Noticias del mercado

-

22:07

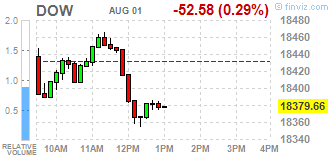

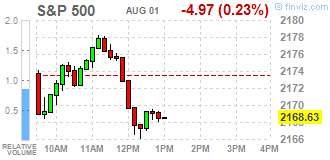

Major US stock indexes finished trading with a slight change

The Dow and S & P 500 dipped slightly, while the Nasdaq remains above the zero mark. The growth of technology companies such as Apple (AAPL), and Alphabet (GOOG), could not compensate for the drop in the energy sector due to the collapse in oil prices.

As the report from the ISM, in July, the activity in the US manufacturing sector has deteriorated moderately, while the fall exceeded the average forecast. The PMI for the US the production sector was 52.6 points versus 53.2 points in June. It was expected that this figure will drop to 53 points.

In addition, it became known that the US construction spending fell 0.6% in June, the decline is evenly distributed in the private and public sectors. This is the Ministry of Commerce said Monday. This was significantly lower than expected. Economists had expected an increase of 0.5%.

However, the final data presented Markit Economics, showed that seasonally adjusted manufacturing PMI index rose to 52.9 in July versus 51.3 in June. The latter value has coincided with the preliminary estimates and forecasts. The index also reached its highest level in 8 months. The report stated that the improvement of the business environment was associated with strong rates of growth in production, new orders and employment. Sub-production index recorded a second monthly increase in a row, and peaked in November 2015. Export sales also increased, the manufacturers associated with successful advertising initiatives and access to new markets. The growth of workloads, in turn, contributed to the accumulation of pending orders for the second month in a row.

Crude oil futures fell significantly, as the increase in the volume of OPEC production and the growth in the number of US rigs raise concerns about a global glut. "The mood among investors is still very negative due to a sharp fall in prices in recent years is now clear that to change the balance take longer than some market participants previously thought, -. Said Eugen Weinberg of at Commerzbank -. Data Reuters pointed to another one an increase in OPEC oil production. Meanwhile, a recent report by Baker Hughes showed that the increase in the number of drilling rigs "continues in the United States.

Most DOW components of the index ended the day mixed. More rest rose stocks Apple Inc. (AAPL, + 1.71%). Outsider were shares of Exxon Mobil Corp. (XOM, -3.65%).

Sector S & P index closed mixed. The leader turned conglomerates sector (+ 2.3%). Most of the basic materials sector fell (-2.7%).

At the close:

Dow -0.15% 18,404.78 -27.46

Nasdaq + 0.43% 5,184.20 +22.07

S & P -0.13% 2,170.80 -2.80

-

21:00

DJIA -42.18 18390.06 -0.23% S&P 500 -3.29 2170.31 -0.15% NASDAQ +21.44 5183.57 +0.42%

-

19:01

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Monday, led by tech stocks such as Apple and Google-parent Alphabet, but a drop in oil prices weighed on energy stocks.

Oil prices fell about 3,8% due to an increase in OPEC production and U.S. oil rig additions. Growth in U.S. gross domestic product in the second quarter unexpectedly remained tepid and came in below expectations. Data on Monday showed U.S. manufacturing activity slowed in July as orders fell broadly and construction spending dropped in June.

Most of Dow stocks in negative area (20 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +1.21%). Top looser - Exxon Mobil Corp. (XOM, -3.11%).

S&P sectors mixed. Top gainer - Conglomerates (+1.9%). Top looser - Basic Materials (-2.2%).

At the moment:

Dow 18307.00 -55.00 -0.30%

S&P 500 2163.25 -5.00 -0.23%

Nasdaq 100 4741.25 +14.50 +0.31%

Oil 40.02 -1.58 -3.80%

Gold 1359.50 +2.00 +0.15%

U.S. 10yr 1.49 +0.03

-

18:00

European stocks closed: FTSE 100 -30.48 6693.95 -0.45% DAX -6.98 10330.52 -0.07% CAC 40 -30.64 4409.17 -0.69%

-

17:39

WSE: Session Results

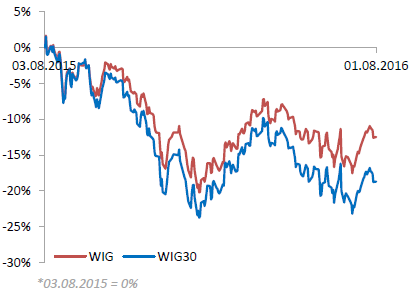

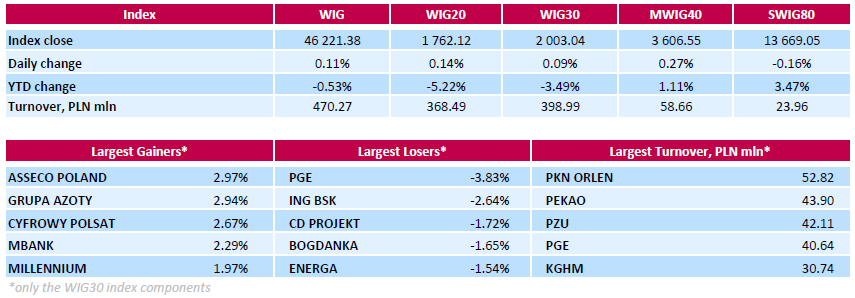

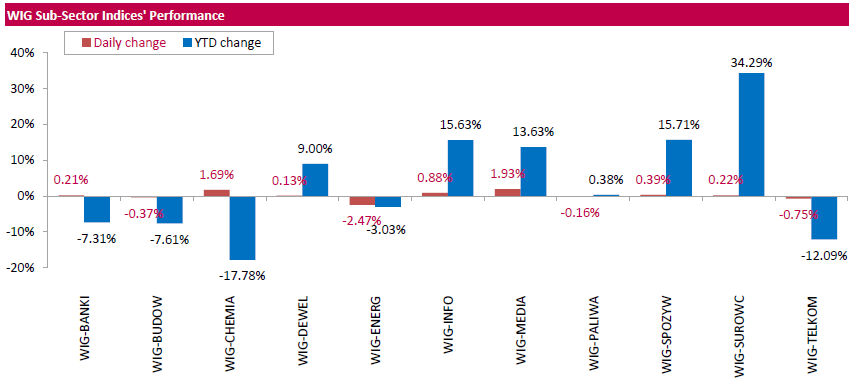

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, added 0.11%. Sector performance within the WIG Index was mixed. Media (+1.93%) outperformed, while utilities (-2.47%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, inched up 0.09%. In the index basket, IT-company ASSECO POLAND (WSE: ACP) and chemical producer GRUPA AZOTY (WSE: ATT) were the biggest advancers, jumping by 2.97% and 2.94% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS) and two banks MBANK (WSE: MBK) and MILLENNIUM (WSE: MIL), which gained 2.67%, 2.29% and 1.97% respectively. On the other side of the ledger, genco PGE (WSE: PGE) led the decliners, tumbling by 3.83%. The Polish treasury asked the company to raise its capital by PLN 5.6 bln, or 30 percent, by increasing the nominal value of its shares. Analysts said this was a way for the treasury, which holds a 58 percent stake in PGE, to force the company to pay an unexpected income tax, disadvantaging minority shareholders and potentially alarming investors in other state-owned companies, including oil and gas producer PGNIG (WSE: PGN), thermal coal miner BOGDANKA (WSE: LWB) and two gencos ENERGA (WSE: ENG) and ENEA (WSE: ENA). All these companies lost between 1.37% and 1.65%.

