Noticias del mercado

-

16:34

Poll: Brexit continues to have a negative impact on consumer confidence

The shock of the recent results of the referendum led to a sharp deterioration in consumer confidence and a slowdown in activity in the construction sector. These are the results of the last survey conducted by YouGov and the Centre for Economics and Business Research (CEBR).

A month after the referendum, the data indicate a sharp deceleration of economic growth, which is likely to increase the chances of further measures by the Bank of England during the August meeting. Most economists predict that the Central Bank will lower interest rates, and may again start buying bonds.

The results of the survey show that in July consumer confidence index fell by almost 5 points to 106.6 points, recording the largest decline since October 2014, and reached its lowest level in the last three years.

"The public still appreciates the EU referendum result, but it is clear that consumer confidence has deteriorated significantly within a month after voting for Brexit, - said Stephen Harmston, head of YouGov Reports -. Many people are particularly concerned about what will happen to the value of their homes and it can be very serious consequences for the housing sector and for the economy as a whole. "

Economists say consumer spending give hope that the UK will avoid a recession. But retailers said that sales fell sharply after the referendum. In the construction sector activity growth also slowed after the vote, and the companies revised plans for employment.

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 380m) 1.1000 (1.7bln) 1.1100 (330m)

USDJPY 104.50 (USD 650m) 105.50 (415m)

GBPUSD 1.3050 (GBP 280m) 1.3200 (230m) 1.3530 (280m)

AUDUSD 0.7500 (AUD 2.9bln) 0.7590 (500m) 0.7600 (500m)

USDCAD 1.3020 (USD 260m) 1.3170 (260m) 1.3350 (520m)

AUDNZD 1.0800 ( AUD 807m)

-

15:42

USD Softness A Reflection Of Positioning; We Stay Long - BNPP

"The FOMC upgraded its statement as our economists were expected and appear to be pathing the way to a September rate hike if US data remains firm. The statement said that "near-term risks to the outlook have diminished", likely referring to the market's calm reaction to Brexit, and upgraded language around the labour market. The confidence in our economists view for the Fed to raise rates in September has increased.

The surprise has been the reaction of the USD: we view that its softness overnight may be reflecting that short-term positioning was for a more direct signal of a September hike. Overall positioning, however, stands at only +6 (out of +/-50) according to our Positioning Analysis.

We do not expect USD weakness to persist and think Fed communication over the coming weeks will shift further in a hawkish direction, forcing the market to increase pricing for a September Fed hike. Two key events are likely to be the minutes of the July meeting (released 17 Aug) and Yellen's Jackson Hole speech (26 Aug).

We remain bullish on the USD accordingly and continue to recommend short GBPUSD* through cash and long USDJPY and short EURUSD via options". - efxnews.

-

14:39

Unemployment claims in US increased last week

According to Bloomberg, jobless claims increased by 14,000 to 266,000 in the week ended July 23, a Labor Department report showed Thursday in Washington. The median forecast in a Bloomberg survey called for 262,000 applications. The less-volatile four-week average dropped to remain at the second-lowest level since 1973.

"The labor market's still firm, and really on a path of gradual improvement," Gennadiy Goldberg, an interest-rate strategist at TD Securities in New York, said before the report. "Companies aren't very keen to lay off workers -- it's a strong signal, and I think it stays that way assuming growth continues, even at its kind of meager pace."

Estimates in the Bloomberg survey ranged from 245,000 to 275,000. The Labor Department revised the prior week's reading to 252,000 from an initially reported 253,000.

-

14:31

German CPI higher than forecasts supporting euro

The inflation rate in Germany as measured by the consumer price index is expected to be +0.4% in July 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.3% on June 2016. The harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to be up 0.4% in July 2016 year on year. Compared with June 2016, the increase is expected to be 0.4%, too.

