Noticias del mercado

-

22:09

Major US stock indexes finished trading above zero

Major US stock indices closed in the green zone, as the strong labor market data helped the financial sector, and the recovery in oil prices sent the energy sector up.

As shown by data provided by Automatic Data Processing (ADP), employment growth in the US private sector accelerated in July, and were higher than forecasts of experts. According to the report, in July, the number of employees increased by 179 thousand. People in comparison with the upwardly revised figure for June at the level of 176 thousand. (Originally reported growth of 172 thousand.). Analysts had expected the number of people employed will increase by 170 thousand.

In addition, final data from Markit Economics showed: the seasonally adjusted index of business activity in the US service sector amounted to 51.4 points in July, unchanged compared with June. Previously it reported a decline to 50.9 points. It was expected that the index was 50.9 points.

It also became known that the index of business activity in the US service sector, calculated by the ISM, deteriorated in June, reaching a level of 55.5 points compared with 56.5 points in the previous month. According to the forecast value of the index was to drop to 56 points.

Oil prices jumped by about 4% and WTI crude oil rose back above $ 41 per barrel. Support to the market have the data from the Ministry of Energy of the United States, who reported a greater than expected reduction of stocks of gasoline. US Department of Energy announced that from 23 July to 29 July oil inventories rose 1.4 million barrels to 522.5 million barrels. Analysts had expected a decline of 2 million. Barrels. Oil reserves in Cushing terminal fell by 1.1 million barrels to 64.1 million barrels.

Most components of the DOW index finished trading in positive territory (16 of 30). More rest up shares JPMorgan Chase & Co. (JPM, + 1.49%). Outsider were shares of Pfizer Inc. (PFE, -3.13%).

Sector S & P index closed mixed. The leader turned out to be the basic materials sector (+ 1.3%). Most utilities sector fell (-0.5%).

At the close:

Dow + 0.22% 18,353.83 +40.06

Nasdaq + 0.43% 5,159.74 +22.01

S & P + 0.31% 2,163.72 +6.69

-

21:00

DJIA +0.03% 18,319.59 +5.82 Nasdaq +0.22% 5,148.93 +11.20 S&P +0.09% 2,159.02 +1.99

-

18:00

European stocks closed: FTSE 100 -11.00 6634.40 -0.17% DAX +25.87 10170.21 +0.26% CAC 40 -6.91 4321.08 -0.16%