-

17:27

Gold price little changed today

Gold is slightly cheaper, departing from the nearly 3-week high as the dollar rebounded from session lows. However, the uncertainty regarding the timing of interest rate increases by the Federal Reserve limited the fall.

Market participants also continue to evaluate Friday's data on US GDP. Recall, the Department of Commerce reported that annualized GDP grew by 1.2 percent in the 2nd quarter. Economists had expected an increase of 2.6 percent. In general, a weaker-than-expected economic growth calls into question the possibility of a rate hike before the end of the year. Precious metals are sensitive to higher rates in the United States, but a gradual increase in prices carries less of a threat to gold, than a series of sharp hikes.

Oficials of the US Federal Reserve policy expressed different views regarding the rate increase: Dallas Fed President Robert Kaplan has called for caution, while the president of the Federal Reserve Bank of San Francisco John Williams said the Fed could raise rates up to two times by the end of this year.

This week markets will be closely watching the US data, particularly the monthly report of NFP. "If the labor market statistics will be weak, investors will fundamentally change their expectations about the US economic outlook and if it will be relatively good, it can compensate for the negative GDP data." - Jiang Shu analyst at Shandong Gold Group.

The cost of the August gold futures on the COMEX fell to $ 1348.70 per ounce.

-

16:20

US construction spending tumbled well below forecasts in June - Marketwatch

Spending on construction tumbled 0.6% in June, with declines spread evenly across the private and public sectors, the Commerce Department said Monday. That was well below forecasts. Economists surveyed by Econoday had expected a 0.6% increase. Outlays are still 6.2% higher for the first six months of the year compared to the same period in 2015. Housing seems to be holding its own: private residential construction was up 2.6% during the month, making it one of the strongest categories.

-

16:05

US ISM manufacturing declined to 52.6

Economic activity in the manufacturing sector expanded in July for the fifth consecutive month, while the overall economy grew for the 86th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

"The July PMI registered 52.6 percent, a decrease of 0.6 percentage point from the June reading of 53.2 percent. The New Orders Index registered 56.9 percent, a decrease of 0.1 percentage point from the June reading of 57 percent. The Production Index registered 55.4 percent, 0.7 percentage point higher than the June reading of 54.7 percent. The Employment Index registered 49.4 percent, a decrease of 1 percentage point from the June reading of 50.4 percent. Inventories of raw materials registered 49.5 percent, an increase of 1 percentage point from the June reading of 48.5 percent.

The Prices Index registered 55 percent, a decrease of 5.5 percentage points from the June reading of 60.5 percent, indicating higher raw materials prices for the fifth consecutive month. Manufacturing registered growth in July for the fifth consecutive month, as 12 of our 18 industries reported an increase in new orders in July (same as in June), and nine of our 18 industries reported an increase in production in July (down from 12 in June)" - Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management.

-

16:00

U.S.: ISM Manufacturing, July 52.6 (forecast 53)

-

16:00

U.S.: Construction Spending, m/m, June -0.6% (forecast 0.5%)

-

15:51

U.S. manufacturers signalled a relatively strong start to the third quarter

U.S. manufacturers signalled a relatively strong start to the third quarter of 2016. Output growth picked up markedly since June, driven by a robust and accelerated expansion of incoming new work. While domestic demand remained the key source of growth in July, there were also signs of renewed momentum in external markets.

Reflecting this, new export sales expanded at the fastest pace since September 2014. Increased workloads also contributed to rising payroll numbers and a solid upturn in input buying during July.

The seasonally adjusted Markit final U.S. Manufacturing Purchasing Managers' Index™ (PMI™) registered 52.9 in July, up from 51.3 in the previous month and comfortably above the postcrisis low seen in May (50.7).

The final PMI reading for July was unchanged from the earlier 'flash' reading (52.9). Improving business conditions reflected stronger rates of output, new order and employment growth during the latest survey period. July data signalled a sustained rebound in production volumes across the manufacturing sector. Higher levels of output have been recorded in each of the past two months, with the latest expansion the fastest since November 2015. Anecdotal evidence cited greater inflows of new work and supportive economic conditions.

-

15:49

WSE: After start on Wall Street

In the afternoon trading phase, most European parquets were on the red side in a greater or lesser extent and the worst behavior was showed by the banking sector.

The moods on the Wall Street are good, although, according to what was indicated by futures, trading starts flat, so still in terms of the volatility of the past two weeks.

The coming quarters may prove to be a crucial clue in terms of sentiment in the final phase of the European session, investors are waiting for data from the USA (ISM index for the industry, 16:00 - Warsaw time).

-

15:45

U.S.: Manufacturing PMI, July 52.9 (forecast 52.9)

-

15:35

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1025 (EUR 570m) 1.0970 (350m) 1.1125 (680m)

USD/JPY 102.00 (USD 740m) 102.50 (420m)

GBP/USD 1.3000 (GBP 545m) 1.3225 (200m) 1.3300 (275m)

USD/CAD 1.3095 (USD 230m)

AUD/NZD 1.0650 ( AUD 413m)

-

15:32

U.S. Stocks open: Dow +0.06%, Nasdaq +0.09%, S&P +0.01%

-

15:28

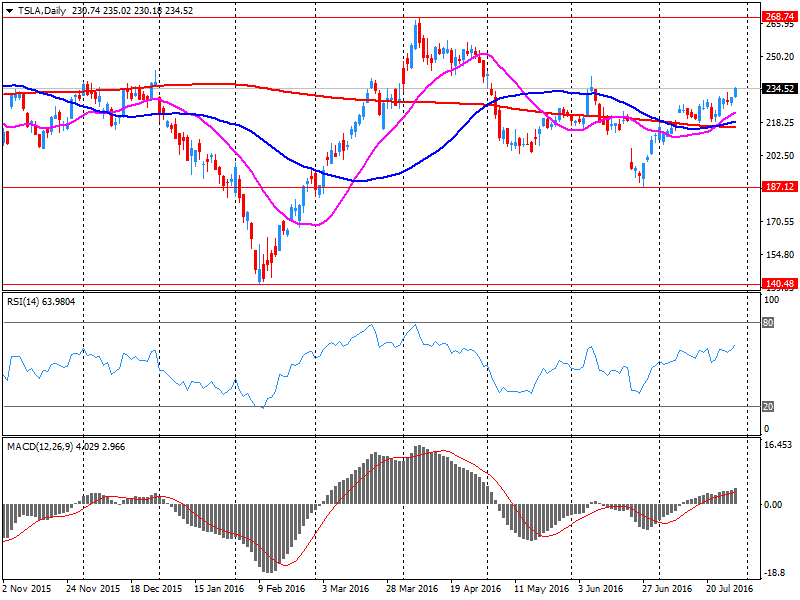

Company News: SolarCity (SCTY) and Tesla Motors (TSLA) have reached a definitive agreement to merge

The SolarCity (SCTY) confirmed the achievement of a definitive merger agreement with Tesla Motors (TSLA). According to the agreement, the shares of SolarCity will be purchased at weighted average price for the five-day trading period ending on July 29 that $ 25.37 / share. The total amount of the transaction is $ 2.6 billion. SolarCity shareholders will receive 0.110 common shares of Tesla per share SolarCity. The companies expect the deal to be completed in the fourth quarter of 2016.

