Noticias del mercado

-

22:07

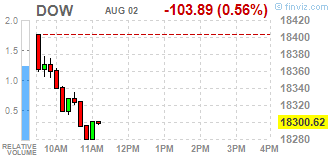

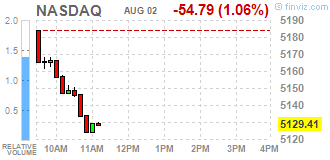

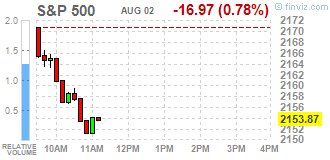

Major US stock indexes finished trading below zero

Major US stock indexes fell on Tuesday after weak US economic data disappointed investors.

As it became known today, in June, personal income increased by $ 29.3 billion (0.2%) in June, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $ 24.6 billion (0.2%), and personal consumption expenditures (the PCE) increased $ 53.0 billion (0.4%).

Real DPI increased by 0.1% in June and a real PCE increased 0.3%. PCE Price Index increased by 0.1%. With the exception of food and energy, PCE price index increased by 0.1%. The increase in personal income in June mainly reflects the growth of private incomes from wages and incomes of non-agricultural owners, which were partially offset by a decrease in personal income in the form of dividends and personal interest income.

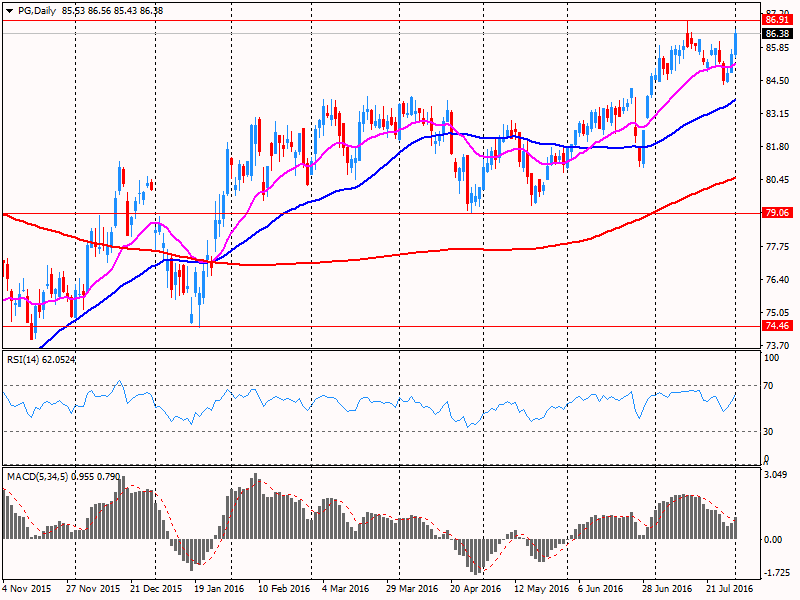

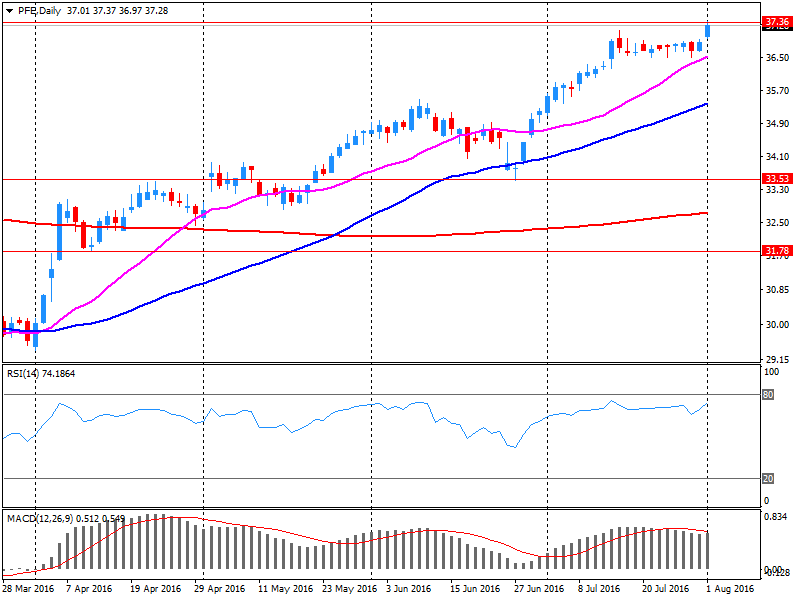

Among the corporate nature of the posts should be noted quarterly reports Pfizer (PFE) and Procter & Gamble (PG). Quarterly results of both companies exceeded analysts' expectations. Pfizer's profit for the second quarter 2016 fingoda reached $ 0.64 per share, which is $ 0.02 higher than the average analyst forecast of $ 0.62. Quarterly revenue rose nearly 11%, to $ 13.147 billion., While the average forecast of analysts expected to increase to $ 13.013 billion. Shares of PFE fell, as the company left unchanged its forecast for the full 2016 fiscal year.

