Noticias del mercado

-

16:30

U.S.: Crude Oil Inventories, August 2.276 (forecast 1.31)

-

16:12

US pending home sales expanded in most of the country in July

Pending home sales expanded in most of the country in July and reached their second highest reading in over a decade, according to the National Association of Realtors. Only the Midwest saw a dip in contract activity last month.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.3 percent to 111.3 in July from a downwardly revised 109.9 in June and is now 1.4 percent higher than July 2015 (109.8). The index is now at its second highest reading this year after April (115.0).

-

16:00

U.S.: Pending Home Sales (MoM) , July 1.3% (forecast 0.6%)

-

15:51

Chicago PMI fell 4.3 points in August led by a large setback in Order Backlogs

The MNI Chicago Business Barometer fell 4.3 points to 51.5 in August from 55.8 in July, led by a large setback in Order Backlogs and a deceleration in New Orders. Four of the five Barometer components fell between July and August. Only Employment increased, hitting a 16-month high. The latest fall left the Barometer, New Orders and Production running at the slowest pace since May, when they all slipped below 50.

-

15:45

U.S.: Chicago Purchasing Managers' Index , August 51.5 (forecast 54.0)

-

15:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1175-80 (EUR 750m) 1.1200-05 (629m) 1.1250 (267m) 1.1300 (291m)

USD/JPY:100.00 (USD 610m) 103.00 (370m) 103.19 (200m) 105.00 (440m)

GBP/USD: 1.3000 (GBP 301m)

AUD/USD: 0.7510-15 (AUD 204m) 0.7600-07 (1.8bln)

USD/CAD: 1.2875 (USD 240m) 1.2995-1.3000 (215m)

NZD/USD 0.7210 (NZD 300m)

-

14:35

Canadian GDP up 0.6% in June

Real gross domestic product (GDP) rose 0.6% in June, essentially offsetting an equivalent decline in May. Mining, quarrying and oil and gas extraction, manufacturing and utilities were the major contributors to the increase.

Goods-producing industries increased 1.6% in June. Mining, quarrying and oil and gas extraction contributed the most to the gain, mainly because of a rise in non-conventional oil extraction, as capacity gradually returned following the Fort McMurray wildfire and evacuation in May. Manufacturing and utilities also rose, while construction and the agriculture and forestry sector decreased.

The output of service-producing industries grew for a ninth consecutive month, rising 0.2% in June. Gains were posted by the public sector (education, health and public administration combined), transportation and warehousing services, and the finance and insurance sector. Retail trade recorded the most notable decline in output.

-

14:30

Canada: GDP (YoY), Quarter II -1.6% (forecast -1.5%)

-

14:30

Canada: GDP (m/m) , June 0.6% (forecast 0.4%)

-

14:30

Canada: GDP QoQ, Quarter II -0.4%

-

14:21

US ADP maintains the strong growth in August

Private sector employment increased by 177,000 jobs from July to August according to the August ADP National Employment Report

Payrolls for businesses with 49 or fewer employees increased by 63,000 jobs in August, down from 68,000 in July. Employment at companies with 50-499 employees increased by 44,000 jobs, down from last month's 71,000. Employment at large companies - those with 500 or more employees - increased by 70,000, up from July's 56,000. Companies with 500-999 employees added 25,000 and companies with more than 1,000 employees added 46,000 in August.

"Job growth in August was stable and consistent with levels from previous months as consumer conditions improve," said Ahu Yildirmaz, vice president and head of the ADP Research Institute. "Continued strong growth in service-providing jobs is offset by weakness in goods-producing areas."

.

-

14:15

U.S.: ADP Employment Report, August 177 (forecast 175)

-

14:09

European session review: the pound traded higher

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 UK House Price Index from Nationwide, m / m in August of 0.5% -0.3% 0.6%

6:00 UK House Price Index from Nationwide, y / y in August 5.2% 4.8% 5.6%

6:00 Germany Retail Sales seasonally adjusted -0.6% Revised July from -0.1% 0.5% 1.7%

6:00 Germany Retail sales, excluding seasonal adjustments, y / y 2.3% Revised July from 2.7% 0.3% -1.5%

