexpected weekly build in U.S. crude and distillate stockpiles and a smaller-than-expected draw in gasoline. Oil was also pressured by the dollar index, trading at a three-week high.

Most of all Dow stocks in negative area (27 of 30). Top gainer - Apple Inc. (AAPL, +0.41%). Top loser - Chevron Corporation (CVX, -1.56%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.3%). Top loser - Basic Materials (-1.6%).

At the moment:

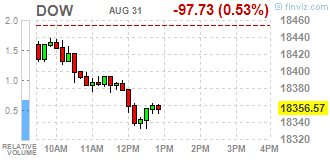

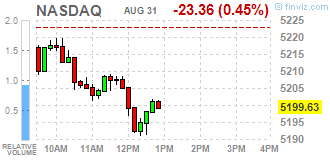

Dow 18347.00 -97.00 -0.53%

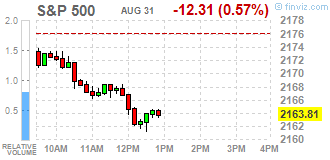

S&P 500 2162.50 -12.75 -0.59%

Nasdaq 100 4761.00 -15.00 -0.31%

Oil 44.78 -1.57 -3.39%

Gold 1311.90 -4.60 -0.35%

U.S. 10yr 1.56 -0.01

-

18:15

WSE: Session Results

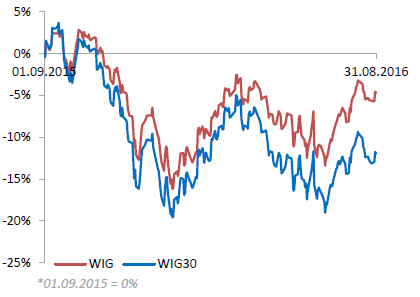

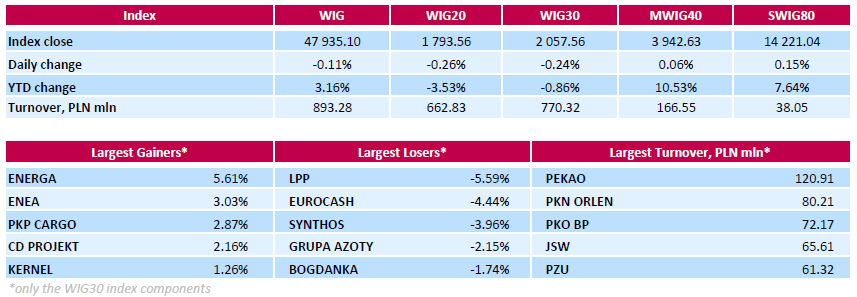

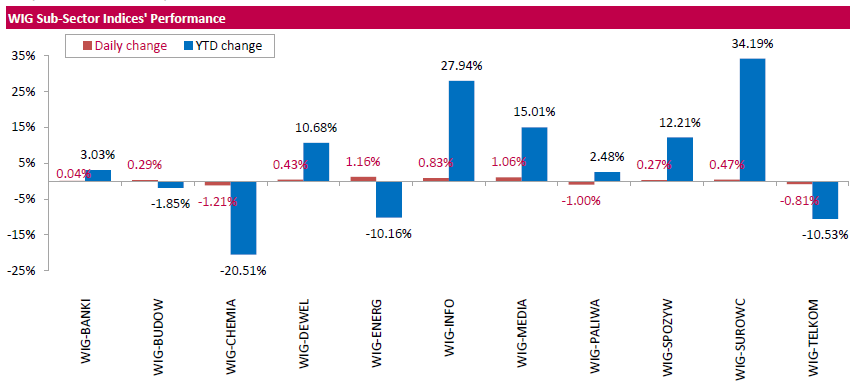

Polish equity market closed lower on Wednesday. The broad market measure, the WIG index, lost 0.11%. From a sector perspective, utilities (+1.16%) recorded the biggest gains, while chemicals (-1.21%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, declined by 0.24%. Within the WIG30 Index components, clothing retailer LPP (WSE: LPP) fared the worst, slumping by 5.59% after the company announced its Q2 financials, which showed the company's profit reduced by 34.4% y/y to PLN 89.8 mln in the reviewed period, in-line with analysts' expectation. Other largest losers were FMCG-wholesaler EUROCASH (WSE: EUR) and two chemical producers SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT), which fell by 4.44%, 3.96% and 2.15% respectively. On the other side of the ledger, gencos ENERGA (WSE: ENG) and ENEA (WSE: ENA) were the biggest gainers, climbing by a respective 5.61% and 3.03% after yesterday's slump.

-

18:00

European stocks closed: FTSE 100 -39.28 6781.51 -0.58% DAX -64.95 10592.69 -0.61% CAC 40 -19.27 4438.22 -0.43%

-

16:02

WSE: After start on Wall Street

One of the most interesting data that flow down to the market on a monthly basis, means ADP report, came in line with expectations. Therefore the market did not show any reaction. Another thing that more emotion evoke monthly labor market data, which will be announced on Friday.