As noted by the company, the merger will create "the world's only vertically integrated energy company that is stable." The companies expect that the synergies from the merger will be $ 150 million in the first year. In addition, they claim, by the merger of customers the opportunity to save by reducing hardware costs, reduce installation costs, increase production efficiency and reduce the cost of customer acquisition. In addition, the company expects that will benefit from the possibility to use 190 Tesla stores and its international presence.

Tesla shares rose to $ 235.34 (+ 0.23%), SCTY shares fell to $ 24.95 (-6.55%).

-

15:25

Before the bell: S&P futures +0.02%, NASDAQ futures +0.04%

U.S. stock-index futures were little changed as investors weighed growth prospects for the world's biggest economy amid rising bets on continuing policy support from the Federal Reserve.

Global Stocks:

Nikkei 16,635.77 +66.50 +0.40%

Hang Seng 22,129.14 +237.77 +1.09%

Shanghai 2,953.39 -25.9534 -0.87%

FTSE 6,700.1 -24.33 -0.36%

CAC 4,410.21 -29.60 -0.67%

DAX 10,316.42 -21.08 -0.20%

Crude $41.06 (-1.30%)

Gold $1355.20 (-0.17%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.57

-0.05(-0.4708%)

18061

ALTRIA GROUP INC.

MO

67.94

0.24(0.3545%)

6763

Amazon.com Inc., NASDAQ

AMZN

758.89

0.08(0.0105%)

9472

Apple Inc.

AAPL

104.7

0.49(0.4702%)

128698

AT&T Inc

T

43.24

-0.05(-0.1155%)

6199

Barrick Gold Corporation, NYSE

ABX

21.88

0.02(0.0915%)

18010

Boeing Co

BA

133.66

0.00(0.00%)

455

Chevron Corp

CVX

101.67

-0.81(-0.7904%)

2933

Cisco Systems Inc

CSCO

30.72

0.19(0.6223%)

8404

Citigroup Inc., NYSE

C

43.81

0.00(0.00%)

2115

Exxon Mobil Corp

XOM

88.5

-0.45(-0.5059%)

9879

Facebook, Inc.

FB

123.65

-0.29(-0.234%)

158636

Ford Motor Co.

F

12.68

0.02(0.158%)

20248

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.08

0.12(0.9259%)

50441

General Electric Co

GE

31.1

-0.04(-0.1285%)

17407

General Motors Company, NYSE

GM

31.31

-0.23(-0.7292%)

7125

Goldman Sachs

GS

159.9

1.09(0.6864%)

935

Google Inc.

GOOG

768.31

-0.48(-0.0624%)

2236

Hewlett-Packard Co.

HPQ

14.02

0.01(0.0714%)

2600

Intel Corp

INTC

34.85

-0.01(-0.0287%)

8322

JPMorgan Chase and Co

JPM

64.12

0.15(0.2345%)

610

McDonald's Corp

MCD

117.6

-0.05(-0.0425%)

4225

Merck & Co Inc

MRK

58.66

-0.00(-0.00%)

100

Microsoft Corp

MSFT

56.65

-0.03(-0.0529%)

5396

Pfizer Inc

PFE

37.07

0.18(0.4879%)

46838

Procter & Gamble Co

PG

85.51

-0.08(-0.0935%)

3595

Tesla Motors, Inc., NASDAQ

TSLA

235.5

0.71(0.3024%)

30212

The Coca-Cola Co

KO

43.65

0.02(0.0458%)

13356

Twitter, Inc., NYSE

TWTR

16.69

0.05(0.3005%)

66823

Verizon Communications Inc

VZ

55.15

-0.26(-0.4692%)

1185

Walt Disney Co

DIS

96.06

0.11(0.1146%)

2351

Yahoo! Inc., NASDAQ

YHOO

38.24

0.05(0.1309%)

4615

Yandex N.V., NASDAQ

YNDX

21.7

0.05(0.231%)

2584

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) removed from US 1 List at BofA/Merrill

-

14:35

European session review: the pound fell after weak data on industrial activity

The following data was published:

(Time / country / index / period / previous value / forecast)

France 7:50 PMI in the manufacturing sector (the final data) July 48.3 48.6 48.6

Germany 7:55 PMI in the manufacturing sector (the final data) July 54.5 53.7 53.8

8:00 Eurozone PMI in the manufacturing sector (the final data) July 52.8 51.9 52

8:30 UK PMI Manufacturing Index July 52.1 49.1 48.2

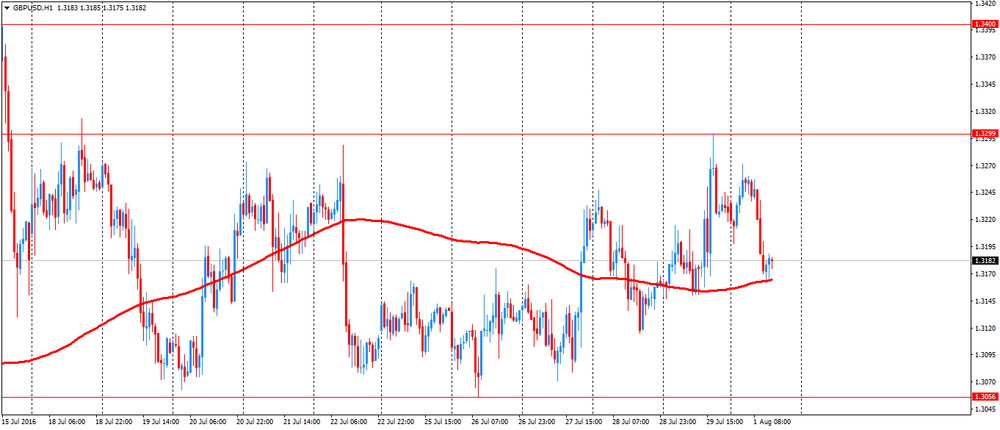

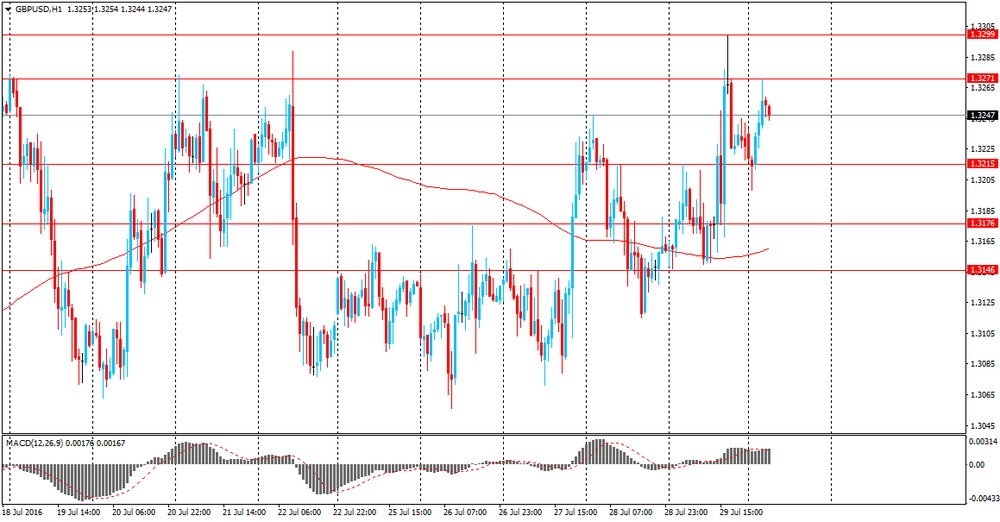

The British pound fell against the dollar after data confirmed the reduction of manufacturing activity in July, down more than the initial estimation, reinforcing fears about the prospects for economic growth.

