Noticias del mercado

-

16:33

BNPP recommends staying short AUD for RBA cut next week. Take it with a pinch of salt

"We maintain our bearish outlook for the AUD heading into next week's Reserve Bank of Australia (RBA) policy meeting on 2 August.

Our economists are still expecting the RBA to cut rates by 25bp (60% is priced into the AUD rates market), despite the slightly firmer Q2, underlying the CPI print this past week.

Our BNP Paribas FX Positioning Analysis highlights that AUD exposure is actually net long, with a score of +14 (on our scale of +/- 50). We view such positioning as far too complacent against a backdrop of declining commodity prices, rising US real yields and potential RBA easing.

We remain very bearish on the AUD targeting a move to 0.70 over the next three months".

-

16:08

Chicago PMI down 1 point from the previous value

- New Orders and Production Expand at a Slower Rate

- Employment Back Above 50

The MNI Chicago Business Barometer fell 1 point to 55.8 in July, slipping from the 1½-year high of 56.8 seen in June, led by a fall in New Orders. Smaller declines were seen in Production and Order Backlogs, which offset a strong increase in the Employment component.

-

16:06

Consumer sentiment in US declined slightly

"Although confidence strengthened in late July, for the month as a whole the Sentiment Index was still below last month's level mainly due to increased concerns about economic prospects among upper income households. The Brexit vote was spontaneously mentioned by record numbers of households with incomes in the top third (23%), more than twice as frequently as among households with incomes in the bottom two-thirds (11%). Given the prompt rebound in stock prices as well as the tiny direct impact on U.S. trade, it is surprising that concerns about Brexit remained nearly as high in late July as immediately following the Brexit vote. While concerns about Brexit are likely to quickly recede, weaker prospects for the economy are likely to remain. Uncertainties surrounding global economic prospects and the presidential election will keep consumers more cautious in their expectations for future economic growth. Based on the strength in personal finances and low interest rates, real consumer spending is now expected to rise by 2.6% through mid 2017" - Surveys of Consumers chief economist, Richard Curtin.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, July 90 (forecast 90.5)

-

15:45

U.S.: Chicago Purchasing Managers' Index , July 55.8 (forecast 54)

-

15:40

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 550m) 1.0970 (350m) 1.1000 (1.8bln) 1.1050 (1.1bln) 1.1200 (250m)

USDJPY 104.00 (USD 365m) 104.75 (600m) 105.00 (750m) 105.70-75 (1.1bln)106.00 (710m) 106.25 (500m) 106.75 (650m) 106.90 (1.2bln) 107.00-10 (845m) 108.00-10 (2.6bln)

AUDUSD 0.7470 (AUD 590m) 0.7600-10 (460m)

AUDNZD 1.0785 ( AUD 1.4bln)

-

15:02

Industrial product prices rose in Canada

The IPPI advanced 0.6% in June, after gaining 1.2% in May. Of the 21 major commodity groups, 14 were up, 4 were down and 3 were unchanged.

Energy and petroleum products (+3.9%) posted gains for a fourth consecutive month and were the largest contributor to the increase in the IPPI. Higher prices for motor gasoline (+2.6%), light fuel oils (+6.5%) and diesel fuel (+5.4%) were the main reasons for the advance in energy and petroleum products. The IPPI excluding energy and petroleum products rose 0.3% in June.

-

14:55

Canadian GDP fell 0.6% in May

Real gross domestic product (GDP) fell 0.6% in May, the largest monthly decline since March 2009. The decrease in May was primarily due to lower non-conventional oil extraction, a consequence of the Fort McMurray wildfire and evacuation.

The Fort McMurray wildfire was the main cause behind a 2.8% decline in the output of goods-producing industries. The mining, quarrying, and oil and gas extraction sector fell 6.4%, as the output of the non-conventional oil extraction industry recorded a 22% drop. Following an 8.1% decrease in April due to maintenance shutdowns at upgrader facilities, the output level in May for this industry was the lowest since May 2011.

Excluding the decline in the non-conventional oil extraction industry, real GDP edged down 0.1% in May. There was little evidence that the Fort McMurray wildfire significantly affected other industries at the national level. Therefore, the difference between the overall 0.6% decline in GDP and the 0.1% decrease in GDP excluding the non-conventional oil and gas industry is an approximation of the direct impact that the Fort McMurray wildfire had on overall growth in May.