6:00 Switzerland indicator of consumer activity from UBS in July 1.34 1.32

7:55 Germany Unemployment rate seasonally adjusted 6.1% in August 6.1% 6.1%

7:55 Germany Change in the number of unemployed in August Revised -8 from -7 -5 -7

9:00 Eurozone July unemployment rate 10.1% 10.0% 10.1%

9:00 Eurozone Consumer Price Index y / y (provisional) in August 0.2% 0.3% 0.2%

9:00 Eurozone consumer price index base value, y / y (provisional) in August 0.9% 0.9% 0.8%

Pound rises sharply after data showed that the UK economy is going through a good period after Brexit. According to the report of Nationwide, house prices in the country remains stable. A survey conducted by the GfK, showed improvement in consumer sentiment. These data allow investors to take profits on short positions on the pound.

In the UK house prices rose at the fastest pace in five months in August, reported Nationwide Building Society. Housing prices rose 5.6 percent year on year in August, after rising 5.2 percent in July. It was the most rapid growth over the past five months. Economists had forecast that the annual growth rate will slow to 4.8 per cent. In monthly terms, housing prices unexpectedly rose 0.6 percent, slightly faster than the growth of 0.5 percent a month ago. Prices were expected to decline by 0.3 percent.

New buyer inquiries softened after the introduction of an additional fee for second homes in and the uncertainty surrounding the EU referendum, said Robert Gardner, chief economist at Nationwide. "What's next on the demand side will determine to a large extent the prospects of the labor market and confidence among potential buyers," says Gardner.

At the same time, the consumer confidence index from the GfK Group has dropped to -7 in August, while analysts expected a decline to -8. Despite the decline, the index was better than the value of July, when the indicator fell to -12. Consumer confidence is weaker than it was prior to the vote on 23 June when the index stood at -1. The index of consumer confidence from the GfK Group is a leading indicator that reflects the level of consumer confidence in economic activity. The index is based on a survey of 2,000 people, conducted from August 1-16.

The euro declines against the background of large-scale strengthening of the US currency on expectations of a fed hike. At the same time, German unemployment dropped more than expected in August. The number of people out of work fell by 7,000 in August compared to July. Economists had forecast a decline of 5,000. At the same time, the unemployment rate remained stable at 6.1% in August. The result was in line with expectations. It was the lowest level since German reunification.

In addition, as shown by preliminary estimates from Eurostat, inflation in the eurozone remained stable in August. Inflation remained unchanged at 0.2%, while economists had expected the index to rise slightly to 0.3%. Inflation remains below the target level of the European Central Bank's' below but close to 2 percent since the beginning of 2013. Core inflation, which excludes energy, food, alcohol and tobacco decreased slightly to 0.8% from 0.9% in July. Core inflation was expected to remain at 0.9%.

