Noticias del mercado

-

22:08

Major US stock indexes finished trading almost unchanged

Major US stock indexes closed near zero, as investors preferred not to take risks before the publication of the report on the number of jobs on Friday.

The decisive monthly data on the labor market will help investors assess the health of the economy and will give hints on when the Fed may raise interest rates to push.

In addition, as it became known today, the number of Americans who applied for unemployment benefits unexpectedly rose last week, but the trend still points to a healthy labor market. Primary applications for unemployment benefits rose by 3,000 and reached a seasonally adjusted 269,000 for the week ended July 30. The data for the previous week were not revised. Economists forecast that initial applications for unemployment benefits fall to 265,000 last week.

At the same time, factory orders in the US for the last month declined by less than expected. According to the report prepared by the US Census Bureau, the figure was -1.5% compared to -1.2% in the previous month. These data were revised downward to -1.0%.

Also, according to data published by the Employment Challenger, Gray & Christmas, it became known that at the end of July, employers fired 45.346 persons compared to 38.536 persons in June. In annual terms, the number of lay-offs decreased by 105.696 people. 359.100 contractions were recorded since the beginning of the year.

Most DOW components of the index showed an increase (16 of 30). Most remaining shares rose Visa Inc. (V, + 1.11%). Outsider were shares of The Walt Disney Company (DIS, -1.07%).

Sector S & P index finished the session mixed. The leader turned out to be the sector of consumer goods (+ 0.4%). conglomerates (-2.6%) sectors fell most.

At the close:

Dow -0.01% 18,352.33 -2.67

Nasdaq + 0.13% 5,166.25 +6.51

S & P + 0.02% 2,164.25 +0.46

-

21:00

DJIA -0.08% 18,339.93 -15.07 Nasdaq +0.14% 5,166.94 +7.20 S&P -0.01% 2,163.66 -0.13

-

18:57

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes little changed on Thursday as investors were wary of making big bets ahead of Friday's payrolls report. The crucial monthly hiring data will help investors gauge the health of the economy and offer clues about when the Federal Reserve could pull the trigger on rates.

Most of Dow stocks in positive area (17 of 30). Top gainer - Visa Inc. (V, +1.12%). Top looser - The Walt Disney Company (DIS, -1.14%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+0.5%). Top looser - Conglomerates (-2.7%).

At the moment:

Dow 18286.00 +17.00 +0.09%

S&P 500 2160.75 +3.75 +0.17%

Nasdaq 100 4739.75 +11.50 +0.24%

Oil 41.81 +0.98 +2.40%

Gold 1369.10 +4.40 +0.32%

U.S. 10yr 1.49 -0.05

-

18:00

European stocks closed: FTSE 100 +105.76 6740.16 +1.59% DAX +57.65 10227.86 +0.57% CAC 40 +24.55 4345.63 +0.57%

-

17:44

WSE: Session Results

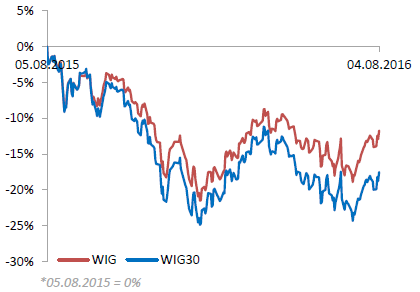

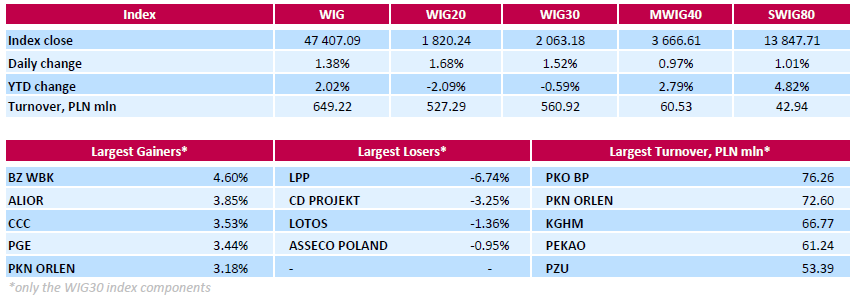

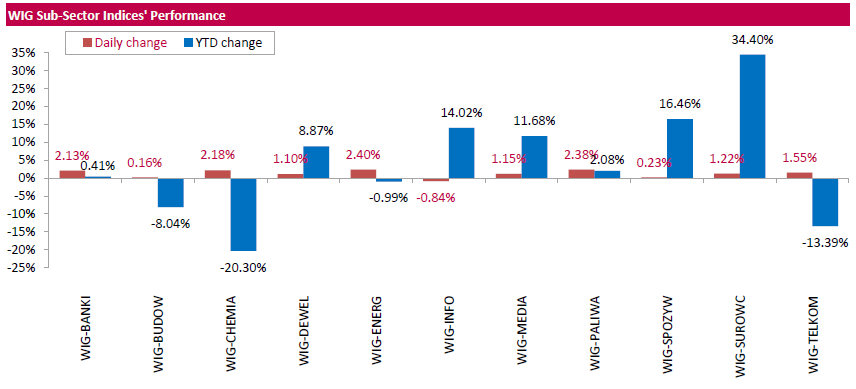

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, surged by 1.38%. All sectors, but for information technology (-0.84%), advanced, with utilities (+2.40%) outpacing.