-

17:44

WSE: Session Results

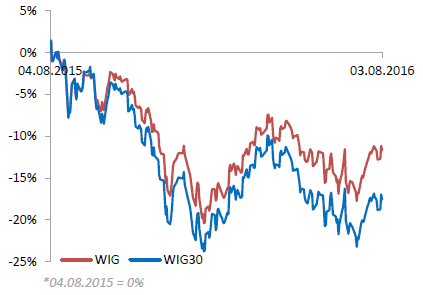

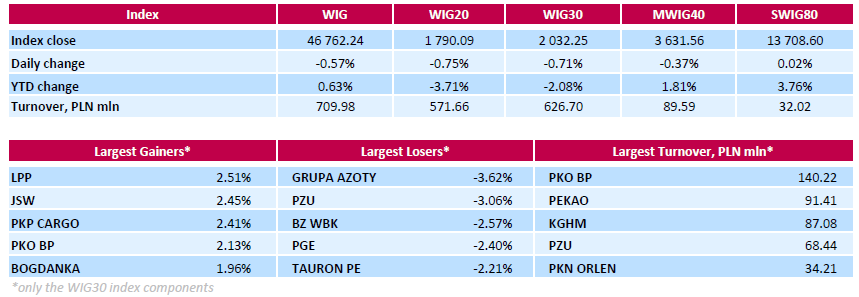

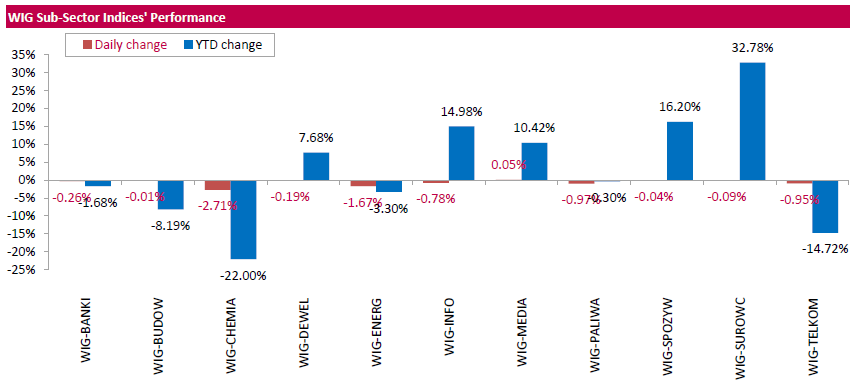

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, dropped by 0.57%. All sectors, but for media (+0.05%), were down, with chemicals (-2.71%) lagging behind.

The large-cap stocks' measure, the WIG30 Index fell by 0.71%. Within the Index components, chemical producer GRUPA AZOTY (WSE: ATT), insurer PZU (WSE: PZU), bank BZ WBK (WSE: BZW) and two gencos PGE (WSE: PGE) and TAURON PE (WSE: TPE) were the weakest performers, returning losses between 2.21% and 3.62%. On the other side of the ledger, clothing retailer LPP (WSE: LPP) led the advancers pack with a 2.51% growth. It was followed by coking coal miner JSW (WSE: JSW) and railway freight transport operator PKP CARGO (WSE: PKP), advancing 2.45% and 2.41% respectively.

-

15:46

WSE: After start on Wall Street

The US data (ADP report showing the estimated change in employment in the United States in a given month, in the private sector outside agriculture) were slightly better than expected, but not enough to significantly deviate from the forecast to provoke serious reaction of markets. However, the reading of 179 thousand against a forecast of 170 thousand maintains the expectation that government data estimating the change in the number of jobs outside agriculture will be close to 180 thousand. Markets have adopted this report calmly.

On the Warsaw market develops correction which may call into question yesterday impetus for the entire index. The WIG20 went down despite the lack of discounts in Euroland, which creates a picture of a relative weakness of the Warsaw market.

-

15:31

U.S. Stocks open: Dow -0.01%, Nasdaq -0.12%, S&P -0.05%

-

15:08

Before the bell: S&P futures -0.17%, NASDAQ futures -0.19%

U.S. stock-index futures slipped amid corporate earnings and employment data, with investors on edge over prospects for growth after crude oil's retreat this week into a bear market.

Global Stocks:

Nikkei 16,083.11 -308.340 -1.88%

Hang Seng 21,739.12 -390.02 -1.76%

Shanghai 2,979.17 +7.89 +0.27%

FTSE 6,628.4 -17.00 -0.26%

CAC 4,298.66 -29.33 -0.68%

DAX 10,125.95 -18.39 -0.18%

Crude $39.83 (+0.81%)

Gold $1371.80 (-0.06%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.35

0.06(0.5831%)

16474

ALTRIA GROUP INC.

MO

67.34

-0.00(-0.00%)

510

Amazon.com Inc., NASDAQ

AMZN

758.8

-1.78(-0.234%)

2945

AMERICAN INTERNATIONAL GROUP

AIG

56.65

2.51(4.6361%)

68906

Apple Inc.

AAPL

104.69

0.21(0.201%)

475686

AT&T Inc

T

42.94

-0.22(-0.5097%)

400

Barrick Gold Corporation, NYSE

ABX

22.64

-0.05(-0.2204%)

105348

Chevron Corp

CVX

99.65

0.06(0.0602%)

590

Cisco Systems Inc

CSCO

30.6

-0.02(-0.0653%)

600

Citigroup Inc., NYSE

C

42.9

-0.09(-0.2093%)

4500

Exxon Mobil Corp

XOM

86.87

-0.17(-0.1953%)

978

Facebook, Inc.

FB

122.66

-0.43(-0.3493%)

29052

Ford Motor Co.

F

12.03

0.09(0.7538%)

60125

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.35

-0.05(-0.4032%)

34550

General Electric Co

GE

31.08

0.03(0.0966%)

7205

General Motors Company, NYSE

GM

30.05

0.12(0.4009%)

8680

Google Inc.