Procter & Gamble in the reporting period made a profit of $ 0.79 per share, which is $ 0.05 higher than the average market forecast. The company's revenue was $ 16,102,000,000., that turned out to be 2.7% per annum less, but 1.7% higher than the average forecast of analysts. The company also lowered its forecast for earnings per share figure for 2017 fiscal year to $ 3.67 against the analysts' forecast of $ 3.97 level.

Most components of the DOW index finished trading in negative territory (23 of 30). More rest up shares Exxon Mobil Corporation (XOM, + 1.06%). Outsider were shares of Pfizer Inc. (PFE, -2.20%).

Almost all sectors of the S & P closed in the red. the services sector fell the most (-1.2%). Maximizing showed conglomerates sector (+ 0.8%).

At the close:

Dow -0.49% 18,313.70 -90.81

Nasdaq -0.90% 5,137.73 -46.47

S & P -0.64% 2,157.03 -13.81

-

21:00

DJIA -0.59% 18,296.55 -107.96 Nasdaq -0.83% 5,141.07 -43.13 S&P -0.71% 2,155.43 -15.41

-

18:00

European stocks closed: FTSE 100 -48.55 6645.40 -0.73% DAX -186.18 10144.34 -1.80% CAC 40 -81.18 4327.99 -1.84%

-

17:39

WSE: Session Results

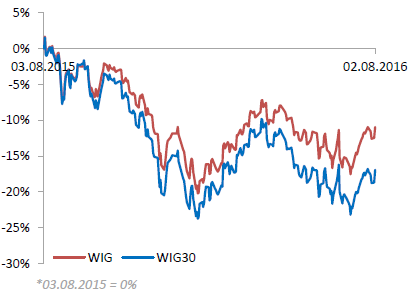

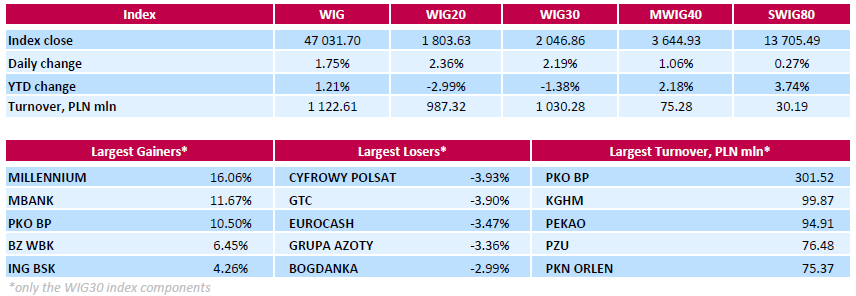

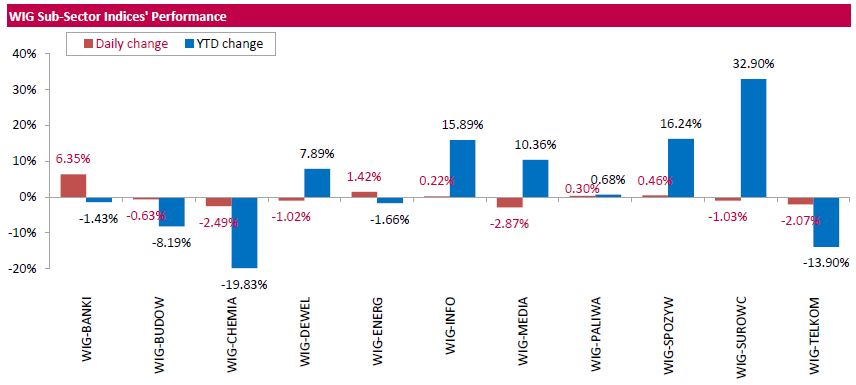

Polish equity market closed higher on Tuesday, with the broad market measure, the WIG Index, surging by 1.75%. Sector performance within the WIG Index was mixed. Banking sector names (+6.35%) were the strongest group, supported by the announcement that the FX loans draft bill does not include forced re-domination of Swiss franc mortgages. At the same time, media stocks (-2.87%) and chemicals names (-2.49%) were the worst performers.