The large-cap stocks grew by 1.52%, as measured by the WIG30 Index. The index constituents closed mainly higher, with the banks BZ WBK (WSE: BZW) and ALIOR (WSE: ALR) recording the biggest gains, up 4.6% and 3.85% respectively. Other major advancers were footwear retailer CCC (WSE: CCC), genco PGE (WSE: PGE), oil refiner PKN ORLEN (WSE: PKN) and chemical producer GRUPA AZOTY (WSE: ATT), which added between 3.12% and 3.53%. At the same time, clothing retailer LPP (WSE: LPP) led a handful of decliners with a 6.74% drop as the company posted Q2 profit of PLN 89 mln versus analysts' consensus estimate of PLN 98 mln. Other underperformers included videogame developer CD PROJEKT (WSE: CDR), oil refiner LOTOS (WSE: LTS) and IT-company ASSECO POLAND (WSE: ACP), which lost 3.25%, 1.36% and 0.95% respectively.

-

17:32

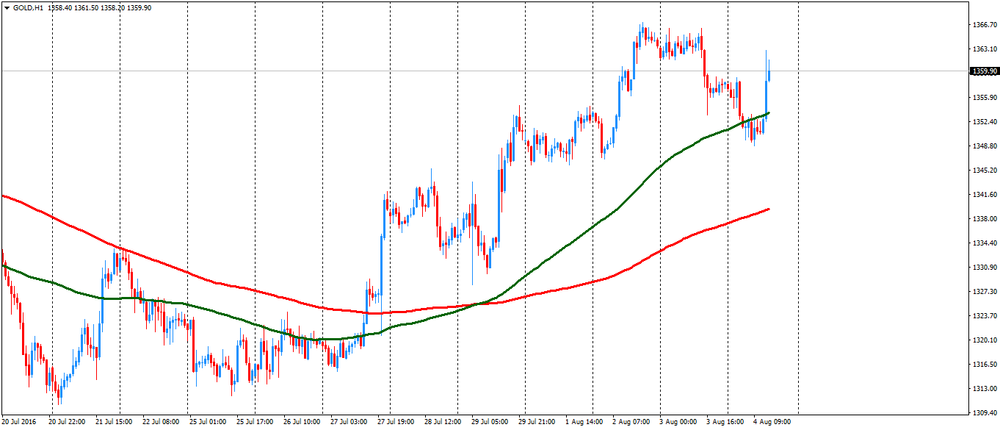

The price of gold has increased

The price of gold rose sharply against the background of the Bank of England's meeting, returning to three-week high. However, further price growth constrained by the strengthening dollar.

Recall, the Bank of England decided to reduce the key rate to 0.25% from 0.50%, and said that in September will start buying government and corporate bonds as part of an extensive program of measures designed to stimulate the British economy.

"Short-term and medium-term growth prospects have deteriorated markedly after Brexit," was noted in the statement of the Central Bank. The Bank also lowered its forecast for GDP growth next year to 0.8% from 2.3%. Bank of England expect to further reduce the key rate this year. This multilateral stimulus program indicates a strong concern for the leaders of the Bank of England over the economic outlook after the referendum. They stated that the economic growth will be 2.5 percentage points lower than they expected before the vote, reflecting a slowdown not only in the short term, but weaker growth as investment reduction.

Recall, gold becomes more attractive to investors than the profitable assets, when interest rates are falling.

"The revised expectations regarding the monetary policy of the USA, Japan, Euro-Zone countries and Britain played a major role in the growth of the price of gold so far this year, and we look forward to a continuation of this dynamic, - said Capital Economics analyst Simon Gambarini. - Monetary policy in the UK, the eurozone and Japan is likely to remain very accommodative, which should be positive for gold prices. "

Meanwhile, the gold reserves in the largest investment fund SPDR Gold Trust fell by 0.3 tonnes to 969.65 tonnes.

The cost of the August gold futures on the COMEX fell to $ 1361.10 per ounce.

-

16:41

US factory orders continued to decline in June

US factory orders last month declined by less than expected. This is confirmed by the official data released on Thursday.

According to the report prepared by the US Census Bureau, the indicator (seasonally adjusted) was -1.5% compared with -1.2% in the previous month (revised downward to -1.0%). Forecasts indicated a decline over the past month to -1.8%.

Factory orders excluding transportation rose 0.4% in June, while excluding defense goods decreased by 1.4%.

Orders for durable goods in June revised to -3.9% from -4.0%.

-

16:00

U.S.: Factory Orders , June -1.5% (forecast -1.8%)

-

15:57

The Czech central bank held its key interest rate steady

The Czech central bank held its key interest rate steady on Thursday, and reaffirmed its currency ceiling.

The Czech National Bank Board held the two-week repo rate at 0.05 percent, in line with economists' expectations. The discount rate was kept at 0.05 percent and the lombard rate at 0.25 percent.

The board also decided to continue using the exchange rate as an additional instrument for easing the monetary conditions.

Policymakers also reaffirmed the bank's commitment to intervene on the foreign exchange market, if needed, to weaken the koruna so that the exchange rate of the koruna against the euro is kept close to CZK 27/EUR.

"This exchange rate commitment is one-sided," the CNB said in a statement.

"This means the CNB will not allow the koruna to appreciate to levels it would no longer be possible to interpret as "close to CZK 27/EUR"."

