Noticias del mercado

-

20:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

16:30

U.S.: Crude Oil Inventories, July 1.671 (forecast -2.45)

-

16:28

IMF: Yen's appreciation may undermine efforts to lower deflation risk

-

Yen gains have moved currency toward fair value

-

Global coordination warranted on growth, not FX rates

-

Yuan in line with fundamentals despite depreciation

-

Swiss franc moderately overvalued

-

Brexit likely to lower pound's equilibrium exchange rate

-

Global FX rates "not so out of whack"

-

-

16:24

US: The number of pending home sales rose slightly in June

The National Association of Realtors reported that the number of pending home sales increased slightly in the past month as the ongoing job growth and low interest rates continued to support the US housing market.

According to the seasonally adjusted data, the index of pending sales in June rose by 0.2% to 111.0 points. The latter value was the second highest in the last 12 months and well above the average reading for 2015 (108.9 points). Analysts had expected the index to increase by 1.4% after falling 3.7% in May. Compared with June 2015 the index increased by 1.0%. It is worth emphasizing, after reaching a maximum in April 2016 (then the figure was 115.0 points), in May, the index recorded its first annual decline since August 2014.

Commenting on the data, Lawrence Yun, the NAR chief economist, said the weak growth in June reflects a slight decrease in activity in the market after a significant increase in the spring.

The data also showed that the biggest number of pending home sales rose in the northeast (3.2%). Slightly smaller increase was noted in the Midwest. Meanwhile, in comparison with May index fell to the west and south. On an annual basis, pending sales were 1.6% -1.8% higher in all regions except the West, where they fell by the same amount.

-

16:00

U.S.: Pending Home Sales (MoM) , June 0.2% (forecast 1.4%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0950 (EUR 2.1bln) 1.1000-10 (EUR 1.5bln) 1.1045 (824m) 1.1065-70 (682m) 1.1100 (548m)

USDJPY 104.00 (USD 1.0bln) 105.00 (490m) 105.25 (330m) 105.50 (290m)

GBPUSD 1.3000 (GBP 345m) 1.3100 (371m) 1.3230 (380m)

EURGBP 0.8310 (EUR 303m)

USDCHF 1.0200 (260m)

AUDUSD 0.7400 (AUD 909m) 0.7445-50 (590m)

-

14:53

European session review: the US dollar strengthened slightly against the pound

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK August 10.1 9.9 10

Switzerland 6:00 UBS indicator of consumer activity in June 1.35 1.34

6:45 France Consumer Confidence Indicator July 97 96 96

8:00 Changing the Eurozone lending to the private sector, the y / y in June 1.6% 1.7% 1.7%

8:00 Eurozone M3 Money Supply, y / y in June 4.9% 5% 5%

8:30 UK GDP q / q (preliminary data) II quarter 0.4% 0.4% 0.6%

8:30 UK GDP y / y (preliminary data) II q 2% 2.0% 2.2%

10:00 UK retail sales according to the Confederation of British PromyshlennikovIyul April 1 -14

The US dollar consolidated against the euro, as investors await the announcement on Fed's monetary policy and analyze the data for Germany and the euro zone. The survey results, presented by the GfK, showed that German consumer confidence index fell in August as economic expectations and prospects for earnings worsened after Britons voted for withdrawal from the EU. The index of consumer climate fell to 10.0 points in August from 10.1 points in July. However, the figure was above forecasts (9.9 points). The index of economic expectations fell by 8.6 points to 9.4 points.

Meanwhile, the European Central Bank said that the monetary aggregate M3 grew in June at 5 percent year on year, confirming the estimates of experts, and accelerated the pace compared to May (when the M3 aggregate rose by 4.9 percent). Private sector credit growth accelerated to 1.5 percent from 1.3 percent in May. The volume of lending to households increased by 1.7 percent y/y, compared with an increase of 1.6 percent in May.

As for the Fed meeting, analysts almost completely eliminate the possibility of a rate hike in July, but market participants are hoping to get new guideline on the possible terms of policy tightening in the coming months after a series of strong data. Futures on Fed rate point out only a 2% chance of a rate hike in July. Meanwhile, the probability of a rate hike in December up almost 20%. Reuters latest survey found that just over half of the 100 economists expect the Fed to raise rates in Q4 to 0.50% -0.75%. The change is likely to occur in December, according to Fed funds futures.

