Noticias del mercado

-

22:25

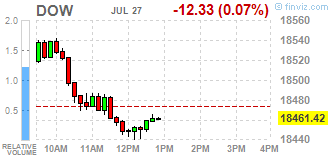

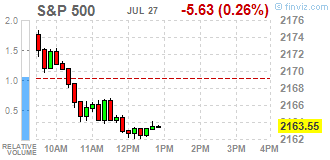

Most U.S. stocks fell

Most U.S. stocks fell, with earnings and the price of crude largely setting the tone for individual shares as investors assessed the Federal Reserve's latest policy decision for the timing of interest-rate increases.

Job gains were "strong" in June and indicators "point to some increase in labor utilization in recent months," the Federal Open Market Committee said in a statement Wednesday after a two-day meeting in Washington. The Fed held rates steady and continued to emphasize a gradual pace of increases.

"Not much has changed, though there's some option for them to raise rates in September," said Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management Company, which manages $89 billion in assets. "That's why the market's not reacting much. We all have to get used to the fact that every one of these meetings is going to be something different."

Fed fund futures show even odds the Fed will raise rates at its December meeting, up from 48 percent before the statement.

The main U.S. equity gauge has surged in the past month with global equities on speculation the Fed won't rush to add stimulus even as the economy shows signs of picking up steam. After recovering its losses following the U.K.'s vote to leave the European Union, the S&P 500 went on to post seven records in 10 days.

Optimism that corporate earnings would help support gains has boosted the gauge by 19 percent from a February low. Analysts have tempered their estimates for second-quarter profit declines to 4.5 percent and are forecasting a rebound starting in the current period. The S&P 500 is now up 6.1 percent for the year, one of the biggest winners among developed-market benchmarks.

Before the Fed's statement, traders priced in little chance of a rate increase today. Uneven data and the possible fall out from Brexit have held down expectations for higher borrowing costs this year. December is the first month for which traders projected an at least even chance of a rate increase.

Apple jumped 6.6 percent, the most since April 2014, after posting a smaller-than-expected revenue decline as its cheaper iPhone model gained more traction. Boeing Co. rose 0.8 percent after reporting a narrower loss than analysts projected. Twitter sank 14.5 percent, the most in three months, after its third-quarter sales fell well short of predictions. Coca-Cola dropped 3.3 percent, the most since April, after sales trailed estimates.

-

21:01

DJIA 18505.80 32.05 0.17%, NASDAQ 5142.10 32.05 0.63%, S&P 500 2169.15 -0.03 0%

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

18:57

Wall Street. Major U.S. stock-indexes demonstrated mixed dynamics

Major U.S. stock-indexes demonstrated mixed dynamics as encouraged by better-than-expected quarterly results of Apple (AAPL) growth in the technology sector was offset by decline in energy sector on weakening oil prices. Investors also expect the US Federal Reserve decision to raise interest rates.

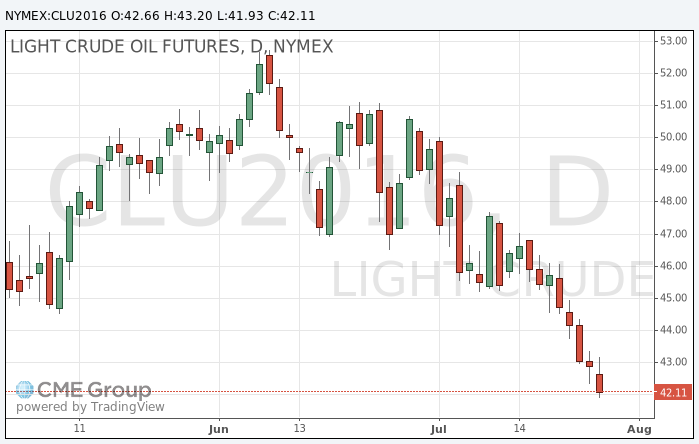

Oil prices dropped sharply after a government report showed that the U.S. crude inventories unexpectedly rose during the week ending July 22.

In macroeconomic environment, the Commerce Department reported orders for the U.S.durable goods fell 4% in June, marking the biggest drop in almost two years. Economists had forecast durable goods orders falling 1.1 percent last month.

The National Association of Realtors (NAR) reported pending home sales in June increased by mere 0.2% to 111.0 points. That was the second highest value in the last 12 months and well above the average reading for 2015 (108.9 points). Economists had expected the index to increase by 1.4% after falling 3.7% in May.

Most of Dow stocks in negative area (22 of 30). Top loser - The Coca-Cola Company (KO, -3.44%). Top gainer - Apple Inc. (AAPL, +6.55%).

All S&P sectors, but for Healthcare (+0.06%), in negative area. Top loser - Utilities (-0.96%).

At the moment:

Dow 18390.00 -8.00 -0.04%

S&P 500 2158.25 -5.00 -0.23%

Nasdaq 100 4686.75 +23.00 +0.49%

Crude Oil 41.96 -0.96 -2.24%

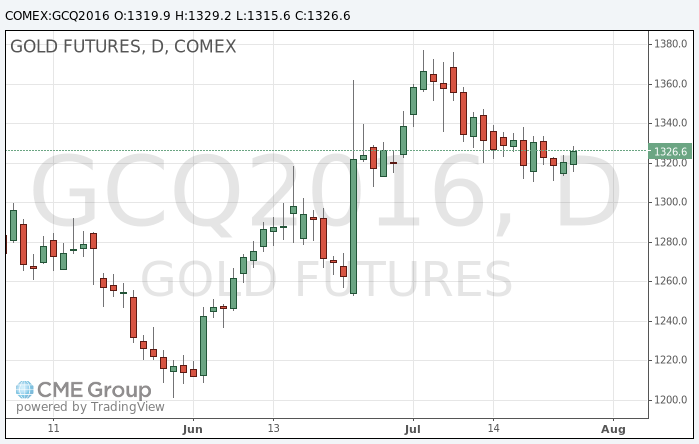

Gold 1325.90 +5.10 +0.39%

U.S. 10yr 1.55 -0.02

-

18:12

WSE: Session Results

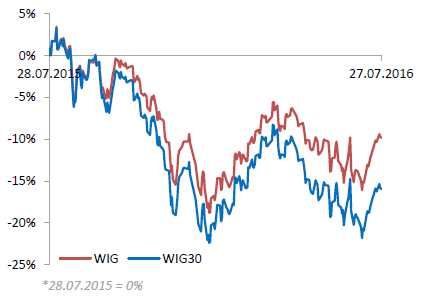

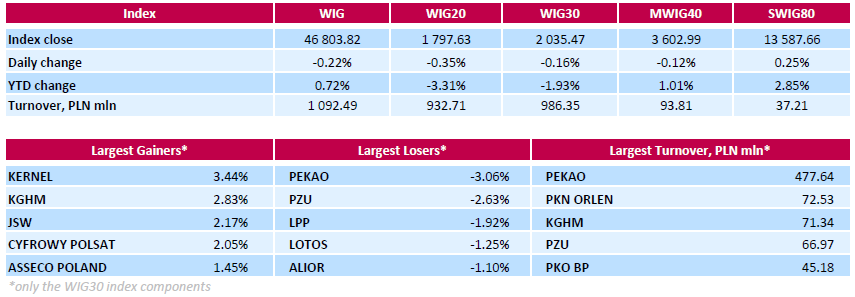

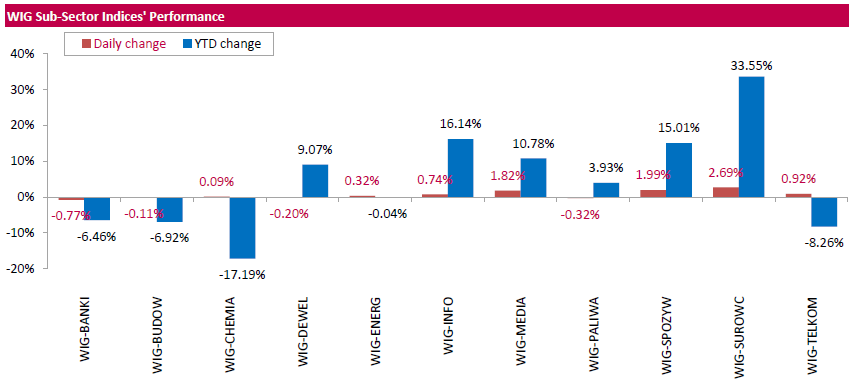

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, fell by 0.22%. Sector performance within the WIG Index was mixed. Banking sector (-0.77%) dropped the most, while materials (+2.69%) fared the best.

The large-cap stocks' measure, the WIG30 index, went down 0.16%. In the index basket, bank PEKAO (WSE: PEO) led the decliners, dropping by 3.06% on the back of the announcement that UniCredit considers selling its stake in the bank. Other biggest losers were insurer PZU (WSE: PZU), clothing retailer LPP (WSE: LPP) and oil refiner LOTOS (WSE: LTS), retreating by 2.63%, 1.92% and 1.25% respectively. On the country, agricultural producer KERNEL (WSE: KER), copper producer KGHM (WSE: KGH) and coking coal miner JSW (WSE: JSW) were the top advancers, gaining 3.44%, 2.83% and 2.17% respectively.

-

18:03

European stocks closed: FTSE 6750.43 26.40 0.39%, DAX 10319.55 71.79 0.70%, CAC 4446.96 52.19 1.19%

-

17:48

Oil prices fell sharply after an unexpected increase in inventories

Oil on NYMEX has fallen 2% to a fresh 3-month low after the US Department of Energy data showed an unexpected increase in oil inventories.

Commercial US crude inventories last week rose by 1 671 thousand barrels -. to 521,133 million barrels, according to the weekly US Department of Energy report.

Commercial gasoline inventories increased by 452 thousand barrels and amounted to 241,452 million barrels.

Commercial distillate stocks fell by 780 thousand barrels, reaching 152,003 million barrels.

Experts interviewed by Bloomberg, expected a reduction of oil reserves 2,2 mln barrels, gasoline inventories to increase by 600 thousand barrels and distillate inventories to increase 950 thousand barrels.

American Petroleum Institute (API) reported that US crude stocks for the week fell by 827 thousand barrels, gasoline inventories -423 thousand barrels.

The excess of oil on the world market suppresses demand for crude oil, moreover, a concern of investors is a slowdown of the world economy.

The cost of the September futures on WTI fell to 41.93 dollars per barrel.

September futures price for Brent fell to 43.62 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

Gold price rose

Gold prices rose during the American session, in anticipation of the Fed statement. Previously, prices were kept within a narrow range.

Investors expect the central bank's guidance as good recent US economic data is more likely to put interest rates hikes on the table this year.

Julius Baer Carsten Menke: " the Fed wants to prepare markets for higher interest rates, which could put pressure on gold."

Rising interest rates typically reduce the attractiveness of gold as it leads to the strengthening of the dollar. Rising interest rates typically reduces investment in safe-haven assets such as gold, which does not provide interest income and stimulate investment in more profitable assets.

Some investors rushed to close their positions in gold before Fed statement says George Gero, managing director of RBC Wealth Management. Although traders do not expect a hike, this scenario have become more active to the end of this year.

"Most traders believe the Fed can except to hint at a rate hike in December, however, the incentive to close the short position remains very strong." - Said Gero.

The cost of the August gold futures on COMEX rose to $ 1329.20 per ounce.

-

16:54

US oil inventories registered an unexpected rise. Oil prices drop sharply

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending July 22, 2016, 277,000 barrels per day less than the previous week's average. Refineries operated at 92.4% of their operable capacity last week. Gasoline production increased last week, averaging about 10.1 million barrels per day. Distillate fuel production decreased last week, averaging over 4.9 million barrels per day. U.S. crude oil imports averaged over 8.4 million barrels per day last week, up by 303,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged 8.2 million barrels per day, 8.7% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 869,000 barrels per day. Distillate fuel imports averaged 93,000 barrels per day last week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.7 million barrels from the previous week. At 521.1 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories increased by 0.5 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories decreased by 0.8 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.2 million barrels last week and are at the upper limit of the average range. Total commercial petroleum inventories increased by 2.7 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, July 1.671 (forecast -2.45)

-

16:28

IMF: Yen's appreciation may undermine efforts to lower deflation risk

-

Yen gains have moved currency toward fair value

-

Global coordination warranted on growth, not FX rates

-

Yuan in line with fundamentals despite depreciation

-

Swiss franc moderately overvalued

-

Brexit likely to lower pound's equilibrium exchange rate

-

Global FX rates "not so out of whack"

-

-

16:24

US: The number of pending home sales rose slightly in June

The National Association of Realtors reported that the number of pending home sales increased slightly in the past month as the ongoing job growth and low interest rates continued to support the US housing market.

According to the seasonally adjusted data, the index of pending sales in June rose by 0.2% to 111.0 points. The latter value was the second highest in the last 12 months and well above the average reading for 2015 (108.9 points). Analysts had expected the index to increase by 1.4% after falling 3.7% in May. Compared with June 2015 the index increased by 1.0%. It is worth emphasizing, after reaching a maximum in April 2016 (then the figure was 115.0 points), in May, the index recorded its first annual decline since August 2014.

Commenting on the data, Lawrence Yun, the NAR chief economist, said the weak growth in June reflects a slight decrease in activity in the market after a significant increase in the spring.

The data also showed that the biggest number of pending home sales rose in the northeast (3.2%). Slightly smaller increase was noted in the Midwest. Meanwhile, in comparison with May index fell to the west and south. On an annual basis, pending sales were 1.6% -1.8% higher in all regions except the West, where they fell by the same amount.

-

16:00

U.S.: Pending Home Sales (MoM) , June 0.2% (forecast 1.4%)

-

15:50

WSE: After start on Wall Street

Today's afternoon we met the preliminary (June) reading of data on the durable goods orders in the US, which were clearly worse than expected and support the scenario in which the Fed's policy will not change until the end of the year. The market reacted accordingly by weakening of the dollar.

The US market started from increases and the situation on the Warsaw Stock Exchange has improved in effect the WIG 20 index has returned to the region of 1,800 points.