In the previous session held late June, the bank had said that the exchange rate ceiling will not be discontinued before 2017 - via RTT.

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 865m) 1.1000 (285m) 1.1020 (256m) 1.1100 (1.25bln) 1.1150 (641m) 1.1185 (218m) 1.1200 (560m) 1.1245-50 (1.58bln)

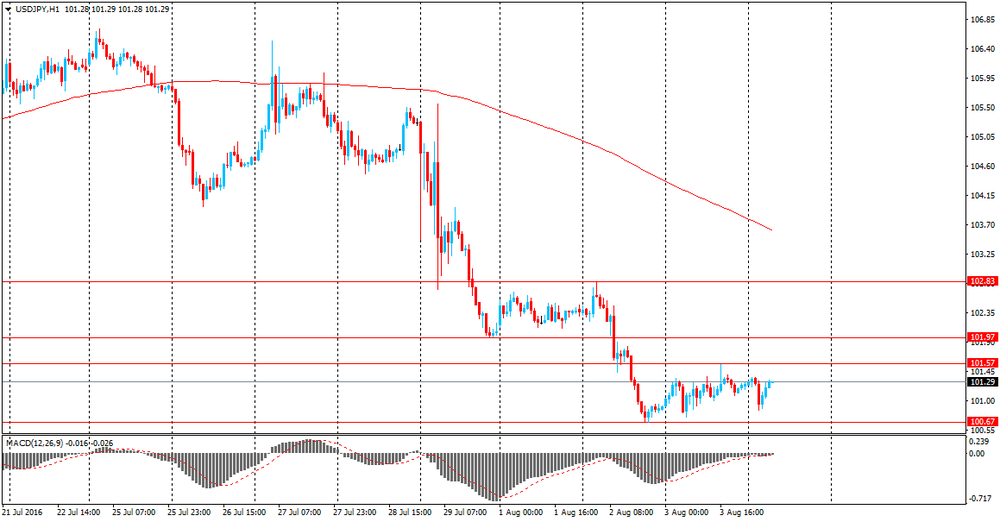

USD/JPY 100.00 (USD 645m) 101.00 (737m) 101.50 (720m) 101.75 (250m) 102.25-40 (550m) 103.00 (257m)

GBP/USD 1.3465 (GBP 350m) 1.3500 (362m)

AUD/USD 0.7490-95 (AUD 383m) 0.7511 (253m) 0.7530 (231m) 0.7550-60 (366m) 0.7565 (519m) 0.7650 (206m)

USD/CAD 1.3000-10 (USD 395m) 1.3070-75 (448m) 1.3450 (350m)

AUD/NZD 1.0420 (AUD 470m)

AUD/JPY 76.50 (AUD 364m)

-

15:44

WSE: After start on Wall Street

The Bank of England has taken a very aggressive actions today. As expected, lowered the rate to 0.25%, but at the same time said that if the economy is so weak, as shown by its forecast, that rates will still fall. Furthermore, the Bank increase the quantitative easing program by 60 billion pounds and introduces two new programs. The British pound after a series of information is weaken and stock markets react positively, but not euphoric.

The American market began with slight rise. Yesterday return of the S&P500 to the threshold of current variability may indicate that the risk of collapse is at least temporarily moved. We'll see today how the market will react, so that the demand could climb back to the highs or the market starts to slide in the direction of the Tuesday's hole.

On the Warsaw Stock Exchange, with some delay, but we have a new daily highs, which leads to make up for yesterday's losses.

-

15:33

U.S. Stocks open: Dow +0.15%, Nasdaq -0.02%, S&P +0.03%

-

15:19

Before the bell: S&P futures +0.12%, NASDAQ futures +0.02%

U.S. stock-index futures were little changed as investors awaited Friday's jobs report for clues on the strength of the economy and the Federal Reserve's next moves.

Global Stocks:

Nikkei 16,254.89 +171.78 +1.07%

Hang Seng 21,832.23 +93.11 +0.43%

Shanghai 2,982.65 +4.19 +0.14%

FTSE 6,718.7 +84.30 +1.27%

CAC 4,329.08 +8.00 +0.19%

DAX 10,210.77 +40.56 +0.40%

Crude $40.72 (-0.27%)

Gold $1368.00 (+0.24%)

-

14:47

US claims higher than the previous week

In the week ending July 30, the advance figure for seasonally adjusted initial claims was 269,000, an increase of 3,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 260,250, an increase of 3,750 from the previous week's unrevised average of 256,500.

There were no special factors impacting this week's initial claims. This marks 74 consecutive weeks of initial claims below 300,000, the longest streak since 1973

-

14:42

-

14:31

U.S.: Initial Jobless Claims, 269 (forecast 265)

-

14:31

U.S.: Continuing Jobless Claims, 2138 (forecast 2130)