The large-cap companies' measure, the WIG30 Index, grew by 2.19%. In the index basket, all six constituents, belonging to the banking sector, generated strong returns with MILLENNIUM (WSE: MIL) outpacing with a 16.06% gain. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS), property developer GTC (WSE: GTC), FMCG-wholesaler EUROCASH (WSE: EUR) and chemical producer GRUPA AZOTY (WSE: ATT) recorded the biggest drops, ranging between 3.36% and 3.93%.

-

17:13

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday after weak U.S. economic data disappointed investors. Data showed U.S. consumer spending rose more than expected in June as households bought a range of goods and services. However, core personal consumption expenditures (PCE), the Federal Reserve's preferred inflation measure, increased 1,6% in the 12 months through June, falling below the central bank's 2% target.

Almost all of Dow stocks in negative area (27 of 30). Top gainer - Exxon Mobil Corporation (XOM, +0.30%). Top looser - Pfizer Inc. (PFE, -2.52%).

All S&P sectors in negative area. Top looser - Services (-1.3%).

At the moment:

Dow 18221.00 -105.00 -0.57%

S&P 500 2147.25 -17.25 -0.80%

Nasdaq 100 4699.25 -45.25 -0.95%

Oil 40.11 +0.05 +0.12%

Gold 1373.00 +13.40 +0.99%

U.S. 10yr 1.54 +0.05

-

15:53

WSE: After start on Wall Street

The market in the United States opened with a slight decrease and remains comfortably within the narrow consolidation lasting from mid-July. Traditionally, in such situations, investors are waiting for the impulse, however the conclusions drawn from the stabilization are positive, as the Wall Street defends itself against declines that prevail today in Europe or in part in Japan.

The Warsaw market today is in a great shape, but in a broader look a potential problem may be the environment. If the core markets, and with them a basket of emerging markets will settle a larger correction of recent weeks gains, the WIG20 might have a problem with self-shaping approach in a longer run.

-

15:35

U.S. Stocks open: Dow -0.02%, Nasdaq -0.10%, S&P -0.06%

-

15:27

Before the bell: S&P futures -0.18%, NASDAQ futures -0.13%

U.S. stock-index futures declined as concern resurfaced about growth prospects with oil back in a bear market.

Global Stocks:

Nikkei 16,391.45 -244.32 -1.47%

Hang Seng 22,129.14 +237.77 +1.09%

Shanghai 2,971.28 +17.89 +0.61%

FTSE 6,693.95 -30.48 -0.45%

CAC 4,350.83 -58.34 -1.32%

DAX 10,330.52 -6.98 -0.07%

Crude $40.61 (+1.37%)

Gold $1370.60 (+0.81%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

178.15

-0.14(-0.0785%)

1032

ALCOA INC.

AA

10.49

0.02(0.191%)

18504

Amazon.com Inc., NASDAQ

AMZN

765.69

-2.05(-0.267%)

10323

Apple Inc.

AAPL

105.76

-0.29(-0.2735%)

117910

AT&T Inc

T

43.05

-0.13(-0.3011%)

3035

Barrick Gold Corporation, NYSE

ABX

22.51

0.28(1.2596%)

115046

Chevron Corp

CVX

99.5

0.39(0.3935%)

4403

Cisco Systems Inc

CSCO

30.84

0.11(0.358%)

4461

Citigroup Inc., NYSE

C

43.28

-0.14(-0.3224%)

18519

Deere & Company, NYSE

DE

77.1

-0.59(-0.7594%)

1510

Exxon Mobil Corp

XOM

86.25

0.39(0.4542%)

14659

Facebook, Inc.

FB

124.19

-0.12(-0.0965%)

40018

Ford Motor Co.

F

12.42

-0.06(-0.4808%)

71359

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.68

0.20(1.6026%)

85445

General Electric Co

GE

31.09

-0.06(-0.1926%)

12618

General Motors Company, NYSE

GM

31.2

-0.10(-0.3195%)

851

Goldman Sachs

GS

157.5

-0.68(-0.4299%)

3374

Google Inc.

GOOG

771

-1.88(-0.2432%)

1900

Hewlett-Packard Co.

