Noticias del mercado

-

21:01

DJIA 17815.73 -22.83 -0.13%, NASDAQ 4947.55 -23.82 -0.48%, S&P 500 2100.98 -4.28 -0.20%

-

18:13

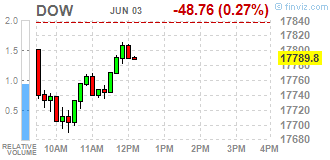

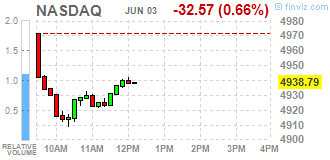

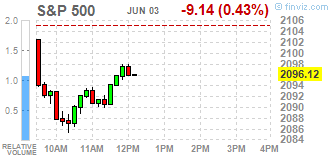

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock indexes sharply lower on Friday after much weaker-than-expected nonfarm payrolls data for May raised doubts if the economy was healthy enough to absorb an interest rate hike in the near term. The U.S. Labor Department said payrolls increased by only 38,000 last month, the smallest gain since September 2010 and well below economists' forecasts of 164,000. The jobless rate fell to 4,7%, the lowest since November 2007.

Most of Dow stocks in negative area (18 of 30). Top looser - The Goldman Sachs Group, Inc. (GS, -2,54%). Top gainer - Caterpillar Inc. (CAT, +1,28%).

Most of S&P sectors also in negative area. Top looser - Financial (-1,2%). Top gainer - Utilities (+1,6%).

At the moment:

Dow 17794.00 -31.00 -0.17%

S&P 500 2095.75 -8.00 -0.38%

Nasdaq 100 4511.25 -21.00 -0.46%

Oil 48.74 -0.43 -0.87%

Gold 1241.80 +29.20 +2.41%

U.S. 10yr 1.71 -0.10

-

18:11

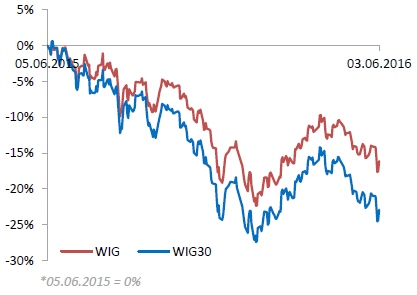

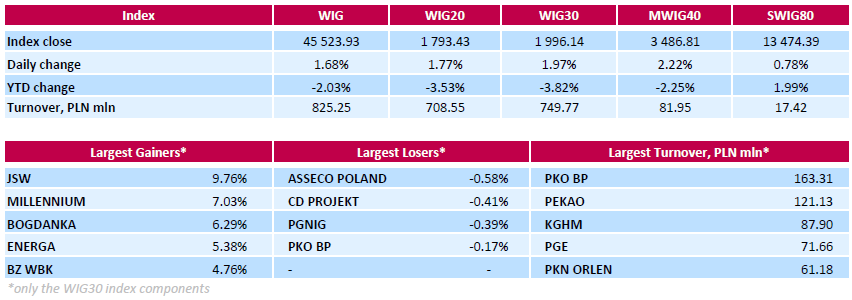

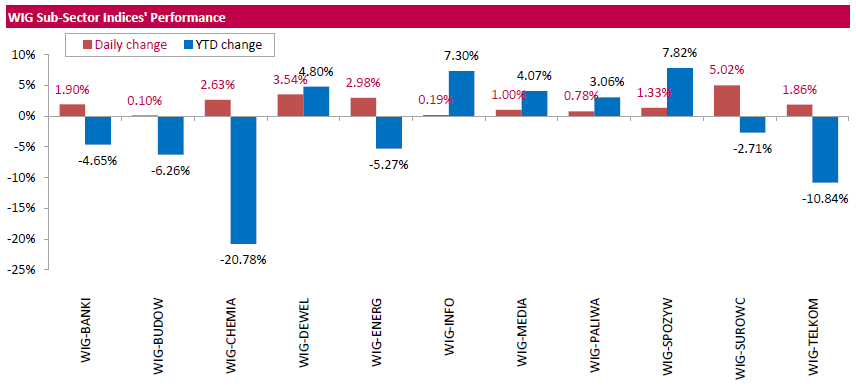

WSE: Session Results

Polish equity market surged on Friday. The broad market measure, the WIG Index, grew by 1.68%. All sectors in the WIG gained, with materials (+5.02%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.97%. There were only four decliners among the index components. IT-company ASSECO POLAND (WSE: ACP) was the worst-performing name, slumping by 0.58%. Other laggards included videogame developer CD PROJEKT (WSE: CDR), oil and gas producer PGNIG (WSE: PGN) and bank PKO BP (WSE: PKO), losing 0.41%, 0.39% and 0.17% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) became the biggest advancer, climbing by 9.76%. It was followed by bank MILLENNIUM (WSE: MIL), thermal coal miner BOGDANKA (WSE: LWB) and genco ENERGA (WSE: ENG), which rose by 7.03%, 6.29% and 5.38% respectively.

-

18:00

European stocks close: stocks closed mixed on the U.S. labour market data

Stock closed slightly mixed on the weak U.S. labour market data. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 38,000 jobs in May, missing expectations for a rise of 164,000 jobs, after a gain of 123,000 jobs in April. It was the smallest rise since September 2010.

Market participants also eyed the economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Friday. Retail sales in the Eurozone were flat in April, missing expectations for a 0.3% rise, after a 0.6% fall in March. March's figure was revised down from a 0.5% decrease.

Non-food sales were flat in April, food, drinks and tobacco sales increased 0.5%, while automotive fuel sales were down 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in April, missing forecasts of a 1.9% gain, after a 1.8% increase in March. March's figure was revised down from a 2.1% rise.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final services purchasing managers' index (PMI) rose to 53.3 in May from 53.1 in April, up from the preliminary reading of 53.2.

The increase was driven by rises in employment and input prices.

Eurozone's final composite output index increased to 53.1 in May from 53.0 in April, up from the preliminary reading of 52.9.

The increase was mainly driven by a rise in output.

"The final PMI numbers for May have come in slightly ahead of the earlier flash readings, but still point a Eurozone economy which seems unable to move out of low gear," Chief Economist at Markit Chris Williamson said.