ONS said that in the 2nd quarter the UK's gross domestic product grew by 0.6 percent compared with an increase of 0.4 percent in the first three months of this year. It was expected that the economy will expand by 0.4 percent. In annual terms, GDP grew by 2.2 percent, recording the strongest growth during the year, and accelerate the pace compared to the first quarter (+2.0 percent). It was predicted that economic growth will stabilize at 2.0 percent. In the 2nd quarter, the services sector recorded an increase of 0.5 percent, while the manufacturing sector - by 2.1 per cent (the best figure since 1999). In contrast, the segment of construction and agriculture reported a decrease of 0.4 percent and 1.0 percent respectively.

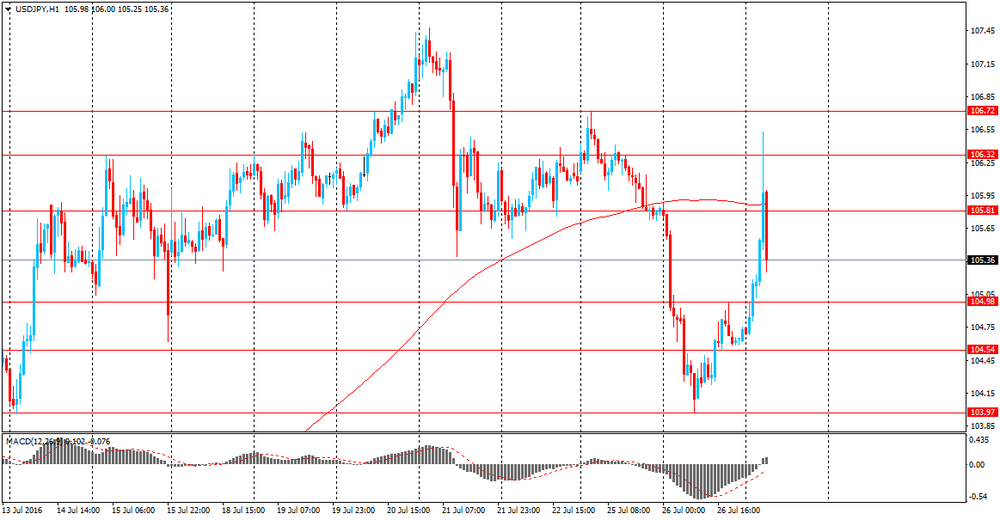

The yen has stabilized against the US dollar after the strong fluctuations in the beginning of the session, which were caused by expectations of action by the Government of Japan. Initially, the yen has weakened sharply after WSJ reports that Japan is considering the release of 50-year Japanese government bonds. However, later the Minister of Finance has denied such information. Additional pressure on the yen have reported that Japanese Prime Minister Abe said Wednesday that the stimulus package amounting to 27 trillion yen. Then Abe personally confirmed that the size of the package is now at 28 trillion yen and added that the package will be ready next week.

Most likely, the Central Bank decides to increase ETF purchases at the upcoming meeting. Also not ruled out is a further reduction in interest rates and increasing government bond purchases.

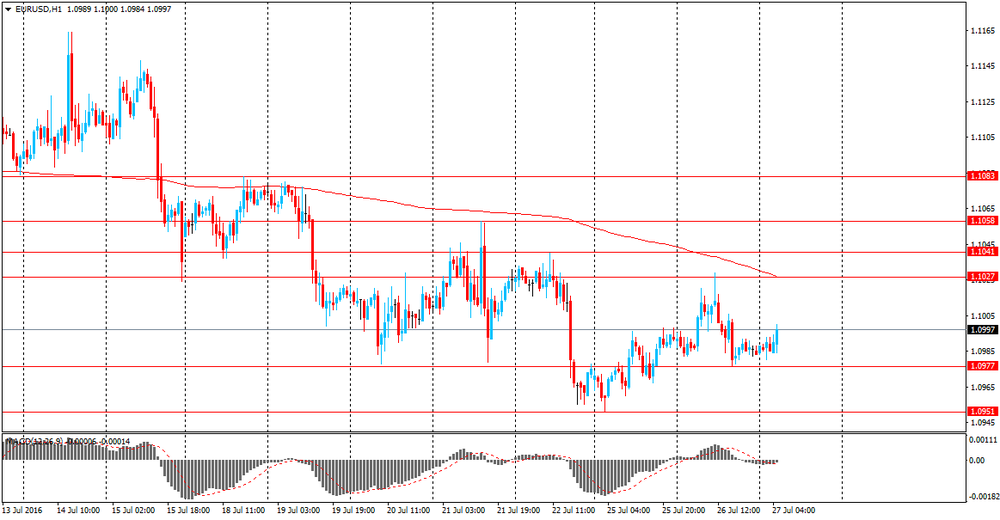

EUR / USD: during the European session, the pair is trading in the range of $ 1.0986- $ 1.1005

