Noticias del mercado

-

21:00

DJIA 18430.62 -25.73 -0.14%, NASDAQ 5162.13 7.14 0.14%, S&P 500 2173.59 3.53 0.16%

-

18:46

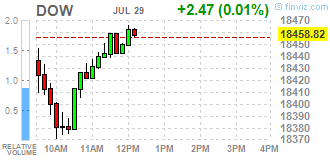

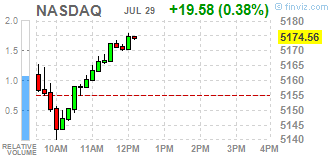

Wall Street. Major U.S. stock-indexes fluctuate

Major U.S. stock-indexes fluctuated. Strong quarterly results of Alphabet (GOOG) and Amazon (AMZN) boosted technology shares. This helped offset the losses in the energy sector, triggered by weak quarterly reports from ExxonMobil (XOM) and Chevron (CVX).

Negative impact on the investors' sentiment had also weaker-than-expected U.S. Q2 GDP data. The Commerce Department reported that the U.S. gross domestic product grew 1.2 percent in the second quarter, following a 0.8 percent in the first quarter. This was well below the 2.6% growth forecast of economists.

Most of Dow stocks in positive area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.35%). Top loser - Exxon Mobil Corp. (XOM, -1.91%).

All S&P sectors, but for Industrial Goods (-0.11%), in positive area. Top gainer - Technology (+0.73%).

At the moment:

Dow 18392.00 +16.00 +0.09%

S&P 500 2171.50 +6.75 +0.31%

Nasdaq 100 4736.00 +16.25 +0.34%

Crude Oil 41.35 +0.21 +0.51%

Gold 1357.50 +16.30 +1.22%

U.S. 10yr 1.47 -0.04

-

18:01

European stocks closed: FTSE 6724.43 3.37 0.05%, DAX 10337.50 62.57 0.61%, CAC 4439.81 19.23 0.44%