GOOG

769.2

-1.87(-0.2425%)

931

Intel Corp

INTC

34.3

-0.00(-0.00%)

2990

Microsoft Corp

MSFT

56.45

-0.13(-0.2298%)

1217

Nike

NKE

54.4

-0.52(-0.9468%)

42723

Pfizer Inc

PFE

36.12

0.03(0.0831%)

3364

Starbucks Corporation, NASDAQ

SBUX

56.35

-0.38(-0.6698%)

8158

Tesla Motors, Inc., NASDAQ

TSLA

226.02

-1.18(-0.5194%)

4458

The Coca-Cola Co

KO

43.48

-0.05(-0.1149%)

4214

Twitter, Inc., NYSE

TWTR

16.26

-0.16(-0.9744%)

32486

Wal-Mart Stores Inc

WMT

72.6

-0.53(-0.7247%)

1665

Walt Disney Co

DIS

94.9

-0.11(-0.1158%)

2647

-

13:19

Major stock indices in Europe show a moderate decline

Stock indices in Europe trading on concerns about economic growth in the euro area and Japan, stimulus package, the scope of which disappointed markets. Meanwhile, shares of most banks rise in price on strong statements.

Shares of the largest French banks Societe Generale and Credit Agricole rose by 4.3% and 2.5% due to an increase in their profit and revenue in the second quarter of 2016.

Quotes of British bank HSBC Securities jumped 3.4%. Europe's largest bank has reduced the profit and revenue in the second quarter, however, it announced its intention to buy back its own shares in the amount of $ 2.5 billion in the second half.

ING capitalization soared by 7.4%. The largest Dutch financial services group increased its net profit in April-June, almost 4 times to 1.3 billion euros thanks to the expansion of the loan portfolio, as well as the preservation of a stable margin.

Meanwhile, the share price of Continental AG products decreased by 1.6%, as profits for the last quarter fell short of market expectations.

Aggreko Plc securities price fell during trading by 12%. Scottish engineering company reported a decline in quarterly profit and revenue.

German publishing house Axel Springer has reduced the market value by 1.7% due to lower revenues in the preceding quarter.

AXA SA shares fell 0.4% after the second largest insurance company in Europe reported a 4% increase in net profit in the first half, below analysts' expectations.

Shares of Next Plc soared 3.6% after the retailer reported an increase in sales in the second quarter by 0.3% year on year, but warned that sales could fall by 2.5% in 2016.

At the moment:

FTSE 6627.90 -17.50 -0.26%

DAX 10142.24 -2.10 -0.02%

CAC 4311.36 -16.63 -0.38%

-

13:09

WSE: Mid session comment

Today's trading does not provide many attractions. Once again the region of 1,800 points was the market stabilizer. After the withdrawal in the first hour the market has found a balance in around the psychological barrier. A significant impact on the stabilization is analogous behavior of core markets. Closely followed in Warsaw the DAX ends mid-morning phase of session in the area of yesterday's close.

Yesterday's intraday lows on the PLN currency pairs has been cosmetically enhanced (to the greatest extent on the EUR / PLN due to withdrawal of Eurodollar), which indicates the still continuing positive sentiment for the domestic market. In the context of the Warsaw Stock Exchange this can therefore be taken at face value. While optimism can be seen on the zloty, light withdrawal of the WIG20 should not cause any serious damage for the bulls side.

The halfway point of trading the WIG20 greeted at the level of 1,799 points (-0.24%) and with the turnover slightly below PLN 250 mln.

-

09:28

Major stock exchanges began trading mixed: DAX 10,147.43 + 3.09 + 0.03%, FTSE 100 6,662.86-31.09-0.46%

-

09:16

WSE: After opening

WIG20 index opened at 1806.56 points (+0.16%)*

WIG 47095.32 0.14%

WIG30 2050.15 0.16%

mWIG40 3642.04 -0.08%

*/ - change to previous close

The futures market (WSE: FW20U1620) began in the area of yesterday's close, which is broadly in line with changes in environment. The daily chart indicates that the game begins on the resistance level, which have already been tested, so there is no new technical content.

Europe began the day with no surprises. The WIG20 index inscribed in the environment, and after the first trades increase of 0.3 percent can be considered as a simple transfer of atmosphere from the environment. The focus is of course the banking sector, which helps positive response to the result of Pekao (WSE: PEO) and harmful light withdrawal entire banking basket with the forefront leaders of yesterday's increases.