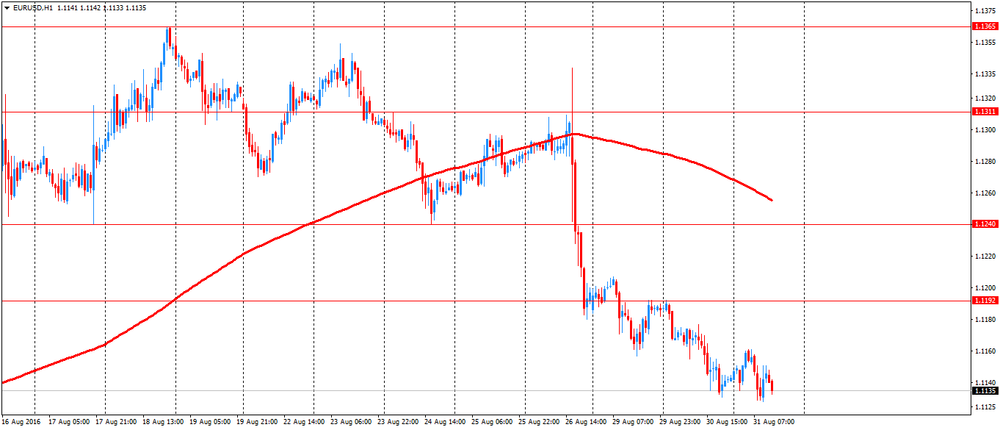

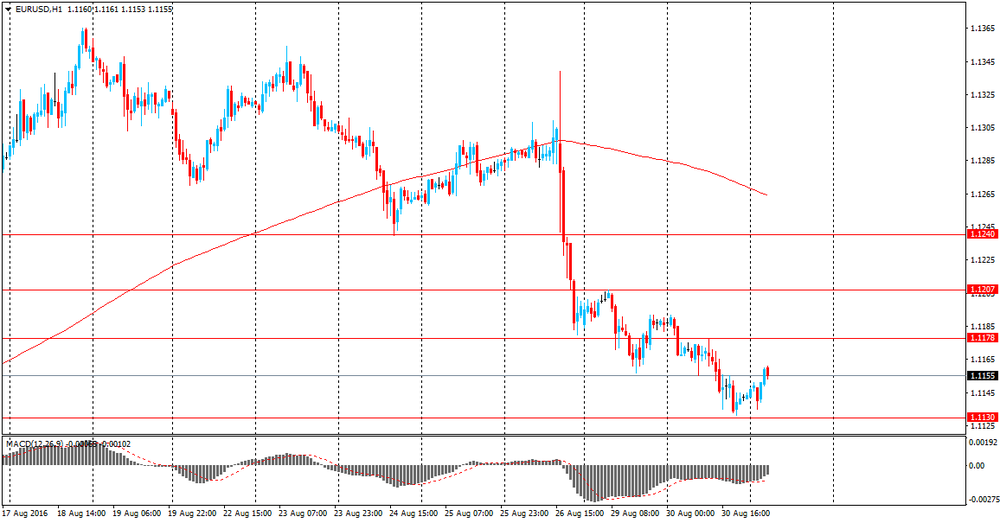

EUR / USD: during the European session, the pair fell to $ 1.1128

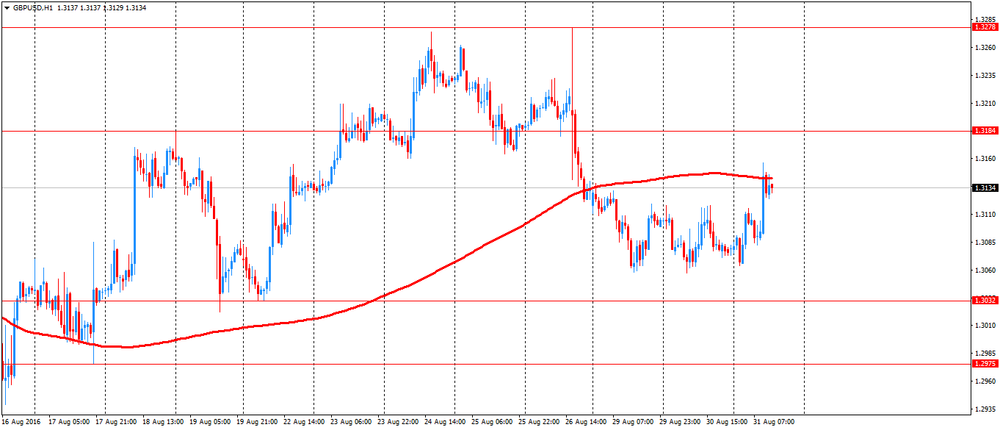

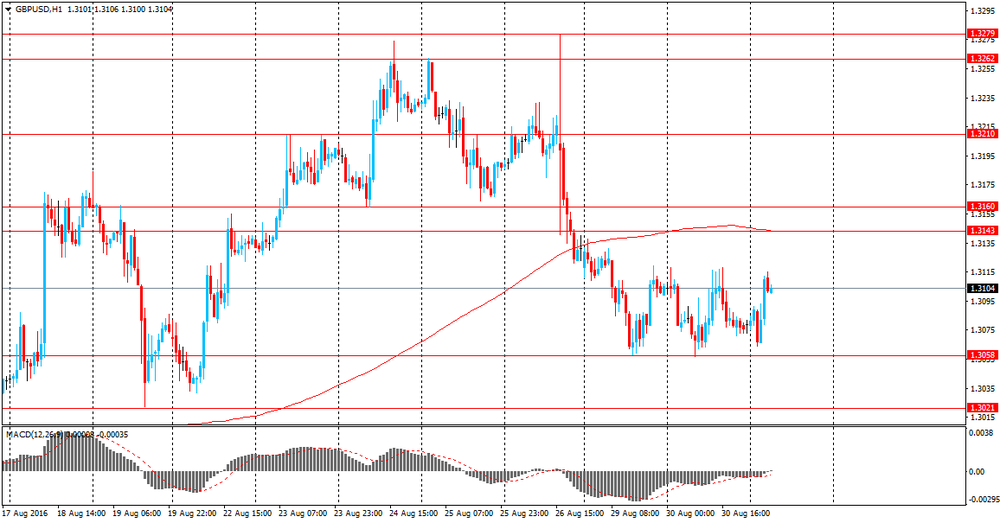

GBP / USD: during the European session, the pair rose to $ 1.3156

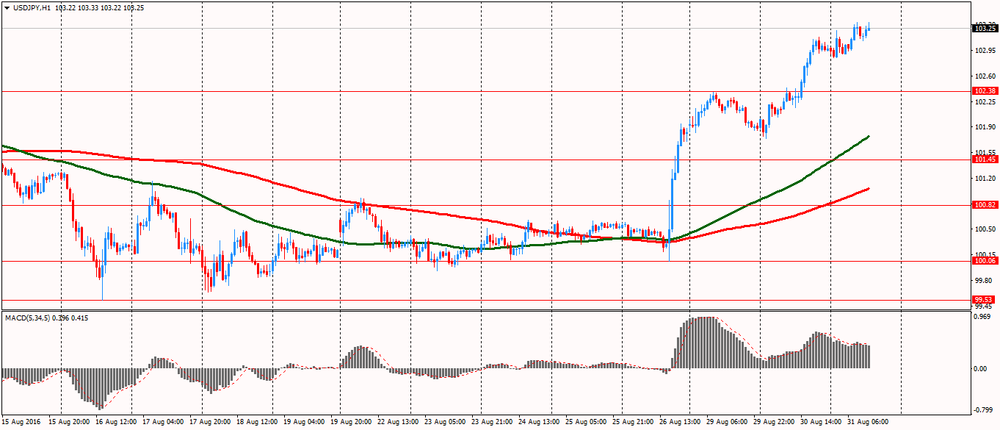

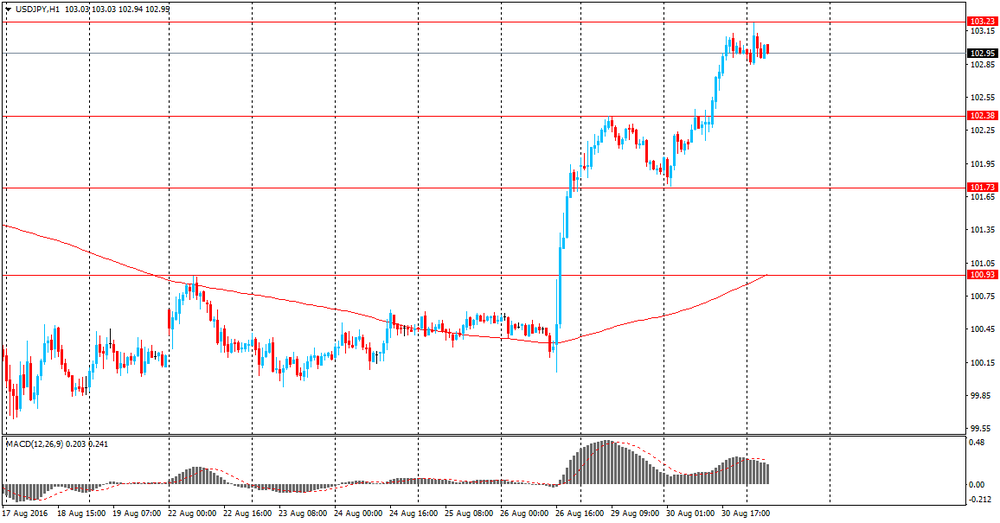

USD / JPY: during the European session, the pair rose to Y103.33

-

13:59

GBP: Staying Short Cable As Long As Spot Remains Below 1.35 - RBS. How to interpret bank recommendations

"Sentiment toward UK assets has improved, helped by a range of anecdotal and high frequency data that suggest the near-term hit to the UK economy may have been less than many feared. These have centred on retail spending, tourism and manufacturing orders. The news on housing has been less positive. Mortgage approvals for house purchases were weaker last week and there are reports of reduced asking prices and weak activity. The sector is also slowing following a front loading of purchases ahead of changes to buy-to-let and stamp-duty.