-

14:30

U.S.: Initial Jobless Claims, 266 (forecast 260)

-

14:30

U.S.: Continuing Jobless Claims, 2139 (forecast 2130)

-

14:28

European session review: USD moderately higher against the British pound

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 UK House Price Index from Nationwide, m / m in July 0.2% 0% 0.5%

6:00 UK House Price Index from Nationwide, y / y in July 5.1% 4.5% 5.2%

7:55 Germany Change in the number of unemployed in July -6 -3 -7

7:55 Germany Unemployment rate seasonally adjusted 6.1% in July 6.1% 6.1%

9:00 Eurozone index of sentiment in the economy in July 104.4 103.7 104.6

9:00 Eurozone consumer confidence index (final data) July -7.2 -7.9 -7.9

9:00 Eurozone Sentiment Index in the business community July 0.22 0.17 0.39

9:00 Eurozone business confidence index in industry in July -2.8 -3.4 -2.4

12:00 Germany Consumer Price Index m / m (preliminary data) July 0.1% 0.2% 0.3%

12:00 Germany Consumer Price Index y / y (preliminary data) July 0.3% 0.3% 0.4%

The euro retreated from a session high against the dollar, but still shows gains. The US currency remains under pressure against the background of the Fed meeting. Recall, the Fed left interest rates unchanged, but gave no clear signals about future plans. The Central Bank indicated that the labor market has strengthened, although six weeks ago it was reported that the pace of job growth has slowed. Fed officials also said that household spending is growing at strong pace and economic activity increased at a moderate pace. In general, the central bank's statement suggests that the economic outlook caused less concern compared with June. However, many investors expected a more explicit guidance on the timing of rate hikes. According to CME Group, FED futures point to 18% probability of a rate hike in September from 27% a day earlier.

Little support for the euro had statistical data for Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after a 6000 declining in June. Analysts had expected a drop to 3 000. The unemployment rate remained at around 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts forecasted that the figure will drop to 103.7 points. The final index of sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points from 0.22 points in June. Analysts had forecast a drop to 0.17 points.

The pound depreciated moderately against the dollar, having lost all earned position. Most likely, the market participants have seen in the recent rally an opportunity to sell. Negligible impact had data from the Society of Motor Manufacturers and Traders (SMMT), which showed that the volume of car production in the UK continued to rise in June, and reached its highest level in 16 years. However, the SMMT warned that the prospects for further growth are unclear, given the expected negative consequences of Brexit. According to the data, at the end of June production of cars increased by 10.4 percent per year, reaching 158.641 units. This was the eleventh consecutive increase in production and the highest level for the month since 1998. 897,157 units were produced in the first half of the year, which is 13 percent more compared to the same period of 2015. It was the largest gain since mid-year 2000. Export demand has risen by 14.9 percent, and production for the domestic market increased by 7.1 percent.

Later this week, market participants will be watching the results of surveys of companies and consumers in Britain that will see just how much Brexit impacted on the economy. Recall preliminary PMI indices showed a reduction of the country's economy at the fastest pace since 2009.

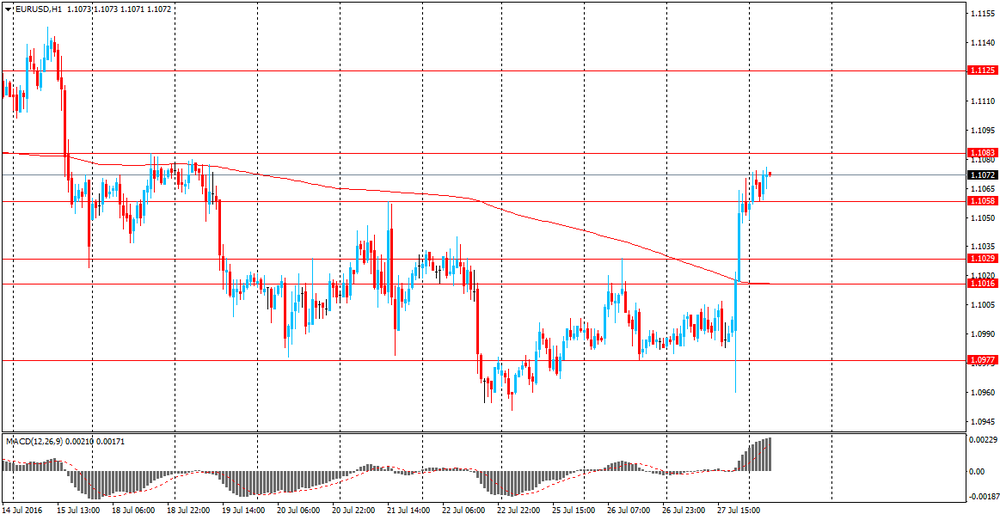

EUR / USD: during the European session, the pair rose to $ 1.1119, but then went back up to $ 1.1080