-

17:54

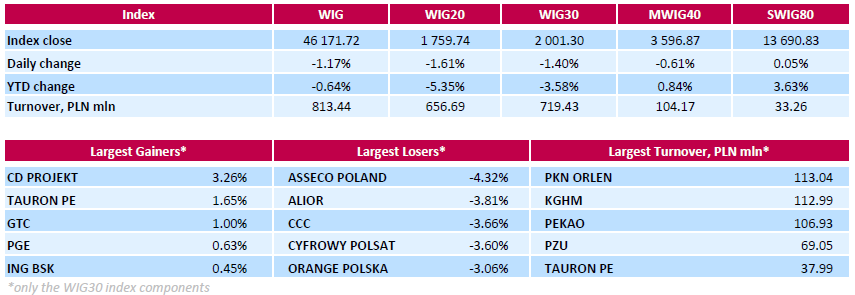

WSE: Session Results

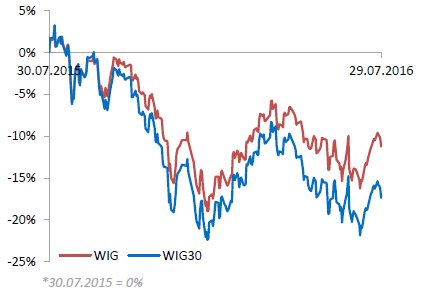

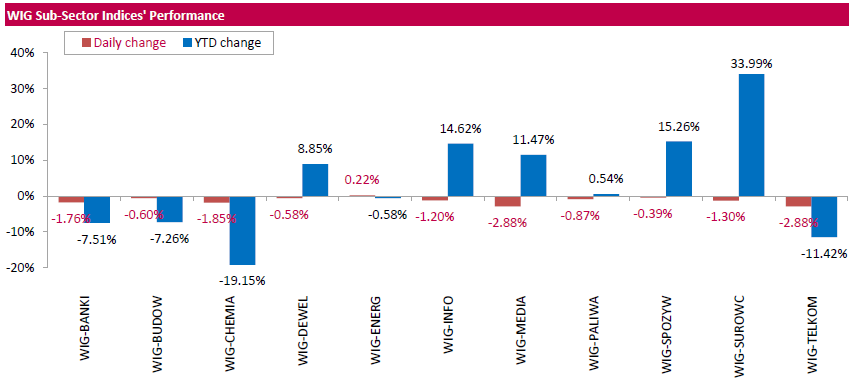

Polish equity market closed lower on Friday. The broad market benchmark, the WIG Index, dropped by 1.17%. All sectors, but for utilities (+0.22%), were down, with media (-2.88%) and telecoms (-2.88%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.4%. A majority of the index components recorded losses. IT-company ASSECO POLAND (WSE: ACP) was hit the hardest, down 4.32%. It was followed by bank ALIOR (WSE: ALR), footwear retailer CCC (WSE: CCC) and media group CYFROWY POLSAT (WSE: CPS), which lost between 3.6% and 3.81% At the same time, the handful advancers included videogame developer CD PROJEKT (WSE: CDR), property developer GTC (WSE: GTC), bank ING BSK (WSE: ING) and two gencos TAURON PE (WSE: TPE) and PGE (WSE: PGE) as well, which added between 0.45% and 3.26%.

-

15:40

WSE: After start on Wall Street

Reading of the US GDP for the second quarter strongly differ from the forecasts. Weak data completes the revision of GDP for the first quarter, which was lowered from 1.1 to 0.8 percent. Today's GDP reading partially neutralizes signal that the Fed may raise interest rates in mid-September. In short, dynamics of the US economy is low enough that we may begin to seriously consider the idea of stagflation, means a low economic growth with inflation. These data will not bring closer the Fed's monetary tightening, which is a positive element for emerging market currencies.

Reading GDP does not help the bulls today in the US although trading began at neutral level.

The beginning of the session in the US does not announce a breakthrough on the S&P500, which moves lateral movement and each party has an equal chance to take over the control. In this context, the worry may be about the weakness of our WIG20 index. The question is about its behavior in a situation when the S&P500 would leave the current consolidation down.

-

15:33

U.S. Stocks open: Dow -0.23%, Nasdaq +0.19%, S&P -0.07%

-

15:13

Before the bell: S&P futures -0.20%, NASDAQ futures -0.04%

U.S. index futures were mixed as investors assessed data on the U.S. Q2 GDP and corporate earnings.

Global Stocks:

Nikkei 16,569.27 +92.43 +0.56%

Hang Seng 21,891.37 -282.970 -1.28%

Shanghai 2,979.38 -14.944 -0.50%

FTSE 6,705.14 -15.92 -0.24%

CAC 4,418.39 -2.19 -0.05%

DAX 10,301.04 +26.11 +0.25%

Crude $40.86 (-0.68%)

Gold $1337.10 (+0.36%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.6

-0.08(-0.7491%)

36980

ALTRIA GROUP INC.

MO

67.09

-0.02(-0.0298%)

359

Amazon.com Inc., NASDAQ

AMZN

768.71

16.10(2.1392%)

162524

Apple Inc.

AAPL

104.37

0.03(0.0288%)

85798

AT&T Inc

T

42.58

0.00(0.00%)

1202

Barrick Gold Corporation, NYSE

ABX

21.51

0.24(1.1284%)

77543

Boeing Co

BA

133.01

-0.00(-0.00%)

4909

Caterpillar Inc

CAT

82.02

-0.90(-1.0854%)

1050

Chevron Corp

CVX

100.33

-1.46(-1.4343%)

31702

Cisco Systems Inc

CSCO

30.49

-0.03(-0.0983%)

14219

Citigroup Inc., NYSE

C

43.95

-0.13(-0.2949%)

23644

Deere & Company, NYSE

DE

76.95

-1.22(-1.5607%)

3087

E. I. du Pont de Nemours and Co

DD

68.5

-0.74(-1.0687%)

100

Exxon Mobil Corp

XOM

87.75

-2.45(-2.7162%)

217701

Facebook, Inc.

FB

124.3

-0.70(-0.56%)

266683

FedEx Corporation, NYSE

FDX

159.38

-2.07(-1.2821%)

600

Ford Motor Co.

F

12.65

-0.06(-0.4721%)

120421

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.75

-0.19(-1.4683%)

59453

General Electric Co

GE

31.3

0.05(0.16%)

7896

General Motors Company, NYSE

GM

30.9

-0.09(-0.2904%)

3029

Goldman Sachs

GS

160.37

-0.16(-0.0997%)

200

Google Inc.