"The survey data are signalling a GDP rise of 0.3% in the second quarter, suggesting the growth spurt seen at the start of the year will prove frustratingly short-lived," he added.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 53.5 in May from 52.3 in April, exceeding expectations for an increase to 52.5. The increase was driven by a faster growth in output. Employment continued to rise in May.

"The PMI surveys show that the pace of economic growth remained subdued in May, as 'Brexit' worries exacerbated existing headwinds. The data so far indicate that the second quarter is likely to see the economy grow by just 0.2%," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,209.63 +24.02 +0.39 %

DAX 10,103.26 -104.74 -1.03 %

CAC 40 4,421.78 -44.22 -0.99 %

-

18:00

European stocks closed: FTSE 6209.63 24.02 0.39%, DAX 10103.26 -104.74 -1.03%, CAC 4421.78 -44.22

-

17:36

Bank of France lower its growth and inflation forecasts

The Bank of France released its growth forecasts on Friday. France's central bank expects the French economy to expand 1.4% in in 2016, unchanged from the previous estimate, 1.5% in 2017, down from the previous estimate of 1.6%, and 1.6% in 2018.

Inflation is expected to be 0.2% in 2016, down from the previous estimate of 1.0%, and 1.1% in 2017, down from the previous estimate of 1.5%.

-

17:08

Bundesbank downgrades its growth and inflation forecasts for Germany

Bundesbank downgraded its growth forecasts for Germany. The economic growth is expected to be 1.7% in 2016, down from the previous estimate of 1.8%, and 1.4% in 2017, down from the previous estimate of 1.7%.

"The German economy's underlying cyclical trend is fairly robust. Its main driver is buoyant domestic demand, which is being bolstered by the favourable situation in the labour market and by rising household income," Bundesbank President Jens Weidmann said.

Inflation is expected to be 0.2% in 2016, down from the previous estimate of 1.1%, and 1.5% in 2017, down from the previous estimate of 2.0%.

Inflation forecasts were downgraded due to low inflation rate for services and industrial goods.

"Fluctuations in the price of crude oil continue to present a risk, particularly for the price projection, but on the whole appear balanced, as do the risks to economic growth," Weidmann noted.

-

16:57

U.S. factory orders climb 1.9% in April

The U.S. Commerce Department released factory orders data on Friday. Factory orders in the U.S. climbed 1.9% in April, in line with expectations, after a 1.7% rise in March. March's figure was revised up from a 1.1% increase.

Durable goods orders were up 0.5% in April, while non-durable goods orders rose 0.4%.

Orders for transportation equipment jumped 1.1% in April.

Factory orders excluding transportation increased 0.5% in April, after a 1.0% rise in March.

-

16:46

ISM non-manufacturing purchasing managers’ index slides to 52.9 in May

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Friday. The index slid to 52.9 in May from 55.7 in April, missing expectations for a decrease to 55.5.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index dropped to 54.2 in May from 59.9 in April.

The business activity/production index decreased to 55.1 in May from 58.8 in April.

The ISM's employment index was down to 49.7 in May from 53.0 in April.

The prices index jumped to 55.6 in May from 53.4 in April.

-

16:42

Final U.S. services PMI falls to 51.3 in May

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Friday. Final U.S. services purchasing managers' index (PMI) fell to 51.3 in May from 52.8 in April, up from the preliminary reading of 51.2.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The decline was driven by a slower growth in output, new orders and emplyoment.

"The service sector reported one of the weakest expansions seen since the recession in May, adding to signs that any rebound of the economy in the second quarter may be disappointingly muted," Chief Economist at Markit Chris Williamson said.

"Add these disappointing service sector numbers to the downturn now being seen in manufacturing, and the PMI surveys point to GDP growing at an annualised rate of just 0.7-8% in the second quarter, notwithstanding any marked change in June," he added.

-

16:26

U.S. trade deficit widens to $37.4 billion in April

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit widened to $37.4 billion in April from a deficit of $35.5 billion in March. March's reading was the smallest gap since December 2013.

March's figure was revised up from a deficit of $40.44 billion.

Analysts had expected a trade deficit of $41.3 billion.

The increase of a deficit was driven by a rise in imports. Exports of goods increased by 0.9% in April, while imports of goods rose by 2.3%.

-

16:00

U.S.: Factory Orders , April 1.9% (forecast 1.9%)

-

16:00

U.S.: ISM Non-Manufacturing, May 52.9 (forecast 55.5)

-

15:49

Option expiries for today's 10:00 ET NY cut

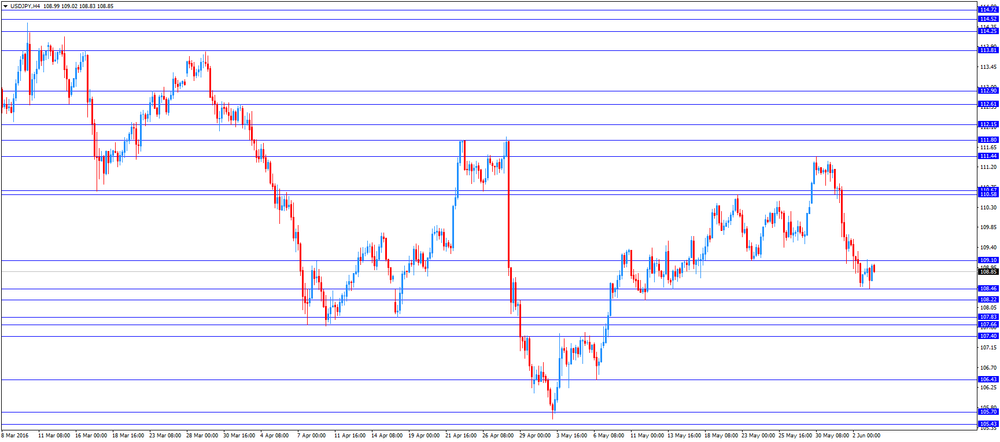

USDJPY 107.00 (USD 293m) 108.00 (434m) 108.70 (466m) 109.00 (1.07bln) 109.90-110.00 (563m) 110.50 (591m)