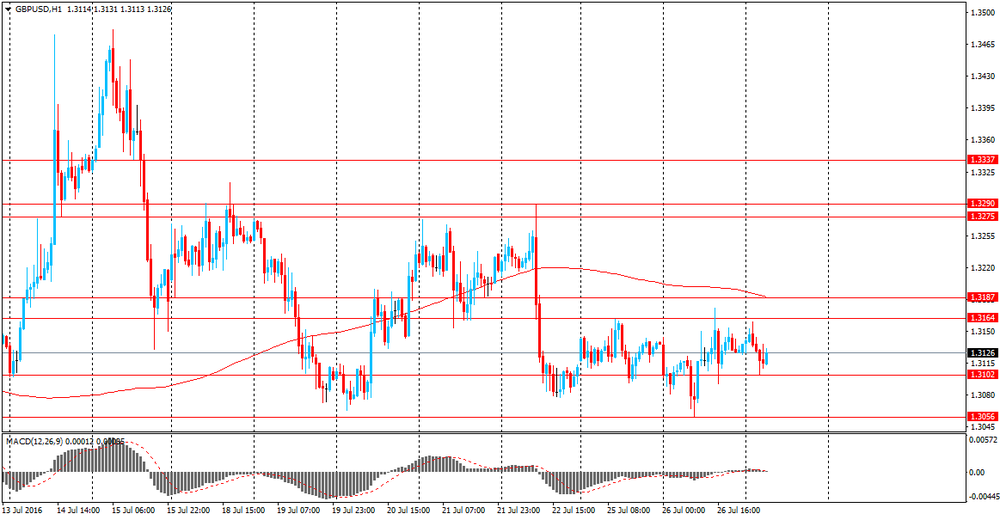

GBP / USD: during the European session, the pair fell to $ 1.3071

USD / JPY: during the European session, the pair rose to Y106.52, but then retreated to Y105.50

-

14:36

Durable goods orders in US fall 4% in June

According to Bloomberg, the median forecast of economists surveyed estimated orders for all durable goods would fall 1.4 percent, with projections ranging from a 5 percent drop to a 2 percent increase. The gain in orders for non-defense capital goods excluding aircraft -- a proxy for business investment -- matched the median estimate.

"Decision-makers are reluctant to spend on equipment," Kevin Cummins, an economist at RBS Securities Inc. in Stamford, Connecticut, said before the report. "That's certainly one thing that has remained pretty weak and lackluster throughout the recovery."

Shipments of non-military capital goods excluding aircraft, which are used to calculate gross domestic product, decreased 0.4 percent in June after falling 0.5 percent the month before.

Companies placed more orders for electrical equipment and appliances in June than they have all year and demand rose for motor vehicles. Still, bookings weakened for metals, machinery, computers and communications equipment.

-

14:30

U.S.: Durable goods orders ex defense, June -3.9%

-

14:30

U.S.: Durable Goods Orders , June -4% (forecast -1.1%)

-

14:30

U.S.: Durable Goods Orders ex Transportation , June -0.5% (forecast 0.3%)