-

13:50

Orders

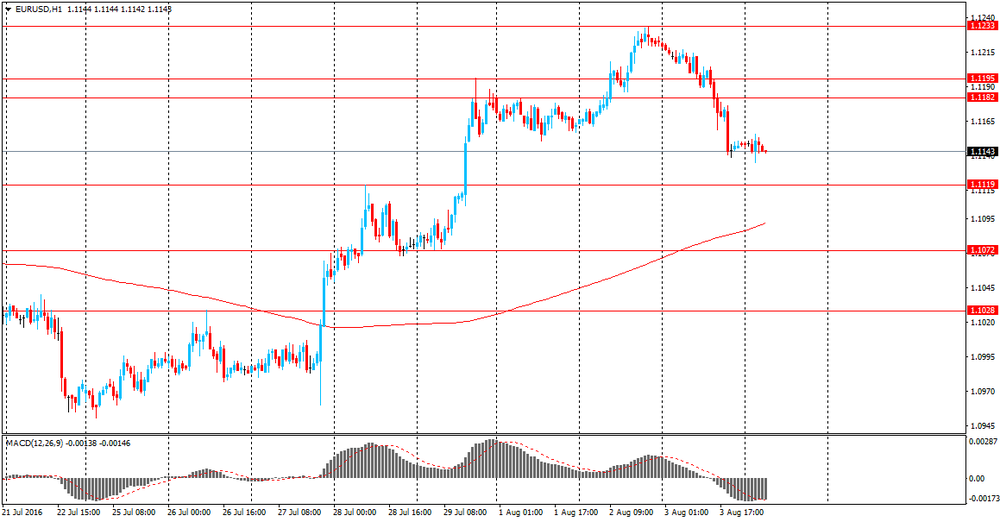

EUR/USD

Offers : 1.1160 1.1180 1.1200 1.1220 1.1230-35 1.1250 1.1280 1.1300-05

Bids: 1.1120 1.1100 1.1085 1.1050-55 1.1035 1.1000 1.0980 1.0960

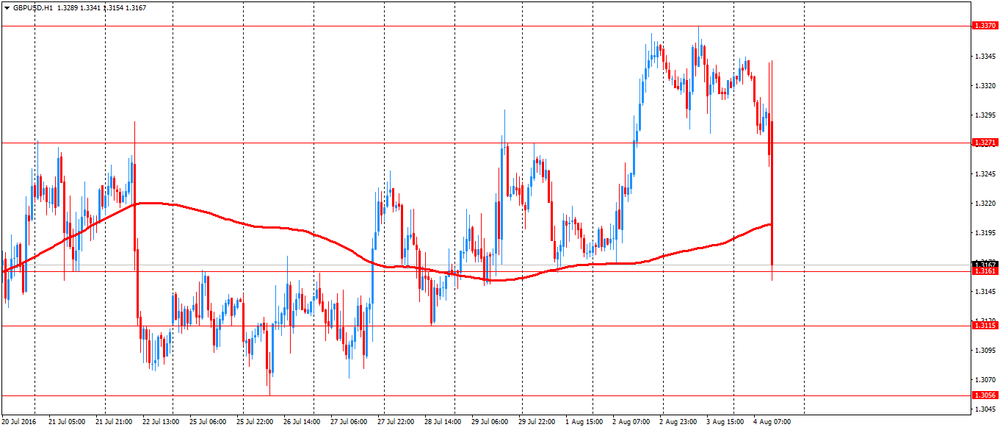

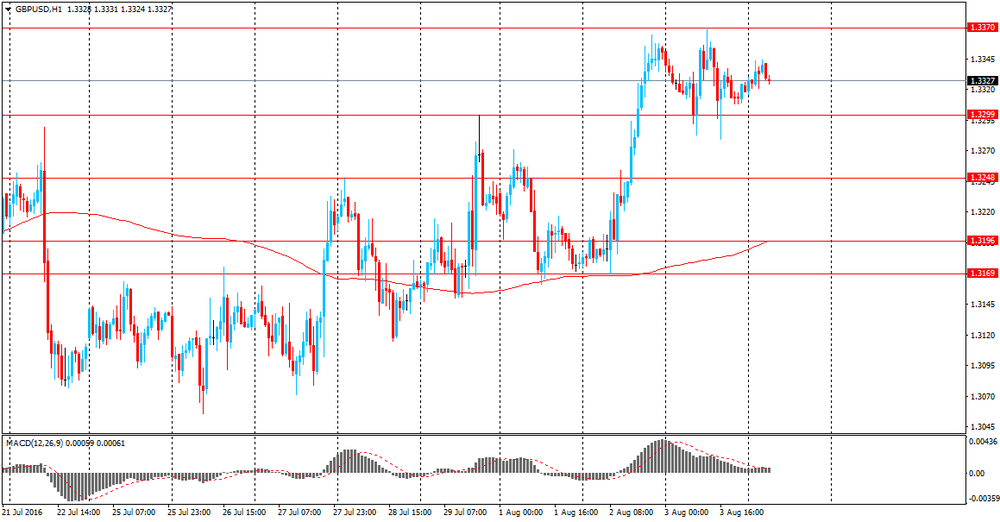

GBP/USD

Offers : 1.3330-35 1.3350 1.3370 1.3385 1.3400 1.3450 1.3470 1.3500

Bids: 1.3280 1.3265 1.3250 1.3230-35 1.3200 1.3170 1.3150 1.3130 1.3100 1.3085 1.3050 1.3000

EUR/GBP

Offers : 0.8385 0.8400 0.8425-30 0.8450-55 0.8485 0.8500 0.8525 0.8550

Bids: 0.8350 0.8330 0.8300 0.8285 0.8265 0.8250 0.8235 0.8200

EUR/JPY

Offers : 113.00 113.20 113.50 113.80 114.00 114.50 114.80 115.00

Bids: 112.50 112.00-10 111.50 111.00 110.80-85 110.50 110.00

USD/JPY

Offers : 101.75-80 102.00 102.30 102.50-55 102.75-80 103.00 103.30 103.50

Bids: 101.20 101.00 100.70-75 100.50 100.00 99.85 99.50 99.30 99.00

AUD/USD

Offers : 0.7620 O.7635 0.7650-55 0.7700 0.7720 0.7750

Bids: 0.7585 0.7565 0.7570 0.7550 0.7520 0.7500 0.7480-85 0.7450

-

13:36

Major stock indices in Europe show gains

Siemens Shares rose 3.5% as the German industrial company improved its full-year profit forecast for the second time this year.