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 2.1bln) 1.1000-10 (EUR 1.5bln) 1.1045 (824m) 1.1065-70 (682m) 1.1100 (548m)

USDJPY 104.00 (USD 1.0bln) 105.00 (490m) 105.25 (330m) 105.50 (290m)

GBPUSD 1.3000 (GBP 345m) 1.3100 (371m) 1.3230 (380m)

EURGBP 0.8310 (EUR 303m)

USDCHF 1.0200 (260m)

AUDUSD 0.7400 (AUD 909m) 0.7445-50 (590m)

-

15:34

U.S. Stocks open: Dow +0.30%, Nasdaq +0.65%, S&P +0.20%

-

15:29

Before the bell: S&P futures +0.21%, NASDAQ futures +0.81%

U.S. index futures rose.

Global Stocks:

Nikkei 16,664.82 +281.78 +1.72%

Hang Seng 22,218.99 +89.26 +0.40%

Shanghai 2,991.12 -59.043 -1.94%

FTSE 6,771.9 +47.87 +0.71%

CAC 4,467.61 +72.84 +1.66%

DAX 10,341.6 +93.84 +0.92%

Crude $42.84 (-0.19%)

Gold $1322.60 (+0.14%)

-

15:04

Upgrades and downgrades before the market open

Upgrades:

Apple (AAPL) upgraded to Outperform from Mkt Perform at Raymond James

Downgrades:

Twitter (TWTR) downgraded to Hold from Buy at Cantor Fitzgerald

Twitter (TWTR) downgraded to Hold from Buy at Canaccord Genuity

Twitter (TWTR) downgraded to Hold at Axiom Capital; target lowered to $16

Other:

Apple (AAPL) reiterated with a Buy Mizuho; target $120

Apple (AAPL) target raised to $115 at Macquarie

Verizon (VZ) target raised to $57 from $54 at FBR Capital

Twitter (TWTR) target lowered to $14 at Wedbush

Twitter (TWTR) target lowered to $17 from $20 at RBC Capital Mkts

Twitter (TWTR) reiterated with a Sell at Stifel; target lowered to to $9

Caterpillar (CAT) target raised to $73 at RBC Capital Mkts

-

14:53

European session review: the US dollar strengthened slightly against the pound

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK August 10.1 9.9 10

Switzerland 6:00 UBS indicator of consumer activity in June 1.35 1.34

6:45 France Consumer Confidence Indicator July 97 96 96

8:00 Changing the Eurozone lending to the private sector, the y / y in June 1.6% 1.7% 1.7%

8:00 Eurozone M3 Money Supply, y / y in June 4.9% 5% 5%

8:30 UK GDP q / q (preliminary data) II quarter 0.4% 0.4% 0.6%

8:30 UK GDP y / y (preliminary data) II q 2% 2.0% 2.2%

10:00 UK retail sales according to the Confederation of British PromyshlennikovIyul April 1 -14

The US dollar consolidated against the euro, as investors await the announcement on Fed's monetary policy and analyze the data for Germany and the euro zone. The survey results, presented by the GfK, showed that German consumer confidence index fell in August as economic expectations and prospects for earnings worsened after Britons voted for withdrawal from the EU. The index of consumer climate fell to 10.0 points in August from 10.1 points in July. However, the figure was above forecasts (9.9 points). The index of economic expectations fell by 8.6 points to 9.4 points.

Meanwhile, the European Central Bank said that the monetary aggregate M3 grew in June at 5 percent year on year, confirming the estimates of experts, and accelerated the pace compared to May (when the M3 aggregate rose by 4.9 percent). Private sector credit growth accelerated to 1.5 percent from 1.3 percent in May. The volume of lending to households increased by 1.7 percent y/y, compared with an increase of 1.6 percent in May.

As for the Fed meeting, analysts almost completely eliminate the possibility of a rate hike in July, but market participants are hoping to get new guideline on the possible terms of policy tightening in the coming months after a series of strong data. Futures on Fed rate point out only a 2% chance of a rate hike in July. Meanwhile, the probability of a rate hike in December up almost 20%. Reuters latest survey found that just over half of the 100 economists expect the Fed to raise rates in Q4 to 0.50% -0.75%. The change is likely to occur in December, according to Fed funds futures.

ONS said that in the 2nd quarter the UK's gross domestic product grew by 0.6 percent compared with an increase of 0.4 percent in the first three months of this year. It was expected that the economy will expand by 0.4 percent. In annual terms, GDP grew by 2.2 percent, recording the strongest growth during the year, and accelerate the pace compared to the first quarter (+2.0 percent). It was predicted that economic growth will stabilize at 2.0 percent. In the 2nd quarter, the services sector recorded an increase of 0.5 percent, while the manufacturing sector - by 2.1 per cent (the best figure since 1999). In contrast, the segment of construction and agriculture reported a decrease of 0.4 percent and 1.0 percent respectively.

The yen has stabilized against the US dollar after the strong fluctuations in the beginning of the session, which were caused by expectations of action by the Government of Japan. Initially, the yen has weakened sharply after WSJ reports that Japan is considering the release of 50-year Japanese government bonds. However, later the Minister of Finance has denied such information. Additional pressure on the yen have reported that Japanese Prime Minister Abe said Wednesday that the stimulus package amounting to 27 trillion yen. Then Abe personally confirmed that the size of the package is now at 28 trillion yen and added that the package will be ready next week.

Most likely, the Central Bank decides to increase ETF purchases at the upcoming meeting. Also not ruled out is a further reduction in interest rates and increasing government bond purchases.

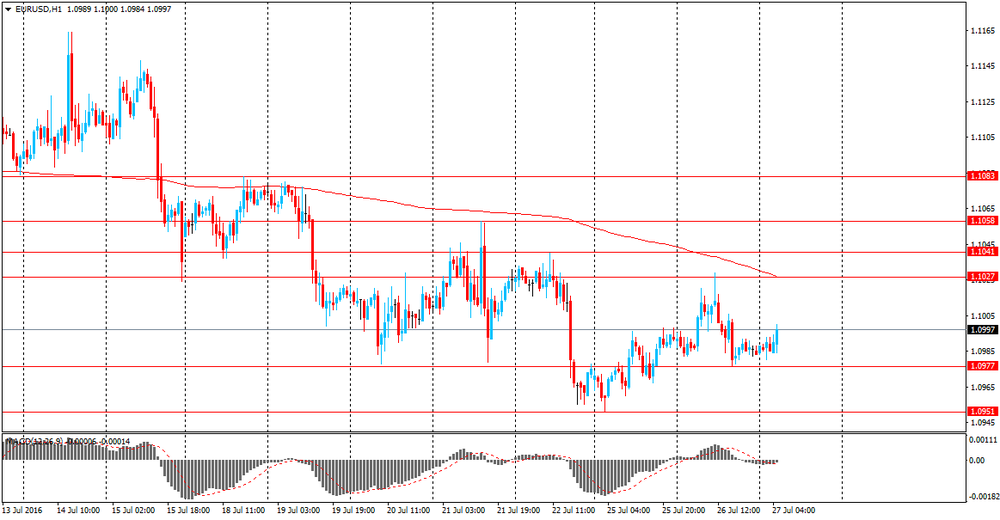

EUR / USD: during the European session, the pair is trading in the range of $ 1.0986- $ 1.1005