-

14:00

Orders

EUR/USD

Offers 1.1020-25 1.1050 1.1075-801.1100 1.1125-30 1.1150 1.1180 1.1200

Bids 1.0980-85 1.0950 1.0930 1.0900 1.0880 1.0850 1.0800

GBP/USD

Offers 1.3155-60 1.3180-85 1.3200 1.3250 1.3270 1.3300

Bids 1.3100 1.3085 1.3050 1.3020 1.3000 1.2980 1.2950 1.2900

EUR/GBP

Offers 0.8400-05 0.8425-30 0.8450 0.8470 0.8485 0.8500 0.8525 0.8550

Bids 0.8350 0.8330 0.8300 0.8285 0.8255-60 0.8235 0.8200

EUR/JPY

Offers 116.40 116.80 117.00 117.50 117.80 118.00

Bids 115.50 115.00 114.60 114.30 114.00 113.75 113.50 113.00

USD/JPY

Offers 105.80 106.00 106.20-25 106.50 106.70 106.85 107.00

Bids 105.00 104.80 104.60-65 104.30 104.00 103.75-85 103.40-50 103.00

AUD/USD

Offers 0.7520 0.7550 0.7580 0.7600 0.7620 O.7635 0.7650-55 0.7700

Bids 0.7450 0.7420 0.7400 0.7385 0.7370 0.7350

-

13:43

Abe set to unveil a stimulus package

Japanese Prime Minister Shinzo Abe on Wednesday said his government is set to unveil a stimulus package of more than 28 trillion yen ($266 billion) to boost the sluggish economy.

He made the announcement in a speech in southwestern Japan and said that the package would include 13 trillion yen in fiscal measures. More details of the plan would be revealed next week.

Expectations that the Abe government was set to announce an economic stimulus have been building since May. Markets were widely expecting a package of over 10 trillion yen.

Meanwhile, the Bank of Japan is set to begin its two-day policy session on Thursday, following which the bank is widely expected to announce further monetary easing on Friday. - rtt

-

12:16

UK: sales volumes declined more rapidly than at any time since January 2012 - CBI

The survey of 132 firms, of which 66 were retailers, showed that sales volumes declined more rapidly than at any time since January 2012, with weaker consumer confidence a likely factor in the immediate period following the EU referendum. Companies expect sales volumes to decline at a broadly similar pace as this month in the year to August.

Within retail, sales by grocers, and furniture and carpets stores were the main drivers of the drop in overall volumes. But some sectors bucked the trend, with non-specialised department stores and retailers of footwear and leather goods reporting higher volumes.

Orders placed on suppliers dropped at the quickest pace since March 2009 and are expected to fall further in August.

In tandem with a weaker retail sector, volumes in wholesaling deteriorated at the fastest pace since April 2013 and are expected to fall further next month.

Meanwhile, sales within the motor trade continued to expand, albeit at slower pace than early this year.

-

12:00

United Kingdom: CBI retail sales volume balance, July -14 (forecast 1)

-

11:34

Fade Upticks on USD/JPY and USD/CAD Targeting 100 & 1.2830 respectively - Barclays

"We are looking for evidence of a top in USDJPY and USDCAD as they approach upside resistance.

Given the multi-month underperformance of the Greenback against both JPY and CAD, we prefer to fade upticks for a return to the year-to-date lows initially.

We are looking for a move lower in USD/JPY towards targets near 103.80, the 21-dma. A close below 103.80 would signal lower towards 100.00".

Copyright © 2016 Barclays Capital, eFXnews™

-

10:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1025-30 (413m) 1.1100 (568m)

USD/JPY: 104.75 (USD 280m) 106.25 (295m) 106.50 (363m) 107.00 (1bln)

GBP/USD 1.2900 (GBP 496m) 1.3100 (562m) 1.3250 (598m)

AUD/USD 0.7435-40 (AUD 800m) 0.7475 (476m) 0.7500 (270m)

-

10:32

UK: the GDP rose 2.2% in Q2

Change in gross domestic product (GDP) is the main indicator of economic growth. GDP was estimated to have increased by 0.6% in Quarter 2 (Apr to June) 2016 compared with growth of 0.4% in Quarter 1 (Jan to Mar) 2016. Output increased in 2 of the main industrial groupings within the economy in Quarter 2 2016. Services increased by 0.5% and production increased by 2.1%. In contrast, construction decreased by 0.4% and agriculture decreased by 1.0%. GDP was 2.2% higher in Quarter 2 2016 compared with the same quarter a year ago. In Quarter 2 2016, GDP was estimated to have been 7.7% higher than the pre-economic downturn.

-

10:30

United Kingdom: GDP, q/q, Quarter II 0.6% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter II 2.2% (forecast 2.0%)

-

10:16

Monetary developments in the euro area

• The annual growth rate of the broad monetary aggregate M3 stood at 5.0% in June 2016, after 4.9% in May 2016.

• The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 8.6% in June, from 9.1% in May.

• The annual growth rate of loans to households stood at 1.7% in June, compared with 1.6% in May.

• The annual growth rate of loans to non-financial corporations stood at 1.7% in June, compared with 1.6% in May (revised from 1.4%)1 .