-

08:25

Expected negative start of trading on the major stock exchanges in Europe: DAX-0.1%, CAC40 -0.1%, FTSE -0.1%

-

08:25

WSE: Before opening

Tuesday's session on Wall Street ended with a slight declines and the S&P500 index retreated by 0.64 percent. The whole of yesterday's session may be called a day of waiting for more important part of the week, which will bring the monthly data from the USA labor market and in this context, Wednesday will be the day of the warm-up before the most important sessions of the week. Today's ADP report will be read as a predictor of government data, which will appear on Friday.

In Europe, the most important event of the week will be Thursday's decision of the Bank of England, which should cut interest rates in response to the negative effects of the Brexit referendum in the UK.

On the Warsaw market, the situation is somewhat more complicated. Yesterday's reflection on the shares of banks - associated with mild version of the President's proposals regarding currency loans - oriented the WSE market in a position detached from the environment and other exchanges. Strong increases in stock prices of banks resulted in return of the WIG20 above 1,800 pts., but we have to keep in mind about another cause of repricing the banking sector in the form of already introduced tax assets, which does not disappear.

-

07:17

Global Stocks

European stocks closed in negative territory Tuesday as bank shares came under pressure, leading the way lower.

The Stoxx Europe 600 SXXP, -1.29% fell 1.3% to end at 335.47.

Among banks, shares of Commerzbank AG CBK, -8.40% sank 9.2% as the German lender warned it won't hit its target of stable net profit for the full year.

Meanwhile, Italy's Banca Monte dei Paschi di Siena BMPS, -16.10% lost 16%. The shares had rallied during Monday's session after the bank's board late Friday approved a privately backed rescue plan for nonperforming loans at the embattled bank.

But BMPS still fared the worst among the 51 banks in the European Banking Authority's stress tests, released late Friday. The Italian banking sector was highlighted as one of the weaker spots in Europe's financial landscape.

U.S. stocks bounced off session lows but still closed lower Tuesday, marking the seventh straight daily loss for the Dow industrials and ending a five-day win streak for the Nasdaq, as investors sifted through quarterly results as well as data on personal income and inflation.

The Dow Jones Industrial Average DJIA, -0.49% fell as much as 157 points but ended with a decline of 90.74 points, or 0.5%, at 18,313.77/

The S&P 500 Index SPX, -0.64% settled with a loss of 13.81 points, or 0.6%, at 2,157.03, paring an earlier 23-point decline, with nine out of 10 main sectors trading lower, led by the consumer-discretionary and industrial sectors.

The Nasdaq Composite Index COMP, -0.90% took the worst of the fall, dropping 46.46 points, or 0.9% to finish at 5,137.73/

Asian shares bowed lower on Wednesday while the yen lorded over a weakened U.S dollar as talk the Bank of Japan may retreat from its massive bond-buying campaign twigged a shakeout in debt markets globally.

Worryingly for energy shares, the broad-based decline in the dollar was still not enough to spare U.S. crude oil from its first finish under $40 a barrel since April.

Japan's Nikkei .N225 lost 1.4 percent as the rising yen pressured exporter stocks while financials slid 2.7 percent.

The sharpest moves were in sovereign bond markets where a sudden spike in yields stirred speculation that a multi-year bull run in prices might finally be nearing its end.

Japanese bonds have suffered their worst sell-off in more than three years as investors feared the BoJ was out of easing ammunition and might leave it to fiscal policy to stimulate the economy.

Brent crude LCOc1 was near four-month lows on Wednesday at $41.86 a barrel. NYMEX crude CLc1 edged up 15 cents but at $39.66 was still under the psychological $40 level.

-

00:31

Stocks. Daily history for Aug 02’2016:

(index / closing price / change items /% change)

Nikkei 225 16,391.45 -244.32 -1.47%

Shanghai Composite 2,970.93 +17.54 +0.59%

S&P/ASX 200 5,540.54 -46.854 -0.84%

FTSE 100 6,645.4 -48.55 -0.73%

CAC 40 4,327.99 -81.180 -1.84%

Xetra DAX 10,144.34 -186.18 -1.80%

S&P/TSX Composite 14,477.01

S&P 500 2,157.03 -13.81 -0.64%

Dow Jones 18,313.77 -90.74 -0.49%-105.73 -0.73%

-