EURUSD: 1.1000 (EUR 500m) 1.1100 (1.05bln) 1.1150 (398m) 1.1175 (318m) 1.1200 (1.03bln) 1.1250 (705m) 1.1300 (883m)

GBPUSD 1.4300 (GBP 190m) 1.4400 (287m) 1.4425 (250m) 1.4450 (181m)

AUDUSD 0.7100 (AUD 570m) 0.7170-75 (586m) 0.7200 (500m) 0.7250-55 (422m)

USDCAD 1.2500 (USD 640m) 1.2800-10 (845m) 1.2850 (330m) 1.2900 (755m) 1.3000 (975m) 1.3050 (600m) 1.3100 (300m)

NZDUSD 0.6600 (NZD 394m)

AUDNZD 1.0750 (AUD 350m)

-

15:45

U.S.: Services PMI, May 51.3 (forecast 51.2)

-

15:36

WSE: After start on Wall Street

The most important macro report of the day and probably the most anticipated report in June turned out much worse than expected. Reading past the forecast by about 100 thousand, which gave the weakest jobs growth for several years. Thus, the market valuation abruptly reduced the likelihood of interest rate hikes in the US this year.

The reaction of the currency market was relatively standard. The weaker dollar, stronger euro and yen and the Polish zloty. In the case of stock markets, however, it is a bit more nervous. The DAX fell by 100 points. However the WIG20 performs well, with the belief that the lack of fast and dynamic increases in US interest rates is conducive to assets in emerging markets and to the aforementioned Polish zloty.

Contracts on the S&P500 lost before the opening of Wall Street 0.5 percent after an earlier peaceful oscillating around the neutral level. The fall after US data also changed the perspective on today's session, at least to the beginning. Instead of the attack on the April highs at the moment we are dealing with a passing down and a bounce from the level of resistance.

-

15:32

U.S. Stocks open: Dow -0.34%, Nasdaq -0.29%, S&P -0.22%

-

15:16

Before the bell: S&P futures -0.51%, NASDAQ futures -0.44%

U.S. stock-index futures retreated after disappointing payroll gains raised concerns that growth is fading.

Global Stocks:

Nikkei 16,642.23 +79.68 +0.48%

Hang Seng 20,947.24 +88.02 +0.42%

Shanghai Composite 2,938.18 +12.95 +0.44%

FTSE 6,206.6 +20.99 +0.34%

CAC 4,447.39 -18.61 -0.42%

DAX 10,160.83 -47.17 -0.46%

Crude $49.15 (-0.04%)

Gold $1234.40 (+1.80%)

-

15:12

U.S. unemployment rate declines to 4.7% in May, 38,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 38,000 jobs in May, missing expectations for a rise of 164,000 jobs, after a gain of 123,000 jobs in April. It was the smallest rise since September 2010.

April's figure was revised down from a rise of 160,000 jobs.

The increase was mainly driven by rises in health care. Health care added 45,700 in May, while mining sector shed 10,200 jobs.

The manufacturing sector shed 10,000 jobs in May.

A strike by Verizon workers weighed on nonfarm payrolls.

The U.S. unemployment rate dropped to 4.7% in May from 5.0% in April, beating expectations for a fall to 4.9%. It was the lowest level since November 2007.

The decline was driven by a fact that people dropped out of the labour force.

Average hourly earnings increased 0.2% in May, in line with forecasts, after a 0.4% rise in April. April's figure was revised up from a 0.3% increase.

The labour-force participation rate decreased to 62.6% in May from 62.8% in April.

The Fed could delay its interest rate this month.

-

14:57

Labour productivity of Canadian businesses rises by 0.4% in the first quarter

Statistics Canada released labour productivity data of Canadian businesses on Friday. The labour productivity of Canadian businesses rose by 0.4% in the first quarter, in line with expectations, after a flat reading in the fourth quarter. The fourth quarter's figure was revised down from a 0.1% gain.

The increase was mainly driven by a rise in productivity of service-producing businesses, which was up 0.6% in the first quarter.

Productivity of goods-producing businesses rose 0.2%.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

167.68

-0.36(-0.2142%)

504

ALCOA INC.

AA

9.35

0.02(0.2144%)

45173

ALTRIA GROUP INC.

MO

64.3

-0.01(-0.0155%)

7525

Amazon.com Inc., NASDAQ

AMZN

725

-3.24(-0.4449%)

30724

American Express Co

AXP

65.34

-1.07(-1.6112%)

1950

AMERICAN INTERNATIONAL GROUP

AIG

57.01

-0.83(-1.435%)

2010

Apple Inc.

AAPL

97.54

-0.18(-0.1842%)

153613

AT&T Inc

T

38.79

-0.05(-0.1287%)

8140

Barrick Gold Corporation, NYSE

ABX

17.79

0.83(4.8939%)

201572

Caterpillar Inc

CAT

73.49

-0.13(-0.1766%)

704

Chevron Corp

CVX

99.89

-0.64(-0.6366%)

1002

Cisco Systems Inc

CSCO

28.92

-0.16(-0.5502%)

7078

Citigroup Inc., NYSE

C

45.71

-1.26(-2.6826%)

180605

Deere & Company, NYSE

DE

84.8

0.74(0.8803%)

4737

E. I. du Pont de Nemours and Co

DD

67.91

-0.19(-0.279%)

500

Exxon Mobil Corp

XOM

88.05

-0.48(-0.5422%)

9636

Facebook, Inc.

FB

118.65

-0.28(-0.2354%)

89860

Ford Motor Co.

F

13.14

-0.07(-0.5299%)

15595

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.98

0.32(3.0019%)

371278

General Electric Co

GE

29.93

-0.12(-0.3993%)

63391

General Motors Company, NYSE

GM

30.11

-0.15(-0.4957%)

4975

Goldman Sachs

GS

156.25

-3.03(-1.9023%)

11234

Google Inc.