-

10:02

Eurozone: Private Loans, Y/Y, June 1.7% (forecast 1.7%)

-

10:00

Eurozone: M3 money supply, adjusted y/y, June 5% (forecast 5%)

-

09:30

France's consumer confidence weakened for a second successive month

According to rttnews, France's consumer confidence weakened for a second successive month in July, as households' unemployment worries increased, figures from INSEE showed Wednesday.

The survey was conducted between June 28 and July 16 and only 2 percent of participants responded after the July 14 terrorist attack in Nice, the agency said.

The consumer confidence index dropped to 96 from 97 in June, in line with economists' expectations. The score has been below its long-term average of 100.

Households' were slightly less pessimistic regarding their financial situation in the next 12 months, but were more negative regarding their future saving capacity. Their saving intentions continued to improve.

Consumers were also more inclined to make big ticket purchases in the next 12 months and they were less pessimistic regarding their standard of living during the time.

-

09:27

Today’s events:

At 12:30 GMT Germany will hold an auction on placement of 30-year bonds

In the 21:00 GMT FOMC decision on interest rate and the accompanying FOMC statement

-

08:45

France: Consumer confidence , July 96 (forecast 96)

-

08:41

Asian session review: the Yen was sold on Bank of Japan news

The following data was published:

1:30 Australia Consumer Price Index q / q II quarter -0.2% 0.4% 0.4%

1:30 Australia Consumer Price Index y / y in the II quarter 1.3% 1.1% 1.0%

01:30 Australia Consumer Price Index (truncated average method), q / q II quarter 0.2% 0.4% 0.5%

1:30 Australia Consumer Price Index (truncated average method), y / y in the II quarter 1.7% 1.5% 1.7%

In the Asian session, USD / JPY trading above 105.40 after briefly rose to the level of 106.50. This happened after reports in the WSJ said that Japan is considering 50-year Japanese government bonds. The maturity of these bonds would be the longest in the postwar period.

Support for the pair also had =Japanese Prime Minister Shinzo Abe who said that the stimulus package amounting to 27 trillion yen. Later, the news agency Kyodo reported that Japanese Prime Minister Abe stated that the economic stimulus package will be more than Y28 trillion. He also announced that the government will decide on a package of measures.

Earlier it was reported that the Japanese government will make less extensive than expected incentives. These reports led markets to doubt the ability of Tokyo to restart the economy and trigger a weakening of the national currency.

Investors have been paying more attention to the dynamics of the yen on the eve of the two-day meeting of the Bank of Japan, which will end on Friday. Some economists have suggested that the central bank may implement a number of stimulus measures, from increasing purchases of assets and helicopter miney, ie direct financing of fiscal stimulus measures.

The Australian dollar rose half a cent to $ 0.7565 US immediately after the release of the consumer price index, but then fell, reaching yesterday's low of $ 0.7455.

The Consumer Price Index, published by the Australian Bureau of Statistics, in the second quarter quarter grew by 1.0% compared to the same period of the previous year. Analysts had expected an increase of 1.1%. Base CPI index rose by 0.4% compared with the first quarter, which corresponds to the forecast. In the first quarter the index fell by -0.2%.

RBA signaled a tendency to mitigate the monetary policy in connection with data on inflation, the labor market and housing sector. Rates are already at a record low of 1.75%. The last time the central bank has lowered the rate was in May.

Analysts at JPMorgan said that inflation in Australia is low enough to convince the RBA to further support the economy.

Now the Reserve Bank of Australia may refrain from lowering rates until November," - said Citigroup economists.

Earlier Citi said that core inflation was unpleasant surprise, forcing the RBA to lower the official interest rate next month. Now it is expected that the rate will be lowered by 25 basis points in November.

The US dollar was little changed against the euro in the run-up to the announcement of the decision of the Federal Reserve on monetary policy. Market participants believe that the probability of a US Federal Reserve interest rates in the coming months has increased thanks to a series of strong economic data. The Fed on Wednesday is likely to leave interest rates unchanged, but investors see a 26% chance the central bank's tightening policy in September, whereas previously, this possibility was evaluated as 12%, according to CME Group data.

"The rhetoric of the Fed is expected to have support for the US dollar in the coming weeks and months", - Deutsche Bank.

Higher rates have a positive impact on the US dollar, increasing its attractiveness for investors.

