Noticias del mercado

-

22:07

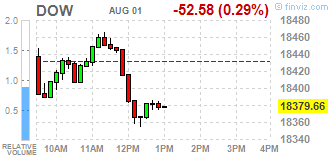

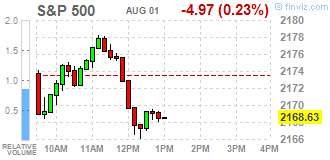

Major US stock indexes finished trading with a slight change

The Dow and S & P 500 dipped slightly, while the Nasdaq remains above the zero mark. The growth of technology companies such as Apple (AAPL), and Alphabet (GOOG), could not compensate for the drop in the energy sector due to the collapse in oil prices.

As the report from the ISM, in July, the activity in the US manufacturing sector has deteriorated moderately, while the fall exceeded the average forecast. The PMI for the US the production sector was 52.6 points versus 53.2 points in June. It was expected that this figure will drop to 53 points.

In addition, it became known that the US construction spending fell 0.6% in June, the decline is evenly distributed in the private and public sectors. This is the Ministry of Commerce said Monday. This was significantly lower than expected. Economists had expected an increase of 0.5%.

However, the final data presented Markit Economics, showed that seasonally adjusted manufacturing PMI index rose to 52.9 in July versus 51.3 in June. The latter value has coincided with the preliminary estimates and forecasts. The index also reached its highest level in 8 months. The report stated that the improvement of the business environment was associated with strong rates of growth in production, new orders and employment. Sub-production index recorded a second monthly increase in a row, and peaked in November 2015. Export sales also increased, the manufacturers associated with successful advertising initiatives and access to new markets. The growth of workloads, in turn, contributed to the accumulation of pending orders for the second month in a row.

Crude oil futures fell significantly, as the increase in the volume of OPEC production and the growth in the number of US rigs raise concerns about a global glut. "The mood among investors is still very negative due to a sharp fall in prices in recent years is now clear that to change the balance take longer than some market participants previously thought, -. Said Eugen Weinberg of at Commerzbank -. Data Reuters pointed to another one an increase in OPEC oil production. Meanwhile, a recent report by Baker Hughes showed that the increase in the number of drilling rigs "continues in the United States.

Most DOW components of the index ended the day mixed. More rest rose stocks Apple Inc. (AAPL, + 1.71%). Outsider were shares of Exxon Mobil Corp. (XOM, -3.65%).

Sector S & P index closed mixed. The leader turned conglomerates sector (+ 2.3%). Most of the basic materials sector fell (-2.7%).

At the close:

Dow -0.15% 18,404.78 -27.46

Nasdaq + 0.43% 5,184.20 +22.07

S & P -0.13% 2,170.80 -2.80

-

21:00

DJIA -42.18 18390.06 -0.23% S&P 500 -3.29 2170.31 -0.15% NASDAQ +21.44 5183.57 +0.42%

-

19:01

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Monday, led by tech stocks such as Apple and Google-parent Alphabet, but a drop in oil prices weighed on energy stocks.

Oil prices fell about 3,8% due to an increase in OPEC production and U.S. oil rig additions. Growth in U.S. gross domestic product in the second quarter unexpectedly remained tepid and came in below expectations. Data on Monday showed U.S. manufacturing activity slowed in July as orders fell broadly and construction spending dropped in June.

Most of Dow stocks in negative area (20 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +1.21%). Top looser - Exxon Mobil Corp. (XOM, -3.11%).

S&P sectors mixed. Top gainer - Conglomerates (+1.9%). Top looser - Basic Materials (-2.2%).

At the moment:

Dow 18307.00 -55.00 -0.30%

S&P 500 2163.25 -5.00 -0.23%

Nasdaq 100 4741.25 +14.50 +0.31%

Oil 40.02 -1.58 -3.80%

Gold 1359.50 +2.00 +0.15%

U.S. 10yr 1.49 +0.03

-

18:00

European stocks closed: FTSE 100 -30.48 6693.95 -0.45% DAX -6.98 10330.52 -0.07% CAC 40 -30.64 4409.17 -0.69%