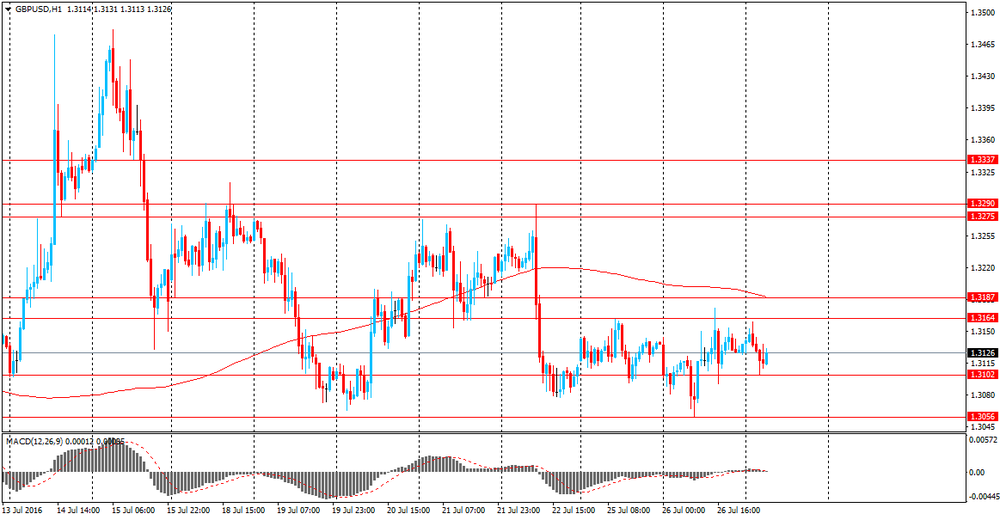

GBP / USD: during the European session, the pair fell to $ 1.3071

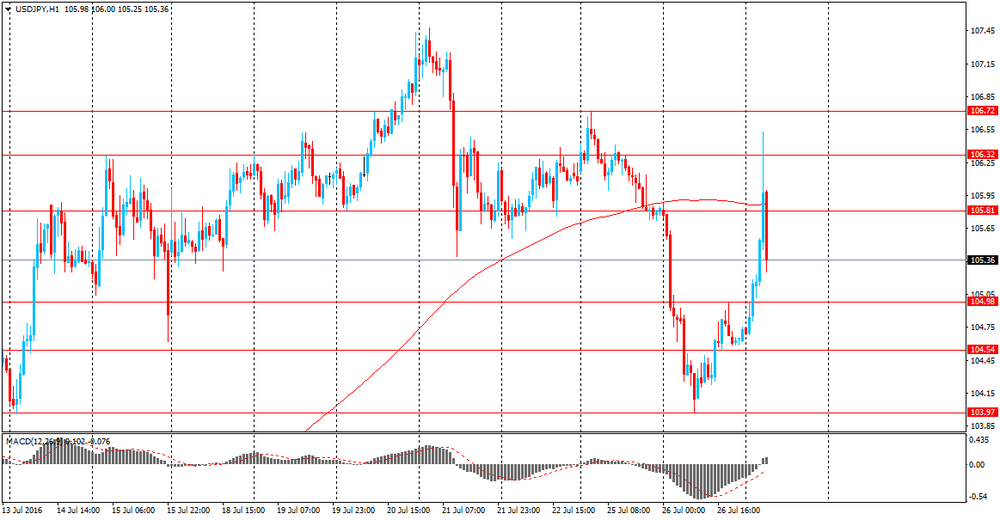

USD / JPY: during the European session, the pair rose to Y106.52, but then retreated to Y105.50

-

14:36

Durable goods orders in US fall 4% in June

According to Bloomberg, the median forecast of economists surveyed estimated orders for all durable goods would fall 1.4 percent, with projections ranging from a 5 percent drop to a 2 percent increase. The gain in orders for non-defense capital goods excluding aircraft -- a proxy for business investment -- matched the median estimate.

"Decision-makers are reluctant to spend on equipment," Kevin Cummins, an economist at RBS Securities Inc. in Stamford, Connecticut, said before the report. "That's certainly one thing that has remained pretty weak and lackluster throughout the recovery."

Shipments of non-military capital goods excluding aircraft, which are used to calculate gross domestic product, decreased 0.4 percent in June after falling 0.5 percent the month before.

Companies placed more orders for electrical equipment and appliances in June than they have all year and demand rose for motor vehicles. Still, bookings weakened for metals, machinery, computers and communications equipment.

-

14:30

U.S.: Durable goods orders ex defense, June -3.9%

-

14:30

U.S.: Durable Goods Orders , June -4% (forecast -1.1%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , June -0.5% (forecast 0.3%)

-

14:27

Company News: Altria (MO) Q2 results beat analysts’ expectations

Altria reported Q2 FY 2016 earnings of $0.81 per share (versus $0.74 in Q2 FY 2015), beating analysts' consensus estimate of $0.80.

The company's quarterly revenues amounted to $6.521 bln (-1.4% y/y), beating analysts' consensus estimate of $5.014 bln.

MO rose to $68.74 (+1.19%) in pre-market trading.

-

14:14

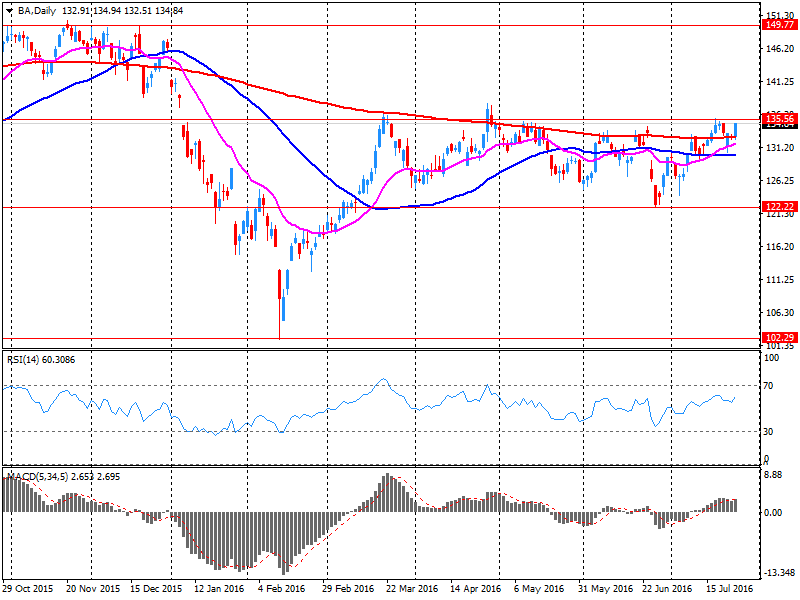

Company News: Boeing (BA) suffers losses in Q2

Boeing reported Q2 FY 2016 loss of $0.44 per share (versus income of $1.62 in Q2 FY 2015), missing analysts' consensus estimate of income of $2.24.