We believe that the impact of the Brexit vote will be a slow-burn as a combination of weaker investment and real incomes growth on higher inflation is gradually felt. Political noise may rise on Parliament's return on September 5th. We may get more on the timing of Article 50 and priorities for fiscal policy at the Autumn Statement.

We maintain our negative bias while spot is below 1.35 and expect resistance at 1.3372".

Copyright © 2016 RBS, eFXnews™

Keep in mind that banks are big market makers so when a bank recommends a trade it may also want to attract liquidity in that particular asset. It may signal that something is going to happen with that pair and a move is about to start. Fundamental factors can be interpret in so many ways and for the most of the time fundamentals are already priced in. The only thing that count is what the chart tells you through periods of accumulation or distribution.

-

13:45

Orders

EUR/USD

Offers : 1.1150 1.1165 1.1180 1.1200 1.1225-30 1.1250 1.1280 1.1300

Bids : 1.1120 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.3120 1.3135 1.3150 1.3180 1.3200 1.3235 1.3250 1.3280 1.3300

Bids : 1.3080 1.3065 1.3050 1.3030 1.3000 1.2980 1.2950

EUR/GBP

Offers : 0.8520-25 0.8535 0.8550 0.8565 0.8580 0.8600 0.8625-30 0.8655-60

Bids : 0.8500 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers : 115.20 115.50 115.75 116.00 116.50 117.00

Bids : 114.80 114.50 114.00 113.80 113.50 113.30 113.00

USD/JPY

Offers : 103.50 103.60 103.75-80 104.00 104.45-50 104.75 105.00 105.50

Bids : 103.00 102.80 102.50 102.20 102.00 101.80 101.65 101.50

AUD/USD

Offers : 0.7530 0.7550 0.7580 0.7600 0.7625-30 0.7650 0.7680 0.7700

Bids : 0.7500 0.7485 0.7450 0.7430 0.7400 0.7385 0.7350

-

12:46

ECB’s Draghi: Cannot Give A Precise Timeline For Buying Greek Debt

-

12:05

Fed’s Evan: slow growth low rate world is a difficult situation

-

low growth low rate world is a difficult situation

-

spike in long run rates unlikely even if Fed finds it needs to raise rates faster than expected

-

expects protracted period of low interest rates ahead

-

-

11:16

Eurozone: Harmonized CPI ex EFAT, Y/Y, August 0.8% (forecast 0.9%)

-

11:06

Euro area seasonally-adjusted unemployment rate was 10.1% in July

The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in July 2016, stable compared to June 2016 and down from 10.8% in July 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in July 2016, stable compared to June 2016 and down from 9.4% in July 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 21.063 million men and women in the EU28, of whom 16.307 million were in the euro area, were unemployed in July 2016. Compared with June 2016, the number of persons unemployed decreased by 29 000 in the EU28 and by 43 000 in the euro area. Compared with July 2015, unemployment fell by 1.688 million in the EU28 and by 1.034 million in the euro area.

-

11:05

Euro area annual inflation stable at 0.2%

Euro area annual inflation is expected to be 0.2% in August 2016, stable compared with July 2016, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in August (1.3%, compared with 1.4% in July), followed by services (1.1%, compared with 1.2% in July), non-energy industrial goods (0.3%, compared with 0.4% in July) and energy (-5.7%, compared with -6.7% in July).

-

11:00

Eurozone: Unemployment Rate , July 10.1% (forecast 10.0%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, August -0.1% (forecast 0.3%)

-

10:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1175-80 (EUR 750m) 1.1200-05 (629m) 1.1250 (267m) 1.1300 (291m)

USD/JPY:100.00 (USD 610m) 103.00 (370m) 103.19 (200m) 105.00 (440m)

GBP/USD: 1.3000 (GBP 301m)

AUD/USD: 0.7510-15 (AUD 204m) 0.7600-07 (1.8bln)

USD/CAD: 1.2875 (USD 240m) 1.2995-1.3000 (215m)

NZD/USD 0.7210 (NZD 300m)

-

10:22

Germany's unemployment declined more than expected in August

According to rttnews, Germany's unemployment declined more than expected in August, reports said citing data from the Federal Labor Agency on Thursday.