Beginning on Wall Street took place as expected. Red, but the scale of decline is so safe that so far no one care about this departure. Even our not so strong market might at this point get away again slightly up from the lows of the session.

Readings of the Chicago PMI missed the estimate and sends a signal to the market that the right may have analysts who point to slightly worse than the optimists want the condition of American industry. An hour before the end of trading the WIG20 index was at the level of 1,784 points (-0.21%).

-

15:34

U.S. Stocks open: Dow -0.20%, Nasdaq -0.19%, S&P -0.19%

-

15:27

Before the bell: S&P futures -0.14%, NASDAQ futures -0.13%

U.S. stock-index futures edged lower as investors awaited monthly jobs data and its implications for interest rates.

Global Stocks:

Nikkei 16,887.40 +162.04 +0.97%

Hang Seng 22,976.88 -39.23 -0.17%

Shanghai 3,085.48 +10.81 +0.35%

FTSE 6,814.54 -6.25 -0.09%

CAC 4,476.25 +18.76 +0.42%

DAX 10,628.78 -28.86 -0.27%

Crude $45.82 (-1.14%)

Gold $1307.90 (-0.65%)

-

13:04

WSE: Mid session comment

There is not too much emotions on the Warsaw market today, both the activity and volatility seem to be subordinated to the core markets. We had a clear example of this in the course of an attempt to stabilize the German DAX, which coincided with the information that Frankfurt Airport was evacuated. Appetites for correction of morning weakness on the German market were undercut and in response our WIG20 went to daily lows. Everything points to the fact that prior to 14:00, and without a help from the core markets the WSE will not stand for serious and validated by turnover changes in the WIG20.

For a little more attention deserves the behavior of companies from the mWIG40 index, that since the hole from June has grown almost 22 percent. Substantial growth momentum suggests that this movement is not exhausted yet.

The second half of today's trading was greeted by the WIG20 index on the level of 1,791 points (-0,37%) and with turnover of PLN 205 mln.

-

12:45

Major stock indices in Europe trading mixed

So far the stock indexes in Western Europe traded mixed and little changed registering growth for a second consecutive month.

Earlier today, data showed that German retail sales rose in July by 1.7%, beating expectations for a 0.5% rise after a 0.6% decline in the previous month. However, on an annualized basis, retail sales fell 1.5%.

At the same time, German unemployment dropped more than expected in August. The number of people out of work fell by 7,000 in August compared to July. Economists had forecast a decline of 5,000. At the same time, the unemployment rate remained stable at 6.1% in August. The result was in line with expectations. It was the lowest level since German reunification.

In addition, as shown by preliminary estimates from Eurostat, inflation in the eurozone remained stable in August. Inflation remained unchanged at 0.2%, while economists had expected the index to rise slightly to 0.3%. Inflation remains below the target level of the European Central Bank's' below but close to 2 percent since the beginning of 2013. Core inflation, which excludes energy, food, alcohol and tobacco decreased slightly to 0.8% from 0.9% in July. Core inflation was expected to remain at 0.9%.

Today, market participants are preparing for the release a report for US ADP emplyment data in search of additional signals on the strength of the economy.

On Tuesday, Fed Vice President Stanley Fischer said that the labor market gained almost full capacity, and the rate of increase of the interest rate will depend on the statistical data.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2% - to 345.48 points.

Price of Commerzbank AG Bank shares jumped 4.7% on media reports that Germany's biggest bank Deutsche Bank planned to acquire its rival. DB securities increased by 2%.

European banks in general, complete a record month of growth since January 2015, since the first time in a long while quarterly profit of most of them was better than forecasts.

Shares of Anglo American Plc dropped in price by 3%. Earlier, analysts of Clarksons Platou Securities warned that iron ore prices experienced downward pressure.

The Swiss manufacturer Straumann Holding AG lost 4.5% of capitalization on news that its largest shareholder GIC Private Ltd. reduced its stake in the company.

Shares of French mobile operator Iliad rose by 1.9%. The company raised its profit and revenue in the 1st half of the year due to the increase in the number of subscribers.

Shares of Airbus Group grew by 1.2% after the company said that more planes than in the same period of last year were delivered, increasing their chances of achieving their goal for 2016 after previous delays in the supply of parts .

Shares of ARM Holdings rose 0.1% after shareholders approved the offer of $ 32 billion from the Japanese SoftBank Group Corp.

At the moment:

FTSE 6808.11 -12.68 -0.19%

DAX 10638.85 -18.79 -0.18%

CAC 4483.36 25.87 0.58%

-

09:41

Negative start for major stock markets: FTSE 100 -0.25%, CAC 40 -0.02%, DAX -0.33%

-

09:22

WSE: After start on Wall Street

WIG20 index opened at 1797.35 points (-0.05%)*

WIG 47946.59 -0.09%

WIG30 2058.22 -0.21%

mWIG40 3945.54 0.13%

*/ - change to previous close

The future market started to a new day from loss of 0.1% (opening: 1,801 points).