GOOG

775.5

29.59(3.967%)

28752

Intel Corp

INTC

34.65

-0.12(-0.3451%)

2500

JPMorgan Chase and Co

JPM

63.8

-0.30(-0.468%)

4275

McDonald's Corp

MCD

119.02

-0.40(-0.335%)

203

Merck & Co Inc

MRK

59.14

0.71(1.2151%)

12017

Microsoft Corp

MSFT

55.81

-0.40(-0.7116%)

17139

Nike

NKE

55.16

-0.29(-0.523%)

3019

Pfizer Inc

PFE

36.68

0.01(0.0273%)

3433

Tesla Motors, Inc., NASDAQ

TSLA

230.5

-0.11(-0.0477%)

5335

The Coca-Cola Co

KO

43.79

0.14(0.3207%)

3270

Twitter, Inc., NYSE

TWTR

16.4

0.09(0.5518%)

83692

UnitedHealth Group Inc

UNH

141.83

-0.93(-0.6514%)

880

Verizon Communications Inc

VZ

54.86

0.00(0.00%)

165

Visa

V

79.01

-0.18(-0.2273%)

340

Walt Disney Co

DIS

95.92

0.01(0.0104%)

1228

Yahoo! Inc., NASDAQ

YHOO

38.31

-0.21(-0.5452%)

450

Yandex N.V., NASDAQ

YNDX

22.31

-0.02(-0.0896%)

1000

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Deere (DE) downgraded to Neutral from Buy at UBS

Ford Motor (F) downgraded to Neutral from Buy at Goldman; target lowered to $13 from $15

Other:

Amazon (AMZN) target raised to $855 from $810 at Mizuho

Amazon (AMZN) target raised to $900 at Cowen; Outperform

Amazon (AMZN) target raised to $877 at Axiom Capital

Alphabet (GOOG) target raised to $900 from $825 at Needham

Alphabet A (GOOGL) target raised to $990 at Axiom Capital; Buy

Alphabet A (GOOGL) target raised to $925 from $888 at Stifel

-

14:47

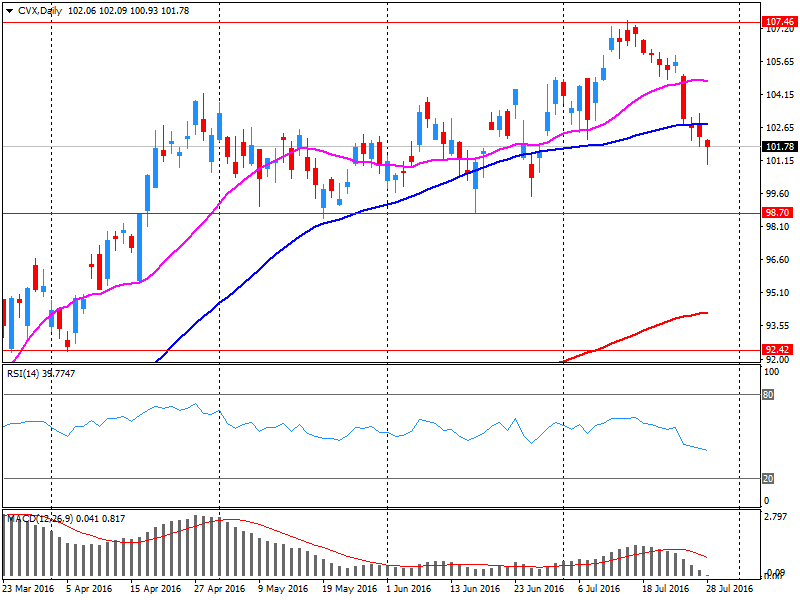

Company News: Chevron (CVX) posts Q2 loss

Chevron reported Q2 FY 2016 loss of $0.78 per share (versus earnings of $0.30 in Q2 FY 2015), missing analysts' consensus estimate of earnings $0.32.

The company's quarterly revenues amounted to $29.282 bln (-27.4% y/y), missing analysts' consensus estimate of $29.650 bln.

CVX fell to $100.32 (-1.44%) in pre-market trading.

