Noticias del mercado

-

22:08

Major US stock indexes finished trading almost unchanged

Major US stock indexes closed near zero, as investors preferred not to take risks before the publication of the report on the number of jobs on Friday.

The decisive monthly data on the labor market will help investors assess the health of the economy and will give hints on when the Fed may raise interest rates to push.

In addition, as it became known today, the number of Americans who applied for unemployment benefits unexpectedly rose last week, but the trend still points to a healthy labor market. Primary applications for unemployment benefits rose by 3,000 and reached a seasonally adjusted 269,000 for the week ended July 30. The data for the previous week were not revised. Economists forecast that initial applications for unemployment benefits fall to 265,000 last week.

At the same time, factory orders in the US for the last month declined by less than expected. According to the report prepared by the US Census Bureau, the figure was -1.5% compared to -1.2% in the previous month. These data were revised downward to -1.0%.

Also, according to data published by the Employment Challenger, Gray & Christmas, it became known that at the end of July, employers fired 45.346 persons compared to 38.536 persons in June. In annual terms, the number of lay-offs decreased by 105.696 people. 359.100 contractions were recorded since the beginning of the year.

Most DOW components of the index showed an increase (16 of 30). Most remaining shares rose Visa Inc. (V, + 1.11%). Outsider were shares of The Walt Disney Company (DIS, -1.07%).

Sector S & P index finished the session mixed. The leader turned out to be the sector of consumer goods (+ 0.4%). conglomerates (-2.6%) sectors fell most.

At the close:

Dow -0.01% 18,352.33 -2.67

Nasdaq + 0.13% 5,166.25 +6.51

S & P + 0.02% 2,164.25 +0.46

-

21:00

DJIA -0.08% 18,339.93 -15.07 Nasdaq +0.14% 5,166.94 +7.20 S&P -0.01% 2,163.66 -0.13

-

18:57

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes little changed on Thursday as investors were wary of making big bets ahead of Friday's payrolls report. The crucial monthly hiring data will help investors gauge the health of the economy and offer clues about when the Federal Reserve could pull the trigger on rates.

Most of Dow stocks in positive area (17 of 30). Top gainer - Visa Inc. (V, +1.12%). Top looser - The Walt Disney Company (DIS, -1.14%).

Most of S&P sectors also in positive area. Top gainer - Basic Materials (+0.5%). Top looser - Conglomerates (-2.7%).

At the moment:

Dow 18286.00 +17.00 +0.09%

S&P 500 2160.75 +3.75 +0.17%

Nasdaq 100 4739.75 +11.50 +0.24%

Oil 41.81 +0.98 +2.40%

Gold 1369.10 +4.40 +0.32%

U.S. 10yr 1.49 -0.05

-

18:00

European stocks closed: FTSE 100 +105.76 6740.16 +1.59% DAX +57.65 10227.86 +0.57% CAC 40 +24.55 4345.63 +0.57%