The number of people out of work decreased by 7,000 in August from July. Economists had forecast a decline of 4,000.

At the same time, the jobless rate held steady at 6.1 percent in August. The rate came in line with expectations. This was the lowest since German reunification.

-

10:10

Italian unemployment at 11.4% in July

In order to improve the timeliness of statistical information on the Italian labour market and in accordance with the agreements made within the European Union, Istat publishes monthly estimates of the main labour market indicators resulting from the "Labour force survey". In July 2016, 22,765 million persons were employed, -0.3% compared with June. Unemployed were 2,944 million, -1.3% over the previous month. The unemployment rate declined 0.2% to 11.4%.

-

09:55

Germany: Unemployment Change, August -7 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , August 6.1% (forecast 6.1%)

-

09:31

Today’s events

At 01:30 GMT the Bank of Japan board member Yukitoshi Funo will deliver a speech

At 07:15 GMT the ECB Board Member Peter Prat will make a speech

At 07:15 GMT FOMC member Eric Rosengren will give a speech

FOMC members Charles Evans will give a speech at 12:00 GMT

-

09:25

Asian session review: US dollar rose against the yen

The US dollar rose against the yen, updating yesterday's high, reaching Y103.25. Support for the pair gave recent comments by Fed officials that increase the likelihood of a rate hike.

The yen was also affected by negative data on Japan's industrial production. As reported today the growth of industrial production in Japan in July was flat, after rising in June by 2.3%. Analysts had expected an increase of 0.8%. On an annual basis, industrial production fell by -3.8%, lower than the previous value of -1.5%.

Industrial production - an indicator published by the Ministry of Economy, Trade and Industry, that reflects the activity of production plants, factories and mining companies. This indicator has attracted attention because it is the main indicator of the strength and health of the manufacturing sector.

The data published today indicate the slowdown of industrial production growth, despite the efforts of Prime Minister Abe to revive the economy.

Also today, was published the data on the number of housing starts, which in July increased 8.9%, after falling -2.5% in June. This indicator reflects the strength of the Japanese housing market, but also gives an idea about the general state of the economy, because it is very sensitive to changes in the business cycle.

Despite the increase in the number of constructions, the volume of orders in the construction sector decreased year on year by 10.9%, after declining by 2.4% in June.

The pound rose against the dollar for a short time after the publication of more positive than expected data on UK consumer confidence from the GfK Group, which in August fell to -7, while analysts expected a decline to -8. Despite the decline, the index was better than the value of July, when the indicator fell to -12. Consumer confidence is weaker than it was prior to the vote on 23 June when the index stood at -1.

The index of consumer confidence from the GfK Group is a leading indicator that reflects the level of consumer confidence in economic activity. The index is based on a survey of 2,000 people, conducted from August 1-16.

The Australian dollar strengthened slightly on data of private sector lending. Report of the Reserve Bank of Australia showed that the amount of money borrowed by Australian private sector increased by 0.4% in June, after rising 0.2% in May. In annual terms, the indicator fell by 0.2% and amounted to 6.0%. This indicator shows whether the private sector can afford large expenses that will support economic growth and is considered an indicator of business conditions and economic situation in Australia as a whole.

EUR / USD: during the Asian session, the pair was trading in $ 1.1135-1.1165 range

GBP / USD: during the Asian session, the pair was tading in $ 1.3065-1.3115 range

USD / JPY: during the Asian session, the pair was trading in Y102.85-103.20 range

-

09:07

ECB Villeroy: helicopter money isn't justifiable

-

monetary policy alone is not enough

-

Europe needs investment union

-

ECB needs to continue current monetary policy

-

helicopter money not a good tool for monetary policy

-

-

08:54

French CPI below forecasts - Insee

In August 2016, according to the provisional estimate made at the end of the month, the Consumer Price Index (CPI) is set to rise by 0.3% month-on-month, as in August 2015. Prices should be mainly driven by the seasonal increases in the manufactured product prices at the end of the summer sales in Metropolitan France and in some services related to tourism. In addition, food prices should keep on rising slightly, especially owing to fresh foodstuffs. These increases are likely to be partially offset by a further decline in petroleum products prices.