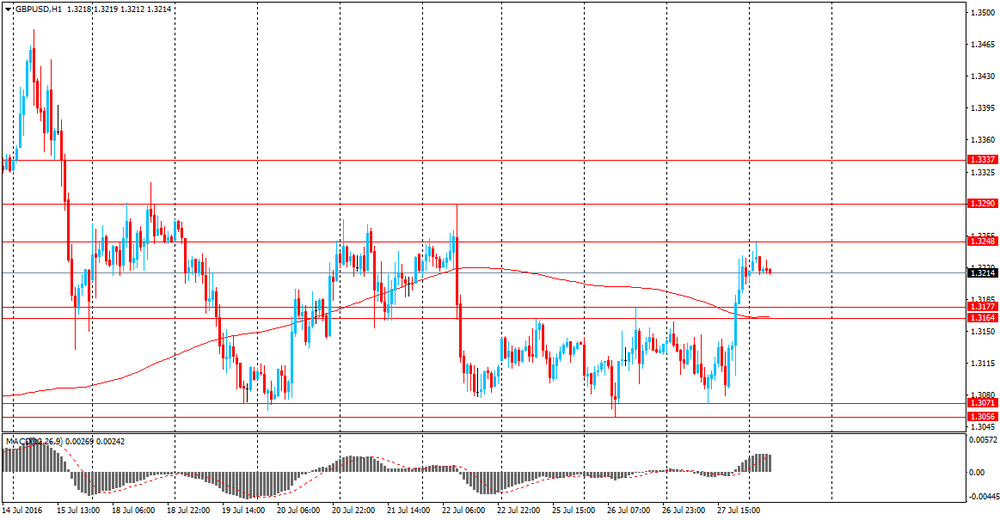

GBP / USD: during the European session, the pair fell to $ 1.3136

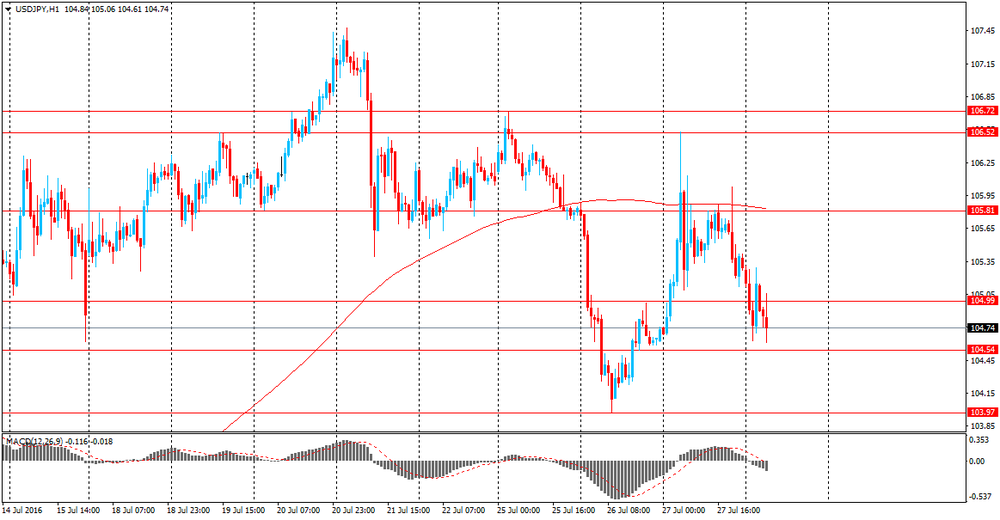

USD / JPY: during the European session, the pair fell to Y104.47

-

14:00

Germany: CPI, y/y , July 0.4% (forecast 0.3%)

-

14:00

Germany: CPI, m/m, July 0.3% (forecast 0.2%)

-

13:45

Orders

EUR/USD

Offers 1.1125-30 1.1150 1.1165 1.1180 1.1200 1.1230 1.1250

Bids 1.1085 1.1050 1.1035 1.1020 1.1000 1.0980 1.0950 1.0930 1.0900

GBP/USD

Offers 1.3250 1.3270 1.3285 1.3300 1.3320 1.3350

Bids 1.3170 1.3150 1.3130 1.3100 1.3085 1.3050 1.3020 1.3000

EUR/GBP

Offers 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8380 0.8350 0.8330 0.8300 0.8285 0.8255-60 0.8235 0.8200