GOOG

728.05

-2.35(-0.3217%)

1215

Home Depot Inc

HD

131.8

-0.61(-0.4607%)

352

Intel Corp

INTC

31.7

-0.06(-0.1889%)

1798

Johnson & Johnson

JNJ

114.5

0.01(0.0087%)

670

JPMorgan Chase and Co

JPM

64.55

-1.26(-1.9146%)

87656

McDonald's Corp

MCD

120.95

-0.22(-0.1816%)

9031

Microsoft Corp

MSFT

52.1

-0.38(-0.7241%)

2647

Nike

NKE

54.53

-0.00(-0.00%)

31730

Pfizer Inc

PFE

34.87

-0.00(-0.00%)

2485

Procter & Gamble Co

PG

81.99

0.04(0.0488%)

1269

Starbucks Corporation, NASDAQ

SBUX

54.4

-0.22(-0.4028%)

7658

Tesla Motors, Inc., NASDAQ

TSLA

219.72

0.76(0.3471%)

10472

The Coca-Cola Co

KO

44.65

-0.07(-0.1565%)

7448

Travelers Companies Inc

TRV

114.05

-0.82(-0.7138%)

202

Twitter, Inc., NYSE

TWTR

15.13

-0.07(-0.4605%)

104431

Verizon Communications Inc

VZ

50.67

-0.10(-0.197%)

5977

Visa

V

79.56

-0.39(-0.4878%)

13135

Wal-Mart Stores Inc

WMT

71.15

0.20(0.2819%)

1824

Walt Disney Co

DIS

98.48

-0.24(-0.2431%)

2932

Yahoo! Inc., NASDAQ

YHOO

37.05

-0.10(-0.2692%)

10742

Yandex N.V., NASDAQ

YNDX

20.73

0.10(0.4847%)

2450

-

14:47

Canada's trade deficit narrows to C$2.94 billion in April

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$2.94 billion in April from a deficit of C$3.18 billion in March. March's figure was revised up from a deficit of C$3.41 billion.

Analysts had expected a trade deficit of C$2.45 billion.

The decline in deficit was driven by a rise in exports. Exports rose 1.5% in April.

Exports of energy products rose 7.6% in April, exports of metal and non-metallic mineral products climbed by 5.7%, while exports of industrial machinery, equipment and parts jumped 10.5%.

Imports rose 0.9% in April.

Imports of aircraft and other transportation equipment and parts jumped by 52.0% in April, imports of energy products increased by 5.9%, while imports of imports of industrial machinery, equipment and parts fell 5.1%.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Buy from Neutral at Goldman

Downgrades:Other:

Tesla Motors (TSLA) initiated with a Buy at Sterne Agee CRT; target $300

Amazon (AMZN) reiterated with an Outperform at RBC Capital Mkts; target $800 -

14:32

Canada: Labor Productivity, Quarter I 0.4% (forecast 0.4%)

-

14:31

U.S.: Average hourly earnings , May 0.2% (forecast 0.2%)

-

14:31

U.S.: Average hourly earnings , May 0.2% (forecast 0.2%)

-

14:31

U.S.: International Trade, bln, April -37.4 (forecast -41.3)

-

14:30

U.S.: Unemployment Rate, May 4.7% (forecast 4.9%)

-

14:30

Canada: Trade balance, billions, April -2.94 (forecast -2.45)

-

14:30

U.S.: Average workweek, May 34.4 (forecast 34.5)

-

14:30

U.S.: Nonfarm Payrolls, May 38 (forecast 164)

-

14:20

Chicago Fed President Charles Evans: the Fed could raise its interest rates twice this year

Chicago Fed President Charles Evans said in an interview with CNBC on Friday that the Fed could raise its interest rates twice this year if the U.S. economy continues to improve. He added that timing of an interest rate hike was not important.

Evans pointed out that the referendum on Britain's membership in the European Union was likely to have an effect on the Fed's interest rate decision in June.

-

14:11

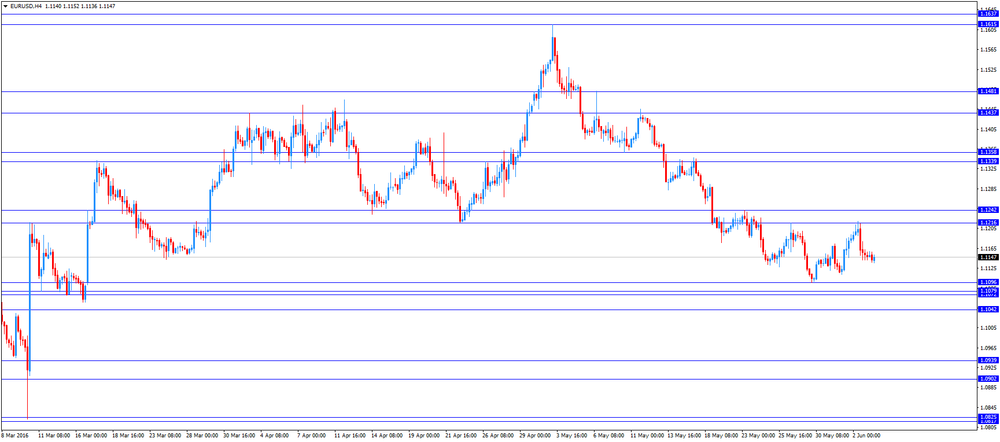

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Labor Cash Earnings, YoY April 1.5% Revised From 1.4% 0.9% 0.3%

01:45 China Markit/Caixin Services PMI May 51.8 52 51.2

07:50 France Services PMI (Finally) May 50.6 51.8 51.6

07:55 Germany Services PMI (Finally) May 54.5 55.2 55.2

08:00 Eurozone Services PMI (Finally) May 53.1 53.1 53.3

08:30 United Kingdom Purchasing Manager Index Services May 52.3 52.5 53.5

09:00 Eurozone Retail Sales (MoM) April -0.6% Revised From -0.5% 0.3% 0.0%

09:00 Eurozone Retail Sales (YoY) April 1.8% Revised From 2.1% 1.9% 1.4%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to decline to 4.9% in May from 5.0% in April. The U.S. economy is expected to add 162,000 jobs in May, after adding 160,000 jobs in April.

The U.S. factory orders are expected to rise 1.9% in April, after a 1.5% gain in March.

The U.S. trade deficit is expected to widen to $41.3 billion in April from $40.44 billion in March.