Year-on-year, consumer prices should grow by 0.2%, as in the two previous months. This rise should arise mainly from the dynamism of service prices, partially offset by falls in the prices of energy and manufactured products.

In August 2016, the Harmonised Index of Consumer Prices is set to grow by 0.3% over the month. Year-on-year, it should expand by 0.4%, as in the previous month.

-

08:35

Morgan Stanley Trade Of The Week: Buy EUR/CAD

"Insurance against an early hike:

As long as the markets have to deal with the prospect of the Fed hiking rates, the USD should remain supported. However, USD strength should be limited and difficult to trade suggesting to us to look into alternative currency pairs which would rally too should the Fed hike rates early.

We think bullish EUR crosses should do well for other reasons too, but an early Fed rate hike would certainly add to upside momentum.

EURCAD, EURAUD or EURKRW are good candidates to rally from here. Our trade of the week is to be long EURCAD," MS says as a rationale behind this call".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:32

A day full of important events as we expect the EU preliminary CPI and US ADP to move the markets significantly. Also oil traders keep an eye on US crude inventories

-

08:28

Options levels on wednesday, August 31, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1280 (5033)

$1.1246 (3951)

$1.1196 (1783)

Price at time of writing this review: $1.1145

Support levels (open interest**, contracts):

$1.1103 (2515)

$1.1053 (4327)

$1.1019 (5286)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 51645 contracts, with the maximum number of contracts with strike price $1,1250 (5033);

- Overall open interest on the PUT options with the expiration date September, 9 is 57239 contracts, with the maximum number of contracts with strike price $1,1000 (5764);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from August, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.3401 (2081)

$1.3302 (2681)

$1.3204 (1613)

Price at time of writing this review: $1.3096

Support levels (open interest**, contracts):

$1.2995 (2084)

$1.2898 (1851)

$1.2799 (2687)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32662 contracts, with the maximum number of contracts with strike price $1,3300 (2681);

- Overall open interest on the PUT options with the expiration date September, 9 is 26561 contracts, with the maximum number of contracts with strike price $1,2800 (2687);

- The ratio of PUT/CALL was 0.81 versus 0.82 from the previous trading day according to data from August, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

Industrial production in Japan fell despite the efforts of Prime Minister Abe to revive the economy

The growth of industrial production in Japan in July was flat, after rising in June by 2.3%. Analysts had expected an increase of 0.8%. On an annual basis, industrial production fell by -3.8%, lower than the previous value of -1.5%.

Industrial production - an indicator published by the Ministry of Economy, Trade and Industry, that reflects the activity of production plants, factories and mining companies. This indicator has attracted attention because it is the main indicator of the strength and health of the manufacturing sector.

The data published today indicate the slowdown of industrial production growth, despite the efforts of Prime Minister Abe to revive the economy.

-

08:20

UBS consumption indicator still suggests a boost in Swiss private consumption

In July, the UBS consumption indicator rose to 1.32 points from 1.21. A slight downward adjustment of the June figure and above-average car sales generated the increase. However, the disappointing June figures for tourism and sluggish consumer sentiment slightly curbed this upward trend.

The rise of the UBS consumption indicator to 1.32 from 1.21 still suggests a boost in Swiss private consumption, but is qualified by the downward adjustment of the June figure. The revision resulted from the much lower number of overnight hotel stays of Swiss guests in June than first projected. The dismal weather severely dampened the general desire to take a vacation, resulting in a 3.3% reduction in overnight stays compared to the previous year.

-

08:17

UK house price growth has remained broadly stable

House prices increased by 0.6% in August.

Annual house price growth increased to 5.6%, from 5.2% in July.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "UK house prices increased by 0.6% in August, resulting in a slight pick up in the annual rate of house price growth to 5.6%, from 5.2% in July, although this remains within the 3- 6% range prevailing since early 2015. "The pick up in price growth is somewhat at odds with signs that housing market activity has slowed in recent months. New buyer enquiries have softened as a result of the introduction of additional stamp duty on second homes in April and the uncertainty surrounding the EU referendum. The number of mortgages approved for house purchase fell to an eighteen-month low in July.