BIC shares increased by 5.9%, as the manufacturer of stationery and shaver confirmed the financial forecast for 2016.

The market value of British insurer Aviva Plc rose 3.6% after the announcement of the company's profit growth in the 1st half of the year. In addition, Aviva raised its interim dividend.

The stock price of another British insurance company - RSA Insurance Group Plc - rose by 2.6%. Its results for the January-June exceeded own forecasts, RSA Insurance expects that 2016 will be a "year of great progress."

The price of Hikma Pharmaceuticals fell by 13% due to the expected decline in annual profit in the division for the production of generic drugs.

Shares of Merck fell 2.9% in Frankfurt trading, while the chemical and pharmaceutical group raised its revenue forecast for 2016 to 14,8-15 billion euro to 14,9-15,1 billion euros, as well as improved the estimate of profit. Merck adjusted earnings in the 2nd quarter jumped 19% to 1.55 euros per share, with a consensus forecast of 1.52 euros per share.

Nokia's shares have fallen by 4.9% after the network equipment maker reported a profit in the second quarter, lower than expected, and a drop in sales by 11% in annual terms.

At the moment:

FTSE 6642.36 7.96 0.12%

DAX 10251.03 80.82 0.79%

CAC 4337.26 16.18 0.37%

-

13:32

-

13:16

Bank of England: all members of the Committee agreed that policy stimulus was warranted at this time

- most MPC members likely to back further rate cut to near zero in 2016 if incoming data in line with forecast

- All members of the Committee agreed that policy stimulus was warranted at this time, and that Bank Rate should be reduced to 0.25% and be supported by a TFS.

- Eight members supported the introduction of a corporate bond scheme, and six members supported further purchases of UK government bonds

- weaker outlook reflects expectation of big-near term falls in business and housing investment

- "likely to see little growth in H2 2016 " but does not forecast recession

*via forexlive

-

13:02

Bank of England cuts rates to 0.25% and adds 70 bln of QE

-

13:01

WSE: Mid session comment

The first half of today's session passed relatively peacefully. Turnover are not particularly high, and in the segment of blue chips reach PLN 160 mln. Initial increases stopped after a slight breach of the level of 1,800 points by the WIG20 index. In the environment we may also see apparent difficulty with enlargement of initial achievements.

Western Europe exchanges are dominated by increases today, although on a different scale. On the main stock exchanges in Paris and Frankfurt increases are 0.3% and 0.6%. It is better in southern Europe, as in Rome and Madrid increases reach 1%.

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

13:00

United Kingdom: Asset Purchase Facility, 435 (forecast 375)

-

12:01

The EU imposed anti-dumping duties on cold-rolled steel from Russia and China

The European Commission imposed anti-dumping duties on cold-rolled steel from Russia and China for a period of five years. This is stated in a report published today in the Official Journal of the EU.

The corresponding decision was the result of anti-dumping investigation, which was launched May 14, 2015 and served as the complaint filed by the European steel producers association (Eurofer) on behalf of producers representing more than 25% of the total output of cold-rolled sheet steel, the document says.

Earlier, in the first quarter of 2016 the EU has already introduced a fee of 20-26% for cold-rolled steel from Russia.

In addition, in July it became known that the EU is starting an anti-dumping investigation against Russian hot-rolled steel. The investigation in respect of hot-rolled steel exports from Russia to the EU in the period from July 2015 to June 2016 will last 15 months. The European Steel Association (Eurofer) complained that the five countries, including Russia, have increased supply of hot-rolled steel in the EU. Russia annually supplies to the EU about 2 million tons of hot-rolled steel.

-

11:35

EU retail PMI improved a bit

Latest Markit Eurozone Retail PMI® survey data showed the continuation of contrasting trends in sales performance across the bloc's big-three retail sectors, with a further sharp drop in sales in Italy offsetting steady growth across Germany and France.

At 48.9 in July, the headline Markit Eurozone Retail PMI - which tracks month-on-month changes in likefor-like retail sales in the bloc's biggest three economies combined - was below the neutral 50.0 mark for the fourth time in the past five months in July, signalling a further, albeit slightly slower (48.5 in June), drop in sales.

Measured on an annual basis, the rate of decline was slightly faster than that recorded in June. Phil Smith, economist at Markit which compiles the Eurozone Retail PMI survey, said: "While German and French retailers are enjoying periods of steady sales growth, their counterparts in Italy have endured back-to-back steep decreases in sales of the likes not seen for over two-and-a-half years.

However, survey evidence points to the tentative renaissance in the French retail sector being supported by the widespread use of promotional offers, which was reflected in a notable deterioration in gross margins. Germany remains the brightest light, with sales rising for the sixth month running and up sharply on a year-on-year basis."