EUR / USD: during the Asian session, the pair was trading in $ 1.0980-1.0995 range

GBP / USD: during the Asian session, the pair was trading in $ 1.3105-1.3125 range

USD / JPY: during the Asian session, the pair was trading in Y104.70-106.50 range

-

08:30

Options levels on wednesday, July 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1210 (3825)

$1.1129 (2020)

$1.1071 (1544)

Price at time of writing this review: $1.0992

Support levels (open interest**, contracts):

$1.0940 (4641)

$1.0874 (7389)

$1.0834 (3277)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 40555 contracts, with the maximum number of contracts with strike price $1,1200 (3825);

- Overall open interest on the PUT options with the expiration date August, 5 is 49972 contracts, with the maximum number of contracts with strike price $1,0900 (7389);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from July, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3405 (1938)

$1.3307 (1106)

$1.3211 (1665)

Price at time of writing this review: $1.3136

Support levels (open interest**, contracts):

$1.3088 (1943)

$1.2992 (1823)

$1.2895 (852)

Comments:

- Overall open interest on the CALL options with the expiration date August, 5 is 26704 contracts, with the maximum number of contracts with strike price $1,3400 (1938);

- Overall open interest on the PUT options with the expiration date August, 5 is 25419 contracts, with the maximum number of contracts with strike price $1,2950 (2786);

- The ratio of PUT/CALL was 0.95 versus 0.96 from the previous trading day according to data from July, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

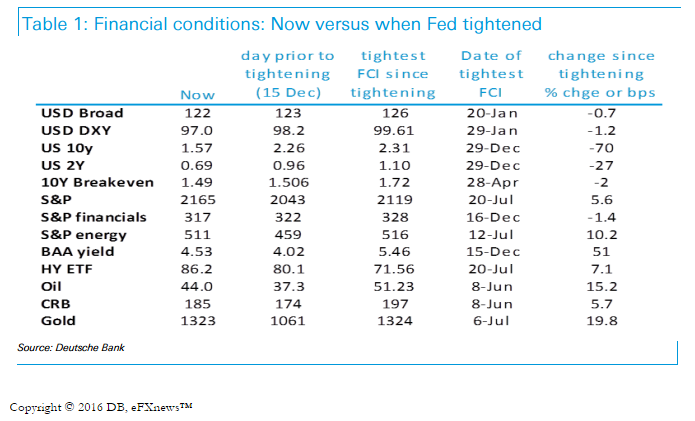

USD Into FOMC - Deutsche Bank

The Fed could not have wished for more sanguine financial markets, or a more benign international events calendar and data backdrop. It begs the question: in a volatile world will 'the ducks' ever align so perfectly for a tightening, and will the Fed miss their opportunity?

The ducks have aligned:

Compare key financial condition indicators to when the Fed tightened in December: the S&P is ~6% higher and nudging all-time highs; the 2y and 10y yields are 26bps and 66bps lower respectively; the Broad TWI dollar is slightly softer; high yield bond prices are substantially stronger and related commodity prices are healthier.

Compare event risks: Rmb day to day variation/depreciation is being readily absorbed; Brexit has passed, and related contagion fears for the US are proving greatly exaggerated.

Compare the numbers: For November 2015 prior to the December 2015 FOMC rate hike, the ISM manufacturing is up close to 5pts; 3m avg of retail sales ex autos is up from zero to over 8% annualized; 3m avg of NFP has decelerated from 241K to 147K as might be expected at this point in the cycle; and the U3 unemployment and U6 'underemployment' rates are down 0.1% and 0.3% respectively.

-

08:22

The consumer climate in Germany weakened slightly in July

The consumer climate in Germany weakened slightly in July. Also as a result of Brexit in the United Kingdom, the Consumer Climate overall indicator forecasts 10.0 points for August, down from 10.1 points in July. Economic and income expectations suffered losses, while propensity to buy increased slightly again.

German consumers, too, have evidently been affected by the Brits' decision to leave the EU. This is signaled by the decline of both economic and income expectations. In contrast, propensity to buy was able to exceed its already very high level.

Economic outlook somewhat dampened by the referendum

For the first time after three successive increases, the economic expectations of German consumers have suffered a setback. The indicator lost 8.6 points in July and is now at 9.4 points, noticeably weakening the positive trend seen over the last few months.