EUR/JPY

Offers 116.80 117.00 117.50 117.80 118.00

Bids 115.50 115.00 114.60 114.30 114.00 113.75 113.50 113.00

USD/JPY

Offers 105.00 105.25 105.50 105.80 106.00 106.20-25 106.50

Bids 104.60-65 104.30 104.00 103.75-85 103.40-50 103.00

AUD/USD

Offers 0.7550 0.7565 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7700

Bids 0.7520 0.7500 0.7485 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

13:44

Merkel: these attacks show we need a better early warning system to alert us to radicalization

-

two of the attackers in Germany were refugees, and that mocks Germany and other refugees

-

attacks in recent days in Germany and elsewhere are shocking

-

will decide on what additional measures are required

-

must undertake a comprehensive analysis before taking any steps in response attacks

-

these attacks show we need a better early warning system to alert us to radicalization

-

the repatriation of migrants process must be improved

-

-

13:13

-

13:04

Major stock indices in Europe declined

European stocks traded slightly downward. Investors analyzed a mixed corporate reporting, as well as waiting for the results of stress tests in the euro zone, which will be published tomorrow.

Focus was also are the results of the July meeting of the Fed. Recall, as expected the Fed left interest rates unchanged, but gave no clear signals about future plans. Investors slightly reduced the likelihood of a rate hike in September, although the Central Bank has improved the economic outlook and said that short-term risks to the economy declined.

According to CME Group, futures on interest rates Fed point to 18% probability of a rate hike in September.

Some support the market have the latest data on Germany and the euro zone. Germany Ministry of Labor said that the number of applications for unemployment benefits in July fell by 7,000 after declining in June 6000. The unemployment rate in July remained at the level of 6.1%, in line with expectations.

Meanwhile, the European Commission reported that the index of economic sentiment rose in July to 104.6 points compared with 104.4 points in June. Experts expect that figure will drop to 103.7 points. Sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. Sentiment index for the retail sector rose to 1.8 from 0.8, and the confidence index for construction reached a level of -16.3 versus -18.2 in June.

The composite index of Europe's largest enterprises Stoxx 600 lost 0.4%.

Shares of the banking sector shows the largest decline among the 19 industry groups in anticipation of the stress tests outcomes "Markets are now digest all previous successes after a decline due to Brexit, - said Philippe Gijsels BNP Paribas -. Corporate profits were generally good, except for a few companies. Investors can exercise some caution on the eve of the meeting of the Bank of Japan and after a strong rally, which may indicate some overbought ".

Shares of Royal Dutch Shell Plc fell 2.5 percent after the company reported that the amount of profit was less than half the average analysts' estimates

Quotes of Lloyds Banking Group Plc fell 3.7 percent amid falling outlook for capital formation in 2016 that increased concerns about rising dividends.

The cost of Dialog Semiconductor Plc sank 7.1 percent as the company cut its forecast for full-year sales

Capitalization of JCDecaux SA decreased by 7 percent after the company's statement that the expected slowdown in the UK will influence the local advertising market

Saipem SpA shares fell 9 percent after lowering profit and sales forecasts for 2016.

At the moment:

FTSE 100 6731.58 -18.85 -0.28%

DAX -5.45 10314.10 -0.05%

CAC -8.35 4438.61 -0.19%

-

12:13

Eurozone: consumer confidence unexpectedly improved in July

The results of the research, published by the European Commission showed that economic confidence in the euro area increased slightly in June, contrary to expectations of a moderate decline.

According to the data, the index of economic sentiment, which is a gauge of consumer and business confidence rose in July to 104.6 points compared with 104.4 points in June.

In addition, it was announced that the final index of sentiment among consumers fell in July from -7.2 points to -7.9 points, confirming the initial assessment and forecasts. The decline reflects the more negative assessment of the future general economic situation, unemployment and the future anticipated savings consumers.

Sentiment in the services sector rose to 11.1 from 10.9 in June (revised from 10.8). Analysts had expected a decline to 10.3. The increase was due to positive expectations of demand. Meanwhile, the index of business optimism in industry rose to -2.4 points to -2.8 points in June. It was expected that the index would fall to -3.4 points. Improved confidence was associated with a more optimistic assessment of the current stock of orders and stocks of finished products. Sentiment Index in the business community has improved to 0.39 points versus 0.22 points in June. Analysts predicted that the rate will fall to 0.17 points. sentiment index for the retail sector rose to 1.8 from 0.8 in June, which was associated with more positive views on the current and expected business situation. confidence index for construction reached -16.3 vs. -18.2 in June.