-

10:30

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 865m) 1.1000 (285m) 1.1020 (256m) 1.1100 (1.25bln) 1.1150 (641m) 1.1185 (218m) 1.1200 (560m) 1.1245-50 (1.58bln)

USD/JPY 100.00 (USD 645m) 101.00 (737m) 101.50 (720m) 101.75 (250m) 102.25-40 (550m) 103.00 (257m)

GBP/USD 1.3465 (GBP 350m) 1.3500 (362m)

AUD/USD 0.7490-95 (AUD 383m) 0.7511 (253m) 0.7530 (231m) 0.7550-60 (366m) 0.7565 (519m) 0.7650 (206m)

USD/CAD 1.3000-10 (USD 395m) 1.3070-75 (448m) 1.3450 (350m)

AUD/NZD 1.0420 (AUD 470m)

AUD/JPY 76.50 (AUD 364m)

-

10:18

ECB update of economic and monetary developments

-

incoming data for Q2 point to subdued global activity and trade

-

risks to outlook for global activity and EMs in particular remain on downside

-

Eurozone markets have weathered post-Brexit uncertainty and volatility with encouraging resilience

-

EZ economic recovery expected to proceed at moderate pace

-

if warranted the ECB gov council will act by using all available instruments

* via forexlive -

-

10:16

Oil is trading mixed

This morning, New York futures rose by + 0.29% for WTI crude oil to $ 40.92 and Brent oil futures were down -0.02% to $ 43.09 per barrel. Thus the black gold continues to recovery, after rising against the background of a significant decline in gasoline stocks in the United States and a significant weakening of the dollar since the end of July. Also, according to the Ministry of Energy, US crude stocks for the week increased by 1.41 million barrels, while traders expected a reduction of 900 th barrels. But gasoline inventories in the US, fell by 3.26 million barrels. At the same time, oil production in the US decreased by 55 th barrels per day, due to reduced production in Alaska. In the remaining 48 states theindex remained at the same level. Utilization of refineries and the volume of oil imports increased.

-

09:29

Today’s events:

At 08:00 GMT, the Economic Bulletin of the ECB

At 10:15 GMT FOMC member Robert Kaplan will deliver a speech

At 11:00 GMT interest rate decision of the Bank of England and the Bank of England report on inflation

At 11:30 GMT the Bank of England Governor Mark Carney will deliver a speech

-

09:28

Major stock exchanges began trading mixed: the FTSE 100 6,639.74-5.66-0.09%, DAX 10,248.19 + 77.98 + 0.77%

-

09:13

WSE: After opening

WIG20 index opened at 1791.12 points (+0.06%)*

WIG 46931.66 0.36%

WIG30 2041.44 0.45%

mWIG40 3637.23 0.16%

*/ - change to previous close

The cash market opens from rise of 0.06% to 1,791 points, with little activity where the highest turnover in the market generate shares of Action. Surrounded the DAX gained about substantial 0.75%, what slightly supports the Warsaw Stock Exchange and may allow to reflect the surrounding of psychological level of 1,800 points. The mood seems to be good.

-

09:06

Asian session review: the pound declined

The markets are waiting for the Bank of England interest rate decision and the volume of purchases of software assets. Most economists polled by to Reuters, expect that today the Bank of England to cut rates by at least 25 basis points to a new record low of 0.25 percent. Recall, the UK central bank rate has not changed since the beginning of 2009. However, 17 of the 36 experts said that the program of quantitative easing (QE), which was suspended in 2012, will also be restarted today.

The yen rose slightly after the comments of the deputy head of the Bank of Japan Kiku Iwata that the Bank of Japan does not have a predetermined course of monetary policy. However, during the trading session the Japanese currency fell, reaching yesterday's low.

"We do not have any specific advance the future course of monetary policy", - said Mr. Iwata and added - "the Bank of Japan Politics and government - is not the same thing as" helicopter money". Mr. Iwata also noted that at the September meeting the evaluation of the monetary will be made from a variety of perspectives.

The US dollar traded in a narrow range after yesterday significantly rise against the euro. Some investors believe that Friday's employment data will be strong, so that the Federal Reserve in the next few months will be able to produce a rise in interest rates. Today futures on interest rates Fed suggest a 18% probability of rate hikes in September and 39% probability to increase rates in December.

The Australian dollar rose after data on retail sales in Australia in June. As reported today, the Australian Bureau of Statistics, retail sales rose in June by 0.1%, which is below analysts' expectations of 0.3% and the previous value of 0.2%. In the second quarter, this indicator grew by 0.4%, while analysts had expected an increase of 0.5%. The volume of retail sales - an indicator that assesses the total volume of retail sales through retail outlets of various types and sizes shown on the basis of a representative sample. It is considered an indicator of the rate of growth of the Australian economy.

According to the Bureau of Statistics, the main reason for the decline in retail sales is the cold weather, which was observed in Australia in recent years.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1130-40 range

GBP / USD: during the Asian session, the pair is trading in the $ 1.3285 range.

USD / JPY: during the Asian session, the pair was trading in Y100.85 - 101.55 range.