Euroland begins sessions with no surprises, the DAX and the CAC slightly depreciating and after the first deal the Warsaw market adapts to the environment. After a quarter of an hour of the session, the WIG20 index lost 0.33% and fell below 1,800 points. This means a clear shortness of breath around the psychological barrier of 1,800 points. Small trading volumes indicate that we will now follow the core markets in anticipation of the data from the US (ADP employment change report, forecast 171k - 14:15 Warsaw time).

-

08:27

Expected negative start of trading on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0, -%, FTSE -0,2%

-

08:27

WSE: Before opening

Tuesday's session on Wall Street ended with a modest changes in the major indexes. In case of the S&P500 loss was amounted to 0.2 percent. Yesterday, the German DAX was dominated by the weakening of the euro against the dollar, which usually is perceived as positive for the German shares. On the morning trading the markets of Euroland may therefore affect two factors - bearish session in the US and night strengthening of the euro against the dollar. The Warsaw market reacts positively to the good attitude of other emerging markets, but may here be a risk in the form of sensitivity of emerging markets for signals impending hike of the US interest rates.

In macro calendar particularly important during today's session will be an indication of ADP (exp. 171k), since the last signals from the J. Yellen most of the markets are waiting for Friday's US Labor Department report, which is seen in terms of tips on what on 21 of September Fed will do. There is also no other reports today, which could have some serious significance.

Today's morning trading on the currency market brings an attempt to stabilize the valuations of PLN after recent discounts. Polish currency is quoted on the market as follows: PLN 4.3586 per euro, PLN 3.9068 against the US dollar. The profitability of Polish debt rose to 2.746% in case of 10-year bonds.

-

07:42

Global Stocks

Stocks in the U.K. ended modestly lower in choppy trade Tuesday as mining shares slumped as the dollar strengthened to multiweek highs, dragging down commodities priced in the currency.

The FTSE 100 UKX, -0.25% lost 0.3% to finish at 6,820.79. Trading was closed Monday for a late-August bank holiday.

While a stronger U.S. economy should be supportive for global growth, the FTSE 100 on Tuesday was "held back by a strong dollar, with the fallers' board looking like a who's who of mining firms," said IG market analyst Joshua Mahony in a note.

U.S. stocks closed slightly lower Tuesday as investors weighed additional comments from Federal Reserve members that emphasized the central bank's intention to raise interest rates sooner rather than later.

The S&P 500 index SPX, -0.20% closed down 4.26 points, or 0.2%, at 2,176.12. Among the S&P 500's 10 sectors, only the financial sector ended the day in positive territory, scoring a 0.8% gain on the prospect of higher interest rates. Utilities led the charge lower with a 1% decline.

The Dow Jones Industrial Average DJIA, -0.26% declined 48.69 points, or 0.3%, to close at 18,454.30. Shares of banks Goldman Sachs Group Inc. GS, +1.90% and J.P. Morgan Chase & Co. JPM, +0.82% led the index's gainers, while shares of Boeing Co. BA, -1.57% topped blue-chip decliners.

Meanwhile, the Nasdaq Composite Index COMP, -0.18% shed 9.34 points, or 0.2%, to finish at 5,222.99. Overall trade remained subdued and rangebound.

Asian shares eased on Wednesday following modest losses on Wall Street, with investors awaiting U.S. jobs numbers for further signs the Federal Reserve may raise rates as soon as September.

The growing prospect for an imminent rate hike lifted the dollar against major currencies such as the yen.

Japan's Nikkei stock index .N225 added 0.8 percent, poised to rise 1.7 percent for the month, boosted by a weaker yen after upbeat U.S. data lifted the dollar overnight. Sluggish domestic data that increased the prospect of further easing by the Bank of Japan also supported stocks.

Japanese industrial output was flat in July from June, data showed earlier on Wednesday, underscoring fragility in factory activity and falling short of economists' median forecast for a 0.8 percent rise.

-

00:29

Stocks. Daily history for Aug 30’2016:

(index / closing price / change items /% change)

Nikkei 225 16,725.36 -12.13 -0.07%

Shanghai Composite 3,076.20 +6.17 +0.20%

S&P/ASX 200 5,478.29 +9.07 +0.17%

FTSE 100 6,820.79 -17.26 -0.25%

CAC 40 4,457.49 +33.24 +0.75%

Xetra DAX 10,657.64 +113.20 +1.07%

S&P 500 2,176.12 -4.26 -0.20%

Dow Jones Industrial Average 18,454.30 -48.69 -0.26%

S&P/TSX Composite 14,684.85 +2.88 +0.02%

-