The company's quarterly revenues amounted to $24.755 bln (+0.9% y/y), beating analysts' consensus estimate of $24.174 bln.

BA rose to $137.00 (+1.59%) in pre-market trading.

-

14:00

Orders

EUR/USD

Offers 1.1020-25 1.1050 1.1075-801.1100 1.1125-30 1.1150 1.1180 1.1200

Bids 1.0980-85 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers 1.3155-60 1.3180-85 1.3200 1.3250 1.3270 1.3300

Bids 1.3100 1.3085 1.3050 1.3020 1.3000 1.2980 1.2950 1.2900

EUR/GBP

Offers 0.8400-05 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8350 0.8330 0.8300 0.8285 0.8255-60 0.8235 0.8200

EUR/JPY

Offers 116.40 116.80 117.00 117.50 117.80 118.00

Bids 115.50 115.00 114.60 114.30 114.00 113.75 113.50 113.00

USD/JPY

Offers 105.80 106.00 106.20-25 106.50 106.70 106.85 107.00

Bids 105.00 104.80 104.60-65 104.30 104.00 103.75-85 103.40-50 103.00

AUD/USD

Offers 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7700

Bids 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

13:49

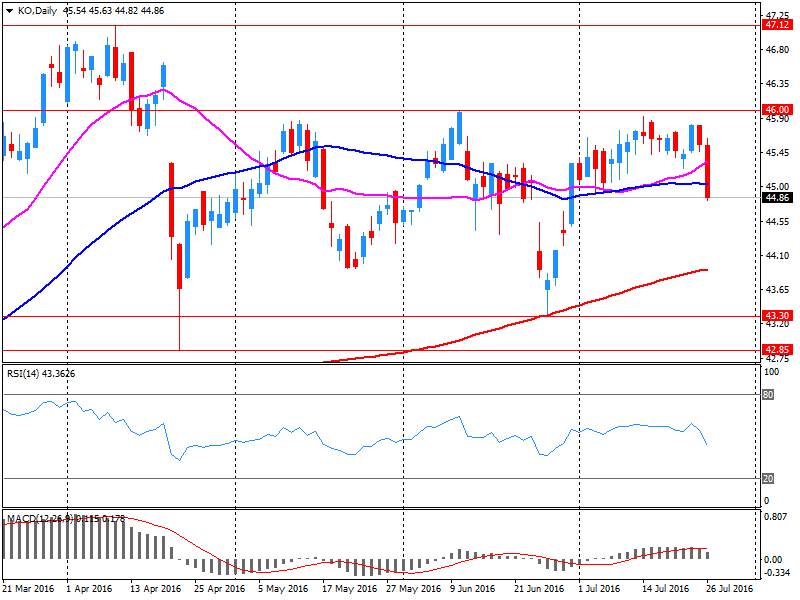

Company News: Coca-Cola (KO) Q2 EPS beat analysts’ estimate

Coca-Cola reported Q2 FY 2016 earnings of $0.60 per share (versus $0.63 in Q2 FY 2015), beating analysts' consensus estimate of $0.58.

The company's quarterly revenues amounted to $11.539 bln (-5.1% y/y), slightly missing analysts' consensus estimate of $11.630 bln.

KO fell to $44.00 (-1.96%) in pre-market trading.

-

13:43

Abe set to unveil a stimulus package

Japanese Prime Minister Shinzo Abe on Wednesday said his government is set to unveil a stimulus package of more than 28 trillion yen ($266 billion) to boost the sluggish economy.

He made the announcement in a speech in southwestern Japan and said that the package would include 13 trillion yen in fiscal measures. More details of the plan would be revealed next week.

Expectations that the Abe government was set to announce an economic stimulus have been building since May. Markets were widely expecting a package of over 10 trillion yen.

Meanwhile, the Bank of Japan is set to begin its two-day policy session on Thursday, following which the bank is widely expected to announce further monetary easing on Friday. - rtt

-

13:11

WSE: Mid session comment

Indices of the Warsaw Stock Exchange record today declines in contrast to the indices in Western Europe, which have clearly increased. The balance of power in the market is dominated by a strong sell-off of shares of Pekao. Discount of Pekao reached more than 4 percent. The backfire of decrease in quotations of Pekao came also in other financial companies (PZU, PKO, Alior). The market has long speculated that the "re-Polonization" of the banking sector in Poland would take place just via PZU.

Noticeably loses the Polish zloty and this refers to the actual supply of PLN, not a response to changes in the eurodollar, which happens to be very stable today.

With the passage of time the pulse associated with Pekao slowly blurred, and the market seeing the stable pros in environment begins to mitigate imbalances. If we manage to finish the trading within level of 1,800 points or above, results of the session would be optimistic, but of course with an open risk for tomorrow's opening in reaction to what the global market will do after the message of the FOMC meeting.

The WIG20 ended the first half of the session at 1,793 points (-0.56%) and with turnover of PLN 403 mln, which almost half of it was made on the shares of Pekao.

-

12:40

Major stock indices in Europe show a positive trend

European stocks showing again strong increases after four days of consolidation, helped by positive corporate earnings and expectations of large package of stimulus measures in Japan. However, investors are cautious on the eve of the announcement of the Federal Reserve and Bank of Japan meetings.

Analysts say that the Fed is likel not to change the interest rate, but market participants are hoping to get new guidelines on the possible timing of interest rate increases in the coming months after a series of strong data in the US. Today futures on interest rates suggest that the market is taken into account a 2% probability of a rate hike in July. Meanwhile, the probability of a rate hike in December, up almost 20%.

Some support for the market had statistical data on Britain. The ONS said that in the 2nd quarter gross domestic product grew by 0.6 percent compared with an increase of 0.4 percent in the first three months of this year. It was expected that the economy will expand again by 0.4 percent. In annual terms, GDP grew by 2.2 percent, recording the strongest growth during the year, and accelerate the pace compared to the first quarter (+2.0 percent). It was predicted that economic growth will stabilize at 2.0 percent. However, experts say that such a steady rate of growth can not continue into the second half of the year, given the shock to the economy as a result of voting for a way out of the EU. In the 2nd quarter, the services sector recorded an increase of 0.5 percent, while the manufacturing sector - by 2.1 percent (the best figure since 1999). In contrast, the segment of construction and agriculture reported a decrease of 0.4 percent and 1.0 percent respectively.

The composite index of the largest companies in Europe Stoxx 600 added 0.5%. The French CAC 40 index, which shows an increase of 1.4%, is the leader among the Western European markets.

Quotes of LVMH Moet Hennessy Louis Vuitton rose 7.8% after the world's largest luxury goods reported a strong demand for champagne and cognac.

PSA Group's shares rose 7.1 percent, as the automaker announced the increase of earnings for the first half of the year.

The cost of Airbus Group SE has grown by 4.9 percent since the airline revenue beat analysts' expectations.

The price of Air France-KLM Group increased by 2.8 percent after the news about the increase in operating profit.

Capitalization of ITV Plc rose 7.5 percent after the British broadcaster reported an increase in sales in the first half of the year.

Cost of Banco Santander SA rose 3.5 percent as the bank's profit exceeded analysts' expectations.