-

17:44

WSE: Session Results

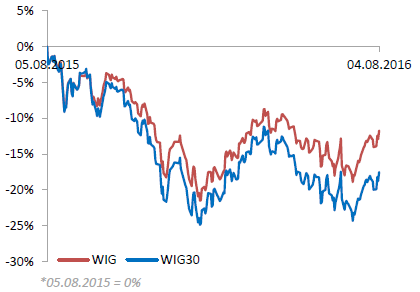

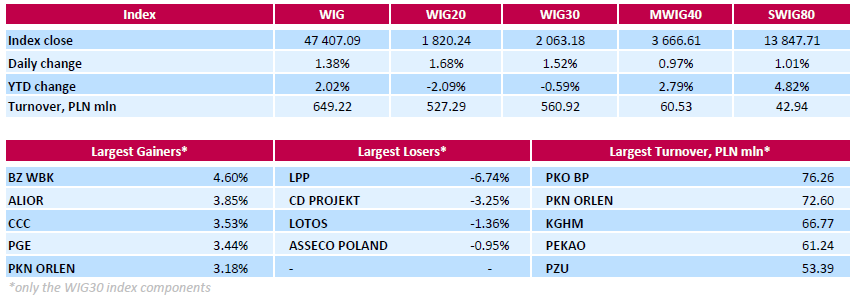

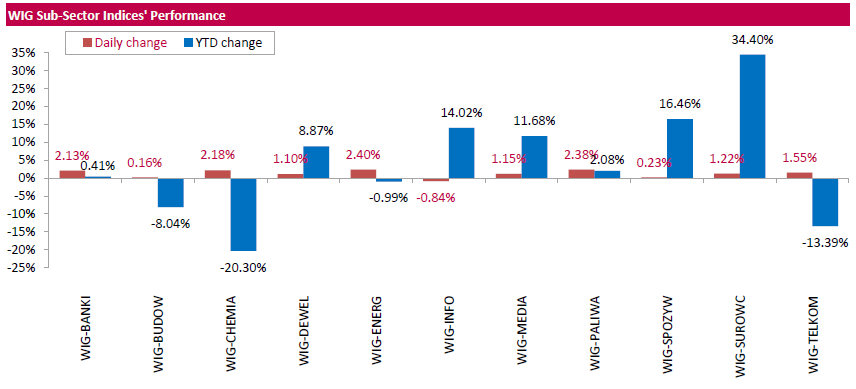

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, surged by 1.38%. All sectors, but for information technology (-0.84%), advanced, with utilities (+2.40%) outpacing.

The large-cap stocks grew by 1.52%, as measured by the WIG30 Index. The index constituents closed mainly higher, with the banks BZ WBK (WSE: BZW) and ALIOR (WSE: ALR) recording the biggest gains, up 4.6% and 3.85% respectively. Other major advancers were footwear retailer CCC (WSE: CCC), genco PGE (WSE: PGE), oil refiner PKN ORLEN (WSE: PKN) and chemical producer GRUPA AZOTY (WSE: ATT), which added between 3.12% and 3.53%. At the same time, clothing retailer LPP (WSE: LPP) led a handful of decliners with a 6.74% drop as the company posted Q2 profit of PLN 89 mln versus analysts' consensus estimate of PLN 98 mln. Other underperformers included videogame developer CD PROJEKT (WSE: CDR), oil refiner LOTOS (WSE: LTS) and IT-company ASSECO POLAND (WSE: ACP), which lost 3.25%, 1.36% and 0.95% respectively.

-

15:44

WSE: After start on Wall Street

The Bank of England has taken a very aggressive actions today. As expected, lowered the rate to 0.25%, but at the same time said that if the economy is so weak, as shown by its forecast, that rates will still fall. Furthermore, the Bank increase the quantitative easing program by 60 billion pounds and introduces two new programs. The British pound after a series of information is weaken and stock markets react positively, but not euphoric.

The American market began with slight rise. Yesterday return of the S&P500 to the threshold of current variability may indicate that the risk of collapse is at least temporarily moved. We'll see today how the market will react, so that the demand could climb back to the highs or the market starts to slide in the direction of the Tuesday's hole.

On the Warsaw Stock Exchange, with some delay, but we have a new daily highs, which leads to make up for yesterday's losses.

-

15:33

U.S. Stocks open: Dow +0.15%, Nasdaq -0.02%, S&P +0.03%

-

15:19

Before the bell: S&P futures +0.12%, NASDAQ futures +0.02%

U.S. stock-index futures were little changed as investors awaited Friday's jobs report for clues on the strength of the economy and the Federal Reserve's next moves.

Global Stocks:

Nikkei 16,254.89 +171.78 +1.07%

Hang Seng 21,832.23 +93.11 +0.43%

Shanghai 2,982.65 +4.19 +0.14%

FTSE 6,718.7 +84.30 +1.27%

CAC 4,329.08 +8.00 +0.19%

DAX 10,210.77 +40.56 +0.40%

Crude $40.72 (-0.27%)

Gold $1368.00 (+0.24%)

-

13:01

WSE: Mid session comment

The first half of today's session passed relatively peacefully. Turnover are not particularly high, and in the segment of blue chips reach PLN 160 mln. Initial increases stopped after a slight breach of the level of 1,800 points by the WIG20 index. In the environment we may also see apparent difficulty with enlargement of initial achievements.

Western Europe exchanges are dominated by increases today, although on a different scale. On the main stock exchanges in Paris and Frankfurt increases are 0.3% and 0.6%. It is better in southern Europe, as in Rome and Madrid increases reach 1%.

-

09:28

Major stock exchanges began trading mixed: the FTSE 100 6,639.74-5.66-0.09%, DAX 10,248.19 + 77.98 + 0.77%

-

09:13

WSE: After opening

WIG20 index opened at 1791.12 points (+0.06%)*

WIG 46931.66 0.36%

WIG30 2041.44 0.45%

mWIG40 3637.23 0.16%

*/ - change to previous close

The cash market opens from rise of 0.06% to 1,791 points, with little activity where the highest turnover in the market generate shares of Action. Surrounded the DAX gained about substantial 0.75%, what slightly supports the Warsaw Stock Exchange and may allow to reflect the surrounding of psychological level of 1,800 points. The mood seems to be good.