The ISM non-manufacturing purchasing managers' index is expected to decline to 55.5 in May from 55.7 in April.

The euro traded lower against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Friday. Retail sales in the Eurozone were flat in April, missing expectations for a 0.3% rise, after a 0.6% fall in March. March's figure was revised down from a 0.5% decrease.

Non-food sales were flat in April, food, drinks and tobacco sales increased 0.5%, while automotive fuel sales were down 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in April, missing forecasts of a 1.9% gain, after a 1.8% increase in March. March's figure was revised down from a 2.1% rise.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final services purchasing managers' index (PMI) rose to 53.3 in May from 53.1 in April, up from the preliminary reading of 53.2.

The increase was driven by rises in employment and input prices.

Eurozone's final composite output index increased to 53.1 in May from 53.0 in April, up from the preliminary reading of 52.9.

The increase was mainly driven by a rise in output.

"The final PMI numbers for May have come in slightly ahead of the earlier flash readings, but still point a Eurozone economy which seems unable to move out of low gear," Chief Economist at Markit Chris Williamson said.

"The survey data are signalling a GDP rise of 0.3% in the second quarter, suggesting the growth spurt seen at the start of the year will prove frustratingly short-lived," he added.

The British pound traded mixed against the U.S. dollar after the release of the better-than-expected services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 53.5 in May from 52.3 in April, exceeding expectations for an increase to 52.5. The increase was driven by a faster growth in output. Employment continued to rise in May.

"The PMI surveys show that the pace of economic growth remained subdued in May, as 'Brexit' worries exacerbated existing headwinds. The data so far indicate that the second quarter is likely to see the economy grow by just 0.2%," the Chief Economist at Markit Chris Williamson said.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian economic data. The Canadian trade deficit is expected to narrow to C$2.45 billion in April from C$3.41 billion in March.

EUR/USD: the currency pair declined to $1.1136

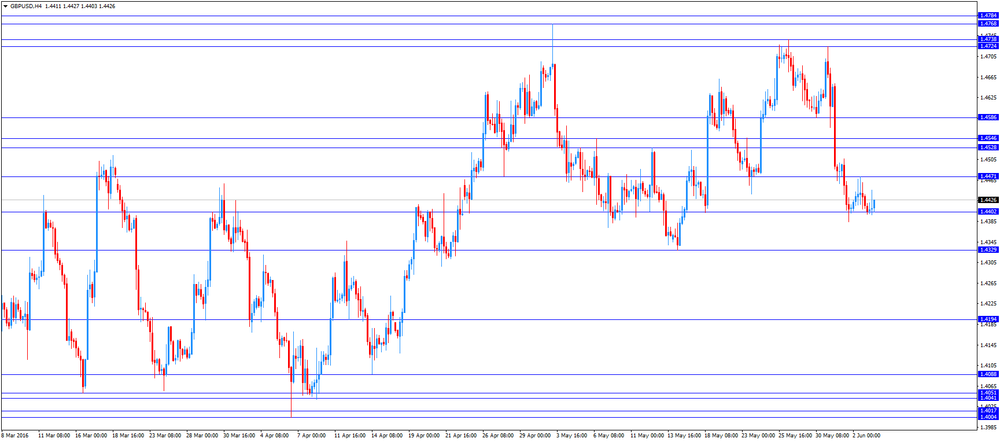

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y109.02

The most important news that are expected (GMT0):

12:30 Canada Labor Productivity Quarter I 0.1% 0.4%

12:30 Canada Trade balance, billions April -3.41 -2.45

12:30 U.S. Average workweek May 34.5 34.5

12:30 U.S. Average hourly earnings May 0.3% 0.2%

12:30 U.S. International Trade, bln April -40.44 -41.3

12:30 U.S. Unemployment Rate May 5% 4.9%

12:30 U.S. Nonfarm Payrolls May 160 164

13:45 U.S. Services PMI (Finally) May 52.8 51.2

14:00 U.S. Factory Orders April 1.5% 1.9%

14:00 U.S. ISM Non-Manufacturing May 55.7 55.5

16:30 U.S. FOMC Member Brainard Speaks

-

13:44

Orders

EUR/USD

Ордера на продажу: 1.1180 1.1200 1.1220-25 1.1250 1.1280-85 1.1300

Bids 1.1130 1.1100-10 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4450-55 1.4480 1.4495-505 1.4530 1.4550 1.4580 1.4600 1.4625-30 1.4650

Bids 1.4400 1.4385 1.4365 1.4350 14330 1.4300-10 1.4280 1.4250 1.4200

EUR/GBP

Offers 0.7750 0.7770 0.7785 0.7800-10 0.7830 0.7850

Bids 0.7720 0.7700 0.7670 0.7650 0.7630 0.7600

EUR/JPY

Offers 121.60 122.00 122.30 122.60 122.80 123.00 123.30 123.50 123.80 124.00

Bids 121.00 120.50 120.00 119.00

USD/JPY

Offers 108.85 109.00 109.20 109.50-60 109.80 110.00 110.20 110.50 110.80 111.00

Bids 108.50 108.00 107.80 107.50 107.20-25 107.00

AUD/USD

Offers 0.7260 0.7285 0.7300 0.7320-25 0.7350 0.7375-80 0.7400

Bids 0.7225 0.7200 0.7180-85 0.7150 0.7135 0.7100

-

13:09

WSE: Mid session comment

Rebound of falls on the Warsaw market gained momentum. Noticeable is also the demand for bank shares. In this context, the average increase of 1.6 percent on the WIG20 looks to be reinforced by market activity. The turnover on the WIG20 index in mid-session was amounted to PLN 375 mln. However we constantly have to remember, that the game in this phase of the session is an bet with reality, which appears after the US data. The Warsaw market now is ahead of the surroundings - the DAX rises by barely 0.6 percent, the CAC by 0.5 percent and futures on the S&P500 are at neutral level. Thus, the potential weakness of the core markets will be easy to move to the Warsaw market.

-

12:00

European stock markets mid session: stocks traded higher ahead of the release of the U.S. labour market data

Stock indices traded higher ahead of the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to decline to 4.9% in May from 5.0% in April. The U.S. economy is expected to add 162,000 jobs in May, after adding 160,000 jobs in April.

