Noticias del mercado

-

17:47

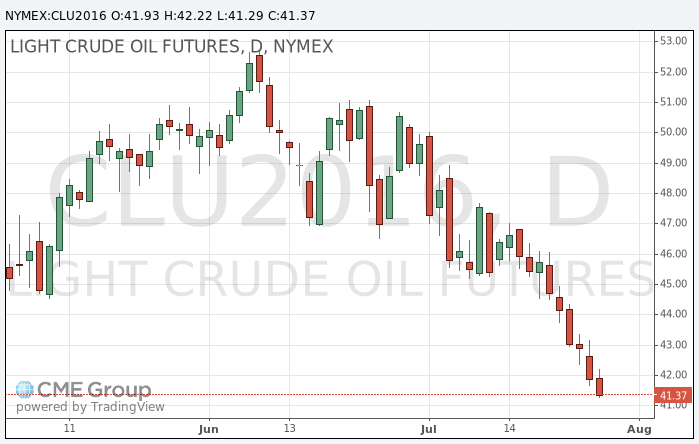

Oil prices continue the downfall

n today's trading, oil prices extended the losses of the previous session, falling to a new three-month low amid lingering concerns about surplus stocks of oil and petroleum products.

A day earlier, WTI crude oil fell to $ 41.68, the lowest level since April 20, after government data showed that crude oil inventories and gasoline in the US unexpectedly rose last week.

US Energy Information Administration (EIA) said in its weekly report that crude oil inventories rose by 1.7 million barrels in the week ended July 22 to 521.1 million barrels, the ministry called "historically high levels for this time of the year".

The report showed that gasoline inventories rose by 452,000 barrels. Despite the height of the summer driving season in the United States, gasoline reserves far exceed the limit of the average range, according to EIA.

In recent weeks, the US standard remains under pressure amid signs of recovery in the US drilling activity combined with higher fuel product inventory.

In the last session, Brent crude was under pressure as prospects for increasing exports from Libya and Iraq have raised concern that an excess of oil will reduce demand from refiners.

Oil prices have fallen nearly 18% from a peak of above $ 50 in early June, as the excess gasoline stocks overshadow prospects for oil demand.

The cost of the September futures on US light crude oil WTI fell to 41.29 dollars per barrel.

September futures price for Brent fell to 42.81 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:25

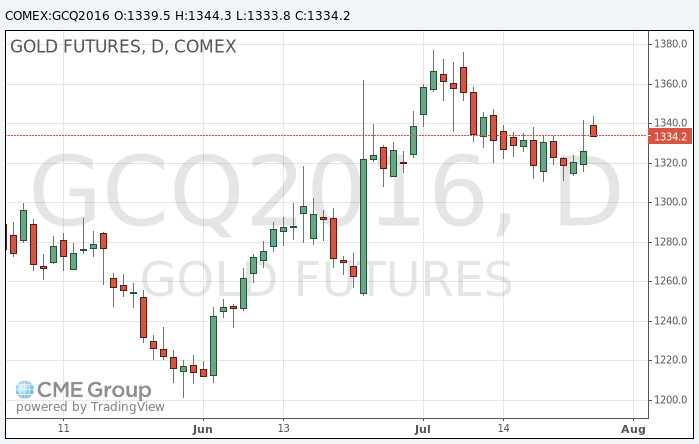

Gold price little changed in a subdued session

In the past few hours, the price of gold retreated from a two-week high reached after the Federal Reserve refrained from any hints of a rate hike at the next meeting in September.

On Wednesday, the Federal Reserve left interest rates unchanged and said that short-term risks to the US economic outlook declined. Nevertheless, the central bank did not give any indication regarding the rate increase in the near future.

Futures on the federal funds currently evaluating the likelihood of a rate hike in September to 18%, below 22% the day before. The probability of a hike in December is now 43% compared to 52% at the beginning of the week.

The precious metal is sensitive to higher interest rates in the United States. The gradual increase of the rate shall be less of a threat to the gold price than a series of sharp rises.

Daniel Brizeman, an analyst at Commerzbank, observes that the Fed decision not to change interest rates positively contributed to the rise in prices.

"The opportunity costs for gold remain low, - he said -. It is surprising that gold has not gone up even more."

"I think they (Fed) will wait a little longer to follow the events in Europe, before making a decision - says Bernard Dada, an analyst at Natixis -. If these events would be disastrous, then, I think they need more time to raise rates. "

Brizeman and Dada expect the next rate hike in December.

The Bank of Japan will announce its decision on monetary policy on Friday, with economists expecting further easing it. Softer monetary policy will mean that Japan's economic problems persist, prompting investors to buy safe-haven assets, including gold.

The cost of the August gold futures on COMEX fell to $ 1333.80 per ounce.

-

12:03

The price of a barrel of Brent crude oil fell below $ 43 for the first time since April 20

Futures price for Brent crude oil delivery in September 2016 on the ICE exchange in London fell compared to the previous closing level of by 2.18% - to 42.99 dollars per barrel. Thus, oil prices fell below 43 dollars a barrel for the first time since 20 April.

Reduced oil continues against the backdrop of US Department of Energy data that show a increase in commercial oil reserves in the country. In particular from 15 to 22 July they rose by 3.2%, or 1.64 million barrels to 521.1 million barrels. At the same time, analysts had expected a decline of stocks by 2.26 million barrels, shows the Bloomberg survey.

-

10:05

Oil little changed in early trading

This morning, New York crude oil futures WTI rose 0.12% to $ 41.97 and Brent oil futures were down -0.07% to $ 43.88 per barrel. Thus, the black gold is trading mixed but with little activity after the recent collapse. Forecasts for oil remain weak, refinery continue to supply more than the market can consume. Also, stocks grew by 1.7 million barrels contrary of an expected reduction of 2.3 million barrels. Oil production in the US has also increased.

-

00:37

Commodities. Daily history for Jul 27’2016:

(raw materials / closing price /% change)

Oil 41.91 -2.35%

Gold 1,339.90 +1.45%

-