-

08:19

WSE: Before opening

Wednesday's session on the New York stock markets ended with slight increases in the major indexes, mainly due to increases in oil prices. The S&P500 rose by 0.31 per cent. Apparently investors refrain in decisions in anticipation of the Friday's release of data from the labor market. If the report will contain strong data this could provoke a strong sell-off on markets as increase the likelihood of interest rate hikes by the Fed. On the Asian parquets moods are balanced, but dominated by small increases. The Nikkei index going up of about 1 per cent.

This should lead to a peaceful early trading in Europe, with the possibility of expansion yesterday initiated approach. European investors in a good mood may wait for the decision of the BoE and count to cut interest rates by 25 basis points and the ability to use other measures to support growth after Brexit.

On the Warsaw market, yesterday's session showed that Tuesday's optimism was somewhat exaggerated, moreover, have confirmed what many analysts suggest, that the topic of conversion of foreign currency loans does not disappear, but only changes form.

A strong echo still reflected a matter of capital increases of PGE, what have adverse effect on minority shareholders. Investors pledge if facing budgetary challenges other companies will not follow a similar path.

-

07:15

Global Stocks

European stocks closed in negative territory Tuesday as bank shares came under pressure, leading the way lower.

The Stoxx Europe 600 SXXP, -1.29% fell 1.3% to end at 335.47.

Among banks, shares of Commerzbank AG CBK, -8.40% sank 9.2% as the German lender warned it won't hit its target of stable net profit for the full year.

Meanwhile, Italy's Banca Monte dei Paschi di Siena BMPS, -16.10% lost 16%. The shares had rallied during Monday's session after the bank's board late Friday approved a privately backed rescue plan for nonperforming loans at the embattled bank.

But BMPS still fared the worst among the 51 banks in the European Banking Authority's stress tests, released late Friday. The Italian banking sector was highlighted as one of the weaker spots in Europe's financial landscape.

U.S. stocks bounced off session lows but still closed lower Tuesday, marking the seventh straight daily loss for the Dow industrials and ending a five-day win streak for the Nasdaq, as investors sifted through quarterly results as well as data on personal income and inflation.

The Dow Jones Industrial Average DJIA, -0.49% fell as much as 157 points but ended with a decline of 90.74 points, or 0.5%, at 18,313.77/

The S&P 500 Index SPX, -0.64% settled with a loss of 13.81 points, or 0.6%, at 2,157.03, paring an earlier 23-point decline, with nine out of 10 main sectors trading lower, led by the consumer-discretionary and industrial sectors.

The Nasdaq Composite Index COMP, -0.90% took the worst of the fall, dropping 46.46 points, or 0.9% to finish at 5,137.73/

Asian shares bowed lower on Wednesday while the yen lorded over a weakened U.S dollar as talk the Bank of Japan may retreat from its massive bond-buying campaign twigged a shakeout in debt markets globally.

Worryingly for energy shares, the broad-based decline in the dollar was still not enough to spare U.S. crude oil from its first finish under $40 a barrel since April.

Japan's Nikkei .N225 lost 1.4 percent as the rising yen pressured exporter stocks while financials slid 2.7 percent.

The sharpest moves were in sovereign bond markets where a sudden spike in yields stirred speculation that a multi-year bull run in prices might finally be nearing its end.

Japanese bonds have suffered their worst sell-off in more than three years as investors feared the BoJ was out of easing ammunition and might leave it to fiscal policy to stimulate the economy.

Brent crude LCOc1 was near four-month lows on Wednesday at $41.86 a barrel. NYMEX crude CLc1 edged up 15 cents but at $39.66 was still under the psychological $40 level.

-

00:33

Stocks. Daily history for Aug 03’2016:

(index / closing price / change items /% change)

Nikkei 225 16,083.11 -308.340 -1.88%

Shanghai Composite 2,979.17 +7.89 +0.27%

S&P/ASX 200 5,465.72 -74.821 -1.35%

FTSE 100 6,634.4 -11.00 -0.17%

CAC 40 4,321.08 -6.91 -0.16%

Xetra DAX 10,170.21 +25.87 +0.26%

S&P 500 2,163.79 +6.76 +0.31%

Dow Jones 18,355 +41.23 +0.23%

S&P/TSX Composite 14,512.05 +35.04 +0.24%

-