-

08:21

UBS consumption indicator rose in June

The rise in the UBS consumption indicator in June from 1.24 to 1.34 points continues to point to an upward trend in Swiss private consumption. The situation in domestic tourism appears to be normalizing. The number of overnight stays in hotels rose by 1.3% in May compared to the previous year, though this was mainly due to domestic visitors, who made up 60% of the additional overnight stays. Furthermore, a slight improvement in the retail industry has also became apparent - despite the recent hefty fall of almost 10% year-on-year in clothing and shoe store revenue, combined with the ongoing exchange rate headwind.

-

08:17

Australian CPI mixed

All groups CPI

- rose 0.4% this quarter, compared with a fall of 0.2% in the March quarter 2016.

- rose 1.0% over the twelve months to the June quarter 2016, compared with a rise of 1.3% over the twelve months to the March quarter 2016.

Overview of CPI movemets

- The most significant price rises this quarter are medical and hospital services (+4.2%), automotive fuel (+5.9%), tobacco (+2.1%) and new dwelling purchase by owner-occupiers (+0.9%).

- The most significant offsetting price falls this quarter are domestic holiday travel and accommodation (-3.7%), motor vehicles (-1.3%) and telecommunication equipment and services (-1.5%).

-

08:12

Germany's import prices decreased by 4.6% in June

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 4.6% in June 2016 compared with the corresponding month of the preceding year. In May and in April 2016 the annual rates of change were -5.5% and -6.6%, respectively. From May to June 2016 the index rose by 0.5%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 2.8% compared with the level of a year earlier.

The index of export prices decreased by 1.3% in June 2016 compared with the corresponding month of the preceding year. In May and in April 2016 the annual rates of change were -1.6% and -2.0%, respectively. From May to June 2016 the index rose by 0.2%.

-

08:06

Interesting developments from Japan lead to choppy JPY but mostly lower

- Japan Ministry of Finance say it is not true they are considering 50yr bonds - debunking earlier WSJ story - Reuters

- Japan's PM Abe: Japan stimulus to be more than 28t yen - Kyodo

- Abe to announce stimulus package next week - Kyodo news agency

-

08:01

Germany: Gfk Consumer Confidence Survey, August 10 (forecast 9.9)

-

08:00

Switzerland: UBS Consumption Indicator, June 1.34

-

08:00

Germany: Gfk Consumer Confidence Survey, August 10.0 (forecast 9.9)

-

03:31

Australia: Trimmed Mean CPI q/q, Quarter II 0.5% (forecast 0.4%)

-

03:30

Australia: CPI, q/q, Quarter II 0.4% (forecast 0.4%)

-

03:30

Australia: CPI, y/y, Quarter II 1.0% (forecast 1.1%)

-

03:30

Australia: Trimmed Mean CPI y/y, Quarter II 1.7% (forecast 1.5%)

-

00:31

Currencies. Daily history for Jul 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0983 -0,08%

GBP/USD $1,3136 0,00%

USD/CHF Chf0,9918 +0,60%

USD/JPY Y104,73 -1,05%

EUR/JPY Y115,02 -1,14%

GBP/JPY Y137,56 -1,06%

AUD/USD $0,7505 +0,51%

NZD/USD $0,7061 +0,95%

USD/CAD C$1,3186 -0,24%

-

00:01

Schedule for today, Wednesday, Jul 27’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia CPI, q/q Quarter II -0.2% 0.4%

01:30 Australia CPI, y/y Quarter II 1.3% 1.1%

01:30 Australia Trimmed Mean CPI q/q Quarter II 0.2% 0.4%

01:30 Australia Trimmed Mean CPI y/y Quarter II 1.7% 1.5%

06:00 Germany Gfk Consumer Confidence Survey August 10.1 9.9

06:00 Switzerland UBS Consumption Indicator June 1.35

06:45 France Consumer confidence July 97 96

08:00 Eurozone Private Loans, Y/Y June 1.6% 1.7%

08:00 Eurozone M3 money supply, adjusted y/y June 4.9% 5%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter II 0.4% 0.4%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter II 2% 2.0%

10:00 United Kingdom CBI retail sales volume balance July 4 1

12:30 U.S. Durable Goods Orders ex Transportation June -0.3% 0.3%

12:30 U.S. Durable goods orders ex defense June -0.9%

12:30 U.S. Durable Goods Orders June -2.2% -1.1%

14:00 U.S. Pending Home Sales (MoM) June -3.7% 1.4%

14:30 U.S. Crude Oil Inventories July -2.342 -2.45

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

-