-

17:39

WSE: Session Results

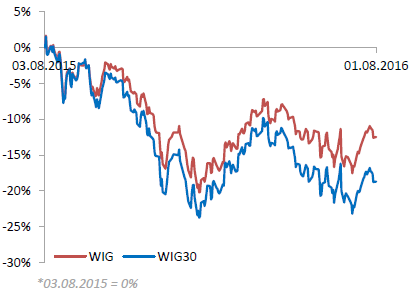

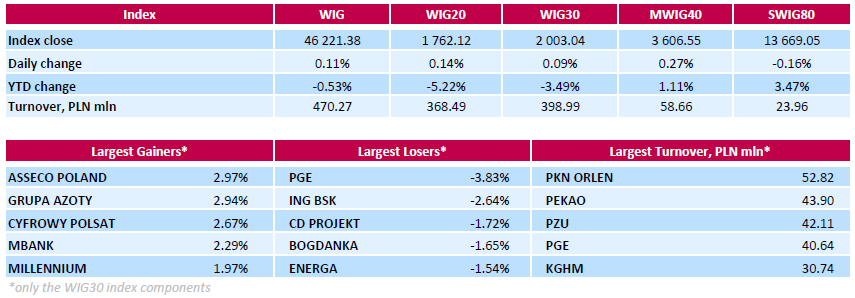

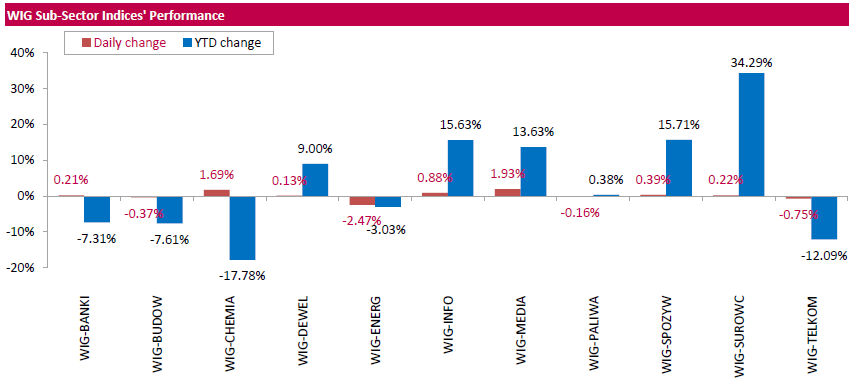

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, added 0.11%. Sector performance within the WIG Index was mixed. Media (+1.93%) outperformed, while utilities (-2.47%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, inched up 0.09%. In the index basket, IT-company ASSECO POLAND (WSE: ACP) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, jumping by 2.97% and 2.94% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS) and two banks MBANK (WSE: MBK) and MILLENNIUM (WSE: MIL), which gained 2.67%, 2.29% and 1.97% respectively. On the other side of the ledger, genco PGE (WSE: PGE) led the decliners, tumbling by 3.83%. The Polish treasury asked the company to raise its capital by PLN 5.6 bln, or 30 percent, by increasing the nominal value of its shares. Analysts said this was a way for the treasury, which holds a 58 percent stake in PGE, to force the company to pay an unexpected income tax, disadvantaging minority shareholders and potentially alarming investors in other state-owned companies, including oil and gas producer PGNIG (WSE: PGN), thermal coal miner BOGDANKA (WSE: LWB) and two gencos ENERGA (WSE: ENG) and ENEA (WSE: ENA). All these companies lost between 1.37% and 1.65%.

-

15:49

WSE: After start on Wall Street

In the afternoon trading phase, most European parquets were on the red side in a greater or lesser extent and the worst behavior was showed by the banking sector.

The moods on the Wall Street are good, although, according to what was indicated by futures, trading starts flat, so still in terms of the volatility of the past two weeks.

The coming quarters may prove to be a crucial clue in terms of sentiment in the final phase of the European session, investors are waiting for data from the USA (ISM index for the industry, 16:00 - Warsaw time).