-

11:52

Weaker GBP Remains The 'Clearest Trend' In Markets; En-Route To 1.25 - ANZ

A weaker GBP remains the clearest trend in markets. Policy easing, political uncertainty, and a twin deficit will all keep the pressure on.

The mix of slowing economic growth, looser monetary policy, and a large twin deficit are negatives for sterling.

The appointment of a new PM and cabinet has stabilised sentiment for now, but the uncertain political climate is far from over.

The UK will not trigger Article 50 until next year. The long drawn-out nature of the process is bad for the economy and sterling.

ANZ targets GBP/USD at 1.25 by the end of the Q3 - efxnews.

-

11:00

Eurozone: Economic sentiment index , July 104.6 (forecast 103.7)

-

11:00

Eurozone: Business climate indicator , July 0.39 (forecast 0.17)

-

11:00

Eurozone: Industrial confidence, July -2.4 (forecast -3.4)

-

11:00

Eurozone: Consumer Confidence, July -7.9 (forecast -7.9)

-

10:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950 (EUR 380m) 1.1000 (1.7bln) 1.1100 (330m)

USD/JPY 104.50 (USD 650m) 105.50 (415m)

GBP/USD 1.3050 (GBP 280m) 1.3200 (230m) 1.3530 (280m)

AUD/USD 0.7500 (AUD 2.9bln) 0.7590 (500m) 0.7600 (500m)

USD/CAD 1.3020 (USD 260m) 1.3170 (260m) 1.3350 (520m)

AUD/NZD 1.0800 ( AUD 807m)

-

10:35

German labor market developed positively in July - Bloomberg

"The labor market developed positively in July," said Frank-Juergen Weise, president of Germany's labor agency. Demand for workers continues to be high, according to the statement.

The number of people out of work fell by some 4,000 each in western Germany and the eastern part of the country, the labor agency said.

German unemployment extended its decline in July, in a sign that Europe's largest economy is showing resilience to uncertainty unleashed by Britain's vote to leave the European Union.

The number of people out of work fell by a seasonally adjusted 7,000 to 2.682 million in July, data from the Federal Labor Agency in Nuremberg showed on Thursday. Economists in a Bloomberg survey forecast a drop of 4,000. The jobless rate remained at a record low of 6.1 percent.

-

10:14

Spanish employment improves

The number of employed people increased by 271,400 in the second quarter of 2016 compared to the previous quarter (1.51%) and stood at 18,301,000. In Seasonally adjusted quarterly variation is 0.29%. Employment has grown by 434,400 people in the last 12 months. The annual rate is 2.43%. - The low occupancy this quarter in 23,200 people in the public sector and increases in 294,600 private. In the past 12 months, employment has increased in 395,700 people in the private sector and 38,700 in the public. - The total wage increases in the second quarter 252,700 (425,500 over the previous year).

-

10:07

Today’s events:

At 09:00 GMT Italy will hold an auction of 10-year bonds

At 18:00 GMT the ECB board member Benoit Coeure will deliver a speech

-

09:55

Germany: Unemployment Change, July -7 (forecast -3)

-

09:55

Germany: Unemployment Rate s.a. , July 6.1% (forecast 6.1%)

-

08:59

Japan’s stimulus package is expected to include around JPY 7 trln in spending

-

Japanese government to fund about JPY 7 trln of its 28 trln + package via driect/local govt spending

-

no time period specified over which spending would be made

-

the money will be part of the JPY 13 trln fiscal measures - via forexlive.

-

-

08:35

We continue to see a good odds of a September hike - BNPP

"The FOMC kept rates unchanged at its 26-27 July meeting, as widely expected. The statement evolved in the way we had expected and if anything, went a little further in preparation for a hike. We think the statement sent a clear warning sign that a hike could be on the horizon as "near-term risks to the outlook have diminished." The odds of a September hike look better than even, and it seems as though the Fed is preparing for one as long as the data fall in line. We expect Fed communication to shift further over the coming weeks, with data releases doing most of the work. Upcoming Fed speeches, the minutes of the July FOMC meeting, and Yellen's Jackson Hole speech will all be important.