At the moment:

FTSE 100 +23.92 6747.95 + 0.36%

DAX +71.12 10318.88 + 0.69%

CAC 40 +60.80 4455.57 + 1.38%

-

12:16

UK: sales volumes declined more rapidly than at any time since January 2012 - CBI

The survey of 132 firms, of which 66 were retailers, showed that sales volumes declined more rapidly than at any time since January 2012, with weaker consumer confidence a likely factor in the immediate period following the EU referendum. Companies expect sales volumes to decline at a broadly similar pace as this month in the year to August.

Within retail, sales by grocers, and furniture and carpets stores were the main drivers of the drop in overall volumes. But some sectors bucked the trend, with non-specialised department stores and retailers of footwear and leather goods reporting higher volumes.

Orders placed on suppliers dropped at the quickest pace since March 2009 and are expected to fall further in August.

In tandem with a weaker retail sector, volumes in wholesaling deteriorated at the fastest pace since April 2013 and are expected to fall further next month.

Meanwhile, sales within the motor trade continued to expand, albeit at slower pace than early this year.

-

12:00

United Kingdom: CBI retail sales volume balance, July -14 (forecast 1)

-

11:34

Fade Upticks on USD/JPY and USD/CAD Targeting 100 & 1.2830 respectively - Barclays

"We are looking for evidence of a top in USDJPY and USDCAD as they approach upside resistance.

Given the multi-month underperformance of the Greenback against both JPY and CAD, we prefer to fade upticks for a return to the year-to-date lows initially.

We are looking for a move lower in USD/JPY towards targets near 103.80, the 21-dma. A close below 103.80 would signal lower towards 100.00".

Copyright © 2016 Barclays Capital, eFXnews™

-

10:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1025-30 (413m) 1.1100 (568m)

USD/JPY: 104.75 (USD 280m) 106.25 (295m) 106.50 (363m) 107.00 (1bln)

GBP/USD 1.2900 (GBP 496m) 1.3100 (562m) 1.3250 (598m)

AUD/USD 0.7435-40 (AUD 800m) 0.7475 (476m) 0.7500 (270m)

-

10:36

Oil trading lower

This morning, New York crude oil futures for WTI fell by -0.35% to $ 42.80 and Brent oil futures were down -0.44% to $ 45.03 per barrel. Thus, the black gold is trading lower because the excess reserves and the economic slowdown put pressure on the markets. Also the US Department of Energy publishes data on the country's oil reserves today, the high level of which remains one of the main negative factors affecting the market. S & P Platts experts expect a decrease in oil reserves last week by 2.6 million barrels.

-

10:32

UK: the GDP rose 2.2% in Q2

Change in gross domestic product (GDP) is the main indicator of economic growth. GDP was estimated to have increased by 0.6% in Quarter 2 (Apr to June) 2016 compared with growth of 0.4% in Quarter 1 (Jan to Mar) 2016. Output increased in 2 of the main industrial groupings within the economy in Quarter 2 2016. Services increased by 0.5% and production increased by 2.1%. In contrast, construction decreased by 0.4% and agriculture decreased by 1.0%. GDP was 2.2% higher in Quarter 2 2016 compared with the same quarter a year ago. In Quarter 2 2016, GDP was estimated to have been 7.7% higher than the pre-economic downturn.

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.6% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.2% (forecast 2.0%)

-

10:16

Monetary developments in the euro area

• The annual growth rate of the broad monetary aggregate M3 stood at 5.0% in June 2016, after 4.9% in May 2016.

• The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 8.6% in June, from 9.1% in May.

• The annual growth rate of loans to households stood at 1.7% in June, compared with 1.6% in May.

• The annual growth rate of loans to non-financial corporations stood at 1.7% in June, compared with 1.6% in May (revised from 1.4%)1 .

-

10:02

Eurozone: Private Loans, Y/Y, June 1.7% (forecast 1.7%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, June 5% (forecast 5%)

-

09:30

France's consumer confidence weakened for a second successive month

According to rttnews, France's consumer confidence weakened for a second successive month in July, as households' unemployment worries increased, figures from INSEE showed Wednesday.

The survey was conducted between June 28 and July 16 and only 2 percent of participants responded after the July 14 terrorist attack in Nice, the agency said.

The consumer confidence index dropped to 96 from 97 in June, in line with economists' expectations. The score has been below its long-term average of 100.

Households' were slightly less pessimistic regarding their financial situation in the next 12 months, but were more negative regarding their future saving capacity. Their saving intentions continued to improve.

Consumers were also more inclined to make big ticket purchases in the next 12 months and they were less pessimistic regarding their standard of living during the time.

-

09:27

Today’s events:

At 12:30 GMT Germany will hold an auction on placement of 30-year bonds

In the 21:00 GMT FOMC decision on interest rate and the accompanying FOMC statement

-

09:20

WSE: After opening

WIG20 index opened at 1800.65 points (-0.18%)*

WIG 46818.98 -0.18%

WIG30 2033.02 -0.28%

mWIG40 3607.99 0.02%

*/ - change to previous close

European exchanges began optimistically, the DAX and the CAC are gaining in value. However, the Warsaw Stock Exchange has a problem with the stock price movements of Pekao (WSE: PEO). As reported in a previous comment, the bank Uncredit considering getting rid of all of his shares in this company. This information dominated morning trading and shares of Pekao stand out both in terms of deflection and turnover. This information spoiled sentiment across the segment of blue chips, and brought the WIG20 index to the level of 1,790 points, which is in the area of support in the form of upward trend line.

-

08:45

France: Consumer confidence , July 96 (forecast 96)

-

08:42

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,3%, FTSE 100 + 0,1%, CAC 40 + 0.4%

-

08:41

Asian session review: the Yen was sold on Bank of Japan news

The following data was published:

1:30 Australia Consumer Price Index q / q II quarter -0.2% 0.4% 0.4%

1:30 Australia Consumer Price Index y / y in the II quarter 1.3% 1.1% 1.0%

01:30 Australia Consumer Price Index (truncated average method), q / q II quarter 0.2% 0.4% 0.5%

1:30 Australia Consumer Price Index (truncated average method), y / y in the II quarter 1.7% 1.5% 1.7%

In the Asian session, USD / JPY trading above 105.40 after briefly rose to the level of 106.50. This happened after reports in the WSJ said that Japan is considering 50-year Japanese government bonds. The maturity of these bonds would be the longest in the postwar period.

Support for the pair also had =Japanese Prime Minister Shinzo Abe who said that the stimulus package amounting to 27 trillion yen. Later, the news agency Kyodo reported that Japanese Prime Minister Abe stated that the economic stimulus package will be more than Y28 trillion. He also announced that the government will decide on a package of measures.

Earlier it was reported that the Japanese government will make less extensive than expected incentives. These reports led markets to doubt the ability of Tokyo to restart the economy and trigger a weakening of the national currency.

Investors have been paying more attention to the dynamics of the yen on the eve of the two-day meeting of the Bank of Japan, which will end on Friday. Some economists have suggested that the central bank may implement a number of stimulus measures, from increasing purchases of assets and helicopter miney, ie direct financing of fiscal stimulus measures.