-

14:51

-

14:37

US GDP misses expectations and rise just 1.2% in the second quarter

Real gross domestic product increased at an annual rate of 1.2 percent in the second quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 0.8 percent (revised).Current-dollar GDP increased 3.5 percent (table 1), or $155.9 billion, in the second quarter to a level of $18,437.6 billion. In the first quarter, current dollar GDP increased 1.3 percent (revised), or $58.9 billion.

The price index for gross domestic purchases increased 2.0 percent in the second quarter, compared with an increase of 0.2 percent in the first (revised). The PCE price index increased 1.9 percent, compared with an increase of 0.3 percent. Excluding food and energy prices, the PCE price index increased 1.7 percent, compared with an increase of 2.1 percent -

14:32

European session review: US dollar fell on month end flows

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Retail Sales seasonally adjusted 0.7% in June -0.1% -0.1%

6:00 Germany Retail sales, excluding seasonal adjustments, y / y in June 2.8% 1.3% 2.7%

6:30 Japan Press Conference of the Bank of Japan

7:00 Switzerland index of leading economic indicators from the KOF July 102.6 101.3 102.7

8:30 UK approved applications for mortgage loans, th. June 66.72 65.65 64.77

8:30 Volume UK net lending to individuals, 4.3 billion in June 4.2 5.2

8:30 UK Changing the volume of consumer lending, one million in June 1599 1400 1837

9:00 Eurozone Consumer Price Index y / y (preliminary data) July 0.1% 0.1% 0.2%

9:00 Eurozone consumer price index base value, y / y in July 0.9% 0.8% 0.9%

9:00 The Eurozone unemployment rate in June 10.1% 10.1% 10.1%

9:00 Eurozone GDP q / q (preliminary data) II quarter 0.6% 0.3% 0.3%

9:00 Eurozone GDP y / y (preliminary data) II quarter 1.7% 1.5% 1.6%

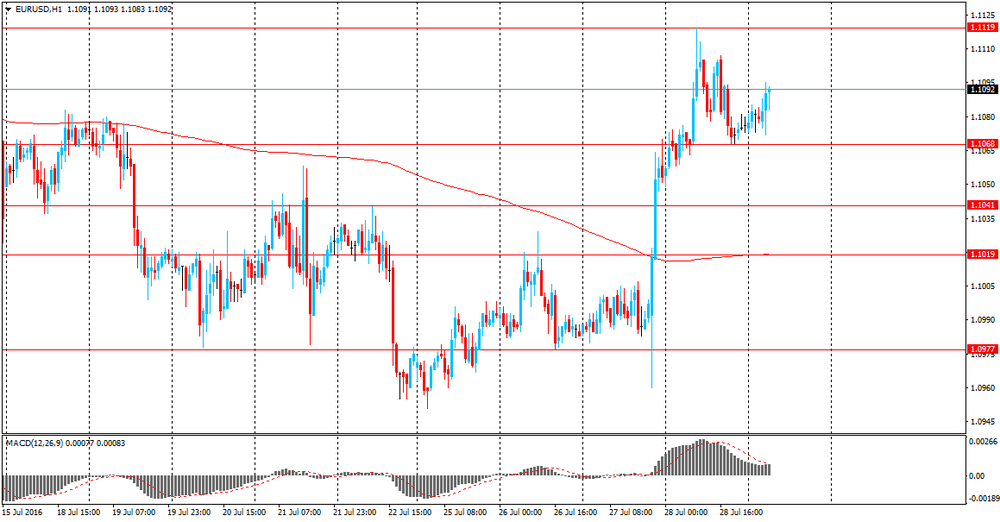

The euro has appreciated against the dollar and came close to yesterday's high,. Preliminary data from Eurostat showed that in the 2nd quarter Eurozone GDP grew by 0.3 per cent compared with an increase of 0.6 percent in the first quarter, in line with expectations. This slow growth was last recorded in the third quarter of 2015. In annual terms, growth slowed to 1.6 percent from 1.7 percent. It was expected that GDP will increase by 1.5 percent.

Another report showed that in July consumer prices in the eurozone rose by 0.2% after rising 0.1% in June. Analysts had expected the index to rise by 0.1%. Core CPI, which does not take into account the volatile energy and food prices, rose in July by 0.9%, which coincided with the change in June.