The Fed just lowered the bar jobs need to achieve to motivate the next hike. Overall, this increases our confidence in our change in view last week from no change in Fed funds to forecasting a hike in September. Upcoming speeches and the minutes will likely shift market expectations in our direction. Payrolls are also expected to be supportive - we expect 175k in the next report, which is comfortably above the level we now think is the threshold for a hike - around 130k.

We continue to see a good odds of a September hike with a second being partially priced in for December.

We do not expect a December hike to be delivered as a September hike will likely tighten financial conditions and we expect a medium-term outlook which is more pessimistic than the Fed's".

-

08:33

Asian session review: the euro strengthened

During the Asian session, the euro holds its positions against the dollar trading near yesterday's high, after the announcement of the US Federal Reserve on monetary policy. Yesterday, the US dollar initially rose after the FOMC announcement but for quick handed its positions, as the Fed's statement, issued after a two-day meeting, led investors to revise their expectations of rising interest rates before the end of the year.

The US Federal Reserve, following the meeting, raised its assessment of the situation in the economy, saying that the short-term risks to the outlook have decreased. The leaders of the central bank left the door open for a rate hike later this year, possibly as early as September. Nine out of ten members of the committe voted to keep the key interest rate range unchanged at 0.25% -0.5%, but more optimistic assess the situation on the labor market and in other sectors of the economy.

Some investors expect the Fed clearer signals regarding the rate hikes in the coming months. CME Group recently pointed out that investors see a 24% probability of a rate hike in September compared to 27% probability earlier on Wednesday.

The Australian dollar strengthened against the background of the widespread weakening of the US dollar. Also today the Australian Bureau of Statistics said that export prices in the second quarter increased by 1.4% after a decline of -4.7% in the first quarter. Agricultural products and minerals account for over 60% of the exports of manufactured goods Australia. Thus, changes in raw material price movements affect the Australian economy and leads to volatility for the Australian currency. The rise in prices is a medium-term risk as the price increase is accompanied by a fall in demand.

Import Price Index in the second quarter decreased by 1%. The decline has been less than in the first quarter, when the import price index weakened to -3%. The higher the price of imported goods, the greater the effect will be on inflation.

The combination of higher export prices and lower import prices trade gain 2.7% for the quarter. This value can be added in the calculation of GDP for the second quarter.

The yen traded mixed on the eve Bank of Japan meeting. It is expected that BoJ will carry out an easing of monetary policy to support the economy.

"Large-scale measures of fiscal stimulus may cause the Bank of Japan to go to more drastic steps - said Marc Chandler of Brown Brothers Harriman -. It seems that market participants remain skeptical."

Yesterday, Prime Minister of Japan Shinzo Abe has made it clear that the government is preparing a stimulus package totaling 28 trillion yen.

"If the Government of Japan intends to revive inflation expectations, it is not enough to repeat the previous incentives should include in the program budget spending to stimulate consumption and capital investment." - SMBC Friend Securities.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-65 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3170-85 range.

USD / JPY: during the Asian session, the pair was trading in Y104.60-80 range.

-

08:20

Aussie export prices rose less than forecast

Export prices in Australia were up 1.4 percent on quarter in the second quarter of 2016, the Australian Bureau of Statistics said on Thursday.

That was shy of forecasts for 3.0 percent following the 4.7 percent contraction in the previous three months.

Import prices slipped 1.0 percent on quarter versus expectations for an increase of 1.5 percent following the 3.0 percent fall in the three months prior.

On a yearly basis, export prices plummeted 8.7 percent, while import prices slipped 2.8 percent.

-

08:18

The dollar weakened after FOMC "risk on" statement

During the Asian session, the euro holds its positions against the dollar trading near yesterday's high, after the announcement of the US Federal Reserve on monetary policy. Yesterday, the US dollar initially rose after the FOMC announcement but for quick handed its positions, as the Fed's statement, issued after a two-day meeting, led investors to revise their expectations of rising interest rates before the end of the year.

The US Federal Reserve, following the meeting, raised its assessment of the situation in the economy, saying that the short-term risks to the outlook have decreased. The leaders of the central bank left the door open for a rate hike later this year, possibly as early as September. Nine out of ten members of the committe voted to keep the key interest rate range unchanged at 0.25% -0.5%, but more optimistic assess the situation on the labor market and in other sectors of the economy.

Some investors expect the Fed clearer signals regarding the rate hikes in the coming months. CME Group recently pointed out that investors see a 24% probability of a rate hike in September compared to 27% probability earlier on Wednesday.