The British manufacturing sector has been hit by the uncertainty associated with "Brexit", both production and orders declined, and the activity was the weakest since the beginning of 2013, showed Markit data.

The final purchasing managers' index for the manufacturing sector fell to 48.2 from 52.4 in June, noting the lowest level since February 2013. Preliminary estimate for the index was 49.1.

PMI value below 50 indicates a reduction in activity. It was only the second time since the beginning of 2013, when the index fell below the neutral mark, according to Markit.

Production dropped at the strongest pace since October 2012, with reductions in all areas.

While domestic demand has suffered from pre- and post-Brexit uncertainty, export orders rose for the second month in a row, mainly due to the recent decline in the exchange rate and efforts of companies to provide new contracts.

However, employment fell the seventh consecutive month. The weaker new orders and a decline in outstanding business volumes also suggest that employment could still fall in the coming months, Markit said.

Purchasing price inflation rose to a maximum of five years in July, due to the increase sterling induced import prices and higher prices for metals and commodities. As a result, selling prices increased at the fastest pace in two years.

"The trend of weakening orders and rising costs of inflation in the future to present a problem for manufacturers," said Markit senior economist Rob Dobson.

"On this account, the weak figures are powerful arguments in favor of quick action policies to prevent recession and will hopefully play a role in restoring confidence and achieve a speedy recovery."

Weak data triggered concerns about the strength of the UK economy and the increased expectations of a rate cut by the Bank of England's meeting monetary policy this week.

Euro traded slightly lower against the US dollar after the release of mixed data on manufacturing activity in the euro area.

Eurozone manufacturing activity grew at a slower pace in July, but the growth rate was faster than the initial estimate showed on Monday.

The manufacturing purchasing managers index fell to 52.0 in July from 6-month high of 52.8 in June. The preliminary reading for July was 51.9.

A reading above 50 indicates expansion. The Index signaled the expansion for 37 consecutive months.

The main factor behind the fall was weaker positive contributions from new orders growth. Although the pace of job creation were slightly lower, they were the fastest in the last five years.

Slower growth was recorded in three of the "big four" economies, namely Germany, Italy and Spain. At the same time, the decline in France continued.

Manufacturing PMI from Markit / BME for Germany fell to 53.8 in July from a 28-month high of 54.5 in On the other hand, the French industrial activity continued to decline in July. The final PMI rose to 48.6, according to initial estimates, from 48.3 in June.

The latter figure was the highest in the last four months, and pointed to a moderate rate of deterioration of operating conditions.