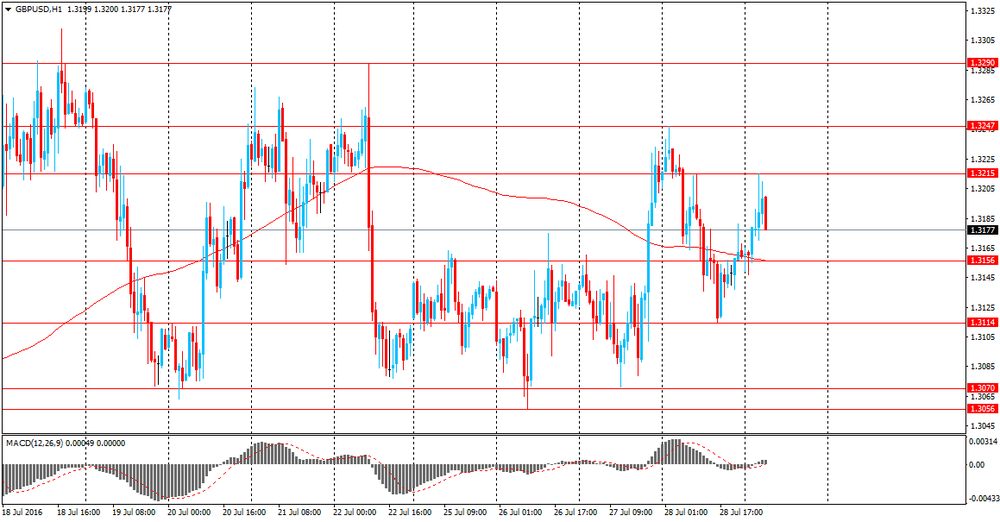

The pound fell slightly against the dollar, returning to the level of opening of the session. A certain pressure on the currency has had a controversial report from the Bank of England. The Bank of England reported that the number of mortgage approvals in Britain fell sharply at the end of June to the lowest level since May 2015, but consumer lending expanded at the fastest pace in nearly 11 years. In June 64.766 mortgages were aprovd compared to 66.722 in May. Consumer lending has increased in June by 10.3 percent y/y, recording the fastest annual growth rate since October 2005. As a result, lending volume amounted to 1.837 billion vs 1.599 billion pound in May (revised from 1.503 billion. Lbs). At the same time, the Bank of England forecast a slowdown in credit growth in the second half of this year due to Brexit.

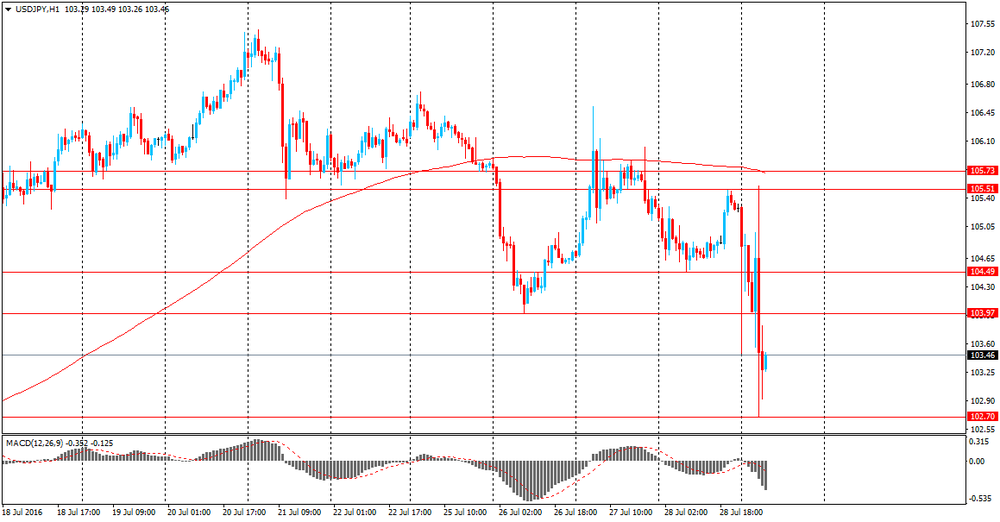

The Japanese yen has stabilized against the US dollar after the sharp fluctuations in the Asian session, which reflected market disappointment about actions of the Bank of Japan. Today the Bank of Japan eased monetary policy but taken weaker measure than expected, increasing the volume of asset purchases, but stressed that this measure is coordinated with the government program. Central Bank said it will buy ETFs to 6 trillion yen per year, almost double the current volume of purchases. At the same time, the Central Bank left unchanged the volume of purchases of government bonds of Japan (in the amount of 80 bln. Yen) and the deposit rate at -0.1%. After the BoJ meeting investors' attention will switch to the government's stimulus measures. Recall, on Wednesday, Japanese Prime Minister Abe said that next week, namely on August 2 will announce the program of budget expenditures in the amount of more than 28 trillion yen.