HPQ

14.21

0.03(0.2116%)

2085

Johnson & Johnson

JNJ

125.48

0.08(0.0638%)

478

JPMorgan Chase and Co

JPM

63.58

-0.22(-0.3448%)

7250

Microsoft Corp

MSFT

56.64

0.06(0.106%)

11282

Nike

NKE

55.56

0.15(0.2707%)

330

Pfizer Inc

PFE

36.75

-0.56(-1.5009%)

173247

Procter & Gamble Co

PG

87.02

0.61(0.7059%)

328983

Starbucks Corporation, NASDAQ

SBUX

57.25

-0.18(-0.3134%)

1606

Tesla Motors, Inc., NASDAQ

TSLA

229.12

-0.89(-0.3869%)

16928

The Coca-Cola Co

KO

43.45

0.00(0.00%)

494

Twitter, Inc., NYSE

TWTR

16.56

-0.08(-0.4808%)

56969

Walt Disney Co

DIS

95

-0.54(-0.5652%)

2550

Yandex N.V., NASDAQ

YNDX

21.2

-0.06(-0.2822%)

4600

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Outperform from Buy at Daiwa

Other:

Barrick Gold (ABX) initiated with a Buy at Citigroup; target $29

Home Depot (HD) resumed with Buy ratings at Stifel

-

13:15

Company News: Procter & Gamble (PG) Q4 results beat analysts’ expectations

Procter & Gamble reported Q4 FY 2016 earnings of $0.79 per share (versus $1.00 in Q4 FY 2015), beating analysts' consensus estimate of $0.74.

The company's quarterly revenues amounted to $16.102 bln (-2.7% y/y), beating analysts' consensus estimate of $15.832 bln.

PG rose to $86.42 (+0.01%) in pre-market trading.

-

13:02

WSE: Mid session comment

The first half of trading on the Warsaw Stock Exchange was a clear concentration on banks. Of the 10 most active companies in the market was 6 banks. The strongest gain values of Bank Millennium (WSE: MIL +13,7%) and GetinNoble (WSE: GTN +25,58%), as these banks are most involved in lending in Swiss francs.

In the mid-session the WIG20 index was at the level of 1,800 (+2,20%) points and with the turnover of over PLN 540 mln.

-

12:59

Major stock indexes in Europe show a negative trend

European stocks decline following stock prices of oil companies, and a number of banks shares continue to become cheaper on the weak results of the stress tests.

Also disappointing manufacturing data in China and the United States continued to weigh on market sentiment, while investors focus today on the next series of corporate reports.

Data released on Monday showed that the official index of business activity in China's manufacturing sector weakened in July to 49.9 from 50.0 in the previous month, compared to expectations for no change.

In addition, the US Institute for Supply Management reported that its index of business activity in the manufacturing sector fell last month to 52.6 from June's 53.2. Analysts had forecast a decline in the index to 53.0.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading on 1,4% - to 335.26 points.

Market attention this week is aimed at meeting the Bank of England, which will be held August 3-4. Experts consensus forecast provides for the reduction of the base interest rate of the British Central Bank to 0.25% from 0.5%.

Shares of Royal Dutch Shell fell during trading on 1,6%, BP by 0.8%.

Securities of British banks Barclays and Royal Bank of Scotland (RBS) fell by 3.2% and 3.3%.

According to the results of stress tests by the European Banking Authority, EBA, Barclays was among the laggards, while RBS would show one of the harshest deterioration of capital adequacy in the negative developments.

Price of Commerzbank shares fell by almost 8%. The cost of InterContinental Hotels Group shares rose during trading on 1,7%. The hotel chain has cut its net profit in January-June by 46%, to $ 200 million, to $ 838 million The company said to be confident in the forecasts for the remainder of the year.

German retailer Metro's shares were down 6.5% as the company reported a surprise loss in the third quarter, mainly related to the cost of the reorganization of its operations in the wholesale markets in Germany, Belgium and Italy.

Shares of the German manufacturer Infineon slowed down 4% after its profit and revenue fell short of forecasts due to falling demand in the power supply and control units of plastic cards.

Shares of Deutsche Lufthansa AG rose 0.4% after the German airline company reported a nearly 12% increase in profits for the first half year on year. However, the group warned that the second half will be more difficult and that it will continue to strive for cost reductions.

At the moment:

FTSE 6660.71 -33.24 -0.50%

DAX 10196.97 -133.55 -1.29%

CAC 4348.49 -60.68 -1.38%

-

12:59

Company News: Pfizer (PFE) Q2 results beat analysts’ expectations

Pfizer reported Q2 FY 2016 earnings of $0.64 per share (versus $0.56 in Q2 FY 2015), beating analysts' consensus estimate of $0.62.

The company's quarterly revenues amounted to $13.147 bln (+10.9% y/y), beating analysts' consensus estimate of $13.013 bln.

PFE rose to $37.60 (+0.78%) in pre-market trading.