Market participants also eyed the economic data from the Eurozone. Eurostat released its retail sales data for the Eurozone on Friday. Retail sales in the Eurozone were flat in April, missing expectations for a 0.3% rise, after a 0.6% fall in March. March's figure was revised down from a 0.5% decrease.

Non-food sales were flat in April, food, drinks and tobacco sales increased 0.5%, while automotive fuel sales were down 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in April, missing forecasts of a 1.9% gain, after a 1.8% increase in March. March's figure was revised down from a 2.1% rise.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final services purchasing managers' index (PMI) rose to 53.3 in May from 53.1 in April, up from the preliminary reading of 53.2.

The increase was driven by rises in employment and input prices.

Eurozone's final composite output index increased to 53.1 in May from 53.0 in April, up from the preliminary reading of 52.9.

The increase was mainly driven by a rise in output.

"The final PMI numbers for May have come in slightly ahead of the earlier flash readings, but still point a Eurozone economy which seems unable to move out of low gear," Chief Economist at Markit Chris Williamson said.

"The survey data are signalling a GDP rise of 0.3% in the second quarter, suggesting the growth spurt seen at the start of the year will prove frustratingly short-lived," he added.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 53.5 in May from 52.3 in April, exceeding expectations for an increase to 52.5. The increase was driven by a faster growth in output. Employment continued to rise in May.

"The PMI surveys show that the pace of economic growth remained subdued in May, as 'Brexit' worries exacerbated existing headwinds. The data so far indicate that the second quarter is likely to see the economy grow by just 0.2%," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,239.74 +54.13 +0.88 %

DAX 10,253.37 +45.37 +0.44 %

CAC 40 4,484.55 +18.55 +0.42 %

-

11:51

Italy’s services PMI drops to 49.8 in May

Markit/ADACI's services purchasing managers' index (PMI) for Italy dropped to 49.8 in May from 52.1 in April.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by drops in output, new business and job creation, while input prices rose.

"The latest PMI data raise the likelihood of Italy's economic recovery slowing in the second quarter. Activity fell slightly across the vast service sector in May, which coincided with a slowdown in manufacturing output growth to a three-month low," an economist at Markit Phil Smith said.

-

11:47

Spain’s services PMI is up to 55.4 in May

Markit Economics released services purchasing managers' index (PMI) for Spain on Friday. Spain's services purchasing managers' index (PMI) was up to 55.4 in May from 55.1 in April.

The rise was driven by a faster growth in in new orders, output and input cost inflation.

"Following on from Wednesday's disappointing Spain manufacturing PMI numbers, the latest services data are something of a relief, with growth in activity and new business ticking up slightly," Senior Economist at Markit Andrew Harker said.

-

11:40

Germany's final services PMI increase to 55.2 in May

Markit Economics released final services purchasing managers' index (PMI) for Germany on Friday. Germany's final services purchasing managers' index (PMI) increased to 55.2 in May from 54.5 in April, in line with the preliminary reading.

The index was mainly driven by a faster growth in output.

"German service providers enjoyed another month of steady output growth in May, with the pace of expansion picking up since April. Moreover, it seems as if the German employment machine keeps humming, with companies continuing adding to their payrolls," an economist at Markit, Oliver Kolodseike, said.

-

11:34

Eurozone's final services PMI rises to 53.3 in May

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final services purchasing managers' index (PMI) rose to 53.3 in May from 53.1 in April, up from the preliminary reading of 53.2.

The increase was driven by rises in employment and input prices.

Eurozone's final composite output index increased to 53.1 in May from 53.0 in April, up from the preliminary reading of 52.9.

The increase was mainly driven by a rise in output.

"The final PMI numbers for May have come in slightly ahead of the earlier flash readings, but still point a Eurozone economy which seems unable to move out of low gear," Chief Economist at Markit Chris Williamson said.

"The survey data are signalling a GDP rise of 0.3% in the second quarter, suggesting the growth spurt seen at the start of the year will prove frustratingly short-lived," he added.

-

11:24

UK’s services PMI rises to 53.5 in May

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 53.5 in May from 52.3 in April, exceeding expectations for an increase to 52.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in output. Employment continued to rise in May.

"The PMI surveys show that the pace of economic growth remained subdued in May, as 'Brexit' worries exacerbated existing headwinds. The data so far indicate that the second quarter is likely to see the economy grow by just 0.2%," the Chief Economist at Markit Chris Williamson said.

-

11:13

Final Markit/Nikkei services purchasing managers' index for Japan increases to 50.4 in May

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan increased to 50.4 in May from 49.3 in April.

A reading below 50 indicates contraction of activity.

The increase was driven by a stronger rise in new orders.

"The service sector in Japan showed signs of improving mid-way through the second quarter of 2016. Both activity and new orders rose, albeit only marginally," economist at Markit, Amy Brownbill, said.

-

11:09

Eurozone’s retail sales are flat in April

Eurostat released its retail sales data for the Eurozone on Friday. Retail sales in the Eurozone were flat in April, missing expectations for a 0.3% rise, after a 0.6% fall in March. March's figure was revised down from a 0.5% decrease.

Non-food sales were flat in April, food, drinks and tobacco sales increased 0.5%, while automotive fuel sales were down 0.1%.

On a yearly basis, retail sales in the Eurozone climbed 1.4% in April, missing forecasts of a 1.9% gain, after a 1.8% increase in March. March's figure was revised down from a 2.1% rise.

Non-food sales gained 1.9% year-on-year in April, gasoline sales jumped 2.2%, while food, drinks and tobacco sales rose 0.8%.

-

11:02

Labour cash earnings in Japan rise 0.3% year-on-year in April

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Friday. Labour cash earnings in Japan rose 0.3% year-on-year in April, missing expectations for a 0.9% gain, after a 1.5% increase in March. March's figure was revised up from a 1.4% gain.

Contractual earnings rose 0.2% year-on-year in April, while special cash earnings gained 4.3%.

Total real wages climbed 0.6% in April, after a 1.6% rise in March.