EUR / USD: during the European session, the pair rose to $ 1.1115

GBP / USD: during the European session, the pair fell to $ 1.3150

USD / JPY: during the European session, the pair rose from Y102.70 to Y103.95, but then pulled back a little bit

-

14:30

Canada: Industrial Product Price Index, m/m, June 0.6% (forecast 0.5%)

-

14:30

Canada: GDP (m/m) , May -0.6% (forecast -0.4%)

-

14:30

U.S.: GDP, q/q, Quarter II 1.2% (forecast 2.6%)

-

14:30

Canada: Industrial Product Price Index, y/y, June -0.8%

-

14:30

U.S.: PCE price index, q/q, Quarter II 1.9% (forecast 2%)

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter II 1.7% (forecast 1.7%)

-

14:01

Orders

EUR/USD

Offers 1.1100-05 1.1120-25 1.1150 1.1165 1.1180 1.1200 1.1230 1.1250

Bids 1.1085 1.1050 1.1035 1.1020 1.1000 1.0980 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3220 1.3250 1.3270 1.3285 1.3300 1.3320 1.3350

Bids 1.3170 1.3150 1.3130 1.3100 1.3085 1.3050 1.3020 1.3000

EUR/GBP

Offers 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8385 0.8350 0.8330 0.8300 0.8285 0.8255-60 0.8235 0.8200

EUR/JPY

Offers 115.50 115.80 116.00 116.50 116.80 117.00 117.50 117.80 118.00

Bids 115.00 114.80 114.60 114.30 114.00 113.75 113.50 113.00 112.80 112.60

USD/JPY

Offers 103.85 104.00 104.50 104.85 105.00 105.25 105.50 105.80 106.00

Bids 103.20-25 103.00 102.80 102.50 102.30 102.00

AUD/USD

Offers 0.7550 0.7565 0.7580 0.76000.7620 O.7635 0.7650-55 0.7700

Bids 0.7480-85 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

12:34

Euro Area unemployment rate stable in June

The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in June 2016, stable compared to May 2016 and down from 11.0% in June 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in June 2016, stable compared to May 2016 and down from 9.5% in June 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.986 million men and women in the EU28, of whom 16.269 million were in the euro area, were unemployed in June 2016. Compared with May 2016, the number of persons unemployed decreased by 91 000 in the EU28 and by 37 000 in the euro area. Compared with June 2015, unemployment fell by 2.114 million in the EU28 and by 1.363 million in the euro area.

Among the Member States, the lowest unemployment rates in June 2016 were recorded in Malta (4.0%), the Czech Republic (4.1%) and Germany (4.2%). The highest unemployment rates were observed in Greece (23.3% in April 2016) and Spain (19.9%). Compared with a year ago, the unemployment rate in June 2016 fell in twenty-five Member States, remained stable in Belgium and Estonia, while it increased in Austria (from 5.7% to 6.2%). The largest decreases were registered in Cyprus (from 15.1% to 11.7%), Croatia (from 16.2% to 13.2%), Bulgaria (from 9.7% to 7.2%) and Spain (from 22.3% to 19.9%).

In June 2016, the unemployment rate in the United States was 4.9%, up from 4.7% in May 2016 and down from 5.3% in June 2015.

-

11:53

-

11:23

UK: mortgage approvals fell but consumer credit increased

According to rttnews, U.K. mortgage approvals declined to a one-year low in June, the Bank of England reported Friday.

The number of mortgages approved in June fell to 64,766 in June from 66,722 in May. This was the lowest since May 2015, when approvals totaled 64,174. It was forecast to drop to 65,500 in June.

Consumer credit increased by a more-than-expected GBP 1.8 billion or 1 percent from May. Economists had forecast a GBP 1.4 billion increase.