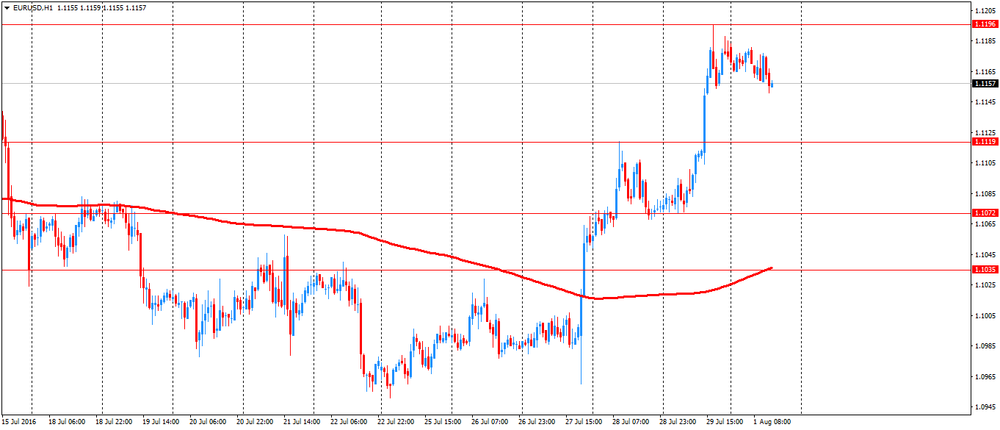

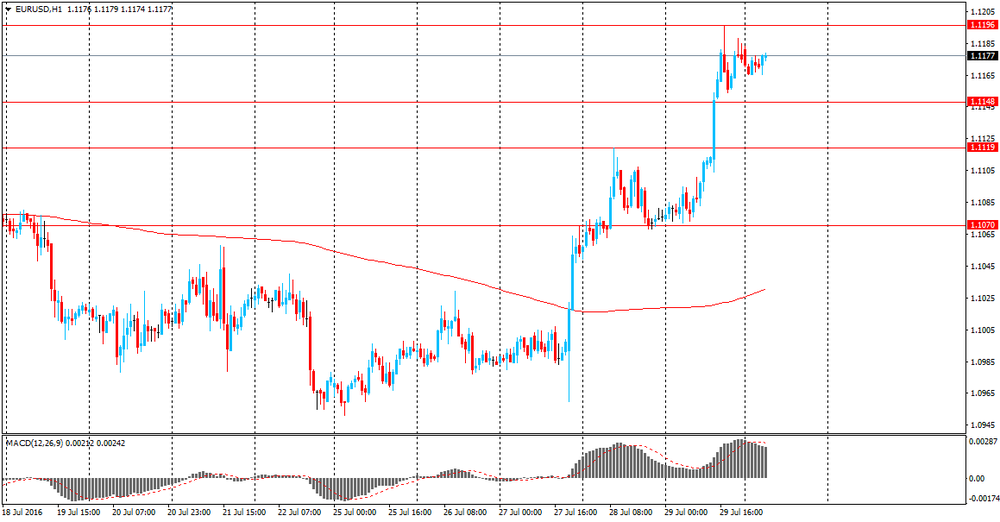

EUR / USD: during the European session, the pair fell to $ 1.1156

GBP / USD: during the European session, the pair fell to $ 1.3161

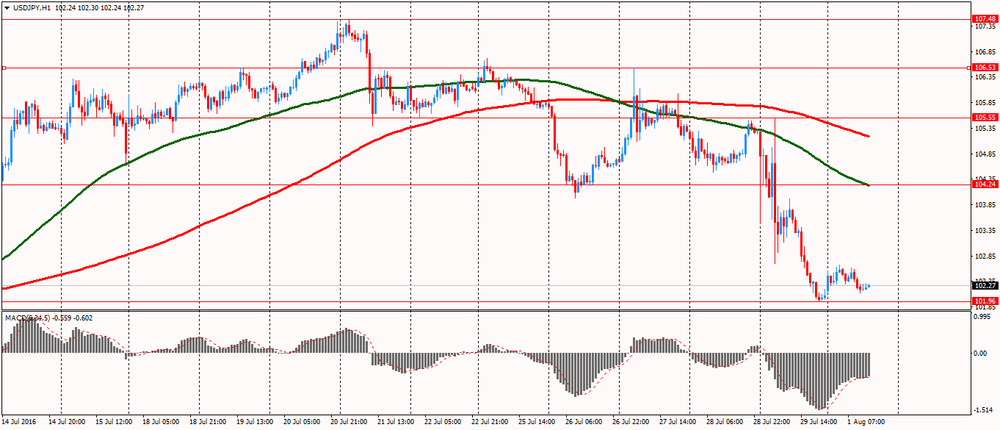

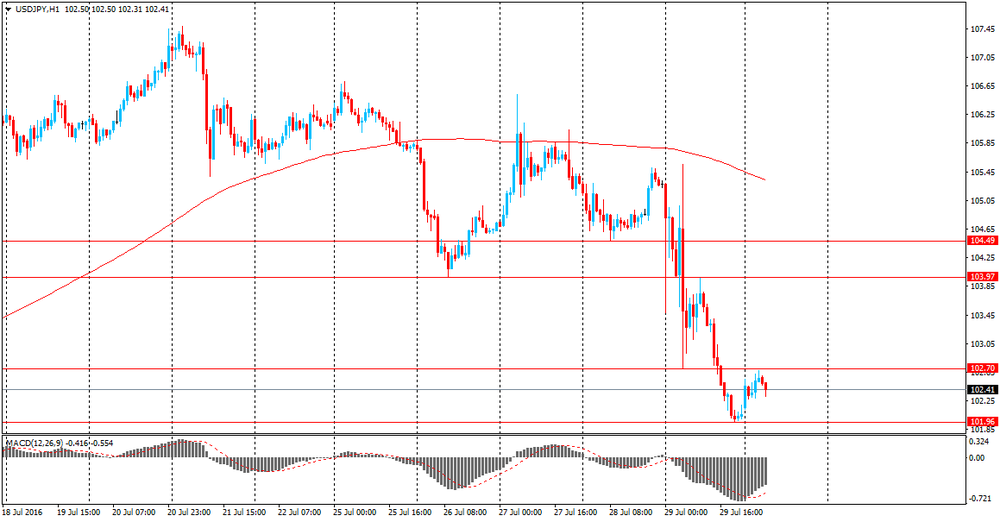

USD / JPY: during the European session, the pair fell to Y102.12

-

13:50

Orders

EUR/USD

Offers : 1.1180-85 1.1200 1.1230 1.1250 1.1280 1.1300-05 1.1335-40 1.1400

Bids: 1.1150-60 1.1120 1.1100 1.1085 1.1050 1.1035 1.1020 1.1000

GBP/USD

Offers : 1.3220 1.3250 1.3270 1.3285 1.3300 1.3320 1.3350-60 1.3400

Bids: 1.3200 1.3180 1.3150 1.3130 1.3100 1.3085 1.3050 1.3020 1.3000

EUR/GBP

Offers : 0.8475 0.8485 0.8500 0.8525 0.8550 0.8580 0.8600

Bids: 0.8420 0.8400 0.8385 0.8350 0.8330 0.8300

EUR/JPY

Offers : 114.80 115.00 115.20 115.50 115.80 116.00 116.50 116.80 117.00

Bids: 114.20 114.00 113.75 113.50 113.00 112.80 112.60 112.00

USD/JPY

Offers : 102.75-80 103.00 103.30 103.50 103.85 104.00 104.50 104.85 105.00

Bids: 102.20 102.00 101.75-80 101.50 101.00 100.80 100.50 100.00

AUD/USD

Offers : 0.7620 O.7635 0.7650-55 0.7700 0.7720 0.7750

Bids: 0.7580 0.7550 0.7535 0.7520 0.7500 0.7480-85 0.7450 0.7420 0.7400

-

13:40

The average price of Urals oil in January - July decreased to $ 38.68 a barrel - Rusian Ministry of Finance

The average price of Urals oil in January - July 2016 decreased by 1.5 times compared to the same period of 2015 and amounted to $ 38.68 per barrel.

-

13:07

WSE: Mid session comment

Morning publications of final PMI's for the European industrial sector was not optimistic. The data for the euro zone remain relatively stable and over the psychological level of 50 pts., but mostly thanks to the continued good shape of Germany. In other countries as in France or Greece the situation remains weak (return of ratio below 50 pts.) or noticeably deteriorated as in Italy or Spain (in Italy, the rate went down from 53.5 points to 51.2 points). Positively showed practically only two countries: the Netherlands and Hungary.

After a higher opening in Europe there were some problems on the demand side, and the German DAX gave almost of the whole morning growth.

The WIG 20 index went down the dash, mainly under the pressure of more than 4 percent depreciation of the PGE (WSE: PGE). The company said in the statement that considering an increase in the share capital using the company's own funds, which may have the effect of tax to the Treasury of more than PLN 1 billion.

In the halfway point of the session the WIG20 index was at the level of 1,755 points (-0,24%) and with turnover of PLN 163 mln.

-

12:43

Major stock indices in Europe trading mixed

European stocks traded mixed against the backdrop of rise in shares of mining companies and the dynamics of banks after the publication of the stress test results.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,3% to 340.72 points.

Stress tests of 51 European banks have produced, in general, positive results, despite the sluggish economic growth in the region and lower interest rates, said the European banking management (European Banking Authority, EBA).

Only 12 banks will face serious problems in case of a severe economic downturn, according to the results published on Friday.

Weak figures showed banks in Italy, Ireland, Spain and Austria. The last place on the list with the worst result took the Italian Banca Monte Paschi di Siena, the oldest active bank in the world. Its capital adequacy ratio in the case of the worst-case scenario would be negative (minus 2.44%), which means bankruptcy.

Also in that group was Unicredit and Raiffeisen, British Barclays and the two largest German bank - Deutsche Bank and Commerzbank.

Share of Monte Paschi di Siena, in spite of the unfavorable results of the stress tests has soared by 6.6%. The bank said it plans to get rid of the portfolio of "bad" assets.

Unicredit Securities fell during trading by 3,9%, Raiffeisen -9.8%. The value of Deutsche Bank increased by 0,6%, HSBC by 0.8%.

Statistical data on the euro zone economy, published on Monday, pointed to a slowdown in the growth of industrial activity in the region.

Thus, PMI index in the industrial sector of the euro area fell to 52 points from 52.8 points a month earlier, according to official data.

Share pof mining companies are rising today after the rise in metal prices on weak statistical data from China.

Heineken shares slowed down 1.6% after the world's third largest brewing company reported revenue for the first half that not reached analysts' forecasts.

Meanwhile, shares of Porsche SE rose 0.3% after the auto company reported net profits in the first half of the year +41%.

At the moment:

FTSE 6717.81 -6.62 -0.10%

DAX 10367.26 29.76 0.29%

CAC 4420.77 -19.04 -0.43%

-

12:30

Earnings Season in U.S.: Major Reports of the Week

August 2

Before the Open:

Pfizer (PFE). Consensus EPS $0.62, Consensus Revenue $13004.95 mln.

Procter & Gamble (PG). Consensus EPS $0.74, Consensus Revenue $15831.63 mln.