-

11:00

Eurozone: Retail Sales (MoM), April 0.0% (forecast 0.3%)

-

11:00

Eurozone: Retail Sales (YoY), April 1.4% (forecast 1.9%)

-

10:47

Australian Industry Group’s services purchasing managers’ index for Australia rises to 51.5 in May

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Thursday evening. The index rose to 51.5 in May from 49.7 in April.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Three of the five activity sub-indexes were above 50 points in May. The increase was mainly driven by rises in new orders, sales and stock levels.

-

10:31

New OPEC secretary-general Mohammed Barkindo: oil market will rebalance starting from the fourth quarter to first/ second quarter of the next year

A former managing director of the Nigerian National Petroleum Corporation (NNPC), Mohammed Barkindo, was appointed the secretary-general of the Organisation of Petroleum Exporting Countries (OPEC) on Thursday. He replaced the Libyan Minister of Oil Abdalla El-Badri.

Barkindo said that the oil market would rebalance starting from the fourth quarter to first/ second quarter of the next year.

-

10:30

United Kingdom: Purchasing Manager Index Services, May 53.5 (forecast 52.5)

-

10:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.00 (USD 293m) 108.00 (434m) 108.70 (466m) 109.00 (1.07bln) 109.90-110.00 (563m) 110.50 (591m)

EUR/USD: 1.1000 (EUR 500m) 1.1100 (1.05bln) 1.1150 (398m) 1.1175 (318m) 1.1200 (1.03bln) 1.1250 (705m) 1.1300 (883m)

GBP/USD 1.4300 (GBP 190m) 1.4400 (287m) 1.4425 (250m) 1.4450 (181m)

AUD/USD 0.7100 (AUD 570m) 0.7170-75 (586m) 0.7200 (500m) 0.7250-55 (422m)

USD/CAD 1.2500 (USD 640m) 1.2800-10 (845m) 1.2850 (330m) 1.2900 (755m) 1.3000 (975m) 1.3050 (600m) 1.3100 (300m)

NZD/USD 0.6600 (NZD 394m)

AUD/NZD 1.0750 (AUD 350m)

-

10:20

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy increase to 43.2 in in the week ended May 29

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.2 in in the week ended May 29 from 42.0 the prior week.

The increase was driven by rises in all sub-indexes. The measure of views of the economy was up to 32.2 from 31.7, the buying climate index climbed to 40.1 from 38.9, while the personal finances index rose to 57.3 from 55.3.

-

10:11

Chinese Markit/Caixin services PMI declines to 51.2 in May

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China declined to 51.2 in May from 51.8 in April, missing expectations for a rise to 52.0.

The decline was mainly driven by a slower growth in new business and job creation.

"All of the index categories, with the exception of output prices, which remained stable, showed signs of deterioration," Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said.

-

10:01

Eurozone: Services PMI, May 53.3 (forecast 53.1)

-

09:55

Germany: Services PMI, May 55.2 (forecast 55.2)

-

09:51

France: Services PMI, May 51.6 (forecast 51.8)

-

09:21

WSE: After opening

WIG20 index opened at 1760.19 points (-0.12%)*

WIG 44809.53 0.08%

WIG30 1958.43 0.04%

mWIG40 3426.74 0.46%

*/ - change to previous close

Europe started the day from adjusting its valuations to yesterday's session on Wall Street. Modest pros in major indexes duplicate Thursday's rise in the US and will not be a surprise for the players in Warsaw, where the WIG20 adjust to the environment and sought increases. The turnover after the first exchanges looks interesting, so the market is no shortage of investors, but in striking contrast is the weakness of the banking sector, what moves the WIG20 on the red side. No growth means that the scenario of another wave of decline and descent of the WIG20 closer to area of 1,700 points has not been away yet.

-

08:28

Options levels on friday, June 3, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1302 (3894)

$1.1255 (3972)

$1.1214 (4766)

Price at time of writing this review: $1.1152

Support levels (open interest**, contracts):

$1.1120 (4040)

$1.1088 (5052)

$1.1046 (3229)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 74153 contracts, with the maximum number of contracts with strike price $1,1400 (5187);

- Overall open interest on the PUT options with the expiration date June, 3 is 85574 contracts, with the maximum number of contracts with strike price $1,1200 (7342);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from June, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.4700 (1991)

$1.4600 (2559)

$1.4501 (3023)

Price at time of writing this review: $1.4413

Support levels (open interest**, contracts):

$1.4299 (2543)

$1.4200 (3018)

$1.4100 (1486)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 33433 contracts, with the maximum number of contracts with strike price $1,4500 (3023);

- Overall open interest on the PUT options with the expiration date June, 3 is 35341 contracts, with the maximum number of contracts with strike price $1,4200 (3018);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from June, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:27

WSE: Before opening

Yesterday's session on Wall Street ended with a stroke of the S&P500 above the level of 2,100 points. Similarly shaped sessions were for the DJIA and the NASDAQ Composite, but the S&P500 finishing the day in the region of 2,105 points sent a signal that in the current phase the game has been going on for a confrontation with the resistance zone, which begins the from psychological barrier of 2,100 points, and ends at all-time record lying above 2,130 points.

Today will be announced the last one, before the June meeting of the FOMC, report of the US Department of Labor. Reading should help to answer the question of what the Fed will do on June 15. A highlight key of the day should be at 14:30 (Warsaw time). Good data will increase the likelihood of interest rate hikes in the US and will affect the trading of all assets.

As for the Warsaw market, the sensitivity of the WIG20 on the condition of the dollar is an element known since the beginning of the year, so the Warsaw Stock Exchange today would have to submit to the reactions of the world to what will be announced in the United States at 14:30.

-

08:23

Asian session: The dollar dropped to a two-week low against yen

The dollar dropped to a two-week low against its Japanese counterpart, though investors' caution ahead of the U.S. jobs report later in the session limited its losses.

Markets expect U.S. employment data due at 1230 GMT to show a non-farm payroll increase of about 164,000 and 0.2 percent rise in average wage earnings in May.

The data will be followed by a speech from Federal Reserve Chair Janet Yellen on Monday, the last chance for the Fed to communicate with markets before it begins a blackout period ahead of its policy meeting on June 14-15.