-

14:21

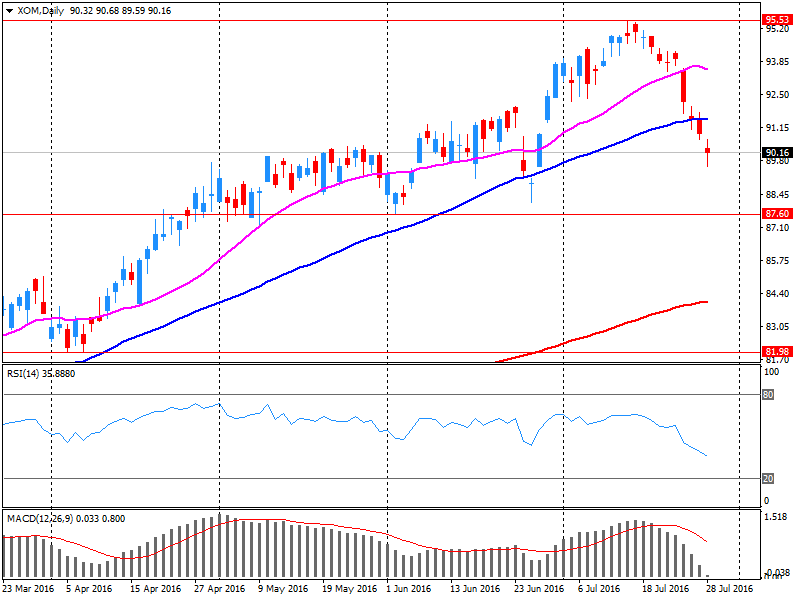

Company News: ExxonMobil (XOM) Q2 results miss analysts’ estimates

ExxonMobil reported Q2 FY 2016 earnings of $0.41 per share (versus $1.00 in Q2 FY 2015), missing analysts' consensus estimate of $0.64.

The company's quarterly revenues amounted to $57.694 bln (-22.2% y/y), missing analysts' consensus estimate of $64.001 bln.

XOM fell to $87.80 (-2.66%) in pre-market trading.

-

13:05

WSE: Mid session comment

In the first hour of today's trading the WIG20 fell by 0.7 percent. In the next hours we saw an attempt to correct this withdrawal, although it was just as sleepy as the decline, which brought the index near the 1.770 points. In the final of the first half of the trading, the WIG20 reported in the daily minimum. This makes the impression of continuing initiated in the morning decline and may mean clear invitation towards the level of 1.750 points.

Market activity today is moderate and almost one quarter of the volume at the largest companies belongs to Pekao shares. In fact, today we have to deal with the continuation of holiday trading.

In the halfway point of the session the WIG 20 was on the level of 1769 points (-1,05%).

-

13:04

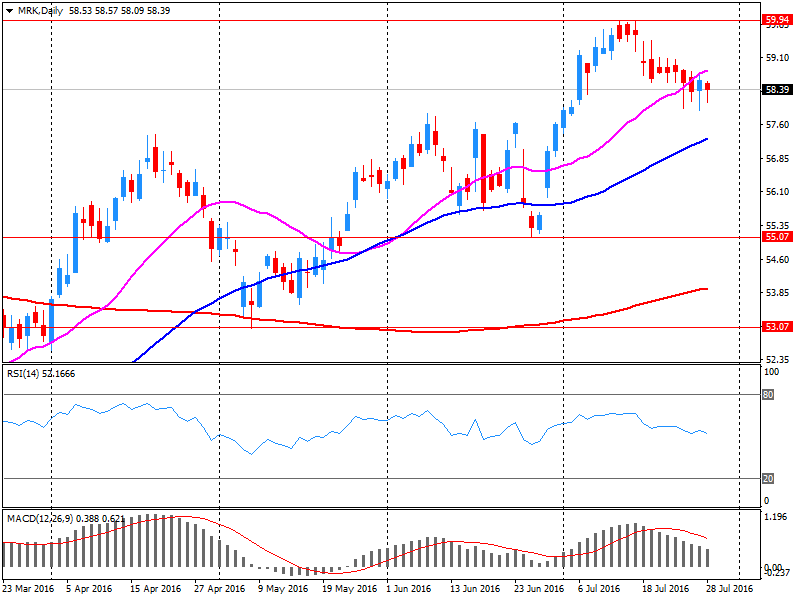

Company News: Merck (MRK) Q2 results beat analysts’ expectations

Merck reported Q2 FY 2016 earnings of $0.93 per share (versus $0.86 in Q2 FY 2015), beating analysts' consensus estimate of $0.91.