-

08:27

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.1%, FTSE + 0.2%

-

08:26

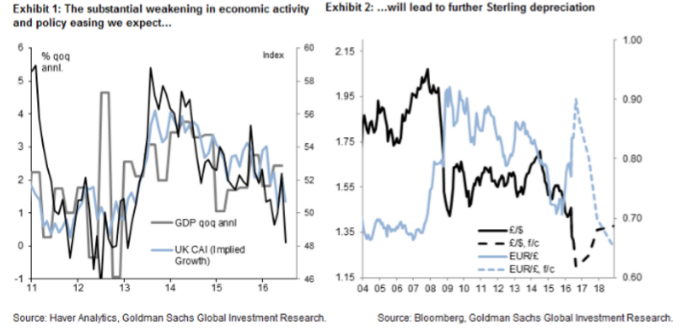

GBP Ahead Of 'A Very Dovish' BoE: 3 Things To Expect - Goldman Sachs

This week, the focus is on the Bank of England's policy meeting and on Sterling's reaction to the announcement of what we expect to be a substantial easing package.

Ahead of a substantial easing package from the BoE: Our UK economist Andrew Benito expects: (i) a 25bp cut to Bank Rate, with a 30% probability that the BoE cuts Bank Rate by 40bp, (ii) the announcement of £100bn of purchases of government and corporate bonds, distributed over a period of 6-months, and (iii) a very dovish MPC significantly downgrading UK growth and providing forward guidance on the future path of policy.

While the rate cut is fully discounted in the forwards, we think there is scope for the currency to weaken as the other elements of the policy package are announced and the BoE updates the economic and inflation outlook. An expansion of the asset purchase facility by £100bn, approximately equal to 10% of UK GDP on an annualised basis, would be a sizeable surprise relative to market consensus, which we estimate at around £50-75bn. While Sterling shorts are sizeable - a potential source of vulnerability to our view - we have showed that speculative positioning for the Pound historically has been a leading (not a contrarian) signal.

We expect more weakness in Sterling...: Sterling fell by about 11% in trade-weighted terms right after the vote on EU membership. But, contrary to our view of further weakness, the Pound has traded in a narrow range since the new government has been in office. Over the next 3- to 12-months, we are comfortable with our view that the slowdown in economic activity will drive the currency lower(we forecast £/$ at 1.20 and 1.25 and EUR/£ at 0.9 and 0.80 in 3- and 12-months, respectively).

Copyright © 2016 Goldman Sachs, eFXnews™

-

08:23

Australian retail sales below forecasts in June

The trend estimate rose 0.2% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.2% in April 2016.

The seasonally adjusted estimate rose 0.1% in June 2016. This follows a rise of 0.2% in May 2016 and a rise of 0.1% in April 2016.

In trend terms, Australian turnover rose 3.1% in June 2016 compared with June 2015.

The following industries rose in trend terms in June 2016: Other retailing (0.5%), Cafes, restaurants and takeaway food services (0.4%), Clothing, footwear and personal accessory retailing (0.5%) and Department stores (0.1%). Food retailing (0.0%) and Household goods retailing (0.0%) were relatively unchanged in trend terms in June 2016.

The following states and territories rose in trend terms in June 2016: New South Wales (0.3%), Victoria (0.2%), South Australia (0.3%), Western Australia (0.1%) and Tasmania (0.3%). Queensland (0.0%) was relatively unchanged. The Northern Territory (-0.4%) and the Australian Capital Territory (-0.2%) fell in trend terms in June 2016.

-

08:20

Swiss consumer sentiment remains subdued

Consumer sentiment remained unchanged between April and July 2016 and is now below the long-term average for the fifth quarter in a row. Most sub-indices also saw no major change, except regarding inflation, with the 1,200 or so individuals questioned expecting prices to rise more sharply over the next twelve months than they had in April. There was also a belief in July that prices had been rising faster over the previous twelve months than had been the case at the time of the April survey. Nevertheless, both indices remain well below the corresponding average.

The Swiss consumer sentiment index has languished below the long-term average of -9 points since the survey undertaken in July 2015. It saw no change between April and July 2016, sticking at -15 points.

-

08:19

WSE: Before opening

Wednesday's session on the New York stock markets ended with slight increases in the major indexes, mainly due to increases in oil prices. The S&P500 rose by 0.31 per cent. Apparently investors refrain in decisions in anticipation of the Friday's release of data from the labor market. If the report will contain strong data this could provoke a strong sell-off on markets as increase the likelihood of interest rate hikes by the Fed. On the Asian parquets moods are balanced, but dominated by small increases. The Nikkei index going up of about 1 per cent.

This should lead to a peaceful early trading in Europe, with the possibility of expansion yesterday initiated approach. European investors in a good mood may wait for the decision of the BoE and count to cut interest rates by 25 basis points and the ability to use other measures to support growth after Brexit.

On the Warsaw market, yesterday's session showed that Tuesday's optimism was somewhat exaggerated, moreover, have confirmed what many analysts suggest, that the topic of conversion of foreign currency loans does not disappear, but only changes form.

A strong echo still reflected a matter of capital increases of PGE, what have adverse effect on minority shareholders. Investors pledge if facing budgetary challenges other companies will not follow a similar path.