Lending to individuals climbed GBP 5.2 billion, bigger than May's GBP 4.5 billion rise. Within total lending, secured lending grew GBP 3.3 billion or 0.3 percent compared to expected growth of GBP 2.7 billion.

Monthly growth in M4 money supply slowed to 1.1 percent in June from 1.3 percent in May. Year-on-year, M4 climbed 3.5 percent, faster than the 1.8 percent increase seen in prior month.

-

11:09

Euro area GDP in line with expectations

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the second quarter of 2016, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the first quarter of 2016, GDP grew by 0.6% in the euro area and by 0.5% in the EU28. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.6% in the euro area and by 1.8% in the EU28 in the second quarter of 2016, after +1.7% and +1.8% respectively in the previous quarter.

-

11:07

Euro area annual inflation up 0.2%

Euro area annual inflation is expected to be 0.2% in July 2016, up from 0.1% in June 2016, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in July (1.4%, compared with 0.9% June), followed by services (1.2%, compared with 1.1% in June), non-energy industrial goods (0.4%, stable compared with June) and energy (-6.6%, compared with -6.4% in June).

-

11:00

Eurozone: Unemployment Rate , June 10.1% (forecast 10.1%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, July 0.2% (forecast 0.1%)

-

11:00

Eurozone: GDP (QoQ), Quarter II 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter II 1.6% (forecast 1.5%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, July 0.9% (forecast 0.8%)

-

10:32

United Kingdom: Net Lending to Individuals, bln, June 5.2 (forecast 4.2)

-

10:31

United Kingdom: Consumer credit, mln, June 1837 (forecast 1400)

-

10:30

United Kingdom: Mortgage Approvals, June 64.77 (forecast 65.65)

-

10:27

Italian unemployment worsened in June

In June 2016, 22.781 million persons were employed, +0.3% compared with May. Unemployed were 2.983 million, +0.9% over the previous month.

Employment rate was 57.3%, +0.1 percentage points compared with May, unemployment rate was 11.6%, +0.1 percentage points over the previous month, and inactivity rate was 35.1%, -0.1 percentage points in a month.

Youth unemployment rate (aged 15-24) was 36.5%, -0.3 percentage points over May and youth

unemployment ratio in the same age group was 9.8%, unchanged over the previous month.

-

10:23

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950 (EUR 550m) 1.0970 (350m) 1.1000 (1.8bln) 1.1050 (1.1bln) 1.1200 (250m)

USD/JPY 104.00 (USD 365m) 104.75 (600m) 105.00 (750m) 105.70-75 (1.1bln) 106.00 (710m) 106.25 (500m) 106.75 (650m) 106.90 (1.2bln) 107.00-10 (845m) 108.00-10 (2.6bln)

AUD/USD 0.7470 (AUD 590m) 0.7600-10 (460m)

AUD/NZD 1.0785 ( AUD 1.4bln)

-

09:28

KOF Economic Barometer: Prospects for the Swiss Economy Remain Favourable

The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the outcome of the vote in the United Kingdom and various other geopolitical risks, the outlook for the Swiss economy remains stable.

Despite increased uncertainty about the international economic development, export opportunities for Swiss enterprises have improved. The indicators for the banking sector also show an upward tendency. On the other hand, the data for the manufacturing industry dampen the development. Barely changed has the outlook for domestic consumption, construction activity and for hotels and catering.

-

09:27

Spanish GDP better than forecasts

Gross Domestic Product generated by the Spanish economy presents a 0.7 % variation in the second quarter of 2016 compared to the previous quarter, according to Quarterly GDP advance estimate . This rate of growth is lower than that recorded in the previous quarter (+0.8%). The annual change in GDP in the second quarter of 2016 is 3.2 % compared to 3.4% in the first quarter of this year.

-

09:25

Spanish CPI down 0.6% y/y

The estimated CPI in July 2016 annual inflation is -0.6 % , according to the leading indicator compiled by the INE . This indicator provides a preview of CPI , if confirmed , would be a increase of two tenths in the annual rate , since in June this change was -0.8 %. This increase is explained mainly by rising food prices and soft drinks , compared to the drop experienced in 2015 . Meanwhile , the annual change in the HICP flash is in July at the -0.6 %. If this information is confirmed, the annual rate of HICP increase three tenths compared to last month.

-

09:23

Today’s events:

At 13:30 GMT FOMC members John Williams will deliver a speech

At 20:00 GMT Eurozone will publish the results of stress tests of European banks. The test was developed with the cooperation of the ECB and the European Commission.