The company's quarterly revenues amounted to $9.844 bln (+0.6% y/y), slightly beating analysts' consensus estimate of $9.783 bln.

MRK closed Thursday's trading session at $58.43 (-0.29%).

-

12:57

Major stock indices in Europe trading mixed

European stocks trading mixed as the rise in price of banks shares compensated the negative dynamics in the mining and energy sectors. Investors are also waiting for the results of stress tests of European banks, which will be published today after the market closes.

Trading dynamic was also influenced by statistics for the euro area and Britain. Preliminary data from Eurostat showed that in the 2nd quarter Eurozone GDP grew by 0.3 per cent compared with an increase of 0.6 percent in the first quarter, in line with expectations. This slow growth was last recorded in the third quarter of 2015. In annual terms, growth slowed to 1.6 percent from 1.7 percent. It was expected that GDP will increase by 1.5 percent.

Another report showed that in July consumer prices in the eurozone rose by 0.2% after rising 0.1% in June. Analysts had expected the index to rise by 0.1%. Core CPI, which does not take into account the volatile energy and food prices, rose in July by 0.9%, which coincided with the change in June.

With regard to data in the UK, the Bank of England reported that the number of mortgage approvals in Britain fell sharply at the end of June to the lowest level since May 2015, but consumer lending expanded at the fastest pace in nearly 11 years. In June 64.766 mortgages were aprovd compared to 66.722 in May. Consumer lending has increased in June by 10.3 percent y/y, recording the fastest annual growth rate since October 2005. As a result, lending volume amounted to 1.837 billion vs 1.599 billion pound in May (revised from 1.503 billion. Lbs). At the same time, the Bank of England forecast a slowdown in credit growth in the second half of this year due to Brexit.

The composite index of Europe's largest enterprises Stoxx 600 added 0.3%. Since the beginning of the month the index rose by 3.2 percent. However, in July it saw record outflows from European equity and lower trading volume, indicating a lack of conviction in the rally. Stoxx 600 remains below its level of 23 June, the day of a referendum on Britain's membership in the EU, while the US and Asian indices have regained all the losses.

"The main fear was a possible market downturn in the second half of the year, but so far there was no evidence that we are moving in this direction - said Guillermo Samper, head of trading at MPPM EK -. It took some time to understand that expectations was much worse than the actual situation. The accounts of many companies exceeded forecasts, and some of them have even revised their estimates upward. "

Capitalization of Barclays Plc jumped 6.6 percent amid reports that the core business profit increased by 19 percent, to 2.4 billion., exceeding the performance of European competitors. Also, the bank said that the performance of non-core businesses will have less pressure on the overall profitability in 2017.

Shares of Banco Bilbao Vizcaya Argentaria SA rose 4.6 percent and UBS Group AG rose 3.3 percent after reported a quarterly profit that topped analysts' estimates.

Shares of Natixis SA rose 6.2 percent, since the amount of earnings and revenue forecasts turned out to be greater tha forecasts.

The price of L'Oreal SA fell 4.5 percent after the sales did not meet expectations. The company stated that the reason for this was the deterioration of conditions in France.

Capitalization of Foxtons Group Plc fell 7.7 percent, as the report pointed to a decline in revenues in the first half the size.

At the moment:

FTSE 100 -8.71 -0.13% 6712.35

DAX +46.33 10321.26 + 0.45%

CAC 40 +5.34 4425.92 + 0.12%

-

09:23

WSE: After opening

WIG20 index opened at 1792.92 points (+0.25%)*

WIG 46754.14 0.08%

WIG30 2031.64 0.09%

mWIG40 3614.57 -0.12%

*/ - change to previous close

The beginning of trading on the Warsaw market was in a peaceful atmosphere, and the major indexes recorded cosmetic changes. European markets responded with increases on yesterday's gains on Wall Street, and the WIG20 - traditionally approached with a distance to the upward pressure from the environment. After the first transaction the WIG20 was in the area of 1783 points. Disturbingly looks the KGHM decline, the company lost 1.6 percent. Continuous emotions may be seen on the shares of Pekao, but this time the company gets more expensive by 0.7 percent.