After the Close:

American Intl (AIG). Consensus EPS $0.94, Consensus Revenue $13096.15 mln.

August 3

After the Close:

Tesla Motors (TSLA). Consensus EPS -$0.63, Consensus Revenue $1657.91 mln.

August 5

After the Close:

Berkshire Hathaway (BRK.B). Consensus EPS $2910.79, Consensus Revenue $56469.41 mln

-

11:51

AUD Dips An Attractive Buy, RBA to disappoint - Citi

"1.50% is greater than zero and 0.75 is less than 1.10. These two certainties form the backbone of our AUD-positive view and are among the reasons why we anticipate that the currency will appreciate well above 0.80 vs. the USD.

In an environment in which ever easier G4 policy is boosting asset prices and driving investors to seek yield, AUD presents an attractive mix of low political risk, high credit standing and significantly positive yield. Indeed, Australia may represent the best mix of these attributes of any of its peers. Given that valuation for AUD remains far more attractive than was the case in previous years when the currency approached highs near 1.10, we expect the currency to attract heavier inflows as longer-term investors begin to respond to recent market and policy developments.

A marginal decline in interest rates or moderate AUD appreciation is unlikely to change this merits and valuation based calculus. Thus domestic threats to AUD, such as cutting rates from 1.75% to 1.50%, are second tier.

...The tactical conclusion is that those looking for the RBA and underlying developments to rein in AUD's performance may be disappointed amid the broader AUD-positive macro backdrop. We are not among those looking for the RBA to ease at its policy meeting this week, with the recent positive surprise on Australian CPI creating additional breathing room for the RBA to be patient. However, even if the RBA surprises us and fulfills market expectations on a possible move, it is not clear that this would represent a significant blow to AUD. Interest rates will still be higher than those elsewhere and much of the rest of the reasoning for AUD buying would be unchanged. Indeed, many investors who have been slow to participate in recent moves might simply view any dip in AUD as providing a more attractive entry point on valuation grounds". - efxnews.

-

11:17

Review of financial and economic press: Head of the Federal Reserve Bank of New York called the three risk factors for higher interest rate

Newspaper. ru

The head of the Federal Reserve Bank of New York William Dudley called the main risks of interest rate increase, reports Reuters. In particular, he called the stability of the dollar, the impact of international developments in the economic and financial spheres as well as the risks associated with the haste of these solutions. He also expressed his opinion about the possible tightening approach in the monetary sphere.

Deutsche Bank entered the top ten worst results of the stress test

Deutsche Bank was recognized as one of the worst credit institutions in Europe as a result of the stress test. This is stated in the report of the European Banking Supervision Service (EBA).

Exxon Mobil's quarterly profit fell 59%

Exxon Mobil announced a 59% fall in quarterly profit for April - June 2016 due to lower raw material prices, reports Reuters.

D / W

Air France strike touched 150 thousand passengers

Due to the cancellation of about 900 flights Air France suffered losses of tens of millions euros

BBC

Theresa May promising to defeat the "evil of modern slavery"

Theresa May said that Britain will lead the fight against modern slavery and promised that ridding the world of this "barbaric evil" will be one of the priorities of her premiership.

-

10:47

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.43% to $ 41.42 and Brent oil futures were down -0.25% to $ 43.41 per barrel. Thus, the black gold has decreased slightly, after last week's colpase and the little rebound on friday. However, analysts are skeptical about market prospects, noting the increase in the number of drilling rigs operating in the US, as well as signals of recovery in exports of raw materials from Libya. According to Baker Hughes, the number of active oil drilling rigs in the United States over the past week has increased by three, the highest since March. In addition, it was reported that four ports in Libya reopened.

-

10:43

Germany’s manufacturing activity shows moderate improvement

The final seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers - a single-figure snapshot of the performance of the manufacturing economy - posted above the 50.0 no-change mark for the twentieth successive month in July, thereby signalling continued growth in Germany's goods-producing sector. Despite falling from June's 28-month high of 54.5 to 53.8, the index remained above its long-run series average (51.9).

Part of the fall in the headline PMI was attributed to a slower rise in new order intakes. Nevertheless, the latest increase in new work was the secondstrongest in 28 months. New export orders also continued to rise during the month, with nearly onequarter of the survey panel reporting an expansion. As was the case with total new business, the rate of increase slowed slightly.

Manufacturers reported an acceleration in output growth at the start of the third quarter, which they generally linked to rising demand and the processing of backlogs. The pace of expansion was the fastest since April 2014. Rising demand in turn helped companies to reduce their finished goods stocks further.

-

10:41

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1025 (EUR 570m) 1.0970 (350m) 1.1125 (680m)

USD/JPY 102.00 (USD 740m) 102.50 (420m)

GBP/USD 1.3000 (GBP 545m) 1.3225 (200m) 1.3300 (275m)

USD/CAD 1.3095 (USD 230m)

AUD/NZD 1.0650 ( AUD 413m)

-

10:41

Euro Zone manufacturing PMI little changed in July

At 52.0 in July, down from June's six-month high of 52.8, the final Markit Eurozone Manufacturing PMI came in slightly above its earlier flash estimate of 51.9. The PMI has now signalled expansion for 37 consecutive months.

The main factor underlying the drop in the headline index was a softer positive contribution from new order growth. Incoming new business rose at a weaker pace than in June and to a lesser extent than the average for the year-to-date. Although the rate of job creation also ticked lower, it remained among the fastest registered over the past five years. This partly reflected further solid growth in production volumes, which held steady at June's six-month peak, and a further accumulation of backlogs of work. Inflows of new Countries ranked by Manufacturing PMI.

Ireland manufacturing data released August 2nd export business* also improved during the latest survey month, albeit at a marginally slower pace, in part aided by the weak euro exchange rate.

-

10:36

UK manufacturing PMI lowest since 2013

The UK manufacturing sector started the third quarter on a weaker footing. Levels of production and incoming new orders both contracted, as the impact of increased business uncertainty on the domestic market offset an exchange rate supported increase in new export business. At 48.2 in July, down from 52.4 in June, the seasonally adjusted Markit/CIPS Purchasing Managers' Index fell to its lowest level since February 2013.

The reading was also below the earlier flash estimate of 49.1. This is only the second time since early-2013 that the PMI has fell to a sub-50.0 level. The decline in production was the steepest since October 2012, with contractions across the consumer, intermediate and investment goods sectors. The intermediate goods sector saw the sharpest drops in both output and new orders. Investment goods manufacturers also saw a moderate decrease in new work received during July, although this partly reflected some payback from June's marked increase.