-

09:01

Switzerland: KOF Leading Indicator, July 102.7 (forecast 101.3)

-

08:50

Bank of Japan, Kuroda: will take additional easing steps if necessary to achieve price target

-

economy likely to expand moderately as a trend

-

today's policy steps and government fiscal stimulus to provide synergy effects on economy

-

CPI likely to reach 2% during FY 2017

-

Will take additional easing steps if necessary to achieve price target

-

will continue QQE with negative rates as long as needed to meet price goal

-

will examine BOJ policy regarding what is necessary in future to meet 2% price target

-

government's economic package is appropriate in helping to achieve BOJ's inflation target

-

QQE has not reached its limits

-

room for deeper negative rates

-

BOJ easing designed to prevent overseas uncertainties from hurting Japanese business

-

-

08:47

Asian session review: the yen strengthened

The yen strengthened against the dollar after the Bank of Japan, decided to leave interest rate unchanged at 0.1%. The decision to keep interest rates on deposits was made on 7-2 vote.

The Bank of Japan has further eased the monetary policy by increasing the amount of asset purchases, but stressed that this measure is coordinated with the government program to revive the economy. The volume of purchases of assets will remain at 80 trillion yen per year. The volume of dollar lending program will increase to $ 24 billion. Annual ETF purchases will increase to 6.0 trillion yen from 3.3 trillion yen, almost double the current volume of purchases of such assets. This measure was taken to protect the economy from the impact of the uncertainties caused by the decision of the UK to leave the EU. The decision to increase the volume of ETF purchases was adopted by 7 votes to 2. The volume of dollar lending program now stands at 12 billion dollars.

"The Bank believes that these measures of monetary policy and government programs will have a synergistic effect on the economy", - said in a statement the central bank about the expectations from the government stimulus package.

Easing of monetary policy is the next step in the update of the economic program of Japanese Prime Minister Abe. On Wednesday, he said that next week will announce the program of budget expenditures in the amount of more than 28 trillion yen.

Leaders of the Bank of Japan believed that the combination of these measures will provide the necessary impetus to the economy and bring it out of stagnation and deflation. However, many economists believe that the updated "abenomics" - nothing more than a repetition of measures that have not worked in the years 2013-2014.

The Bank of Japan also announced that real GDP is likely to grow by 0.9% in fiscal 2018, whereas previously expected to grow by 1.0%. In fiscal 2017 GDP to grow 1.3% vs previously projected growth of 0.1%. In this fiscal year, GDP is likely to grow by 1.0 against the previous forecast of +1.2%.

Earlier, during the Asian session, the yen traded mixed on controversial economic data from Japan. As the national consumer price index published by Statistics Bureau of Japan, fell by 0.4% in June, as well as in the previous month.

Consumer prices excluding prices for fresh food in June fell by 0.5% compared to the same period of the previous year, showing a fall in the fourth consecutive month. Economists had expected a decline of 0.4%.

Excluding energy and food prices, the consumer price index in June rose by 0.4% compared to June 2015, although the growth rate slowed down compared to May, when the index rose 0.6%.

The Bureau of Statistics of Japan said that the consumer price index in June declined at the fastest pace since 2013, while consumption was weaker than expected, despite the most favorable situation on the labor market in decades. The target level of inflation of the Bank of Japan is 2%.

The unemployment rate published by the Ministry of Health, Labour and Welfare and the Bureau of Statistics of Japan, fell in June to 3.1% from the previous value of 3.2%.

It also became known that the vacancies ratio was137 to 100 workers in June. This indicates an improvement compared to the previous month.

Wage growth in Japan has been modest in the past three years. The economists and the central bank had expected improvement in the labor market that will contribute to the growth of inflation as workers demand higher wages, pushing prices up.

Household spending in June fell by 2.2% compared to the same period of the previous year, the drop observed for the fourth month in a row, as households spend less on housing, education and transportation. According to economists, the mood of households are likely to affect long-term growth rate of the yen and a decrease in the stock market of Japan.