The Australian dollar rose half a cent to $ 0.7565 US immediately after the release of the consumer price index, but then fell, reaching yesterday's low of $ 0.7455.

The Consumer Price Index, published by the Australian Bureau of Statistics, in the second quarter quarter grew by 1.0% compared to the same period of the previous year. Analysts had expected an increase of 1.1%. Base CPI index rose by 0.4% compared with the first quarter, which corresponds to the forecast. In the first quarter the index fell by -0.2%.

RBA signaled a tendency to mitigate the monetary policy in connection with data on inflation, the labor market and housing sector. Rates are already at a record low of 1.75%. The last time the central bank has lowered the rate was in May.

Analysts at JPMorgan said that inflation in Australia is low enough to convince the RBA to further support the economy.

Now the Reserve Bank of Australia may refrain from lowering rates until November," - said Citigroup economists.

Earlier Citi said that core inflation was unpleasant surprise, forcing the RBA to lower the official interest rate next month. Now it is expected that the rate will be lowered by 25 basis points in November.

The US dollar was little changed against the euro in the run-up to the announcement of the decision of the Federal Reserve on monetary policy. Market participants believe that the probability of a US Federal Reserve interest rates in the coming months has increased thanks to a series of strong economic data. The Fed on Wednesday is likely to leave interest rates unchanged, but investors see a 26% chance the central bank's tightening policy in September, whereas previously, this possibility was evaluated as 12%, according to CME Group data.

"The rhetoric of the Fed is expected to have support for the US dollar in the coming weeks and months", - Deutsche Bank.

Higher rates have a positive impact on the US dollar, increasing its attractiveness for investors.

EUR / USD: during the Asian session, the pair was trading in $ 1.0980-1.0995 range

GBP / USD: during the Asian session, the pair was trading in $ 1.3105-1.3125 range

USD / JPY: during the Asian session, the pair was trading in Y104.70-106.50 range

-

08:30

Options levels on wednesday, July 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1210 (3825)

$1.1129 (2020)

$1.1071 (1544)

Price at time of writing this review: $1.0992

Support levels (open interest**, contracts):

$1.0940 (4641)

$1.0874 (7389)

$1.0834 (3277)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40555 contracts, with the maximum number of contracts with strike price $1,1200 (3825);

- Overall open interest on the PUT options with the expiration date August, 5 is 49972 contracts, with the maximum number of contracts with strike price $1,0900 (7389);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from July, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1938)

$1.3307 (1106)

$1.3211 (1665)

Price at time of writing this review: $1.3136

Support levels (open interest**, contracts):

$1.3088 (1943)

$1.2992 (1823)

$1.2895 (852)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26704 contracts, with the maximum number of contracts with strike price $1,3400 (1938);

- Overall open interest on the PUT options with the expiration date August, 5 is 25419 contracts, with the maximum number of contracts with strike price $1,2950 (2786);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

WSE: Before opening

Tuesday's session on Wall Street ended on neutral levels and the S&P500 index gained 0.03 percent, so we may expect that openings in Europe will not be particularly exciting. It is worth to note the increase in the share price of Apple in post-session trade - associated with the quarterly results, which turned out to be better than expected at both the net profit and revenue. In response to the results of the share price of Apple's in post-session trade grew more than 5 percent

Warsaw WIG20 index is trying to move away from the level of 1,800 points, but with rather weak attempts. The credibility of the market does not improve low turnover, which signals the summer phase of the trade.

The attention of investors on the Warsaw market should be focused on the banking sector. To the familiar theme of currency loans today comes news that UniCredit is considering a full exit from shareholding of Polish bank Pekao SA (WSE: PEO).

During today's session, there is no significant macroeconomic publications from the domestic market. Investors will focus on the ending of the Fed meeting. No one expects the FOMC hikes interest rate, however, any clues will be searched as to the likelihood of the loan price increase at the September meeting of the American central bank authorities.

From the currencies point of view, on the most currency pairs linked to PLN we may see consolidation in anticipation of a new impetus to trade.

-

08:25

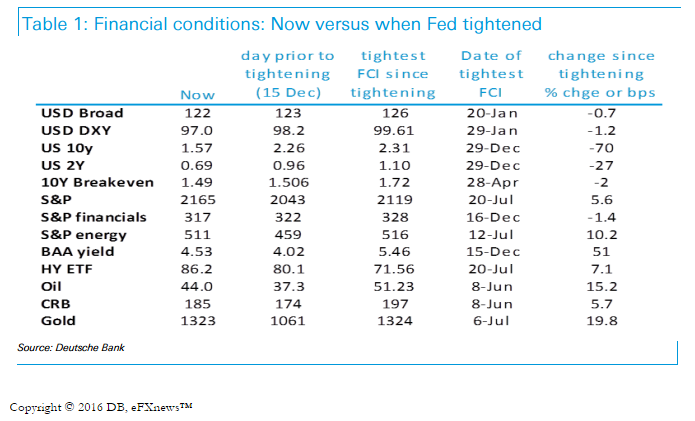

USD Into FOMC - Deutsche Bank

The Fed could not have wished for more sanguine financial markets, or a more benign international events calendar and data backdrop. It begs the question: in a volatile world will 'the ducks' ever align so perfectly for a tightening, and will the Fed miss their opportunity?

The ducks have aligned:

Compare key financial condition indicators to when the Fed tightened in December: the S&P is ~6% higher and nudging all-time highs; the 2y and 10y yields are 26bps and 66bps lower respectively; the Broad TWI dollar is slightly softer; high yield bond prices are substantially stronger and related commodity prices are healthier.

Compare event risks: Rmb day to day variation/depreciation is being readily absorbed; Brexit has passed, and related contagion fears for the US are proving greatly exaggerated.

Compare the numbers: For November 2015 prior to the December 2015 FOMC rate hike, the ISM manufacturing is up close to 5pts; 3m avg of retail sales ex autos is up from zero to over 8% annualized; 3m avg of NFP has decelerated from 241K to 147K as might be expected at this point in the cycle; and the U3 unemployment and U6 'underemployment' rates are down 0.1% and 0.3% respectively.

-

08:22

The consumer climate in Germany weakened slightly in July

The consumer climate in Germany weakened slightly in July. Also as a result of Brexit in the United Kingdom, the Consumer Climate overall indicator forecasts 10.0 points for August, down from 10.1 points in July. Economic and income expectations suffered losses, while propensity to buy increased slightly again.

German consumers, too, have evidently been affected by the Brits' decision to leave the EU. This is signaled by the decline of both economic and income expectations. In contrast, propensity to buy was able to exceed its already very high level.

Economic outlook somewhat dampened by the referendum

For the first time after three successive increases, the economic expectations of German consumers have suffered a setback. The indicator lost 8.6 points in July and is now at 9.4 points, noticeably weakening the positive trend seen over the last few months.

-

08:21

UBS consumption indicator rose in June

The rise in the UBS consumption indicator in June from 1.24 to 1.34 points continues to point to an upward trend in Swiss private consumption. The situation in domestic tourism appears to be normalizing. The number of overnight stays in hotels rose by 1.3% in May compared to the previous year, though this was mainly due to domestic visitors, who made up 60% of the additional overnight stays. Furthermore, a slight improvement in the retail industry has also became apparent - despite the recent hefty fall of almost 10% year-on-year in clothing and shoe store revenue, combined with the ongoing exchange rate headwind.