"If we see a job figure that is largely in line with market consensus and if Yellen maintains a positive tone on rate hikes, I think the chance of a rate hike in June is pretty high," said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

Currently U.S. money market futures are pricing in only about 20 percent chance of a hike in June and 60 percent by July.

In recent weeks global markets have been puzzling over what the Fed will do in the near term as relatively upbeat U.S. data have been eclipsed by a still-sluggish global economy and worries over the risk of Britain exiting the European Union.

"Markets are pricing in smaller chances of a hike partly because of worries about 'Brexit'. That is also something that could influence the Fed," Ichikawa added.

The uncertain global backdrop was underlined by the European Central Bank, which on Thursday predicted consumer price growth would remain below target through 2018 as it struggles with cheap energy feeding into the price of other goods and services.

The ECB kept its negative rates unchanged, with President Mario Draghi saying stimulus from previously approved and yet to be implemented measures were expected to work its way through the system.

The euro was little changed at $1.115 on Friday, after sliding from this week's high of $1.1221 touched early on Thursday.

Against the yen, it last stood at 121.38 after falling to a three-year low of 121.065 yen in the previous session.

The yen held steady at 108.915 per dollar, after hitting a two-week high of 108.525 on Thursday, a move some market players attributed to disappointment over a lack of a clear plan on stimulus from Japanese Prime Minister Shinzo Abe. It is poised for a gain of 1.3 percent for the week.

The yen tends to strengthen when there is bad news on the economy because it is often used as a funding currency for investment in higher-yielding riskier assets.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1145-50GBP / USD: during the Asian session, the pair was trading in the $ 1.4405-10

USD / JPY: during the Asian session, the pair is trading in the range of $ 108.50-109.15

Based on Reuters materials

-

07:09

Global Stocks

European blue-chip stocks managed a small gain Thursday after a up-and-down session.

Stocks vacillated amid a pair of important meetings from the European Central Bank, which issued its monetary policy statement and the Organization of the Petroleum Exporting Countries, which offered no new plans to stem a glut of crude oil that has dogged global markets.

The S&P 500 index and the Nasdaq Composite closed above their April highs Thursday, completing bullish technical patterns that suggest new uptrends have begun.

The two major stock market indexes joined the Russell 2000 Index RUT, +0.65% of small-capitalization stocks, which reached that threshold on Tuesday, and several other broad-market indexes that did the same Wednesday.

Asian shares advanced on Friday as investors looked to U.S. employment data that could add to or detract from the case for a Federal Reserve interest rate hike this month or in July.

MSCI's broadest index of Asia-Pacific shares outside Japan was up 0.4 percent, setting it up for a rise of 0.3 percent for the week. Japan's Nikkei gained 0.2 percent, paring losses for the week to 1.5 percent.

Chinese shares were mixed, with the CSI 300 index little changed, while the Shanghai Composite slipped 0.2 percent, putting both on track for weekly gains of about 3.5 percent.

Hong Kong's Hang Seng index climbed 0.3 percent, set for an advance of 1.7 percent for the week.

-

04:04

Nikkei 225 16,597.46 +34.91 +0.21 %, Hang Seng 20,967.88 +108.66 +0.52 %, Shanghai Composite 2,921.11 -4.12 -0.14 %

-

03:45

China: Markit/Caixin Services PMI, May 51.2 (forecast 52)

-

02:00

Japan: Labor Cash Earnings, YoY, April 0.9% (forecast 0.9%)

-

01:31

Australia: AIG Services Index, May 51.5

-

00:33

Commodities. Daily history for Jun 02’2016:

(raw materials / closing price /% change)

Oil 49.06 -0.22%

Gold 1,212.90 +0.02%

-

00:32

Stocks. Daily history for Jun 02’2016:

(index / closing price / change items /% change)

Nikkei 225 16,562.55 -393.18 -2.32 %

Hang Seng 20,859.22 +98.24 +0.47 %

S&P/ASX 200 5,278.89 -44.28 -0.83 %

Shanghai Composite 2,925.07 +11.56 +0.40 %

FTSE 100 6,185.61 -6.32 -0.10 %

CAC 40 4,466 -9.39 -0.21 %

Xetra DAX 10,208 +3.56 +0.03 %

S&P 500 2,105.26 +5.93 +0.28 %

NASDAQ Composite 4,971.36 +19.11 +0.39 %

Dow Jones 17,838.56 +48.89 +0.27 %

-

00:31

Currencies. Daily history for Jun 02’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1151 -0,30%

GBP/USD $1,4415 +0,03%

USD/CHF Chf0,9905 +0,23%

USD/JPY Y108,84 -0,56%

EUR/JPY Y121,37 -0,87%

GBP/JPY Y156,88 -0,55%

AUD/USD $0,7224 -0,37%

NZD/USD $0,6807 -0,10%

USD/CAD C$1,3095 +0,14%

-

00:01

Schedule for today, Friday, Jun 03’2016:

(time / country / index / period / previous value / forecast)

00:00 Japan Labor Cash Earnings, YoY April 1.4% 0.9%

01:45 China Markit/Caixin Services PMI May 51.8 52

07:50 France Services PMI (Finally) May 50.6 51.8

07:55 Germany Services PMI (Finally) May 54.5 55.2

08:00 Eurozone Services PMI (Finally) May 53.1 53.1

08:30 United Kingdom Purchasing Manager Index Services May 52.3 52.5

09:00 Eurozone Retail Sales (MoM) April -0.5% 0.3%

09:00 Eurozone Retail Sales (YoY) April 2.1% 1.9%

12:30 Canada Labor Productivity Quarter I 0.1% 0.4%

12:30 Canada Trade balance, billions April -3.41 -2.45

12:30 U.S. Average workweek May 34.5 34.5

12:30 U.S. Average hourly earnings May 0.3% 0.2%

12:30 U.S. International Trade, bln April -40.44 -41.3

12:30 U.S. Unemployment Rate May 5% 4.9%

12:30 U.S. Nonfarm Payrolls May 160 162

13:45 U.S. Services PMI (Finally) May 52.8 51.2

14:00 U.S. Factory Orders April 1.5% 1.9%

14:00 U.S. ISM Non-Manufacturing May 55.7 55.5

16:30 U.S. FOMC Member Brainard Speaks

-