Japan Industrial production rose 1.9% after falling -2.6% in May. Analysts had expected an increase of 0.7%. On an annual basis down -1.9% after a previous decline of 0.4%.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1070-80

GBP / USD: during the Asian session, the pair was trading in the $ 1.3150-55

USD / JPY: during the Asian session, the pair fell to Y102.65

-

08:33

Options levels on thursday, July 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1220 (3836)

$1.1185 (3630)

$1.1134 (2149)

Price at time of writing this review: $1.1085

Support levels (open interest**, contracts):

$1.1011 (2911)

$1.0977 (5172)

$1.0938 (3750)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40929 contracts, with the maximum number of contracts with strike price $1,1200 (3836);

- Overall open interest on the PUT options with the expiration date August, 5 is 53525 contracts, with the maximum number of contracts with strike price $1,0900 (8850);

- The ratio of PUT/CALL was 1.31 versus 1.23 from the previous trading day according to data from July, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.3502 (1823)

$1.3404 (2043)

$1.3306 (1219)

Price at time of writing this review: $1.3189

Support levels (open interest**, contracts):

$1.3091 (2050)

$1.2994 (1817)

$1.2897 (844)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 27510 contracts, with the maximum number of contracts with strike price $1,3400 (2043);

- Overall open interest on the PUT options with the expiration date August, 5 is 25726 contracts, with the maximum number of contracts with strike price $1,2950 (2981);

- The ratio of PUT/CALL was 0.94 versus 0.95 from the previous trading day according to data from July, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Australian business confidence eased in July, a move that is largely seasonal - ANZ

Firms' own activity expectations, employment and investment intentions continue to point to robust growth.

Inflation gauges remain low.

The stimulants and beta-blockers have been evaluated by businesses; confidence eased somewhat in July. A net 16% of businesses are optimistic about prospects over the coming year, down 4 points on the month prior.

Construction and services remain front of the peloton though both were dragged lower in the month. Business confidence across agriculture fell to a net 26% expecting worse times. Business sentiment itself however, often masks what is happening across the general economy.

-

08:26

Japan’s national consumer price index declined 0.4% in June

Japan's national consumer price index (CPI) declined 0.4% in June from a year earlier, following a similar decline in May, the Statistics Bureau said in a report on Friday. It was the fourth consecutive month this so-called core inflation rate had contracted.

Core inflation, which strips away both food and energy, declined 0.5% in the 12 months through June following a 0.4% drop the prior month.

Core CPI inflation in Tokyo, the country's capital and largest city, declined 0.4% in July from a year earlier following an annualized decline of 0.5% the month before.

-

08:22

Germany’s retail sales up 2.7% in June

According to provisional results of the Federal Statistical Office (Destatis), retail turnover in June 2016 in Germany increased in real and in nominal terms 2.7% compared with the corresponding month of the previous year. The number of days open for sale was 26 in June 2016 and 26 in June 2015, too.

Compared with the previous year, turnover in retail trade was in the first six months 2016 in real terms 2.3% and in nominal terms 2.4% larger than in the corresponding period of the previous year.

When adjusted for calendar and seasonal variations (Census-X-12-ARIMA), the June turnover was in real terms 0.1% and in nominal terms 0.3% smaller than that in May 2016.

-

08:20

Japan's housing starts declined

Japan's housing starts declined for the first time in six months in June, though at a slower-than-expected pace, the Ministry of Land, Infrastructure, Transport and Tourism said Friday.

Housing starts fell 2.5 percent year-over-year in June, reversing a 9.8 percent surge in the previous month, which was the biggest rise since June 2015.

Economists had forecast a 2.7 percent drop for the month.

Annualized housing starts decreased to 1.0 million in June from 1.02 million in the preceding month. It was expected to fall to 998,000.

Meanwhile, construction orders received by 50 big contractor rose 1.5 percent annually in June, in contrast to a 2.4 percent fall a month ago.

-

08:15

BoJ dissapoints so far. Usd/JPY down 300 pips. Up next the press conference

The Bank of Japan taken further steps to mitigate the monetary policy. The volume of purchases of assets will remain at 80 trillion yen per year. The volume of lending program will increase to $ 24 billion. Annual ETF purchases will increase to 6.0 trillion yen from 3.3 trillion yen. The decision to increase the volume of ETF purchases was adopted by 7 votes to 2. The head of the Bank of Japan Kuroda published an overall assessment of policy easing measures on the next meeting. The volume of lending program now stands at 12 billion dollars.