-

15:32

U.S. Stocks open: Dow +0.06%, Nasdaq +0.09%, S&P +0.01%

-

15:28

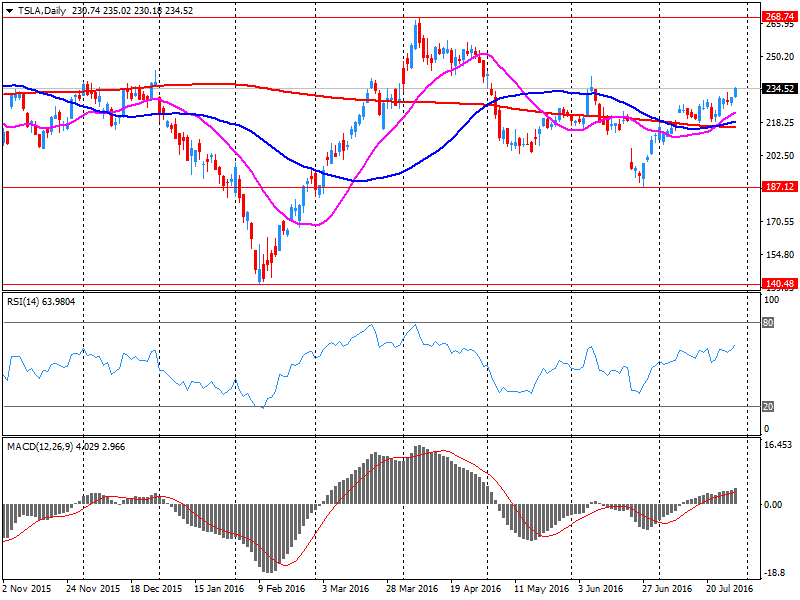

Company News: SolarCity (SCTY) and Tesla Motors (TSLA) have reached a definitive agreement to merge

The SolarCity (SCTY) confirmed the achievement of a definitive merger agreement with Tesla Motors (TSLA). According to the agreement, the shares of SolarCity will be purchased at weighted average price for the five-day trading period ending on July 29 that $ 25.37 / share. The total amount of the transaction is $ 2.6 billion. SolarCity shareholders will receive 0.110 common shares of Tesla per share SolarCity. The companies expect the deal to be completed in the fourth quarter of 2016.

As noted by the company, the merger will create "the world's only vertically integrated energy company that is stable." The companies expect that the synergies from the merger will be $ 150 million in the first year. In addition, they claim, by the merger of customers the opportunity to save by reducing hardware costs, reduce installation costs, increase production efficiency and reduce the cost of customer acquisition. In addition, the company expects that will benefit from the possibility to use 190 Tesla stores and its international presence.

Tesla shares rose to $ 235.34 (+ 0.23%), SCTY shares fell to $ 24.95 (-6.55%).

-

15:25

Before the bell: S&P futures +0.02%, NASDAQ futures +0.04%

U.S. stock-index futures were little changed as investors weighed growth prospects for the world's biggest economy amid rising bets on continuing policy support from the Federal Reserve.

Global Stocks:

Nikkei 16,635.77 +66.50 +0.40%

Hang Seng 22,129.14 +237.77 +1.09%

Shanghai 2,953.39 -25.9534 -0.87%

FTSE 6,700.1 -24.33 -0.36%

CAC 4,410.21 -29.60 -0.67%

DAX 10,316.42 -21.08 -0.20%

Crude $41.06 (-1.30%)

Gold $1355.20 (-0.17%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.57

-0.05(-0.4708%)

18061

ALTRIA GROUP INC.

MO

67.94

0.24(0.3545%)

6763

Amazon.com Inc., NASDAQ

AMZN

758.89

0.08(0.0105%)

9472

Apple Inc.

AAPL

104.7

0.49(0.4702%)

128698

AT&T Inc

T

43.24

-0.05(-0.1155%)

6199

Barrick Gold Corporation, NYSE

ABX

21.88

0.02(0.0915%)

18010

Boeing Co

BA

133.66

0.00(0.00%)

455

Chevron Corp

CVX

101.67

-0.81(-0.7904%)

2933

Cisco Systems Inc

CSCO

30.72

0.19(0.6223%)

8404

Citigroup Inc., NYSE

C

43.81

0.00(0.00%)

2115

Exxon Mobil Corp

XOM

88.5

-0.45(-0.5059%)

9879

Facebook, Inc.

FB

123.65

-0.29(-0.234%)

158636

Ford Motor Co.

F

12.68

0.02(0.158%)

20248

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.08

0.12(0.9259%)

50441

General Electric Co

GE

31.1

-0.04(-0.1285%)

17407

General Motors Company, NYSE

GM

31.31

-0.23(-0.7292%)

7125

Goldman Sachs

GS

159.9

1.09(0.6864%)

935

Google Inc.

GOOG

768.31

-0.48(-0.0624%)

2236

Hewlett-Packard Co.