-

08:17

Australian CPI mixed

All groups CPI

- rose 0.4% this quarter, compared with a fall of 0.2% in the March quarter 2016.

- rose 1.0% over the twelve months to the June quarter 2016, compared with a rise of 1.3% over the twelve months to the March quarter 2016.

Overview of CPI movemets

- The most significant price rises this quarter are medical and hospital services (+4.2%), automotive fuel (+5.9%), tobacco (+2.1%) and new dwelling purchase by owner-occupiers (+0.9%).

- The most significant offsetting price falls this quarter are domestic holiday travel and accommodation (-3.7%), motor vehicles (-1.3%) and telecommunication equipment and services (-1.5%).

-

08:12

Germany's import prices decreased by 4.6% in June

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 4.6% in June 2016 compared with the corresponding month of the preceding year. In May and in April 2016 the annual rates of change were -5.5% and -6.6%, respectively. From May to June 2016 the index rose by 0.5%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 2.8% compared with the level of a year earlier.

The index of export prices decreased by 1.3% in June 2016 compared with the corresponding month of the preceding year. In May and in April 2016 the annual rates of change were -1.6% and -2.0%, respectively. From May to June 2016 the index rose by 0.2%.

-

08:06

Interesting developments from Japan lead to choppy JPY but mostly lower

- Japan Ministry of Finance say it is not true they are considering 50yr bonds - debunking earlier WSJ story - Reuters

- Japan's PM Abe: Japan stimulus to be more than 28t yen - Kyodo

- Abe to announce stimulus package next week - Kyodo news agency

-

08:01

Germany: Gfk Consumer Confidence Survey, August 10 (forecast 9.9)

-

08:00

Switzerland: UBS Consumption Indicator, June 1.34

-

08:00

Germany: Gfk Consumer Confidence Survey, August 10.0 (forecast 9.9)

-

07:23

Global Stocks

European stocks closed with small gains Tuesday as analysts pinned the muted action on traders waiting for news from central banks due later in the week.

Investors waded through a slew of corporate updates, including a higher takeover bid for brewer SABMiller PLC and the potential breakdown of a deal involving Italy's Mediaset SpA that drove its shares down by double digits.

The Stoxx Europe 600 SXXP, +0.10% inched up 0.1% to finish at 341.26, after ending 0.2% higher on Monday.

On Tuesday, U.S. equity markets closed mixed while stocks in Europe traded slightly higher with all eyes were on the Fed, which concludes its two-day policy meeting later on Wednesday.

The U.S. central bank is widely expected to stand pat on monetary policy and the markets will sift through its statements - a post-meeting news conference will not be held - for any hints of the timing on future interest rate hikes. Expectations of a September increase are clouded ahead of the U.S. presidential election in November, but markets see a roughly 50-50 chance of a rise in December.

Asian stocks climbed to fresh near one-year highs and the Japanese yen weakened on Wednesday as awaited central bank meetings this week that could see fresh stimulus in Japan and provide clues on U.S. interest rates.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.2 percent, climbing to its highest since Aug. 11 2015. It is up 10 percent in a month.

Japan's Nikkei .N225 gained 1.1 percent, leading the region.

There is a near-consensus among traders that the Bank of Japan will ease on Friday, most likely by ramping up its already massive purchases of government bonds and riskier assets.

Cutting interest rates into negative territory has proved unpopular with the public and the government, so deepening those cuts is a less likely option, sources familiar with central bank thinking say.

But some market watchers say a BOJ move may be too close to call, and many central bank policymakers may prefer to hold off on action as they expect an anticipated fiscal stimulus package and a delay in next year's sales tax hike to boost growth.

Japanese Prime Minister Shinzo Abe will announce details of a long-awaited 27 trillion yen ($254.2 billion) fiscal stimulus package later on Wednesday, Fuji TV reported. That would be more than expected earlier, but critics will be watching to see how much is actually new spending.

Hong Kong stocks .HSI rose 0.4 percent as mainland Chinese investors continued to snap up shares through a stock market connection scheme.

-

04:04

Nikkei 225 16,600.87 +1.33%, Shanghai Composite 3,050.55 +0.01%, S&P/ASX 200 5,532 -0.10%

-

03:31

Australia: Trimmed Mean CPI q/q, Quarter II 0.5% (forecast 0.4%)

-

03:30

Australia: CPI, q/q, Quarter II 0.4% (forecast 0.4%)

-

03:30

Australia: CPI, y/y, Quarter II 1.0% (forecast 1.1%)

-

03:30

Australia: Trimmed Mean CPI y/y, Quarter II 1.7% (forecast 1.5%)

-

00:34

Commodities. Daily history for Jul 26’2016:

(raw materials / closing price /% change)

Oil 42.64 -0.65%

Gold 1,320.20 -0.05%

-

00:32

Stocks. Daily history for Jun Jul 26’2016:

(index / closing price / change items /% change)

Nikkei 225 16,383.04 -1.43%

Shanghai Composite 3,050.18 +1.14%

S&P/ASX 200 5,537.47 +0.07%

Xetra DAX 10,247.76 +0.49%

FTSE 100 6,724.03 +0.21%

CAC 40 4,394.77 +0.15%

S&P 500 2,169.18 +0.03%

Dow Jones 18,473.75 -0.10%

S&P/TSX Composite 14,550 +0.36%

-

00:31

Currencies. Daily history for Jul 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0983 -0,08%

GBP/USD $1,3136 0,00%

USD/CHF Chf0,9918 +0,60%

USD/JPY Y104,73 -1,05%

EUR/JPY Y115,02 -1,14%

GBP/JPY Y137,56 -1,06%

AUD/USD $0,7505 +0,51%

NZD/USD $0,7061 +0,95%

USD/CAD C$1,3186 -0,24%

-

00:01

Schedule for today, Wednesday, Jul 27’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia CPI, q/q Quarter II -0.2% 0.4%

01:30 Australia CPI, y/y Quarter II 1.3% 1.1%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.2% 0.4%

01:30 Australia Trimmed Mean CPI y/y Quarter II 1.7% 1.5%

06:00 Germany Gfk Consumer Confidence Survey August 10.1 9.9

06:00 Switzerland UBS Consumption Indicator June 1.35

06:45 France Consumer confidence July 97 96

08:00 Eurozone Private Loans, Y/Y June 1.6% 1.7%

08:00 Eurozone M3 money supply, adjusted y/y June 4.9% 5%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.4%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2% 2.0%

10:00 United Kingdom CBI retail sales volume balance July 4 1

12:30 U.S. Durable Goods Orders ex Transportation June -0.3% 0.3%

12:30 U.S. Durable goods orders ex defense June -0.9%

12:30 U.S. Durable Goods Orders June -2.2% -1.1%

14:00 U.S. Pending Home Sales (MoM) June -3.7% 1.4%

14:30 U.S. Crude Oil Inventories July -2.342 -2.45

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

-