-

08:13

Bank of Japan votes 7-2 to leave interest rates unchanged

The yen rose significantly against the dollar and other currencies after the Bank of Japan decision to leave interest rate unchanged at 0.1%. The decision to keep interest rates on deposits was made under 7-2 vote.

-

08:00

Germany: Retail sales, real unadjusted, y/y, June 2.7% (forecast 1.3%)

-

08:00

Germany: Retail sales, real adjusted , June -0.1% (forecast -0.1%)

-

07:19

Japan: Construction Orders, y/y, June -2.4%

-

07:18

Japan: Housing Starts, y/y, June -2.5% (forecast -3%)

-

05:46

Japan: BoJ Interest Rate Decision, -0.1%

-

03:31

Australia: Private Sector Credit, m/m, June 0.2% (forecast 0.5%)

-

03:31

Australia: Private Sector Credit, y/y, June 6.2%

-

03:30

Australia: Producer price index, q / q, Quarter II 0.1% (forecast 0.2%)

-

03:30

Australia: Producer price index, y/y, Quarter II 1.0%

-

03:01

New Zealand: ANZ Business Confidence, July 16

-

01:51

Japan: Industrial Production (YoY), June -1.9%

-

01:50

Japan: Industrial Production (MoM) , June 1.9% (forecast 0.6%)

-

01:50

Japan: Retail sales, y/y, June -1.4% (forecast -1.5%)

-

01:32

Japan: Tokyo Consumer Price Index, y/y, July -0.4% (forecast -0.4%)

-

01:32

Japan: Tokyo CPI ex Fresh Food, y/y, July -0.4% (forecast -0.5%)

-

01:31

Japan: Unemployment Rate, June 3.1% (forecast 3.2%)

-

01:31

Japan: Household spending Y/Y, June -2.2% (forecast -0.3%)

-

01:30

Japan: National CPI Ex-Fresh Food, y/y, June -0.4% (forecast -0.4%)

-

01:30

Japan: National Consumer Price Index, y/y, June -0.4% (forecast -0.4%)

-

01:18

Currencies. Daily history for Jul 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1076 +0,21%

GBP/USD $1,3159 -0,39%

USD/CHF Chf0,9804 -0,58%

USD/JPY Y105,27 -0,02%

EUR/JPY Y116,60 +0,18%

GBP/JPY Y138,54 -0,38%

AUD/USD $0,7504 +0,21%

NZD/USD $0,7075 +0,06%

USD/CAD C$1,3153 -0,17%

-

01:04

United Kingdom: Gfk Consumer Confidence, July -12 (forecast -8)

-

00:45

New Zealand: Building Permits, m/m, June 16.3%

-

00:03

Schedule for today, Friday, Jul 29’2016:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence July 20.2

01:30 Australia Private Sector Credit, m/m June 0.4% 0.5%

01:30 Australia Private Sector Credit, y/y June 6.5%

01:30 Australia Producer price index, q / q Quarter II -0.2% 0.2%

01:30 Australia Producer price index, y/y Quarter II 1.2%

03:00 Japan BoJ Interest Rate Decision -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275

05:00 Japan Housing Starts, y/y June 9.8% -3%

05:00 Japan Construction Orders, y/y June 34.5%

06:00 Germany Retail sales, real adjusted June 0.9% -0.1%

06:00 Germany Retail sales, real unadjusted, y/y June 2.6% 1.3%

06:30 Japan BOJ Press Conference

07:00 Switzerland KOF Leading Indicator July 102.4 101.3

08:30 United Kingdom Mortgage Approvals June 67.04 65.65

08:30 United Kingdom Net Lending to Individuals, bln June 4.3 4.2

08:30 United Kingdom Consumer credit, mln June 1503 1400

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) July 0.1% 0.1%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) July 0.9% 0.8%

09:00 Eurozone Unemployment Rate June 10.1% 10.1%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.6% 0.3%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.7% 1.5%

12:30 Canada Industrial Product Price Index, m/m June 1.1% 0.5%

12:30 Canada Industrial Product Price Index, y/y June -1.1%

12:30 Canada GDP (m/m) May 0.1% -0.4%

12:30 U.S. PCE price index, q/q (Preliminary) Quarter II 0.2% 2%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter II 2.0% 1.7%

12:30 U.S. GDP, q/q (Preliminary) Quarter II 1.1% 2.6%

13:45 U.S. Chicago Purchasing Managers' Index July 56.8 54

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) July 93.5 90.5

-