-

08:18

Options levels on thursday, August 4, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1259 (2710)

$1.1223 (3462)

$1.1183 (1999)

Price at time of writing this review: $1.1140

Support levels (open interest**, contracts):

$1.1084 (3029)

$1.1041 (3238)

$1.0995 (5195)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 38795 contracts, with the maximum number of contracts with strike price $1,1300 (3732);

- Overall open interest on the PUT options with the expiration date August, 5 is 51512 contracts, with the maximum number of contracts with strike price $1,0900 (5581);

- The ratio of PUT/CALL was 1.33 versus 1.33 from the previous trading day according to data from August, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.3601 (1557)

$1.3503 (2096)

$1.3406 (2127)

Price at time of writing this review: $1.3303

Support levels (open interest**, contracts):

$1.3196 (703)

$1.3098 (2671)

$1.2999 (1951)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 29027 contracts, with the maximum number of contracts with strike price $1,3400 (2127);

- Overall open interest on the PUT options with the expiration date August, 5 is 27566 contracts, with the maximum number of contracts with strike price $1,2950 (3077);

- The ratio of PUT/CALL was 0.95 versus 0.94 from the previous trading day according to data from August, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:15

Global Stocks

European stocks closed in negative territory Tuesday as bank shares came under pressure, leading the way lower.

The Stoxx Europe 600 SXXP, -1.29% fell 1.3% to end at 335.47.

Among banks, shares of Commerzbank AG CBK, -8.40% sank 9.2% as the German lender warned it won't hit its target of stable net profit for the full year.

Meanwhile, Italy's Banca Monte dei Paschi di Siena BMPS, -16.10% lost 16%. The shares had rallied during Monday's session after the bank's board late Friday approved a privately backed rescue plan for nonperforming loans at the embattled bank.

But BMPS still fared the worst among the 51 banks in the European Banking Authority's stress tests, released late Friday. The Italian banking sector was highlighted as one of the weaker spots in Europe's financial landscape.

U.S. stocks bounced off session lows but still closed lower Tuesday, marking the seventh straight daily loss for the Dow industrials and ending a five-day win streak for the Nasdaq, as investors sifted through quarterly results as well as data on personal income and inflation.

The Dow Jones Industrial Average DJIA, -0.49% fell as much as 157 points but ended with a decline of 90.74 points, or 0.5%, at 18,313.77/

The S&P 500 Index SPX, -0.64% settled with a loss of 13.81 points, or 0.6%, at 2,157.03, paring an earlier 23-point decline, with nine out of 10 main sectors trading lower, led by the consumer-discretionary and industrial sectors.

The Nasdaq Composite Index COMP, -0.90% took the worst of the fall, dropping 46.46 points, or 0.9% to finish at 5,137.73/

Asian shares bowed lower on Wednesday while the yen lorded over a weakened U.S dollar as talk the Bank of Japan may retreat from its massive bond-buying campaign twigged a shakeout in debt markets globally.

Worryingly for energy shares, the broad-based decline in the dollar was still not enough to spare U.S. crude oil from its first finish under $40 a barrel since April.

Japan's Nikkei .N225 lost 1.4 percent as the rising yen pressured exporter stocks while financials slid 2.7 percent.

The sharpest moves were in sovereign bond markets where a sudden spike in yields stirred speculation that a multi-year bull run in prices might finally be nearing its end.

Japanese bonds have suffered their worst sell-off in more than three years as investors feared the BoJ was out of easing ammunition and might leave it to fiscal policy to stimulate the economy.

Brent crude LCOc1 was near four-month lows on Wednesday at $41.86 a barrel. NYMEX crude CLc1 edged up 15 cents but at $39.66 was still under the psychological $40 level.

-

03:30

Australia: Retail Sales, M/M, June 0.1% (forecast 0.4%)

-

00:34

Commodities. Daily history for Aug 03’2016:

(raw materials / closing price /% change)

Oil 41.17 +0.83%

Gold 1,364.50 -0.01%

-

00:33

Stocks. Daily history for Aug 03’2016:

(index / closing price / change items /% change)

Nikkei 225 16,083.11 -308.340 -1.88%

Shanghai Composite 2,979.17 +7.89 +0.27%

S&P/ASX 200 5,465.72 -74.821 -1.35%

FTSE 100 6,634.4 -11.00 -0.17%

CAC 40 4,321.08 -6.91 -0.16%

Xetra DAX 10,170.21 +25.87 +0.26%

S&P 500 2,163.79 +6.76 +0.31%

Dow Jones 18,355 +41.23 +0.23%

S&P/TSX Composite 14,512.05 +35.04 +0.24%

-

00:32

Currencies. Daily history for Aug 03’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1148 -0,66%

GBP/USD $1,3318 -0,24%

USD/CHF Chf0,963 -0,15%

USD/JPY Y101,25 +0,34%

EUR/JPY Y112,88 -0,32%

GBP/JPY Y134,84 +0,09%

AUD/USD $0,7584 -0,25%

NZD/USD $0,7151 -1,17%

USD/CAD C$1,3073 -0,24%

-

00:02

Schedule for today, Thursday, Aug 04’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Retail Sales, M/M June 0.2% 0.4%

08:00 Eurozone ECB Economic Bulletin

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.25%

11:00 United Kingdom Bank of England Minutes

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BOE Inflation Letter

11:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Continuing Jobless Claims 2139 2130

12:30 U.S. Initial Jobless Claims 266 265

14:00 U.S. Factory Orders June -1% -1.8%

23:30 Australia AiG Performance of Construction Index July 53.2

-