-

09:45

Major stock exchanges began trading lower: FTSE -0.2%, DAX -0.1%, CAC40 -0.3%, FTMIB -0.2%, IBEX -0.3%

-

09:12

WSE: After opening

WIG20 index opened at 1777.79 points (+0.89%)*

WIG 46700.67 1.04%

WIG30 2029.44 1.32%

mWIG40 3629.44 0.63%

*/ - change to previous close

The cash market (the WIG20 index) opens with a rise of 0.89% to 1,777 points, affected by the good attitude of banks, especially those with portfolios of CHF loans. Investors clearly believe in very mild currency loans Act, but it turns out that it will be after 11:00 (Warsaw time), when is scheduled to begin a press conference. The turnover is considerable, and attention for obvious reasons is focused on banks.

Behavior of the environment, or whether it is the core markets of Euroland or the emerging markets of the region, is for us a second-plan (if not even less) important.

-

08:21

WSE: Before opening

Yesterday's trading on Wall Street ended with a slight, expected, declines. Tuesday morning is quiet with greater volatility visible only in case of falling by 1,3% Nikkei. Trade in Hong Kong today practically does not take place due to a typhoon, and the other parquets are dominated by small changes similar to those observed ones. Thus we may say that yesterday the worst of all the major markets preserved Europe.

Investors' attention will focus today on the presentation of project of the currency loans Act prepared by the office of the President. According to "Rzeczpospolita" the Act will be less severe for banks due to the awareness of the risks around the European banking sector and the relatively good condition of the national institutions. If these reports are confirmed we may be witnessing the positive market reaction to the less severe form of the Act, which should support the PLN and national banks. On the broad market is worth to pay attention to the data of PPI from the Euro Zone and the readings from the United States about expenditures and revenues.

-

08:20

Expected negative start of trading on the major stock exchanges in Europe: DAX-0.3%, CAC40 -0.3%, FTSE -0.3%

-

07:27

Global Stocks

European stocks declined on Monday, with bank shares losing steam following stress-test results for the industry, and as an update on eurozone manufacturing activity showed further slowing.

The stress tests were aimed at showing how much capital, or cushion against losses, banks would have left on their balance sheets in a severe downturn. Italian, Irish and Spanish banks put in the worst performances of the 51 firms tested.

Banks that suffered hits to their capital buffers in the test scenarios included Italy's UniCredit SpA, London-based Barclays PLC and German lender Deutsche Bank AG. UniCredit UCG, -9.40% and Barclays BARC, -2.04% BCS, -3.03% opened higher but since flipped lower, losing 9.4% and 2%, respectively. Deutsche Bank shares DBK, -2.56% DB, -2.75% also gave up gains, closing 1.8% lower.

U.S. stocks lost momentum to finish mostly lower Monday as crude-oil futures returned to bear-market territory and weaker-than-expected manufacturing data raised doubts about the strength of the economy.

The S&P 500 SPX, -0.13% shed 2.76 points, or 0.1%, to close at 2,170.84 after the large-cap gauge hit a record intraday high of 2,178.29.

The Dow Jones Industrial Average DJIA, -0.15% fell 27.73 points, or 0.2%, to close at 18,404.51.

However, the Nasdaq Composite Index COMP, +0.43% climbed 22.06 points, or 0.4%, to end at 5,184.20, boosted by appetite for tech giants, including a 1.8% jump in shares of Apple Inc. AAPL, +1.77%

Meanwhile, losses for crude CLU6, +0.17% snowballed, with the U.S. oil benchmark dropping almost 4% and at one point trading below the key $40 level amid worries about a supply glut and subdued demand. Crude oil is now off 21.8% from its peak of $51.23 a barrel hit in early June, signifying a bear market, or drop of at least 20% from a recent peak.

Asian shares slipped on Tuesday, taking their cues from a modestly lower day on Wall Street, while crude oil prices stabilized after their overnight tumble and the U.S. dollar edged higher.

Reserve Bank of Australia has cut its cash rate target to 1.5% from 1.75%

-

00:35

Stocks. Daily history for Aug 01’2016:

(index / closing price / change items /% change)

Nikkei 22 16,635.77 +66.50 +0.40%

Shanghai Composite 2,953.39 -25.9534 -0.87%

S&P/ASX 200 5,587.39 +25.03 +0.45%

FTSE 100 6,693.95 -30.48 -0.45%

Xetra DAX 10,330.52 -6.98 -0.07%

CAC 40 4,409.17 -30.64 -0.69%

S&P 500 2,170.84 -2.76 -0.13%

Dow Jones 18,404.51 -27.73 -0.15%

-