HPQ

14.02

0.01(0.0714%)

2600

Intel Corp

INTC

34.85

-0.01(-0.0287%)

8322

JPMorgan Chase and Co

JPM

64.12

0.15(0.2345%)

610

McDonald's Corp

MCD

117.6

-0.05(-0.0425%)

4225

Merck & Co Inc

MRK

58.66

-0.00(-0.00%)

100

Microsoft Corp

MSFT

56.65

-0.03(-0.0529%)

5396

Pfizer Inc

PFE

37.07

0.18(0.4879%)

46838

Procter & Gamble Co

PG

85.51

-0.08(-0.0935%)

3595

Tesla Motors, Inc., NASDAQ

TSLA

235.5

0.71(0.3024%)

30212

The Coca-Cola Co

KO

43.65

0.02(0.0458%)

13356

Twitter, Inc., NYSE

TWTR

16.69

0.05(0.3005%)

66823

Verizon Communications Inc

VZ

55.15

-0.26(-0.4692%)

1185

Walt Disney Co

DIS

96.06

0.11(0.1146%)

2351

Yahoo! Inc., NASDAQ

YHOO

38.24

0.05(0.1309%)

4615

Yandex N.V., NASDAQ

YNDX

21.7

0.05(0.231%)

2584

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) removed from US 1 List at BofA/Merrill

-

13:07

WSE: Mid session comment

Morning publications of final PMI's for the European industrial sector was not optimistic. The data for the euro zone remain relatively stable and over the psychological level of 50 pts., but mostly thanks to the continued good shape of Germany. In other countries as in France or Greece the situation remains weak (return of ratio below 50 pts.) or noticeably deteriorated as in Italy or Spain (in Italy, the rate went down from 53.5 points to 51.2 points). Positively showed practically only two countries: the Netherlands and Hungary.

After a higher opening in Europe there were some problems on the demand side, and the German DAX gave almost of the whole morning growth.

The WIG 20 index went down the dash, mainly under the pressure of more than 4 percent depreciation of the PGE (WSE: PGE). The company said in the statement that considering an increase in the share capital using the company's own funds, which may have the effect of tax to the Treasury of more than PLN 1 billion.

In the halfway point of the session the WIG20 index was at the level of 1,755 points (-0,24%) and with turnover of PLN 163 mln.

-

12:43

Major stock indices in Europe trading mixed

European stocks traded mixed against the backdrop of rise in shares of mining companies and the dynamics of banks after the publication of the stress test results.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,3% to 340.72 points.

Stress tests of 51 European banks have produced, in general, positive results, despite the sluggish economic growth in the region and lower interest rates, said the European banking management (European Banking Authority, EBA).

Only 12 banks will face serious problems in case of a severe economic downturn, according to the results published on Friday.

Weak figures showed banks in Italy, Ireland, Spain and Austria. The last place on the list with the worst result took the Italian Banca Monte Paschi di Siena, the oldest active bank in the world. Its capital adequacy ratio in the case of the worst-case scenario would be negative (minus 2.44%), which means bankruptcy.

Also in that group was Unicredit and Raiffeisen, British Barclays and the two largest German bank - Deutsche Bank and Commerzbank.

Share of Monte Paschi di Siena, in spite of the unfavorable results of the stress tests has soared by 6.6%. The bank said it plans to get rid of the portfolio of "bad" assets.

Unicredit Securities fell during trading by 3,9%, Raiffeisen -9.8%. The value of Deutsche Bank increased by 0,6%, HSBC by 0.8%.

Statistical data on the euro zone economy, published on Monday, pointed to a slowdown in the growth of industrial activity in the region.

Thus, PMI index in the industrial sector of the euro area fell to 52 points from 52.8 points a month earlier, according to official data.

Share pof mining companies are rising today after the rise in metal prices on weak statistical data from China.

Heineken shares slowed down 1.6% after the world's third largest brewing company reported revenue for the first half that not reached analysts' forecasts.

Meanwhile, shares of Porsche SE rose 0.3% after the auto company reported net profits in the first half of the year +41%.

At the moment:

FTSE 6717.81 -6.62 -0.10%

DAX 10367.26 29.76 0.29%

CAC 4420.77 -19.04 -0.43%

-

12:30

Earnings Season in U.S.: Major Reports of the Week

August 2

Before the Open:

Pfizer (PFE). Consensus EPS $0.62, Consensus Revenue $13004.95 mln.

Procter & Gamble (PG). Consensus EPS $0.74, Consensus Revenue $15831.63 mln.

After the Close:

American Intl (AIG). Consensus EPS $0.94, Consensus Revenue $13096.15 mln.

August 3

After the Close:

Tesla Motors (TSLA). Consensus EPS -$0.63, Consensus Revenue $1657.91 mln.

August 5

After the Close:

Berkshire Hathaway (BRK.B). Consensus EPS $2910.79, Consensus Revenue $56469.41 mln

-

09:24

Major stock exchanges open higher: FTSE 100 6,740.59 + 19.53 + 0.29%, DAX 10,428.97 + 91.47 + 0.88%

-

09:21

WSE: After opening

The cash market (the WIG20 index) began the day with a modest increase of 0.04% to 1,760 points., which enabled fast leveling of Friday ends, when it came to accelerate sales on the final straight. If we assume that some players shortened positions before the weekend fearing for the publication of the project of currency loans law, it is now created a little space to the market return, which does not change the fact that the risk still remains.