However, the decline in demand appears to have been matched by weakness on the supply side of the market. Surveyors report that instructions to sell have also declined and the stock of properties on the market remains close to thirty-year lows. This helps to explain why the pace of house price growth has remained broadly stable".

-

08:14

German adjusted retail sales up 1.7% in July

According to provisional results of the Federal Statistical Office (Destatis), retail turnover in July 2016 in Germany decreased in real terms 1.5% and in nominal terms 1.2% compared with the corresponding month of the previous year. The number of days open for sale was 26 in July 2016 and 27 in July 2015.

Compared with the previous year, turnover in retail trade was in the first seven months 2016 in real terms 1.7% and in nominal terms 1.9% larger than in in the corresponding period of the previous year.

When adjusted for calendar and seasonal variations, the July turnover was in real terms 1.7% and in nominal terms 1.8% larger than that in June 2016.

-

08:01

United Kingdom: Nationwide house price index , August 0.6% (forecast -0.3%)

-

08:01

United Kingdom: Nationwide house price index, y/y, August 5.6% (forecast 4.8%)

-

08:00

Germany: Retail sales, real adjusted , July 1.7% (forecast 0.5%)

-

08:00

Switzerland: UBS Consumption Indicator, July 1.32

-

08:00

Germany: Retail sales, real unadjusted, y/y, July -1.5% (forecast 0.3%)

-

07:04

Japan: Housing Starts, y/y, July 8.9% (forecast 7.4%)

-

07:03

Japan: Construction Orders, y/y, July -10.9%

-

03:30

Australia: Private Sector Credit, m/m, July 0.4% (forecast 0.4%)

-

03:30

Australia: Private Sector Credit, y/y, July 6.0%

-

03:00

New Zealand: ANZ Business Confidence, August 15.5

-

01:04

United Kingdom: Gfk Consumer Confidence, August -7 (forecast -8)

-

00:28

Currencies. Daily history for Aug 30’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1143 -0,39%

GBP/USD $1,3079 -0,20%

USD/CHF Chf0,9834 +0,54%

USD/JPY Y102,97 +1,06%

EUR/JPY Y114,75 +0,68%

GBP/JPY Y134,68 +0,86%

AUD/USD $0,7511 -0,84%

NZD/USD $0,7221 -0,44%

USD/CAD C$1,309 +0,62%

-

00:00

Schedule for today, Wednesday, Aug 31’2016

(time / country / index / period / previous value / forecast)

01:00 Australia RBA Assist Gov Debelle Speaks

01:00 New Zealand ANZ Business Confidence August 16

01:30 Australia Private Sector Credit, m/m July 0.2% 0.4%

01:30 Australia Private Sector Credit, y/y July 6.2%

05:00 Japan Construction Orders, y/y July -2.4%

05:00 Japan Housing Starts, y/y July -2.5% 7.4%

06:00 United Kingdom Nationwide house price index August 0.5% -0.3%

06:00 United Kingdom Nationwide house price index, y/y August 5.2% 4.8%

06:00 Germany Retail sales, real adjusted July -0.1% 0.5%

06:00 Germany Retail sales, real unadjusted, y/y July 2.7% 0.3%

06:00 Switzerland UBS Consumption Indicator July 1.34

07:55 Germany Unemployment Rate s.a. August 6.1% 6.1%

07:55 Germany Unemployment Change August -7 -5

09:00 Eurozone Unemployment Rate July 10.1% 10.0%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August 0.2% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) August 0.9% 0.9%

12:15 U.S. ADP Employment Report August 179 175

12:30 Canada GDP (m/m) June -0.6% 0.4%

12:30 Canada GDP QoQ Quarter II 0.6%

12:30 Canada GDP (YoY) Quarter II 2.4% -1.5%

13:45 U.S. Chicago Purchasing Managers' Index August 55.8 54.0

14:00 U.S. Pending Home Sales (MoM) July 0.2% 0.6%

14:30 U.S. Crude Oil Inventories August 2.501

23:30 Australia AIG Manufacturing Index August 56.4

23:50 Japan Capital Spending June 4.2% 5.6%

-