-

08:25

WSE: Before opening

Yesterday's end of the day on Wall Street was much better than expect by European investors. The S&P500 index closing session increased by 0.16%. Currently the contract for the S&P500 is at neutral level, which will be conducive for increasing beginning in Europe.

The Bank of Japan has announced in its communication, that there are problems of a global nature, such as the planned output of the UK from the EU, the slowdown in emerging markets and the general uncertainty and volatility in the financial markets and decided to act. Announced therefore increase purchasing of ETFs and decided to enlarge the loan program from 12 billion USD to 24 billion USD. The market nevertheless found the attitude of the BoJ disappointing. It was expected to increase the scale of the increase in the monetary base and the transition to a more negative interest - and this was not.

From the point of view of the Warsaw Stock Exchange, the last session of the month promotes pulling up by investment funds valuations of small and medium sized companies, which are doing better recently than blue chips. In the case of blue chips final session of the month will take place in the context of the confusion surrounding the sale of Pekao shares by UniCredit and general situation of banks in Europe, which will hit this evening by the results of "stress tests".

Everyone will pay attention to the condition of the banking sector in Italy, but for the Warsaw Stock Exchange will be important also what occurs in the case of Deutsche Bank.

-

07:17

Global Stocks

European stocks fell Thursday, as bank shares were dragged down and as investors grappled with a stream of corporate earnings reports from key companies such as Royal Dutch Shell PLC and Adidas AG.

The Stoxx Europe 600 SXXP, -0.95% fell 1% to close at 339.47, marking the first loss in four sessions. The pan-European index on Wednesday finished up by 0.4%, led by a surge in French equities.

The topic of Brexit, or the U.K.'s pending exit from the European Union, has been a major theme in European earnings reports in the wake of the U.K.'s June 23 referendum. The impact of currency headwinds and low oil prices have also been areas of concerns for companies.

U.S. stocks closed little changed Thursday following a mixed bag of earnings reports and a slight reprieve from a close correlation with declining oil prices. The Dow Jones Industrial Average DJIA, -0.09% declined 15.82 points, or 0.1%, to close at 18.456.35, weighed down by shares of Boeing Co. BA, -2.17% which closed down 2.2%. The S&P 500 Index SPX, +0.16% advanced 3.48 points, or 0.2%, to close at 2,170.06, led by gains in the consumer-staples and utilities sectors. The Nasdaq Composite Index COMP, +0.30% rose 15.17 points, or 0.3%, to finish at 5,154.98 its highest close since Dec. 1, 2015. Oil futures for September delivery CLU6, -0.34% dropped 1.9% to settle at $41.14 a barrel.

Asian shares slipped after touching a near one-year peak on Friday, while Japanese stocks tumbled and the yen strengthened as the Bank of Japan's fresh stimulus measures disappointed markets.

The BOJ modestly increased purchases of exchange-traded funds, but maintained its base money target at 80 trillion yen ($775 billion) and the pace of purchases of other assets, including Japanese government bonds.

The central bank also held at 0.1 percent the interest it charges to a portion of excess reserves financial institutions leave with the central bank.

Japan's Nikkei .N225, which swung between gains and losses right after the announcement, was last trading down 1.5 percent. The index, which touched a seven-week high last week, was on track for a 2.4 percent weekly drop, shrinking gains for July to 4.2 percent.

-

04:04

Nikkei 225 16,441.73 -0.21%, Shanghai Composite 2,991.99 -0.08%

-

01:23

Stocks. Daily history for Jun Jul 28’2016:

(index / closing price / change items /% change)

Nikkei 22 16,476.84 -1.13%

Shanghai Composite 2,994.98 +0.10%

CAC 40 4,420.58 -0.59%

Xetra DAX 10,274.93 -0.43%

FTSE 100 6,721.06 -0.44%

S&P 500 2,170.06 +0.16%

Dow Jones 18,456.35 -0.09%

-