-

08:16

Options levels on thursday, July 28, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1303 (3662)

$1.1210 (3825)

$1.1129 (2020)

Price at time of writing this review: $1.1088

Support levels (open interest**, contracts):

$1.0982 (2965)

$1.0940 (4641)

$1.0874 (7389)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40555 contracts, with the maximum number of contracts with strike price $1,1200 (3825);

- Overall open interest on the PUT options with the expiration date August, 5 is 49972 contracts, with the maximum number of contracts with strike price $1,0900 (7389);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from July, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3503 (1819)

$1.3405 (1938)

$1.3307 (1106)

Price at time of writing this review: $1.3177

Support levels (open interest**, contracts):

$1.3088 (1943)

$1.2992 (1823)

$1.2895 (852)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26704 contracts, with the maximum number of contracts with strike price $1,3400 (1938);

- Overall open interest on the PUT options with the expiration date August, 5 is 25419 contracts, with the maximum number of contracts with strike price $1,2950 (2786);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:14

UK house prices increased by 0.5% in July

UK house prices increased by 0.5% in July and, as a result, the annual rate of house price growth was little changed at 5.2%, compared with 5.1% in June. "This is the first month's data following the EU referendum. However, it is important to note that, in constructing the index, we use data at the mortgage offer stage - this means any impact from the vote may not be fully evident in July's figures, as there is a short lag between a buyer making the decision to purchase a property and applying for a mortgage.

-

08:01

United Kingdom: Nationwide house price index, y/y, July 5.2% (forecast 4.5%)

-

08:01

United Kingdom: Nationwide house price index, y/y, July 5.2% (forecast 4.5%)

-

08:01

United Kingdom: Nationwide house price index , July 0.5% (forecast 0%)

-

03:30

Australia: Import Price Index, q/q, Quarter II -1.0% (forecast 1.6%)

-

03:30

Australia: Export Price Index, q/q, Quarter II 1.4% (forecast 2.9%)

-

00:35

Currencies. Daily history for Jul 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1053 +0,63%

GBP/USD $1,3210 +0,56%

USD/CHF Chf0,9861 -0,58%

USD/JPY Y105,29 +0,53%

EUR/JPY Y116,3 +1,18%

GBP/JPY Y139,07 +1,09%

AUD/USD $0,7488 -0,23%

NZD/USD $0,7071 +0,14%

USD/CAD C$1,3176 -0,08%

-

00:00

Schedule for today, Thursday, Jul 28’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Export Price Index, q/q Quarter II -4.7% 2.9%

01:30 Australia Import Price Index, q/q Quarter II -3.0% 1.6%

06:00 United Kingdom Nationwide house price index July 0.2% 0%

06:00 United Kingdom Nationwide house price index, y/y July 5.1% 4.5%

07:55 Germany Unemployment Change July -6 -3

07:55 Germany Unemployment Rate s.a. July 6.1% 6.1%

09:00 Eurozone Economic sentiment index July 104.4 103.7

09:00 Eurozone Consumer Confidence (Finally) July -7.2 -8

09:00 Eurozone Business climate indicator July 0.22 0.17

09:00 Eurozone Industrial confidence July -2.8 -3.4

12:00 Germany CPI, m/m (Preliminary) July 0.1% 0.2%

12:00 Germany CPI, y/y (Preliminary) July 0.3% 0.3%

12:30 U.S. Continuing Jobless Claims 2128 2130

12:30 U.S. Initial Jobless Claims 253 260

22:45 New Zealand Building Permits, m/m June -0.9%

23:05 United Kingdom Gfk Consumer Confidence July -1 -8

23:30 Japan Household spending Y/Y June -1.1% -0.3%

23:30 Japan Unemployment Rate June 3.2% 3.2%

23:30 Japan Tokyo Consumer Price Index, y/y July -0.5% -0.4%

23:30 Japan Tokyo CPI ex Fresh Food, y/y July -0.5% -0.5%

23:30 Japan National Consumer Price Index, y/y June -0.4% -0.4%

23:30 Japan National CPI Ex-Fresh Food, y/y June -0.4% -0.4%

23:50 Japan Retail sales, y/y June -1.9% -1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) June -2.6% 0.6%

23:50 Japan Industrial Production (YoY) (Preliminary) June -0.4%

-