In Europe, the mood is good, although a higher opening cause some problems with their magnification.

There have been published Polish PMI data and after the indication of 50.3 points we have some disappointment, especially since the number of new orders fell for the first time in almost two years. Polish PMI recorded the lowest value since September 2014 and is certainly not a positive image.

-

08:30

Expected positive start of trading on the major stock exchanges in Europe: DAX + 1,1%, FTSE 100 + 0.5%

-

08:21

WSE: Before opening

New month on the stock markets starts in optimistic mood. Friday's trading on Wall Street ended slightly positive. Not bad cope Asian stock markets, the Nikkei index increases by approx. 0.5%. This is due to a weaker dollar and probably less likely to increase interest rates in the US after Friday's weak GDP data in the second quarter. Also increase the valuation of US contracts, which should result in a positive effect of the morning openings in Europe.

In the macro calendar, traditionally the first session in August will bring a series of PMI and ISM readings for the industry. The most important information will come from China (PMI) and the USA (ISM).

On Friday, there have been published stress tests of European banks. Today's session will be under considerable influence of these results, but rather it is hard to talk about the big surprise. The weakest results among the 51 surveyed European banks took the Italian Monte dei Paschi, the Austrian Raiffeisen, Spanish Banco Popular and two major banks in Ireland.

Not the best side show the largest Italian bank UniCredit, which will affect the bank Pekao (WSE: PEO), sales plans of Pekao remain in force. In the group of 12 weakest banks were also German Deutsche Bank, Commerzbank, and British Barclays.

-

07:12

Global Stocks

European stocks closed higher Friday as bank shares fared well ahead of the release of stress-test results for the industry and investors reacting to another deluge of quarterly results.

The Stoxx Europe 600 SXXP, +0.71% rose 0.7% to finish at 341.89, sending it up 3.6% for the month. That marks the best monthly advance since October last year.

U.S. stocks ended the month on a high note, with the S&P 500 closing just a few points off a record level. All three main indexes posted solid monthly gains. For the benchmark S&P 500 and Dow industrials this was the fifth consecutive monthly advance. For the Nasdaq Composite, the monthly gain was the largest since March. The S&P 500 index SPX, +0.16% hit an intraday record level at 2,177.13, but closed off the highs. The index rose 3.54 points, or 0.2% to 2,173.60, finishing the week flat. Over the month, the index of large-cap stocks gained 3.6%. The Dow Jones Industrial Average DJIA, -0.13% slipped 24.11 points, 0.1% to 18,432.24 and posted a 0.8% loss over the week. Over the month, the blue-chip index gained 2.8%. Meanwhile, the Nasdaq Composite Index COMP, +0.14% ended the session up 7.15 points, or 0.1%, at 5,162.13, posting a 1.2% gain over the week and a 6.6% gain over the month.

Asian shares hit a one-year high on Monday after disappointing U.S. economic growth data reduced expectations that the U.S. Federal Reserve will raise interest rates in the next few months.

U.S. gross domestic product increased at a 1.2 percent annual rate in the April-June period, less than a half of a 2.6 percent growth rate economists had expected.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1.1 percent, hitting its highest level in about a year.

Asian markets showed limited reaction to a better-than-expected private survey on China's factory sector.

The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) rose to a 1 1/2-year high of 50.6, beating market expectations of 48.7 and up from 48.6 in June.

An official survey showed factory activity eased in July.

Japan's Nikkei .N225 was flat, having erased early losses of 1.5 percent triggered by the yen's jump after the Bank of Japan's stimulus plans left investors underwhelmed.

-

00:31

Stocks. Daily history for Jun Jul 29’2016:

(index / closing price / change items /% change)

Nikkei 225 16,569.27 +92.43 +0.56%

Shanghai Composite 2,979.38 -14.944 -0.50%

S&P/ASX 200 5,562.36 +5.80 +0.10%

FTSE 100 6,724.43 +3.37 +0.05%

Xetra DAX 10,337.5 +62.57 +0.61%

CAC 40 4,439.81 +19.23 +0.44%

S&P 500 2,173.6 +3.54 +0.16%

Dow Jones 18,432.24 -24.11

S&P/TSX Composite 14,582.74 +30.02 +0.21%

-