There was, a modest increase in new orders to consumer goods producers, albeit at a substantially reduced pace of growth than in the prior survey month.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , July 48.2 (forecast 49.1)

-

10:00

Eurozone: Manufacturing PMI, July 52 (forecast 51.9)

-

09:55

Germany: Manufacturing PMI, July 53.8 (forecast 53.7)

-

09:50

France: Manufacturing PMI, July 48.6 (forecast 48.6)

-

09:30

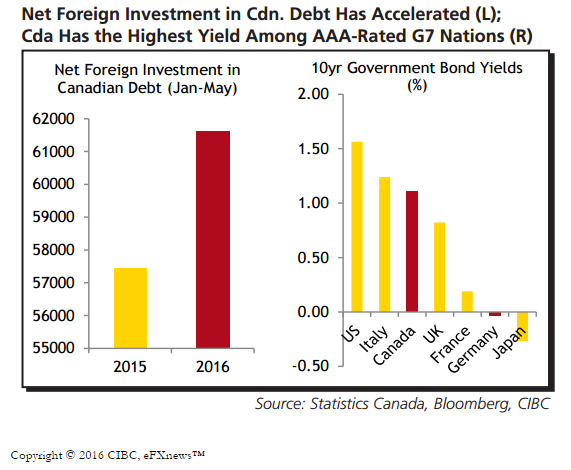

CAD Supported On Inflows Vs EUR, GBP - CIBC

"So far this year foreign investors having been piling into Canadian debt at a striking rate. Year-to-date inflows into Canadian debt are running roughly $4 bn ahead of the pace seen in 2015. In some ways, though, that's not surprising since Canada is one of only two AAArated credits among G7 countries.

With the other being Germany, who's 10-year yield currently sits in negative territory, international investors are viewing Canada as both safe and rewarding.

Looking ahead, with the BoE and ECB likely to ease policy later in the year, and the BoJ already adding some stimulus earlier this week, the pace of inflows could remain healthy, supporting the Canadian dollar against those currencies".

-

09:24

Major stock exchanges open higher: FTSE 100 6,740.59 + 19.53 + 0.29%, DAX 10,428.97 + 91.47 + 0.88%

-

09:21

WSE: After opening

The cash market (the WIG20 index) began the day with a modest increase of 0.04% to 1,760 points., which enabled fast leveling of Friday ends, when it came to accelerate sales on the final straight. If we assume that some players shortened positions before the weekend fearing for the publication of the project of currency loans law, it is now created a little space to the market return, which does not change the fact that the risk still remains.

In Europe, the mood is good, although a higher opening cause some problems with their magnification.

There have been published Polish PMI data and after the indication of 50.3 points we have some disappointment, especially since the number of new orders fell for the first time in almost two years. Polish PMI recorded the lowest value since September 2014 and is certainly not a positive image.

-

08:56

Asian session review: tight ranges across the board

During the Asian session, the US dollar traded in a narrow range against major currencies after widespread fall on Friday as weak data on economic growth have exacerbated doubts about the likely increase in US Federal Reserve interest rates this year.

The US Commerce Department announced that US economic growth stalled in the second quarter. According to seasonally adjusted data, gross domestic product grew by 1.2% annually in the second quarter. The last reading was well below the average forecast (+ 2.6%). We also add that economic growth for the first quarter was revised downward to + 0.8% from + 1.1%. The economy expanded by less than 2% for three consecutive quarters. Despite the fact that the recession was over seven years ago, the growth rate has not accelerated since. The average annual growth rate during the current business cycle remains the weakest since 1949.

The weakness of the economy has increased concerns about whether it will be able to transfer the increase in rates this year. On Wednesday, the US Federal Reserve left monetary policy unchanged.

Futures on interest rates on Friday indicate that investors see 12% chance of a rate hike in September, compared with 18% a day ago, according to CME Group.

The Australian dollar rose after the publication of positive data on the index of business activity in the manufacturing sector of China from Caixin. The index rose in July to 50.6, higher than analysts expectations of 48.7 and the previous value of 48.6. This is the first increase in the index for the last 17 months. New orders increased, but new export orders fell again. The unemployment rate rose, showing a significant loss of jobs. According to Markit Economics China's economy began to show signs of stabilization due to the gradual implementation of fiscal policy. However, the pressure on economic growth remain, and supportive fiscal and monetary policy should be continued.

Also, the Chinese Federation of Logistics and Supply were published data on the index of business activity in the service sector, according to which the index rose to 53.9 from 53.7 the previous value.

The index of activity in the manufacturing sector of the Australia, published by the Australian Industry Group, was 56.4 in July, higher than the previous value of 51.8. The group explores the results of a survey of 200 hundred producers in the aspect of assessment of business conditions including employment, production, orders, prices and stocks, as well as short-term planning. A reading above 50 is positive for the Australian dollar. New orders increased by 4.7 points, employment had grown to the highest level since December 2014. Sales increased by 6.5 points, which is the highest rate since September 2009. Inventories rose by 1.4 points. Exports increased by 9.6 points on the month to its highest level since March 2008

Sales of new homes in Australia in June increased by 8.2% after a decline of -4.4% in May. This indicator expresses the volume of new home sales in Australia. It evaluates the conditions of the housing market. Thus, the high value of the index is a positive factor for the Australian currency..

According to Australia's Housing Association new home sales rose in June after two months of decline. Sales of detached houses increased by 7.2%, while sales of apartments by 11.5%.

The yen weakened against the dollar as investors took profits after the Japanese currency on Friday rose sharply as the Bank of Japan decided on additional measures that fell short of investors' expectations. The central bank announced its intention to increase the purchase of ETF, but left interest rates and the amount of the bond purchase program unchanged.

It became known that the index of business activity in the manufacturing sector of Japan in July amounted to 49.3 points, which is higher than the previous value of 48.1 and economists' expectations of 49.0. However, this indicator is below 50 for the fifth month in a row on a background of weak demand. In addition, the strong yen is a negative impact on exports.

Production and new orders fell again, but at a slower pace. Slightly more positively proved the employment component, which has recently reached a historic high.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1160-65 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.3200-40 range

USD / JPY: during the Asian session, the pair was trading in Y102.15-50 range

-

08:38

Fed, Dudley: USD strength creating challenges for exporters

- Financial market conditions matter for setting policy

- Global developments also important for US outlook

- Federal Reserve monetary policy can impact far beyond US borders

- Should be cautious in raising rates, flatter path appropriate

- Global recovery since crisis has been disappointing

- US economy being held back by slower global growth

- USD strength creating challenges for exporters

- US quite close to employment and inflation objectives

- Inflation somewhat below objective but making progress

-

08:33

Inflation gauge from TD Securities Australia fell in July

Inflation expectations fell by 0.3% after rising 0.6% in June. In annual terms, inflation rose by 1.0%, lower than the previous value of 1.5%.

Information from the TD Securities inflation published by the Faculty of Economics and Commerce at the University of Melbourne estimates the level of inflation in the Australian economy. Overall, the decline is a negative factor for the Australian dollar.

-

08:30

Expected positive start of trading on the major stock exchanges in Europe: DAX + 1,1%, FTSE 100 + 0.5%

-

08:23

Chinese manufacturing sector showed increased activity in July

July survey data signalled a renewed upturn in operating conditions faced by Chinese manufacturers, with output, new orders and buying activity all returning to growth. However, employment continued to decline and at a solid pace, which in turn contributed to the quickest rise in outstanding business since March 2011. Meanwhile, increased prices for raw materials led to a marked rise in average input costs, which companies generally passed on to clients in the form of higher output charges. At 50.6 in July, the seasonally adjusted Purchasing Managers' Index™ (PMI™) - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - rose from 48.6 in June to signal a renewed improvement in operating conditions. Though only slight, it was the first strengthening in the health of the sector since February 2015.

