Noticias del mercado

-

17:43

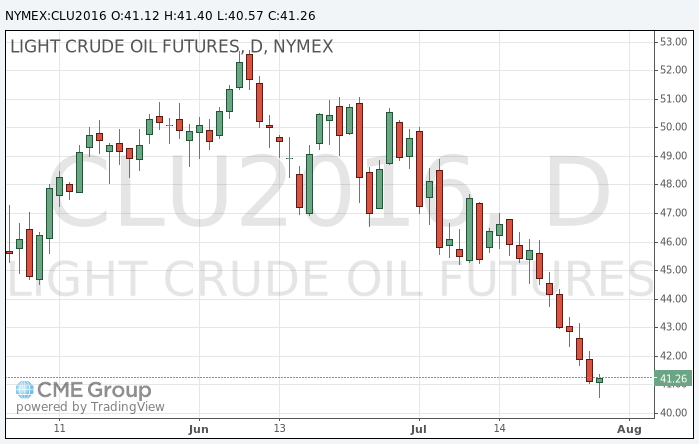

OIL prices show moderate gains and maybe a reversal

Oil prices on NYMEX have moved into positive territory on the background of buying at low prices at the expiry of contracts.

Earlier today, WTI oil prices fell to a new three-month low, as concerns over the glut of world reserves of oil and petroleum products continue to dominate market sentiment.

Oil prices remain under pressure after the US Energy Information Administration (EIA) said in its weekly report that crude oil inventories rose by 1.7 million barrels in the week ended July 22 to 521.1 million barrels, the ministry called "historically high levels for this time of year."

In recent weeks, the US standard remains under pressure amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

Oil prices have fallen nearly 18% from a peak of $ 50 in early June, as the excess gasoline stocks overshadow prospects for oil demand.

The cost of the September futures on WTI rose to 41.40 dollars per barrel.

September futures price for North Sea petroleum mix of Brent crude rose to 43.45 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:25

Gold price rose

Gold prices rose, supported by weak data on economic growth in the United States and month end flows.

The US Commerce Department announced that US economic growth stalled in the second quarter.

According to seasonally adjusted data gross domestic product grew by 1.2% annually in the second quarter. The last reading was well below the average forecast (+ 2.6%). We also add that economic growth for the first quarter was revised downward to + 0.8% from + 1.1%.

The economy expanded by less than 2% for three consecutive quarters. Despite the fact that the recession was over seven years ago, the growth rate has not accelerated since. The average annual growth rate during the current business cycle remains the weakest since 1949.

Weaker-than-expected GDP data call into question the possibility of raising interest rates before the end of this year.

The dollar index recently fell by 1%.

Earlier on Friday, the price of gold rose rapidly after the Bank of Japan announced its intention to buy ETF for 6 trillion yen, whereas previously this amount was 3.3 trillion yen. Investors assumed that the central bank will introduce more extensive measures to support the economy and increase inflation.

The cost of the August gold futures on the COMEX rose to $ 1347.10 per ounce.

-

13:49

Oil price forecast kept at $ 40-50 per barrel in 2016 - Novak

Energy Minister of the Russian Federation retains the forecast for oil prices in 2016 in the range of $ 40-50 per barrel, Alexander Novak said after talks with Minister of Communications and Information Technology of Iran, co-chair of the Intergovernmental Russian-Iranian commission, Mahmoud Vaezi.

"The forecasts we made that oil will be between 40 and 50$ per barrel correspond to reality," - he said.

Novak added that the outlook for the balancing of the market has not changed - the middle of 2017.

Today, the cost of the futures on Brent crude for delivery in September 2016 on the ICE exchange in London fell 2% compared to the closing level, to 41.86 dollars per barrel. Thus, oil prices fell below 42 dollars for the first time since April 18.

-

10:21

Oil is trading lower

Today, oil is trading near the lows from April. The price of oil is down due to negative expectations related to the global economic outlook and and excess supply of oil and petroleum products in the markets.

The cost of the September futures for Brent oil on the London Stock Exchange dropped to $ 42.59 a barrel. Futures pfor WTI crude oil September on New York Mercantile Exchange (NYMEX) decreased to $ 41 per barrel.

-

08:59

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,4%, FTSE 100 + 0,1%, CAC 40 + 0.6%

-

01:24

Commodities. Daily history for Jul 28’2016:

(raw materials / closing price /% change)

Oil 41.13 -0.02%

Gold 1,333.40 +0.08%

-