Noticias del mercado

-

17:48

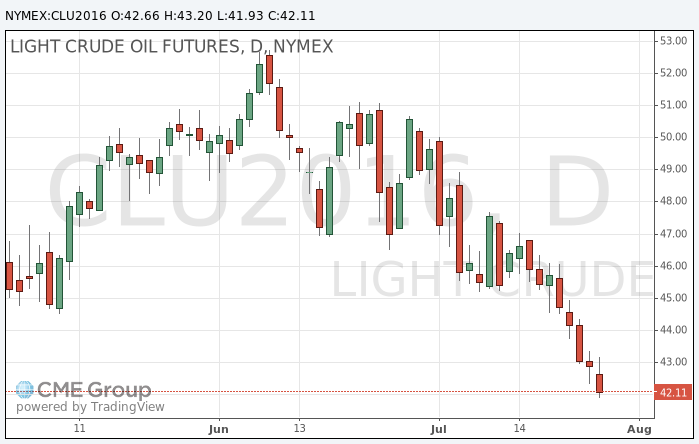

Oil prices fell sharply after an unexpected increase in inventories

Oil on NYMEX has fallen 2% to a fresh 3-month low after the US Department of Energy data showed an unexpected increase in oil inventories.

Commercial US crude inventories last week rose by 1 671 thousand barrels -. to 521,133 million barrels, according to the weekly US Department of Energy report.

Commercial gasoline inventories increased by 452 thousand barrels and amounted to 241,452 million barrels.

Commercial distillate stocks fell by 780 thousand barrels, reaching 152,003 million barrels.

Experts interviewed by Bloomberg, expected a reduction of oil reserves 2,2 mln barrels, gasoline inventories to increase by 600 thousand barrels and distillate inventories to increase 950 thousand barrels.

American Petroleum Institute (API) reported that US crude stocks for the week fell by 827 thousand barrels, gasoline inventories -423 thousand barrels.

The excess of oil on the world market suppresses demand for crude oil, moreover, a concern of investors is a slowdown of the world economy.

The cost of the September futures on WTI fell to 41.93 dollars per barrel.

September futures price for Brent fell to 43.62 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

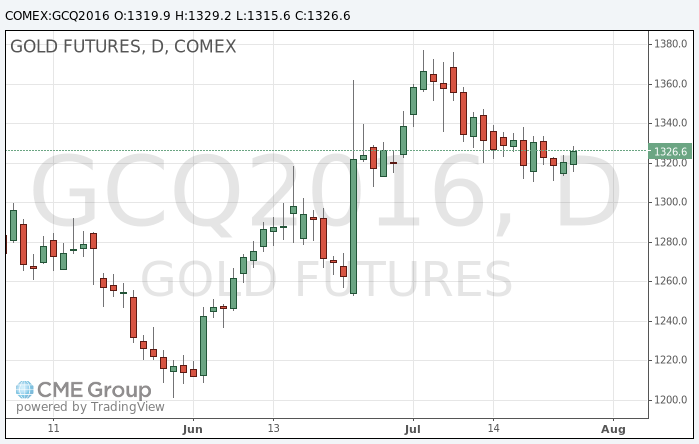

Gold price rose

Gold prices rose during the American session, in anticipation of the Fed statement. Previously, prices were kept within a narrow range.

Investors expect the central bank's guidance as good recent US economic data is more likely to put interest rates hikes on the table this year.

Julius Baer Carsten Menke: " the Fed wants to prepare markets for higher interest rates, which could put pressure on gold."

Rising interest rates typically reduce the attractiveness of gold as it leads to the strengthening of the dollar. Rising interest rates typically reduces investment in safe-haven assets such as gold, which does not provide interest income and stimulate investment in more profitable assets.

Some investors rushed to close their positions in gold before Fed statement says George Gero, managing director of RBC Wealth Management. Although traders do not expect a hike, this scenario have become more active to the end of this year.

"Most traders believe the Fed can except to hint at a rate hike in December, however, the incentive to close the short position remains very strong." - Said Gero.

The cost of the August gold futures on COMEX rose to $ 1329.20 per ounce.

-

16:54

US oil inventories registered an unexpected rise. Oil prices drop sharply

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending July 22, 2016, 277,000 barrels per day less than the previous week's average. Refineries operated at 92.4% of their operable capacity last week. Gasoline production increased last week, averaging about 10.1 million barrels per day. Distillate fuel production decreased last week, averaging over 4.9 million barrels per day. U.S. crude oil imports averaged over 8.4 million barrels per day last week, up by 303,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged 8.2 million barrels per day, 8.7% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 869,000 barrels per day. Distillate fuel imports averaged 93,000 barrels per day last week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.7 million barrels from the previous week. At 521.1 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories increased by 0.5 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories decreased by 0.8 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.2 million barrels last week and are at the upper limit of the average range. Total commercial petroleum inventories increased by 2.7 million barrels last week.

-

10:36

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.35% to $ 42.80 and Brent oil futures were down -0.44% to $ 45.03 per barrel. Thus, the black gold is trading lower because the excess reserves and the economic slowdown put pressure on the markets. Also the US Department of Energy publishes data on the country's oil reserves today, the high level of which remains one of the main negative factors affecting the market. S & P Platts experts expect a decrease in oil reserves last week by 2.6 million barrels.

-

00:34

Commodities. Daily history for Jul 26’2016:

(raw materials / closing price /% change)

Oil 42.64 -0.65%

Gold 1,320.20 -0.05%

-