-

08:21

WSE: Before opening

New month on the stock markets starts in optimistic mood. Friday's trading on Wall Street ended slightly positive. Not bad cope Asian stock markets, the Nikkei index increases by approx. 0.5%. This is due to a weaker dollar and probably less likely to increase interest rates in the US after Friday's weak GDP data in the second quarter. Also increase the valuation of US contracts, which should result in a positive effect of the morning openings in Europe.

In the macro calendar, traditionally the first session in August will bring a series of PMI and ISM readings for the industry. The most important information will come from China (PMI) and the USA (ISM).

On Friday, there have been published stress tests of European banks. Today's session will be under considerable influence of these results, but rather it is hard to talk about the big surprise. The weakest results among the 51 surveyed European banks took the Italian Monte dei Paschi, the Austrian Raiffeisen, Spanish Banco Popular and two major banks in Ireland.

Not the best side show the largest Italian bank UniCredit, which will affect the bank Pekao (WSE: PEO), sales plans of Pekao remain in force. In the group of 12 weakest banks were also German Deutsche Bank, Commerzbank, and British Barclays.

-

08:16

Japan’s index of business activity in the manufacturing sector rose slightly

The index of business activity in the manufacturing sector in July amounted to 49.3 points, which is slightly higher than the previous value of 49.0. Nikkei PMI provides a preliminary assessment of the health of the manufacturing sector in Japan - an important indicator of business conditions and the general economic conditions in Japan.

This indicator is below 50 for the fifth month in a row on a background of weak demand. In addition, the strong yen is a negative impact on exports.

Production and new orders fell again, but at a slower pace. Slightly more positively proved the employment component, which has recently reached a historic high.

-

07:12

Global Stocks

European stocks closed higher Friday as bank shares fared well ahead of the release of stress-test results for the industry and investors reacting to another deluge of quarterly results.

The Stoxx Europe 600 SXXP, +0.71% rose 0.7% to finish at 341.89, sending it up 3.6% for the month. That marks the best monthly advance since October last year.

U.S. stocks ended the month on a high note, with the S&P 500 closing just a few points off a record level. All three main indexes posted solid monthly gains. For the benchmark S&P 500 and Dow industrials this was the fifth consecutive monthly advance. For the Nasdaq Composite, the monthly gain was the largest since March. The S&P 500 index SPX, +0.16% hit an intraday record level at 2,177.13, but closed off the highs. The index rose 3.54 points, or 0.2% to 2,173.60, finishing the week flat. Over the month, the index of large-cap stocks gained 3.6%. The Dow Jones Industrial Average DJIA, -0.13% slipped 24.11 points, 0.1% to 18,432.24 and posted a 0.8% loss over the week. Over the month, the blue-chip index gained 2.8%. Meanwhile, the Nasdaq Composite Index COMP, +0.14% ended the session up 7.15 points, or 0.1%, at 5,162.13, posting a 1.2% gain over the week and a 6.6% gain over the month.

Asian shares hit a one-year high on Monday after disappointing U.S. economic growth data reduced expectations that the U.S. Federal Reserve will raise interest rates in the next few months.

U.S. gross domestic product increased at a 1.2 percent annual rate in the April-June period, less than a half of a 2.6 percent growth rate economists had expected.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1.1 percent, hitting its highest level in about a year.

Asian markets showed limited reaction to a better-than-expected private survey on China's factory sector.

The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) rose to a 1 1/2-year high of 50.6, beating market expectations of 48.7 and up from 48.6 in June.

An official survey showed factory activity eased in July.

Japan's Nikkei .N225 was flat, having erased early losses of 1.5 percent triggered by the yen's jump after the Bank of Japan's stimulus plans left investors underwhelmed.

-

07:06

Options levels on monday, August 1, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1277 (3067)

$1.1250 (3864)

$1.1230 (2902)

Price at time of writing this review: $1.1180

Support levels (open interest**, contracts):

$1.1121 (1840)

$1.1084 (2976)

$1.1041 (3091)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 39781 contracts, with the maximum number of contracts with strike price $1,1200 (3864);

- Overall open interest on the PUT options with the expiration date August, 5 is 52250 contracts, with the maximum number of contracts with strike price $1,0900 (6812);

- The ratio of PUT/CALL was 1.31 versus 1.31 from the previous trading day according to data from July, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1860)

$1.3405 (2068)

$1.3309 (1572)

Price at time of writing this review: $1.3250

Support levels (open interest**, contracts):

$1.3191 (585)

$1.3094 (2423)

$1.2997 (1805)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 28060 contracts, with the maximum number of contracts with strike price $1,3400 (2068);

- Overall open interest on the PUT options with the expiration date August, 5 is 26062 contracts, with the maximum number of contracts with strike price $1,2950 (3065);

- The ratio of PUT/CALL was 0.93 versus 0.94 from the previous trading day according to data from July, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:00

Japan: Manufacturing PMI, July 49.3 (forecast 49)

-

03:46

China: Markit/Caixin Manufacturing PMI, July 50,6

-

03:01

China: Manufacturing PMI , July 49,9 (forecast 50)

-

03:00

Australia: HIA New Home Sales, m/m, June 8.2%

-

03:00

China: Non-Manufacturing PMI, July 53.9

-

01:32

Australia: AIG Manufacturing Index, July 56.4

-

00:32

Commodities. Daily history for Jul 29’2016:

(raw materials / closing price /% change)

Oil 41.38 -0.53%

Gold 1,357.90 +0.03%

-

00:31

Stocks. Daily history for Jun Jul 29’2016:

(index / closing price / change items /% change)

Nikkei 225 16,569.27 +92.43 +0.56%

Shanghai Composite 2,979.38 -14.944 -0.50%

S&P/ASX 200 5,562.36 +5.80 +0.10%

FTSE 100 6,724.43 +3.37 +0.05%

Xetra DAX 10,337.5 +62.57 +0.61%

CAC 40 4,439.81 +19.23 +0.44%

S&P 500 2,173.6 +3.54 +0.16%

Dow Jones 18,432.24 -24.11

S&P/TSX Composite 14,582.74 +30.02 +0.21%

-

00:31

Currencies. Daily history for Jul 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1175 +0,89%

GBP/USD $1,3227 +0,51%

USD/CHF Chf0,9693 -1,15%

USD/JPY Y102,06 -3,15%

EUR/JPY Y114,06 -2,23%

GBP/JPY Y134,96 -2,65%

AUD/USD $0,7599 +1,25%

NZD/USD $0,7206 +1,82%

USD/CAD C$1,3032 -0,93%

-

00:00

Schedule for today, Monday, Aug 01’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia MI Inflation Gauge, m/m July 0.6%

01:00 Australia HIA New Home Sales, m/m June -4.4%

01:00 China Manufacturing PMI July 50 50

01:00 China Non-Manufacturing PMI July 53.7

01:45 China Markit/Caixin Manufacturing PMI July 48.6

02:00 Japan Manufacturing PMI (Finally) July 48.1 49

07:50 France Manufacturing PMI (Finally) July 48.3 48.6

07:55 Germany Manufacturing PMI (Finally) July 54.5 53.7

08:00 Eurozone Manufacturing PMI (Finally) July 52.8 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing July 52.1 49.1

13:45 U.S. Manufacturing PMI (Finally) July 51.3 52.9

14:00 U.S. Construction Spending, m/m June -0.8% 0.5%

14:00 U.S. ISM Manufacturing July 53.2 53

-